Download Kosovo Report - The European Times

Download Kosovo Report - The European Times

Download Kosovo Report - The European Times

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

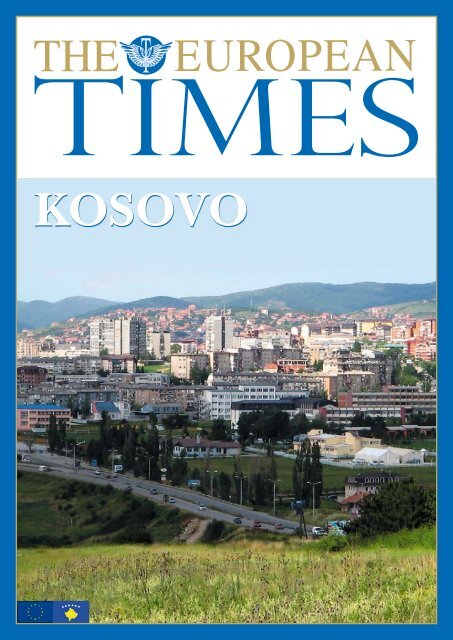

KOSOVO<br />

1

Content<br />

<strong>Kosovo</strong>: World’s Newest Country<br />

INTRODUCTION<br />

• Institutions of the Republic of <strong>Kosovo</strong> 4<br />

• President Welcomes Investors to High Potential<br />

Economy 5<br />

• A Melting Pot of Cultures: <strong>Kosovo</strong>’s Rich Past<br />

Points to a Bright Future 6<br />

• <strong>Kosovo</strong>’s Fact File 8<br />

BUSINESS & INVESTMENTS OPPORTUNITIES<br />

• Increasing Competition and Efficiency, the<br />

Privatisation Process Is Going into Overdrive 12<br />

• Forward-Thinking Chamber Promoting <strong>Kosovo</strong><br />

as Gateway 14<br />

• Central Bank of the Republic of <strong>Kosovo</strong> 16<br />

• On the Road to the Union, <strong>Kosovo</strong> has Already<br />

Made Big Strides 18<br />

• Improved Stability and Measured Growth Point<br />

to a Maturing Economy 20<br />

FINANCE & BANKING<br />

• Ministry of Economy and Finance 24<br />

• NLB Prishtina 26<br />

• Raiffeissen Bank 27<br />

• ProCredit Bank <strong>Kosovo</strong> 28<br />

• Dukagjini Group 29<br />

TRADE & INDUSTRY<br />

• Ministry of Trade and Industry 31<br />

• Sharrcem 33<br />

• Xella Group 34<br />

TRANSPORT & COMMUNICATIONS<br />

• Ministry of Transport and Telecommunication 36<br />

• All Roads Lead to <strong>Kosovo</strong>: the Government’s<br />

Main Target Is Upgrading the Road and Rail<br />

Infrastructure 38<br />

• <strong>Kosovo</strong> Railways 40<br />

• Kosova Airlines 41<br />

• Calling the Shots: Competition Is Bringing<br />

Increased Quality to the Sector 42<br />

• IPKO 44<br />

AGRICULTURE & FOOD INDUSTRY<br />

• Ministry of Agriculture, Forestry and Rural<br />

Development 46<br />

• Lay of the Land: <strong>The</strong> Government Is<br />

Overseeing the Commercialisation of the<br />

Country’s Farms 48<br />

• Peja Brewery 49<br />

• Meridian Corporation 50<br />

ENERGY & MINING<br />

• Ministry of Energy and Mining 52<br />

• A New Power Plant and Untapped Coal<br />

Reserves Are Set to Electrify the Industry 55<br />

• Mine Games: A Growth in Exploration and<br />

Mining Licenses Should Usher in Explosive<br />

Growth 56<br />

• Lydian International 59<br />

ENVIRONMENT & SPATIAL PLANNING<br />

• Regional Water Company-Prishtina 61<br />

• Ministry of Environment and Spatial Planning 62<br />

• Infrastructure and Housing Requirements<br />

Are Driving the Sector Forward 64<br />

• Dukagjini Group 66<br />

TOURISM<br />

• <strong>The</strong> Industry Has Several Strings to Its Bow<br />

Pointing the Way to an Effervescent Future 68<br />

• Eurokoha Reisen 70<br />

Regional Manager:<br />

Tudor Stamatian<br />

Country Director:<br />

Rutger de Groot<br />

Editorial:<br />

Patrick Wrigley<br />

Production Coordinator:<br />

Katrien Delamotte<br />

Design:<br />

Martine Vandervoort, Carine<br />

Thaens, Johny Verstegen,<br />

Walter Vranken, Dirk Van Bun<br />

<strong>The</strong> <strong>European</strong> <strong>Times</strong><br />

90 Vasall Road, London SW9 6JA<br />

United Kingdom<br />

Phone: +44 (0)208 371 2356<br />

Fax: +44 (0)208 371 2410<br />

info@european-times.com<br />

www.european-times.com<br />

<strong>The</strong> <strong>European</strong> <strong>Times</strong> is a trading name of United International<br />

Press Ltd<br />

This guide is protected by copyright. All rights reserved. This<br />

publication, or any part thereof, may not be reproduced,<br />

stored electronically or transmitted in any form, without the<br />

prior written permission of <strong>European</strong> <strong>Times</strong>.<br />

