Event Studies in Economics and Finance A. Craig MacKinlay ...

Event Studies in Economics and Finance A. Craig MacKinlay ...

Event Studies in Economics and Finance A. Craig MacKinlay ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Event</strong> <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance<br />

A. <strong>Craig</strong> MacK<strong>in</strong>lay<br />

Journal of Economic Literature, Vol. 35, No. 1. (Mar., 1997), pp. 13-39.<br />

Stable URL:<br />

http://l<strong>in</strong>ks.jstor.org/sicisici=0022-0515%28199703%2935%3A1%3C13%3AESIEAF%3E2.0.CO%3B2-W<br />

Journal of Economic Literature is currently published by American Economic Association.<br />

Your use of the JSTOR archive <strong>in</strong>dicates your acceptance of JSTOR's Terms <strong>and</strong> Conditions of Use, available at<br />

http://www.jstor.org/about/terms.html. JSTOR's Terms <strong>and</strong> Conditions of Use provides, <strong>in</strong> part, that unless you have obta<strong>in</strong>ed<br />

prior permission, you may not download an entire issue of a journal or multiple copies of articles, <strong>and</strong> you may use content <strong>in</strong><br />

the JSTOR archive only for your personal, non-commercial use.<br />

Please contact the publisher regard<strong>in</strong>g any further use of this work. Publisher contact <strong>in</strong>formation may be obta<strong>in</strong>ed at<br />

http://www.jstor.org/journals/aea.html.<br />

Each copy of any part of a JSTOR transmission must conta<strong>in</strong> the same copyright notice that appears on the screen or pr<strong>in</strong>ted<br />

page of such transmission.<br />

The JSTOR Archive is a trusted digital repository provid<strong>in</strong>g for long-term preservation <strong>and</strong> access to lead<strong>in</strong>g academic<br />

journals <strong>and</strong> scholarly literature from around the world. The Archive is supported by libraries, scholarly societies, publishers,<br />

<strong>and</strong> foundations. It is an <strong>in</strong>itiative of JSTOR, a not-for-profit organization with a mission to help the scholarly community take<br />

advantage of advances <strong>in</strong> technology. For more <strong>in</strong>formation regard<strong>in</strong>g JSTOR, please contact support@jstor.org.<br />

http://www.jstor.org<br />

Sun Jan 27 17:44:51 2008

Journal of Economic Literature<br />

Vol. XXXV (March 1997), pp. 13-39<br />

<strong>Event</strong> <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> <br />

F<strong>in</strong>ance <br />

A. CRAIG MACKINLAY<br />

The IVlzarton Sclzool, University of Pennsylvania<br />

T11nrlk.t to Johri CnrnpDcll, BI-cicc GI-rr~lcly, A~irl~aic Lo, ci~lrl tico ci~~o~i~y~~iocii rcfercc.i,fi)r Izel/~fi~I<br />

COITIIII~II~.~ (i~rcl di

14 Journal of Economic Literature, 1701. XXX17 (March 1997)<br />

creased <strong>in</strong> 57 of the cases <strong>and</strong> the price<br />

decl<strong>in</strong>ed <strong>in</strong> only 26 <strong>in</strong>stances. Over the<br />

decades from the early 1930s until the<br />

late 1960s the level of sophistication of<br />

event studies <strong>in</strong>creased. John H. Myers<br />

<strong>and</strong> Archie Bakay (1948), C. Aust<strong>in</strong><br />

Barker (1956, 1957, 1958), <strong>and</strong> John<br />

Ashley (1962) are examples of studies<br />

dur<strong>in</strong>g this ti<strong>in</strong>e period. The i<strong>in</strong>provements<br />

<strong>in</strong>cluded remov<strong>in</strong>g general stock<br />

<strong>in</strong>arket price <strong>in</strong>ove<strong>in</strong>ents <strong>and</strong> separat<strong>in</strong>g<br />

out confound<strong>in</strong>g events. In the late<br />

1960s sem<strong>in</strong>al studies by Ray Ball <strong>and</strong><br />

Philip Brown (1968) <strong>and</strong> Eugene Fa<strong>in</strong>a<br />

et al. (1969) <strong>in</strong>troduced the methodology<br />

that is essentially the same as that whicll<br />

is <strong>in</strong> use today. Ball <strong>and</strong> Brown considered<br />

the <strong>in</strong>for<strong>in</strong>ation content of earn<strong>in</strong>gs,<br />

<strong>and</strong> Fa<strong>in</strong>a et al. studied the effects<br />

of stock splits after remov<strong>in</strong>g the effects<br />

of simultaneous dividend <strong>in</strong>creases.<br />

In the years s<strong>in</strong>ce these pioneer<strong>in</strong>g<br />

studies, a number of <strong>in</strong>odifications have<br />

been developed. These modifications relate<br />

to co<strong>in</strong>plications aris<strong>in</strong>g from violations<br />

of the statistical assu<strong>in</strong>ptions used<br />

<strong>in</strong> the early work <strong>and</strong> relate to adjustments<br />

<strong>in</strong> the design to accommodate<br />

more specific hypotheses. Useful papers<br />

whicll deal with the practical i<strong>in</strong>portance<br />

of <strong>in</strong>any of the co<strong>in</strong>plications <strong>and</strong> adjust<strong>in</strong>ents<br />

are the work by Stephen ~rown<br />

<strong>and</strong> Jerold Warner published <strong>in</strong> 1980 <strong>and</strong><br />

1985. The 1980 paper considers implementation<br />

issues for data sampled at a<br />

monthly <strong>in</strong>terval <strong>and</strong> the 1985 paper<br />

deals with issues for daily data.<br />

In this paper, event study <strong>in</strong>ethods are<br />

reviewed <strong>and</strong> sum<strong>in</strong>arized. The paper<br />

beg<strong>in</strong>s with discussion of one possible<br />

procedure for conduct<strong>in</strong>g an event study<br />

<strong>in</strong> Section 2. Section 3 sets up a sample<br />

event study which will be used to illustrate<br />

the <strong>in</strong>ethodology. Central to an<br />

event study is the <strong>in</strong>easure<strong>in</strong>ent of an abnormal<br />

stock return. Section 4 details<br />

the first step-measur<strong>in</strong>g the nor<strong>in</strong>al<br />

performance-<strong>and</strong> Section 5 follows<br />

with the necessary tools for calculat<strong>in</strong>g<br />

an abnormal return, mak<strong>in</strong>g statistical <strong>in</strong>ferences<br />

about these returns, <strong>and</strong> aggregat<strong>in</strong>g<br />

over <strong>in</strong>any event observations.<br />

The null hypothesis that the event has no<br />

impact on the distribution of returns is<br />

ma<strong>in</strong>ta<strong>in</strong>ed <strong>in</strong> Sections 4 <strong>and</strong> 5. Section 6<br />

discusses modify<strong>in</strong>g this null hypotllesis<br />

to focus only on the <strong>in</strong>ean of the return<br />

distribution. Section 7 presents analysis<br />

of the power of an event study. Section 8<br />

presents nonpara<strong>in</strong>etric approaches to<br />

event studies which elim<strong>in</strong>ate the need<br />

for parametric structure. In some cases<br />

theory provides hypotheses concern<strong>in</strong>g<br />

the relation between the magnitude of<br />

the event abnormal return <strong>and</strong> firm characteristics.<br />

Section 9 presents a crosssectional<br />

regression approach that is useful<br />

to <strong>in</strong>vestigate such hypotheses.<br />

Section 10 considers so<strong>in</strong>e further issues<br />

relat<strong>in</strong>g event study design <strong>and</strong> the paper<br />

closes with the conclud<strong>in</strong>g discussion<br />

<strong>in</strong> Section 11.<br />

2. Procedure for an <strong>Event</strong> Study<br />

At the outset it is useful to briefly discuss<br />

the structure of an event study. This<br />

will provide a basis for the discussion of<br />

details later. \Vhile there is no unique<br />

structure, there is a general flow of<br />

analysis. This flow is discussed <strong>in</strong> this<br />

section.<br />

The <strong>in</strong>itial task of conduct<strong>in</strong>g an event<br />

study is to def<strong>in</strong>e the event of <strong>in</strong>terest<br />

<strong>and</strong> identify the period over which the<br />

security prices of the firms <strong>in</strong>volved <strong>in</strong><br />

this event will be exam<strong>in</strong>ed-the event<br />

w<strong>in</strong>dow. For example, if one is look<strong>in</strong>g at<br />

the <strong>in</strong>formation content of an earn<strong>in</strong>gs<br />

with daily data, the event will be the<br />

earn<strong>in</strong>gs announcement <strong>and</strong> the event<br />

w<strong>in</strong>dow will <strong>in</strong>clude the one day of the<br />

announcement. It is custo<strong>in</strong>ary to def<strong>in</strong>e<br />

the event w<strong>in</strong>dow to be larger than the<br />

specific period of <strong>in</strong>terest. This per<strong>in</strong>its<br />

exam<strong>in</strong>ation of periods surround<strong>in</strong>g the

MacK<strong>in</strong>lay: <strong>Event</strong> <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance<br />

