Annual Report - ESB Retired Staff Homepage

Annual Report - ESB Retired Staff Homepage

Annual Report - ESB Retired Staff Homepage

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page A<br />

MPF<br />

<strong>ESB</strong> <strong>Staff</strong> Medical Provident Fund<br />

<strong>Annual</strong> <strong>Report</strong><br />

Year Ending 31st December 2009

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page B

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 1<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

CONTENTS<br />

Board of Trustees 2<br />

Manager’s & Adviser’s 2<br />

Operational Statistics 3<br />

Membership Profile 3<br />

<strong>Report</strong> of Trustees 4<br />

Administration 7<br />

Trustees’ Responsibilities 7<br />

<strong>Report</strong> of Auditors 8<br />

Income & Expenditure Account 9<br />

Balance Sheet 10<br />

Accounting Policies 11<br />

Notes to Financial Statements 12<br />

Notice of AGM 15<br />

Contact Addresses and Numbers 16<br />

This <strong>Report</strong> and the Members Guide to Benefits and Subscription Rates can<br />

be viewed by serving staff on the <strong>ESB</strong> Intranet (Click on <strong>Staff</strong> Services and<br />

Health Insurance) and by retired members on www.esbretiredstaff.ie.<br />

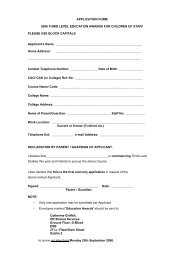

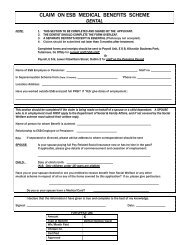

Application forms for membership and benefit claims can also be downloaded<br />

from both sites.<br />

E-mail Address: mpf@esb.ie<br />

Produced by MPF Medical Provident Fund © MPF 2010

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 2<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

BOARD OF TRUSTEES<br />

<strong>ESB</strong> Appointees<br />

Cathy Casey<br />

Niall Dineen<br />

James O’Loughlin<br />

Marguerite Sayers<br />

Elected<br />

Helen Henry<br />

Dan Hickey<br />

Joe La Cumbre<br />

Martina Mannix<br />

ADVISERS AND MANAGERS<br />

Actuary<br />

Mercer Human Resource Consulting Limited<br />

Auditors<br />

Group Internal Audit, <strong>ESB</strong><br />

and Whelan Dowling<br />

Bankers<br />

Allied Irish Banks Plc.<br />

Custodians<br />

Citibank N.A.<br />

Investment Advisers<br />

Mercer Human Resource Consulting Ltd.<br />

Investment Managers<br />

Irish Life Investment Managers<br />

Fund Manager<br />

Dave McCabe<br />

2

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 3<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

OPERATIONAL HEADLINES FOR 2009<br />

31.12.08 31.12.09<br />

€000’s<br />

€000’s<br />

Subscription Income 26,209 29,357<br />

Claims & Other Expenditure 26,469 30,337<br />

Operating Surplus/Deficit (260) (980)<br />

Investment Income after tax 157 114<br />

Realised/Unrealised Investment Gains/Losses (6,016) 3,607<br />

Surplus transferred to Reserves (6,119) 2,741<br />

Market Value of Reserves 23,220 25,961<br />

Number of approved Claims 31,739 32,325<br />

Membership 27,243 26,633<br />

MEMBERSHIP PROFILE<br />

31-Dec-08<br />

31-Dec-09<br />

Ordinary Scheme<br />

<strong>Staff</strong> 2,763 2,666<br />

<strong>Retired</strong> 1,290 1,332<br />

Adult Associates 6,334 6,177<br />

Children (Under 18) 5,116 4,768<br />

Number in Ordinary Scheme 15,503 14,943<br />

Extra Benefits Scheme<br />

<strong>Staff</strong> 3,478 3,205<br />

<strong>Retired</strong> 2,729 2,957<br />

Adult Associates 5,267 5,265<br />

Children (Under 18) 266 263<br />

Number in Extra Benefits Scheme 11,740 11,690<br />

Total Membership 27,243 26,633<br />

3

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 4<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

REPORT OF THE TRUSTEES<br />

This <strong>Annual</strong> <strong>Report</strong> of the <strong>ESB</strong> <strong>Staff</strong> Medical Provident Fund explains the main objectives of the<br />