Every effort has been made to ensure information<br />

contained in this publication is correct and up-to-date.<br />

<strong>The</strong> authors and publisher accept no responsibility<br />

for any errors it may contain, or for any loss, financial<br />

or otherwise, sustained by any person using this<br />

publication.<br />

3

KOSOVO<br />

Introduction<br />

Institutions of the Republic of <strong>Kosovo</strong><br />

Office of the President<br />

Tel.: +381 38 213 222/333<br />

Fax: +381 38 211 651<br />

www.president-ksgov.net<br />

Assembly of the Republic of <strong>Kosovo</strong><br />

Office for Media and Publications<br />

Tel.: +381 38 211 186/189/949<br />

Fax: +381 38 211 188<br />

www.kuvendikosoves.org<br />

Office of the Prime Minister<br />

Fax: +381 38 211 202<br />

info_pmo@ks-gov.net<br />

www.ks-gov.net/pm<br />

Ministry of Education, Science and Technology<br />

Tel.: +381 38 542 715<br />

Fax: +381 38 542 757<br />

www.masht-gov.net<br />

Ministry of Justice<br />

www.md-ks.org<br />

Ministry of Energy and Mining<br />

Tel.: +381 38 200 213 05<br />

mem.informimi@gmail.com<br />

www.ks-gov.net/mem<br />

Ministry of Finance and Economy<br />

Tel.: +381 38 200 34 101<br />

Fax: +381 38 213 113<br />

abeiqi@mfe-ks.org<br />

www.mfe-ks.org<br />

Ministry of Environment and Spatial Planning<br />

Tel.: +381 38 517 800<br />

Fax: +381 38 517 845<br />

webmaster.mmph@ks-gov.net<br />

www.ks-gov.net/mmph<br />

Ministry of Local Government Administration<br />

Tel: +381 38 544 377<br />

www.ks-gov.net/map<br />

Ministry of Internal Affairs<br />

Tel.: +381 38 213 307<br />

merita.vidishiqi@ks-gov.net<br />

www.mpb-ks.org<br />

Ministry of Foreign Affairs<br />

Tel: +381 38 213 963<br />

Fax: +381 38 213 985<br />

mfa@ks-gov.net<br />

www.ks-gov.net/mpj<br />

Ministry of Health<br />

Tel.: +381 38 211 192<br />

www.mshgov-ks.org<br />

Ministry of Labour and Social Welfare<br />

Tel.: +381 38 213 814<br />

Fax: +381 38 213 022<br />

info_mpms@yahoo.com<br />

www.mpms-ks.org<br />

Ministry of Community and Return<br />

Tel.: +381 38 212 754<br />

Tel./Fax: +381 38 212 755<br />

sasa.rasic@ks-gov.net<br />

www.ks-gov.net/mkk<br />

Ministry of Public Services<br />

Tel.: +381 38 200 30 020/942/660<br />

Info-mshp@ks-gov.net<br />

www.ks-gov.net/mshp<br />

Ministry of Culture, Youth and Sports<br />

Tel.: +381 38 211 064, +381 38 211 557<br />

Fax: +381 38 211 440<br />

info@mkrs-ks.org<br />

www.mkrs-ks.org<br />

Ministry of Transport and Telecommunication<br />

info.mtpt@ks-gov.net<br />

www.mtpt.org<br />

Ministry of Agriculture, Forestry and Rural<br />

Development<br />

Tel.: +381 38 211 375<br />

Fax: +381 38 212 598<br />

www.mbpzhr-ks.org<br />

Ministry of Trade and Industry<br />

Tel.: +381 38 200 36010<br />

Fax: +381 38 212 807<br />

www.mti-ks.org<br />

4

KOSOVO<br />

Introduction<br />

President Welcomes Investors to<br />

High Potential Economy<br />

Fatmir Sejdiu, President of <strong>Kosovo</strong>, says that the<br />

country’s declaration of independence in February 2008<br />

is “the beginning of a new chapter for <strong>Kosovo</strong>, and a<br />

reassuring guarantee of a prosperous future.” Around<br />

45 (1)<br />

countries have already recognised <strong>Kosovo</strong> as an<br />

independent nation, and the country is swiftly moving<br />

away from its war torn past to become a productive<br />

contributor to the <strong>European</strong> and global economy.<br />

<strong>The</strong> President welcomes foreign investors, and<br />

points out that <strong>Kosovo</strong> has focused on providing<br />

stability and security for foreign investment through<br />

implementing <strong>European</strong> and international laws and<br />

regulations. <strong>Kosovo</strong> is particularly well placed to<br />

attract <strong>European</strong> investment. “Almost three-quarters<br />

of all the countries that have recognised <strong>Kosovo</strong> are<br />

from the <strong>European</strong> Union, including seven of the<br />

world’s biggest countries. As of today, over 60% of the<br />

nations that lead the global economy have recognised<br />

<strong>Kosovo</strong> as well as around 80% of the members of the<br />

United Nations. This demonstrates the world’s faith<br />

in <strong>Kosovo</strong>’s future,” he says.<br />

Energy sector offers strong potential<br />

As it rebuilds its economy, <strong>Kosovo</strong> offers significant<br />

growth potential, particularly in the energy sector,<br />

according to the President. He adds that the<br />

government has proven its commitment to transparency<br />

and that it has targeted energy, agriculture,<br />

industry, education, health and security as priorities<br />

for development.<br />

<strong>The</strong> ongoing privatisation campaign is creating new<br />

opportunities for investment, and substantial financial<br />

assistance totalling some €1.2 billion (pledged at<br />

July’s Donor’s Conference) has provided a strong<br />

foundation for future growth. <strong>The</strong> EU’s Community<br />

Assistance for Reconstruction, Development and<br />

Stabilisation (CARDS) programme, for example,<br />

provided over €1 billion in aid to <strong>Kosovo</strong> between 1999<br />

Fatmir Sejdiu, President of <strong>Kosovo</strong><br />

© Bashkim Hasani<br />

and 2005 alone, and is continuing to support projects<br />

that offer outstanding investment potential. “We are<br />

committed to an open market with equal opportunities<br />

for foreign investors. We want high quality companies<br />

to succeed here, which will make others confident to<br />

come,” President Fatmir Sejdiu says.<br />

As for the future, <strong>Kosovo</strong> will move beyond reconstruction<br />

to be more creative in developing its economy,<br />

the President says, noting that the government still<br />

needs to come to a decision about the possible privatisation<br />

of the Trepca mines. Boosting GDP from the<br />

current 4% on average and reducing unemployment<br />

and corruption are key challenges for <strong>Kosovo</strong> today.<br />

“<strong>The</strong>re will be zero tolerance of corruption,” the<br />

President vows. He concludes, “<strong>Kosovo</strong> aims to become<br />

fully integrated with Europe, it has excellent human<br />

resources, and it offers great growth potential.”<br />

(1)<br />

<strong>The</strong> number has reached 51 as of today<br />

5

KOSOVO<br />

Introduction<br />

<strong>Kosovo</strong>’s Fact File<br />

Diversity and Ambition: <strong>The</strong> Twin Pillars of<br />

<strong>Kosovo</strong>’s Appeal<br />

<strong>Kosovo</strong> has hit the international headlines in recent<br />

months as the country has shed the skin of its troubled<br />

past and declared a new beginning with independence.<br />

However, despite wide press coverage, most international<br />

readers know very little about this diverse and<br />

ambitious country nestled in the south western corner<br />

of the Balkans. With a rich cultural legacy, enchanting<br />

natural beauty, and abundant natural and human<br />

resources, it is unlikely that <strong>Kosovo</strong> will remain a secret<br />

to Europe and the wider world for too much longer.<br />

Population<br />

Perhaps what is best about Prishtina, and indeed<br />

the country as a whole, is the young, fun-loving<br />

and ambitious people. <strong>Kosovo</strong> has a population of<br />

approximately 2.2 million with 42% of them living<br />

in the country’s cities and towns. However, what<br />

makes <strong>Kosovo</strong> so appealing is that the country has<br />

the youngest population in Europe with 70% of<br />

the population under the age of 35. This gives an<br />

impressive sense of urgency, ambition and positivity to<br />

Kosovar encounters. Ninety per cent of the population<br />

is Albanian, 5% is Serb, 2% is Muslim Slav (Bosniaks<br />

and Goranis) while the remainder is Roma and Turks.<br />

Languages<br />

This diversity of origin brings a multi-lingual<br />

environment to <strong>Kosovo</strong> with a number of languages<br />

overheard on the nation’s streets. <strong>The</strong> most prominent<br />

languages are Albanian and Serbian; however,<br />

Turkish and a number of other Balkan languages can<br />

be heard. Moreover, with such an exposure to donor<br />

organisations, multinationals and NGOs, English has<br />

almost become a semi-official language. It certainly<br />

has become the preferred language of business in the<br />

country and in the urban areas, at the very least, it is<br />

easily understood.<br />

Geography<br />

<strong>The</strong> land of <strong>Kosovo</strong>, which reclines upon almost<br />

11,000 sq km, lies in a horse shoe shaped bowl, with<br />

mountains enclosing the country in the north, west<br />

and south. <strong>The</strong> most impressive of these are the<br />

somnolent Sharr in the South and the famous and<br />

rugged ‘Accursed Mountains’ in the west forming<br />

a border with both Albania and Montenegro.<br />

Central <strong>Kosovo</strong> lies on a low flood plain stretching<br />

out unbounded and allowing unhindered views of<br />

mountain ranges in three directions. Fifty three per<br />

cent of the country is fertile agricultural land while<br />

39% is forest which plays a vital role in <strong>Kosovo</strong>’s<br />

burgeoning wood processing industry.<br />

<strong>The</strong> most prominent cities in terms of size, strategic<br />

importance, economic clout and historical resonance<br />

form a skewed diamond with Mitrovica in the north,<br />

Prizren in the south, Peja in the west and Prishtina,<br />

the capital, in the east. Prishtina has truly grown into<br />

its own skin emerging as a modern, vibrant capital<br />

city which manages to retain a distinct local flavour.<br />

Indeed, the old and the modern, the foreign and the<br />

local all jostle for attention in an easy unaffected way.<br />

6

<strong>The</strong> EU and the Flag<br />

<strong>Kosovo</strong>’s commitment to a future in the EU was writ large on the country’s new flag. Although there was some<br />

debate, and even a design competition, over the future look of the newly independent country’s flag, a decisive<br />

body of opinion fell behind six yellow stars on a blue background embossed by the outline of the country stencilled<br />

below. <strong>The</strong> international design competition organised by the UN backed provisional government received just<br />

under 1,000 entries but the blue flag with yellow stars won out in vote in the National Assembly requiring a<br />

two-thirds majority. <strong>The</strong> six stars are meant to represent the six ethnicities of <strong>Kosovo</strong>, Albanian, Serbian, Bosniak,<br />

Gorani, Turk and Roma. However, the overwhelming symbolism of the new flag will not be lost on anyone, echoing<br />

as it does the EU’s very own standard, a blue flag with a circle of yellow stars. Indeed, <strong>Kosovo</strong> hopes that sooner<br />

rather than later the two flags will be flying next to each other over the parliament building in Prishtina.<br />

