IN ADDITION TO THE APPLICATION, please enclose - MIG Bank

IN ADDITION TO THE APPLICATION, please enclose - MIG Bank

IN ADDITION TO THE APPLICATION, please enclose - MIG Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

D-CLIENT-01-01-CN_v1.0<br />

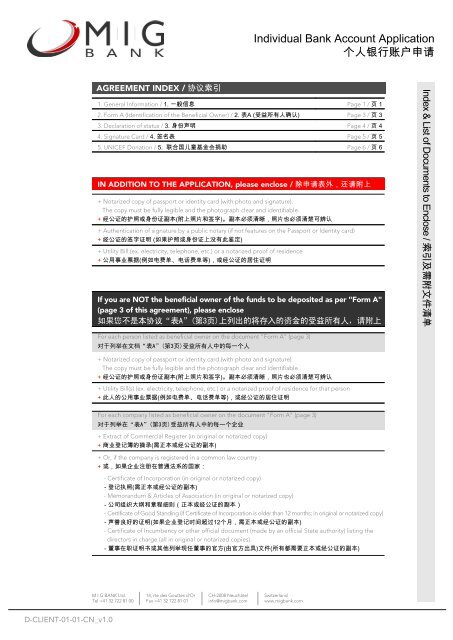

AGREEMENT <strong>IN</strong>DEX / 协议索引<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

1. General Information / 1. 一般信息 Page 1 / 页 1<br />

2. Form A (Identification of the Beneficial Owner) / 2. 表A (受益所有人确认) Page 3 / 页 3<br />

3. Declaration of status / 3. 身份声明 Page 4 / 页 4<br />

4. Signature Card / 4. 签名表 Page 5 / 页 5<br />

5. UNICEF Donation / 5. 联合国儿童基金会捐助 Page 6 / 页 6<br />

<strong>IN</strong> <strong>ADDITION</strong> <strong>TO</strong> <strong>THE</strong> <strong>APPLICATION</strong>, <strong>please</strong> <strong>enclose</strong> / 除申请表外,还请附上<br />

+ Notarized copy of passport or identity card (with photo and signature).<br />

The copy must be fully legible and the photograph clear and identifiable.<br />

+ 经公证的护照或身份证副本(附上照片和签字)。副本必须清晰,照片也必须清楚可辨认<br />

+ Authentication of signature by a public notary (if not features on the Passport or Identity card)<br />

+ 经公证的签字证明 (如果护照或身份证上没有此鉴定)<br />

+ Utility Bill (ex. electricity, telephone, etc.) or a notarized proof of residence<br />

+ 公用事业票据(例如电费单、电话费单等),或经公证的居住证明<br />

If you are NOT the beneficial owner of the funds to be deposited as per "Form A"<br />

(page 3 of this agreement), <strong>please</strong> <strong>enclose</strong><br />

如果您不是本协议“表A”(第3页)上列出的将存入的资金的受益所有人,请附上<br />

For each person listed as beneficial owner on the document "Form A" (page 3)<br />

对于列举在文档“表A”(第3页)受益所有人中的每一个人<br />

+ Notarized copy of passport or identity card (with photo and signature)<br />

The copy must be fully legible and the photograph clear and identifiable<br />

+ 经公证的护照或身份证副本(附上照片和签字)。副本必须清晰,照片也必须清楚可辨认<br />

+ Utility Bill(s) (ex. electricity, telephone, etc.) or a notarized proof of residence for that person<br />

+ 此人的公用事业票据(例如电费单、电话费单等),或经公证的居住证明<br />

For each company listed as beneficial owner on the document "Form A" (page 3)<br />

对于列举在“表A”(第3页)受益所有人中的每一个企业<br />

+ Extract of Commercial Register (in original or notarized copy)<br />

+ 商业登记簿的摘录(需正本或经公证的副本)<br />

+ Or, if the company is registered in a common law country :<br />

+ 或,如果企业注册在普通法系的国家:<br />

- Certificate of Incorporation (in original or notarized copy)<br />

- 登记执照(需正本或经公证的副本)<br />

- Memorandum & Articles of Association (in original or notarized copy)<br />

- 公司组织大纲和章程细则(正本或经公证的副本)<br />

- Certificate of Good Standing (if Certificate of Incorporation is older than 12 months; in original or notarized copy)<br />

- 声誉良好的证明(如果企业登记时间超过12个月,需正本或经公证的副本)<br />

- Certificate of Incumbency or other official document (made by an official State authority) listing the<br />

directors in charge (all in original or notarized copies).<br />

- 董事在职证明书或其他列举现任董事的官方(由官方出具)文件(所有都需要正本或经公证的副本)<br />

M I G BANK Ltd.<br />

Tel +41 32 722 81 00<br />

14, rte des Gouttes d’Or<br />

Fax +41 32 722 81 01<br />

CH-2008 Neuchâtel<br />

info@migbank.com<br />

Switzerland<br />

www.migbank.com<br />

Index & List of Documents to Enclose / 索引及需附文件清单

PERSONAL <strong>IN</strong>FORMATION / 个人信息<br />

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

Please complete the application form below. If you have any questions about the application, <strong>please</strong> contact the<br />

Customer Desk. Fields marked with a “*” are mandatory.<br />

请完成下面的申请表。如果您对申请有任何疑问,请联系客户服务。“*”号栏目为必填。<br />

Title / 称呼*:<br />

Family name / 姓*:<br />

First name / 名* :<br />

Mr. / 先生 Mrs. / 夫人 Ms. / 女士<br />

Date of Birth (Day / Month / Year) / 出生日期(日/月/年)*:<br />

Passport or identity document number : / 护照或身份证明号码 :<br />

Nationality / 国籍*:<br />

Residence Address / 居住地址<br />

Street & Number / 街道及门牌号码*:<br />

Place of birth / 出生地:<br />

City / 城市*: Postal code / 邮政编码*:<br />

State / Province / 州/省: Country / 国家*:<br />

Contact details / 详细联系方式<br />

E-mail / 电子邮件*:<br />

� NOTE : Please enter your Country Code followed by City Code, then the phone number / � 注意:请依次填写您的国家代码、城市代码、电话号码<br />

Day Phone Number Mobile Phone<br />

日常电话号码*: 移动电话号码:<br />

Alternative Phone Fax Number<br />

其他联系电话: 传真号:<br />

Other Personal Information / 其他个人信息<br />

Occupation / 职业*: Company / 公司*:<br />

Language for correspondence / 联系语言*: Marital Status / 婚姻状况:<br />

TYPE OF ACCOUNT / 账户种类<br />

I wish to open an account in accordance with the General Business Conditions and Safe Custody Regulations of the <strong>Bank</strong>.<br />

我愿意依照银行的一般商业条款和安全保管制度开户。<br />

ONL<strong>IN</strong>E TRAD<strong>IN</strong>G / 在线交易<br />

I wish to have access to one or more terminals, including terminal access through the <strong>Bank</strong> internet browser, for the electronic<br />

transmission of orders and/or transactions, for my accounts with M I G BANK.<br />

我希望有权使用一个或多个终端,包括从银行因特网浏览器所登入的终端,从而对我在<strong>MIG</strong> BANK的账户进行电子传输指令和/或<br />

交易。<br />

BASE CURRENCY / 基础货币<br />

Unless otherwise directed, amounts deposits will be converted in the currency selected below.<br />

除非另外指明,存入的资金将被兑换为下面所选择的货币<br />

USD EUR GBP CHF JPY<br />

Type of currency*<br />

货币种类*<br />

美元 欧元 英镑 瑞郎 日元<br />

Estimated initial deposit / 估计首次存款*:<br />

Estimated total deposit within one year / 估计一年内存款总额*:<br />

PLANNED <strong>IN</strong>VESTMENT (<strong>please</strong> check the appropriate boxes) / 计划投资(请在相应的框中作出标记)<br />

Forex<br />

外汇<br />

CFD<br />

差价合约<br />

Commodities<br />

商品<br />

Futures/Options<br />

期货/期权<br />

Bonds/Shares<br />

债券/股票<br />

AUD<br />

澳元<br />

Funds<br />

基金<br />

CAD<br />

加元<br />

1. General Information / 一般信息<br />

1 / 7 | Page

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

PRODUCT EXPERIENCE (<strong>please</strong> check the appropriate boxes, all these fields are mandatory)<br />

投资经历(请在相应的框中作出标记,所有这些选项为必填)<br />

Nr. of Years<br />

大概年限<br />

none / 无<br />

less than 1 / 少于一年<br />

1-3 years / 1-3年<br />

more than 3 / 超过3年<br />

Forex<br />

外汇<br />

CFD<br />

差价合约<br />

Commodities<br />

商品<br />

Futures/Options<br />

期货/期权<br />

Bonds/Shares<br />

债券/股票<br />

DO YOU ALREADY HAVE AN ACCOUNT AT <strong>MIG</strong> BANK? / 你已经有了<strong>MIG</strong> BANK的账号吗?<br />

No / 没有 Yes, account number / 有。账号是<br />

DID YOU OPEN A DEMO ACCOUNT WITH M I G BANK? / 你有没有在M I G BANK开立模拟账户?<br />

No / 没有 Yes, account number / 有。账号是<br />

WERE YOU CONTACTED BY A MEMBER OF M I G BANK’S TEAM?<br />

之前是否有M I G BANK团队成员联系过您?<br />

No / 没有 Yes, by Mr./Mrs. / 是的,联系人是 先生/ 女士:<br />

HAVE YOU BEEN <strong>IN</strong>TRODUCED <strong>TO</strong> M I G BANK BY SOMEBODY ?<br />

曾经有人将您介绍到M I G BANK吗?<br />

No / 没有 Yes, introduced by / 是的,介绍人是:<br />

CLIENT F<strong>IN</strong>ANCIAL <strong>IN</strong>FORMATION / 客户财务信息<br />

Origin of money to invest (Select as many as apply, min. 1 choice) / 投资资金的来源(至少选一项,可以多选)<br />

