Unmarried partner nomination form - Pensions

Unmarried partner nomination form - Pensions

Unmarried partner nomination form - Pensions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

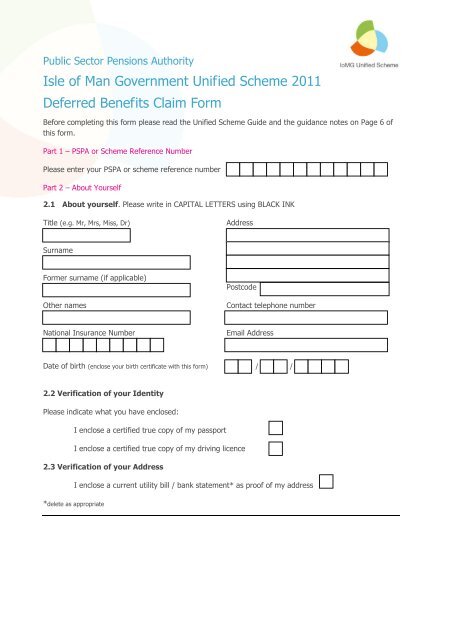

GUS 4<br />

Public Sector <strong>Pensions</strong> Authority<br />

Isle of Man Government Unified Scheme 2011<br />

Deferred Benefits Claim Form<br />

Before completing this <strong>form</strong> please read the Unified Scheme Guide and the guidance notes on Page 6 of<br />

this <strong>form</strong>.<br />

Part 1 – PSPA or Scheme Reference Number<br />

Please enter your PSPA or scheme reference number<br />

Part 2 – About Yourself<br />

2.1 About yourself. Please write in CAPITAL LETTERS using BLACK INK<br />

Title (e.g. Mr, Mrs, Miss, Dr)<br />

Address<br />

Surname<br />

Former surname (if applicable)<br />

Other names<br />

Postcode<br />

Contact telephone number<br />

National Insurance Number<br />

Email Address<br />

Date of birth (enclose your birth certificate with this <strong>form</strong>) / /<br />

2.2 Verification of your Identity<br />

Please indicate what you have enclosed:<br />

I enclose a certified true copy of my passport<br />

I enclose a certified true copy of my driving licence<br />

2.3 Verification of your Address<br />

I enclose a current utility bill / bank statement* as proof of my address<br />

*delete as appropriate

2.4 About your status – Please ensure that all documents supplied are the originals or a certified true copy<br />

Single (not previously married)<br />

Married Please give date / /<br />

(enclose your marriage certificate and spouse‟s birth certificate)<br />

Civil Partnership Please give date / /<br />

(enclose your civil <strong>partner</strong>ship registration and civil <strong>partner</strong>s birth certificate)<br />

Widowed/surviving <strong>partner</strong> Please give date / /<br />

(enclose your spouse‟s or civil <strong>partner</strong>s death certificate)<br />

Divorced or dissolved civil <strong>partner</strong>ship Please give date / /<br />

(enclose your decree absolute or certified civil <strong>partner</strong>ship dissolution order)<br />

2.5 About your spouse/civil <strong>partner</strong><br />

Your spouse‟s or civil <strong>partner</strong>‟s surname<br />

Your spouse‟s or civil <strong>partner</strong>s other names<br />

Your spouse‟s or civil <strong>partner</strong>‟s date of birth<br />

/ /<br />

Your spouse‟s or civil <strong>partner</strong>‟s NI No.<br />

2.6 Have you any dependant children? No Yes Please give details below<br />

Surname Forenames Gender (M/F) Date of birth<br />

Continue on a separate sheet if needed<br />

Part 3 Type of Pension and Retirement Lump Sum<br />

3.1 Why are you claiming your deferred benefits? Please tick the box(es) which applies to you.<br />

Retirement based on age*<br />

*For Existing Deferred Members your benefits may be actuarially reduced to take account of this<br />

Early payment of benefits based on ill-health grounds<br />

Commuted early payment of benefits based on ill-health grounds<br />

Date you are claiming your benefits from<br />

2

3.2 Benefits - If you need a pension benefits estimate to help you decide how much lump sum you<br />

need, please see Notes Page 6 which will tell you how to request one.<br />

Do you wish to give up part of your pension Yes continue below No go to part 4<br />

to receive a lump sum or if you are an<br />

Existing Deferred Member a higher lump<br />

Sum?<br />

If YES do you want the maximum Yes go to part 4 No continue below<br />

lump sum permitted?<br />

If NO, please specify the amount required not more than the maximum amount permitted<br />

