Download Switzerland Report - The European Times

Download Switzerland Report - The European Times

Download Switzerland Report - The European Times

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Canton of Berne<br />

BEKB | BCBE<br />

Creating Value with a Long-Term<br />

Strategy<br />

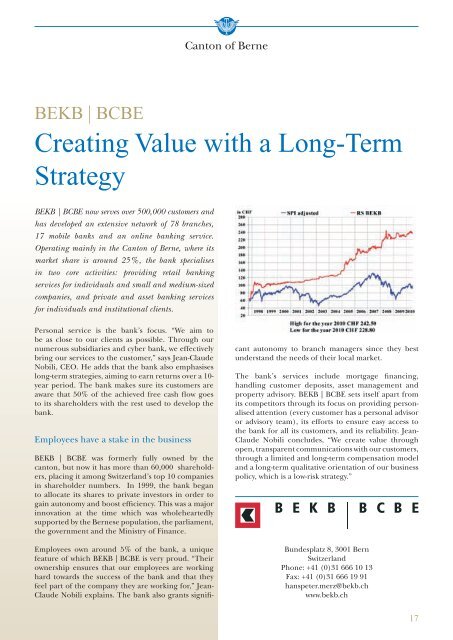

BEKB | BCBE now serves over 500,000 customers and<br />

has developed an extensive network of 78 branches,<br />

17 mobile banks and an online banking service.<br />

Operating mainly in the Canton of Berne, where its<br />

market share is around 25%, the bank specialises<br />

in two core activities: providing retail banking<br />

services for individuals and small and medium-sized<br />

companies, and private and asset banking services<br />

for individuals and institutional clients.<br />

Personal service is the bank’s focus. “We aim to<br />

be as close to our clients as possible. Through our<br />

numerous subsidiaries and cyber bank, we effectively<br />

bring our services to the customer,” says Jean-Claude<br />

Nobili, CEO. He adds that the bank also emphasises<br />

long-term strategies, aiming to earn returns over a 10-<br />

year period. <strong>The</strong> bank makes sure its customers are<br />

aware that 50% of the achieved free cash flow goes<br />

to its shareholders with the rest used to develop the<br />

bank.<br />

Employees have a stake in the business<br />

BEKB | BCBE was formerly fully owned by the<br />

canton, but now it has more than 60,000 shareholders,<br />

placing it among <strong>Switzerland</strong>’s top 10 companies<br />

in shareholder numbers. In 1999, the bank began<br />

to allocate its shares to private investors in order to<br />

gain autonomy and boost efficiency. This was a major<br />

innovation at the time which was wholeheartedly<br />

supported by the Bernese population, the parliament,<br />

the government and the Ministry of Finance.<br />

Employees own around 5% of the bank, a unique<br />

feature of which BEKB | BCBE is very proud. “<strong>The</strong>ir<br />

ownership ensures that our employees are working<br />

hard towards the success of the bank and that they<br />

feel part of the company they are working for,” Jean-<br />

Claude Nobili explains. <strong>The</strong> bank also grants significant<br />

autonomy to branch managers since they best<br />

understand the needs of their local market.<br />

<strong>The</strong> bank’s services include mortgage financing,<br />

handling customer deposits, asset management and<br />

property advisory. BEKB | BCBE sets itself apart from<br />

its competitors through its focus on providing personalised<br />

attention (every customer has a personal advisor<br />

or advisory team), its efforts to ensure easy access to<br />

the bank for all its customers, and its reliability. Jean-<br />

Claude Nobili concludes, “We create value through<br />

open, transparent communications with our customers,<br />

through a limited and long-term compensation model<br />

and a long-term qualitative orientation of our business<br />

policy, which is a low-risk strategy.”<br />

Bundesplatz 8, 3001 Bern<br />

<strong>Switzerland</strong><br />

Phone: +41 (0)31 666 10 13<br />

Fax: +41 (0)31 666 19 91<br />

hanspeter.merz@bekb.ch<br />

www.bekb.ch<br />

17