Fund, outlines the main issues facing the Trustees and also includes the audited financial statements<br />

for the fund year ending 31 December 2009. An abridged version of this report has been issued to<br />

each subscriber.<br />

Both reports give key information to provide you with a good overview of the financial and long-term<br />

position of the Fund. The Accounts and the related notes, which form part of the Financial<br />

Statements are included in pages 9 to 14 of this report and have been audited by Whelan Dowling<br />

& Associates, Chartered Accountant & Registered Auditor on behalf of Group Internal Audit, <strong>ESB</strong>.<br />

The Accounts were approved by the Trustees on 22 June 2010.<br />

Objectives of the Fund<br />

Since being founded in 1955, MPF has as its objective the assisting of members in the payment of<br />

medical expenses. This includes both inpatient and outpatient costs with a priority being applied to<br />

maintaining the best possible inpatient cover. As a health insurance provider, MPF is regulated under<br />

the Health Insurance Act 1994 – S.I. No. 80 of Health Insurance Act, 1994 (Registration)<br />

Regulations, 1996 and subsequent Acts and Regulations.<br />

Financial Results<br />

An operating deficit arises for the year under review. Claim expenditure exceeded Subscription<br />

income by €825,397. When administrative expenses, bank interest, tax is taken into account the<br />

overall operating deficit was €866,262.<br />

For 2009, contributions increased by 12% to €29.357 million but expenditure on benefits was up<br />

by 14% to €30.183 million. This reflects not just an increase in the cost of these claims but also the<br />

effect of an upward trend in actual claim numbers, which increased to over 32,000 for the year.<br />

The good news is that we had a major improvement on investment markets and the return on invested<br />

reserves for the year was a very positive + 20.2%. After providing for Tax the gains amounted to<br />

over €3.6 million.<br />

These gains less the operating deficit allowed for a surplus of €2.741 million to be transferred to<br />

Reserves. The value of the Fund increased to €25.961 million.<br />

4

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 5<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

Investments<br />

The reserves of the Fund are managed under contract by Irish Life Investment Managers (ILIM). On<br />

the recommendation of our advisers, Mercer Limited, we have divided the invested reserves between<br />

global equities (65%) and government bonds (35%).<br />

For the equity portion, the ILIM mandate is to manage the Fund in order to match a benchmark return<br />

based on the FTSE Eurobloc Index and the FTSE World ex-Eurobloc indices. ILIM are required to<br />

select stocks that closely match those in the indices. This is called passive or index investment management.<br />

For the fixed interest portion of the Fund, the investment manager is required to outperform a composite<br />

benchmark index comprised of 75% Merrill Lynch over 5 year bonds and 25% Merrill Lynch<br />

under 5 year bonds.<br />

The overall performance for the year was +20.2% against a benchmark target of +20.4%. At this<br />

stage of 2010, markets have continued to stay in positive territory.<br />

The EU non-life insurance directive requires that the minimum solvency level for the our type of fund<br />

must not be less than 26% of the average cost of benefit claims over the previous three year period.<br />

The value of the reserves is well in excess of this requirement.<br />

The Irish Health Insurance system<br />

The Government recently reiterated its commitment to supporting the established community rated<br />

system in this country. This means that all insured members of any particular scheme pay the same<br />

premium for the same range of benefits. The intention is that younger healthier members continue to<br />

support older members thus maintaining an inter-generational support for the system.<br />

The Minister also announced some months ago that a new Risk Equalisation Scheme was being prepared<br />

for launch in a few years time. In the meantime, the levy/tax credit interim arrangements would<br />

continue for all commercial insurers but excluding Restricted Membership Undertakings like MPF.<br />

The exclusion of MPF is depriving us of an opportunity to avail of credit payments in respect of our<br />

older members and is of continuing concern for the Trustees. We will be seeking that MPF be allowed<br />

to join the new Risk Equalisation scheme when it is launched.<br />

5

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 6<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

The Future<br />

While we continue to press for inclusion of all health insurance subscribers in general national<br />

schemes, other avenues are also being explored such as:<br />

•Introducing a new health Insurance plan, which would have more modest benefits than either the<br />

Ordinary or Extra Benefit schemes but would consequently be more keenly priced<br />