15<br />

event. In practice, the period of <strong>in</strong>terest<br />

is often exp<strong>and</strong>ed to multiple days, <strong>in</strong>clud<strong>in</strong>g<br />

at least tlle day of tlle announcement<br />

<strong>and</strong> the day after the announcement.<br />

This captures the price<br />

effects of an,nounce<strong>in</strong>ents which occur<br />

after the stock market closes on the announcement<br />

day. The periods prior to<br />

<strong>and</strong> after the event may also be of <strong>in</strong>terest.<br />

For example, <strong>in</strong> the earn<strong>in</strong>gs announcement<br />

case, tlle market may acquire<br />

<strong>in</strong>formation about the earn<strong>in</strong>gs<br />

prior to the actual announcement <strong>and</strong><br />

one can <strong>in</strong>vestigate this possibility by exam<strong>in</strong><strong>in</strong>g<br />

pre-event returns.<br />

After identify<strong>in</strong>g the event, it is necessary<br />

to determ<strong>in</strong>e tlle selection criteria<br />

for the <strong>in</strong>clusion of a given firm <strong>in</strong> the<br />

study. The criteria may <strong>in</strong>volve restrictions<br />

imposed by data availability such as<br />

list<strong>in</strong>g on the New York Stock Exchange<br />

or the American Stock Exchange or may<br />

<strong>in</strong>volve restrictions such as membership<br />

<strong>in</strong> a specific <strong>in</strong>dustry. At this stage it is<br />

useful to sumlnarize some sa<strong>in</strong>ple characteristics<br />

(e.g., firm market capitalization,<br />

<strong>in</strong>dustry representation, distribution<br />

of events througll time) <strong>and</strong> note<br />

any potential biases which may have<br />

been <strong>in</strong>troduced through the sample selection.<br />

Appraisal of the event's impact requires<br />

a measure of the abnormal return.<br />

The abnormal return is the actual ex post<br />

return of the security over the event w<strong>in</strong>dow<br />

m<strong>in</strong>us the nor<strong>in</strong>al return of the fir<strong>in</strong><br />

over the event w<strong>in</strong>dow. The normal return<br />

is def<strong>in</strong>ed as the expected return<br />

without condition<strong>in</strong>g on the event tak<strong>in</strong>g<br />

place. For firm i <strong>and</strong> event date T the<br />

abnormal return is<br />

ARi, = R,, - E(R,,IX',) (1)<br />

where AR,,, R,,, <strong>and</strong> E(R,,lX',) are the abnormal,<br />

actual, <strong>and</strong> normal returns respectively<br />

for time period T. X', is the<br />

condition<strong>in</strong>g <strong>in</strong>formation for the norlnal<br />

return model. There are two common<br />

clloices for model<strong>in</strong>g the normal return-the<br />

constant mean return model<br />

where X, is a constant, <strong>and</strong> the market<br />

model where XiT is the market return.<br />

The constant mean return model, as the<br />

name implies, assumes that the mean<br />

return of a given security is constant<br />

through time. The market model assumes<br />

a stable l<strong>in</strong>ear relation between<br />

the market return <strong>and</strong> the security return.<br />

Given the selection of a norlnal performance<br />

model, tlle estimation w<strong>in</strong>dow<br />

needs to be def<strong>in</strong>ed. The most common<br />

choice, when feasible, is us<strong>in</strong>g the period<br />

prior to the event w<strong>in</strong>dow for tlle estimation<br />

w<strong>in</strong>dow. For example, <strong>in</strong> an event<br />

study us<strong>in</strong>g daily data <strong>and</strong> tlle market<br />

model, the market model parameters<br />

could be estimated over the 120 days<br />

prior to the event. Generally the event<br />

period itself is not <strong>in</strong>cluded <strong>in</strong> the estimation<br />

period to prevent the event from<br />

<strong>in</strong>fluenc<strong>in</strong>g the nor<strong>in</strong>al performance<br />

model parameter estimates.<br />

With the parameter estimates for the<br />

normal performance model, the abnormal<br />

returns can be calculated. Next<br />

comes the design of the test<strong>in</strong>g framework<br />

for tlle abnormal returns. Important<br />

considerations are def<strong>in</strong><strong>in</strong>g the null<br />

hypotllesis <strong>and</strong> determ<strong>in</strong><strong>in</strong>g the techniques<br />

for aggregat<strong>in</strong>g tlle <strong>in</strong>dividual<br />

firm abnormal returns.<br />

The presentation of the empirical results<br />

follows the formulation of the<br />

econometric design. In addition to present<strong>in</strong>g<br />

the basic e<strong>in</strong>pirical results, the<br />

presentation of diagnostics can be fruitful.<br />

Occasionally, especially <strong>in</strong> studies<br />

with a limited number of event observations,<br />

tlle empirical results can be heavily<br />

<strong>in</strong>fluenced by one or two firms.<br />

Knowledge of this is important for gaug<strong>in</strong>g<br />

the importance of the results.<br />

Ideally the empirical results will lead<br />

to <strong>in</strong>sights relat<strong>in</strong>g to underst<strong>and</strong><strong>in</strong>g the<br />

sources <strong>and</strong> causes of the effects (or lack

16 Journal of Econonzic Literature, Vol. XXXV (March 1997)<br />

of effects) of the event under study. Additional<br />

analysis <strong>in</strong>ay be <strong>in</strong>cluded to dist<strong>in</strong>guish<br />

between compet<strong>in</strong>g explanations.<br />

Conclud<strong>in</strong>g coiil<strong>in</strong>ents complete<br />

the study.<br />

3. An Exan~ple of nrz <strong>Event</strong> Study<br />

The F<strong>in</strong>ancial Account<strong>in</strong>g St<strong>and</strong>ards<br />

Board (FASB) <strong>and</strong> the Securities Exchange<br />

Co<strong>in</strong><strong>in</strong>ission strive to set report<strong>in</strong>g<br />

regulations so that f<strong>in</strong>ancial state<strong>in</strong>ents<br />

<strong>and</strong> related <strong>in</strong>for<strong>in</strong>ation releases<br />

are <strong>in</strong>formative about the value of the<br />

firm. In sett<strong>in</strong>g st<strong>and</strong>ards, the <strong>in</strong>formation<br />

content of the f<strong>in</strong>ancial disclosures<br />

is of <strong>in</strong>terest. <strong>Event</strong> studies provide an<br />

ideal tool for exam<strong>in</strong><strong>in</strong>g the <strong>in</strong>forn~ation<br />

content of the disclosures.<br />

In this section the description of an<br />

exa<strong>in</strong>ple selected to illustrate event<br />

study <strong>in</strong>etllodology is presented. One<br />

particular type of disclosure-quarterly<br />

earn<strong>in</strong>gs announcements-is considered.<br />

The objective is to <strong>in</strong>vestigate the <strong>in</strong>for<strong>in</strong>ation<br />

content of these announcements.<br />

In other words, the goal is to see<br />

if the release of account<strong>in</strong>g <strong>in</strong>forniation<br />

provides <strong>in</strong>forniation to the marketplace.<br />

If so there should be a correlation between<br />

the observed change of the market<br />

value of the company <strong>and</strong> the <strong>in</strong>formation.<br />

The example will focus on the quarterly<br />

earn<strong>in</strong>gs announcements for the 30<br />

fir<strong>in</strong>s <strong>in</strong> the Dobv Jones Industrial Index<br />

over the five-year period fro<strong>in</strong> January<br />

1989 to December 1993. These announcements<br />

correspond to the quarterly<br />

earn<strong>in</strong>gs for the last quarter of 1988<br />

through the third quarter of 1993. Tlle<br />

five years of data for 30 firms provide a<br />

total sa<strong>in</strong>ple of 600 annouiicenients. For<br />

each firm <strong>and</strong> quarter, three pieces of <strong>in</strong>formation<br />

are compiled: the date of the<br />

announcement, the actual earn<strong>in</strong>gs, <strong>and</strong><br />

a <strong>in</strong>easure of the expected earn<strong>in</strong>gs. The<br />

source of the datc of the announcement<br />

is Datastrea<strong>in</strong>, <strong>and</strong> the source of the actual<br />

earn<strong>in</strong>gs is Compustat.<br />

If earn<strong>in</strong>gs announcements convey <strong>in</strong>formation<br />

to <strong>in</strong>vestors, one would expect<br />

the announcement impact on the market's<br />

valuation of the fir<strong>in</strong>'s equity to depend<br />

on the magnitude of the unexpected<br />

co<strong>in</strong>ponent of the announcement.<br />

Thus a <strong>in</strong>easure of the deviation of the<br />

actual announced earn<strong>in</strong>gs from the market's<br />

prior expectation is required. For<br />

construct<strong>in</strong>g such a <strong>in</strong>easure, the mean<br />

quarterly earn<strong>in</strong>gs forecast reported by<br />

the Institutional Brokers Estimate Systen1<br />

(I/B/E/S) is used to proxy for the<br />

market's expectation of earn<strong>in</strong>gs. I/B/E/S<br />

compiles forecasts from analysts for a<br />

large nu<strong>in</strong>ber of companies <strong>and</strong> reports<br />

sum<strong>in</strong>ary statistics each month. Tlle<br />

mean forecast is taken fro<strong>in</strong> the last<br />

<strong>in</strong>ontll of the quarter. For exa<strong>in</strong>ple, the<br />