Savings<br />

储蓄<br />

Gift<br />

获赠<br />

Earned income/pension<br />

工作收入/退休金<br />

Other (<strong>please</strong> specify)<br />

其他(请详细说明):<br />

Inheritance<br />

继承财产<br />

DO YOU HAVE AN IMPORTANT PUBLIC FUNCTION? / 您担任重要公职吗?<br />

Funds<br />

基金<br />

Financial markets earnings<br />

金融市场收益<br />

Do you hold any prominent public office (e.g. head of state or government; senior politician, high-ranking official in the public administration, the<br />

judiciary, the armed forces or political party; senior executive officer of a state-owned enterprise of national importance)? Or do you have close<br />

family, or personal or business relations with any such person? Or does any person likely to be involved in the client relationship or anyone close to<br />

them hold such office?<br />

您是否担任重要的公职(如国家和政府的主要领导、高级政府官员、公共管理机构的高级官员、法官、军队官员或政党领导、大型国有企业的高级管<br />

理人员等)?或者您和这些担任重要公职的人员有紧密的家庭、个人或商业关系吗?或者任何人可能介入客户关系吗,或者任何接近他们的人担任这<br />

样的职位吗?<br />

No / 没有 Yes, <strong>please</strong> describe / 是的,请描述:<br />

GENERAL CONDITIONS AND CONTRACT DOCUMENTS / 一般条款和合同文件<br />

By signing below, you hereby agree that you have received, read, understood, consented and accepted any and all of the General<br />

Business Conditions and Safe Custody Regulations.<br />

You confirm you have received, read, understood, consented and accepted the “Special risks in securities trading” brochure.<br />

下方签名表明您确认,您已经收到、阅读、理解、赞同并接受所有的一般商业条款和安全保管制度。您确认已经收到、阅读、理解、赞同并接受《证<br />

券交易的特别风险》手册<br />

Place / 地点 Signature / 签名<br />

Date / 时间<br />

1. General Information / 一般信息<br />

2 / 7 | Page

Please note that this form will not be accepted if it contains any alterations<br />

请注意,本表格涂改无效<br />

VERIFICATION OF <strong>THE</strong> BENEFICIAL OWNER / 受益所有人确认<br />

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

According to the Swiss regulation the <strong>Bank</strong> must identify the economical beneficial owner(s) of the assets deposited on the account.<br />

If you are the beneficial owner of the assets, <strong>please</strong> check the first box to confirm that you are the beneficial owner and then sign at<br />

the bottom of the page. If you are not the beneficial owner, <strong>please</strong> check the second box and fill in all the requested information.<br />

Please also provide us with a notarized copy of the passport or company documents of this person(s) or company(ies).<br />

根据瑞士法律,银行必须确认银行账户资产的经济受益所有人。 如果您是资产的受益所有人,请在第一个框内作出标记,确认您<br />

是受益所有人,并在页面下方签字。如果您不是财产的受益所有人,请在第二个框内作出标记,并按需求填写信息。另外还请您提<br />

供一份这个(这些)人或这家(这些)公司经公证的护照或公司文件的副本。<br />

The contracting partner hereby declares / 签约人于此声明<br />

That the contracting partner is the beneficial owner of the assets deposited with M I G BANK<br />

签约人即在M I G BANK所存资产的受益所有人<br />

OR / 或<br />

That the beneficial owner(s) of the assets deposited with M I G BANK is(are) (write below)<br />

在M I G BANK存款资产的受益所有人是(下方填写):<br />

Family name / First name<br />

or Company name<br />

姓/名或企业名称<br />

Date of birth or<br />

incorporation (D / M / Y)<br />

出生/企业创建日期(日/月/年)<br />

Nationality or country<br />

of incorporation<br />

国籍或企业创建所在国<br />

Address<br />

地址<br />

Country<br />

国家<br />

The contracting partner(s) undertake(s) to automatically inform M I G BANK of any changes.<br />

It is a criminal offence to deliberately provide false information on this item (Art. 251 of the Swiss Penal Code, document forgery;<br />

penalty : imprisonment for up to five years or a fine).<br />

签约人承诺,如果信息有任何更改,将主动通知 M I G BANK<br />

在本表格上蓄意提供虚假信息是犯罪行为 (根据瑞士刑法第 251条,可处以最高5年的监禁或者罚款)<br />

Translation of documents is provided for the added convenience of the Client. In the event of conflict between the original English<br />

text and any translation or any other agreement between the <strong>Bank</strong> and the Client, the English version shall take precedence.<br />

翻译文件供客户方便之用。若英文原文与任何翻译之内容存在冲突,或者与本行和客户之间的其他协议存在冲突,均应以英文版本为准。<br />

Place / 地点 Signature / 签名<br />

Date / 时间<br />

2. Form A (Identification of the Beneficial Owner) / 表格A(受益所有人确认)<br />

3 / 7 | Page

DECLARATRION OF STAT US OF "NON-US PERSON" OR "US PERSON"<br />

“非美国人”和“美国人”的身份<br />

Your answer to this field to this field is mandatory / 本栏目为必填<br />

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

The account holder is a “non-US person”, i.e. not a US citizen (be it by single, dual or multiple nationality), does not have<br />

“resident alien” status (for example by holding a “Green Card” or having carried out frequent visits to the USA in the current<br />

year and the previous two years).<br />

签约人是在 M I G BANK 存款资产的受益所有人账户持有人是“非美国人”,即并非美国公民(单一国籍、双国籍或多国籍),<br />

没有“居住外国人”的身份(例如持有“绿卡”或在当年及过去两年频繁造访美国)。<br />

OR / 或<br />

The account holder is a “US person”, i.e. a US citizen (single, dual or multiple nationality) or that he holds the “resident<br />

alien” status (for example by holding a “Green Card” or having carried out frequent visits to the USA in the current year and<br />

the previous two years). The account holder accepts that the <strong>Bank</strong>, due to legal and fiscal reasons, prohibits the access to<br />

any US securities (in particular access to the US stock markets and US securities listed on other stock markets) as well as other<br />

investments considered US relevant.<br />

账户持有人是“美国人”,即美国公民(单一国籍、双国籍或多国籍),或持有“居住外国人”的身份(例如持有“绿卡”或在<br />

当年及过去两年频繁造访美国)。账户持有人同意,基于法律和财政原因,本银行禁止交易任何美国有价证券(尤其是美国股市<br />

和在其他股票市场上市的美国股票),以及其他与美国相关的投资。<br />

Under penalties of perjury, I declare that I have examined the information on this item and to the best of my knowledge and belief, it is true, correct and complete.<br />

在理解对伪证的惩罚后,本人特此声明,本人已经检查了此处的信息,据本人所知并相信,这些信息是真实、正确和完整的。<br />

TAXATION OF SAV<strong>IN</strong>GS <strong>IN</strong>COME FROM <strong>THE</strong> EUROPEAN UNION<br />

欧盟征收的利息税<br />

This point applies only to EU citizens and residents / 本部分仅针对欧盟公民和居民<br />

The account holder has been informed of the Agreement between Switzerland and the European Union which requires the <strong>Bank</strong><br />

either to apply a withholding tax on relevant interest payments or to communicate all payments of such interests to the relevant<br />

authorities.<br />

账户持有人被告知,根据欧盟和瑞士之间的协议,银行被要求代扣相关的利息税,或者将所有此类利息的支付告知相<br />

关主管部门。<br />

I authorize the <strong>Bank</strong> to transmit such information (complete identity, account number, details of interest paid) to the relevant<br />

tax authorities in my country of residence.<br />

本人授权银行将这些信息(完整的身份、账号、利息支付的详细资料)发送给本人居住国的相关税务机构。<br />

OR / 或<br />

I authorize the <strong>Bank</strong> to apply the withholding tax rather than informing to the relevant tax authorities in my country of<br />

residence.<br />

本人授权银行代扣利息税,而不是将信息提供给本人居住国的相关税务机构。<br />

Translation of documents is provided for the added convenience of the Client. In the event of conflict between the original English text and any translation or any<br />

other agreement between the <strong>Bank</strong> and the Client, the English version shall take precedence.<br />

翻译文件供客户方便之用。若英文原文与任何翻译之内容存在冲突,或者与本行和客户之间的其他协议存在冲突,均应以英文版本为准。<br />

Place / 地点 Signature / 签名<br />

Date / 时间<br />

3. Declaration of status / 3. 身份声明<br />

4 / 7 | Page

SIGNATURE SPECIMEN / 签名样卡<br />

Family name / 姓*:<br />

First name / 名* :<br />

Nationality / 国籍*:<br />

Date of Birth (Day / Month / Year) / 出生日期(日/月/年)*:<br />

Please sign in both boxes below / 请在下面两个框中签名<br />

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

4. Signature Card / 签名卡<br />

5 / 7 | Page

Please note that it is not mandatory to return this form<br />

请注意:此表格并不强制要求交回<br />

CLIENT NAME / 客户姓名<br />

Family name / 姓*:<br />

First name / 名* :<br />

M I G AND UNICEF / M I G 和 联合国儿童基金会<br />

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

Since January 1st 2007, M I G BANK collaborates with UNICEF to support its role as the World’s driving force for the wellbeing<br />

of children. M I G BANK backs this initiative by donating a percentage of its profits to UNICEF projects.<br />

M I G BANK 自2007年1月1日开始与联合国儿童基金会合作,支持其对全球儿童福利的推动。M I G BANK按照利润的百分比向联合<br />

国儿童基金会的项目提供捐助。<br />

We encourage you to join us in this program by selecting the donation of your choice<br />

我们鼓励您加入这个计划,选择您的捐献方式:<br />

I wish to donate USD 25.- to UNICEF and therefore instruct M I G bank to withdraw the donation from my account upon<br />

receipt of the first deposit in my account in order to credit UNICEF<br />

我希望向联合国儿童基金会捐款25美元。指定 M I G BANK 在收到我账户上的首次存款后,从中提取捐款并转给联合国儿童基金会。<br />

I wish to donate USD ____________ to UNICEF and therefore instruct M I G BANK to withdraw the donation from<br />

my account upon receipt of the first deposit in my account in order to credit UNICEF<br />