Amount of lump sum £<br />

(whole pounds only)<br />

3.3 Trivial Commutation of Pension<br />

If your pension entitlement is small you may be able to claim your pension on grounds of Triviality.<br />

Do you wish to claim your pension benefits Yes continue below No go to part 4<br />

on the grounds of triviality?<br />

Is your overall pension fund value from all Yes No<br />

your pension‟s schemes, including the<br />

Unified Scheme less than £18,000 (or<br />

overall pension entitlement less than £900 pa)?<br />

Part 4 – Employment Details<br />

What was the name of your last IOM Government Employer?<br />

What date did you leave? / /<br />

What was your job title?<br />

Are you currently working for the Yes No<br />

IOM Government?<br />

If YES, where are you employed?<br />

What date will you be leaving?<br />

We cannot pay your pension without this in<strong>form</strong>ation<br />

Do you intend to work for the IOM Yes No<br />

Government after you get your pension?<br />

If yes, please provide the name and address of your employer<br />

Name<br />

Address<br />

Postcode 3

Part 5 Payment Details<br />

About yourself. Please write in CAPITAL LETTERS using BLACK INK<br />

Title (e.g. Mr, Mrs, Miss, Dr)<br />

Address<br />

Surname<br />

Former surname (if applicable)<br />

Other names<br />

Postcode<br />

Contact telephone number<br />

National Insurance Number<br />

Email Address<br />

Bank/Building Society account details:<br />

Name(s) of account holder (either applicants own account or a joint account with someone else)<br />

Full name and address of your bank or building Society (IOM, UK, Channel Islands only)<br />

Branch sort code<br />

-- --<br />

Account number to be credited<br />

And/or Building Society Roll No.<br />

4

Part 6 – Declaration<br />

Please sign and date this in the presence of a witness. The notes below explain who can witness.<br />

I DECLARE that:<br />

I have read the Isle of Man Government Unified Scheme 2011 Guide Book and or the Retirement Fact<br />

Sheet and the application guidance notes attached to this <strong>form</strong>.<br />

The in<strong>form</strong>ation I have given is correct and complete to the best of my knowledge and belief. If I<br />

become aware of any change in the in<strong>form</strong>ation given on the <strong>form</strong> or any further new in<strong>form</strong>ation<br />

relevant to the <strong>form</strong>, after I have sent it I hereby agree to notify the Public Sector <strong>Pensions</strong> Authority<br />

(PSPA) of those changes and any further or new in<strong>form</strong>ation at the earliest possible opportunity.<br />

Applicants usual signature<br />

Date<br />

Please ask your witness to sign and complete the section below.<br />

Section 4 – Witness declaration<br />

A witness must be an authorised Bank Official, Public or Civil Servant, Doctor, Justice of the Peace or a<br />

Solicitor. By signing below, the witness confirms they are not a relative or nominee and were present at<br />

the time the applicant signed above.<br />

Title (Mr, Mrs, Miss, Ms, Dr,<br />

other )<br />

Surname<br />

Other names (in full)<br />

Address<br />

Occupation<br />

Witness signature<br />

Date<br />

Return to<br />

Please return your completed PSPA Deferred Benefits Claim Form and enclosures to:<br />

Public Sector <strong>Pensions</strong> Authority<br />

Goldie House<br />

1 - 4 Goldie Terrace, Upper Church Street<br />

Douglas, ISLE OF MAN<br />

IM1 1EB<br />

5

Deferred Benefits Claim Form<br />

Guidance Notes for Applicants<br />

General<br />

Before you complete the claim <strong>form</strong> you may need to read the scheme member guide or download<br />

further in<strong>form</strong>ation from the PSPA website at www.pspa.im<br />

Requesting an Estimate<br />

Your annual statement will give you an estimate of the pension and lump sum benefit that is payable to<br />

you at retirement. If you need an up to date estimate, you can request one by emailing<br />

pensions@pspa.im To help us deal with your request, please include your full name, address, date of<br />

birth and scheme reference number (this can be found on your annual statement). Please also include<br />

the date you wish to claim your benefits from.<br />

Part 1 Your PSPA or Scheme Reference Number<br />

Please enter your reference number. It will usually be stated on any correspondence from us. If you<br />

don‟t know it, leave this blank.<br />

Part 2 – About Yourself<br />

2.1 Personal Details<br />

Please enter details about yourself including your contact telephone number and email address, if you<br />

have one. You must enclose your original birth certificate or an original certified copy of it. If you do not<br />

have an original birth certificate you may send your original passport. All documents will be returned to<br />

you promptly. If you prefer, you can call in to our offices in Douglas and we will take a copy of your birth<br />

certificate or passport.<br />

2.2 and 2.3 Verification of Identity and Address<br />

As with any type of financial claim, we need to ensure you are who you say you are and that you live at<br />

the address you have provided. We verify this in<strong>form</strong>ation by requesting sight of a:<br />

