information - Colin Ng and Partners

information - Colin Ng and Partners

information - Colin Ng and Partners

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Special Risk Sharing Initiative (“SRI”)<br />

The Singapore Government has recently introduced measures to keep credit <strong>and</strong> financing flowing in the<br />

face of present global economic conditions. Measures comprise: (a) the Special Risk-Sharing Initiative<br />

(“SRI”); (b) enhancements to existing credit schemes; <strong>and</strong> (c) tax benefits.<br />

The SRI has two components:<br />

1. The new Bridging Loan Programme (“BLP”); <strong>and</strong><br />

2. Trade Finance Schemes, comprising:<br />

(a) Loan Insurance Scheme (“LIS”) enhancements (ie LIS3 <strong>and</strong> LIS Plus (“LIS+”); <strong>and</strong><br />

(b) Trade Credit Insurance Programme (“TCIP”).<br />

This update focuses on the SRI, particularly on the BLP <strong>and</strong> LIS3 <strong>and</strong> LIS+. It does not deal with the TCIP.<br />

Through the SRI, the Government will make available funds for the participating banks <strong>and</strong> finance<br />

companies, ie the Participating Financial Institutions (“PFIs”), to lend <strong>and</strong> it will take on a significant share<br />

of the risks of that lending.<br />

New Bridging Loan Programme (“BLP”)<br />

CNPUpdate<br />

9 March 2009<br />

a bi-monthly publication by CNP Issue 09/03<br />

Under the BLP, the Government makes funds available to the PFIs to lend to Small <strong>and</strong> Medium Enterprises<br />

(“SMEs”) (ie with more than 10 employees) which need funding for working capital. The BLP applies to<br />

loans with an interest rate of 5% or more. The provision of funds by the Government overcomes problems<br />

the PFIs are having in obtaining funds in the interbank market. PFIs process <strong>and</strong> approve loans <strong>and</strong> release<br />

the loan funds in the usual way.<br />

As part of the SRI, enhancements were made to the BLP in January <strong>and</strong> February 2009. There has been a<br />

decrease in the interest rate floor for eligible loans, a substantial increase in the maximum facility amount<br />

for each borrower group <strong>and</strong> a broader range of companies are eligible to borrow under the BLP. In<br />

addition, the Government takes a greater share of the risk of defaults under loans made by PFIs under the<br />

BLP, whether or not the loans were made by the PFIs with funds provided by the Government. Details of<br />

the BLP are set out in the table below:<br />

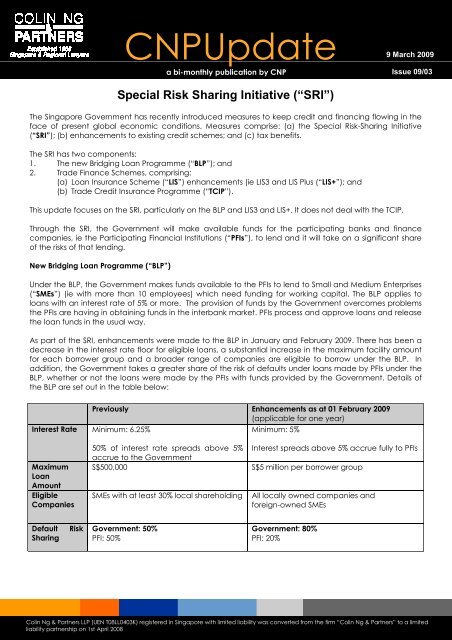

Previously Enhancements as at 01 February 2009<br />

(applicable for one year)<br />

Interest Rate Minimum: 6.25%<br />

Minimum: 5%<br />

Maximum<br />

Loan<br />

Amount<br />

Eligible<br />

Companies<br />

50% of interest rate spreads above 5%<br />

accrue to the Government<br />

S$500,000<br />

SMEs with at least 30% local shareholding<br />

Interest spreads above 5% accrue fully to PFIs<br />

S$5 million per borrower group<br />

All locally owned companies <strong>and</strong><br />

foreign-owned SMEs<br />

Default Risk<br />

Sharing<br />

Government: 50%<br />

PFI: 50%<br />

Government: 80%<br />

PFI: 20%<br />

<strong>Colin</strong> <strong>Ng</strong> & <strong>Partners</strong> LLP (UEN T08LL0403K) registered in Singapore with limited liability was converted from the firm “<strong>Colin</strong> <strong>Ng</strong> & <strong>Partners</strong>” to a limited<br />

