Task force on Promoting Affordable Housing - Naredco

Task force on Promoting Affordable Housing - Naredco

Task force on Promoting Affordable Housing - Naredco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<str<strong>on</strong>g>Task</str<strong>on</strong>g> Force <strong>on</strong> <strong>Promoting</strong> <strong>Affordable</strong> <strong>Housing</strong><br />

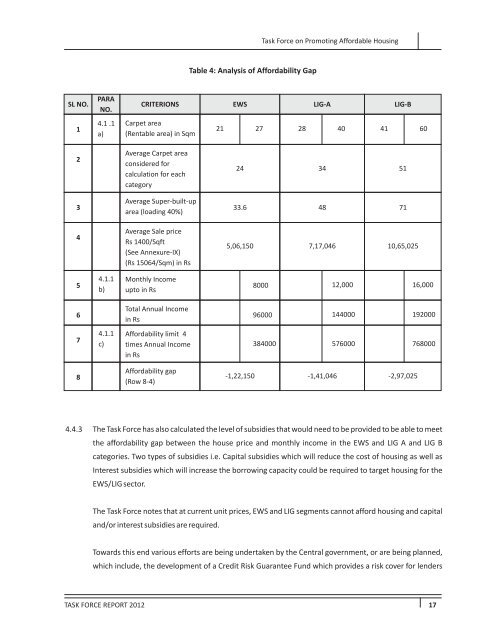

Table 4: Analysis of Affordability Gap<br />

SL NO.<br />

PARA<br />

NO.<br />

CRITERIONS<br />

EWS<br />

LIG-A<br />

LIG-B<br />

1<br />

4.1 .1<br />

a)<br />

Carpet area<br />

(Rentable area) in Sqm<br />

21 27 28 40 41 60<br />

2<br />

Average Carpet area<br />

c<strong>on</strong>sidered for<br />

calculati<strong>on</strong> for each<br />

category<br />

24<br />

34 51<br />

3<br />

Average Super-built-up<br />

area (loading 40%)<br />

33.6 48 71<br />

4<br />

Average Sale price<br />

Rs 1400/Sqft<br />

(See Annexure-IX)<br />

(Rs 15064/Sqm) in Rs<br />

5,06,150<br />

7,17,046<br />

10,65,025<br />

5<br />

4.1.1<br />

b)<br />

M<strong>on</strong>thly Income<br />

upto in Rs<br />

8000<br />

12,000<br />

16,000<br />

6<br />

Total Annual Income<br />

in Rs<br />

96000<br />

144000<br />

192000<br />

7<br />

4.1.1<br />

c)<br />

Affordability limit 4<br />

times Annual Income<br />

in Rs<br />

384000<br />

576000<br />

768000<br />

8<br />

Affordability gap<br />

(Row 8-4)<br />

-1,22,150<br />

-1,41,046<br />

-2,97,025<br />

4.4.3 The <str<strong>on</strong>g>Task</str<strong>on</strong>g> Force has also calculated the level of subsidies that would need to be provided to be able to meet<br />

the affordability gap between the house price and m<strong>on</strong>thly income in the EWS and LIG A and LIG B<br />

categories. Two types of subsidies i.e. Capital subsidies which will reduce the cost of housing as well as<br />

Interest subsidies which will increase the borrowing capacity could be required to target housing for the<br />

EWS/LIG sector.<br />

The <str<strong>on</strong>g>Task</str<strong>on</strong>g> Force notes that at current unit prices, EWS and LIG segments cannot afford housing and capital<br />

and/or interest subsidies are required.<br />

Towards this end various efforts are being undertaken by the Central government, or are being planned,<br />

which include, the development of a Credit Risk Guarantee Fund which provides a risk cover for lenders<br />

TASK FORCE REPORT 2012<br />

17