Download the Annual Report - Norbert Dentressangle

Download the Annual Report - Norbert Dentressangle

Download the Annual Report - Norbert Dentressangle

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 0 0 8 A N N U A L R E P O R T

FINANCIAL INFORMATION<br />

PATRICK BATAILLARD<br />

Financial Director<br />

Tel.: +33 475 232 526<br />

Fax: +33 475 235 227<br />

Shareholder service: Tel.: +33 475 235 878<br />

Website: www.norbert-dentressangle.com (“FINANCES” section)<br />

AUDITORS<br />

ERNST & YOUNG AUDIT<br />

Member of <strong>the</strong> “Compagnie Régionale de Versailles”<br />

CABINET ACTITUD AUDIT<br />

Member of <strong>the</strong> “Compagnie Régionale de Lyon”<br />

Current auditors<br />

NORBERT DENTRESSANGLE GROUP<br />

BP 98 - 26241 Saint-Vallier-sur-Rhône - France<br />

RCS ROMANS 309 645 539

2008 ANNUAL REPORT<br />

CONTENTS<br />

4 A MAJOR PLAYER IN THE SUPPLY CHAIN<br />

8 TRANSPORT<br />

10 LOGISTICS<br />

12 30 YEARS OF MANAGED GROWTH<br />

14 GOVERNANCE OF THE NORBERT DENTRESSANGLE GROUP<br />

18 MESSAGE FROM THE CHAIRMAN OF THE SUPERVISORY BOARD<br />

20 INTERVIEW WITH THE CEO<br />

22 KEY FIGURES OF THE NORBERT DENTRESSANGLE GROUP<br />

24 A FAMILY-OWNED GROUP LISTED ON THE STOCK EXCHANGE<br />

26 4 DIRECTIONS FOR THE FUTURE<br />

28 ALL YOUR NORBERT IN ALL COUNTRIES<br />

34 MEN AND WOMEN WHO STRIVE FOR EXCELLENCE<br />

36 EMPHASIZING WHAT MAKES US DIFFERENT<br />

42 SUSTAINABLE DEVELOPMENT EACH AND EVERY DAY<br />

49 2008 FINANCIAL REPORT<br />

50 EXECUTIVE BOARD MANAGEMENT REPORT<br />

85 CONSOLIDATED FINANCIAL STATEMENTS<br />

131 COMPANY FINANCIAL STATEMENTS<br />

137 DRAFT RESOLUTIONS SUBMITTED BY THE EXECUTIVE BOARD<br />

3

2008 ANNUAL REPORT<br />

NORBERT DENTRESSANGLE<br />

A MAJOR PLAYER<br />

IN THE SUPPLY CHAIN<br />

TRANSPORT<br />

International<br />

National<br />

TRANSPORT<br />

National<br />

Regional<br />

Indivisible loads<br />

and/or large quantities<br />

Retail<br />

Capillary network<br />

LOGISTICS<br />

Production<br />

units of raw<br />

materials<br />

Processing<br />

units or<br />

assembly lines<br />

Storage and<br />

preparation<br />

for marketing<br />

Outlets<br />

Consumers<br />

Indivisible loads<br />

and/or large quantities<br />

TRANSPORT<br />

International<br />

National<br />

Sectors in which <strong>Norbert</strong> <strong>Dentressangle</strong> is active<br />

4

2008 ANNUAL REPORT<br />

THE NORBERT DENTRESSANGLE MARKET<br />

EUROPE-WIDE TRANSPORT<br />

AND LOGISTICS<br />

A potential of<br />

220 billion Euros<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> is active in 64% of <strong>the</strong> European supply chain market<br />

150<br />

150<br />

120<br />

90<br />

70 67<br />

60<br />

30<br />

0<br />

Road transport<br />

Third party logistics<br />

Courier and express delivery<br />

33<br />

23<br />

Rail transport<br />

O<strong>the</strong>r*<br />

Transport of goods on <strong>the</strong> European continent.<br />

Road transport and logistics are at <strong>the</strong> heart of <strong>the</strong> goods flow<br />