mean third quarter forecast fro<strong>in</strong> September<br />

1990 is used as the measure of<br />

expected earn<strong>in</strong>gs for the third quarter<br />

of 1990.<br />

To facilitate the exa<strong>in</strong><strong>in</strong>ation of the<br />

impact of the earn<strong>in</strong>gs announce<strong>in</strong>ent on<br />

the value of the firm's equity, it is essential<br />

to posit the relation between the <strong>in</strong>formation<br />

release <strong>and</strong> the change <strong>in</strong><br />

value of tlie equity. In this example the<br />

task is straightforward. If the earn<strong>in</strong>gs<br />

disclosures have <strong>in</strong>formation content,<br />

higlier than expected earn<strong>in</strong>gs sllould be<br />

associated with <strong>in</strong>creases <strong>in</strong> value of the<br />

equity <strong>and</strong> lower than expected earn<strong>in</strong>gs<br />

with decreases. To capture this association,<br />

each announcement is assigned to<br />

one of three categories: good news, no<br />

news, or bad news. Each announce<strong>in</strong>ent<br />

is categorized us<strong>in</strong>g the deviation of the<br />

actual earn<strong>in</strong>gs fro<strong>in</strong> the expected earn<strong>in</strong>gs.<br />

If the actual exceeds expected by<br />

<strong>in</strong>ore thaii 2.5 percent the announcement<br />

is designated as good news, <strong>and</strong> if<br />

the actual is <strong>in</strong>ore than 2.5 percent less<br />

than expected the announce<strong>in</strong>ent is designated<br />

as bad news. Those announce-

MacK<strong>in</strong>lay: <strong>Event</strong> <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance<br />

17<br />

<strong>in</strong>ents where the actual earn<strong>in</strong>gs is <strong>in</strong> the<br />

5 percent range centered about the expected<br />

earn<strong>in</strong>gs are designated as no<br />

news. Of the 600 announcements, 189<br />

are good news, 173 are no news, <strong>and</strong> the<br />

rema<strong>in</strong><strong>in</strong>g 238 are bad news.<br />

With the announcements categorized,<br />

the next step is to specify the parameters<br />

of the empirical design to analyze the equity<br />

return, i.e., the percent change <strong>in</strong><br />

value of the equity. It is necessary to<br />

specify a leiigtll of observation <strong>in</strong>terval,<br />

an event w<strong>in</strong>dow, <strong>and</strong> an estimation w<strong>in</strong>dow.<br />

For this exa<strong>in</strong>ple the <strong>in</strong>terval is set<br />

to one day, thus daily stock returns are<br />

used. A 41-day event w<strong>in</strong>dow is employed,<br />

comprised of 20 pre-event days,<br />

the event day, <strong>and</strong> 20 post-event days.<br />

For each announcement the 250 trad<strong>in</strong>g<br />

day period prior to the event w<strong>in</strong>dow is<br />

used as tlle estirnatioii w<strong>in</strong>dow. After<br />

present<strong>in</strong>g the methodology of an event<br />

study, this exa<strong>in</strong>ple will be drawn upon<br />

to illustrate the execution of a study.<br />

4. Models for Measur<strong>in</strong>g Normal<br />

Performance<br />

A nu<strong>in</strong>ber of approaches are available<br />

to calculate the normal return of a given<br />

security. The approaclles can be loosely<br />

grouped <strong>in</strong>to two categories-statistical<br />

<strong>and</strong> econo<strong>in</strong>ic. Models <strong>in</strong> the first category<br />

follow from statistical assu<strong>in</strong>ptions<br />

concern<strong>in</strong>g the behavior of asset returns<br />

<strong>and</strong> do not depend on any economic arguments.<br />

In contrast, <strong>in</strong>odels <strong>in</strong> the second<br />

category rely on assu<strong>in</strong>ptions concern<strong>in</strong>g<br />

<strong>in</strong>vestors' behavior <strong>and</strong> are not<br />

based solely on statistical assumptions. It<br />

should, however, be noted that to use<br />

econo<strong>in</strong>ic models <strong>in</strong> practice it is necessary<br />

to add statistical assu<strong>in</strong>ptions. Thus<br />

the potential advantage of economic<br />

<strong>in</strong>odels is not the absence of statistical<br />

assumptions, but the opportunity to calculate<br />

more precise measures of the nor<strong>in</strong>al<br />

return us<strong>in</strong>g economic restrictions.<br />

For the statistical <strong>in</strong>odels, the assumption<br />

that asset returns are jo<strong>in</strong>tly multivariate<br />

normal <strong>and</strong> <strong>in</strong>dependently <strong>and</strong><br />

identically distributed tllrougll ti<strong>in</strong>e is<br />

imposed. This distributional assu<strong>in</strong>ption<br />

is sufficient for the constant mean return<br />

model <strong>and</strong> the market model to be correctly<br />

specified. While this assu<strong>in</strong>ption is<br />

strong, <strong>in</strong> practice it generally does not<br />

lead to proble<strong>in</strong>s because the assu<strong>in</strong>ption<br />

is empirically reasonable <strong>and</strong> <strong>in</strong>ferences<br />

us<strong>in</strong>g the normal return <strong>in</strong>odels tend to<br />

be robust to deviations from the assumption.<br />

Also one can easily <strong>in</strong>odify the statistical<br />

framework so that the analysis of<br />

the abnormal returns is autocorrelation<br />

<strong>and</strong> lieteroskedasticity consistent by us<strong>in</strong>g<br />

a generalized method-of-mo<strong>in</strong>ents<br />

approach.<br />

A. Constant Mean Return Model<br />

Let p, be the mean return for asset i.<br />

Then the constant mean return model is<br />

Rir = CLi +

1S Journal of Econonzic Literature, Val. XXXV (March 1997)<br />

B. Market Model<br />

Tlle <strong>in</strong>arket model is a statistical<br />

<strong>in</strong>odel wllicll relates the return of any<br />

given security to the return of the <strong>in</strong>arket<br />

portfolio. The model's l<strong>in</strong>ear specification<br />

follows from the assumed jo<strong>in</strong>t<br />

nor<strong>in</strong>ality of asset returns. For any security<br />

i the <strong>in</strong>arket <strong>in</strong>odel is<br />

where R,, <strong>and</strong> R,,,t are the period-t returns<br />

on security i <strong>and</strong> the <strong>in</strong>arket portfolio,<br />

respectively, <strong>and</strong> ~ , tis the zero<br />

mean disturbance term. a,, P,, <strong>and</strong> o$,<br />

are the parameters of the market <strong>in</strong>odel.<br />

In applications a broad based stock <strong>in</strong>dex<br />

is used for the <strong>in</strong>arket portfolio,<br />

with the S&P 500 Index, the CRSP<br />

Value Weighted Index, <strong>and</strong> the CRSP<br />

Equal Weighted Index be<strong>in</strong>g popular<br />

choices.<br />

The <strong>in</strong>arket <strong>in</strong>odel represents a potential<br />

i<strong>in</strong>prove<strong>in</strong>ent over the constant mean<br />

return model. By remov<strong>in</strong>g the portion<br />

of the return that is related to variation<br />

<strong>in</strong> the market's return, the variance of<br />

the abnormal return is reduced. This <strong>in</strong><br />

turn can lead to <strong>in</strong>creased ability to detect<br />

event effects. Tlle benefit from us<strong>in</strong>g<br />

the <strong>in</strong>arket <strong>in</strong>odel will depend upon<br />

the Rbf the <strong>in</strong>arket <strong>in</strong>odel regression.<br />

The lligller the Rqthe greater is the variance<br />

reduction of the abnormal return,<br />

<strong>and</strong> the larger is the ga<strong>in</strong>.<br />

C. Other Statistical Models<br />

A number of other statistical <strong>in</strong>odels<br />

have been proposed for model<strong>in</strong>g the<br />

nor<strong>in</strong>al return. A general type of statistical<br />

<strong>in</strong>odel is the factor model. Factor<br />

models are nlotivated by the benefits of<br />

reduc<strong>in</strong>g the variance of the abnormal<br />

return by expla<strong>in</strong><strong>in</strong>g <strong>in</strong>ore of the variation<br />