•Linking up with another health insurer, if this could provide mutual benefits and also help safeguard<br />

the long-term future of MPF members<br />

Subscription Rates<br />

As stated last year, while we are generally experiencing a period of negative price inflation, medical<br />

inflation continues at levels around +8%. When this is coupled with our older age profile, we have little<br />

option but to increase subscription rates annually or cut benefits. We are aware that some members,<br />

especially those who are on pension are now becoming more conscious of the level of premiums<br />

required. The general view is that members do not wish to see major cuts in benefits within the<br />

existing two schemes.<br />

It is expected that the possible introduction of a third scheme with reduced premiums and more modest<br />

benefits may be of interest to some members.<br />

Benefits<br />

The benefits provided by MPF schemes are outlined in the Members Guide to Benefits and<br />

Subscription Rates, which issued to each subscriber in early January 2010. If you have mislaid your<br />

Guide, a further copy can be obtained from the Limerick office or immediate access is available via the<br />

<strong>ESB</strong> Intranet or the retired staff web-site – www.esbretiredstaff.ie<br />

Membership<br />

Total membership at 31 December 2009 was 26,633, a reduction of 610 on the previous year. The<br />

major element of this reduction is made up of associate child members exiting the fund when they are<br />

no longer dependants of the main member. When deaths etc. are also taken into account, the number<br />

of new joiners exceeded the number of resignations from the Fund in the year. The Trustees are also<br />

happy that while health insurance is becoming more expensive in Ireland the quality of the health insurance<br />

plans on offer by MPF is reflected in the continuing loyalty of our membership. A profile of membership<br />

is shown on Page 3.<br />

If you are a member of the Ordinary Scheme, please consider transferring to the Extra Benefits scheme<br />

at an early age rather than waiting until a serious medical problem arises. It is important to take account<br />

of the higher cover available in this scheme for both inpatient and outpatient treatments. Shortfalls can<br />

6

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 7<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

arise in Beacon, Mount Carmel, Whitfield and Mater Private Hospitals and in both in Blackrock and<br />

Galway Clinics and if you avail of private accommodation in any hospital.<br />

Membership is open to all staff in <strong>ESB</strong> Group. If you leave <strong>ESB</strong> on voluntary service, you can retain<br />

membership if you are in receipt of ongoing pay/pension from <strong>ESB</strong> or have preserved pension rights.<br />

Administration<br />

The MPF Office in Limerick administers scheme benefits and membership, arranges collection of<br />

subscriptions and makes payments to members, hospitals, consultants and other service providers.<br />

The Office also provides general advice and support on cover.<br />

Over 32,000 claims were assessed and processed during 2009. The Trustees wish to express their<br />

gratitude to everyone in the MPF Team for continuing to provide both a considerate and efficient service,<br />

which is appreciated by members and all other stakeholders.<br />

The administrative expenses of operating the office, with the exception of certain professional fees,<br />

are borne directly by <strong>ESB</strong>. The Trustees acknowledge this ongoing support as they do the contribution<br />

of EAP Officers and many other individuals within <strong>ESB</strong>.<br />

Respective responsibilities of Trustees and Auditor<br />

The Trustees are responsible for the preparation of the financial statements in accordance with generally<br />

accepted accounting practice in Ireland including the accounting standards issued by the<br />

Accounting Standards Board and published by the Institute of Chartered Accountants in Ireland, and<br />

in accordance with Rule 16 of the <strong>ESB</strong> <strong>Staff</strong> Medical Provident Fund.<br />

Our responsibility is to audit the financial statements in accordance with relevant legal and regulatory<br />

requirements and International Standards on Auditing (UK and Ireland).<br />

7

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 8<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

<strong>Report</strong> of the Auditors<br />

We report to you our opinion as to whether the financial statements give a true and fair view, in<br />

accordance with generally accepted accounting practice in Ireland. We also report to you whether<br />

in our opinion, proper books of account have been kept by the Fund and whether the information<br />

given in the Trustees’ <strong>Report</strong> is consistent with the financial statements. In addition, we state<br />

whether we have obtained all the information and explanations necessary for the purposes of our<br />

audit and whether the Fund’s balance sheet and its income and expenditure account are in agreement<br />

with the books of account.<br />

Basis of Audit Opinion<br />

We conducted our audit in accordance with International Standards on Auditing (UK and Ireland)<br />

issued by the Auditing Practices Board. An audit includes examination on a test basis, of evidence<br />

