PDF version - Maison Franco-Japonaise

PDF version - Maison Franco-Japonaise

PDF version - Maison Franco-Japonaise

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

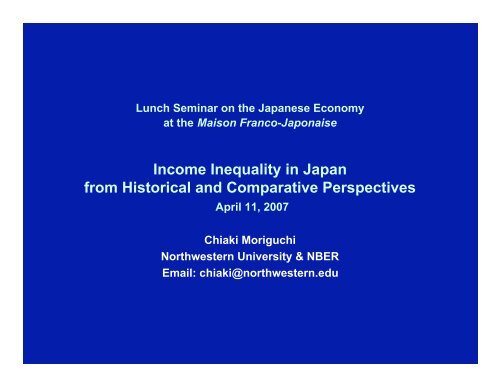

Lunch Seminar on the Japanese Economy<br />

at the <strong>Maison</strong> <strong>Franco</strong>-<strong>Japonaise</strong><br />

Income Inequality in Japan<br />

from Historical and Comparative Perspectives<br />

April 11, 2007<br />

Chiaki Moriguchi<br />

Northwestern University & NBER<br />

Email: chiaki@northwestern.edu

Today's Talk<br />

Part 1. Income Inequality in Japan from Historical Perspectives<br />

– Is today's Japan "equal society"<br />

– If so, since when<br />

– How did it happen<br />

New findings from Moriguchi and Saez (2006).<br />

Part 2. Income Inequality in Japan from Comparative Perspectives<br />

– Is Japan's historical experience unique<br />

– What can other countries' experience tell us<br />

Recent findings from high income studies in major OECD countries by<br />

Atkinson, Piketty, Saez et al. (2006).<br />

2

Income Inequality in Japan: What We Know<br />

♦<br />

Japan widely perceived as "equal society."<br />

OECD income distribution studies<br />

– Sawyer (1976)<br />

– Atkinson et al. (1995)<br />

♦<br />

Is income inequality rising in Japan<br />

– Tachibanaki (2001): "Equal society is a myth."<br />

– Ohtake (2005): "Increase in inequality due to demographic change,<br />

not due to structural change."<br />

3

Income Inequality in OECD Countries in the late 1980s<br />

Table A: Income Before Tax & Transfers<br />

Table B: Income After Tax & Transfers<br />

Country Year Gini Coeficient Country Year Gini Coefficient<br />

Ireland 1987 0.461 U.S. 1986 0.347<br />

Sweden 1987 0.439 Switzerland 1982 0.346<br />

U.K. 1986 0.428 Ireland 1987 0.341<br />

France 1984 0.417 U.K. 1986 0.323<br />

U.S. 1986 0.411 Italy 1986 0.321<br />

Switzerland 1982 0.407 France 1984 0.311<br />

Germany 1984 0.395 Canada 1987 0.305<br />

Finland 1987 0.379 Japan 1985 0.298<br />

Canada 1987 0.374 Sweden 1987 0.281<br />

Italy 1986 0.361 Germany 1984 0.277<br />

Netherlands 1987 0.348 Netherlands 1987 0.266<br />

Japan 1989 0.317 Belgium 1988 0.260<br />

Belgium 1988 0.273 Finland 1987 0.255<br />

Source: Nishizaki et al. (1998) Source: Kokumin Seikatsukyoku (1999), Chapter 3;<br />

Atkinson et al. (1996), Table 4-10.<br />

4

Income Inequality in Japan, 1955-2005<br />

0.55<br />

0.50<br />

0.45<br />

EES/FIES<br />

PLCS1<br />

PLCS2<br />

IRS<br />

HHS<br />

Gini Coefficient<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

0.20<br />

1956 1962 1968 1974 1980 1986 1992 1998 2002<br />

5

Income Inequality in Japan, 1890-2005<br />

Gini Coefficient<br />

0.70<br />

0.65<br />

0.60<br />

0.55<br />

0.50<br />

0.45<br />

0.40<br />

0.35<br />

EES/FIES<br />

PLCS1<br />

PLCS2<br />

HHS<br />

IRS<br />

WD/NIT<br />

LESJ<br />

NIT/LIT<br />

0.30<br />

0.25<br />

0.20<br />

1890 1900 1910 1920 1925 1935 1940 1950 1959 1966 1971 1977 1983 1989 1995 2001 2003<br />

6

Income Inequality in Japan, 1890-2005<br />

0.70<br />

0.65<br />

0.60<br />

0.55<br />

Gini Coefficient<br />

0.50<br />

0.45<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

0.20<br />

1890 1900 1910 1920 1925 1935 1940 1950 1959 1966 1971 1977 1983 1989 1995 2001 2003<br />