<br />

<br />

Photographic identity (by way of a original or certified copy of your driving licence or passport)<br />

and<br />

An original utility bill or bank statement<br />

2.4 and 2.5 About Your Adult Dependants<br />

It is important that your tell us your current status and supply details of your spouse or civil <strong>partner</strong>, if<br />

you have one. This in<strong>form</strong>ation is used in the event of your death and in<strong>form</strong>s us if there is any<br />

survivor‟s benefits payable if you die before your spouse or civil <strong>partner</strong>. Having these details will speed<br />

up the payment of any survivor‟s benefits due and will also put less strain on your dependants at that<br />

time. You must enclose original or certified copies of any certificate or documents asked <strong>form</strong>.<br />

Photocopies are not acceptable. If you have previously nominated a <strong>partner</strong> by sending us Form GUS 4,<br />

please refer to this here.<br />

2.6 Dependant Children<br />

A child allowance may be payable on your death. The terms „child allowance‟ and „child‟ can cover a<br />

number of other possible dependants as well as your own children – see below for more in<strong>form</strong>ation.<br />

6

An allowance may be paid if the child is dependant on you, both at retirement and on death, and they<br />

are:<br />

‣ Below age 18;<br />

‣ Below age 23 and undergoing full time education or vocational training; or<br />

‣ Aged 23 or over and incapable of earning a living due to permanent mental or physical disability<br />

which he/she is suffering at the time of your death<br />

“Child” can include:<br />

‣ Your natural children<br />

‣ Your step children and children of a civil <strong>partner</strong>ship<br />

‣ Adopted children<br />

‣ Natural grandchild who was financially dependent on you at the date of your death<br />

A full list of the definitions of a Child can be found in the Scheme Rules available on the website at<br />

www.pspa.im<br />

Enter the details of any qualifying children in the boxes.<br />

Part 3 – Type of Pension and Retirement Lump Sum<br />

3.1 In this part of the <strong>form</strong> we ask you to indicate the type of pension you are claiming.<br />

Retirement based on your age. You can claim this if you are aged 55 or over.<br />

If you are an Existing Deferred Members the early payment of your deferred benefits, before the normal<br />

pension age specified on your Statement of Entitlement, will be reduced to take account of this.<br />

You will need to supply the date from which you would like your retirement benefits to be paid. The<br />

„date‟ can be the later of your minimum pension age, the date you first made your enquiry about<br />

receiving these benefits or the date you sign this claim <strong>form</strong>. You must insert a date or your application<br />

<strong>form</strong> will be returned.<br />

Early payment of deferred benefits on Ill-health grounds. You can claim this if you have been<br />

notified that your ill-health retirement application has been accepted.<br />

Commuted early payment of deferred benefits on Ill-health grounds. Your ill-health retirement<br />

benefits can be paid as a one off lump sum if you are terminally ill. You can claim this if you have been<br />

notified that your ill-health retirement application has been accepted.<br />

3.2 In this part of the <strong>form</strong> we ask you to indicate if you wish to commute or ‘give up’ some<br />

of your pension in exchange for a lump sum.<br />

How this work will depend on what type of deferred member you are.<br />

If you are an Existing Deferred member with the right to an automatic lump sum – see note 3.2a<br />

If you are an Existing Deferred member with no right to an automatic lump sum or a deferred member<br />

from the Unified Scheme – see note 3.2b.<br />

3.2a Deferred Members with a right to an automatic lump sum<br />

Some Existing Deferred Members have a right to an automatic lump sum as well as having the option to<br />

a commute or „give up‟ some of your pension for a higher lump sum. Your Statement of Entitlement will<br />

confirm your right to an automatic lump Sum. You can refer to our Existing Deferred Members Factsheet<br />

on the resources page of our website for more in<strong>form</strong>ation.<br />

7

You are able to give up part of your pension for a higher one-off cash lump sum of up to 30% of the<br />

value of your benefits. For each £1 of pension given up, a lump sum of £18 will be paid.<br />