relevant to the amounts and disclosures in the financial statements. It also includes an assessment<br />

of the significant estimates and judgements made by the Trustees in the preparation of the financial<br />

statements, and of whether the accounting policies are appropriate to the Fund’s circumstances,<br />

consistently applied and adequately disclosed.<br />

We planned and performed our audit so as to obtain all the information and explanations which we<br />

considered necessary in order to provide us with sufficient evidence to give reasonable assurance<br />

that the financial statements are free from material misstatement, whether caused by fraud or other<br />

irregularity or error. In forming our opinion we also evaluated the overall adequacy of the presentation<br />

of information in the financial statements.<br />

Opinion<br />

In our opinion the financial statements give a true and fair view of the state of the Fund’s affairs as<br />

at 31 December 2009 and of its results for the year then ended and have been properly prepared<br />

in accordance with generally accepted accounting practice in Ireland and the applicable rules of the<br />

fund.<br />

We have obtained all the information and explanations we consider necessary for the purposes of<br />

our audit. In our opinion, proper books of account have been kept by the Fund. The financial statements<br />

are in agreement with the books of account.<br />

In our opinion the information given in the Trustees’ <strong>Report</strong> is consistent with the financial statements.<br />

Whelan Dowling & Associates<br />

Chartered Accountants & Registered Auditors, 33 Westland Square, Dublin 2<br />

29th April 2010<br />

8

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 9<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

<strong>ESB</strong> STAFF MEDICAL PROVIDENT FUND<br />

INCOME AND EXPENDITURE ACCOUNT<br />

FOR YEAR ENDED 31 DECEMBER 2009<br />

INCOME Notes 2008 2009<br />

€ €<br />

Contributions 2 26,209,258 29,357,304<br />

Claims 3 (26,404,880) (30,182,701)<br />

Gross Profit/Deficit (195,622) (825,397)<br />

Administrative Expenses 4 (64,062) (155,065)<br />

Operating Profit/Deficit (259,684) (980,462)<br />

Investment Income 195,700 149,565<br />

Tax on Investment Income 5 (39,140) (35,365)<br />

Sub total 156,560 114,200<br />

Surplus/Deficit before unrealised gains (103,124) (866,262)<br />

Unrealised Gain (7,812,594) 4,939,709<br />

Capital Gains Tax Provision for<br />

unrealised gains 5 1,796,897 (1,332,642)<br />

SURPLUS FOR YEAR 10 (6,118,821) 2,740,805<br />

APPROPRIATED AS FOLLOWS:<br />

To Reserves 820,320 (2,198,904)<br />

To Revaluation Reserve (6,939,141) 4,939,709<br />

Statement of total recognised gains and losses<br />

The fund has no recognised gains and losses other than those included in the Income and<br />

Expenditure account above and therefore, no separate statement of total recognised gains and<br />

losses has been prepared. All the activities of the fund are classified as continuing.<br />

9

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 10<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

<strong>ESB</strong> STAFF MEDICAL PROVIDENT FUND<br />

BALANCE SHEET AS AT 31 DECEMBER 2009<br />

FINANCIAL ASSETS Notes 2008 2009<br />

€ €<br />

Investments 6 24,471,195 29,410,904<br />

CURRENT ASSETS<br />

Debtors 7 1,918,769 810,117<br />

Cash at bank and in hand 8<br />

___________<br />

3,585,772<br />

___________<br />

4,333,359<br />

___________<br />

5,504,541<br />

___________<br />

5,143,476<br />

Creditors: amounts falling due<br />

within one year 9 (6,755,347) (8,593,186)<br />

Net Current Liabilities (1,250,806) (3,449,710)<br />

Total Assets less Current<br />

Liabilities 23,220,389 25,961,194<br />

Net Assets 23,220,389 25,961,194<br />

Financed by:<br />

Reserves<br />

Revenue Reserve 10 23,106,916 20,908,012<br />

Revaluation Reserve 10 113,473 5,053,182<br />

Members' Fund 23,220,389 25,961,194<br />

The financial statements were approved and authorised for issue by the Trustees<br />

on 22 June 2010<br />

10

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 11<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