我希望向联合国儿童基金会捐款______________美元。指定M I G BANK在收到我账户上的首次存款后,从中提取捐款并转给联<br />

合国儿童基金会。<br />

I do not wish to donate to UNICEF<br />

我不希望向联合国儿童基金会捐款。<br />

Who is UNICEF ?<br />

UNICEF is the United Nations Children’s Fund created with the<br />

purpose in mind to work with others to overcome the obstacles<br />

that poverty, violence, disease and discrimination place in a<br />

child’s path. It works in 190 countries through country<br />

programmes and National Committees.<br />

It advocates for measures to give children the best start in life,<br />

because proper care at the youngest age forms the strongest<br />

foundation for a person’s future.<br />

It promotes girls’ education – ensuring that they complete<br />

primary education as a minimum – because it benefits all<br />

children, both girls and boys. Girls who are educated grow up to<br />

become better thinkers, better citizens, and better parents to<br />

their own children.<br />

It acts so that all children are immunized against common<br />

childhood diseases, and are well nourished, because it is wrong<br />

for a child to suffer or die from a preventable illness.<br />

It works to prevent the spread of HIV / AIDS among young<br />

people because it is right to keep them from harm and enable<br />

them to protect others. It helps children and families<br />

affected by HIV / AIDS to live their lives with dignity.<br />

联合国儿童基金会是一个怎样的机构?<br />

联合国儿童基金会的宗旨是集社会各界力量,帮助儿童战胜贫<br />

穷、暴力、疾病和歧视,帮助他们茁壮成长。联合国儿童基金<br />

会在全球190个国家以国家计划和国民委员会的方式开展工<br />

作。<br />

该组织致力于让儿童拥有最好的人生开端,因为在儿童最小的<br />

年纪给予正确的呵护将为他们的未来打下最坚实的基础。<br />

该基金会推动女孩教育——确保她们至少完成初等教育——因<br />

为这对包括男孩和女孩在内的所有儿童都有益。受过教育的女<br />

孩长大后可以更好地思考,成为更好的公民,并且成为他们自<br />

己的孩子的更好的父母。<br />

该基金会采取行动,确保所有儿童都接种常见病疫苗,并获得<br />

充足的营养,因为让儿童染上或死于可预防的疾病是不正当<br />

的。<br />

该基金会致力于防止艾滋病在青少年当中的传播,因为让他们<br />

免受伤害并让他们能够保护其他人是最适宜的做法。该基金会<br />

帮助感染艾滋病的儿童和家庭有尊严地生活。<br />

5. UNICEF Donation / 联合国儿童基金会捐助<br />

6 / 7 | Page

It involves everyone in creating protective environments for<br />

children. It is present to relieve suffering during emergencies,<br />

and wherever children are threatened, because no child should<br />

be exposed to violence, abuse or exploitation.<br />

UNICEF upholds the Convention on the Rights of the Child. It<br />

works to assure equality for those who are discriminated against,<br />

girls and women in particular.<br />

It works for the Millennium Development Goals and is part of the<br />

Global Movement for Children – a broad coalition dedicated to<br />

improving the life of every child. Through this movement, and<br />

events such as the United Nations Special Session on Children, it<br />

encourages young people to speak out and participate in the<br />

decisions that affect their lives.<br />

Please refer to www.unicef.org should you be interested in<br />

further understanding.<br />

D-CLIENT-01-01-CN_v1.0<br />

Individual <strong>Bank</strong> Account Application<br />

个人银行账户申请<br />

该基金会让所有人能够参与创建保护儿童的环境,致力于减轻<br />

儿童受到紧急事件和任何威胁的伤害,因为任何儿童都不应遭<br />

受暴力、虐待和剥削。<br />

联合国儿童基金会支持《儿童权利公约》,致力于确保受歧视<br />

者,尤其是女孩和妇女能得到平等对待。<br />

该基金会隶属于联合国“新千年人类发展目标”,是“全球儿<br />

童运动”的一部分,“全球儿童运动”是一个致力于改善所有<br />

儿童生活的广泛同盟。通过该运动以及“联合国关于儿童问题<br />

的特别会议”等活动,该基金会鼓励儿童发言,并参与到影响<br />

他们生活的决定中。<br />

若想深入了解更多,请登陆网站 www.unicef.org<br />

Translation of documents is provided for the added convenience of the Client. In the event of conflict between the original English<br />

text and any translation or any other agreement between the <strong>Bank</strong> and the Client, the English version shall take precedence.<br />

翻译文件供客户方便之用。若英文原文与任何翻译之内容存在冲突,或者与本行和客户之间的其他协议存在冲突,均应以英文版本为准。<br />

Place / 地点 Donor’s Signature / 捐助人签名<br />

Date / 时间<br />

5. UNICEF Donation / 联合国儿童基金会捐助<br />

7 / 7 | Page

<strong>IN</strong>TRODUCTION / 介绍<br />

This document contains important information regarding the terms and<br />

conditions applicable to an account holder (i.e. contractual partner)<br />

hereinafter referred to as the “Client” of M I G <strong>Bank</strong> (the “<strong>Bank</strong>”). The<br />

access to and the use of an account and the <strong>Bank</strong>’s services are subject to<br />

the Client’s compliance with all terms and conditions set forth hereinafter.<br />

The Client understands and acknowledges that the <strong>Bank</strong> may modify,<br />

alter or change the terms and conditions set forth herein by posting such<br />

modifications or changes online or by other communication deemed<br />

appropriate by the <strong>Bank</strong>.<br />

Neither the information nor any opinion expressed in the <strong>Bank</strong> website<br />

and/or the <strong>Bank</strong> contractual or other documentation constitutes a<br />

solicitation, an offer or a recommendation of the <strong>Bank</strong> to buy or sell any<br />

currencies or to engage in financial investments or transactions, or in any<br />

other transaction.<br />

The present General Business Conditions (the “Conditions”) and Safe<br />

Custody Regulations (the “Regulations”, hereinafter collectively referred<br />

to as the “Conditions and Regulations”) govern the relationship between<br />

the Client and the <strong>Bank</strong> (together with the Client hereinafter collectively<br />

referred to as the “Parties”).<br />

I. GENERAL BUS<strong>IN</strong>ESS CONDITIONS / I.一般商业条款<br />

1. SERVICES<br />

<strong>Bank</strong>’s services include banking transactions (see 2.1) and technical<br />

installation to enable the Client to conduct banking transactions via the<br />

Internet (see 2.2) through the <strong>Bank</strong>’s website (http://migbank.com) or<br />

through (www.migbank.com).<br />

The Client acknowledges that the only liable source of information about<br />

the <strong>Bank</strong> and its services is the official website of the <strong>Bank</strong> and the official<br />

marketing material released by the <strong>Bank</strong>. The Client takes good notice<br />

that the <strong>Bank</strong> does not endorse any information about the <strong>Bank</strong> nor its<br />

services that may be contained on any other website or any other<br />

marketing material.<br />

2.1 BANK<strong>IN</strong>G TRANSACTION<br />

2.1.1 TRANSACTIONS<br />

Transactions shall include, but are not limited to :<br />

a) Spot and forward foreign currency contracts;<br />

b) Foreign currency OTC options;<br />

c) Foreign currency rollover transactions;<br />

d) All related currency transactions;<br />

e) Precious metals trading;f) CFD’s<br />

g) Current account;<br />

h) Fiduciary transactions;<br />

i) Equity trading<br />

j) Futures;<br />

k) Funds;<br />

l) Options;<br />

In addition, some investments shall be governed by special agreement<br />

between the Client and the <strong>Bank</strong>.<br />

Transactions may involve margins where the Client is required to deposit<br />

cash or other assets to secure performance of the Client’s obligations<br />

under the transaction.<br />

2.1.2 RISK AWARNESS<br />

The Client is aware and accepts the risks resulting from foreign exchange<br />

transactions and all related transactions. Risk of loss in trading foreign<br />

exchange can be substantial. Before entering into transactions, the Client<br />

acknowledges that he/she has fully understood :<br />

+ The nature and fundamentals of the transactions and the market<br />

underlying such transactions;<br />

+ The extent of the economic risk to which the Client is exposed as a<br />

result of such transactions (and determine that such risk is suitable for the<br />

Client in light of its specific experience in relation to the transaction and<br />

its financial objectives, circumstances and resources);<br />

+ The legal terms and conditions for such transactions.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

本文件包括适用于账户持有人(即契约人)的条款和规定的重要信息,即<br />

下文中所称的M I G <strong>Bank</strong>(即“本行”)的“客户”。在登入和使用账号<br />

和本行的服务时,客户必须遵从下文列举的所有条款和规定。<br />

客户知道并同意,本行可能会修订、改变或更换本文件中的条款和规<br />

定,并通过网络或其他本行认为合适的方式将这些修订和更改予以公<br />

布。<br />

发布在本行网站以及/或者本行契约、文件中的信息或观点,均不构成<br />

对任何货币买卖、金融投资或交易、或任何其他交易的诱导、推动或推<br />

荐。<br />

现行的一般商业条款(本“条款”)和安全保管制度(本“规章”,下文<br />

将全部称为“条款和规章”)管辖客户和本行(与客户一起,下文将全部<br />

称为“当事人”)之间的关系。<br />

1. 服务<br />

本行的服务包括本行业务(见2.1)和让客户可以通过本行网站( http://<br />

migbank.com或www.migbank.com) 进行网上业务的技术安装(见2.2)。<br />

客户同意,本行的官方网站和本行发布的官方市场资料才是获取本行信<br />

息和服务的唯一可靠途径。客户应特别注意,本行不认可在可能出现在<br />

任何其他网站或其他市场资料上的关于本行和本行服务的信息。<br />

2.1 本行业务<br />

2.1.1 业务<br />

业务将包括,但不仅限于:<br />

a) 现货和远期外汇合约;<br />

b) 外汇场外期权;<br />

c) 外汇展期业务;<br />

d) 所有相关的外汇业务;<br />

e) 贵金属交易;<br />

f) 差价合约;<br />

g) 活期账户;<br />

h) 信托业务;<br />

i) 股市交易;<br />

j) 期货;<br />

k) 基金;<br />

l) 期权<br />

另外,部分投资将受到客户和本行之间的特别协议的管辖。<br />

业务可能会涉及到保证金,客户需要存入现金或其他资产,作为客户在<br />

业务中履行职责的保证。<br />

2.1.2 风险披露<br />

客户知道并接受外汇及所有相关业务带来的风险。在外汇交易中,出现<br />

亏损的风险可能非常高。在开始交易前,客户承认他/她完全理解:<br />

+ 客户由于这些交易而暴露的经济风险的程度(并根据客户有关该交易<br />

的具体经验以及其财务目标、状况和资源,确定该风险是否适合);<br />

+ 客户由于这些交易而暴露的经济风险的程度(并根据客户有关该交易<br />

的具体经验以及其财务目标、状况和资源,确定该风险是否适合);<br />

+ 这些交易的法律条款和规定<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

1 / 14 | Page

The Client should also be aware of the following :<br />

+ The Client understands the terms and conditions of the transactions to<br />

be undertaken, including, without limitation :<br />

- The terms as to price, term, expiration date, restrictions on exercising an<br />