7

What We Don't Know<br />

♦ No data between 1940 and 1955.<br />

♦<br />

Pre-1940 data only for selected years.<br />

♦<br />

Can not compare the levels of pre-1940 series and post-1955 series<br />

due to data discontinuity.<br />

♦<br />

Japan became an "equal society" by 1970 — but how<br />

♦<br />

Little knowledge on high income groups.<br />

8

High Income Studies using Income Tax Statistics<br />

♦ Pioneered by Piketty (2003) and Piketty & Saez (2003).<br />

♦<br />

Construct long-run, homogenous, and continuous top income shares<br />

series using income tax statistics.<br />

♦<br />

Precise data on the level and composition of the high-end of income<br />

distribution (not available in household surveys).<br />

♦<br />

Document the evolution of income concentration over many decades.<br />

♦<br />

Facilitate international comparison of the experience of major<br />

economies — France, U.K., U.S., Netherlands, Sweden, etc.<br />

9

Studying Japan<br />

♦ Comprehensive income tax system introduced in 1887.<br />

Cf: U.K. in 1908, France in 1910, U.S. in 1913.<br />

♦ Income tax statistics published every year since 1887 to date.<br />

♦ Because Japan's modern economic growth started circa 1886,<br />

the data span the entire process of industrialization.<br />

♦ Investigate the relationships between economic growth and<br />

income inequality.<br />

10

Real Income per Capita in Japan, 1885-2002<br />

10,000<br />

100.00<br />

Income in 2002 thousands of Yen<br />

1,000<br />

Real Income per Capita<br />

CPI 2002<br />

10.00<br />

1.00<br />

0.10<br />

100<br />

1885<br />

1890<br />

1895<br />

1900<br />

1905<br />

1910<br />

1915<br />

1920<br />

1925<br />

1930<br />

1935<br />

1940<br />

1945<br />

1950<br />

1955<br />

1960<br />

1965<br />

1970<br />

1975<br />

Consumer Price Index (base 100 in 2002)<br />

1980<br />

1985<br />

1990<br />

1995<br />

2000<br />

0.01<br />

11

Methodology<br />

♦<br />

♦<br />

♦<br />

<br />

<br />

<br />

Income before tax (wages & bonuses; business, farm & self-employed<br />

incomes; interest, dividends & rents, but exclude capital gains).<br />

Top income groups (10%, 1%, 0.1%, 0.01%) defined relative to total<br />

number of adults.<br />

Top 1% income share<br />

= incomes accrued to top 1% income earners / total personal income.<br />

Due to high level of income tax exemption before 1940, less than 5% of<br />

adults filed income tax returns in Japan.<br />

"Reported income" subject to tax evasion & avoidance.<br />

Due to numerous tax reforms and revisions, need careful adjustments<br />

to create homogenous series.<br />

12

Top 1% and Next 4% Income Shares in Japan, 1886-2002<br />

22%<br />

20%<br />

18%<br />

Top 1%<br />

Top 5-1%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

1886<br />

1890<br />

1894<br />

1898<br />

1902<br />

1906<br />

1910<br />

1914<br />

1918<br />

1922<br />

1926<br />

1930<br />

1934<br />

1938<br />

1942<br />

1946<br />

1950<br />

1954<br />

1958<br />

1962<br />

1966<br />

1970<br />

1974<br />

1978<br />

1982<br />

1986<br />

1990<br />

1994<br />

1998<br />

2002<br />

Income share<br />

13

Decomposition of Top 1% Income Share in Japan, 1886-2002<br />

10%<br />

9%<br />

8%<br />

7%<br />

Top 0.1%<br />

Next 0.4%<br />

Bottom 0.5%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

1886<br />

1890<br />

1894<br />

1898<br />

1902<br />

1906<br />

1910<br />

1914<br />

1918<br />

1922<br />

1926<br />

1930<br />

1934<br />

1938<br />

1942<br />

1946<br />

1950<br />

1954<br />

1958<br />

1962<br />

1966<br />

1970<br />

1974<br />

1978<br />

1982<br />

1986<br />

1990<br />

1994<br />

1998<br />

2002<br />

Income share<br />

14

Top 0.1% Income Share with Capital Gains in Japan<br />

10%<br />

9%<br />

8%<br />

Without Capital Gains<br />

With Capital Gains<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

1886<br />

1890<br />

1894<br />

1898<br />

1902<br />

1906<br />

1910<br />

1914<br />

1918<br />

1922<br />

1926<br />

1930<br />

1934<br />

1938<br />

1942<br />

1946<br />

1950<br />

1954<br />

1958<br />

1962<br />

1966<br />

1970<br />

1974<br />

1978<br />

1982<br />

1986<br />

1990<br />

1994<br />

1998<br />

2002<br />

Income share<br />

15

Composition of Top 1% Income in Japan, 1886-2002<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