1. STATEMENT OF ACCOUNTING POLICIES<br />

The following accounting policies have been applied consistently in dealing with items which<br />

are considered material in relation to the fund's financial statements:<br />

1.1 Basis of Preparation<br />

The audited financial statements are prepared in accordance with generally accepted accounting<br />

principles under the historical cost convention, with the exception of financial investments<br />

which are stated at market value.<br />

Accounting standards generally accepted in Ireland in preparing financial statements giving a<br />

true and fair view are those published by the Institute of Chartered Accountants in Ireland and<br />

issued by the Accounting Standards Board.<br />

1.2 Financial Investments<br />

Financial Investments are stated at market value. Unrealised gains/losses on investments are<br />

calculated as the difference between the market valuation of those investments at the balance<br />

sheet date and their valuation at the previous balance sheet date or their purchase price if purchased<br />

during the year. Realised gains/losses are determined on an average cost basis. Both<br />

unrealised and realised gains/losses are recorded in the Income and Expenditure Account.<br />

1.3 Deferred Taxation<br />

Deferred tax is recognised in respect of all timing differences that have originated but not<br />

reversed at the balance sheet date where transactions or events have occurred at that date that<br />

will result in an obligation to pay more, or a right to pay less or to receive more tax relief, with<br />

the following exceptions:<br />

Provision is made for tax on gains arising from the revaluation (and similar fair value adjustments)<br />

of fixed assets and gains on disposal of fixed assets that have been rolled over into<br />

replacement assets, only to the extent that, at the balance sheet date, there is a binding agreement<br />

to dispose of the assets concerned. However, no provision is made where, on the basis<br />

of all available evidence at the balance sheet date, it is more likely than not that the taxable gain<br />

will be rolled over into replacement assets and charged to tax only where the replacement<br />

assets are sold.<br />

1.4 Contributions<br />

Contributions received represent the total value of premiums received from the members of the<br />

fund during the year.<br />

11

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 12<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

2. Income<br />

The total income of the fund for the year has been derived from its principal activity, wholly<br />

undertaken in Ireland.<br />

3. Claims<br />

Claims incurred comprise claims and related expenses paid in the period and changes in the<br />

provisions for outstanding claims, including provisions for claims incurred but not reported and<br />

related expenses. Where applicable, deductions are made for recoveries.<br />

The fund takes all reasonable steps to ensure that it has appropriate information regarding its<br />

claims exposures. However, given the uncertainty in establishing claims provisions, it is likely<br />

that the final outcome will prove to be different from the original liability established.<br />

The estimation of claims incurred but not reported is generally subject to a greater degree of<br />

uncertainty than the estimation of the cost of settling claims, where more information about the<br />

claim event is generally available.<br />

The provision for outstanding claims €7,360,000 (2008 - €6,620,000) note 9, is based on<br />

post year-end information and a reasonable estimate of expected but unreported claims.<br />

4. ADMINISTRATIVE EXPENSES € €<br />

2008 2009<br />

Health Insurance Authority Levy 36,450 41,353<br />

Professional Fees 17,571 19,169<br />

Advances not recoverable 10,041 94,543<br />

64,062 155,065<br />

5. TAXATION<br />

Tax on Investment Income 39,140 35,365<br />

CGT provision on unrealised gains (1,796,897) 1,332,642<br />

CGT on realised gains 0 0<br />

(1,757,757) 1,368,007<br />

Tax on investment income is charged at 25% of the total investment income. Capital Gains Tax on<br />

realised and unrealised gains is charged at 25% of the total gains. An additional 3% taxation<br />

charge applies to gains within a unitised fund.<br />

12

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 13<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

6. FINANCIAL INVESTMENTS Market value<br />

€<br />

At 1 January 2009 24,471,195<br />

Unrealised gains<br />

___________<br />

4,939,709<br />

At 31 December 2009<br />

___________<br />

29,410,904<br />

Market Value 2008 2009<br />

€ €<br />

Unitised equities 16,018,844 19,522,958<br />

Bonds & Gilts<br />

___________<br />

8,452,351<br />

___________<br />

9,887,946<br />

___________<br />

24,471,195<br />

___________<br />

29,410,904<br />

7. DEBTORS 2008 2009<br />

€ €<br />

Outstanding contributions 1,292,428 453,482<br />

Claims advances outstanding 361,702 336,811<br />

CGT asset on unrealised loss 232,190 0<br />

Accrued Income – Interest Receivable<br />

___________<br />

32,449<br />

___________<br />

19,824<br />

___________<br />

1,918,769<br />

___________<br />

810,117<br />

8. Cash at bank and in hand 2008 2009<br />

€ €<br />

Bank Overdraft (952,874) (1,610,817)<br />

AIB Deposit Account 1,019,453 2,327,374<br />

AIB Call Deposit Accounts<br />

___________<br />

3,519,193<br />

___________<br />

3,616,802<br />

___________<br />

3,585,772<br />

___________<br />

4,333,359<br />

The bank overdraft is due to uncashed cheques at the year end. It is replenished from the deposit<br />