OTC option and of the terms material to the transactions;<br />

- Any terms describing risk factors, such as volatility, liquidity, and so on;<br />

and - The circumstances under which the Client may become obliged to<br />

make or take delivery of a leveraged foreign exchange transactions or<br />

options transaction.<br />

+ The high degree of leverage that is often obtainable in foreign<br />

exchange and precious metals trading can work against the Client as well<br />

as for the Client, due to fluctuating market conditions. Trading in such<br />

instruments can lead to large losses as well as gains in response to a small<br />

market movement.<br />

If the market moves against the Client, he/she may not only sustain a total<br />

loss of its initial margin deposit, and any additional funds deposited with<br />

the <strong>Bank</strong> to maintain its position, but the Client may also incur further<br />

liability to the <strong>Bank</strong>. The Client may be called upon to “top-up” its margin<br />

by substantial amounts at short notice to maintain its position, failing<br />

which the <strong>Bank</strong> may have to liquidate its position at a loss and the Client<br />

would be liable for any resulting loss.<br />

Under certain market conditions the Client may find it difficult or<br />

impossible to liquidate a position, to assess a fair price or assess risk<br />

exposure. This can happen, for example, where the market for a<br />

transaction is illiquid or where there is a failure in electronic or<br />

telecommunications systems, or where there is the occurrence of an event<br />

commonly known as “Force Majeure Event”. Placing contingent orders,<br />

such as “stop-loss” orders, will not necessarily limit losses to the intended<br />

amounts, as it may be impossible to execute such orders under certain<br />

market conditions. When placing a stop order or stop loss order, the<br />

Client must be aware that in certain market conditions the Client may be<br />

filled at a different price than initially requested.<br />

Because the prices and characteristics of over-the-counter transactions<br />

are individually negotiated and there is no central source for obtaining<br />

prices, there are inefficiencies in transaction pricing. The <strong>Bank</strong><br />

consequently cannot and do not warrant that prices or the prices the <strong>Bank</strong><br />

secures for the Client are or will at any time be the best prices available to<br />

the Client.<br />

+ Transactions in options involve a high degree of risk and are not<br />

suitable for many members of the public. Such transactions should be<br />

entered into only by persons who have read, understood and familiarized<br />

themselves with the type of options, style of exercise, the nature and<br />

extent of rights and obligations and the associated risks.<br />

The Client acknowledges that many transactions will be affected subject<br />

to, and in accordance with, Market Rules. In particular, the Client<br />

acknowledges that Market Rules usually contain wide powers in an<br />

emergency or otherwise undesirable situation, and the Client agrees that<br />

if any market or other organization takes any action which affects a<br />

transaction then the <strong>Bank</strong> may take any action which it, in its discretion,<br />

considers desirable in the interests of the Client and/or the <strong>Bank</strong>. The<br />

<strong>Bank</strong> shall not be liable for any loss suffered by the Client as a result of<br />

the acts or omissions of any market or organization or any action<br />

reasonably taken by the <strong>Bank</strong> as a result of such acts or omissions. The<br />

<strong>Bank</strong> may, in its reasonable opinion, determine that an emergency or an<br />

exceptional market condition exists (“Force Majeure”) and in due course,<br />

will take reasonable steps to inform the Client.<br />

A Force Majeure Event shall include, but is not limited to, the following :<br />

a) any act, event or occurrence (including, without limitation, any<br />

interruption of power supply or electronic or communication equipment<br />

failure, strike, riot or civil commotion) which, in the <strong>Bank</strong> opinion, prevents<br />

it from maintaining an orderly market in one or more of the currencies in<br />

respect of which the <strong>Bank</strong> ordinarily allows the Client to enter into<br />

transactions;<br />

b) the suspension or closure of any market or the abandonment or failure<br />

of any event upon which the <strong>Bank</strong> bases, or to which it in any way relates,<br />

its quote, or the imposition of limits or special or unusual terms on the<br />

trading in any such market or on any such event; or<br />

c) the occurrence of an excessive movement in the level of any exchange<br />

rate and/or corresponding market.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

客户还应了解以下内容:<br />

+ 客户理解将实施的交易的条款和规定,包括但不限于:<br />

- 有关价格、期限、到期日和场外期权执行限制的条款以及重要的交易<br />

条款;<br />

- 说明风险因素的任何条款,如波动性、流动性等;<br />

- 以及客户可能不得不履约或交割杠杆外汇交易或期权交易的情形。<br />

+ 由于市场的波动性,外汇和贵金属交易中经常能获得的高杠杆率可能<br />

对客户有利,也有可能造成不利。通过这些工具,就算是小幅市场波<br />

动,就可能带来巨额收益,也可能导致巨额损失。<br />

如果市场朝不利于客户的方向变动,他/她不仅可能亏损掉所有的原始<br />

保证金以及存放于本行的任何维持补充资金,还有可能会导致客户对本<br />

行的进一步负债。客户可能要按照通知立即“补足”你的保证金亏空以<br />

保持你的头寸,否则本行可能会在账户处于亏损的状态下强行平仓,客<br />

户要对由此引起的任何损失承担责任。<br />

在某些市场状况下,客户可能会发现很难或无法平仓、评估正常价格或<br />

评估暴露的风险。比如当一项交易的市场无流动性或出现电子或电信系<br />

统故障,或发生一个通常称为“不可抗力”的事件时,这种情况就会发<br />

生。一些附加条件委托,如“止损”委托,并不一定会按照预定数额限<br />

制亏损,因为在某些市场状况下可能无法执行该等委托。在发出限价委<br />

托或止损委托时,客户必须清楚,在某些市场状况下,客户可能会在与<br />

最初要求不同的价格上成交。<br />

因为场外交易的价格和特征是单独议价的,并不存在获取价格的中心来<br />

源,所以在交易定价中存在效率低下的情况。因此,本行不能也不会保<br />

证,其价格或提供给客户的价格在任何时候都是或将是客户所能获得的<br />

最优价格。<br />

+ 期权交易具有高度风险,对很多公众投资者来说并不适合。该等交易<br />

应仅由那些已了解、理解和熟悉期权类型、履约方式、权利和义务的性<br />

质和范围,以及相关风险的人来进行。<br />

客户承认,很多交易将会受到市场法则影响、并与市场法则保持一致。<br />

特别地,客户承认,市场法则通常包含在紧急或其他意外情况下的广泛<br />

权力,客户同意,如果任何市场或其他组织采取任何影响到交易的行<br />

动,那么本行可单方面决定采取自认为符合客户和/或本行利益的任何<br />

行动做出应对。 如果任何市场或组织的行为和疏忽导致客户受到损<br />

失,或这些行为和疏忽迫使本行采取适度的举措导致客户受到损失,本<br />

行概不对此负责。本行可在其认为合理时,宣布进入紧急或异常市场状<br />

况(“不可抗力事件”),并将采取合理的步骤通知客户。<br />

不可抗力事件包括,但不限于以下事件:<br />

a) 在本行看来,妨碍其为客户维持一种或多种货币的有序市场的任何<br />

行为、事件或事故(包括但不限于,任何电力供应的中断或电子或通信<br />

设备故障、罢工、暴乱或民变),而在通常情况下本行可以让客户进行<br />

这些交易;<br />

b) 本行以之为基础的、或本行以任何方式关联其报价的任何市场的暂<br />

停或关闭,或任何活动的取消或失败,或在任何此等市场或任何此等活<br />

动中,交易遭受限制或被施以特殊或不寻常条款,或<br />

c) 任何汇率和/或相应市场出现过度波动。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

2 / 14 | Page

2.1.3 STREAML<strong>IN</strong>E DEAL<strong>IN</strong>G<br />

The <strong>Bank</strong> offers streamline dealing and fixed spreads for all Foreign<br />

Exchange transactions. Streamline dealing does not guarantee that requotes<br />

will not be given and the client accepts to receive a requote on<br />

the requested price prior to a trade being confirmed. Requotes are given<br />

if the requested price is not favorable to the <strong>Bank</strong> and in case of re-quote,<br />

the Client is free to accept the new quote and the <strong>Bank</strong> shall remain<br />

harmless of any damages or costs arising thereof. In certain market<br />

conditions and upon <strong>Bank</strong>’s sole discretion, the <strong>Bank</strong> may change the<br />

quoted prices and/or spreads in the online trading platform and the <strong>Bank</strong><br />

shall remain harmless of any damages or costs arising thereof.<br />

The Client is informed that the <strong>Bank</strong> does not accept clients using<br />

scalping methods. In particular, the <strong>Bank</strong> reserves the right to close all<br />

open positions of such clients and to close their account(s).<br />

The <strong>Bank</strong> also offers a mechanical trade system (MTS, also called “Expert<br />

Advisor”) linked up to a plot. This system does not only inform about a<br />

possible entry and exit points but can also generate orders automatically<br />

on behalf of the <strong>Bank</strong>’s Client and direct them to the trade server. This<br />

system is enabled by default. The use of this system is at the Client’s risk.<br />

The <strong>Bank</strong> does thus not guarantee the result of the use of this system and<br />

the <strong>Bank</strong> shall remain harmless of any damages or costs arising thereof.<br />

The <strong>Bank</strong> may at its sole discretion de-activate this feature if the Client is<br />

deemed to be using this feature for abusive purposes.<br />

Trailing Stop features are enabled by default. The Client acknowledges<br />

being fully aware of how this feature works. The use of this feature is at<br />

the Client’s risk. The <strong>Bank</strong> does thus not guarantee the result of the use of<br />

this feature and the <strong>Bank</strong> shall remain harmless of any damage or costs<br />

arising thereof.<br />

The Client may request to have his account not be charged or given any<br />

swap fees for open positions. Such request is made separately from the<br />

Client and the Client thereby agrees to pay any additional fees or costs as<br />

the <strong>Bank</strong> specifies from time to time for handling such account. If the<br />

<strong>Bank</strong> finds that a client is using such account for abusive purposes, the<br />

<strong>Bank</strong> may, at its sole discretion, decide to close all open positions for<br />

such an account and deduct or add any swap fees for all the transactions<br />

currently and/or previously made with the Client and decline from<br />

accepting any further request from the Client to be exempted from swap<br />

fees.<br />

2.1.4 <strong>IN</strong>STRUCTIONS / COMMUNICATIONS<br />

The Client may give the <strong>Bank</strong> oral or written instructions. The Client is<br />

authorized to grant, a power of attorney without right of substitution to a<br />

third person in order to represent him/her in any business with the <strong>Bank</strong>.<br />