The maximum lump sum you can take is approximately 5.8 times your pension, before you take a lump<br />

sum.<br />

Claiming a bigger lump sum does not affect the level of survivor benefits payable to a <strong>partner</strong> or<br />

dependent child.<br />

You must indicate whether or not you want an additional lump sum by ticking the appropriate box. If you<br />

want an additional lump sum select either the maximum lump sum permitted or enter an additional lump<br />

sum amount in whole £s and in multiples of £18, which together with any standard lump sum is not<br />

greater than the permitted maximum lump sum.<br />

3.2b Deferred Members with no automatic lump sum<br />

If you are a deferred member, with no automatic right to a lump sum i.e. an Ex member of a Nuvos,<br />

Premium, NHS 2008 or Unified Scheme you would not have had a automatic lump sum. Instead, you<br />

have the option of receiving a retirement lump sum by giving up a part of your pension.<br />

You are able to give up part of your pension for a higher one-off cash lump sum of up to 30% of the<br />

value of your benefits. For each £1 of pension given up, a lump sum of £18 will be paid.<br />

The maximum lump sum you can take is approximately 5.8 times your pension, before you take a lump<br />

sum.<br />

Claiming a bigger lump sum does not affect the level of survivor benefits payable to a <strong>partner</strong> or<br />

dependent child.<br />

You must indicate whether or not you want a lump sum by ticking the appropriate box. If you want a<br />

lump sum then select either:<br />

• the maximum lump sum permitted; or<br />

• enter a lump sum in whole £s in multiples of £18, which is not greater than the<br />

permitted maximum lump sum.<br />

3.3 Trivial <strong>Pensions</strong><br />

If your expected total pension income from all your pension arrangements, including the Unified Scheme<br />

is small at less than £900 per year or has a value of £18,000 or less, then you may be able to claim them<br />

on grounds of triviality.<br />

This means that instead of paying you a small pension each year, we will exchange the pension for a<br />

one-off trivial cash lump sum.<br />

If you choose to do this, any surviving <strong>partner</strong> pension will be included in the trivial lump sum. All liability<br />

for a surviving <strong>partner</strong> pension and any death benefit lump sum will be discharge once the trivial<br />

commutation is paid.<br />

This can only be paid to you if you are under age 75 at the time of payment.<br />

Part 4 – Employment Details<br />

In this part of the <strong>form</strong> we ask for details of your previous/current IOM Government employer. We also<br />

ask for future employer details if you intend to work (or continue to work) for the IOM Government after<br />

you get your pension in case it is subject to suspension or abatement.<br />

8

If you are claiming benefits from the Unified Scheme, you will normally have stopped working for the Isle<br />

of Man Government. However, if you are in employment being in receipt of a deferred pension may<br />

affect your right to future participation of the Unified Scheme.<br />

Part 5 – Payment Details<br />

You must fully complete this section, including entering your personal details again.<br />

Please enter the details of Bank or Building Society where you would like your benefits to be paid. Your<br />

benefits will only be paid into a bank or building society account, as this is the safest method of<br />

payment.<br />

Payments will only be made to IOM, UK or Channel Islands bank accounts that are capable of receiving<br />

secure electronic payments of funds.<br />

<strong>Pensions</strong> are paid in monthly instalments on the 25th of each month, direct to either your bank or<br />

building society account. It is important to note that for any retirements that fall after the 7th of the<br />

month, the first instalments will not be paid into your back account until the 25th of the following month.<br />

Lump Sums are paid by directly into your bank or building society account. It is important to note that<br />

the PSPA aim to pay out the lump sum on the Friday following your retirement date and within 2 weeks<br />

of your retirement date.<br />

Important Note: We would encourage all members to check with the pension administrators when<br />

your pension and or lump sum will be paid, before making any financial commitments.<br />

Part 6 – Declaration<br />

You must read the declaration before you sign and date the application <strong>form</strong> in front of a witness and<br />

ask them to certify this by completing their details and also signing the <strong>form</strong>.<br />

You must read the retirement in<strong>form</strong>ation in our Scheme Guide and any associated factsheets if you are<br />

unclear on any of the points in this section.<br />

Please return the completed PSPA Deferred Benefits Claim Form to:<br />

Public Sector <strong>Pensions</strong> Authority<br />

Goldie House<br />

1 - 4 Goldie Terrace, Upper Church Street<br />

Douglas<br />

ISLE OF MAN<br />

IM1 1EB<br />

Where can I find more in<strong>form</strong>ation?<br />

You can find more in<strong>form</strong>ation using the resources on our website at www.pspa.im<br />

9