liability partnership on 1st April 2008

MICA (P) 2136/07/2008<br />

CNPUpdate<br />

a bi-monthly publication by CNP<br />

9 March 2009<br />

Issue 09/03<br />

LIS (trade finance scheme) enhancements: LIS3 <strong>and</strong> LIS+<br />

As part of the SRI, LIS3 <strong>and</strong> LIS+ have been introduced as enhancements to the existing LIS trade finance<br />

scheme.<br />

LIS3 <strong>and</strong> LIS+ apply to domestic <strong>and</strong> export-oriented trade finance <strong>and</strong> cover facilities for inventory/stock financing,<br />

working capital <strong>and</strong> factoring financing. Under LIS, the Government makes funds available to the PFIs<br />

to enable them to undertake this financing. Also under LIS, the Government subsidises the cost of the insurance<br />

premiums payable by the borrowers to the PFIs for the cost of the PFI’s insurance cover against borrower insolvency<br />

<strong>and</strong> default risk. This subsidy has increased under LIS3.<br />

In addition, under LIS+, where the amount of a loan exceeds the limit a LIS insurer is able to cover against borrower<br />

insolvency <strong>and</strong> default risk, the LIS insurer will insure the loan up to its limit <strong>and</strong> the Government will cover<br />

the amount above the LIS insurer’s limit, ie the Government shares the risk with the LIS insurer <strong>and</strong> the PFI. Under<br />

LIS+, the level of premium payable by the borrower with reference to the amount covered by the Government’s<br />

insurance is 0.5% pa. PFIs process <strong>and</strong> approve loans <strong>and</strong> release the loan funds in the usual way.<br />

Details of LIS3 <strong>and</strong> LIS+ are set out in the table below.<br />

LIS3<br />

LIS+<br />

Maximum Loan Amount No limit but LIS insurer may refuse to insure S$15 million per borrower group<br />

loan amounts over S$1 million<br />

Effective Date <strong>and</strong> Period With effect from 1 December 2008 for one<br />

year<br />

With effect from 1 February 2009 for<br />

one year<br />

Turnover Cap Removed No change<br />

Qualifying Criteria for<br />

Companies<br />

For domestic facilities<br />

• Company must have at least 30% local<br />

shareholding<br />

No change<br />

For export-oriented facilities<br />

• Company must be Singapore-based<br />

• Company must have at least three<br />

strategic business functions located in<br />

Singapore<br />

Risk Share Insurer: 75%<br />

PFI: 25%<br />

No change<br />

Government: 75%<br />

PFI: 25%<br />

Insurance Premium<br />

1.5% pa of the total loan amount approved<br />

Government subsidy of the cost of the<br />

insurance premium increased to 90% of 1.5%,<br />

ie 1.35% pa of the total loan amount<br />

approved<br />

Remaining 0.15% is payable by the borrower<br />

company <strong>and</strong> will be collected upfront by<br />

the PFI upon loan acceptance<br />

Government will bear the cost of<br />

insuring loan amounts beyond the LIS<br />

insurers’ capacities<br />

0.5% pa of the amount insured by<br />

Government<br />

For more <strong>information</strong>, please contact:<br />

Bill Jamieson<br />

Partner<br />

Tel: (65) 6349 8680<br />

Email: billjamieson@cnplaw.com<br />

<strong>Colin</strong> <strong>Ng</strong> & <strong>Partners</strong> LLP (UEN T08LL0403K) registered in Singapore with limited liability was converted from the firm “<strong>Colin</strong> <strong>Ng</strong> & <strong>Partners</strong>” to a limited<br />

liability partnership on 1st April 2008