To that effect, the Client undertakes to use the <strong>Bank</strong>’s standard form that<br />

may be downloaded on its website http://migbank.com and must be sent<br />

duly completed and signed to the <strong>Bank</strong>. The <strong>Bank</strong> shall be entitled to act<br />

upon the oral or written instructions of any person so authorized,<br />

notwithstanding that the person is not, in fact, so authorized. For these<br />

purposes, written instructions may be given by letter, facsimile, or via the<br />

Internet or other electronic means of communication and oral instructions<br />

in person or by telephone. The <strong>Bank</strong> shall not be obliged to confirm such<br />

instructions.<br />

Any instruction in writing shall set out the names and specimen signatures<br />

of the Client or person so authorized.<br />

The Client accepts that the <strong>Bank</strong> is entitled, though not obliged, to ask<br />

for personal data in order to establish its identity with greater certainty.<br />

The <strong>Bank</strong> shall not incur any liability as a result of refusing to execute any<br />

order(s) issued by a person whose identity it considers not to have been<br />

sufficiently established.<br />

Once an instruction has been given by, or on behalf of the Client, it<br />

cannot be rescinded, withdrawn or amended without the <strong>Bank</strong> express<br />

consent. The <strong>Bank</strong> may at its absolute discretion refuse any dealing<br />

instruction given by, or on behalf of, the Client without giving any reason<br />

or being liable for any loss occasioned thereby.<br />

The Client shall promptly (and within the limits imposed by the <strong>Bank</strong>) give<br />

any instructions the <strong>Bank</strong> may request from the Client in respect of any<br />

transaction or proposed transaction. If the Client does not provide such<br />

instructions promptly, the <strong>Bank</strong> may, in its absolute discretion, take such<br />

steps at the Client’s cost as the <strong>Bank</strong> considers appropriate for its own<br />

protection or for the protection of the Client.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

2.1.3 流处理交易<br />

本行在所有外汇交易中提供流处理交易和固定的买卖点差。流处理交易<br />

并不保证不给出重新报价,客户同意在确认一项交易之前接受对委托价<br />

格的重新报价。如果本行不接受委托价格,可给出重新报价,在重新报<br />

价时,客户可自行决定是否接受新的报价,且本行应免于因此造成的任<br />

何损失或费用。在某些市场状况下,并根据本行的自行决定,本行可能<br />

会改变在线交易平台的报价/点差,且本行应免于因此造成的任何损失<br />

或费用。<br />

客户被告知,本行并不接受客户“剥头皮”交易方式。尤其是,本行保<br />

留了结此类客户所有未平仓头寸以及关闭其账户的权利。<br />

本行同时会提供与图表相结合自动交易系统(MTS,亦称“专家顾<br />

问”)。该系统不仅告知可能的进出点,而且还会为本行客户自动生成<br />

指令,并将其发送至交易服务器。该系统为默认激活。该系统的使用风<br />

险将由客户承担。本行并不保证该系统的使用结果,且应免于由此产生<br />

的任何损失或出现的费用。 如果客户被认为滥用该功能,本行可以单<br />

方面决定撤销该项功能。<br />

移动止损功能为默认激活。客户承认完全了解该功能的运行。该系统的<br />

使用风险将由客户承担。本行并不保证该系统的使用结果,且应免于由<br />

此产生的任何损失或出现的费用。<br />

客户可要求其账户免于对未平仓头寸收取或支付任何隔夜掉期费用。该<br />

要求由客户单独做出,客户于此同意,将支付本行不时为处理该账户的<br />

任何额外费用或成本。如果本行发现客户将该账户用于滥用目的,本行<br />

可自行决定了结该账户的所有未平仓头寸,扣除或增加客户对当前和/<br />

或过去完成的任何交易的所有掉期费用,并拒绝接受客户关于免除掉期<br />

费用的任何进一步要求。<br />

2.1.4 指令/通信<br />

客户可向本行发出口头或书面指令。客户有权通过授权书,委托第三方<br />

代表(但不可取代)其开展与本行的所有业务。这种情况下,客户承诺,<br />

使用从本行网站 http://migbank.com下载的标准表格,并在完整填写<br />

并签名后交回本行。本行应有权依照任何获得该授权的人口头或书面指<br />

令行事,尽管该人事实上并未获得该授权。为此目的,书面指令可通过<br />

信函、传真或国际互联网或其他电子通信方式发出,而口头指令可亲自<br />

或通过电话发出。 本行没有义务确认该等指令。<br />

任何书面形式的指令,应列出客户或授权代理人的姓名和签名样本。<br />

客户接受,本行有权,但无义务,要求其提供个人资料,以更加肯定地<br />

确定其身份。 如果本行因指令发出人的身份不能得到充分确定而拒绝<br />

执行指令,本行不承担任何责任。<br />

指令一经客户或其代理人发出,未经本行明示同意均不得撤销、收回或<br />

赔偿。本行可无条件地单方面拒绝客户或其代理人发出的任何交易指<br />

令,无需给出任何理,并不用对由此产生的任何损失承担责任。<br />

对于银行提出的关于交易或准备交易的要求,客户应即时(且在本行规<br />

定的时限内)发出指令。如果客户未能即时提供相关指令,本行可单方<br />

面自行采取任何本行认为对自身或客户带来保护的合适措施,并由客户<br />

承担费用。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

3 / 14 | Page

If the Client does not provide the <strong>Bank</strong> with notice of its intention to<br />

exercise an OTC option at the time stipulated by the <strong>Bank</strong>, the <strong>Bank</strong> may<br />

treat the option as abandoned by the Client and, if so, will notify the<br />

Client.<br />

If the <strong>Bank</strong> does not receive instructions from the Client to settle any<br />

open transactions by the close of the business day two days prior to value<br />

date of the said transactions, is hereby authorized (but not obliged) to<br />

rollover all said transactions to the next value date traded.<br />

During market holidays and weekends pre-announced by the <strong>Bank</strong>, the<br />

<strong>Bank</strong> does not execute orders for clients.<br />

The Client agrees to indemnify and hold the <strong>Bank</strong> harmless for and<br />

against any damages or losses it may incur as a result of instructions<br />

transmitted by any of the above means.<br />

Communications may be made to the Client at such address, telephone,<br />

facsimile or email address notified from time to time to the <strong>Bank</strong> for this<br />

purpose. Any communication by telephone, facsimile or email shall be<br />

deemed to have been made or (as the case may be) delivered when<br />

dispatched. Any communication by letter shall be deemed to have been<br />

made forty-eight hours after being sent to it at that address by prepaid<br />

first-class post in the case of an address in Switzerland, or, in the case of<br />

an address outside Switzerland, six business days after being sent to it at<br />

that address by mail. The Client shall ensure that at all times the <strong>Bank</strong> will<br />

be able to communicate with the Client or his appointed representative<br />

by telephone, facsimile or email.<br />

At the specific request and at cost of the Client, the <strong>Bank</strong> will reconstruct<br />

the instructions and/or the exchange of communications.<br />

Communications may be made to the <strong>Bank</strong> at the address and telephone<br />

number notified to the Client or this purpose and shall be considered to<br />

have been duly made only upon their actual receipt by the <strong>Bank</strong>.<br />

The above conditions are also applicable to any attorney(s) appointed by<br />

the Client.<br />

The Client is aware of the risks associated with these means of<br />

communication and release the <strong>Bank</strong> from any liability resulting from their<br />

use. The Client confirms that he/she shall assume all risks of abuse of<br />

these means of communication, such as non-discovered falsifications,<br />

mistakes, distortions, duplications, misunderstandings or losses that<br />

might occur, as a result of instructions given by any of the above<br />

communication means.<br />

2.1.5 MARG<strong>IN</strong> DEPOSITS, COLLATERAL AND PAYMENTS<br />

The Client shall pay to the <strong>Bank</strong> :<br />

a) such amounts of money as required by the <strong>Bank</strong>, and in a currency<br />

acceptable to the <strong>Bank</strong>, as initial or variation margin;<br />

b) such amounts of money, as may be required from time to time, due to<br />

the <strong>Bank</strong> under a transaction; and<br />

c) such amounts of money as may be required in or towards clearance of<br />

any debit balance on any account.<br />

With the prior agreement of the <strong>Bank</strong>, the Client may provide the <strong>Bank</strong><br />

with a bank guarantee, in a form acceptable to the <strong>Bank</strong>, instead of cash,<br />

for the purpose of complying with its obligations under clause above.<br />

Without limiting the Client’s obligation to pay margin deposits, the <strong>Bank</strong><br />

will have no obligation to ensure margin deposit requirements have been<br />

satisfied by the Client before effecting a transaction and the Client’s<br />

obligations in respect of a transaction will not be diminished by any failure<br />

by the <strong>Bank</strong> to enforce payment of outstanding margin deposits prior to<br />

entering into the transaction.<br />

The Client shall promptly deliver any money deliverable by it under a<br />

transaction in accordance with the terms of that transaction and with any<br />

instructions given by the <strong>Bank</strong> for the purpose of enabling the <strong>Bank</strong> to<br />

perform its obligations under any corresponding transaction entered into<br />

between the <strong>Bank</strong> and a third party.<br />

The <strong>Bank</strong> may (but shall not be obliged to) convert any monies held by it<br />

for the Client into such other currency as the <strong>Bank</strong> considers necessary or<br />

desirable to cover the Client’s obligations and liabilities in that currency at<br />

such rate of exchange as the <strong>Bank</strong> shall select.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