management system.<br />

Figures indicated in billions of Euros.<br />

* Freight forwarding by sea, river and air.<br />

5

2008 ANNUAL REPORT<br />

NORBERT DENTRESSANGLE<br />

A GIANT IN EUROPEAN<br />

TRANSPORT<br />

AND LOGISTICS<br />

TURNOVER IN 2008:<br />

3.107 billion<br />

EUROS,<br />

OF WHICH:<br />

- 56% IN TRANSPORT<br />

- 44% IN LOGISTICS<br />

55.6% France<br />

21.6% United Kingdom<br />

10.7% Spain<br />

3.6% Italy<br />

2.7% The Ne<strong>the</strong>rlands<br />

5.8% O<strong>the</strong>r countries<br />

• Germany • Portugal<br />

• Belgium • Czech Republic<br />

• Ireland<br />

• Romania<br />

• Luxembourg • Switzerland<br />

• Poland<br />

PORTUGAL<br />

263<br />

DISTRIBUTION OF TURNOVER GENERATED BY NORBERT DENTRESSANGLE IN EUROPE<br />

6

2008 ANNUAL REPORT<br />

UNITED KINGDOM<br />

+ IRELAND<br />

8,747<br />

FRANCE<br />

14,497<br />

BELGIUM<br />

442<br />

THE NETHERLANDS<br />

727<br />

LUXEMBOURG<br />

171<br />

SWITZERLAND<br />

30<br />

GERMANY<br />

122<br />

CZECH<br />

REPUBLIC<br />

261<br />

POLAND<br />

1,099<br />

ITALY<br />

340<br />

ROMANIA<br />

516<br />

SPAIN<br />

1,384<br />

28,600<br />

EMPLOYEES IN<br />

14 COUNTRIES<br />

7

2008 ANNUAL REPORT<br />

TRANSPORT<br />

THE ROOTS OF NORBERT<br />

DENTRESSANGLE<br />

TURNOVER:<br />

¤<br />

1,743 Million<br />

14,300 employees<br />

9 countries<br />

ON 158 SITES IN<br />

7,900 tractor units<br />

WITH 36% LOCATED OUTSIDE OF FRANCE<br />

8,900 trailers<br />

8

2008 ANNUAL REPORT<br />

67.7% France<br />

13.5% Spain<br />

11.8% United Kingdom<br />

2.2% Portugal<br />

1.6% Germany<br />

1.3% Poland<br />

1.2% Italy<br />

0.5% Luxembourg<br />

0.2% Romania<br />

€ 941 Million<br />

Transport of general<br />

cargo and goods<br />

under controlled<br />

temperature<br />

€ 565 Million<br />

Pallet distribution<br />

€ 237 Million<br />

Transport<br />

of bulk products<br />

DISTRIBUTION OF TURNOVER IN EUROPE<br />

A COMPREHENSIVE RANGE OF SERVICES<br />

82%<br />

General cargo<br />

(including high cube<br />

products and pallet<br />

distribution)<br />

14%<br />

Bulk products<br />

4%<br />

Controlled<br />

temperature products<br />

TIPPERS 134<br />

FOODSTUFF TANKERS 23<br />

CHEMICAL TANKERS 265<br />

HYDROCARBON TANKERS 193<br />

POWDER TANKERS 1,052<br />

BOX TRAILERS 1,313<br />

FLATBEDS AND SKELETAL TRAILERS 311<br />

CURTAINSIDED TRAILERS 4,969<br />

REFRIGERATED TRAILERS 629<br />

PRESENT ON ALL THE MAJOR MARKETS<br />

EUROPE’S N O 1 VEHICLE FLEET<br />

66% France<br />

16% United Kingdom<br />

6.4% Spain<br />

5.4% Poland<br />

2% Romania<br />

1.9% Portugal<br />

1.2% Luxembourg<br />

0.9% Germany<br />

0.2% Italy<br />

DISTRIBUTION OF EMPLOYEES IN EUROPE<br />

9

2008 ANNUAL REPORT<br />

LOGISTICS<br />

NORBERT DENTRESSANGLE,<br />

A REFERENCE IN EUROPE<br />

TURNOVER:<br />

¤<br />

1,364 Million<br />

14,300 employees<br />

11 countries<br />

ON 197 SITES IN<br />

5,400,000 M 2<br />

STORAGE SPACE<br />

2,700,000 M 3<br />

COLD STORAGE VOLUMES<br />

10

2008 ANNUAL REPORT<br />

40.3% France<br />

34.1% United Kingdom<br />

7.2% Spain<br />

6.8% Italy<br />

6.1% The Ne<strong>the</strong>rlands<br />

3.2% Belgium<br />

0.8% Czech Republic<br />

0.6% Poland<br />

0.5% Romania<br />

0.4% Switzerland<br />

DISTRIBUTION OF TURNOVER IN EUROPE<br />

€ 374 Million<br />

Chilled logistics ;<br />

Fresh and frozen<br />

€ 990 Million<br />

Ambient and<br />

reverse logistics<br />

A COMPREHENSIVE RANGE OF SERVICES<br />

72%<br />

Ambient<br />

temperature<br />

and reverse<br />

logistics<br />

28%<br />

Chilled and frozen<br />

product logistics<br />

PRESENT ON TWO MARKETS -<br />

AMBIENT AND CHILLED LOGISTICS<br />

45.2% United Kingdom<br />

35.4% France<br />

5.1% The Ne<strong>the</strong>rlands<br />

3.2% Spain<br />

3.1% Belgium<br />

2.2% Poland<br />

2.2% Italy<br />

1.9% Czech Republic<br />

1.5% Romania<br />

0.2% Switzerland<br />

DISTRIBUTION OF EMPLOYEES IN EUROPE<br />

FRANCE 2,340,585<br />

UNITED KINGDOM 1,960,503<br />

THE NETHERLANDS 290,449<br />

ITALY 260,901<br />

SPAIN 249,613<br />

POLAND 100,940<br />

CZECH REPUBLIC 48,900<br />

BELGIUM 44,500<br />

ROMANIA 38,300<br />

SWITZERLAND 31,920<br />

PORTUGAL 24,886<br />

UNITED KINGDOM 1,271,706<br />

BELGIUM 558,200<br />

FRANCE 422,180<br />

THE NETHERLANDS 401,000<br />

ITALY 56,000<br />

DISTRIBUTION OF WAREHOUSE SPACE (IN M²) DISTRIBUTION OF FROZEN STORAGE VOLUMES (IN M 3 )<br />

11

2008 ANNUAL REPORT<br />

30 YEARS OF MANAGED<br />

GROWTH<br />

The spirit of enterprise that runs through <strong>the</strong> veins of <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> brand has enabled us to rise to many<br />

challenges over <strong>the</strong> last 30 years. Since its creation, <strong>Norbert</strong> <strong>Dentressangle</strong> has prioritised international development and<br />

taken on a real European dimension with its acquisition of Christian Salvesen.<br />

12

2008 ANNUAL REPORT<br />

> 1979 - 1989<br />

FRANCE, UNITED KINGDOM, AND<br />

EUROPE: 10 YEARS OF MAJOR<br />

GROWTH<br />

It was in 1979 that <strong>Norbert</strong> <strong>Dentressangle</strong><br />

began its international road transport activities<br />

in London. <strong>Norbert</strong> <strong>Dentressangle</strong> went on to<br />

establish itself rapidly as a transport company<br />

in Italy, Spain and <strong>the</strong> Benelux countries.<br />

> 1994<br />

NORBERT DENTRESSANGLE ENTERS<br />

THE STOCK MARKET<br />

In order to facilitate its development, <strong>Norbert</strong><br />

<strong>Dentressangle</strong> was listed on <strong>the</strong> Paris Stock<br />

Exchange in 1994.<br />

> 1997 - 1998<br />

A STRATEGIC ADVANTAGE:<br />

INTEGRATION OF LOGISTICS<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> took its first steps in <strong>the</strong><br />

logistics market by acquiring leading French<br />

companies within this sector.<br />

THE 2000’S: ACCELERATED GROWTH<br />

During <strong>the</strong> 2000’s, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

experienced major European growth in <strong>the</strong><br />

transport and logistics sectors, particularly<br />

with acquisitions in Italy, Ne<strong>the</strong>rlands, Spain<br />

and Central Europe.<br />

In 2006, <strong>Norbert</strong> <strong>Dentressangle</strong> took over <strong>the</strong><br />

French logistics and transport activities of TNT.<br />

Acquisition of <strong>the</strong> Christian Salvesen Group<br />

in December 2007: <strong>Norbert</strong> <strong>Dentressangle</strong><br />

becomes a European leader in transport<br />

and logistics.<br />

13

2008 ANNUAL REPORT<br />

NORBERT DENTRESSANGLE<br />

SUPERVISORY BOARD<br />

GOVERNANCE OF THE NORBERT DENTRESSANGLE GROUP<br />

Since 1998, <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group has been controlled by an Executive Board and Supervisory Board.<br />

14

2008 ANNUAL REPORT<br />

1 - Bruno Rousset<br />

Date of first nomination: 2007.<br />

Independent member.<br />

Member of <strong>the</strong> audit committee.<br />

Bruno Rousset is <strong>the</strong> founder and<br />

President of <strong>the</strong> April Group, as well<br />

as <strong>the</strong> investment fund Evolem.<br />

2 - Pierre-André Martel<br />

Date of first nomination: 2005.<br />

Independent member.<br />

Pierre-André Martel is President<br />

of <strong>the</strong> Caravelle company,<br />

which he founded in 1995.<br />

3 - Henri Lachmann<br />

Date of first nomination: 1998.<br />

Independent member.<br />

Henri Lachmann is Chairman<br />

of <strong>the</strong> Supervisory Board of<br />

Schneider Electric.<br />

4 - François-Marie Valentin<br />

Date of first nomination: 1998.<br />

François-Marie Valentin is a<br />

corporate merger consultant.<br />

5 - Jean-Luc Poumarède<br />

Date of first nomination: 2008.<br />

Independent member.<br />

President of <strong>the</strong> audit committee.<br />

Jean-Luc Poumarède, former CEO<br />

of Deloitte France, is a shareholder<br />

and <strong>the</strong> manager of <strong>the</strong> personal<br />

services company To Do Today.<br />

6 - Vincent Ménez<br />

Date of first nomination: 2008.<br />

Member of <strong>the</strong> audit committee.<br />

Vincent Ménez previously occupied<br />

various positions at Crédit National<br />

before joining <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> Group and<br />

subsequently Financière <strong>Norbert</strong><br />

<strong>Dentressangle</strong>.<br />

7 - <strong>Norbert</strong> <strong>Dentressangle</strong><br />

Chairman of <strong>the</strong> Supervisory Board<br />

since 1998.<br />

Founder of <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> Group in 1979<br />

with responsibility for operational<br />

management until 1998.<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> is also<br />

Deputy Chairman of <strong>the</strong><br />

Supervisory Board of AXA.<br />

8 - Evelyne <strong>Dentressangle</strong><br />

Deputy Chairman of <strong>the</strong> Supervisory<br />

Board since 1998.<br />

Evelyne <strong>Dentressangle</strong> is<br />

responsible for <strong>the</strong> management<br />

of various real estate companies,<br />

which are subsidiaries of Financière<br />

<strong>Norbert</strong> <strong>Dentressangle</strong>.<br />

1<br />

2<br />

6<br />

3 4 5 7 8<br />

15

2008 ANNUAL REPORT<br />

NORBERT DENTRESSANGLE<br />

EXECUTIVE BOARD<br />

16

2008 ANNUAL REPORT<br />

From left to right:<br />

Patrick Bataillard<br />

CFO.<br />

(44) / EM Lyon<br />

Joined <strong>Norbert</strong> <strong>Dentressangle</strong> in<br />

1998 as Group Financial Controller.<br />

Financial Director (Transport) 2000 -<br />

2001.<br />

Group CFO and Member of <strong>the</strong><br />

Executive Board since 2001.<br />

François Bertreau<br />

CEO<br />

in charge of <strong>the</strong> Logistics Division.<br />

(54) / ESCP / MBA INSEAD.<br />

Joined <strong>Norbert</strong> <strong>Dentressangle</strong> in<br />

1998 as Director of <strong>the</strong> Logistics<br />

Division. Member of <strong>the</strong> Executive<br />

Board since 2002.<br />

Hervé Montjotin<br />

Executive Vice President<br />

in charge of <strong>the</strong> Transport Division.<br />

(44) / Ecole Normale Supérieure.<br />

Mastère ESCP.<br />

Joined <strong>Norbert</strong> <strong>Dentressangle</strong> in<br />

1995. Director of Human Resources<br />

1996 - 2001.<br />

Member of <strong>the</strong> Executive Board<br />

since 1998.<br />

Executive responsible for<br />

Organisation and Human Resources<br />

2001 - 2005.<br />

GOVERNANCE<br />

The governance of <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group reflects two of its<br />

key characteristics:<br />

• A majority family shareholding with strong representation on <strong>the</strong><br />

Supervisory Board presided over by <strong>Norbert</strong> <strong>Dentressangle</strong>,<br />

SUPERVISORY<br />

BOARD<br />

EXECUTIVE BOARD<br />

• A tightly managed Executive Board, fully focused on operational<br />

management and <strong>the</strong> fulfilment of growth and profitability objectives.<br />

LOGISTICS<br />

DIVISION<br />

TRANSPORT<br />

DIVISION<br />

17

2008 ANNUAL REPORT<br />

MESSAGE FROM THE CHAIRMAN<br />

OF THE SUPERVISORY BOARD<br />

NORBERT DENTRESSANGLE<br />

Above all, I will always remember 2008 for <strong>the</strong> remarkable way in<br />

which we handled <strong>the</strong> integration of Christian Salvesen’s activities<br />

into <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group.<br />

This operation was exemplary in several ways - how quickly <strong>the</strong><br />

transaction was completed, how we achieved <strong>the</strong> expected<br />

synergies, as well as <strong>the</strong> fluidity of <strong>the</strong> whole process, which was<br />

implemented in a very calm social climate, and <strong>the</strong> immediate<br />

loyalty shown by Christian Salvesen employees to our corporate<br />

culture.<br />

I attribute this performance to <strong>the</strong> efficiency and expertise of <strong>the</strong><br />