7

Currency<br />

<strong>Kosovo</strong>’s close relationship with the <strong>European</strong> Union<br />

is also borne out by their currency which is the Euro.<br />

<strong>The</strong> country switched to this from the German mark<br />

after that country also adopted the Euro. Beyond the<br />

symbolism of the country and the government using<br />

the Euro as their main currency, the adoption has<br />

added practical benefits. Indeed, the use of the Euro,<br />

gives <strong>Kosovo</strong>’s infant economy a sense of stability and<br />

a strong currency.<br />

Education<br />

<strong>The</strong> poly-lingualism<br />

of <strong>Kosovo</strong> is not only<br />

testament to a diversity<br />

of cultures but also<br />

to the education<br />

standards of the<br />

country. With such<br />

a young population,<br />

the government has<br />

recognised that this<br />

is a crucial pillar for<br />

development. <strong>The</strong><br />

reform process is well under way and <strong>Kosovo</strong>’s two<br />

public universities have over 30,000 students with a<br />

further 10,000 at the various private universities and<br />

colleges dotted around the country. At the primary<br />

and secondary level, <strong>Kosovo</strong> has almost 1,200 schools<br />

serving approximately 420,000 students.<br />

Business Environment<br />

This may well help the country to attract more investors; however,<br />

it is certainly not the only incentive. <strong>The</strong> country has low taxes<br />

and a transparent tax system. <strong>Kosovo</strong> has also been working hard<br />

to harmonise and bring into line its laws with those of <strong>European</strong><br />

countries and the <strong>European</strong> Union. <strong>The</strong> country has a transparent<br />

and open investment climate with the Investment Promotion Agency<br />

of <strong>Kosovo</strong> (IPAK) working hard to attract more foreign direct<br />

investment (FDI). IPAK offers a number of free services including<br />

information on investment opportunities in <strong>Kosovo</strong>, information on<br />

the business and legal environment, market analysis, assistance with<br />

local authorities and after-care-services.<br />

<strong>The</strong> country’s VAT stands at 15% with a reduced rate of 0% for agricultural<br />

inputs. Exporters also receive a full VAT rebate. For import taxes, the tariff stands at 10% with an exemption<br />

for certain capital and intermediary goods. Income tax is in the range of 0-20%. <strong>The</strong>se figures compare extremely<br />

well with the region and mark <strong>Kosovo</strong> out as the least taxed country in South Eastern Europe.<br />

Business procedures and the investment regime are also simple. On average, business registration is completed<br />

within 3 days. Moreover, the investment regime is the same for both <strong>Kosovo</strong>’s citizens and foreign investors<br />

including national treatment, guarantees for unrestricted use of income, protection against expropriations and<br />

the outlawing of discrimination. However, the country is not resting on its laurels with the government and UNMIK<br />

constantly refining and monitoring investment procedures.<br />

<strong>The</strong> practical business environment is comparable to that of the rest of the Western world. Working hours for<br />

businesses and shops tend to be from 9am to 5 or 6pm. For business meetings and offices, a suit is usually worn.<br />

Combined with its strategic position and youthful population, <strong>Kosovo</strong>’s business environment provides an attractive<br />

proposition for foreign investors. Indeed, beyond the economy, the country has a lot to offer visitors and long term<br />

guests. From its rich historical and cultural legacy to the country’s natural beauty, <strong>Kosovo</strong> is a unique proposition.<br />

While independence was gained less than a year ago, the country has been working a lot longer to take its place as<br />

a key player in Europe’s future. While many <strong>European</strong>s may still have a hazy knowledge of the country, it is clear<br />

that this will change sooner rather than later.<br />

8

• Increasing Competition and Efficiency, the Privatisation Process Is Going into Overdrive<br />

• On the Road to the Union, <strong>Kosovo</strong> Has Already Made Big Strides<br />

