Protective Puts â Insurance for your stocks How to ... - CommSec

Protective Puts â Insurance for your stocks How to ... - CommSec

Protective Puts â Insurance for your stocks How to ... - CommSec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

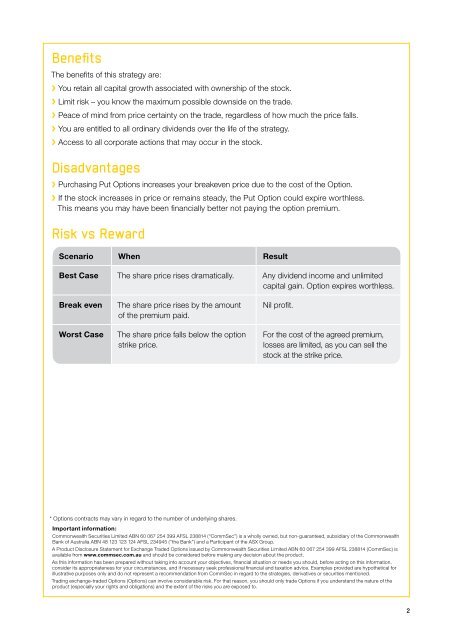

Benefits<br />

The benefits of this strategy are:<br />

You retain all capital growth associated with ownership of the s<strong>to</strong>ck.<br />

Limit risk – you know the maximum possible downside on the trade.<br />

Peace of mind from price certainty on the trade, regardless of how much the price falls.<br />

You are entitled <strong>to</strong> all ordinary dividends over the life of the strategy.<br />

Access <strong>to</strong> all corporate actions that may occur in the s<strong>to</strong>ck.<br />

Disadvantages<br />

Purchasing Put Options increases <strong>your</strong> breakeven price due <strong>to</strong> the cost of the Option.<br />

If the s<strong>to</strong>ck increases in price or remains steady, the Put Option could expire worthless.<br />

This means you may have been financially better not paying the option premium.<br />

Risk vs Reward<br />

Scenario When Result<br />

Best Case The share price rises dramatically. Any dividend income and unlimited<br />

capital gain. Option expires worthless.<br />

Break even<br />

Worst Case<br />

The share price rises by the amount<br />

of the premium paid.<br />

The share price falls below the option<br />

strike price.<br />

Nil profit.<br />

For the cost of the agreed premium,<br />

losses are limited, as you can sell the<br />

s<strong>to</strong>ck at the strike price.<br />

* Options contracts may vary in regard <strong>to</strong> the number of underlying shares.<br />

Important in<strong>for</strong>mation:<br />

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (“<strong>CommSec</strong>”) is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth<br />

Bank of Australia ABN 48 123 123 124 AFSL 234945 (“the Bank”) and a Participant of the ASX Group.<br />

A Product Disclosure Statement <strong>for</strong> Exchange Traded Options issued by Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (<strong>CommSec</strong>) is<br />

available from www.commsec.com.au and should be considered be<strong>for</strong>e making any decision about the product.<br />

As this in<strong>for</strong>mation has been prepared without taking in<strong>to</strong> account <strong>your</strong> objectives, financial situation or needs you should, be<strong>for</strong>e acting on this in<strong>for</strong>mation,<br />

consider its appropriateness <strong>for</strong> <strong>your</strong> circumstances, and if necessary seek professional financial and taxation advice. Examples provided are hypothetical <strong>for</strong><br />

illustrative purposes only and do not represent a recommendation from <strong>CommSec</strong> in regard <strong>to</strong> the strategies, derivatives or securities mentioned.<br />

Trading exchange-traded Options (Options) can involve considerable risk. For that reason, you should only trade Options if you understand the nature of the<br />

product (especially <strong>your</strong> rights and obligations) and the extent of the risks you are exposed <strong>to</strong>.<br />

2