<strong>Norbert</strong> <strong>Dentressangle</strong> teams when it comes to acquisitions. This<br />

expertise has been developed over <strong>the</strong> last twenty years, in <strong>the</strong><br />

course of which we have acquired over thirty transport and logistics<br />

companies.<br />

I consider that we have a real <strong>Norbert</strong> <strong>Dentressangle</strong> integration<br />

model based on fundamentals, such as our single brand, standard<br />

processes and systems within each sector, <strong>the</strong> centralisation of backoffices<br />

and objectives-based management focused on <strong>the</strong> profession<br />

and based on key operational indicators.<br />

This “entrepreneurial” model immediately won over and motivated<br />

<strong>the</strong> Christian Salvesen employees.<br />

This highly successful integration fur<strong>the</strong>r underlines <strong>the</strong> strategic<br />

nature of our acquisition of Christian Salvesen.<br />

This move enabled us to turn a major corner and truly transformed<br />

us into a leader within <strong>the</strong> European transport and logistics market.<br />

By means of this acquisition, <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group took<br />

a major step forward, greatly expanded its European geographical<br />

coverage and added new professions to its range of services in order<br />

to develop a diversified portfolio. This includes customers of all sizes<br />

located in most industrial and commercial sectors.<br />

The second defining characteristic of 2008 was <strong>the</strong> unprecedented<br />

economic situation that witnessed growth in <strong>the</strong> first year half<br />

followed by a violent and sudden economic downturn.<br />

Due to <strong>the</strong> dimensions that we have achieved in Europe, we are<br />

obviously exposed to major swings in <strong>the</strong> economy and have had to<br />

cope with a downturn in business for our customers with contrasting<br />

effects.<br />

The fall in business is more pronounced for our transport activities,<br />

mainly due to customers in <strong>the</strong> automobile sector, whereas our<br />

logistics activities, more closely linked to household consumption,<br />

have suffered less of an impact.<br />

While <strong>the</strong> sudden nature and scale of <strong>the</strong> crisis came as a surprise<br />

during <strong>the</strong> final months of 2008, I have <strong>the</strong> satisfaction of seeing that<br />

<strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> teams reacted quickly and effectively to<br />

reach <strong>the</strong> break-even point with <strong>the</strong> objective of returning to an<br />

economic performance in line with our ambitions as rapidly as<br />

possible.<br />

The Group’s balance sheet remains solid and <strong>the</strong> Executive Board<br />

team is firmly committed to <strong>the</strong> careful management of financial<br />

balances.<br />

In light of this macro-economic context, <strong>the</strong> decisions taken in 2008<br />

in order to develop our Group’s governance are proving even more<br />

appropriate and pertinent.<br />

The choice of a reduced Executive Board team, in direct contact with<br />

<strong>the</strong> operational business unit managers, close to <strong>the</strong> field and<br />

customers, proves to be <strong>the</strong> optimum configuration to lead <strong>the</strong><br />

<strong>Norbert</strong> <strong>Dentressangle</strong> Group with high reactivity and efficiency in<br />

an environment that leaves less room for manoeuvre.<br />

The creation of an audit committee and increased expertise of <strong>the</strong><br />

Supervisory Board through <strong>the</strong> inclusion of two new additional<br />

members were also timely decisions that have reinforced <strong>the</strong><br />

effective management of our company.<br />

I am firmly convinced that all <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group’s<br />

assets have helped it to wea<strong>the</strong>r <strong>the</strong> storm. It is made up of<br />

entrepreneur-employees at all levels, its business model<br />

demonstrates its flexibility and reactivity, while its close relationship<br />

with its customers is based on high quality services and confidence.<br />

Moreover, its financial situation is healthy and solid.<br />

The <strong>Norbert</strong> <strong>Dentressangle</strong> Group is already in a position to increase<br />

its market shares in transport and logistics in Europe and we will<br />

certainly be able to take immediate advantage when <strong>the</strong> economy<br />

begins to recover.<br />

<strong>Norbert</strong> <strong>Dentressangle</strong><br />

Chairman of <strong>the</strong> Supervisory Board<br />

18

19<br />

2008 ANNUAL REPORT

2008 ANNUAL REPORT<br />

INTERVIEW WITH THE CEO<br />

FRANÇOIS BERTREAU<br />

How do you assess <strong>Norbert</strong> <strong>Dentressangle</strong>’s<br />

results for 2008<br />

The results for 2008 reflect <strong>the</strong> change in scale that<br />

we achieved through our acquisition of Christian<br />

Salvesen and are marked by an economic environment<br />

that deteriorated dramatically and profoundly<br />

in <strong>the</strong> last quarter.<br />

In 2008, despite <strong>the</strong> decline recorded at <strong>the</strong> end<br />

of <strong>the</strong> year, we experienced satisfactory growth<br />

in our consolidated turnover which rose to<br />

€ 3,107 million, a 72% increase compared to<br />

2007, mainly due to <strong>the</strong> consolidation of Christian<br />

Salvesen half way through <strong>the</strong> year.<br />

Operational profitability was characterised by<br />

contrasting performances.<br />

Our current operating income was € 78.9 million,<br />

with an increase of 17%, and represents<br />

2.5% of turnover. This is compared to<br />

€ 91 million in <strong>the</strong> pro forma data for 2007<br />

and a margin of 3.1%.<br />

The Logistics Division achieved a very good<br />

performance in 2008, with a current operating<br />

result of € 42.7 million, marking an<br />

increase of 48%, with a profit margin within<br />

our normal range, rising by 1 point to<br />

5.3%.<br />

The current operating income of <strong>the</strong><br />

Transport Division was € 36.2 million,<br />

with a fall of 7%, primarily due to <strong>the</strong> very<br />

poor performances of <strong>the</strong> transport activities<br />

of<br />

Christian Salvesen in Great Britain, <strong>the</strong> associated<br />

restructuring costs and <strong>the</strong> fall in<br />

business during <strong>the</strong> final quarter. All of this was in<br />

spite of our traditional transport and our pallet<br />

distribution activities from Christian Salvesen in<br />

Spain and France holding up relatively well.<br />

The overall net result was € 42.4 million, with a<br />

fall of 14% compared to 2007 due to financial<br />

costs linked to <strong>the</strong> purchase of Christian Salvesen.<br />

For <strong>the</strong> financial year 2008, our net financial debt<br />

was € 553 million, leading to a net debt<br />

ratio/EBITDA of 2.8, which enabled us to report a<br />

sound balance sheet.<br />

The integration of Christian Salvesen was<br />

a major challenge in 2008. How was this<br />

transaction conducted<br />

The operational integration of Christian Salvesen<br />

involved integrating <strong>the</strong> eight business units that<br />

make up this company in our two specialist Transport<br />

and Logistics Divisions.<br />

This simple and coherent integration plan with our<br />

managerial organisation was highly effective and<br />

most of <strong>the</strong> “operational takeover” of Christian<br />

Salvesen activities was complete by <strong>the</strong> end of <strong>the</strong><br />

first quarter of 2008. The synergies anticipated<br />

upon acquisition have been confirmed or<br />

achieved.<br />

Three business units from Christian Salvesen have<br />

been integrated into our Transport Division:<br />

• In France, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

Distribution (formerly Darfeuille Services)<br />

These activities were an additional business unit of<br />

<strong>the</strong> Transport Division and, in line with our organisational<br />

principles, its accounting and payroll<br />

departments have been combined with <strong>the</strong> division’s<br />

shared back-office services. Specialising in<br />

pallet distribution, this business unit benefited<br />

from a strong business dynamic and generated one<br />

of <strong>the</strong> best levels of operational profitability for <strong>the</strong><br />

Transport Division in 2008.<br />

• In Spain and Portugal, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

Gerposa (formerly Christian Salvesen Gerposa)<br />

We gained a high quality management team<br />

within this activity, which was also experienced<br />

and large enough to take charge of <strong>the</strong> traditional<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> activities in Spain and<br />

Portugal. Although this business unit performed<br />

well in 2008, it also suffered from its relative<br />

exposure to <strong>the</strong> automobile sector.<br />

• In Great Britain, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

Transport Services (formerly Christian Salvesen<br />

Logistics)<br />

For several years, <strong>the</strong> transport activities of<br />

Christian Salvesen in Great Britain produced a<br />

loss. A new management team was formed in<br />

2008 in order to implement a radical recovery<br />

plan and fully remodel <strong>the</strong> operational system of<br />

this business unit. The steps taken must produce<br />

20

2008 ANNUAL REPORT<br />

positive short-term effects and make us confident<br />

in our ability to restore profitability in this sector.<br />

Five business units from Christian Salvesen have<br />

been integrated into our Logistics Division:<br />

• In France: Chilled logistics<br />

According to <strong>the</strong> organisation plan of <strong>the</strong> Logistics<br />