• Improved Stability and Measured Growth Point to a Maturing Economy<br />

Business & Investment<br />

Opportunities<br />

9

KOSOVO<br />

Business & Investment Opportunities<br />

When the UN Mission in <strong>Kosovo</strong><br />

(UNMIK) first arrived in <strong>Kosovo</strong>,<br />

the legacies of the Yugoslavian<br />

legal system and governance model<br />

persisted. However, since the turn<br />

of the century, the government and<br />

UNMIK have come a long way in<br />

bringing the country into line with<br />

economic best practice. Perhaps<br />

the best illustration of this is the<br />

ambitious privatisation drive, which<br />

has created thousands of jobs and<br />

boosted company revenues.<br />

Increasing Competition<br />

Process Is Going into<br />

In 2002, when the <strong>Kosovo</strong> Trust<br />

Agency was founded there were<br />

500 Socially Owned Enterprises<br />

(SOEs) awaiting privatisation.<br />

However, the level of productivity<br />

was low with only 30% of these<br />

companies operational. <strong>The</strong><br />

turnaround in these fortunes has<br />

been dramatic. As of December<br />

2007, 310 SOEs had been<br />

privatised accounting for more<br />

than 90% by value of all these<br />

companies. This swift transfer<br />

of social assets to the private<br />

sector has been the catalyst for<br />

a significant increase in Kosovar<br />

exports and a swelling investor<br />

confidence.<br />

10

KOSOVO<br />

Business & Investment Opportunities<br />

and Efficiency, the Privatisation<br />

Overdrive<br />

However, the process is by no means<br />

over. Obstacles remain including<br />

the need to pay creditors of some<br />

of the SOEs and the need to sell<br />

the remaining non core assets of<br />

these businesses. Furthermore,<br />

the privatisation process has<br />

enshrined the notion of distributing<br />

proceeds from the programme<br />

to the workers of these SOEs.<br />

Indeed, under this scheme, 20%<br />

of the proceeds from tenders are<br />

to be paid to the workers. This distribution<br />

is still being carried out.<br />

Yet it is clear that the privatisation<br />

process has already had a dramatic<br />

impact upon the economy of<br />

<strong>Kosovo</strong>. Under the thirty waves of<br />

privatisation, 545 new companies<br />

have been tendered with 343 sales<br />

contracts signed. This has raised<br />

significant capital with total privatisation<br />

proceeds exceeding €353.5<br />

million of which €70.7million has<br />

been earmarked for employee<br />

entitlements. Most privatisations<br />

will be in the agriculture and trade<br />

sectors which account for almost<br />

34% of all SOEs. In addition to<br />

this the <strong>Kosovo</strong> Trust Agency<br />

board has sanctioned 106 liquidations<br />

with consequent proceeds of<br />

€8.3 million.<br />

While the privatisations have not<br />

been breathtaking in number, they<br />

have been critical for the future<br />

strategic growth of the country.<br />

Some estimates suggest that the<br />

SOEs account for 90% of <strong>Kosovo</strong>’s<br />

industrial assets and as much as<br />

20% of its prime agricultural real<br />

estate and 60% of its forests. It<br />

was therefore crucial that these<br />

companies were overhauled to<br />

align themselves with efficient and<br />

competitive international business<br />

practices.<br />

<strong>The</strong> privatisation programme<br />

has been two-pronged with<br />

regular and special spin-offs.<br />

<strong>The</strong> latter, which account for 20<br />

of the sales contracts hitherto<br />

signed, are designed to protect<br />

the character and value of the<br />

tendered company. Under this<br />

scheme, the bidder has to make<br />

certain assurances to the <strong>Kosovo</strong><br />

Trust Agency that the original<br />

character of the business will be<br />

maintained, that a certain level<br />

of investment will be injected<br />

into the company and that a<br />

certain number of people will be<br />

employed. <strong>The</strong> biggest special<br />

spin-offs thus far have been the<br />

Hotel Grand in Prishtina and<br />

the Ferronikeli Nickel Mine.<br />

Under the latter tender, it was<br />

stipulated that there must be a<br />

minimum investment size of €20<br />

million and that 1,000 workers<br />

be hired within a year of the sale<br />

finalisation. Other significant<br />

sell-offs include the Peja Brewery,<br />

<strong>Kosovo</strong>’s only major beer<br />

producer, the Rahoveci Winery,<br />

the country’s largest winery, and<br />

IDGJ Tobacco.<br />

Under the regular spin-offs, the<br />

purchasing company has no<br />

further obligations to the <strong>Kosovo</strong><br />

Trust Agency upon signing a sales<br />

contract. However, the spin-off<br />

itself is a two- stepped process with<br />

the assets initially being transferred<br />

to a joint stock company 100%<br />

owned by the SOE. <strong>The</strong>refore,<br />

a new company is formed for<br />

privatisation.<br />

<strong>The</strong> privatisation process had<br />

already generated 4,200 investor<br />

contacts in the <strong>Kosovo</strong> Trust<br />

Agency by June 2006. Moreover,<br />

further high profile privatisations<br />

are expected over the coming<br />

years. While the government has<br />

thus far held on to its utility and<br />

infrastructure providers, they may<br />

well be lined up for privatisation<br />

in the future. Hitherto, these<br />

publicly owned enterprises (POEs)<br />

have been incorporated, which<br />

has allowed for the review and<br />

valuation of all assets and liabilities<br />

as well as an overview of operating<br />

procedures and efficiencies. This<br />

has paved the way for modern<br />

competitive service providers,<br />

which could be handed over to<br />

the private sector. Indeed, perhaps<br />

the most attractive company being<br />

lined up for a potential sell-off is<br />

the incumbent mobile operator,<br />

Vala.<br />

While much has already been<br />

achieved, the future, therefore,<br />

looks extremely positive for<br />

<strong>Kosovo</strong>’s former SOEs and POEs.<br />

This will not only create instant<br />

revenue but will help to grow the<br />

country’s economy in a number of<br />

ways from increasing freight traffic<br />

to boosting exports. <strong>The</strong> private<br />

sector is therefore becoming<br />

an equal partner in the future<br />

economic success story of <strong>Kosovo</strong>.<br />

11

KOSOVO<br />

Business & Investment Opportunities<br />

Forward-Thinking Chamber<br />

Promoting <strong>Kosovo</strong> as Gateway<br />

<strong>The</strong> <strong>Kosovo</strong> Chamber of Commerce<br />

is an international, non-profit,<br />

independent organisation which<br />

unites foreign and domestic<br />

companies and is focused on<br />

enhancing business opportunities in<br />

<strong>Kosovo</strong>. It has formed links with other<br />

chambers of commerce throughout the<br />

world and welcomes new members.<br />

Besim Beqaj, President, discusses the<br />

chamber’s activities and the services<br />

it can provide to foreign investors.<br />

ET: <strong>Kosovo</strong> officially became<br />

independent earlier this year. What<br />

has been the impact on the business<br />

sector and how has the chamber<br />

been involved in new initiatives?<br />

B. Beqaj: Many international<br />

companies were waiting for <strong>Kosovo</strong>’s<br />

official status as an independent<br />

country. From a business point of<br />

view, independence has increased<br />

international interest in <strong>Kosovo</strong> and<br />

a number of fact finding missions<br />

have been launched to help<br />

potential investors better understand<br />

the country. <strong>The</strong> Chamber of<br />

Commerce has hosted these missions<br />

and organised visits with many<br />

companies here in <strong>Kosovo</strong>. Another<br />

recent achievement since independence<br />

has been <strong>Kosovo</strong>’s significant<br />

reform of its fiscal policy, something<br />

for which the Chamber has been<br />

lobbying strongly for the past few<br />

years. With the new government, we<br />

have achieved the new fiscal policy<br />

Besim Beqaj, President <strong>Kosovo</strong> Chamber of<br />

Commerce<br />

and have lowered taxes, which will<br />

make <strong>Kosovo</strong> more business-friendly<br />

and competitive.<br />

ET: Many <strong>European</strong>s have mistaken<br />

ideas about current conditions in<br />

<strong>Kosovo</strong>, associating the country with<br />

the war years. How is the Chamber of<br />

Commerce working to better inform<br />

potential investors about <strong>Kosovo</strong>?<br />

B. Beqaj: It’s very important to dispel<br />

misunderstandings about <strong>Kosovo</strong> in<br />

Europe and around the world. We<br />

welcome the opportunity to show<br />

people the real <strong>Kosovo</strong>. This country<br />

is already well on the way to catching<br />

up with the rest of Europe. We are<br />

witnessing increasing interest in<br />

<strong>Kosovo</strong> and our experience is that<br />

once people come here and see<br />

what the country is really like, they<br />

discover that it is a very open, business-friendly<br />

environment. This is the<br />

time and place to take advantage of a<br />

developing economy’s potential.<br />

ET: What makes <strong>Kosovo</strong> business<br />

friendly?<br />

B. Beqaj: In addition to its sound<br />

fiscal policy and tax advantages,<br />

<strong>Kosovo</strong> has a very clear and strong<br />

legal system, especially compared<br />

to other countries in the region,<br />

and this has reassured and helped<br />

many companies. <strong>The</strong> Chamber<br />

recognises that a country’s regulatory<br />

environment and legal system are<br />

crucial factors for business, so we<br />

are strongly promoting the fact that<br />

<strong>Kosovo</strong>’s legal system was started<br />

from scratch to achieve compliance<br />

with EU standards. <strong>The</strong> chamber<br />

is working to show the world what<br />

<strong>Kosovo</strong> has accomplished concerning<br />

its regulatory environment and how<br />

advantageous this is for the business<br />

sector. Other advantages include<br />

<strong>Kosovo</strong>’s membership in CEFTA and<br />

its attractive customs agreement with<br />

the EU, which make <strong>Kosovo</strong> an ideal<br />

base for trade.<br />

ET: What is the Chamber of<br />

Commerce doing to promote<br />

<strong>Kosovo</strong> as a better choice than<br />

competing countries, for example<br />

Croatia?<br />

B. Beqaj: <strong>The</strong> Chamber is actively<br />

involved in correcting misconceptions<br />

about <strong>Kosovo</strong>. Three years ago I read<br />

an article in an Austrian publication<br />

that contained many errors about<br />

<strong>Kosovo</strong> and presented the country<br />

in a very negative light. I contacted<br />

the editor of the publication and the<br />

Austrian Embassy in Belgrade and<br />

12

KOSOVO<br />

Business & Investment Opportunities<br />

invited Austrian media representatives<br />

to visit <strong>Kosovo</strong> and see it with<br />

their own eyes. This one initiative<br />

resulted in very positive articles<br />

about <strong>Kosovo</strong> in 14 different publications.<br />

Our goal is to show people<br />

that any negative ideas they might<br />

have about <strong>Kosovo</strong> are not justified.<br />

We also want to show people that<br />

<strong>Kosovo</strong> offers definite advantages<br />

over its neighbours, including a<br />

central location and the legal system<br />

I have already mentioned. We also<br />

have a youthful population and a<br />

skilled and low-cost labour force. In<br />

addition, new highways being built<br />

will link <strong>Kosovo</strong> even more closely<br />

with Albania, Serbia and other destinations.<br />

Enhancing connectivity with<br />

the rest of the region is a high priority<br />

in the government’s development<br />

plans. Both the government and<br />

international organisations,<br />

including the World Bank<br />

and the EIB, will<br />

be making<br />

major investments in <strong>Kosovo</strong>’s infrastructure<br />

next year and beyond. This<br />

will include road networks, telecom<br />

infrastructure and such projects as<br />

the new Drenas business park, which<br />

is set to open in 2015.<br />

ET: What are some of the chamber’s<br />