<strong>in</strong> the nor<strong>in</strong>al return. Typically the<br />

factors are portfolios of traded securities.<br />

The market model is an examnle of a one<br />

L <br />

factor model. Other <strong>in</strong>ultifactor models<br />

<strong>in</strong>clude <strong>in</strong>dustry <strong>in</strong>dexes <strong>in</strong> addition to<br />

the market. \Villiam Sllarpe (1970) <strong>and</strong><br />

Sharpe, Gordon Alex<strong>and</strong>er, <strong>and</strong> Jeffery<br />

Bailey (1995, p. 303) provide discussion<br />

of <strong>in</strong>dex models with factors based on <strong>in</strong>dustry<br />

classification. Another variant of a<br />

factor model is a procedure wllicll calculates<br />

the abnormal return by tak<strong>in</strong>g the<br />

difference between the actual return <strong>and</strong><br />

a portfolio of firms of si<strong>in</strong>ilar size, where<br />

size is measured by market value of equity.<br />

In this approach typically ten size<br />

groups are considered <strong>and</strong> the load<strong>in</strong>g on<br />

the size portfolios is restricted to unity.<br />

This procedure implicitly assumes that<br />

expected return is directly related to<br />

<strong>in</strong>arket value of equity.<br />

Generally, the ga<strong>in</strong>s from e<strong>in</strong>ploy<strong>in</strong>g<br />

<strong>in</strong>ultifactor <strong>in</strong>odels for event studies are<br />

limited. The reason for the limited ga<strong>in</strong>s<br />

is the empirical fact that the marg<strong>in</strong>al<br />

explanatory power of additional factors<br />

the <strong>in</strong>arket factor is s<strong>in</strong>all, <strong>and</strong> hence,<br />

there is little reduction <strong>in</strong> the variance of<br />

tlle abnormal return. The variance reduction<br />

will typically be greatest <strong>in</strong> cases<br />

where the sample fir<strong>in</strong>s have a co<strong>in</strong><strong>in</strong>on<br />

characteristic, for exa<strong>in</strong>ple they are all<br />

<strong>in</strong>embers of one <strong>in</strong>dustry or they are all<br />

fir<strong>in</strong>s concentrated <strong>in</strong> one <strong>in</strong>arket capitalization<br />

group. In these cases tlle use<br />

of a <strong>in</strong>ultifactor <strong>in</strong>odel warrants consideration.<br />

The use of other models is dictated by<br />

data availability. An example of a normal<br />

performance return model implemented<br />

<strong>in</strong> situations with limited data is the market-adjusted<br />

return model. For some<br />

events it is not feasible to have a preevent<br />

estimation period for the nor<strong>in</strong>al<br />

<strong>in</strong>odel parameters, <strong>and</strong> a <strong>in</strong>arket-adjusted<br />

abnor<strong>in</strong>al return is used. The <strong>in</strong>arket-adjusted<br />

return <strong>in</strong>odel can be viewed<br />

as a restricted <strong>in</strong>arket <strong>in</strong>odel with a, constra<strong>in</strong>ed<br />

to be zero <strong>and</strong> p, constra<strong>in</strong>ed to<br />

be one. Because the <strong>in</strong>odel coefficients

MacK<strong>in</strong>lny: Euent <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance<br />

19<br />

are prespecified, an esti<strong>in</strong>ation period is<br />

not required to obta<strong>in</strong> parameter estimates.<br />

An exanlple of wllen such a model<br />

is used is <strong>in</strong> studies of the under pric<strong>in</strong>g<br />

of <strong>in</strong>itial public offer<strong>in</strong>gs. Jay Ritter<br />

(1991) presents sucll an example. A general<br />

recommendation is to only use such<br />

restricted models if necessary, <strong>and</strong> if<br />

necessary, consider the possibility of biases<br />

aris<strong>in</strong>g from the ilnposition of the<br />

restrictions.<br />

D. Economic Models<br />

Econolnic models can be cast as restrictions<br />

on the statistical models to<br />

provide more constra<strong>in</strong>ed normal return<br />

models. Two common economic lnodels<br />

which provide restrictions are the Capital<br />

Asset Pric<strong>in</strong>g Model (CAPM) <strong>and</strong> the<br />

Arbitrage Pric<strong>in</strong>g Theory (APT). The<br />

CAPM due to Sharpe (1964) <strong>and</strong> John<br />

L<strong>in</strong>tner (196Fj) is an equilibrium theory<br />

where the expected return of a given asset<br />

is determ<strong>in</strong>ed by its covariance with<br />

the market portfolio. The APT due to<br />

Stephen Ross (1976) is an asset pric<strong>in</strong>g<br />

theory where the expected return of a<br />

given asset is a l<strong>in</strong>ear comb<strong>in</strong>ation of<br />

multiple risk factors.<br />

The use of the Capital Asset Pric<strong>in</strong>g<br />

Model is comnlon <strong>in</strong> event studies of the<br />

1970s. However, deviations from the<br />

CAPM have been discovered, imply<strong>in</strong>g<br />

that the validity of the restrictions imposed<br />

by the CAPM on the lnarket<br />

<strong>in</strong>odel is questionable.~llis has <strong>in</strong>troduced<br />

the possibility that the results<br />

of the studies may be sensitive to the<br />

specific CAPM restrictions. Because<br />

this potential for sensitivity can be<br />

avoided at little cost by us<strong>in</strong>g the market<br />

model, the use of the CAPM has almost<br />

ceased.<br />

Similarly, other studies have employed<br />

multifactor normal performance models<br />

'Eugene Fama <strong>and</strong> Kenneth French (1996)<br />

provide discussion of these anonlalies.<br />

motivated by the Arbitrage Pric<strong>in</strong>g<br />

Theory. A general f<strong>in</strong>d<strong>in</strong>g is that with<br />

the APT the most i<strong>in</strong>portant factor behaves<br />

like a market factor <strong>and</strong> additional<br />

factors add relatively little explanatory<br />

power. Thus the ga<strong>in</strong>s from us<strong>in</strong>g an<br />

APT motivated model versus the lnarket<br />

<strong>in</strong>odel are small. See Stephen Brown<br />

<strong>and</strong> Mark \Ve<strong>in</strong>ste<strong>in</strong> (1985) for further<br />

discussion. The ma<strong>in</strong> potential ga<strong>in</strong><br />

from us<strong>in</strong>g a model based on the arbitrage<br />

pric<strong>in</strong>g theory is to elim<strong>in</strong>ate the<br />

biases <strong>in</strong>troduced by us<strong>in</strong>g the CAPM.<br />

However, because the statistically motivated<br />

lnodels also elim<strong>in</strong>ate these biases,<br />

for event studies such models<br />

dom<strong>in</strong>ate.<br />

5. Measur<strong>in</strong>g <strong>and</strong> Analyz<strong>in</strong>g Abnormal<br />

Returns<br />

I11 this section the problem of <strong>in</strong>easur<strong>in</strong>g<br />

<strong>and</strong> analyz<strong>in</strong>g abnormal returns is<br />

considered. The framework is developed<br />

us<strong>in</strong>g the market <strong>in</strong>odel as the nor<strong>in</strong>al<br />

performance return model. The analysis<br />

is virtually identical for the constant<br />

mean return model.<br />

So<strong>in</strong>e notation is first def<strong>in</strong>ed to facilitate<br />

the measurement <strong>and</strong> analysis of abnormal<br />

returns. Returns will be <strong>in</strong>dexed<br />

<strong>in</strong> event time us<strong>in</strong>g 7. Def<strong>in</strong><strong>in</strong>g .t = 0 as<br />

the event date, .t = TI+ 1 to 7 = T2represents<br />

the event w<strong>in</strong>dow, <strong>and</strong> 7 = To+ 1 to<br />

7 = TI constitutes the estimation w<strong>in</strong>dow.<br />

Let L1= T1- To <strong>and</strong> L, = TZ- T1 be the<br />

length of the estimation w<strong>in</strong>dow <strong>and</strong> the<br />

event w<strong>in</strong>dow respectively. Even if the<br />

event be<strong>in</strong>g considered is an announcelnent<br />

on given date it is typical to<br />

set the event w<strong>in</strong>dow length to be larger<br />

than one. This facilitates the use of abnormal<br />

returns around the event day <strong>in</strong><br />

the analysis. \$'hen applicable, the postevent<br />

w<strong>in</strong>dow will be from .t = T2+ 1 to<br />

T = T; <strong>and</strong> of length L:i = T:3- T2.The tim<strong>in</strong>g<br />

sequence is illustrated wit11 a time<br />

l<strong>in</strong>e <strong>in</strong> Figure 1.