Division in France, <strong>the</strong>se activities have been<br />

distributed between <strong>the</strong> various management<br />

regions and form <strong>the</strong> subject of an improvement<br />

plan for current performances.<br />

• In Great Britain: <strong>Norbert</strong> <strong>Dentressangle</strong><br />

Logistics UK (formerly Christian Salvesen<br />

Logistics)<br />

With this integration, Great Britain has become, in<br />

terms of turnover and employees, <strong>the</strong> second<br />

largest country for our Logistics Division. Developing<br />

both ambient and chilled logistics services,<br />

this business unit has benefited from a good<br />

business dynamic and a favourable tendency in<br />

terms of developing its performances.<br />

• In Belgium: <strong>Norbert</strong> <strong>Dentressangle</strong> Logistics<br />

Belgium<br />

As we are convinced that market proximity is one<br />

of <strong>the</strong> key success factors for logistics, <strong>the</strong> former<br />

Christian Salvesen “Benelux” organisation has<br />

been remodelled to create a management entity<br />

specifically for <strong>the</strong> Belgian market. This business<br />

unit, which represents <strong>the</strong> first time <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> Logistics Division has been represented<br />

in Belgium, is a major player in <strong>the</strong> chilled<br />

logistics market.<br />

• In <strong>the</strong> Ne<strong>the</strong>rlands, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

Logistics Nederland<br />

In 2008, <strong>the</strong> Dutch part of Christian Salvesen<br />

logistics was merged with <strong>the</strong> traditional <strong>Norbert</strong><br />

<strong>Dentressangle</strong> activities in <strong>the</strong> Ne<strong>the</strong>rlands, thus<br />

doubling <strong>the</strong> volume of business in this country.<br />

• In Spain and Portugal, Salvesen Logistica<br />

In Spain and Portugal, we are now linked to<br />

Danone as part of a joint venture within “Salvesen<br />

Logistica”. This company, a real logistics operator,<br />

develops chilled logistics for agri-food manufacturers<br />

and retailers.<br />

What are <strong>the</strong> consequences of <strong>the</strong> crisis<br />

for <strong>Norbert</strong> <strong>Dentressangle</strong> and how do<br />

you intend to survive this uncertain<br />

period<br />

The sudden decline in economic activity in all<br />

sectors and countries impacts heavily on our<br />

business volumes.<br />

Since <strong>the</strong> last quarter of 2008, our transport activities<br />

recorded a - 7% reduction in turnover due<br />

to <strong>the</strong> fall in activity and fuel prices. The downturn<br />

also affected our logistics activities, <strong>the</strong> internal<br />

growth of which<br />

increased to<br />

+ 4% during <strong>the</strong><br />

last quarter of<br />

2008.<br />

Since early 2009,<br />

we have observed<br />

a lack of visibility<br />

in terms<br />

of <strong>the</strong> development<br />

of business<br />

for our customers.<br />

For this reason, our teams have been working hard<br />

since <strong>the</strong> last quarter of 2008 to reduce <strong>the</strong> breakeven<br />

point. The flexibility of our business model,<br />

both in transport and logistics, enables and facilitates<br />

<strong>the</strong> necessary adjustment of our production<br />

capacities and structures in line with our evaluation<br />

of levels of activity for our customers, which<br />

applies in all <strong>the</strong> countries where we are active.<br />

All <strong>the</strong> steps taken at <strong>the</strong> end of February 2009<br />

should already generate an annual cost saving of<br />

approx. € 80 million.<br />

Does <strong>the</strong> crisis serve to challenge your<br />

strategic decisions for <strong>the</strong> development<br />

of <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group<br />

This crisis does not change <strong>the</strong> fundamental characteristics<br />

of <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group,<br />

particularly our decentralised organisation based<br />

on <strong>the</strong> strong accountability of our employees<br />

and our culture based on <strong>the</strong> values of entrepreneurship,<br />

commitment, unity and excellence.<br />

This crisis does not challenge our market<br />

positioning: two complementary sectors and a<br />

business model based on ownership of transport<br />

assets that is still appropriate.<br />

Nei<strong>the</strong>r does this crisis challenge our direction or<br />

ambition to become <strong>the</strong> European leader and an<br />

international reference. <strong>Norbert</strong> <strong>Dentressangle</strong><br />

has always based its development on growth and<br />

<strong>the</strong> goal of becoming a reference.<br />

In <strong>the</strong> short and medium term, our growth is<br />

based on three axes:<br />

1 - Transport<br />

We have major growth engines, such as <strong>the</strong> development<br />

in Central<br />

Europe, our<br />

determination to<br />

The major professionalism and<br />

commitment of our teams, our<br />

broad range of services and<br />

European network represent key<br />

assets that will enable us to win over<br />

and secure <strong>the</strong> loyalty of markets.<br />

net-<br />

distribution<br />

work.<br />

become <strong>the</strong> European<br />

transport<br />

organisation leader<br />

and <strong>the</strong> creation of<br />

a European pallet<br />

2 - Logistics<br />

We benefit from<br />

our size and market share in France and, to a<br />

certain extent, in Great Britain, but we must<br />

achieve equivalent leadership in Sou<strong>the</strong>rn and<br />

Central European countries and participate in <strong>the</strong><br />

Nor<strong>the</strong>rn European market.<br />

In <strong>the</strong> chilled logistics market, our prospects for<br />

development are equally great.<br />

3 - Freight forwarding<br />

The medium-term acquisition of expertise in this<br />

third sector forms part of our strategy of extending<br />

our range and developing our current sectors<br />

beyond Europe.<br />

But it must be stressed that our priority for 2009 is<br />

to preserve and reinforce our competitiveness by<br />

constantly adjusting our business methods,<br />

without ever sacrificing <strong>the</strong> quality of our services,<br />

which sets us apart.<br />

François Bertreau<br />

CEO<br />

21

2008 ANNUAL REPORT<br />

KEY FIGURES<br />

FINANCIAL STRENGTH<br />

THE BASIS FOR EUROPEAN<br />

DEVELOPMENT<br />

Our consolidated turnover for 2008 was<br />

€ 3,107 million which represented a 72%<br />

increase compared to 2007, taking into account<br />

<strong>the</strong> integration of Christian Salvesen mid-way<br />

through <strong>the</strong> year, which was acquired on<br />

14 December 2007. The development of this<br />

indicator reflects <strong>the</strong> effect of <strong>the</strong> scale and<br />

expansion of <strong>the</strong> European coverage that we<br />

targeted with <strong>the</strong> acquisition of Christian<br />

Salvesen.<br />

I must stress that 44% of our<br />

turnover is now generated<br />

outside of France.<br />

Organic growth at a<br />

comparable exchange rate<br />

was + 4.3% for <strong>the</strong> year;<br />

+ 2.8% of which was<br />

generated by <strong>the</strong> Transport<br />

Division with a major decline<br />

in <strong>the</strong> 4th quarter (– 7.2%)<br />

and + 7.0% by <strong>the</strong> Logistics<br />

Division.<br />

The EBITDA (Earnings Before<br />

Interest Taxes, Depreciation<br />

and Amortization) was<br />

€ 196 million. This reflects <strong>the</strong> capacity of our<br />

Group to produce a high cash level in relation to<br />

its size.<br />

In a complex context characterised by <strong>the</strong><br />

operational integration of Christian Salvesen, <strong>the</strong><br />

first effects of <strong>the</strong> economic crisis and major<br />

exchange rate fluctuations, <strong>the</strong> operating income<br />

before goodwill (EBITA) shows 23% growth<br />

compared to 2007, rising to € 98.2 million (32%<br />

of consolidated turnover).<br />

The net result was € 42.4 million and 1.4% of<br />

turnover. It fell by 14% in terms of absolute value<br />

compared to <strong>the</strong> net result for 2007<br />

(€ 49.3 million), taking into account rising interest<br />

rates due to <strong>the</strong> acquisition of Christian Salvesen.<br />

At all levels, <strong>the</strong> soundness of <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> Group balance sheet represents a<br />

key factor that will enable <strong>the</strong> company to face<br />

<strong>the</strong> crisis and see its<br />

competitive position<br />

reinforced. It will also<br />

The soundness<br />

of <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> Group<br />

balance sheet represents<br />

a key factor that<br />

will enable us to face<br />

<strong>the</strong> crisis and see our<br />

competitive position<br />

reinforced.<br />

“<br />

”<br />

protect its independence.<br />

The net situation was<br />

€ 311 million compared<br />

to € 334 million<br />

at <strong>the</strong> close of 2007.<br />

Despite a positive<br />

result for <strong>the</strong> period<br />

and <strong>the</strong> distribution of<br />

dividends for a reasonable<br />

amount, this<br />

development is essentially<br />

due to a negative<br />

difference in <strong>the</strong><br />

exchange rate and <strong>the</strong> financial re-evaluation of<br />

swaps at market value rates on 31/12/2008.<br />

The net financial debt on 31 December 2008<br />

was € 553 million, including € 591 million in<br />

gross debts, minus € 38 million in cash. This debt<br />

represents 178% of shareholder equity. I would<br />

emphasise that most of this debt represents funds<br />

allocated for <strong>the</strong> purchase of <strong>the</strong> state-of-<strong>the</strong>-art<br />

vehicles and materials. For this reason, only<br />

€ 172 million can be considered as <strong>the</strong><br />

outstanding balance to be repaid on 31 December<br />

2008 by virtue of <strong>the</strong> acquisition debt for<br />

Christian Salvesen. This situation is fully in line<br />

with <strong>the</strong> assumptions adopted upon acquisition.<br />

There were fixed assets worth € 612 million on<br />

31 December 2008. Four logistics sites were sold<br />

in <strong>the</strong> course of <strong>the</strong> year. We also proceeded with<br />