current initiatives?<br />

B. Beqaj: We plan to invest even<br />

more in communications efforts, to<br />

strengthen our partnership with the<br />

government, to work more closely with<br />

other chambers of commerce<br />

throughout the region,<br />

and in general<br />

to boost our<br />

networking<br />

activities.<br />

As the<br />

president of the <strong>Kosovo</strong> Chamber of<br />

Commerce, I have worked very hard<br />

to improve the image of the chamber<br />

within <strong>Kosovo</strong>’s business community<br />

and government, and now we are<br />

going into the next phase, which is<br />

to increase our regional and international<br />

presence. We would like to<br />

have strong partners in the <strong>European</strong><br />

Union. We aim to show international<br />

companies that <strong>Kosovo</strong> can be<br />

their best gateway to South-Eastern<br />

Europe.<br />

13

KOSOVO<br />

Business & Investment Opportunities<br />

Central Bank of the Republic of <strong>Kosovo</strong><br />

Central Bank Committed to Best<br />

<strong>Kosovo</strong> built its financial sector from scratch beginning<br />

in 1999, employing the highest international standards<br />

to build a strong foundation for future growth. With<br />

the support of the International Monetary Fund and<br />

other international organisations, the government<br />

has succeeded in establishing a world-class regulatory<br />

environment and a strong Central Bank of the Republic<br />

of <strong>Kosovo</strong> (the CBK).<br />

Hashim Rexhepi, the CBK’s Governor, says, “We<br />

have implemented international best practices with<br />

regards to regulation and supervision of all financial<br />

institutions in <strong>Kosovo</strong>. In only a short time, the<br />

CBK has built a strong management team, a solid<br />

legal framework and excellent cooperation with the<br />

regional and international financial community, the<br />

above will continue to constitute an important part of<br />

the CBK’s activities.<br />

<strong>The</strong> CBK’s main goals are to foster a sound, solvent,<br />

efficiently functioning, stable, market-based financial<br />

system; to encourage the emergence of safe financial<br />

instruments on the <strong>Kosovo</strong> market; to provide services<br />

to the financial community by fostering an efficient<br />

and safe payment system; and to contribute to<br />

<strong>Kosovo</strong>’s economic development through its analysis<br />

related to general policies in <strong>Kosovo</strong>.<br />

Adoption of euro boosted investors’<br />

confidence<br />

Along with applying international standards, <strong>Kosovo</strong><br />

adopted the euro as its currency beginning in 2002,<br />

which has enhanced the financial sector performance<br />

and created more confidence in the Kosovar economy.<br />

“Having the euro also means no exchange risks, and<br />

our monetary policy is built on that of the <strong>European</strong><br />

Central Bank. All this reassures foreign investors,”<br />

Hashim Rexhepi explains.<br />

Hashim Rexhepi, Governor<br />

In fact, the CBK has played a major role in attracting<br />

more foreign investors to <strong>Kosovo</strong>’s financial services<br />

sector. “Over 90% of financial sector assets are<br />

under foreign ownership, around 67% of insurance<br />

sector assets are with foreign ownership, whereas<br />

the banking sector now includes strong banks from<br />

<strong>Kosovo</strong>, elsewhere in the region and from the EU.<br />

This foreign presence has brought investments in<br />

capital, experience, good corporate governance<br />

and stability to <strong>Kosovo</strong>’s financial sector,” Hashim<br />

Rexhepi points out.<br />

Increasing transparency<br />

<strong>The</strong> CBK has performed its tasks step by step. First, it<br />

focused on simply establishing a new payments and<br />

14

KOSOVO<br />

Business & Investment Opportunities<br />

Practices<br />

financial system for <strong>Kosovo</strong>. <strong>The</strong>n,<br />

it concentrated on opening up<br />

<strong>Kosovo</strong>’s financial sector to foreign<br />

participation, on strengthening the<br />

sector overall, and on establishing<br />

strong regulatory systems for both the<br />

banking and the insurance sectors.<br />

Next, the CBK fine-tuned the sector<br />

by finding solutions for any problems<br />

that had appeared. “Today, now that<br />

we have a very strong, sound and<br />

stable financial sector, our objective<br />

for the future is to increase transparency<br />

and advance market conduct,”<br />

Hashim Rexhepi says.<br />

<strong>The</strong> CBK is currently focusing<br />

on implementing Basel II criteria<br />

concerning disclosure and transparency.<br />

“We have continuously<br />

received technical assistance from<br />

the EU, the United States Agency<br />

for International Development<br />

(USAID), the IMF and the World<br />

Bank concerning revising our legal<br />

framework and capacity building<br />

of our staff. We can confidently say<br />

that our legal framework is very<br />

much in line with all EU directives.<br />

Moreover, our procedures are<br />

competitive with procedures in<br />

other EU countries concerning<br />

licensing and supervision,” Hashim<br />

Rexhepi explains.<br />

Hashim Rexhepi adds that the CBK<br />

not only consults EU directives<br />

when devising new policies, but<br />

also adopts best practices both<br />

regionally and internationally<br />

recognised and accepted. “We try<br />

to harmonise and balance the two<br />

elements: EU directives and the<br />

environment in which we operate,”<br />

he says.<br />

Boosting financial sector’s<br />

GDP contribution<br />

<strong>The</strong> CBK serves not only to bring<br />

stability and transparency to the<br />

financial sector and foster efficient<br />

payment systems, but also to<br />

advise the government concerning<br />

<strong>Kosovo</strong>’s economic development.<br />

A guiding principle for the CBK is<br />

to enhance <strong>Kosovo</strong>’s economy, and<br />

thanks to the financial institution’s<br />

efforts the financial sector has<br />

become a significant contributor to<br />

<strong>Kosovo</strong>’s GDP.<br />

<strong>The</strong> CBK is also working to<br />

alleviate unemployment in <strong>Kosovo</strong>,<br />

which Hashim Rexhepi singles out<br />

as one of the main problems the<br />

country currently faces. “Certainly<br />

the financial sector has played a<br />

key role in the reduction of unemployment,<br />

since all financial institutions<br />

in <strong>Kosovo</strong> hire local staff,”<br />

he says.<br />

Three new banking licenses<br />

last year<br />

<strong>Kosovo</strong>’s financial sector had new<br />

entries last year. Hashim Rexhepi<br />

points out that two local banks were<br />

acquired by NLB Bank (Slovenian<br />

Bank) in order to increase<br />

competition in the banking sector,<br />

and the CBK issued three more<br />

banking licenses. “More foreign<br />

investors are looking for ways to<br />

invest in <strong>Kosovo</strong>’s financial sector<br />

because confidence in the sector is<br />

increasing,” he says.<br />

Foreign investors in <strong>Kosovo</strong> should<br />

know that the local financial sector<br />

is sound and can fulfil their needs.<br />

As Hashim Rexhepi points out,<br />

“<strong>The</strong> return on assets is very high<br />

in <strong>Kosovo</strong>; in fact, it is the highest<br />

in South East Europe. In addition,<br />

our legal framework ensures equal<br />

opportunities for foreign investors,<br />

efficient payment systems and the<br />

use of euro provides an added<br />

value, and our laws on terrorism<br />

funding and money laundering<br />

are based on EU directives. At<br />

the CBK, we are committed to<br />

best practices and have ensured<br />

a very transparent and profitable<br />

financial sector. <strong>The</strong> sector’s<br />

steady growth over the past eight<br />

years shows the inherent strength<br />

of <strong>Kosovo</strong>’s financial system.”<br />

Throughout, CBK will devote all<br />

efforts to carrying out its tasks in<br />

the most independent and professional<br />

manner, and assist further<br />

in the integration of <strong>Kosovo</strong>’s<br />

financial sector in regional and<br />

<strong>European</strong> initiatives.<br />

Central Bank<br />

of the Republic of <strong>Kosovo</strong><br />

Garibaldi str. 33<br />

10000 Prishtina - <strong>Kosovo</strong><br />

Tel.: +381 38 243 766<br />

Fax: +381 38 243 763<br />

www.cbak-kos.org<br />

15

KOSOVO<br />

Business & Investment Opportunities<br />

On the Road to the Union, <strong>Kosovo</strong><br />

Has Already Made Big Strides<br />

With the seminal step of independence<br />

achieved relatively smoothly,<br />

<strong>Kosovo</strong> now has its sights firmly set<br />

on <strong>European</strong> integration and EU<br />

succession. <strong>The</strong> country already has<br />

an established history of working<br />

with <strong>European</strong> institutions to aid<br />

economic development and institution<br />

building. It is now moving on from<br />

this solid base to meet the criteria<br />

necessary for entry to the top table of<br />

EU membership.<br />

This is no distant ambition but a<br />

driving force in the first post-independent<br />

steps of Europe’s newest<br />

country. It is also writ large in the<br />

country’s founding document, the<br />

Kosovar constitution. According<br />

to Agim Ceku, Prime Minister of<br />

<strong>Kosovo</strong>, “<strong>The</strong> government of <strong>Kosovo</strong><br />

embraces the values of the <strong>European</strong><br />

Union: peace, economic development<br />

and freedom of movement for all.<br />

EU membership is not a dream. Our<br />

experience in accomplishing the<br />

goals established in the Standards<br />

process will help us in achieving our<br />

accession obligations.”<br />

<strong>The</strong> EU has played a crucial role in<br />

supporting these ambitions. Indeed,<br />

Europe has been the biggest donor to<br />

<strong>Kosovo</strong> over the past decade providing<br />

€1.6 billion in financial support<br />

since 1999. <strong>The</strong> main EU vehicle<br />

for helping Kosovar development is<br />

the <strong>European</strong> Commission Liaison<br />

Office (ECLO) which implements<br />

assistance under the Instrument of<br />

16

Pre-Accession Assistance (IPA). In 2008, the ECLO has<br />

taken over the Community Assistance for Reconstruction,<br />

Development and Stability (CARDS) programmes<br />

from the <strong>European</strong> Agency for Reconstruction (EAR).<br />

Since the year 2000, the CARDS programme has run<br />

more than 1,600 contracts ranging in value from €5,000<br />

to €50 million. Currently, in 2008, 150 contracts are still<br />

open and now being run by the ECLO.<br />

<strong>The</strong> CARDS programme, whose aim was democratic<br />

stabilisation, social and economic development,<br />

institution building and good governance, is now<br />

being replaced with the IPA. <strong>Kosovo</strong> will benefit from<br />

two components of this EU initiative: the ‘Institution<br />

Building and Transition Support’ and the ‘Cross-Border<br />

Cooperation’. For the funding period 2007-2011,<br />

the EU has earmarked more than €400 million under<br />

these components and will offer more aid per capita to<br />

<strong>Kosovo</strong> than any other place in the world over the next<br />

three years.<br />

This targeted assistance falls under the wider EU<br />

framework for the Western Balkans called the Stabilisation<br />

and Association Process (SAP). SAP has been<br />

established to confirm the EU belief that the whole<br />

Western Balkans has a <strong>European</strong> perspective and to<br />

create a mechanism under which all participants to the<br />

process can pass through a transparent and standardised<br />

set of benchmarks at their own rate of progress.<br />

This process also monitors and encourages convergence<br />

with EU practices, standards and norms on a range of<br />

issues both political and economic. It also aims to have<br />

a specific influence on critical areas of reform such as<br />

transport, the environment and agriculture.<br />

However, <strong>Kosovo</strong> is at the beginning of this journey.<br />

Although the <strong>The</strong>ssaloniki Summit of June 2003 formally<br />

recognised that <strong>Kosovo</strong> has a <strong>European</strong> perspective, the<br />

