Opt out form - Pensions

Opt out form - Pensions

Opt out form - Pensions

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

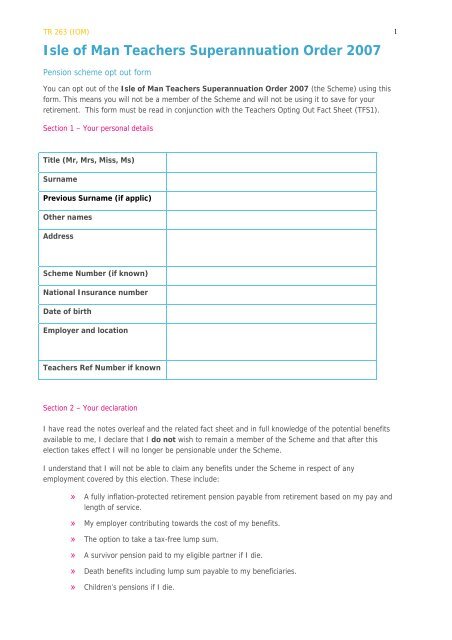

TR 263 (IOM) 1<br />

Isle of Man Teachers Superannuation Order 2007<br />

Pension scheme opt <strong>out</strong> <strong>form</strong><br />

You can opt <strong>out</strong> of the Isle of Man Teachers Superannuation Order 2007 (the Scheme) using this<br />

<strong>form</strong>. This means you will not be a member of the Scheme and will not be using it to save for your<br />

retirement. This <strong>form</strong> must be read in conjunction with the Teachers <strong>Opt</strong>ing Out Fact Sheet (TFS1).<br />

Section 1 – Your personal details<br />

Title (Mr, Mrs, Miss, Ms)<br />

Surname<br />

Previous Surname (if applic)<br />

Other names<br />

Address<br />

Scheme Number (if known)<br />

National Insurance number<br />

Date of birth<br />

Employer and location<br />

Teachers Ref Number if known<br />

Section 2 – Your declaration<br />

I have read the notes overleaf and the related fact sheet and in full knowledge of the potential benefits<br />

available to me, I declare that I do not wish to remain a member of the Scheme and that after this<br />

election takes effect I will no longer be pensionable under the Scheme.<br />

I understand that I will not be able to claim any benefits under the Scheme in respect of any<br />

employment covered by this election. These include:<br />

» A fully inflation-protected retirement pension payable from retirement based on my pay and<br />

length of service.<br />

» My employer contributing towards the cost of my benefits.<br />

» The option to take a tax-free lump sum.<br />

» A survivor pension paid to my eligible partner if I die.<br />

» Death benefits including lump sum payable to my beneficiaries.<br />

» Children’s pensions if I die.

TR 263 (IOM) 2<br />

» Access to Ill-health retirement benefits.<br />

I have read and understand the points on page 1 and above.<br />

Your signature<br />

Date<br />

Notes:<br />

You must now forward this application to your last employer to complete Section 3. If you have more<br />

than one employer, each must complete a Section 3.<br />

Section 3 – To be completed by your Employing Authorities pay office<br />

The section below is to be completed by your relevant payroll or finance representative once you have<br />

completed Section 1 and 2 of your <strong>form</strong>.<br />

Date <strong>Opt</strong> Out <strong>form</strong> issued to<br />

employee<br />

Date <strong>Opt</strong> Out <strong>form</strong> received<br />

from employee<br />

Date current period of<br />

employment commenced<br />

Date current period of scheme<br />

membership commenced<br />

Employee last day of scheme<br />

membership<br />

Employee payroll or<br />

assignment number<br />

Has the member paid<br />

contributions in this<br />

employment<br />

Did you receive this <strong>form</strong> from<br />

the employee within the first 3<br />

months pay period with<strong>out</strong><br />

crossing a financial year end<br />

YES/NO<br />

Yes - please refund the<br />

contribution through the pay<br />

roll system<br />

No – The PSPA will pay any<br />

refund due on receipt of the<br />

members leaver <strong>form</strong> and<br />

Gen 1/12 from the employer<br />

Date Gen 1/12 and Gen 2/12<br />

forwarded to PSPA (if<br />

relevant)

TR 263 (IOM) 3<br />

Completed by: Name and<br />

designation<br />

Employing Authority Name and<br />

Address<br />

Signature<br />

Date<br />

Important notes ab<strong>out</strong> your decision<br />

Please read these notes carefully:<br />

1. You should only complete this <strong>form</strong> if you do not wish your future employment to be pensionable under the<br />

Teachers Superannuation Order 2007 (the Scheme) and you are either:<br />

a. currently in employment which is pensionable under those regulations; OR<br />

b. intending to take up such employment in the future.<br />

2. The election will have effect from either of the following:<br />

a. If you complete the <strong>form</strong> within three months after taking up an appointment in employment which<br />

would be pensionable under the Scheme, the first day of that employment.<br />

b. The first day of the month following the date you sign the <strong>form</strong>.<br />

You will be notified as soon as the election has been processed.<br />

3. Any teaching service you do complete after the date the election takes effect will not be pensionable under the<br />

Teachers Scheme Regulations. The election will not, however, affect any pension rights you have built up in<br />

respect of service completed before the date on which it takes effect.<br />

4. If at any time in the future you wish to consider coming back into the Scheme you can obtain further<br />

in<strong>form</strong>ation ab<strong>out</strong> the conditions for rejoining the Scheme by contacting the administrator.<br />

5. Please complete Sections 1 and 2, before returning it to your employer to complete Section 3.<br />

6. Note to employers: Upon receipt of this <strong>form</strong> from your employee, action opt <strong>out</strong> decision and complete Section<br />

3 and then return the completed <strong>form</strong> to:<br />

Public Sector <strong>Pensions</strong> Authority<br />

Goldie House<br />

1 - 4 Goldie Terrace, Upper Church Street<br />

Douglas<br />

ISLE OF MAN<br />

IM1 1EE<br />

Or Email to pensions@pspa.im<br />

Where can I find more in<strong>form</strong>ation<br />

You can find more in<strong>form</strong>ation using the resources on our website