Trading the Opening Range - The Swing Trading Guide

Trading the Opening Range - The Swing Trading Guide

Trading the Opening Range - The Swing Trading Guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

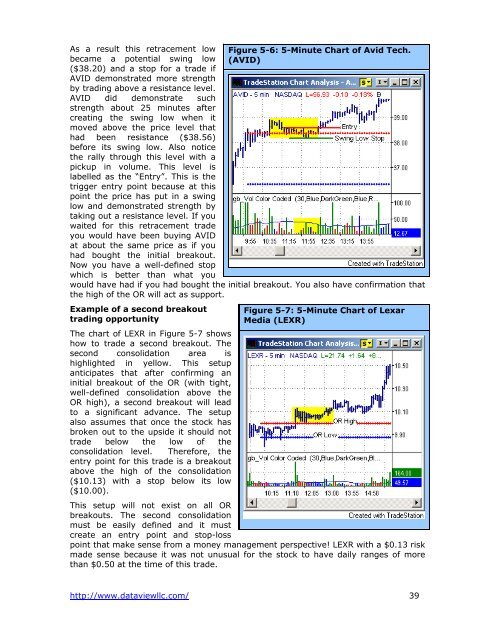

As a result this retracement low<br />

became a potential swing low<br />

($38.20) and a stop for a trade if<br />

AVID demonstrated more strength<br />

by trading above a resistance level.<br />

AVID did demonstrate such<br />

strength about 25 minutes after<br />

creating <strong>the</strong> swing low when it<br />

moved above <strong>the</strong> price level that<br />

had been resistance ($38.56)<br />

before its swing low. Also notice<br />

<strong>the</strong> rally through this level with a<br />

pickup in volume. This level is<br />

labelled as <strong>the</strong> “Entry”. This is <strong>the</strong><br />

trigger entry point because at this<br />

point <strong>the</strong> price has put in a swing<br />

low and demonstrated strength by<br />

taking out a resistance level. If you<br />

waited for this retracement trade<br />

you would have been buying AVID<br />

at about <strong>the</strong> same price as if you<br />

had bought <strong>the</strong> initial breakout.<br />

Now you have a well-defined stop<br />

which is better than what you<br />

would have had if you had bought <strong>the</strong> initial breakout. You also have confirmation that<br />

<strong>the</strong> high of <strong>the</strong> OR will act as support.<br />

Example of a second breakout<br />

trading opportunity<br />

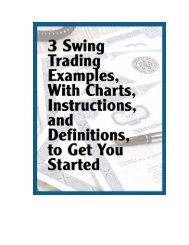

<strong>The</strong> chart of LEXR in Figure 5-7 shows<br />

how to trade a second breakout. <strong>The</strong><br />

second consolidation area is<br />

highlighted in yellow. This setup<br />

anticipates that after confirming an<br />

initial breakout of <strong>the</strong> OR (with tight,<br />

well-defined consolidation above <strong>the</strong><br />

OR high), a second breakout will lead<br />

to a significant advance. <strong>The</strong> setup<br />

also assumes that once <strong>the</strong> stock has<br />

broken out to <strong>the</strong> upside it should not<br />

trade below <strong>the</strong> low of <strong>the</strong><br />

consolidation level. <strong>The</strong>refore, <strong>the</strong><br />

entry point for this trade is a breakout<br />

above <strong>the</strong> high of <strong>the</strong> consolidation<br />

($10.13) with a stop below its low<br />

($10.00).<br />

Figure 5-6: 5-Minute Chart of Avid Tech.<br />

(AVID)<br />

Figure 5-7: 5-Minute Chart of Lexar<br />

Media (LEXR)<br />

This setup will not exist on all OR<br />

breakouts. <strong>The</strong> second consolidation<br />

must be easily defined and it must<br />

create an entry point and stop-loss<br />

point that make sense from a money management perspective! LEXR with a $0.13 risk<br />

made sense because it was not unusual for <strong>the</strong> stock to have daily ranges of more<br />

than $0.50 at <strong>the</strong> time of this trade.<br />

http://www.dataviewllc.com/ 39