country still has to embark on a process of political,<br />

legal and institutional transformation to achieve this<br />

end goal. According to Renzo Daviddi, Head of the<br />

ECLO, “I guess the main challenge <strong>Kosovo</strong> now faces<br />

is how to build up institutions and how to make the<br />

transformation from the embryonic stage to a more<br />

adult stage.” However, the country has also made great<br />

strides. “I think the legal framework for a number of<br />

reasons, including the fact that there has been a large<br />

international community presence, perhaps is more<br />

advanced than other countries in the region. This is an<br />

area where <strong>Kosovo</strong> has a large advantage compared to<br />

other countries looking for EU accession,” adds Renzo<br />

Daviddi.<br />

Renzo Daviddi, Head of <strong>European</strong> Commission Liaison Office<br />

<strong>Kosovo</strong> is now working in partnership with the<br />

EU to take the necessary steps to enact these<br />

transformations. Under the Stabilisation and<br />

Association Process Tracking Mechanism (STM),<br />

enshrined in the <strong>The</strong>ssaloniki Summit, the EU<br />

can monitor and help <strong>Kosovo</strong> progress within<br />

SAP at its own pace. Likewise, <strong>Kosovo</strong> itself has<br />

also set up mechanisms to make sure domestic<br />

reform is aligned with the goals of EU accession.<br />

Indeed, the <strong>Kosovo</strong> authorities established the<br />

<strong>European</strong> Partnership Action Plan (EPAP) which<br />

creates a framework and concrete policies for the<br />

creation and prosecution of legislation and the<br />

establishment of institutional structures in line<br />

with <strong>European</strong> requirements. In practical terms,<br />

these partnerships and associations will help track<br />

and implement measures on a number of issues<br />

including human and minority rights, freedom<br />

of movement and goods, public procurement,<br />

intellectual property law, customs and taxation,<br />

education and research and agriculture and<br />

fisheries policy.<br />

<strong>The</strong>refore, although there is some way to go,<br />

<strong>Kosovo</strong> has already made giant strides towards<br />

convergence with <strong>European</strong> norms and EU<br />

accession. Indeed, as the EU has offered a<br />

guiding hand at the very conception of the<br />

country, <strong>Kosovo</strong> is well placed to establish itself as<br />

a leading protagonist and advocate of <strong>European</strong><br />

values and governance.<br />

17

Improved Stability and Measured<br />

Growth Point to a Maturing Economy<br />

While independence was only achieved in February 2008,<br />

<strong>Kosovo</strong> has been pursuing a stable and fruitful economic<br />

policy for some time now. This has been borne out by<br />

the increasingly impressive figures for both GDP growth<br />

and the budget. Indeed, the country is creeping towards<br />

Southeast <strong>European</strong> (SEE) levels of growth while still<br />

managing to balance the books. Under the stewardship<br />

of the <strong>European</strong> Union, the country has been able to<br />

resist the temptation to overreach itself while ensuring<br />

that many sectors have been liberalised and export-orientated<br />

industries have been unshackled. However, this<br />

is still a work in progress and the government has set<br />

ambitious targets to further stimulate the economy over<br />

the coming five years.<br />

In 2007, the country recorded GDP growth of 3.5%<br />

slightly below the SEE average of 5.9% but a clear<br />

increase on growth in 2005 which stood at 0.3%. This<br />

translated into a GDP figure of €2.4 billion and an<br />

ever improving GDP per capita of €1,400. This was<br />

achieved despite a decline in the donor sector. More<br />

importantly, this growth was not boosted by public<br />

expenditure but by the expanding role of the private<br />

sector in economic life. In 2006, non-housing private<br />

investment increased by 61% while banks loans to<br />

the private sector also increased markedly.<br />

Indeed, the economy has become less reliant on<br />

government and donor sector expenditure. Donor<br />

sector expenditures, in terms of consumption and<br />

investments fell 1.7% in 2007 amounting to €355<br />

million or 14.4% of GDP. Government spending on<br />

goods and services fell 8.3% in 2007 although after a<br />

18

KOSOVO<br />

Business & Investment Opportunities<br />

two year decrease of 11.6%, total government expenditures<br />

actually increased by 6.2% in 2007 to €426<br />

million or 17.3% of GDP.<br />

Moreover, the country bucked the regional trend<br />

and recorded a budgetary surplus of €233.7<br />

million which represents approximately 9.8% of<br />

GDP. This was largely the result of an increase in<br />

non-tax revenues. While the country has a current<br />

account deficit of 22.5% of GDP driven by a trade<br />

deficit of 9%, exports have been increasing steadily.<br />

Indeed, <strong>Kosovo</strong>’s exports grew by a staggering 54%<br />

in 2006. In 2007, exports reached €146.6 million<br />

mainly consisting of minerals, base metals, vegetable<br />

products and foodstuffs. Government estimates<br />

suggest that exports could climb as high as €350<br />

than €1 billion invested since the year 2000. This<br />

impressive growth is expected to increase rapidly<br />

with the government estimating that the FDI level<br />

will touch €700 million in 2008.<br />

<strong>Kosovo</strong>’s liberal trade regime has also stimulated<br />

imports into the country. <strong>Kosovo</strong> is a member of the<br />

Central <strong>European</strong> Free Trade Agreement (CEFTA)<br />

which allows for free trade between the members of<br />

the bloc and enables producers to access a regional<br />

market of 28 million consumers free of customs<br />

duties. Indeed, the largest number of exports came<br />

from CEFTA countries in 2007. Overall imports have<br />

been increasing steadily since 2002 and had touched<br />

almost €1.6 billion in 2007. This is a significant<br />

increase in a two year period for imports were below<br />

<strong>Kosovo</strong> real GDP by sector, in million euro<br />

Private Sector<br />

Government Sector<br />

Donor Sector<br />

3.5<br />

3.0<br />

2.5<br />

-<br />

-<br />

-<br />

2.33<br />

Net Exports (right axis)<br />

2.45<br />

Real GDP Growth (right axis)<br />

2.65<br />

3.1<br />

2.04<br />

3.5<br />

-<br />

-<br />

-<br />

5<br />

4<br />

2.0<br />

-<br />

2.0<br />

-<br />

3<br />

1.5<br />

1.0<br />

0.5<br />

-<br />

-<br />

-<br />

0.51 0.43<br />

0.45<br />

0.38<br />

0.40 0.36<br />

0.43<br />

0.35<br />

-<br />

-<br />

-<br />

2<br />

1<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

-<br />

-<br />

-<br />

-<br />

-0.95<br />

-1.0<br />

-0.98<br />

-1.01<br />

-1.11<br />

- 0<br />

-<br />

-1<br />

-<br />

- -2<br />

2004 2005 2006 2007<br />

Source: 2007 annual report of the Central Banking Authority of <strong>Kosovo</strong><br />