如果客户未能在本行规定的时限内向本行通告是否履行场外期权的意<br />

向,本行将其视为客户放弃该期权,如果是这样,将通知客户。<br />

如果本行在起息日前两个营业日结束时,仍未收到客户结算任何未平仓<br />

合约的指令,本行于此有权(但无义务)将所有上述合约展期至下一个<br />

交易起息日。<br />

在已经事先预告的市场节假日和周末,本行不会为客户执行任何委托指<br />

令。<br />

如果上述方式中,指令的传达造成任何损失或亏损,客户同意做出赔<br />

偿,及确保本行免于伤害。<br />

为此,本行会时常通过预留的地址、电话、传真或电子邮件地址与客户<br />

通信。一旦电话、传真或电子邮件的通信行为发生,即被认为已经做出<br />

(视情况而定)或送达。任何采用信函方式的通信,对于瑞士国内的地<br />

址,应在通过邮资已付的一等邮件寄往该地址后48小时;对于瑞士国外<br />

的地址,在寄往该地址后6个营业日之后,即被认为邮件已送达。客户<br />

应始终确保本行将能够通过电话、传真或电子邮件与客户或其指定代表<br />

保持通信。<br />

如果客户要求并承担费用,本行可以调出指令和/或相互通信的内容。<br />

客户可以根据本行告知地址和电话号码与本行联系,并应仅在本行实际<br />

收到时才被认为完成通信。<br />

上述条款同样适用于客户指认的任何委托人。<br />

客户知晓与这些通信方式相关的风险,并免除本行由于使用这些方式而<br />

产生的任何责任。客户于此确认,他/她将承担滥用这些通信方式的一<br />

切风险,例如由于使用任何上述通信方式发出指令而产生未被发现的伪<br />

造、错误、差错、曲解或损失。<br />

2.1.5 保证金、抵押和支付<br />

客户应支付给本行<br />

a) 本行要求的款项,并且是本行可接受的货币,作为初始或价格变动保证<br />

金;<br />

b) 本行根据交易可能不时要求的应付款项;和<br />

c) 为清算任何账户的任何借方差额可能要求或需要的任何款项。<br />

经本行事先同意,客户可以向本行提供经认可的银行担保,而非现金,<br />

以完成上面条款所提到的责任和义务。<br />

在不限制客户支付保证金的义务的前提下,本行将无义务确认客户在实施<br />

交易前已满足保证金要求。即便是本行在开始交易之前,未能强迫客户支<br />

付所欠的保证金,客户的欠款也不会因此而减少。<br />

客户应该根据交易相关的条款,立即缴纳每笔交易需支付的费用,以及<br />

提供本行通知的、以授权本行与第三方在相关交易中履行职责和义务的<br />

指令。<br />

本行可以(但并非有义务)将客户持有的任何资金按本行选择的任何汇<br />

率兑换成本行认为必要的或可取的任何其他货币,以履行该客户该货币<br />

的义务和负债。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

4 / 14 | Page

If the Client fails to provide any margin deposit or other sum due under<br />

this Conditions and Regulations in respect of any transaction, the <strong>Bank</strong><br />

may close out any open transaction without prior notice to the Client and<br />

apply any proceeds thereof to payment of any amounts due to the <strong>Bank</strong>.<br />

2.1.6 TRANSACTION MONI<strong>TO</strong>R<strong>IN</strong>G<br />

Each transaction entered into by the <strong>Bank</strong> with the Client can be seen<br />

through the Online Service provided by the <strong>Bank</strong>. Transaction entered<br />

after 23:00 PM CET will be treated as having been effected on the next<br />

following business day.<br />

History of transactions can be printed from the Online Service provided<br />

by the <strong>Bank</strong> any time.<br />

The Client must verify the contents of each document received from the<br />

<strong>Bank</strong> and all transactions published on its online service continuously.<br />

Such documents and transactions published shall, in the absence of<br />

manifest error, be conclusive unless the Client notifies the <strong>Bank</strong> the<br />

contrary immediately after having access to this information.<br />

2.1.7 DEFAULT<br />

Without prior notice to, or receiving further authority from the Client,<br />

the <strong>Bank</strong> shall have the right to close out all or any part of any transaction,<br />

and realize any assets of the Client held by the <strong>Bank</strong>, upon or at<br />

any time after the happening of any of the following events :<br />

a) the Client fails to make any payment due under these Conditions<br />

and Regulations on the due date;<br />

b) the Client fails to observe or perform in whole or in part any of<br />

the provisions of these Conditions and Regulations or commits a<br />

material breach of the representations, warrants or undertakings;<br />

c) the Client dies, is declared absent or becomes of unsound mind;<br />

d) a bankruptcy petition is presented in respect to the Client or, if a<br />

partnership, in respect to one or more of its partners or, if a<br />

company, any steps are taken or proceedings initiated or<br />

protection sought under, any applicable bankruptcy<br />

reorganization or insolvency law by it in respect of itself or against<br />

it including, without limitation, the taking of any steps for the<br />

appointment of a receiver, trustee, administrator or similar officer<br />

to be appointed over its undertakings or assets or any part of them;<br />

e) a petition is presented for the winding up of the Client;<br />

f) an order is made or a resolution is passed for the winding up of<br />

the Client (other than for the purposes of a bona fide<br />

reconstruction or amalgamation);<br />

g) the Client convenes a meeting for the purpose of making or<br />

proposing or entering into any arrangement or composition for<br />

the benefit of its creditors (other than for the purposes of a bona<br />

fide reconstruction or amalgamation);<br />

h) a distress, execution, or other process is levied against any<br />

property of the Client and is not removed, discharged or paid<br />

within seven days;<br />

i) any security created by a mortgage or charge created by the<br />

Client becomes enforceable and the mortgagee or the charge<br />

take steps to enforce the security;<br />

j) any indebtedness of the Client or any of its subsidiaries becomes<br />

immediately due and payable, or capable of being declared so<br />

due and payable, prior to its stated maturity by reason of default<br />

of the Client (or any of its subsidiaries) or the Client (or any of its<br />

subsidiaries) fails to discharge any indebtedness on its due date;<br />

k) the <strong>Bank</strong> or the Client is requested to close out a transaction (or<br />

any part of a transaction) by any regulatory agency or authority;<br />

l) the <strong>Bank</strong> reasonably considers it necessary for its own protection.<br />

Without prejudice to any other rights the <strong>Bank</strong> may have, it shall be<br />

entitled to combine or consolidate all or any of the accounts maintained<br />

by the Client with the <strong>Bank</strong> to set off any amount at any time<br />

owing from the Client against any amount owing by the <strong>Bank</strong> to the<br />

Client. Any security, guarantee or indemnity given to the <strong>Bank</strong> by<br />

the Client for any purpose shall extend to any amount owing from<br />

the Client after exercise of such right set-off.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

如果客户未能提供本条款和制度要求的任何交易的任何保证金或本条款<br />

和制度下其他应付款项,本行可了结任何未平仓合约,而无须事先通知<br />

客户,并将其任何收入用于支付任何应付本行的款项。<br />

2.1.6 交易监控<br />

银行与客户之间进行的每次交易,都能在银行提供的在线服务中看到。<br />

欧洲中部时间下午23:00之后进行的交易,将被视为在接下来的交易日<br />

生效。<br />

任何时候都可以通过银行提供的在线服务中,打印历史交易记录。<br />

客户必须查阅从本行收到的每个文件的内容,以及其在线服务中持续更<br />

新的交易信息。除非客户在获得这些信息后,立即提出异议,否则,在<br />

没有明显错误的情况下,银行所发布的文件和交易都是正确可靠的。<br />

2.1.7 违约<br />

任何时候发生以下任何事件时,本行可无须事先通知或收到客户的进一<br />

步授权,随时了结全部或任何部分的任何交易,并将本行持有客户的任<br />

何资产变现:<br />

a) 客户未能在到期日支付相关条款和制度下的任何应付款;<br />

b) 客户未能遵守或履行相关条款和制度全部或任何部分的规定,或实<br />

性地违反其声明、保证或承诺;<br />

c) 客户死亡、被宣布失踪或出现精神失常;<br />

d) 针对客户提出破产申请或,如果是合伙企业,针对其一名或多名合<br />

伙人或,如果是公司,它就/对自己采取任何步骤或启动法律程序或寻<br />

求任何适用的破产重组或破产法下的保护,包括但不限于,采取任何步<br />

骤指定将对其承诺或资产或任何部分指定的接收人、受托人、管理人或<br />

类似官员;<br />

e) 客户清盘申请;<br />

f) 为重组或并购,做出或通过客户清盘的命令或决议;<br />

g) 客户为制定或提议或订立任何为其债权人的利益之安排或债务和解<br />

协议之目的召集会议(除为善意重建或合并之目的);<br />

h) 对客户的任何财产施行扣押、执行或其他程序,且未在七日内取<br />

消、解除或偿付;<br />

i) 客户创设的任何抵押或质押担保变为可执行,抵押权人或质押权人<br />

采取步骤执行该担保; 客户基于抵押或赊购的证券被强制执行,且承<br />

受抵押人已经开始进行强制执行。<br />

j) 客户或其任何子公司的任何债务变为立即到期和应付,或由于客户<br />

(或其任何子公司)违约导致可能在正常期限前出现上述状况,或客户<br />

(或其任何子公司)在其到期日未能偿还任何债务;<br />

k) 任何监管机构或当局要求本行或客户了结交易(或交易的任何部<br />

分);<br />

l) 本行认为是必要的自我保护的情况。<br />

在不损及本行可能享有的任何其他权利的前提下,本行有权组合或合并<br />

客户在本行保有的全部或任何账户,随时将客户所欠的任何款项与本行<br />

应付客户的任何款项进行抵消。在准确的完成上述抵消后,客户为任何<br />

目的在本行存放的证券、抵押品或保证物,将转入客户的任意账户中。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

5 / 14 | Page

2.1.8 CLIENT REPRESENTATIONS AND WARRANTIES<br />

The Client represents, warrants and undertakes at the time this<br />

agreement is made and the making of each transactions hereunder that :<br />

a) it is not under any legal disability with respect to, and is not subject to<br />

any law or regulation which prevents its performance of, this agreement<br />

or any transaction contemplated by this Agreement;<br />

b) it has obtained all necessary consents and has the authority to enter<br />

into this agreement (and if the Client is a company, it is properly<br />

empowered and has obtained necessary corporate or other authority<br />

pursuant to its constitutional and organizational documents);<br />

c) all sums made by way of deposit or security shall, subject to this<br />

agreement, at all times be free from any charge, lien, pledge or<br />

encumbrance;<br />

d) it is in compliance with all laws to which it is subject including, without<br />

limitation, all tax laws and regulations, exchange control requirements<br />

and registration requirements; and<br />

e) the information provided by the Client to the <strong>Bank</strong> is complete,<br />

accurate and not misleading in any material respect.<br />

2.1.9 TAPE RECORD<strong>IN</strong>G OF CONVERSATION<br />

The Client acknowledges and expressly accepts that the <strong>Bank</strong> shall record<br />

all telephone conversations between the parties as per regulatory<br />

applicable requirements. Such recordings shall remain the property of the<br />

<strong>Bank</strong> and the Client agrees to the use thereof or transcript there from as<br />

evidence by the <strong>Bank</strong> in any dispute or anticipated dispute between the<br />

parties.<br />

Any such recordings or transcripts made by the <strong>Bank</strong> may be destroyed<br />

by it in accordance with its usual practice.<br />

2.1.10 BANK<strong>IN</strong>G SECRECY <strong>IN</strong>FORMATION DISCLOSURE<br />

In its capacity as a bank pursuant to the Federal Law on <strong>Bank</strong>s and<br />