<strong>the</strong> policy of renewing <strong>the</strong> fleet of vehicles both<br />

in <strong>the</strong> established and ex-Christian Salvesen<br />

activities.<br />

The “cash flow” generated by business after<br />

investment is + € 19 million following a financial<br />

year characterised by a high level of investment.<br />

This release of funds will have enabled <strong>the</strong> Group<br />

to honour its redemption dates.<br />

We now have sufficient cash funds and funding<br />

lines (revolving) to cope with our liquidity needs,<br />

target development and regularly renew our<br />

investments in production equipment.<br />

Patrick Bataillard<br />

Group CFO<br />

22

2008 ANNUAL REPORT<br />

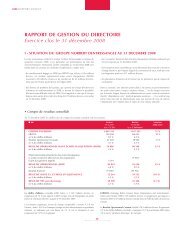

3,107<br />

3000<br />

98.2 100<br />

2500<br />

83.1 (1) 79.8<br />

80<br />

80<br />

1,804<br />

2000<br />

65.0<br />

60<br />

60<br />

64.7 (1) 49.8 49.3 42.4<br />

1,608<br />

1,399<br />

1,303<br />

1500<br />

1000<br />

51.5<br />

40<br />

36.2<br />

40<br />

500<br />

20<br />

20<br />

0<br />

0<br />

0<br />

2004 2005 2006 20072008<br />

2004 2005 2006 20072008<br />

2004 2005 2006 20072008<br />

TURNOVER<br />

IN MILLION EUROS<br />

OPERATING INCOME BEFORE GOODWILL<br />

(EBITA)<br />

IN MILLION EUROS<br />

(1)<br />

including <strong>the</strong> exceptional product<br />

of VAT recovered on motorways<br />

NET EARNINGS - GROUP SHARE<br />

IN MILLION EUROS<br />

(1)<br />

including negative goodwill acquisition<br />

on TNT<br />

200<br />

178%<br />

159%<br />

150<br />

6.77<br />

8<br />

7<br />

6<br />

81%<br />

100<br />

3.66<br />

5.19 5.14 5<br />

4.43<br />

4<br />

61%<br />

3<br />

41%<br />

50<br />

2<br />

1<br />

0<br />

0<br />

2004 2005 2006 20072008<br />

2004 2005 2006 20072008<br />

NET GEARING<br />

AS A PERCENTAGE<br />

OF EQUITY<br />

NET EARNINGS PER SHARE<br />

IN EUROS<br />

23

2008 ANNUAL REPORT<br />

A FAMILY-OWNED GROUP<br />

LISTED ON THE STOCK EXCHANGE<br />

CAPITAL<br />

On 28/02/09, <strong>the</strong> capital of <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group amounted to € 19,672,482, consisting of 9,836,241 shares of € 2 in nominal value.<br />

DISTRIBUTION OF CAPITAL AND VOTING RIGHTS<br />

Situation on 31 December 2008 Shares Voting rights<br />

Quantity<br />

Quantity<br />

<strong>Dentressangle</strong> family 545,646 1,091,292<br />

Financière <strong>Norbert</strong> <strong>Dentressangle</strong> 6,045,400 12,090,800<br />

Employees 64,582 90,904<br />

Public 2,911,542 2,915,513<br />

Shares held by <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group 269,071 0<br />

TOTAL 9,836,241 16,188,509<br />

29.60%<br />

2.74% 5.55% 61.46%<br />

Financière <strong>Norbert</strong> <strong>Dentressangle</strong> (1)<br />

74.69%<br />

18.01%<br />

Public<br />

Employees<br />

0.56%<br />

<strong>Dentressangle</strong> family<br />

0.66%<br />

Shares held by<br />

<strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> Group<br />

6.74%<br />

Distribution of capital<br />

(1) 100% of <strong>the</strong> capital of Financière <strong>Norbert</strong><br />

<strong>Dentressangle</strong> is held by <strong>the</strong> <strong>Dentressangle</strong> family<br />

Distribution of voting rights<br />

DIVIDEND<br />

There is a dividend of € 0.70 per share for 2008. It will be paid on 3 June 2009.<br />

Stock exchange figures 2008 2007 2006<br />

Price on 31/12 in € 27.5 71.5 69.00<br />

Number of shares on 31/12 (including treasury shares) 9,836,241 9,836,241 9,835,693<br />