million in 2008 as the country’s productive capabilities<br />

increase dramatically. <strong>The</strong> largest export<br />

market for <strong>Kosovo</strong> is the EU closely followed by the<br />

Central <strong>European</strong> Free Trade Agreement (CEFTA)<br />

countries.<br />

Likewise, the country has had considerable success<br />

in attracting foreign direct investment (FDI). High<br />

profile <strong>European</strong> banks, Raiffeisen and Pro-Credit<br />

moved into the market during the transition phase.<br />

However, they are just the most visible tip of the<br />

iceberg. According to Business Registry data for<br />

2007, <strong>Kosovo</strong> has 2,012 companies of foreign or<br />

mixed ownership. Such investment has translated<br />

into an FDI figure of €300 million for 2007 with more<br />

€1 billion in 2005. <strong>The</strong>se imports have not only been<br />

stimulated by CEFTA but also by <strong>Kosovo</strong>’s non-reciprocal<br />

customs free access to the EU market through<br />

the EU Autonomous Trade Preference (ATP) regime.<br />

<strong>The</strong> main imports of commodity goods are centred<br />

on minerals and prepared foodstuffs.<br />

<strong>The</strong> economy is therefore becoming increasingly<br />

robust with trade, construction and the financial<br />

services sector being the mainstay of growth.<br />

Indeed, driven by the banking industry, the financial<br />

sector has been expanding rapidly. According to<br />

the Central Bank of <strong>Kosovo</strong>, financial sector assets<br />

reached 58.5% of GDP in 2007 up from 49% in 2006.<br />

<strong>The</strong> banking sector makes up the lion’s share of this<br />

19

KOSOVO<br />

Business & Investment Opportunities<br />

accounting for 90% of financial sector assets in 2007.<br />

<strong>The</strong> sector is undoubtedly buoyant with significant<br />

investment in 2007 leading to the establishment of<br />

new operators and increased foreign ownership.<br />

<strong>The</strong> real economy is also progressing well. Overall<br />

consumption in 2007 rose by 3.8% to €2.8 billion.<br />

This represents 114.3% of GDP and has been<br />

growing steadily over the last 4 years from a figure<br />

of €2.57 billion in 2004. Much of this was fuelled<br />

by the private sector which was responsible for €2.2<br />

billion of consumption in 2007, an increase of 5.2%<br />

on 2006. Investments as a share of GDP have also<br />

been increasing significantly rising by 15.2% in 2007<br />

to reach 33% of GDP. This is a marked increase on<br />

2006 when they stood at 29.9% of GDP. <strong>The</strong> private<br />

particularly from non-tax sources which increased as<br />

a share of total revenues to 17.3% in 2007 from 8%<br />

in 2006.<br />

<strong>The</strong> budget surplus has given the country some leeway<br />

and goes against the grain of the region where most<br />

regional countries, with the exception of Montenegro<br />

having a deficit in 2007 and a four year average well<br />

below the Kosovar surplus of 1.2% of GDP. Given<br />

this surplus, the Central Bank of <strong>Kosovo</strong> predicts that<br />

expenditure in the country will rise substantially in<br />

2008. Indeed, it predicts that expenditure will reach<br />

€1.1 billion in 2008 which is a 68.9% increase on<br />

2007. <strong>The</strong> three areas of particular spending focus<br />

will be capital expenditure, subsidies and transfers<br />

and the purchase of goods and services.<br />

Imports and Exports by commodity groups as share to total, as of 2007<br />

Live animals,<br />

3.9%<br />

Stone, Plaster,<br />

Ceramic,<br />

4.4%<br />

Textiles,<br />

3.3%<br />

Imports<br />

Other,<br />

9.8%<br />

Mineral products,<br />

20.2%<br />

Prep.<br />

foodstuffs,<br />

5.1%<br />

Plastics and<br />

articles,<br />

4.1%<br />

Exports<br />

Other,<br />

10.9%<br />

Plastics and<br />

articles,<br />

4.6%<br />

Transport<br />

means,<br />

5.2%<br />

Vegetable<br />

products,<br />

5.3%<br />

Prod. of<br />

chemical<br />

industry,<br />

7.5%<br />

Base metals,<br />

9.2%<br />

Machinery,<br />

12.5%<br />

Prep.<br />

foodstuffs,<br />

14.1%<br />

Vegetable<br />

products,<br />

5.7%<br />

Machinery,<br />

13.1%<br />

Mineral<br />

products,<br />

15.4%<br />

Base metals,<br />

45.7%<br />

Source: 2007 annual report of the Central Banking Authority of <strong>Kosovo</strong><br />

sector once again plays a vital role here reaching<br />

€647 million or 26.3% of GDP in 2007. Indeed,<br />

private sector investment growth stood at 14.6% in<br />

2007.<br />

Consumer Price Index (CPI) inflation rose to 4.5%<br />

in 2007 from 0.62% the previous year. However, this<br />

is largely attributable to the global increase in oil<br />

and food prices. Indeed, despite this, the country’s<br />

fiscal planning is on a sure footing. <strong>Kosovo</strong>’s consolidated<br />

budget revenues showed an annual increase<br />

of 25.9% in 2007 hitting €896.4 million for the year.<br />

This accounts for 37.7% of GDP and is an impressive<br />

31.3% higher than the government’s planned targets.<br />

This was a result of higher than expected revenues<br />

<strong>The</strong> country is therefore well placed to consolidate<br />

and build on its recent economic successes. With<br />

both domestic production and the trade regime<br />

becoming ever more healthy, the prospects for<br />

future growth look rosy. This is confirmed by the<br />

country’s attractive tax regime and impressive<br />

investment climate that should see FDI exceed the<br />

already upward trends that have been set. Indeed,<br />

<strong>Kosovo</strong>’s economy is taking on an increasingly<br />

diversified hue with productive sectors such as<br />

industry and agriculture sitting alongside financial<br />

services and other service sectors in recording good<br />

growth. This should ensure that the improving<br />

economic outlook can be sustained for the long<br />

term.<br />

20

• Now Is the Time to Invest in <strong>Kosovo</strong><br />

Finance & Banking<br />

“<strong>Kosovo</strong>’s market is open and<br />

ready for investment. If you<br />

look at other Baltic countries<br />

that are now EU members, you<br />

can see the potential.”<br />

Ahmet Shala, Minister of Economy and Finance

KOSOVO<br />

Finance & Banking<br />

Ministry of Economy and Finance<br />

Now Is the Time to Invest<br />

Ahmet Shala, <strong>Kosovo</strong>’s Minister of Economy and<br />

Finance, discusses recent developments in <strong>Kosovo</strong>’s<br />

financial sector and the country’s investment<br />

potential.<br />

Ahmet Shala, Minister of Economy and Finance<br />

ET: How important are the banking and insurance sectors<br />

for <strong>Kosovo</strong>’s economic development?<br />

A. Shala: <strong>The</strong>y are extremely important. Over the past eight<br />

years, for post-conflict structural reasons, the government has<br />

emphasized public sector institutional development, but now<br />

we must shift towards the private sector since this is where both<br />

growth and new jobs will be generated. A credible financial<br />

sector is essential for <strong>Kosovo</strong>’s economic development, and our<br />

financial sector, although young and emerging, has performed<br />

well and demonstrated a capacity for stability.<br />

ET: What are your priorities for the financial sector?<br />

A. Shala: A key task is to ensure that the financial sector can<br />

fulfill the needs of the private sector. So far, the availability of<br />

liquidity and loans has been adequate, but for a relatively low<br />

level of economic development. <strong>The</strong> financial sector must work<br />

with private business to develop good credible business plans<br />

from which private investment can be generated.<br />

22

KOSOVO<br />

Finance & Banking<br />

in <strong>Kosovo</strong><br />

ET: What is <strong>Kosovo</strong> doing to achieve EU integration?<br />

A. Shala: <strong>The</strong> government’s Medium Term Expenditure<br />

Framework was very well received at a <strong>Kosovo</strong> donors’<br />

conference hosted by the <strong>European</strong> Commission in<br />

Brussels in July, and <strong>Kosovo</strong> has been accepted into<br />

the pre-accession process and is receiving EU support<br />

through Instrument of Pre-Accession funding. <strong>Kosovo</strong><br />

has also joined the Central <strong>European</strong> Free Trade<br />

Association. <strong>European</strong> investors should know that<br />

the EU integration process is now in place, and that<br />

there is considerable scope for helping local institutions<br />

establish well-backed credit lines, develop leasing<br />

activities, and so on.<br />

ET: What incentives does <strong>Kosovo</strong> offer foreign investors?<br />

A. Shala: <strong>The</strong> fundamental approach to economic<br />

development in <strong>Kosovo</strong> has been to put in place an institutional<br />