account, as required, to avoid any interest charges arising.<br />

13

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 14<br />

MPF <strong>Annual</strong> <strong>Report</strong> Year Ending 31.12.2009<br />

9. CREDITORS: 2008 2009<br />

€ €<br />

Provision for outstanding claims (Note 3) 6,620,000 7,360,000<br />

Withholding tax provision 105,749 124,178<br />

Income tax provision 18,254 (6,347)<br />

CGT provision on unrealised gains 0 1,100,452<br />

Accruals – Professional Fees/Levies<br />

___________<br />

11,344<br />

___________<br />

14,903<br />

___________<br />

6,755,347<br />

___________<br />

8,593,186<br />

10. RESERVES<br />

Revenue Revaluation<br />

Reserve Reserve Total<br />

€ € €<br />

At 1 January 2009 23,106,916 113,473 23,220,389<br />

Increase/Decrease in reserves<br />

___________<br />

(2,198,904)<br />

___________<br />

4,939,709<br />

___________<br />

2,740,805<br />

At 31 December 2009<br />

___________<br />

20,908,012<br />

___________<br />

5,053,182<br />

___________<br />

25,961,194<br />

11. CAPITAL COMMITMENTS<br />

No capital commitments existed at 31 December 2009.<br />

12. CONTINGENT LIABILITIES<br />

There were no contingent liabilities at 31 December 2009.<br />

14

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 15<br />

ANNUAL GENERAL MEETING<br />

In accordance with Rule 9.3, the Trustees have convened the <strong>Annual</strong> General Meeting of the <strong>ESB</strong><br />

<strong>Staff</strong> Medical Provident Fund. The details are as follows:<br />

Date: Thursday, 16 September 2010<br />

Time:<br />

Venue:<br />

8.00 pm<br />

Maryborough House Hotel, Cork<br />

AGENDA<br />

1. Minutes of AGM held on 10 September 2009<br />

2. Trustees <strong>Annual</strong> <strong>Report</strong> for year ended 31 December 2009<br />

3. Audited accounts for year ended 31 December 2009<br />

4. Any other Business<br />

15

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page 16<br />

Addresses and Contact Numbers for MPF Personnel<br />

The e-mail address for MPF is mpf@esb.ie.<br />

Phone Numbers<br />

e-mail address<br />

Internal External<br />

Catriona Hurley 55306 061-430506 Catriona.Hurley@esb.ie<br />

Noreen Ryan 55211 061-430411 Noreen.Ryan@esb.ie<br />

Ciaran O'Callaghan 55323 061-430523 Ciaran.OCallaghan@esb.ie<br />

Anne Johnson 55361 061-430561 Anne.Johnson@esb.ie<br />

Michelle Carney 55381 061-430581 Michelle.Carney@esb.ie<br />

Eimear Barrett 55386 061-430586 Eimear.Barrett@esb.ie<br />

John Conneely 55274 061-430474 John.Conneely@esb.ie<br />

Dave McCabe, Fund Manager who also acts as Secretary to the Trustees and as Compliance Officer<br />

for the Fund is based at 27 Lower Fitzwilliam Street, Dublin 2 - Phone Number 087-9971078. e-mail:<br />

David.McCabe@esb.ie<br />

All claim and membership correspondence should be forwarded to the Limerick Office. If posting<br />

externally please use the following address:<br />

<strong>ESB</strong> <strong>Staff</strong> Medical Provident Fund, P.O. Box 384, Rosbrien, Limerick<br />

16

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page C

MPF 2009 <strong>Annual</strong> <strong>Report</strong>:MPF 2004 <strong>Annual</strong> <strong>Report</strong> 20/08/2010 10:00 Page D<br />

<strong>ESB</strong> <strong>Staff</strong> Medical Provident Fund<br />

27 Lower Fitzwilliam Street<br />

Dublin 2.