Market capitalisation in million € 270.50 703.3 679<br />

Net earnings per share in € 4.43 5.14 5.19<br />

Net dividend in € 0.70 1.1 1.00<br />

Distribution ratio in € 15.8 21.4 19.8<br />

24

2008 ANNUAL REPORT<br />

TRANSACTIONS<br />

80<br />

Highest and lowest<br />

share price<br />

Highest Lowest<br />

(in €) (in €)<br />

Average<br />

closing price<br />

(in €)<br />

Number<br />

of securities<br />

traded<br />

(daily average)<br />

Capital<br />

(daily average<br />

in thousand €)<br />

60<br />

Jan. 2007 70.00 62.00 66.35 3,864 256<br />

40<br />

Feb. 2007 72.95 63.10 67.86 3,364 230<br />

20<br />

Mar. 2007 72.40 62.15 66.45 8,689 596<br />

April 2007 71.00 68.34 69.64 7,280 509<br />

May 2007 73.79 68.83 71.20 5,969 420<br />

June 2007 76.00 69.00 72.95 6,231 455<br />

0<br />

Jan. 2007<br />

Mar. 2007<br />

May 2007<br />

July 2007<br />

Sept. 2007<br />

Nov. 2007<br />

Jan. 2008<br />

Mar. 2008<br />

May 2008<br />

July 2008<br />

Sept. 2008<br />

AVERAGE CLOSING PRICE<br />

(in Euros) 2007 - 2008<br />

Nov. 2008<br />

Jan. 2009<br />

Feb. 2009<br />

July 2007 77.00 69.60 72.66 3,586 260<br />

Aug. 2007 77.00 70.05 73.31 4,457 326<br />

10,000<br />

Sept. 2007 78.92 72.00 75.45 4,965 373<br />

8,000<br />

Oct. 2007 89.50 74.81 83.36 7,041 581<br />

Nov. 2007 83.00 73.16 77.20 9,393 720<br />

Dec. 2007 76.01 73.14 74.96 8,458 634<br />

6,000<br />

4,000<br />

Jan. 2008 61.44 58.34 59.43 8,395 498<br />

2,000<br />

Feb. 2008 57.48 55.49 56.01 9,334 522<br />

Mar. 2008 57.00 49.50 54.12 10,811 582<br />

April 2008 62.90 53.00 57.22 6,577 370<br />

0<br />

Jan. 2007<br />

Mar. 2007<br />

May 2007<br />

July 2007<br />

Sept. 2007<br />

Nov. 2007<br />

Jan. 2008<br />

NUMBER OF SECURITIES TRADED<br />

(daily average) 2007 - 2008<br />

Mar. 2008<br />

May 2008<br />

July 2008<br />

Sept. 2008<br />

Nov. 2008<br />

Jan. 2009<br />

Feb. 2009<br />

May 2008 61.99 57.00 59.39 3,327 197<br />

June 2008 62.77 56.00 59.64 9,294 552<br />

July 2008 59.60 52.11 56.00 5,742 320<br />

Aug. 2008 58.01 53.70 55.99 2,177 121<br />

700<br />

600<br />

500<br />

400<br />

Sept. 2008 61.00 55.50 58.65 5,991 350<br />

300<br />

Oct. 2008 57.02 38.01 47.94 2,309 112<br />

200<br />

Nov. 2008 44.50 35.50 41.51 1,173 49<br />

100<br />

Dec. 2008 40.80 24.70 33.36 2,708 87<br />

Jan. 2009 32.18 24.10 27.37 1,189 33<br />

Feb. 2009 25.88 22.26 23.71 3,854 91<br />

0<br />

Jan. 2007<br />

Mar. 2007<br />

May 2007<br />

July 2007<br />

Sept. 2007<br />

Nov. 2007<br />

Jan. 2008<br />

CAPITAL TRADED<br />

(daily average in thousand Euros) 2007-2008<br />

Mar. 2008<br />

May 2008<br />

July 2008<br />

Sept. 2008<br />

Nov. 2008<br />

Jan. 2009<br />

Feb. 2009<br />

25

2008 ANNUAL REPORT<br />

4 DIRECTIONS FOR THE FUTURE<br />

26

2008 ANNUAL REPORT<br />

1All your <strong>Norbert</strong><br />

in all countries<br />

We set ourselves <strong>the</strong><br />

objective and have <strong>the</strong><br />

necessary resources to<br />

deploy our expertise and<br />

know-how throughout<br />

Europe.<br />

2Men and women<br />

who strive for<br />

excellence<br />

The four values shared by<br />

our employees:<br />

Entrepreneurship, Unity,<br />

Commitment and<br />

Excellence.<br />

3Emphasizing what<br />

makes us different<br />

Our professional<br />

characteristics, our<br />

capacity for innovation<br />

and <strong>the</strong> strength of our<br />

brand make <strong>Norbert</strong><br />

<strong>Dentressangle</strong> a player that<br />

is flourishing throughout<br />

Europe.<br />

4Sustainable<br />

development each<br />

and every day<br />

More than a commitment,<br />

this strategy is an everyday<br />

reality and represents an<br />

integral part of each employee’s<br />

work.<br />

27

2008 ANNUAL REPORT<br />

1<br />

ALL YOUR NORBERT<br />

IN ALL COUNTRIES<br />

With <strong>the</strong> acquisition of Christian Salvesen, <strong>Norbert</strong> <strong>Dentressangle</strong> took a major leap forward, its geographical coverage in Europe<br />

expanded greatly and new sectors have been added to its range of services.<br />

Based on its long-term experience of transport and logistics, which encompasses most economic sectors in Europe, and its wide<br />

range of services, covering both upstream and downstream sides of <strong>the</strong> supply chain, <strong>Norbert</strong> <strong>Dentressangle</strong> can give its customers<br />

a unique advantage - cross-fertilisation.<br />

In fact, <strong>the</strong> diverse range of solutions designed by <strong>the</strong> Group and implemented in various business sectors enables it to build on<br />

good practices and offer transport and logistics services that are known for <strong>the</strong>ir tried and tested efficiency.<br />

Throughout Europe, from <strong>the</strong> organisation of <strong>the</strong> transport of raw materials to <strong>the</strong> management of logistics platforms and distribution<br />

of finished products, <strong>Norbert</strong> <strong>Dentressangle</strong> enables its customers to benefit from its wealth of new ideas in order to optimise <strong>the</strong>ir<br />

supply chain. The <strong>Norbert</strong> <strong>Dentressangle</strong> Group <strong>the</strong>refore helps <strong>the</strong>m to fulfil <strong>the</strong>ir key objective, which is to improve <strong>the</strong>ir<br />

performance.<br />

28

2008 ANNUAL REPORT<br />

All your <strong>Norbert</strong> in all countries<br />

A YEAR OF COMMERCIAL SUCCESS IN LOGISTICS<br />

■ In <strong>the</strong> United Kingdom<br />

New contracts in <strong>the</strong> following sectors:<br />

- Consumer electronics,<br />

- Small household appliances,<br />

- Agri-foods.<br />

■ In <strong>the</strong> Ne<strong>the</strong>rlands<br />

New contract in <strong>the</strong> agri-food sector.<br />

■ In Poland<br />

Launch of <strong>the</strong> new platform dedicated to Redcats Home<br />

Shopping Europe.<br />

After gaining a foothold in <strong>the</strong> Polish transport market at <strong>the</strong><br />

start of <strong>the</strong> 2000’s, for <strong>the</strong> last two years <strong>Norbert</strong> <strong>Dentressangle</strong><br />

is rapidly gaining power as a logistician in this country.<br />

In terms of design and execution, <strong>the</strong> site dedicated to Redcats<br />

Home Shopping Europe in Myslowice has profited from all <strong>the</strong><br />

engineering expertise of <strong>the</strong> Logistics Division, with its<br />

excellent command of <strong>the</strong> latest processes and technologies in<br />

order to consistently combine productivity gains and maximum<br />

service quality.<br />

An additional new contract in <strong>the</strong> cosmetics sector.<br />

■ In Spain<br />

New contract in <strong>the</strong> “D-I-Y superstore” sector.<br />

■ In France<br />

Renewal of 100% of customer contracts expiring in 2008.<br />

Launch in Vatry of <strong>the</strong> platform dedicated to Cora (retail sector):<br />

this platform, which has been operational since May 2007,<br />

was designed to support Cora’s activities by benefitting from<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> expertise in <strong>the</strong> receipt of goods,<br />

storage, order preparation, stock management and <strong>the</strong><br />

shipment of goods.<br />

The range of products handled by <strong>the</strong> platform includes textile<br />

products, automotive consumables, large and small<br />

multimedia, tools, small household appliances, large<br />

household appliances and Carte Cora for <strong>the</strong>ir distribution in<br />

France, overseas departments and territories, Belgium, Hungary<br />

and Romania.<br />

The construction of this platform is fur<strong>the</strong>r proof of <strong>Norbert</strong><br />

<strong>Dentressangle</strong>’s commitment to sustainable development:<br />

laminated wood frame, large-scale natural lighting, solar<br />

panels, photovoltaic cells, recovery of rainwater for sanitary<br />

installations. The creation of this platform has enabled <strong>the</strong><br />

creation of 95 jobs.<br />

29

2008 ANNUAL REPORT<br />

All your <strong>Norbert</strong> in all countries<br />

TRANSPORT: MARKET SHARE GAINS IN 2008 THROUGHOUT EUROPE<br />

AND ALL TRANSPORT SECTORS<br />

In <strong>the</strong> context of a dramatic fall in <strong>the</strong> volume of goods requiring<br />

transport in <strong>the</strong> last quarter, <strong>Norbert</strong> <strong>Dentressangle</strong> maintained a<br />

business dynamic supported by:<br />

- A strong “network” effect reinforcing <strong>Norbert</strong> <strong>Dentressangle</strong>’s<br />

relationships with its major European customers,<br />

- Top rate references within <strong>the</strong> relevant sectors, which increase <strong>the</strong><br />

attractiveness and credibility of transport services offered by <strong>Norbert</strong><br />

<strong>Dentressangle</strong> in <strong>the</strong> various sectors of industry and business.<br />

■ In Spain<br />

Market share gains in <strong>the</strong> specialist retail, textile, specialist steel,<br />

consumer product, household electrical and toy sectors.<br />

■ In <strong>the</strong> Ne<strong>the</strong>rlands<br />

New markets in new sectors with increasingly sophisticated<br />

services.<br />

■ In France<br />

Increased presence of <strong>Norbert</strong> <strong>Dentressangle</strong> in general retail,<br />

specialist retail and consumer product sectors, as well<br />

as market share gains in terms of bulk product transport in <strong>the</strong><br />

hydrocarbon and food product sectors.<br />

Our attractive range of pallet distribution services<br />

■ In France<br />

Market share gains in all regions with small and medium-sized<br />

companies striving to give <strong>the</strong>ir own customers a high quality<br />

service.<br />

■ In Spain<br />

Launch of Premium Service.<br />

■ In <strong>the</strong> United Kingdom<br />

Development in terms of press distribution.<br />

30

2008 ANNUAL REPORT<br />

All your <strong>Norbert</strong> in all countries<br />

The <strong>Norbert</strong> <strong>Dentressangle</strong> Key-PL® service<br />

With 10% growth in 2008, <strong>the</strong> transport solution service available<br />

under <strong>the</strong> Key-PL ® banner confirms its capacity to win <strong>the</strong> loyalty of<br />

customers and new contracts with increasingly large-scale contracts<br />

and sophisticated solutions.<br />

• 95% of transport solution contracts were renewed in 2008.<br />

• Transport solution contracts represent 36% of turnover for <strong>the</strong><br />

Transport Division.<br />

Design and<br />

implementation<br />

Objectives and<br />

progress plan<br />

How can security, transparency and performance be combined<br />

In order to cope with new logistic challenges, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

has created <strong>the</strong> Key-PL ® (Key Partner in Logistics), which links <strong>the</strong><br />

organisation and guaranteed execution of transport in a unique way,<br />

in order to offer customers <strong>the</strong> key to new performances.<br />

Manufacturers and retailers, who are <strong>Norbert</strong> <strong>Dentressangle</strong> customers,<br />

impose new demands in addition to <strong>the</strong> classic equation linking <strong>the</strong><br />

cost and efficiency of logistics, in order to develop <strong>the</strong>ir performance in<br />

<strong>the</strong> context of globalisation of trade. In addition to flow management,<br />