20 Journal of Economic Literature, Vol. XXXV (March 1997)<br />

estrrnation<br />

( I ] LsEv]<br />

post-event<br />

( ~v<strong>in</strong>clo~v]<br />

T,, T, 0 T1.<br />

---I---<br />

T,3<br />

'K<br />

Fig~~re 1. Time l<strong>in</strong>e for an event study.<br />

It is typical for the estimation w<strong>in</strong>dow<br />

<strong>and</strong> the event w<strong>in</strong>dow not to overlap.<br />

This design provides estimators for the<br />

parameters of the normal return <strong>in</strong>odel<br />

which are not <strong>in</strong>fluenced by the returns<br />

around the event. Includ<strong>in</strong>g tlle event<br />

w<strong>in</strong>dow <strong>in</strong> the estimation of tlle normal<br />

model parameters could lead to the<br />

event returns hav<strong>in</strong>g a large <strong>in</strong>fluence<br />

on the norrnal return measure. In<br />

this situation both the normal returns<br />

<strong>and</strong> the abnorrnal returns would capture<br />

the event impact. This would be<br />

problematic because the <strong>in</strong>ethodology<br />

is built around the assumption that<br />

the event irnpact is captured by the<br />

abnormal returns. On occasion, the<br />

post event w<strong>in</strong>dow data is <strong>in</strong>cluded<br />

with the estimation w<strong>in</strong>dow data to<br />

estimate the nor<strong>in</strong>al return <strong>in</strong>odel.<br />

The goal of this approach is to <strong>in</strong>crease<br />

the robustness of the norrnal market<br />

return rneasure to gradual changes<br />

<strong>in</strong> its parameters. In Section 6 exp<strong>and</strong><strong>in</strong>g<br />

the null hypothesis to acco<strong>in</strong><strong>in</strong>odate<br />

changes <strong>in</strong> the risk of a firm<br />

around the event is considered. In this case<br />

an estimation framework which uses the<br />

event w<strong>in</strong>dow returns will be required.<br />

A. Estimation of the Marlcet Model<br />

Under general conditions ord<strong>in</strong>ary<br />

least squares (OLS) is a consistent estimation<br />

procedure for the market model<br />

parameters. Further, given the assumptions<br />

of Section 4, OLS is efficient. For<br />

the it11 firm <strong>in</strong> event time, the OLS estimators<br />

of the rnarket model paranleters<br />

for an estimation w<strong>in</strong>dow of observations<br />

are<br />

where<br />

<strong>and</strong><br />

Ri, <strong>and</strong> R,,,, are the return <strong>in</strong> event period<br />

T for security i <strong>and</strong> the rnarket respectively.<br />

The use of the OLS esti<strong>in</strong>ators<br />

to nleasure abnorrnal returns <strong>and</strong> to<br />

develop their statistical properties is addressed<br />

next. First, the properties of a<br />

given security are presented followed by<br />

consideration of the properties of abnormal<br />

returns aggregated across securities.<br />

B. Statistical Properties of Abnorrl~al<br />

Returns<br />

Given the market nlodel parameter<br />

estimates, one can nleasure <strong>and</strong> analyze<br />

the abnorrnal returns. Let ARiT, T = T1+<br />

1,. . . , T,, be the sample of Lq abnornlal<br />

returns for firrn i <strong>in</strong> the event w<strong>in</strong>dow.<br />

Us<strong>in</strong>g the market <strong>in</strong>odel to measure the<br />

nor<strong>in</strong>al return, tlle sample abnor<strong>in</strong>al return<br />

is<br />

The abnor<strong>in</strong>al return is the disturbance<br />

term of the market rnodel calculated on<br />

an out of sanlple basis. Under the null<br />

hypothesis, conditional on the event w<strong>in</strong>-

MacK<strong>in</strong>lay: Euent <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance 21<br />

dow <strong>in</strong>arket returns, the abnormal returns<br />

will be jo<strong>in</strong>tly nor<strong>in</strong>ally distributed<br />

with a zero conditional <strong>in</strong>ean <strong>and</strong> conditional<br />

variance o"ARiT) where<br />

From (S), the conditional variance has<br />

two co<strong>in</strong>ponents. One component is the<br />

disturbance variance oz, frorn (3) <strong>and</strong> a<br />

second component is additional variance<br />

due to the salnpl<strong>in</strong>g error <strong>in</strong> al <strong>and</strong> Pi.<br />

This sarnpl<strong>in</strong>g error, which is common<br />

for all the event w<strong>in</strong>dow observations,<br />

also leads to serial correlation of the<br />

abnorrnal returns despite tlle fact that<br />

the true disturbances are <strong>in</strong>dependent<br />

through ti<strong>in</strong>e. As the length of the est<strong>in</strong>lation<br />

w<strong>in</strong>dow L1 beconles large, the<br />

second term approaches zero as the sampl<strong>in</strong>g<br />

error of the parameters vanishes.<br />

The variance of the abnormal return will<br />

be o:, <strong>and</strong> the abnorrnal return observations<br />

will become <strong>in</strong>dependent through<br />

ti<strong>in</strong>e. In practice, the estimation w<strong>in</strong>dow<br />

can usually be chosen to be large enough<br />

to rnake it reasonable to assunle that the<br />

contribution of the second conlponent to<br />

the variance of the abnorrnal return is<br />

zero.<br />

Under the null hypothesis, Ho, that<br />

the event has no i<strong>in</strong>pact on tlle behavior<br />

of returns (mean or variance)<br />

the distributional properties of the<br />

abnorrnal returns can be used to draw<br />

<strong>in</strong>ferences over any period with<strong>in</strong> the<br />

i I<br />

event w<strong>in</strong>dow. Under Ho the distribution<br />

of the sarnple abnorrnal return of a<br />

given observation <strong>in</strong> the event w<strong>in</strong>dow is<br />

AR,, - N(O,o"AR,,)). (9)<br />

Next (9)is built upon to consider the aggregation<br />

of the abnormal returns.<br />

C. Aggregation of Abnormal Returns<br />

The abnornlal return observations<br />

must be aggregated <strong>in</strong> order to draw<br />

overall <strong>in</strong>ferences for the event of <strong>in</strong>terest.<br />

The aggregation is along two dimensions-through<br />

time <strong>and</strong> across securities.<br />

We will first consider aggregation<br />

through time for an <strong>in</strong>dividual security<br />

<strong>and</strong> then will consider aggregation both<br />

across securities <strong>and</strong> through ti<strong>in</strong>e. The<br />

concept of a cunlulative abnormal return<br />

is necessary to acconlrnodate a multiple<br />

period event w<strong>in</strong>dow. Def<strong>in</strong>e CARi(zl,z,)<br />

as the sample cu<strong>in</strong>ulative abnor<strong>in</strong>al return<br />

(CAR) fro<strong>in</strong> 71 to 72 where<br />

T1< zl 5 z2 5 T2.The CAR fro<strong>in</strong> 7, to T~ is<br />

the sum of the <strong>in</strong>cluded abnorrnal returns.<br />

7,<br />

CAR,(z,,z,) = AR,,. (10)<br />

7 = 7,<br />

Asy<strong>in</strong>ptotically (as L1 <strong>in</strong>creases) the variance<br />

of CAR,is<br />

This large sarnple estimator of the variance<br />

can be used for reasonable values of<br />

L1. However, for srnall values of L1 the<br />

variance of the cu<strong>in</strong>ulative abnor<strong>in</strong>al return<br />

should be adjusted for the effects of<br />

the estimation error <strong>in</strong> the nor<strong>in</strong>al model<br />

parameters. This adjustment <strong>in</strong>volves the<br />

second term of (S) <strong>and</strong> a further related<br />

adjustment for the serial covariance of<br />

the abnormal return.<br />

The distribution of the cumulative abnorrnal<br />

return under Ho is<br />

CARi(z1,z2)- N(O,o(z,,z,)). (12)<br />

Given the null distributions of tlle abnorrnal<br />

return <strong>and</strong> the cunlulative abnornlal<br />

return, tests of the null hypothesis can<br />

be conducted.<br />

However, tests with one event observation<br />

are not likely to be useful so it is<br />

necessary to aggregate. The abnormal return<br />

observations must be aggregated for<br />

the event w<strong>in</strong>dow <strong>and</strong> across observations<br />

of the event. For this aggregation,

Journal of Econonzic Literature, Vol. XXXV (March 1997)<br />

<strong>Event</strong><br />

Day<br />

AR<br />

-20 ,093<br />

-19 -.I77<br />

-18 ,088<br />

-17 ,024<br />

-16 -.018<br />

-15 -.040<br />

-14 ,038<br />

-13 ,056<br />

-12 ,065<br />

-11 ,069<br />

-10 ,028<br />

-9 ,155<br />

-8 ,057<br />

--i -.010<br />

-6 ,104<br />

-5 ,085<br />

-4 ,099<br />

-3 ,117<br />

-2 ,006<br />

-1 ,164<br />

0 ,965<br />

1 .251<br />

2 -.014<br />

3 -.I64<br />

4 -.014<br />

5 ,135<br />

6 -.052<br />

-<br />

,060<br />

8 ,155<br />

9 -.008<br />

10 ,164<br />

11 -.081<br />

12 -.058<br />

13 -.I65<br />

14 -.081<br />

15 -.007<br />

16 ,065<br />

17 ,081<br />

18 ,172<br />

19 -.043<br />

20 ,013<br />

TABLE 1<br />

Market Model<br />

Good News No News Bad News<br />

CAR AR CAR AR CAR<br />

,093<br />

-.084<br />

,004<br />

,029<br />

,011<br />

-.029<br />

,008<br />

,064<br />

,129<br />

,199<br />

,227<br />

,382<br />

,438<br />

,428<br />

,532<br />

,616<br />

,715<br />

,832<br />

,838<br />

1.001<br />

1.966<br />

2.217<br />

2.203<br />

2.039<br />

2.024<br />

2.160<br />

2.107<br />

2.167<br />

2.323<br />

2.315<br />

2.479<br />

2.398<br />

2.341<br />

2.176<br />

2.095<br />

2.088<br />

2.153<br />

2.234<br />

2.406<br />

2.363<br />

2.377

MacK<strong>in</strong>lay: Erjent <strong>Studies</strong> <strong>in</strong> Econonzics <strong>and</strong> F<strong>in</strong>ance 23<br />