1886<br />

1890<br />

1894<br />

1898<br />

1902<br />

1906<br />

1910<br />

1914<br />

1918<br />

1922<br />

1926<br />

1930<br />

1934<br />

1938<br />

1942<br />

1946<br />

1950<br />

1954<br />

1958<br />

1962<br />

1966<br />

1970<br />

1974<br />

1978<br />

1982<br />

1986<br />

1990<br />

1994<br />

1998<br />

2002<br />

Income Share<br />

Employment<br />

Business<br />

Rents<br />

Interest<br />

Dividends<br />

16

Top 0.01% vs. Top 1-0.5% Estate Sizes in Japan, 1905-2002<br />

Top 0.01% Estate (in 2002 thousand yen)<br />

100,000,000<br />

10,000,000<br />

1,000,000<br />

100,000<br />

Top 0.01% estate<br />

Top 1-0.5% estate<br />

10,000<br />

1905<br />

1910<br />

1915<br />

1920<br />

1925<br />

1930<br />

1935<br />

1940<br />

1945<br />

1950<br />

1955<br />

1960<br />

1965<br />

1970<br />

1975<br />

1980<br />

1985<br />

1990<br />

1995<br />

2000<br />

1,000,000<br />

100,000<br />

10,000<br />

1,000<br />

Top 1-0.5% Estate (in 2002 thousand yen)<br />

100<br />

17

Top Estate Compositions in Japan: 1935, 1950, and 1987<br />

Estate Composition<br />

Year<br />

Agricultural<br />

Land<br />

Residential<br />

Land<br />

Houses &<br />

Structures<br />

Business<br />

Assets<br />

Stocks<br />

Fixed Claim<br />

Assets<br />

Other Assets<br />

1935 22.5% 13.8% 8.4% 3.9% 25.9% 22.6% 2.9%<br />

1950 11.8% 15.1% 37.3% 13.5% 4.8% 12.1% 19.7%<br />

1987 20.6% 43.6% 3.7% 0.8% 10.2% 11.7% 9.5%<br />

18

Historical Explanations (1):<br />

High Income Concentration in 1886-1938<br />

♦ Top 1% income group receiving 18% of total income in 1900-38.<br />

♦ Top 0.1% income group receiving 8% of total income in 1900-38.<br />

♦ Capital income component roughly 40% of top 1% income before 1938.<br />

Reasons (Yazawa 1992; Okazaki 2000):<br />

1) Concentration of land ownership to “absentee landlords.”<br />

2) Large shareholders receiving high dividends.<br />

3) Large year-end bonuses paid to CEOs.<br />

4) Primogeniture with low estate tax rates.<br />

5) Low marginal income tax rates.<br />

19

Historical Explanations (2):<br />

Income De-concentration during WWII<br />

♦ Top 1% income share fell from 20% to 7% in 1938-45.<br />

♦ Top 0.1% income share fell from 9% to 2% in 1938-45.<br />

♦ Collapse of capital income component in top 1% income in 1938-45.<br />

♦ Top 1% wage income share fell from 8% to 3% in 1935-44.<br />

Reasons (Nishida 2003; Okazaki 2000; Yazawa & Minami 1993) :<br />

– 1938 General Mobilization Act (regulation on land rents, dividends,<br />

wages and bonuses in 1939-45)<br />

– Increases in income tax rates in 1938-45.<br />

– Wartime inflation in 1938-45.<br />

– War destruction in 1944-45.<br />

20

♦<br />

Historical Explanations (3):<br />

Impact of U.S. Occupational Reforms (1947-52) Reconsidered<br />

Occupational policies:<br />

Land reform in 1947-50,<br />

Zaibatsu dissolution in 1946-48,<br />

Property tax in 1946-51.<br />

with Hyperinflation in 1944-48.<br />

Considered to be major causes of income equalization (Minami 1995).<br />

Then why no impact on top income shares<br />

Explanations:<br />

– Discontinuity in data Tax reforms in 1940, 1947, 1950, but unlikely to<br />

produce large enough bias.<br />

– Occupational reforms largely continuation of wartime policies (Dore<br />

1985; Gordon 1985; Okazaki 2000; Moriguchi 2000).<br />

– Played big role in (not income but) wealth redistribution.<br />

21

Historical Explanations (4):<br />

Why Did Not Top Income Shares Recover after WWII<br />

♦ Top 1% income share remains stable at 8% in 1950-2002.<br />

♦ Top 0.1% income shares remains at 2% in 1950-2002.<br />

♦ Top 1% "wage income" share remains at 7% in 1970-2002.<br />

Reasons: Changes in institutional infrastructure after WWII:<br />

– Primogeniture abolished in 1947,<br />

– Progressive estate tax since 1950,<br />

– Progressive individual & corporate income tax since 1950,<br />

– Restrictive land and house lease laws since 1941,<br />

– Tax-exempted savings for the middle class since 1963,<br />

– Change in corporate governance (bank finance, cross shareholding),<br />