<strong>the</strong> organiser must also be able to guarantee <strong>the</strong> execution of<br />

transports, <strong>the</strong> transparency of costs and management of delivery<br />

exceptions, within a predefined framework. Based on its experience<br />

of resource management, information system management and<br />

commitment capacity, <strong>Norbert</strong> <strong>Dentressangle</strong> has designed its Key-PL ®<br />

service, which provides an integrated response at all operational,<br />

process, financial and contractual levels:<br />

• A modular control system configured according to criteria defined<br />

by <strong>the</strong> customer,<br />

• A volume of transport resources guaranteed by <strong>Norbert</strong><br />

<strong>Dentressangle</strong>,<br />

• Transparent management of access to subcontractor or partners,<br />

• The guarantee of a predefined back-up system due to <strong>the</strong> capacity<br />

of <strong>the</strong> <strong>Norbert</strong> <strong>Dentressangle</strong> fleet to rectify any problems caused by<br />

partners,<br />

• A continuous process of improvement based on quantifiable<br />

objectives.<br />

Flow<br />

management<br />

team<br />

ERP Customer<br />

Sales and distribution<br />

Warehouse<br />

Accounting/Auditing<br />

(SAP SD) (SAP WM) (SAP FI/CO)<br />

Customer deliveries<br />

Loading<br />

TMS<br />

Key-PL ®<br />

Forecast - Pre-invoice<br />

Transport order - Dates of execution - Pre-invoicing- Quality events<br />

LINK NORBERT<br />

DENTRESSANGLE GROUP<br />

Information<br />

process<br />

and system<br />

EDI<br />

Secure<br />

transport<br />

plan<br />

ON-LINE DATA INPUT<br />

Contractor 2 Contractor 3<br />

Transport Transport Transport<br />

31

2008 ANNUAL REPORT<br />

All your <strong>Norbert</strong> in all countries<br />

NORBERT DENTRESSANGLE: A COMPREHENSIVE<br />

TRANSPORT<br />

Transport Solution<br />

Pallet distribution<br />

Contract distribution<br />

Fleet take-over<br />

Multimodal<br />

Domestic and International full loads<br />

International groupage<br />

AMBIENT LOGISTICS<br />

Warehousing, stock management<br />

Co-packing<br />

Pre/post-manufacturing<br />

Order preparation<br />

E-commerce logistics<br />

Reverse logistics<br />

32

2008 ANNUAL REPORT<br />

All your <strong>Norbert</strong> in all countries<br />

RANGE OF TRANSPORT AND LOGISTICS SERVICES<br />

CHILLED LOGISTICS<br />

Consolidation, warehousing and co-packing<br />

Cross-docking<br />

Point of sale delivery<br />

Reverse logistics<br />

Support services<br />

Quality controls<br />

Aviation logistics<br />

INFORMATION SYSTEMS<br />

In order to relay information and guarantee traceability<br />

throughout <strong>the</strong> supply chain, <strong>Norbert</strong> <strong>Dentressangle</strong> develops<br />

systems in order to manage both transport flows and flows in and<br />

out of warehouses (WMS, TMS, RMS), as well as new technologies,<br />

such as RFID, voice command, etc.<br />

33

2008 ANNUAL REPORT<br />

2<br />

MEN AND WOMEN<br />

WHO STRIVE<br />

FOR EXCELLENCE<br />

ENTREPRENEUR-EMPLOYEES<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> Group employees are its main asset.<br />

In a service company, competitiveness depends directly on <strong>the</strong><br />

motivation of people, toge<strong>the</strong>r with <strong>the</strong>ir skills and commitment to <strong>the</strong><br />

company’s projects.<br />

Above all, <strong>the</strong> human resources policy at <strong>Norbert</strong> <strong>Dentressangle</strong> aims<br />

to promote entrepreneurship in all its employees. The key elements of<br />

this policy are:<br />

• Hands-on management with short management lines,<br />

• Linking employees with growth and performance,<br />

• Training aimed at increasing employee expertise and enabling <strong>the</strong>m<br />

to cope with <strong>the</strong> continuous development of transport and logistics<br />

at <strong>Norbert</strong> <strong>Dentressangle</strong>,<br />

• Prioritising internal promotion,<br />

• Internal communication.<br />

In 2008, <strong>the</strong> cultural values of <strong>Norbert</strong> <strong>Dentressangle</strong> (Entrepreneurship<br />

- Excellence - Commitment - Unity) formed <strong>the</strong> subject of a major<br />

internal communication campaign across all 370 sites in Europe.<br />

HUMAN RESOURCE MANAGEMENT:<br />

IDENTIFYING, FOLLOWING UP AND<br />

DEVELOPING POTENTIALS<br />

The process aimed at <strong>the</strong> evaluation of skills and <strong>the</strong> identification<br />

of potentials in 2008 has been completed.<br />

A succession plan was produced in order to review key posts in <strong>the</strong><br />

transport and logistics divisions and corporate responsibilities. The<br />

associated development axes have been defined and will form <strong>the</strong><br />

subject of development initiatives.<br />

EUROPEAN MANAGEMENT<br />

Due to <strong>the</strong> new dimension acquired by <strong>Norbert</strong> <strong>Dentressangle</strong><br />

following <strong>the</strong> integration of Christian Salvesen, an international<br />

mobility policy has been produced, which defines <strong>the</strong> principles and<br />

rules within <strong>the</strong> Group. This policy has been implemented since early<br />

2009.<br />

On <strong>the</strong> photo:<br />

Yves ANTOINE,<br />

Patrick BATAILLARD,<br />

François BERTREAU,<br />

Jean-Luc BESSADE,<br />

Mike BRIDGES,<br />

Eric BURLAT,<br />

Jérôme BURTIN,<br />

Jean-Claude CARELLE,<br />

Damien CHAPOTOT,<br />

Guillaume COL,<br />

Raf COOLS,<br />

Jacques DAUTEUILLE,<br />

Dominique DE LA CRUZ,<br />

Frédéric DEBUS,<br />

Jean-Luc DECLAS,<br />

Nathalie DELBREUVE,<br />

<strong>Norbert</strong> DENTRESSANGLE,<br />

Sébastien DESREUMAUX,<br />

Gilles FAVELLET,<br />

Jean-Luc FEREYRE,<br />

Peter FULLER,<br />

Eduardo GALILEA,<br />

Ube GASPARI,<br />

Luis Angel GOMES,<br />

Olivier GOUIRAND,<br />

Daniel GUILBOT,<br />

Justino HEVIA,<br />

Michèle JULLIOT,<br />

Stéphane LAUGERY,<br />

Georges LAURENT,<br />

Frédéric LAVERGNE,<br />

Thierry LEDUC,<br />

Pascal LEROUX,<br />

Daniel LETARD,<br />

Henri LINIERE,<br />

Stephen MACDONALD,<br />

Gérard MARTIN,<br />

Vincent MENEZ,<br />

Jean-Pascal MEUNIER,<br />

Yves MONTIGNOT,<br />

Hervé MONTJOTIN,<br />

Dan MYERS,<br />

Richard NOEL,<br />

Ludovic OSTER,<br />

Michel PERRIN,<br />

Michel PHILIBERT,<br />

Stéphane POINT,<br />

Nicole ROCA,<br />

Jérôme SAVOURE,<br />

Patrice SCHNEIDER,<br />

José Maria SERRANO,<br />

Phil SHAW,<br />

Didier TALLARON,<br />

Christophe TCHORDJALLIAN,<br />

Mauro UNGHERETTI,<br />

Pierre VEAUX,<br />

Antoine VERMERSCH,<br />

Christophe VEROT,<br />

David WALKOWIAK,<br />

Rémi WEIDENMANN,<br />

Malcolm WILSON.<br />

Absent from <strong>the</strong> photo:<br />

Marc PASTUZAK,<br />

Emmanuel SAMINADA,<br />

Jürgen THIER.<br />

34

2008 ANNUAL REPORT<br />

Men and women who strive for excellence<br />

Participants at <strong>the</strong> Executive Convention in January 2009<br />

35

2008 ANNUAL REPORT<br />

3<br />

EMPHASIZING WHAT MAKES<br />

US DIFFERENT<br />

36

2008 ANNUAL REPORT<br />

Emphasizing what makes us different<br />

OPERATIONAL MANAGEMENT: THE KEY TO HIGH QUALITY SERVICES<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> sets itself apart through its high quality standards for <strong>the</strong> services provided to its customers. This commitment<br />

is based primarily on <strong>the</strong> rigorous daily operational management of <strong>the</strong> Group’s teams. The Group has demonstrated its<br />

commitment to quality by obtaining <strong>the</strong> most demanding certifications.<br />

A high level of service quality recognised<br />

by customers in 2008:<br />

Great Britain: Velux<br />

“Customer First Award”<br />

for <strong>Norbert</strong> <strong>Dentressangle</strong> Transport Services<br />