structure that encourages development within<br />

a liberal market framework. Tax rates are relatively<br />

low and the corporate tax rate was recently reduced to<br />

10%. <strong>The</strong> tax base is wide and the structure is simple,<br />

the labour market is liberal as is the environment for<br />

foreign trade, it is relatively easy to set up a business,<br />

and the public sector has an excellent good-practice<br />

financial management process. In other words, <strong>Kosovo</strong><br />

is fundamentally investor friendly.<br />

ET: For many people, <strong>Kosovo</strong> is associated with its war<br />

torn past. How are you countering this international image?<br />

A. Shala: People should be aware that international<br />

financial institutions are very active in <strong>Kosovo</strong> and<br />

support our efforts, which is an excellent reflection of<br />

<strong>Kosovo</strong>’s stability and growth potential. <strong>Kosovo</strong> recently<br />

applied to join the International Monetary Fund and<br />

the World Bank, a further guarantee of stability. In<br />

addition, <strong>Kosovo</strong> has adopted the euro, which has had<br />

a highly beneficial effect on controlling inflation and<br />

promoting financial stability. Deposit insurance is now<br />

under discussion and we are working to ensure credit<br />

and liquidity for small and medium sized enterprises.<br />

All this gives the country credibility.<br />

ET: Why should <strong>European</strong> investors choose <strong>Kosovo</strong> as<br />

an investment destination?<br />

A. Shala: <strong>The</strong> government’s approach is clear: to put<br />

<strong>Kosovo</strong> solidly on the path to EU integration. <strong>Kosovo</strong> is<br />

already within the <strong>European</strong> Stability Pact framework, it<br />

is receiving official financial support from the EU, and<br />

it is making sure it is EU compliant in every area. Our<br />

laws respect the EU Acquis Communautaire. <strong>The</strong> EU<br />

integration process has worked very well in other small<br />

countries, such as Ireland, Estonia, Latvia and Lithuania.<br />

<strong>The</strong>re is no reason why it should not succeed equally well<br />

here in <strong>Kosovo</strong>.<br />

<strong>Kosovo</strong>’s specific advantages include its young population,<br />

massive reserves of lignite and other minerals, and<br />

enormous potential for tourism, such as skiing and hiking<br />

in the mountains. Our privatisation programme has<br />

proved to be a success and we are now focusing on our<br />

investment and export promotion. <strong>The</strong> important thing is<br />

to create the right market environment, and <strong>Kosovo</strong> is well<br />

on the way to achieving this.<br />

ET: What is your personal message to potential investors?<br />

A. Shala: <strong>The</strong>re is a simple but powerful paradigm that<br />

has applied to virtually all Central <strong>European</strong> and Balkan<br />

countries: in the immediate post-Soviet and post-Yugoslavia<br />

transition, the sequence in very simple terms has been to<br />

liberalise markets, privatise the financial sector and public<br />

utilities (which attracts foreign direct investment and<br />

creates new jobs), and stimulate the growth of smaller and<br />

medium sized enterprises to create more jobs. This process<br />

takes time, but a lot of this has already been put into place<br />

in <strong>Kosovo</strong>.<br />

My message to investors, therefore, is that <strong>Kosovo</strong>’s<br />

market is open and ready for investment. If you look at<br />

other Baltic countries that are now EU members, you<br />

can see the potential. Who would have expected this 20<br />

years ago? Come and visit <strong>Kosovo</strong> and discover all the<br />

many unexplored investment opportunities the country<br />

offers. Just make sure you come here ahead of your<br />

competitors!<br />

23

KOSOVO<br />

Finance & Banking<br />

NLB Prishtina<br />

Leading Commercial Bank Positioned<br />

to Partner Foreign Investors<br />

NLB Prishtina, with a 16%<br />

share of the local market, is one of<br />

<strong>Kosovo</strong>’s top commercial banks. It<br />

offers highly trained professionals,<br />

flexibility, innovation, efficiency,<br />

and a wide range of services to its<br />

local and international clientele,<br />

and has the largest network of any<br />

bank in <strong>Kosovo</strong>.<br />

Albert Lumezi, General Manager,<br />

explains that NLB Prishtina is<br />

the product of a merger of two<br />

local banks, NBK and KasaBank.<br />

<strong>The</strong> new bank began operating<br />

on January 1, 2008 with some<br />

€200 million in assets, making it<br />

<strong>Kosovo</strong>’s third largest bank. NLB<br />

Prishtina has positioned itself as<br />

the partner of choice for international<br />

investors. “We are absolutely<br />

ready to support businesses coming<br />

to <strong>Kosovo</strong> by providing them with<br />

sound financial services,” Albert<br />

Lumezi says.<br />

Albert Lumezi, General Manager<br />

NLB’s competitive edge is that<br />

it provides diverse products and<br />

services, it has the backing of regional<br />

leader the NLB Group, and it has<br />

developed a strategy of sustainable<br />

growth. “We aim to make NLB one<br />

of the best banks in <strong>Kosovo</strong>. We<br />

are focused on both the retail and<br />

corporate segments. Our primary<br />

intention is to serve the business<br />

community by fulfilling companies’<br />

objectives and development goals,”<br />

Albert Lumezi says. <strong>The</strong> bank’s local<br />

reputation is so strong that 95% of<br />

its clientele is from <strong>Kosovo</strong>.<br />

supporting the country’s continued<br />

economic development.” He adds<br />

that <strong>Kosovo</strong>’s investment appeal also<br />

includes low taxes, an EU compatible<br />

regulatory framework, political<br />

stability, a young and multilingual<br />

population, competitive labour<br />

prices, and strong growth potential.<br />

Banking dominates the local financial<br />

sector, accounting for 85% of total<br />

assets. <strong>The</strong> banking sector has been<br />

growing by 15% per year on average<br />

for the past three years, Albert Lumezi<br />

explains. He adds, “It is also worth<br />

mentioning that the average return<br />

on investments in <strong>Kosovo</strong>’s banking<br />

sector is higher than the regional<br />

average. In addition, financial sector<br />

regulations meet EU standards, and<br />

the use of the euro has contributed<br />

to controlling inflation. <strong>Kosovo</strong>’s<br />

financial sector is far ahead of those<br />

of its neighbours.”<br />

Urging international investors to<br />

investigate opportunities in <strong>Kosovo</strong>,<br />

Albert Lumezi concludes, “Now is<br />

the right time to invest here, and you<br />

will have a strong partner in NLB<br />

Prishtina.”<br />

Financial sector a success<br />

story<br />

<strong>Kosovo</strong> offers significant investment<br />

opportunities, and the progress the<br />

country has made in upgrading<br />

its financial sector reflects its long<br />

term potential. As Albert Lumezi<br />

says, “<strong>Kosovo</strong>’s financial sector has<br />

achieved real progress in providing<br />

sound services and thereby<br />

NLB Bank Prishtina<br />

Rr. Rexhep Luci Nr.5<br />

Tel. +381 38234 111<br />

Fax: +381 38246 189<br />

info@nlbprishtina-kos.com<br />

www.nlbprishtina-kos.com<br />

24

KOSOVO<br />

Finance & Banking<br />

Raiffeisen Bank<br />

Raiffeisen Bank <strong>Kosovo</strong> Named<br />

Bank of the Year 2007<br />

Raiffeisen Bank, with the strongest<br />

capitalisation of any bank in<br />

<strong>Kosovo</strong>, had a record year in 2007.<br />

<strong>The</strong> bank’s assets grew by more than<br />

27% over the year to reach €477<br />

million and its profits totalled<br />

€14.9 million. “Raiffeisen Bank<br />

has recorded a significant growth<br />

every year since it started to operate<br />

in <strong>Kosovo</strong>,” says CEO Bogdan<br />

Merfea. <strong>The</strong> Banker, a magazine of<br />

the Financial <strong>Times</strong> Group, named<br />

Raiffeisen Bank <strong>Kosovo</strong> ‘Bank of<br />

the Year’ in 2007.<br />

<strong>The</strong> bank was acquired by the<br />

Raiffeisen International group in<br />

2003 and now offers international<br />

reach and expertise as well as in-depth<br />

local knowledge. Raiffeisen International,<br />

its parent company, is known<br />

for its success in emerging markets<br />

and has activities in 17 Central and<br />

Eastern <strong>European</strong> countries with<br />

banking and leasing subsidiaries, as<br />

well as a number of other financial<br />

service providers.<br />

Bogdan Merfea, CEO<br />

Raiffeisen Bank <strong>Kosovo</strong> is a<br />

commercial bank serving both retail<br />

and corporate customers. “Currently<br />

we are in the sustainable growth stage<br />

with our individual and corporate<br />

clients contributing equally to our<br />