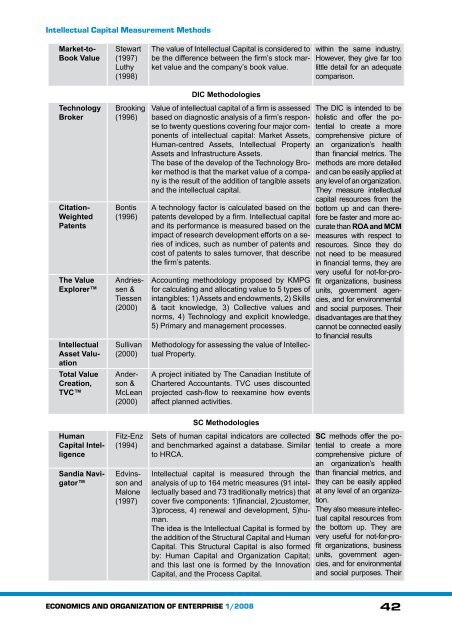

Intellectual Capital Measurement Methods

Intellectual Capital Measurement Methods

Intellectual Capital Measurement Methods

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Intellectual</strong> <strong>Capital</strong> <strong>Measurement</strong> <strong>Methods</strong><br />

Market-to-<br />

Book Value<br />

Technology<br />

Broker<br />

Citation-<br />

Weighted<br />

Patents<br />

The Value<br />

Explorer<br />

<strong>Intellectual</strong><br />

Asset Valuation<br />

Total Value<br />

Creation,<br />

TVC<br />

Stewart<br />

(1997)<br />

Luthy<br />

(1998)<br />

Brooking<br />

(1996)<br />

Bontis<br />

(1996)<br />

Andriessen<br />

&<br />

Tiessen<br />

(2000)<br />

Sullivan<br />

(2000)<br />

Anderson<br />

&<br />

McLean<br />

(2000)<br />

The value of <strong>Intellectual</strong> <strong>Capital</strong> is considered to<br />

be the difference between the firm’s stock market<br />

value and the company’s book value.<br />

DIC Methodologies<br />

Value of intellectual capital of a firm is assessed<br />

based on diagnostic analysis of a firm’s response<br />

to twenty questions covering four major components<br />

of intellectual capital: Market Assets,<br />

Human-centred Assets, <strong>Intellectual</strong> Property<br />

Assets and Infrastructure Assets.<br />

The base of the develop of the Technology Broker<br />

method is that the market value of a company<br />

is the result of the addition of tangible assets<br />

and the intellectual capital.<br />

A technology factor is calculated based on the<br />

patents developed by a firm. <strong>Intellectual</strong> capital<br />

and its performance is measured based on the<br />

impact of research development efforts on a series<br />

of indices, such as number of patents and<br />

cost of patents to sales turnover, that describe<br />

the firm’s patents.<br />

Accounting methodology proposed by KMPG<br />

for calculating and allocating value to 5 types of<br />

intangibles: 1) Assets and endowments, 2) Skills<br />

& tacit knowledge, 3) Collective values and<br />

norms, 4) Technology and explicit knowledge,<br />

5) Primary and management processes.<br />

Methodology for assessing the value of <strong>Intellectual</strong><br />

Property.<br />

A project initiated by The Canadian Institute of<br />

Chartered Accountants. TVC uses discounted<br />

projected cash-flow to reexamine how events<br />

affect planned activities.<br />

within the same industry.<br />

However, they give far too<br />

little detail for an adequate<br />

comparison.<br />

The DIC is intended to be<br />

holistic and offer the potential<br />

to create a more<br />

comprehensive picture of<br />

an organization’s health<br />

than financial metrics. The<br />

methods are more detailed<br />

and can be easily applied at<br />

any level of an organization.<br />

They measure intellectual<br />

capital resources from the<br />

bottom up and can therefore<br />

be faster and more accurate<br />

than ROA and MCM<br />

measures with respect to<br />

resources. Since they do<br />

not need to be measured<br />

in financial terms, they are<br />

very useful for not-for-profit<br />

organizations, business<br />

units, government agencies,<br />

and for environmental<br />

and social purposes. Their<br />

disadvantages are that they<br />

cannot be connected easily<br />

to financial results<br />

Human<br />

<strong>Capital</strong> Intelligence<br />

Fitz-Enz<br />

(1994)<br />

Sandia Navigator<br />

Edvinsson<br />

and<br />

Malone<br />

(1997)<br />

SC Methodologies<br />

Sets of human capital indicators are collected<br />

and benchmarked against a database. Similar<br />

to HRCA.<br />

<strong>Intellectual</strong> capital is measured through the<br />

analysis of up to 164 metric measures (91 intellectually<br />

based and 73 traditionally metrics) that<br />

cover five components: 1)financial, 2)customer,<br />

3)process, 4) renewal and development, 5)human.<br />

The idea is the <strong>Intellectual</strong> <strong>Capital</strong> is formed by<br />

the addition of the Structural <strong>Capital</strong> and Human<br />

<strong>Capital</strong>. This Structural <strong>Capital</strong> is also formed<br />

by: Human <strong>Capital</strong> and Organization <strong>Capital</strong>;<br />

and this last one is formed by the Innovation<br />

<strong>Capital</strong>, and the Process <strong>Capital</strong>.<br />

SC methods offer the potential<br />

to create a more<br />

comprehensive picture of<br />

an organization’s health<br />

than financial metrics, and<br />

they can be easily applied<br />

at any level of an organization.<br />

They also measure intellectual<br />

capital resources from<br />

the bottom up. They are<br />

very useful for not-for-profit<br />

organizations, business<br />

units, government agencies,<br />

and for environmental<br />

and social purposes. Their<br />

ECONOMICS AND ORGANIZATION OF ENTERPRISE 1/2008<br />

42