Savings <strong>Bank</strong>s, the <strong>Bank</strong> is subject to banking secrecy. The <strong>Bank</strong> is<br />

therefore obliged to observe the strictest discretion regarding all<br />

business relations with the Client, even after the Client’s relationship with<br />

the <strong>Bank</strong> is ceased. Swiss banking secrecy does, however, only apply to<br />

data located in Switzerland.<br />

However, by entering into this agreement the Client authorizes the <strong>Bank</strong><br />

to disclose such information relating to the Client as may be required by<br />

any law, rule or regulatory authority, including any applicable Market<br />

Rules, without prior notice to the Client.<br />

2.1.11 SWISS ACT ON <strong>THE</strong> PREVENTION OF<br />

MONEYLAUNDER<strong>IN</strong>G (“MLA ”)<br />

As the Client is aware that the <strong>Bank</strong> has to comply with the Swiss Federal<br />

Money Laundering Act the Client agrees to provide the <strong>Bank</strong>, as per<br />

separate document, with full and accurate information regarding, among<br />

others, the identification of the contracting partner, the identification of<br />

the beneficial owner and the origin of the assets.<br />

The <strong>Bank</strong> is also entitled to ask the Client to supply information regarding<br />

the circumstances or background of a certain transaction. In such event,<br />

the Client must immediately disclose such information as requested. As<br />

long as the Client fails to supply the information requested by the <strong>Bank</strong>,<br />

the <strong>Bank</strong> is entitled not to carry out the instructions received from the<br />

Client, and in particular not to execute instructions requiring the transfer<br />

of assets. In case the <strong>Bank</strong> deems the information supplied unsatisfactory<br />

or incomplete, it may at its discretion immediately terminate the business<br />

relationship with the Client and ordain that assets may no longer be<br />

withdrawn. Furthermore, the <strong>Bank</strong> may, pursuant to the provisions of the<br />

MLA and the Swiss regulation on banks, submit a report to the competent<br />

prosecuting authorities and take precautionary measures to freeze the<br />

Client relationship until the authorities have decided the case at hand.<br />

Provided the <strong>Bank</strong> has proceeded in accordance with the provisions and<br />

regulations set forth in the Swiss legislation for the prevention of money<br />

laundering (e.g. the MLA) and the rules and regulation of the Swiss<br />

banking regulator (F<strong>IN</strong>MA), respectively, the Client shall bear losses<br />

resulting from unexecuted instructions or the delayed execution of<br />

instructions.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

2.1.8 客户声明和保证<br />

客户在本协议签订和进行每项交易时,声明、保证和承诺如下:<br />

a) 本协议及本协议所构成的所有交易,任何情况下都不会失去法律资<br />

格,并且不会遵从妨碍其执行的法律和法规;<br />

b) 客户已获得一切必要的批准,并被授权订立本协议(如果客户是一<br />

家公司,该公司已经获得授权,并依照相关章程和大纲,其拥有必要的<br />

企业或其他资质);<br />

c) 本协议下的所有存款和证券方式的资产,在任何时候都将免于担<br />

保、留置、质押或财产负担;<br />

d) 遵守所有的管辖法律,包括但不限于,所有税务法律和法规,外汇<br />

管制要求和注册登记要求;以及<br />

e) 客户向本行提供的信息,在任何实质性方面都是完整的、准确的和<br />

不易误解的。<br />

2.1.9 对话的磁带录音<br />

客户承认和明确接受,本行可对双方之间的电话通话进行录音。这些录<br />

音为本行所有,客户同意,当双方出现争议或可能出现争议时,本行可<br />

以将此录音或副本作为证据。<br />

本行可以依照自己的通常做法,将这些录音或副本进行销毁。<br />

2.1.10 银行保密信息披露<br />

根据银行和储蓄银行的联邦法律,本行应遵从银行保密。在于客户的所<br />

有业务交往中,本行将遵照最为严谨的做法,即便是本行与客户之间的<br />

业务关系结束后也是如此。不过,瑞士银行业的保密仅针对在瑞士的数<br />

据。<br />

不过,在签署本协议之后,如果有法律、法规或监管机构,包括任何适<br />

用的市场规则提出要求,客户授权本行向他们提供客户的相关信息,且<br />

无需事先通知客户。<br />

2.1.11 瑞士反洗钱法案<br />

客户清楚,本行必须遵照瑞士联邦反洗钱法案。客户同意,在单独的文<br />

件中,向本行提供关于签约人和受益所有人身份认证以及资金来源的全<br />

面、详细信息。<br />

本行同时有权要求客户提供某一交易的详情和背景。在这种情况下,客<br />

户必须立即披露所要求的信息。如果客户未能提供本行所要求的信息,<br />

本行有权拒绝执行该客户发出的指令,尤其是拒绝执行该客户关于资产<br />

转移的指令。如果本行认为提供的信息不可信或不完整,可单方面自行<br />

决定立即终止与该客户的业务关系,而且其资产将不能提取。此外,根<br />

据反洗钱法和瑞士银行法规,本行可向检察部门提交报告,在检察部门<br />

作出决定之前,冻结本行与客户的关系。<br />

如果本行的行为符合瑞士关于防止洗钱法律(例如反洗钱法),或瑞士银<br />

行业监管机构(瑞士金融市场监管局)的条款和法规,客户将承担因本行<br />

拒绝或延迟执行指令而造成的损失。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

6 / 14 | Page

Furthermore, the Client confirms wishing to execute cross-border or<br />

foreign currency payments in the future. Learning about the rules for<br />

cross-border or foreign currency payments the Client authorizes the <strong>Bank</strong><br />

to disclose his name and further Client details in case of payments made<br />

to <strong>Bank</strong> account abroad, or payments made in foreign currencies both<br />

within Switzerland as well as abroad.<br />

2.1.12 EXAM<strong>IN</strong>ATION OF SIGNATURES AND LEGITIMAT<strong>IN</strong>G<br />

The <strong>Bank</strong> undertakes to examine the signatures of Clients and their<br />

authorized attorneys with care. The <strong>Bank</strong> is not required to undertake any<br />

additional extensive check of their identity. The <strong>Bank</strong> will not be<br />

responsible for the consequences of any falsifications or faulty<br />

identification that it has not recognized provided it has observed due<br />

care.<br />

2.1.13 CIVIL <strong>IN</strong>CAPACITY<br />

Losses resulting from the Client’s civil incapacity are exclusively borne by<br />

the Client, unless that incapacity has been published in an official Swiss<br />

gazette. In any case, the Client will bear the loss resulting from the civil<br />

incapacity of the people he/she has mandated or of other third parties<br />

having access to the Client’s account(s)/save custody account(s).<br />

2.1.14 JO<strong>IN</strong>T ACCOUNTS<br />

If the Client is more than one person (in the case of joint account holders),<br />

the liabilities of each such person shall be joint and several, and the <strong>Bank</strong><br />

may act upon instructions received from any one person who is, or<br />

appears to the <strong>Bank</strong> to be, such a person.<br />

2.1.15 COMPLA<strong>IN</strong>TS BY <strong>THE</strong> CLIENT<br />

Any complaint by the Client concerning the execution or non-execution<br />

of any order, and any dispute concerning an account or other<br />

communication from the <strong>Bank</strong> must be issued immediately after receiving<br />

the information, but not later than one day after the date of<br />

communication, failing of which the execution or non-execution and the<br />

corresponding statements and communications will be taken to have<br />

been approved. In the case of a late complaint, the Client will bear any<br />

resulting loss. If the Client does not react according to this clause within<br />

the period of time allowed, statements are deemed to have been<br />

accepted. Express or tacit acknowledgement of the account statement<br />

implies approval of the individual headings it contains and of any<br />

reservation the <strong>Bank</strong> may have formulated.<br />

Any claim for indemnification must be addressed in writing (per post) by<br />

the Client or its representative to the address of the <strong>Bank</strong> to the attention<br />

of the Chief Executive Officer. The Client acknowledges that the <strong>Bank</strong> will<br />

not answer any claim which is not addressed in writing and/or not signed<br />

by its author.<br />

2.1.16 RIGHT OF PLEDGE, LIEN SET-OFF AND RETENTION<br />

The <strong>Bank</strong> has a right of lien for the discharge of all indebtedness and the<br />

Client’s other obligations towards the <strong>Bank</strong> on securities and other<br />

property now or hereafter held, carried or maintained by the <strong>Bank</strong> in its<br />

possession or control, for any purpose, in or for the benefit of any of the<br />

Client’s accounts, now or hereafter opened, including any account in<br />

which the Client may have an interest. The <strong>Bank</strong> has a right of set-off<br />

regarding all debts receivable against its existing claims against the Client<br />

regardless of the dates they are due for payment or the currencies in<br />

which they are expressed.<br />

The same applies to all the credits it has granted in exchange for the<br />

issuing of special guarantees or guarantees in blank. Upon notice served<br />

on the Client, the <strong>Bank</strong> is entitled, at its sole discretion, to proceed with<br />

the compulsory realization or the over-the-counter or market sale of the<br />

securities pledged, at the Client’s cost if necessary. The Client authorizes<br />

the <strong>Bank</strong> and the <strong>Bank</strong> shall have the right to transfer securities and other<br />

property held on behalf of the Client or his/her representative from or to<br />

any other account of the Client at the <strong>Bank</strong> whenever, in the <strong>Bank</strong>’s<br />

judgment, it considers such transfer necessary for its protection.<br />

The <strong>Bank</strong> shall, at any time, be entitled to offset against each other the<br />

balances of all accounts the Client maintains with the <strong>Bank</strong> (regardless<br />

of designation of currency of the account) or to offset each balance<br />

individually. For all its claims arising from its business relations with the<br />

Client, irrespective of the maturity dates of such claims or of the<br />

currencies in which they are denominated, including unsecured or<br />

collateralized claims, the <strong>Bank</strong> shall have a right of lien and pledge, and<br />

a right of retention, on all assets held in the Client’s name or otherwise<br />

deposited with the <strong>Bank</strong>.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