TABLE 1(Cont.)<br />

Constant Mean Return Model<br />

Good News No News Bad News<br />

AR CAR AR CAR AR CAR<br />

,105 .lo5 ,019 ,019 -.077 -.077<br />

-.235 -.I29 -.048 -.029 -.I42 -.219<br />

,069 -.060 -.086 -.I15 -.043 -.262<br />

-.026 -.086 -.I40 -.255 -.057 -.319<br />

-.086 -.I72 ,039 -.216 -.075 -.394<br />

-.I83 -.355 ,099 -.I17 -.037 -.431<br />

-.020 -.375 -. 150 -.266 -.lo1 -.532<br />

-.025 -.399 -.I91 -.458 -.069 -.GO1<br />

,101 -.298 ,133 -.325 -.lo6 -.I01<br />

- -<br />

,126 -.I72 ,006 -.319 -.I69 -.876<br />

,134 -.038 ,103 -.216 -.009 -.885<br />

,210 ,172 ,022 -.I94 ,011 -.874<br />

,106 ,278 ,163 .-031 ,135 -.738<br />

-.002 ,277 ,009 -.022 -.027 -.765<br />

,011 ,288 -.029 -.051 ,030 -.735<br />

,061 ,349 -.068 -.I20 ,320 -.415<br />

,031 ,379 ,089 -.031 -.205 -.620<br />

,067 ,447 ,013 -.018 ,085 -.536<br />

,010 ,456 ,311 ,294 -.256 -.791<br />

,198 ,654 -.I70 ,124 -.227 -1.018<br />

1.034 1.688 -.I64 -.040 -.643 -1.661<br />

,357 2.045 -.I70 -.210 -.212 -1.873<br />

-.013 2.033 ,054 -.I56 ,078 -1.795<br />

,088 1.944 -.I21 -.277 ,146: -1.648<br />

,041 1.985 ,023 -.253 ,149 -1.499<br />

,248 2.233 -.003 -256 ,286 -1.214<br />

-.035 2.198 -.319 -.575 ,070 -1.143<br />

,017 2.215 -. 112 -.687 ,102 -1.041<br />

,112 2.326 -.I87 -.874 ,056 -.986<br />

-.052 2.274 -.057 -.931 -.071 -1.056<br />

,147 2.421 ,203 -.728 ,267 -.789<br />

-.013 2.407 ,045 -.683 ,006 -.783<br />

-.054 2.354 ,299 -.384 ,017 -.766<br />

-.246 2.107 -.067 -.451 ,114 -.652<br />

-.011 2.096 -.024 -.475 ,089 -.564<br />

-.027 2.068 -.059 -.534 -.022 -.585<br />

,103 2.171 -.046 -.580 -.084 -.670<br />

,066 2.237 -.098 -.677 -.054 -.724<br />

,110 2.347 ,021 -.656 -.071 -.795<br />

-.055 2.292 ,088 -.568 ,026 -.769<br />

,019 2.311 ,013 -554 -.I15 -.884<br />

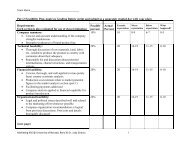

Abnormal retulns for an event study of the <strong>in</strong>formation content of earn<strong>in</strong>gs announcements. The sample consists of<br />

a total of 600 quarterly announcements for the 30 companies <strong>in</strong> the Dow Jones Industrial Index for the five year<br />

period Januay 1989to December 1993.Two models are considered for the normal returns, the market model us<strong>in</strong>g<br />

the CRSP value-weighted <strong>in</strong>dex <strong>and</strong> the constant return model. The announcements are categorized <strong>in</strong>to three<br />

groups, good news, no news, <strong>and</strong> bad news. AR is the sample average abnormal return for the specified day <strong>in</strong> event<br />

time <strong>and</strong> CAR is the sample average cumulative abnormal return for day -20 to the specified day <strong>Event</strong> time is days<br />

relative to the announcement date.

24 Journal of Economic Literature, Vol. XXXV (March 1997)<br />

it is assumed that there is not any cluster<strong>in</strong>g.<br />

That is, there is not any overlap<br />

<strong>in</strong> the event w<strong>in</strong>dows of the <strong>in</strong>cluded securities.<br />

The absence of any overlap <strong>and</strong><br />

the ma<strong>in</strong>ta<strong>in</strong>ed distributional assumptions<br />

imply that the abnormal returns <strong>and</strong> the<br />

cumulative abnorrnal returns will be <strong>in</strong>dependent<br />

across securities. Later <strong>in</strong>ferences<br />

with cluster<strong>in</strong>g will be discussed.<br />

The <strong>in</strong>dividual securities' abnormal returns<br />

can be aggregated us<strong>in</strong>g AR,, b<strong>in</strong> (7)<br />

for each event period, z = TI + 1, . . . ,Te<br />

Given N events, the sa<strong>in</strong>ple aggregated<br />

abnor<strong>in</strong>al returns for period T is<br />

1<br />

Y<br />

AT,=-xAR,,<br />

N<br />

i=l<br />

<strong>and</strong> for large L1, its variance is<br />

- A'<br />

Us<strong>in</strong>g these estimates, the abnor<strong>in</strong>al returns<br />

for any event period can be analyzed.<br />

The average abnor<strong>in</strong>al returns can<br />

then be aggregated over the event w<strong>in</strong>dow<br />

us<strong>in</strong>g the same approach as that<br />

used to calculate the curnulative abnormal<br />

return for each security i. For any<br />

<strong>in</strong>terval <strong>in</strong> the event w<strong>in</strong>dow<br />

72<br />

V~~(C~(T~,T~)) = x var (AT,). (16)<br />

7 = 5,<br />

Observe that equivalently one can forrn<br />

the CAR'S security by security <strong>and</strong> then<br />

aggregate through tirne,<br />

For the variance estimators the assumption<br />

that the event w<strong>in</strong>dows of the N securities<br />

do not overlap is used to set the<br />

covariance terms to zero. Inferences<br />

about the cunlulative abnormal returns<br />

can be drawn us<strong>in</strong>g<br />

to test the null hypothesis that the abnorrnal<br />

returns are zero. In practice, because<br />

ozi is unknown, an estimator rnust<br />

be used to calculate the variance of the<br />

abnorrnal returns as <strong>in</strong> (14). The usual<br />

sanlple variance measure of o:, frorn the<br />

rnarket model regression <strong>in</strong> the esti<strong>in</strong>ation<br />

w<strong>in</strong>dow is an appropriate choice.<br />

Us<strong>in</strong>g this to calculate vaI(AxT) <strong>in</strong> (14),<br />

Ho can be tested us<strong>in</strong>g<br />

This distributional result is asyrnptotic<br />

with respect to the nurnber of securities<br />

N <strong>and</strong> the length of estimation w<strong>in</strong>dow LI.<br />

Modifications to the basic approach<br />

presented above are possible. One corn<strong>in</strong>on<br />

modification is to st<strong>and</strong>ardize each<br />

abnornlal return us<strong>in</strong>g an est<strong>in</strong>lator of its<br />

st<strong>and</strong>ard deviation. For certa<strong>in</strong> alternatives,<br />

such st<strong>and</strong>ardization can lead to<br />

<strong>in</strong>ore powerful tests. James Pate11 (1976)<br />

presents tests based on st<strong>and</strong>ardization<br />

<strong>and</strong> Brown <strong>and</strong> Warner (1980, 1985)<br />

provide comparisons with the basic approach.<br />

D. CAR:s for tlze Earn<strong>in</strong>gs<br />

Announcement Example<br />

The <strong>in</strong>formation content of earn<strong>in</strong>gs<br />

exanlple previously described illustrates<br />

the use of sample abnorrnal residuals <strong>and</strong><br />

sa<strong>in</strong>ple cumulative abnornlal returns. Table<br />

1 presents the abnor<strong>in</strong>al returns av-

MacK<strong>in</strong>lay: Euent <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance<br />