Spain:<br />

“Renault Supplier Quality Award”<br />

for <strong>Norbert</strong> <strong>Dentressangle</strong> Gerposa<br />

Six areas are analysed: Management - Health - Safety - Environment -<br />

Equipment - Operation.<br />

■ MASE (Industrial Safety Manual)<br />

This system makes it possible to continuously improve <strong>the</strong> safety,<br />

industrial health and environment according to five axes:<br />

Management commitment - Professional skills and qualifications<br />

of employees - Preparation and organisation of work - Measuring<br />

results, analysing discrepancies and corrective steps - Follow-up<br />

and long-term commitments.<br />

■ GMP (European guidelines) and QUALIMAT (French guidelines)<br />

Traceability guidelines for <strong>the</strong> washing of tankers or containers used<br />

for <strong>the</strong> transport of products intended for animal feed products.<br />

■ HACCP<br />

Approaches to food safety.<br />

Certification for our transport activities<br />

■ ISO 9001 (Service quality)<br />

90% of traditional <strong>Norbert</strong> <strong>Dentressangle</strong> activities are certified in<br />

compliance with this standard.<br />

For its hazardous and sensitive product transport activities, <strong>Norbert</strong><br />

<strong>Dentressangle</strong> complies with <strong>the</strong> strictest recommendations included<br />

in <strong>the</strong> applicable safety and quality standards for <strong>the</strong> industry and is<br />

certified according to <strong>the</strong> following standards:<br />

■ SQAS (Safety and Quality Assessment System)<br />

This system makes it possible to guarantee that <strong>the</strong> storage, handling<br />

and transport of bulk chemical products is conducted with optimum<br />

safety and quality in terms of protecting employees, <strong>the</strong> public and<br />

<strong>the</strong> environment.<br />

Certification of our logistics activities<br />

■ ISO 9001 (Service quality)<br />

• 72% of European turnover in logistics is certified according to this<br />

standard<br />

■ ISO 22000 (Food safety)<br />

• 5 warehouses are certified in <strong>the</strong> United Kingdom<br />

• 1 warehouse is certified in Switzerland<br />

■ ISO 18001 (Employee safety)<br />

• 12 warehouses are certified in <strong>the</strong> United Kingdom<br />

• 1 warehouse is certified in Switzerland<br />

■ HACCP (Food safety)<br />

• 43 warehouses are certified in Europe<br />

■ ISO 13485 (Quality Standard Management for Medical Devices)<br />

In 2008, <strong>the</strong> Logistics Division has initiated <strong>the</strong> process of preparing<br />

for certification in compliance with this standard.<br />

37

2008 ANNUAL REPORT<br />

Emphasizing what makes us different<br />

INNOVATION<br />

In a supply market, innovation is essential. The fact that we offer an innovative service creates added value and forms <strong>the</strong> basis for<br />

a quality customer relationship. Innovation is not limited to commercial supply or <strong>the</strong> development of cutting edge technologies<br />

by our engineering services. It represents a progress factor in all areas of <strong>the</strong> company: productivity, purchasing, everyday<br />

processes, etc.<br />

In 2008, <strong>the</strong> Group launched its “INNOVATION AWARDS”, an inhouse<br />

challenge open to all employees, which aims to identify, reward<br />

and implement innovative initiatives introduced by <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> teams in <strong>the</strong>ir everyday work.<br />

This in-house challenge is based on four key ideas:<br />

• Innovation is <strong>the</strong> driving force behind <strong>the</strong> Group<br />

• There is no such thing as a small innovation<br />

• Everyone can be innovative<br />

• Innovation is only of value if shared<br />

Innovations considered for <strong>the</strong> award must cover one of <strong>the</strong> following<br />

three categories:<br />

• Operational excellence<br />

All innovations that clearly and significantly help to improve <strong>the</strong><br />

performance of an activity or site.<br />

• Safety and security<br />

All innovations that clearly and significantly help to improve <strong>the</strong><br />

safety and security of people, sites, materials and goods.<br />

• Environment protection<br />

All innovations that clearly and significantly help <strong>Norbert</strong><br />

<strong>Dentressangle</strong> to make progress in terms of environment protection.<br />

INNOVATION AWARDS jury and announcement of results: end of June<br />

2009.<br />

38

2008 ANNUAL REPORT<br />

Emphasizing what makes us different<br />

39

2008 ANNUAL REPORT<br />

Emphasizing what makes us different<br />

THE “NORBERT DENTRESSANGLE” BRAND<br />

The brand expresses <strong>the</strong> Group’s determination to live up to its ambitions and values. Within <strong>the</strong> Group, it gives <strong>the</strong> teams a sense<br />

of direction. On <strong>the</strong> outside, it inspires confidence because it symbolises <strong>Norbert</strong> <strong>Dentressangle</strong>’s commitments.<br />

In 2008 a new method of internal communication was introduced in<br />

order to cope with both <strong>the</strong> change in size and “Europeanisation” of<br />

<strong>the</strong> Group.<br />

Its objectives are to help all employees understand <strong>the</strong> <strong>Norbert</strong><br />

<strong>Dentressangle</strong> Group, enabling <strong>the</strong> sharing and communication<br />

of values and <strong>Norbert</strong> <strong>Dentressangle</strong> commitments and to make<br />

employees feel proud to be part of <strong>the</strong> Group.<br />

A new in-house magazine called “La Vie en Rouge” has been launched<br />

with this purpose in mind. Published in <strong>the</strong> 10 languages used within<br />

<strong>the</strong> Group, it is sent to every employee’s home twice per year.<br />

40

2008 ANNUAL REPORT<br />

Emphasizing what makes us different<br />

In order to reinforce <strong>the</strong> attraction of <strong>Norbert</strong> <strong>Dentressangle</strong> services for<br />

European manufacturers and distributors, <strong>the</strong> “Talents” magazine was<br />

enriched in 2008 by <strong>the</strong> addition of new expertise in transport and<br />

logistics from Christian Salvesen.<br />

Two editions have been published, in spring and autumn, with over<br />

20,000 copies per communication campaign.<br />

The website www.norbert-dentressangle.com has also been updated<br />

with versions for all <strong>the</strong> countries, in which <strong>Norbert</strong> <strong>Dentressangle</strong> is<br />

represented.<br />

41

2008 ANNUAL REPORT<br />

4<br />

SUSTAINABLE DEVELOPMENT<br />

EACH AND EVERY DAY<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> is considered a pioneer in <strong>the</strong> transport and logistics sector due to its commitment to sustainable<br />

development, which it introduced over four years ago.<br />

Trucks are and will certainly remain <strong>the</strong> most efficient method of transporting goods in <strong>the</strong> medium term in Europe. The main task is<br />

<strong>the</strong>refore to reduce <strong>the</strong> impact of trucks on <strong>the</strong> environment, particularly by dramatically reducing greenhouse gas emissions and<br />

continuously improving road safety.<br />

Since 2004, <strong>Norbert</strong> <strong>Dentressangle</strong>’s sustainable development policy has been based on four axes:<br />

1 - Integration and social promotion 3 - Environmental site management<br />

2 - Reduction of greenhouse gas emissions 4 - Road safety<br />

42

2008 ANNUAL REPORT<br />

Sustainable development each and every day<br />

On <strong>the</strong> occasion of <strong>the</strong> first “Etoiles EthiFinance” awards ceremony<br />

held on Tuesday 14 October 2008 in Paris, <strong>Norbert</strong> <strong>Dentressangle</strong><br />

was awarded <strong>the</strong> “Etoile Centaure de la Gestion de<br />

l’Environnement” by Jacques Bregeon,<br />

Director of <strong>the</strong> “Collège des Hautes Etudes de<br />

l’Environnement et du Développement<br />

Durable”, and Emmanuel de la Ville, CEO of<br />

EthiFinance, <strong>the</strong> independent extra-financial<br />

rating agency that launched <strong>the</strong>se new awards. Every year, <strong>the</strong><br />

“Etoiles EthiFinance” aim to honour companies that excel in <strong>the</strong>ir<br />

commitment to socially responsible investment.<br />

In terms of environmental management, <strong>the</strong> jury considered that<br />

<strong>Norbert</strong> <strong>Dentressangle</strong> had performed best, based on four<br />

evaluation criteria: quality of environmental policy, performance of<br />

environmental management system, analysis<br />

of energy sources and consumption, waste<br />

and greenhouse gas emissions.<br />

“This prize encourages us to continue our<br />

efforts to meet <strong>the</strong> challenge of respecting <strong>the</strong><br />

environment with logistics plans, <strong>the</strong> efficiency of which is currently<br />

based mostly on road transport,” declared François Bertreau on<br />

accepting <strong>the</strong> award.<br />

EthiFinance<br />

HUMAN RESOURCES: INTEGRATION AND SOCIAL PROMOTION<br />

The indicator applied by <strong>Norbert</strong> <strong>Dentressangle</strong> on this axis of<br />

integration and social promotion is <strong>the</strong> rate of internal promotion, in<br />