– Change in human resource management (enterprise unions, internal<br />

promotion, joint consultation).<br />

22

Marginal Income Tax Rates in Japan, 1886-2002<br />

90%<br />

80%<br />

70%<br />

60%<br />

Highest Statutory MTR<br />

Top 0.01% MTR<br />

Top 0.1% MTR<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

1886<br />

1890<br />

1894<br />

1898<br />

1902<br />

1906<br />

1910<br />

1914<br />

1918<br />

1922<br />

1926<br />

1930<br />

1934<br />

1938<br />

1942<br />

1946<br />

1950<br />

1954<br />

1958<br />

1962<br />

1966<br />

1970<br />

1974<br />

1978<br />

1982<br />

1986<br />

1990<br />

1994<br />

1998<br />

2002<br />

Marginal Tax Rate<br />

23

Japan's Experience in Comparative Perspectives<br />

♦<br />

Top income shares series constructed by the similar methods:<br />

• France (Piketty 2003)<br />

• U.S. (Piketty and Saez 2003)<br />

• Canada (Saez and Veall 2005)<br />

• U.K. and Australia (Atkinson and Leigh 2004)<br />

• Netherlands (Atkinson and Salverda 2005)<br />

• Switzerland (Dell, Piketty, and Saez 2006)<br />

• Sweden (Roine and Waldenstrom 2006)<br />

• Japan (Moriguchi and Saez 2006)<br />

24

Top 0.1% Income Shares in France, U.K., and U.S., 1900-2005<br />

12%<br />

10%<br />

Japan<br />

France<br />

Top 0.1% Income Share<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

1900<br />

1905<br />

1910<br />

1915<br />

1920<br />

1925<br />

1930<br />

1935<br />

1940<br />

1945<br />

1950<br />

1955<br />

1960<br />

1965<br />

1970<br />

1975<br />

1980<br />

1985<br />

1990<br />

1995<br />

2000<br />

2005<br />

UK<br />

US<br />

25

Top 0.1% Income Shares in Anglo-Saxon Countries, 1900-2005<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

1900<br />

1905<br />

1910<br />

1915<br />

1920<br />

1925<br />

1930<br />

1935<br />

1940<br />

1945<br />

1950<br />

1955<br />

1960<br />

1965<br />

1970<br />

1975<br />

1980<br />

1985<br />

1990<br />

1995<br />

2000<br />

2005<br />

Top 0.1% Income Share<br />

Japan<br />

U.S.<br />

U.K.<br />

Canada<br />

Australia<br />

26

Top 0.1% Income Shares in Netherlands, Sweden, and<br />

Switzerland, 1900-2005<br />

12%<br />

Japan<br />

Top 0.1% Income Share<br />

10%<br />

8%<br />

6%<br />

4%<br />

Netherlands<br />

Sweden<br />

2%<br />

0%<br />

1900<br />

1905<br />

1910<br />

1915<br />

1920<br />

1925<br />

1930<br />

1935<br />

1940<br />

1945<br />

1950<br />

1955<br />

1960<br />

1965<br />

1970<br />

1975<br />

1980<br />

1985<br />

1990<br />

1995<br />

2000<br />

2005<br />

Switzerland<br />

27

Is Japan's Experience Unique<br />

♦<br />

In most OECD countries, income concentration was once extremely<br />

high, and then fell dramatically during 1910-1945.<br />

♦<br />

Decline in top income shares during WWII seen in all participating<br />

countries (including winners), but was most dramatic in Japan.<br />

♦<br />

Top income shares have increased sharply since 1980 in Anglo-Saxon<br />

countries (but remained low elsewhere). Rise in executive<br />

compensation in the U.S. considered to be major driving force.<br />

28

Main Results & Conclusions<br />

♦<br />

♦<br />

♦<br />

♦<br />

♦<br />

Income concentration in Japan was high throughout the 1885-1938 period,<br />

then declined dramatically during WWII.<br />

Collapse of top capital income during WWII was the primary reason for the<br />

income de-concentration. Wage income concentration also fell sharply<br />

during WWII.<br />

Postwar institutional reforms made the one-time income de-concentration<br />

irreversible. Both capital income and wage income became much more<br />

equally distributed after WWII.<br />

Japan achieved two "economic miracles" under very different social, legal,<br />

and institutional settings. No clear relationships between income inequality<br />

and economic growth.<br />

The process of income de-concentration driven mainly by large historical<br />

shocks (wars, depressions) that destroyed wealth or triggered government<br />

intervention. Important policy implications for developing countries.<br />

29