25<br />

<strong>Event</strong> T<strong>in</strong>ie<br />

--+Good Neu-s Firms ----+-- No h'eu-s Firms Bad News Films<br />

Figure 2a. Plot of culnulative abnormal return for earn<strong>in</strong>g announcements from event day -20 to event<br />

day 20. The abnormal return is calculated us<strong>in</strong>g the market model as the normal return measure.<br />

eraged across the 600 event observations<br />

(30 firms, 20 announcenlents per firm)<br />

as well as the aggregated cumulative abnormal<br />

return for each of the three earn<strong>in</strong>gs<br />

news categories. Two norrnal return<br />

models are considered; the market<br />

nlodel <strong>and</strong> for comparison, the constant<br />

rnean return model. Plots of the cumulative<br />

abnormal returns are also <strong>in</strong>cluded,<br />

with the CAR's from the market <strong>in</strong>odel<br />

<strong>in</strong> Figure 2a <strong>and</strong> the CAR's frorn the<br />

constant rnean return nlodel <strong>in</strong> Figure<br />

2b.<br />

The results of this example are largely<br />

consistent with the exist<strong>in</strong>g literature on<br />

the <strong>in</strong>formation content of earn<strong>in</strong>gs. The<br />

evidence strongly supports the hypothesis<br />

that earn<strong>in</strong>gs announce<strong>in</strong>ents do <strong>in</strong>-<br />

deed convey <strong>in</strong>fornlation useful for the<br />

valuation of firms. Focus<strong>in</strong>g on the announcelllent<br />

day (day 0) the sa<strong>in</strong>ple average<br />

abnornlal return for the good news<br />

firm us<strong>in</strong>g the market nlodel is 0.965<br />

percent. Given the st<strong>and</strong>ard error of the<br />

one day good news average abnormal return<br />

is 0.104 percent, the value of O1 is<br />

9.28 <strong>and</strong> the null hypothesis that the<br />

event has no impact is strongly rejected.<br />

The story is the same for the bad news<br />

firms. The event day sa<strong>in</strong>ple abnormal<br />

return is -0.679 percent, with a st<strong>and</strong>ard<br />

error of 0.098 percent, lead<strong>in</strong>g to O1<br />

equal to -6.93 <strong>and</strong> aga<strong>in</strong> strong evidence<br />

aga<strong>in</strong>st the null hypothesis. As would be<br />

expected, the abnornlal return of the no<br />

news firrns is srnall at -0.091 percent <strong>and</strong>

26 Journal of Economic Literature, Vol. XXXV (March 1997)<br />

- 0 . 0 2 5 0 1<br />

-21 -18 -15 -12 -9 -6 -3 0 3 G 9 12 15<br />

<strong>Event</strong> Time<br />

C;ood News Firllls -No News Firms ----t- Had News Firms<br />

Figure 2b. Plot of cu<strong>in</strong>ulative abnormal return for earn<strong>in</strong>g announcements fro<strong>in</strong> event day -20 to event<br />

day 20. The abnormal return is calculated us<strong>in</strong>g the constant mean return model as the normal return<br />

with a st<strong>and</strong>ard error of 0.098 percent<br />

is less than one st<strong>and</strong>ard error from zero.<br />

There is some evidence of the announcement<br />

effect on day one. The average<br />

abnormal return is 0.251 percent <strong>and</strong><br />

-0.204 percent for the good news <strong>and</strong><br />

the bad news firms respectively. Both<br />

these values are more than two st<strong>and</strong>ard<br />

errors from zero. The source of these<br />

day one effects is likely to be that some<br />

of the earn<strong>in</strong>gs announcements are made<br />

on event day zero after the close of the<br />

stock market. In these cases, the effects<br />

will be captured <strong>in</strong> the return on day<br />

one.<br />

The conclusions us<strong>in</strong>g the abnormal<br />

returns from the constant return model<br />

are consistent with those from the market<br />

model. However, there is some loss<br />

of precision us<strong>in</strong>g the constant return<br />

model, as the variance of the average abnormal<br />

return <strong>in</strong>creases for all three<br />

categories. When measur<strong>in</strong>g abnormal<br />

returns with the constant mean return<br />

model the st<strong>and</strong>ard errors <strong>in</strong>crease from<br />

0.104 percent to 0.130 percent for good<br />

news firms, from 0.098 percent to 0.124<br />

percent for no news firms, <strong>and</strong> from<br />

0.098 percent to 0.131 percent for bad<br />

news firms. These <strong>in</strong>creases are to be expected<br />

when consider<strong>in</strong>g a sample of<br />

large firms such as those <strong>in</strong> the Dow Index<br />

because these stocks tend to have an<br />

important market component whose variability<br />

is elim<strong>in</strong>ated us<strong>in</strong>g the market<br />

model.<br />

The CAR plots show that to some extent<br />

the market gradually learns about<br />

the forthcom<strong>in</strong>g announcement. The average<br />

CAR of the good news firms<br />

gradually drifts up <strong>in</strong> days -20 to -1<br />

<strong>and</strong> the average CAR of the bad news<br />

firms gradually drifts down over this<br />

period. In the days after the an-

MacK<strong>in</strong>lay: <strong>Event</strong> <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance 27<br />

nouncement the CAR is relatively stable<br />

as would be expected, although there<br />

does tend to be a slight (but statistically<br />

<strong>in</strong>significant) <strong>in</strong>crease with the<br />

bad news firms <strong>in</strong> days two through<br />

eight.<br />

E. Inferences tuith Cluster<strong>in</strong>g<br />

The analysis aggregat<strong>in</strong>g abnormal returns<br />

has assumed that the event w<strong>in</strong>dows<br />

of the <strong>in</strong>cluded securities do not<br />

overlap <strong>in</strong> calendar time. This assumption<br />

allows us to calculate the variance of<br />

the aggregated sample cumulative abnormal<br />

returns without concern about the<br />

covariances across securities because<br />

they are zero. However, when the event<br />

w<strong>in</strong>dows do overlap <strong>and</strong> the covariances<br />

between the abnormal returns will not<br />

be zero, the distributional results presented<br />

for the aggregated abnormal returns<br />

are no longer applicable. Victor<br />

Bernard (1987) discusses some of the<br />

problems related to cluster<strong>in</strong>g.<br />

Cluster<strong>in</strong>g can be accommodated <strong>in</strong><br />

two ways. The abnormal returns can be<br />

aggregated <strong>in</strong>to a portfolio dated us<strong>in</strong>g<br />

event time <strong>and</strong> the security level analysis<br />

of Section 5 can applied to the portfolio.<br />

This approach will allow for cross correlation<br />

of the abnormal returns.<br />

A second method to h<strong>and</strong>le cluster<strong>in</strong>g<br />

is to analyze the abnormal returns without<br />

aggregation. One can consider test<strong>in</strong>g<br />

the null hypothesis of the event hav<strong>in</strong>g<br />

no impact us<strong>in</strong>g unaggregated<br />

security by security data. This approach<br />

is applied most commonly when there is<br />

total cluster<strong>in</strong>g, that is, there is an event<br />

on the same day for a number of firms.<br />

The basic approach is an application of<br />

a multivariate regression model with<br />

dummy variables for the event date. This<br />

approach is developed <strong>in</strong> the papers of<br />

Kather<strong>in</strong>e Schipper <strong>and</strong> Rex Thompson<br />

(1983, 1985) <strong>and</strong> Daniel Coll<strong>in</strong>s <strong>and</strong><br />

Warren Dent (1984). The advantage of<br />

the approach is that, unlike the portfolio<br />

approach, an alternative hypothesis<br />

where some of the firms have positive<br />

abnormal returns <strong>and</strong> some of the firms<br />

have negative abnormal returns can be<br />

accommodated. However, <strong>in</strong> general<br />

the approach has two drawbacks-frequently<br />

the test statistic will have<br />

poor f<strong>in</strong>ite sample properties except <strong>in</strong><br />

special cases <strong>and</strong> often the test will<br />

have little power aga<strong>in</strong>st economically<br />

reasonable alternatives. The multivariate<br />

framework <strong>and</strong> its analysis is similar<br />

to the analysis of multivariate tests<br />

of asset pric<strong>in</strong>g models. MacK<strong>in</strong>lay<br />

(1987) provides analysis <strong>in</strong> that context.<br />

6. Modijiy<strong>in</strong>g the Null Hypothesis<br />

Thus far the focus has been on a s<strong>in</strong>gle<br />

null hypothesis-that the given event has<br />

no impact on the behavior of the returns.<br />

With this null hypothesis either a mean<br />

effect or a variance effect will represent<br />

a violation. However, <strong>in</strong> some applications<br />

one may be <strong>in</strong>terested <strong>in</strong> test<strong>in</strong>g for<br />

a mean effect. In these cases, it is necessary<br />

to exp<strong>and</strong> the null hypothesis to allow<br />

for chang<strong>in</strong>g (usually <strong>in</strong>creas<strong>in</strong>g)<br />