此外,客户确认希望在未来执行跨国或外汇支付。在了解跨国和外汇支<br />

付的规则之后,客户授权本行在收到海外付款,或在瑞士国内外收到外<br />

汇时,披露客户的姓名及进一步信息。<br />

2.1.12 签名和合法性的核查<br />

本行承诺将谨慎核对客户及其授权代理人的签名。本行不必承诺对他们<br />

的身份进行更加深入的查对。如果即便是本行尽守职责,也未能分辨出<br />

虚假或错误身份,本行对此产生的后果概不负责。<br />

2.1.13 丧失民事行为能力<br />

对于因客户丧失民事行为能力所造成的损失,由客户全部承担,除非在<br />

瑞士官方公报中对此予以通报。在任何情况下,如果客户委托的人或其<br />

他有权进入该客户账户/储蓄保管账户的第三方丧失民事行为能力,因<br />

此造成的损失由客户承担。<br />

2.1.14 联合账户<br />

如果客户是多人(对于联合账户持有人),他们各人应承担连带责任,<br />

本行会执行其中任何一人,或本行认为是其中一人的指令。<br />

2.1.15 客户投诉<br />

如果客户对于定单的执行或未执行、对账户或来自本行的其他通信有所<br />

质疑,应在收到信息后立即反馈,不能超过信息发送起之后一天。如果<br />

没有及时反馈,定单的执行或未执行、相应的声明和通信将被视为获得<br />

批准。如果在有效期之后投诉,客户将承担所有损失。如果客户在本条<br />

款规定的时间内没有提出异议,将被视为接受报告。明确表示或默许对<br />

账户报告的承认,意味着客户同意报告中包括的所有单独的条款,以及<br />

本行陈述的所有约定。<br />

任何赔偿要求,都应该是由客户或其代理人,以书面的方式(通过邮<br />

局),邮寄至本行的首席执行官。如果赔偿要求并非以书面方式,或没<br />

有签名,本行将不予处理。<br />

2.1.16 质押权、留置权、抵消权和扣留权<br />

对于客户对本行发生的所有欠款或其他债务,本行享有债务清偿留置<br />

权,留置本行当前或今后持有、传送或维护的,因为任何目的、代表客<br />

户的任何账户的利益而占有或控制的证券或其他的客户财产;客户的账<br />

户包括当前或今后开立的账户,以及客户可能在其中拥有利益的任何账<br />

户。本行对客户的所有应收债务享有针对其现有对客户债权的抵消权,<br />

不论到期还款日如何,也不论是何币种。<br />

抵消权同样适用于本行发放的所有信贷与特殊抵押品或全额抵押品之间<br />

的相抵。在通知客户后,本行有权自行决定对质押证券,如有必要按客<br />

户成本价,采取强制平仓或场外或场内出售。客户授权本行,且本行应<br />

有权在任何时候当本行根据自身判断认为有必要采取保护性转账措施<br />

时,将其代表客户或客户的代表持有的证券和其他财产从客户在本行的<br />

任何其他账户转出或转入此等账户。<br />

本行任何时候都将有权对客户在本行保有的所有账户的余额(不管账户<br />

币种如何)进行相互抵消,或单独对某个账户的余额进行相互抵消。对<br />

于由于与客户的业务关系而引起的一切债权,不管该债权的到期日或其<br />

货币单位如何,包括无担保或有抵押债权,本行对以客户名义或以其他<br />

方式存放于本行的所有资产将享有留置权和质押权以及扣留权。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

7 / 14 | Page

2.1.17 FEES AND RATES<br />

The <strong>Bank</strong> shall charge fees and rates for its services according to its<br />

prevailing Schedule of Fees & Rates with which the Client declares himself<br />

to be in agreement. These fees and rates are published on our website<br />

www.migbank.com.<br />

The Client expressly acknowledges that the <strong>Bank</strong> may pay remunerations<br />

to third parties, such as business finders and/or external asset managers<br />

under cooperation agreements. Such remunerations may be based on the<br />

volume of assets and/or transaction-related fees and rates on any Client<br />

transaction. The Client will receive a special information from the <strong>Bank</strong> on<br />

any additional spread or commission he may be charged as per<br />

agreement given.<br />

The Client understands and agrees that the <strong>Bank</strong> may receive payments,<br />

or other pecuniary benefits of any kind, from third parties. Such payments<br />

may be based on the volume of assets invested and/or may be based on<br />

the volume of clients transaction. The client agrees that such payments<br />

may be treated and retained by the <strong>Bank</strong> as compensation in addition to<br />

that paid by the Client for the services provided by the <strong>Bank</strong>, and need<br />

not to be paid on to the Client. The <strong>Bank</strong> shall not be obliged to disclose<br />

the nature or amount of any payment received.<br />

2.1.18 ACCOUNTS MANAGED BY <strong>THE</strong> CLIENT<br />

The Client shall be solely responsible for making any investments or<br />

trading decision on his assets deposited with the <strong>Bank</strong> and shall make<br />

such decisions entirely at his own risk. The Client acknowledges and<br />

agrees that the <strong>Bank</strong> shall not be liable in respect of any investment or<br />

trading decision made by the Client or any potential consequences<br />

resulting therefrom.<br />

All act performed by the Client shall be fully binding upon the client. The<br />

Client hereby releases the <strong>Bank</strong> fully and in advance from any<br />

responsibility and liability for any of the Client’s act and/or omission. In<br />

particular, the <strong>Bank</strong> is under no obligation to examine the instructions of<br />

the Client with respect to their appropriateness, suitability, frequency or<br />

extent. No liability shall accrue the <strong>Bank</strong> in respect of any investment<br />

decision made by the Client and the Client hereby expressly releases the<br />

<strong>Bank</strong> from any obligation to provide any advice, information or warning<br />

whatsoever in relation to the acts or omissions of the Client.<br />

2.1.19 ACCOUNTS MANAGED BY A THIRD PARTY<br />

The Client shall be solely responsible for any investments or trading<br />

decision done by any Attorney designated by the Client on assets of the<br />

Client deposited with the <strong>Bank</strong> and such decisions are made entirely at<br />

the own risk of the Client. The Client acknowledges and agrees that the<br />

<strong>Bank</strong> shall not be liable in respect of any investment or trading decision<br />

made by the Attorney or any potential consequences resulting therefrom.<br />

All act performed by an Attorney shall be fully binding upon the Client.<br />

The Client hereby releases the <strong>Bank</strong> fully and in advance from any<br />

responsibility and liability for any of the Attorney’s act and/or omission. In<br />

particular, the <strong>Bank</strong> is under no obligation to examine the instructions of<br />

the Attorney with respect to their appropriateness, suitability, frequency<br />

or extent. No liability shall accrue the <strong>Bank</strong> in respect of any investment<br />

decisions made by the Attorney and the Client hereby expressly releases<br />

the <strong>Bank</strong> from any obligation to provide any advice, information or<br />

warning whatsoever in relation to the acts or omissions of the Attorney.<br />

Furthermore, the Client acknowledges that the <strong>Bank</strong> does not monitor<br />

the volume or the appropriateness of the remuneration paid to the<br />

Attorney. The Client undertakes to monitor at all times the remuneration<br />

paid to the Attorney.<br />

D-CLIENT-01-07-CN_v1.0<br />

General Business Conditions And Safe Custody<br />

Regulations<br />

2.1.7 收费<br />

本行将主要按照客户宣布同意的收费标准对服务收费。收费标准在本行<br />

网站www.migbank.com上公示。<br />

客户明确承认,本行可能会向签订了合作协议的业务拓展商和/或外部<br />

资产管理者之类的第三方支付报酬。此类报酬可能会基于资产数量和/<br />

或客户任何交易产生的交易相关费用。本行可能会按照协议向客户收取<br />

额外点差或佣金,客户将收到相关的特别信息。<br />

客户了解并同意,本行可能会从第三方收到报酬或其他任何种类的金钱<br />

利益。此类报酬可能会基于投资资产的数额和/或客户的交易量。客户<br />

同意,本行可将此类报酬视为额外报酬予以保留,与本行向客户提供服<br />

务而收取的报酬无关,不需要支付给客户。本行没有义务披露收受的任<br />

何报酬的的性质或数量。<br />

2.1.8 账户由客户管理<br />

客户对存在本行的资产作出任何投资或交易决定,都应该由客户独自负<br />

责,并且应该为其决定承担全部风险。客户承认并同意,对于客户作出<br />

的任何投资或交易决定或由此引起的任何潜在后果,本行将概不负责。<br />

客户的所有行为将完全由客户负责。客户于此完全、提前免除本行对客<br />

户任何行为和/或疏忽的责任和义务。特别是,本行没有义务检查客户<br />

指令的正确性、适宜性以及频率或范围。本行不对客户的任何投资决定<br />

负责,客户于此明确免除本行向客户的行为或疏忽提供任何建议、信息<br />

或警告等等的义务。<br />

2.1.9 账户由第三方管理<br />

客户指定的任何代理人对客户存在本行的资产作出任何投资或交易决<br />

定,都应该由客户独自负责,并且客户应该为此类决定承担全部风险。<br />

客户承认并同意,对于代理人作出的任何投资或交易决定或由此引起的<br />

任何潜在后果,本行将概不负责。<br />

代理人的所有行为将对客户有完全的约束力。客户于此完全、提前免除<br />

本行对代理人任何行为和/或疏忽的责任和义务。特别是,本行没有义<br />

务检查代理人指令的正确性、适宜性以及频率或范围。本行不对代理人<br />

的任何投资决定负责,客户于此明确免除本行向代理人的行为或疏忽提<br />

供任何建议、信息或警告等等的义务。<br />

此外,客户承认,本行不监控付给代理人的报酬的数额或正确性。客户<br />

负责一直监控付给代理人的报酬。<br />

General Business Conditions And Safe Custody Regulations / 一般商业条款和安全保管规章<br />

8 / 14 | Page

2.2 TECHNICAL <strong>IN</strong>STALLATION AND PASSWORD<br />

2.2.1 LOG<strong>IN</strong> / IDENTIFICATION<br />

The <strong>Bank</strong> sends the User ID and password per e-mail. Together with the<br />

User ID, the password allows access to banking services provided by the<br />

<strong>Bank</strong>. The Client is at any time requested to keep the password and the<br />

User ID secret and to protect them from misuse.<br />

Anyone who identifies himself/herself each time he/she uses the system<br />

by entering the User ID and the personal password or identifies himself/<br />

herself when remitting orders by telephone to the <strong>Bank</strong>’s telephone<br />

consumer representative using the User ID and the personal password,<br />

has access to the <strong>Bank</strong>’s electronic transaction devices and other services<br />

as provided on the <strong>Bank</strong>’s onlinetrading site. At the occasion of contact<br />

over the telephone the <strong>Bank</strong>’s telephone consumer representatives will<br />

require the complete User ID and three positions of the 8-digit personal<br />

password, chosen at random.<br />

The Client is requested to modify the password regularly and to keep it in<br />

safe custody denying access to third person. The Client bears all risks<br />