variances. To allow for chang<strong>in</strong>g variance<br />

as part of the null hypothesis, it is necessary<br />

to elim<strong>in</strong>ate the reliance on the<br />

past returns to estimate the variance of<br />

the aggregated cumulative abnormal returns.<br />

This is accomplished by us<strong>in</strong>g the<br />

cross section of cumulative abnormal returns<br />

to form an estimator of the variance<br />

for test<strong>in</strong>g the null hypothesis.<br />

Ekkehart Boehmer, Jim Musumeci, <strong>and</strong><br />

Annette Poulsen (1991) discuss methodology<br />

to accommodate chang<strong>in</strong>g variance.<br />

The cross sectional approach to estimat<strong>in</strong>g<br />

the variance can be applied to<br />

the average cumulative abnormal return<br />

--<br />

(CAR (T,,T~)).Us<strong>in</strong>g the cross-section to<br />

form an estimator of the variance gives

28 Journal of Economic Literature, Vol. XXXV (March 1997)<br />

For this estimator of the variance to be<br />

consistent, the abnormal returns need to<br />

be uncorrelated <strong>in</strong> the cross-section. An<br />

absence of cluster<strong>in</strong>g is sufficient for this<br />

requirement. Note that cross-sectional<br />

homoskedasticity is not required. Given<br />

this variance estimator, the null hypothesis<br />

that the cumulative abnormal returns<br />

are zero can then be tested us<strong>in</strong>g the<br />

usual theory.<br />

One may also be <strong>in</strong>terested <strong>in</strong> the<br />

question of the impact of an event on the<br />

risk of a firm. The relevant measure of<br />

risk must be def<strong>in</strong>ed before this question<br />

can be addressed. One choice as a risk<br />

measure is the market model beta which<br />

is consistent with the Capital Asset Pric<strong>in</strong>g<br />

Model be<strong>in</strong>g appropriate. Given this<br />

choice, the market model can be formulated<br />

to allow the beta to change over<br />

the event w<strong>in</strong>dow <strong>and</strong> the stability of the<br />

risk can be exam<strong>in</strong>ed. Edward Kane <strong>and</strong><br />

Haluk Unal (1988) present an application<br />

of this idea.<br />

7. Analysis of Pozoer<br />

An important consideration when sett<strong>in</strong>g<br />

up an event study is the ability to<br />

detect the presence of a non-zero abnormal<br />

return. The <strong>in</strong>ability to dist<strong>in</strong>guish<br />

between the null hypothesis <strong>and</strong> economically<br />

<strong>in</strong>terest<strong>in</strong>g alternatives would<br />

suggest the need for modification of the<br />

design. In this section the question of<br />

the likelihood of reject<strong>in</strong>g the null hypothesis<br />

for a specified level of abnormal<br />

return associated with an event is addressed.<br />

Formally, the power of the test<br />

is evaluated.<br />

Consider a two-sided test of the null<br />

hypothesis us<strong>in</strong>g the cumulative abnormal<br />

return based statistic 8, from (20).<br />

It is assumed that the abnormal returns<br />

are uncorrelated across securities; thus<br />

3'<br />

the variance of CARis 1/~" ~(zl,zz)<br />

i=l<br />

<strong>and</strong> N is the sample size. Because the<br />

null distribution of 8, is st<strong>and</strong>ard normal,<br />

for a two sided test of size a, the null<br />

hypothesis will be rejected if 81is <strong>in</strong> the<br />

critical region, that is,<br />

where c(x) = $-'(x). $(.) is the st<strong>and</strong>ard<br />

normal cumulative distribution function<br />

(CDF).<br />

Given the specification of the alternative<br />

hypothesis HA <strong>and</strong> the distribution<br />

of for this alternative, the power of a<br />

test of size a can be tabulated us<strong>in</strong>g the<br />

power function,<br />

The distribution of 81under the alternative<br />

hypothesis considered below will be<br />

normal. The mean will be equal to the<br />

true cumulative abnormal return divided<br />

by the st<strong>and</strong>ard deviation of CAR <strong>and</strong><br />

the variance will be equal to one.<br />

To tabulate the power one must posit<br />

economically plausible scenarios. The alternative<br />

hypotheses considered are<br />

four levels of abnormal returns, 0.5<br />

percent, 1.0 percent, 1.5 percent, <strong>and</strong><br />

2.0 percent <strong>and</strong> two levels of the average<br />

variance for the cumulative abnormal<br />

return of a given security over the<br />

event period, 0.0004 <strong>and</strong> 0.0016. The

MacK<strong>in</strong>lay: <strong>Event</strong> <strong>Studies</strong> <strong>in</strong> <strong>Economics</strong> <strong>and</strong> F<strong>in</strong>ance 29<br />

TABLE 2<br />

Abllorlnal Return<br />

Abnorlnal Return<br />

Sample<br />

Size<br />

,005<br />

,010 ,015<br />

0 = 0.02<br />

,020 ,005<br />

,010 ,015<br />

0 = 0.04<br />

,020<br />

Power of event study illethodology for test of the null hypothesis that the abnormal return is zero. The power is<br />

reported for a two-sided test us<strong>in</strong>g 81 with a size of 5 percent. The sample size is the number of event observations<br />

<strong>in</strong>cluded the study <strong>and</strong> 0 is the square root of the average variance of the abnorlnal return across firms.<br />

sample size, that is the number of securi- ues calculated us<strong>in</strong>g c(a/2) <strong>and</strong> c(1 -<br />

ties for which the event occurs, is a/2) are -1,96 <strong>and</strong> 1.96 respectively. Of<br />

varied from one to 200. The power for course, <strong>in</strong> applications, the power of the<br />

a test with a size of 5 percent is docu- test should be considered when select<strong>in</strong>g<br />

mented. With a = 0.05, the critical val- the size.

30 Journal of Econo~nic Literature, Vol. XXXV (March 1997)<br />

Nlui~l~er of Securities<br />

Figure 3a. 1'on.c.r of everit study test statistic 0, to reject tlie lilill li~potliesis that tlie al~riormal retlnn is zero, IT-Ire11 the<br />

sqilare root of die a\wage \.arialice of tlre n1)lioririal retl~rn across fir<strong>in</strong>s 1s 2 percerit.<br />

The power results are presented <strong>in</strong> Table<br />

2, <strong>and</strong> are plotted <strong>in</strong> Figures 3a <strong>and</strong><br />

3b. The results <strong>in</strong> the left panel of Table<br />

2 <strong>and</strong> Figure 3a are for the case where<br />

the average variance is 0.0004. This corresponds<br />

to a cu<strong>in</strong>ulative abnormal return<br />

st<strong>and</strong>ard deviation of 2 percent <strong>and</strong><br />

is an appropriate value for an event<br />

which does not lead to <strong>in</strong>creased variance<br />

<strong>and</strong> can be exam<strong>in</strong>ed us<strong>in</strong>g a oneday<br />

event w<strong>in</strong>dow. In terms of hav<strong>in</strong>g<br />

high power this is the best case scenario.<br />

The results illustrate that when the abnormal<br />

return is only 0.5 percent the<br />

power can be low. For example with a<br />

sample size of 20 the power of a 5<br />

percent test is only 0.20. One needs a<br />

sample of over 60 firms before the<br />

power reaches 0.50. However, for a<br />

given sample size, <strong>in</strong>creases <strong>in</strong> power<br />

are substantial when the abnormal<br />

return is larger. For example, when the<br />

abnormal return is 2.0 percent the<br />

power of a 5 percent test with 20 firms<br />

is almost 1.00 with a value of 0.99.<br />

The general results for a variance of<br />

0.0004 is that when the abnormal return<br />

is larger than 1 percent the power is<br />

quite high even for small sample sizes.<br />

When the abnormal return is small a<br />

larger sa<strong>in</strong>ple size is necessary to achieve<br />

high power.<br />

In the right panel of Table 2 <strong>and</strong> <strong>in</strong><br />

Figure 3b the power results are presented<br />

for the case where the average<br />

variance of the cumulative abnormal return<br />

is 0.0016. This case corresponds<br />

roughly to either a multi-day event w<strong>in</strong>dow<br />

or to a one-day event w<strong>in</strong>dow with<br />

tlle event lead<strong>in</strong>g to <strong>in</strong>creased variance

MacK<strong>in</strong>lay: Euent <strong>Studies</strong> <strong>in</strong> Econo~nics <strong>and</strong> F<strong>in</strong>ance 31<br />

Figure 3b. Poxver of event stildy test statistic 8, to reject the nil11 li~potliesis t1i;tt tlie a11nor<strong>in</strong>;tl retilni is zero, wlien<br />

the scp~aw root of tlie average varialice of the al)norii~;~l return across Arms is 3 percent.<br />

which is acco<strong>in</strong><strong>in</strong>odated as part of the<br />

null hypothesis. When the average variance<br />

of the CAR is <strong>in</strong>creased from<br />

0.0004 to 0.0016 there is a dramatic<br />

power decl<strong>in</strong>e for a 5 percent test. When<br />

the CAR is 0.5 percent the power is only<br />

0.09 with 20 fir<strong>in</strong>s <strong>and</strong> is only 0.42 with a<br />

sample of 200 firms. This magnitude of<br />

abnormal return is difficult to detect<br />

with the larger variance. In contrast,<br />

when the CAR is as large as 1.5 percent<br />

or 2.0 percent the 5 percent test is still<br />

has reasonable power. For example,<br />

when the abnormal return is 1.5 percent<br />

<strong>and</strong> there is a sample size of 30 the<br />

power is 0.54. Generally if the abnormal<br />

return is large one will have little difficulty<br />

reject<strong>in</strong>g the null hypothesis of no<br />

abnormal return.<br />

In the preced<strong>in</strong>g analysis the power is<br />

considered analytically for the given distributional<br />

assumptions. If the distributional<br />

assumptions are <strong>in</strong>appropriate<br />

then the results may differ. However,<br />

Brown <strong>and</strong> Warner (1985) consider this<br />