D 58008 - Food Service Europe

D 58008 - Food Service Europe

D 58008 - Food Service Europe

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

D <strong>58008</strong><br />

INTERNATIONAL TRADE JOURNAL<br />

FOR THE HOTEL, RESTAURANT<br />

AND CATERING INDUSTRY<br />

EDITION 6/2012<br />

www.food-service-europe.com<br />

www.cafe-future.net<br />

Special Features: 13th <strong>Europe</strong>an <strong>Food</strong>service Summit, Top 99 Operators in <strong>Europe</strong>

C ONTENTS<br />

4 Editorial<br />

6 Statistics<br />

<strong>Europe</strong> by Numbers<br />

8 Pan-<strong>Europe</strong>an Survey<br />

Micro-Breweries and Brew-Pubs: Gaining<br />

Ground in a Declining Beer Market. Part<br />

One: Germany, UK, France – and the US<br />

18 Hot Trend<br />

Artisanal Ice-Cream Concepts (Part Two):<br />

Commitment to Regional Sourcing and<br />

All-Natural Ingredients<br />

page 8 ■ ■ ■<br />

Giving a home to beer: whilst the average<br />

consumption of beer has been<br />

declining in many <strong>Europe</strong>an countries<br />

in recent years, small, independent<br />

micro-breweries, many of them running<br />

their own F&B outlet or brewpub,<br />

have profited from consumers’<br />

rising demand for new tastes and regionally<br />

rooted specialist beers. Part<br />

1 of our pan-<strong>Europe</strong>an survey.<br />

Market Analysis<br />

22 <strong>Europe</strong><br />

Top 99 <strong>Food</strong>service Operators 2011 Enjoy<br />

Combined Sales Growth of 5.5% to More<br />

than ¤85 bn<br />

38 Interview<br />

Ron Shaich, Chairman/Co-CEO and Prime<br />

Mover of US Fast Casual Pioneer Panera Bread<br />

Middle East Section<br />

46 Fast Casual<br />

BurgerFuel: Gourmet Burgers from Down<br />

Under Set to Conquer the Middle Eastern<br />

Market<br />

■ ■ ■ page 38<br />

At this year’s 13th <strong>Europe</strong>an <strong>Food</strong>service Summit,<br />

Panera Bread Chairman/co-CEO Ron Shaich told participants<br />

about the importance of a ‘higher purpose’<br />

rather than simply driving short term results. In our<br />

interview, Shaich explains his approach of making a<br />

difference not just to food quality perceptions, but<br />

also to the lives of customers, staff and communities.<br />

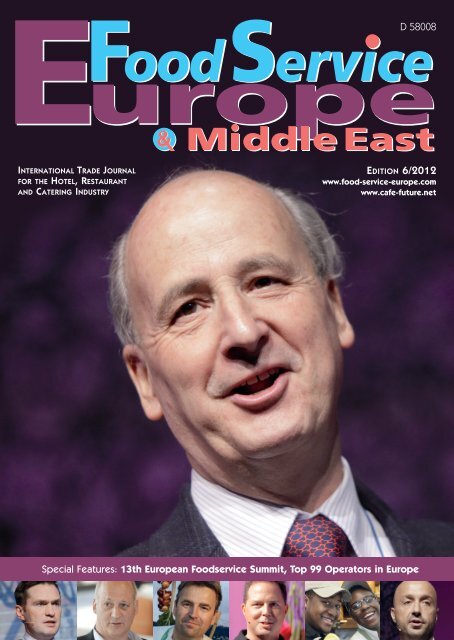

front cover ■ ■ ■<br />

Commenting on the gloomy challenges which confront<br />

<strong>Europe</strong>an business, Stéphane Garelli, professor<br />

at IMD and University of Lausanne and a world authority<br />

on competitiveness, helped the audience to<br />

digest the basically bad news with a catching sense<br />

of humour. Photo: Thomas Fedra<br />

13th <strong>Europe</strong>an <strong>Food</strong>service Summit<br />

50 Summit Report<br />

In a Nutshell: Key Actors and Key Lessons to<br />

Be Learned<br />

58 Consumer Research<br />

OOH Market in <strong>Europe</strong>’s Big 6 Countries:<br />

Comparative Insights<br />

60 Management<br />

Securing Growth in Difficult Times: Statements<br />

from Five <strong>Food</strong>service Professionals<br />

63 Contributing Authors<br />

64 Suppliers<br />

MKN, Wolfenbuettel: More Versatile<br />

Equipment to Multiply the Cooking Options<br />

66 Top Trend Products<br />

Supplier Present their Latest F&B and<br />

Equipment Solutions<br />

68 Show Dates<br />

Major Trade Fairs and Events<br />

page 22 ■ ■ ■<br />

<strong>Europe</strong>’s top 99 foodservice operators<br />

rang up combined sales of more than<br />

¤85 bn (net) in 2011, a growth of 5.5%<br />

(in constant currency) compared to<br />

+4.5% in 2010 – despite a tough economic<br />

climate in most parts of <strong>Europe</strong>.<br />

Our ranking lists the leaders of the<br />

pack and their facts & figures.<br />

■ ■ ■<br />

Turnover 2011: Top 99 <strong>Europe</strong> ■<br />

– By Sector –<br />

10.2%<br />

Travel (11)<br />

10.9%<br />

Restaurants<br />

(23)<br />

Verlagsgruppe Deutscher Fachverlag<br />

Mainzer Landstrasse 251 | 60326 Frankfurt/Main | Germany<br />

Phone +49.69.7595-1512 | Fax +49.69.7595-1510<br />

info@food-service-europe.com<br />

10.7%<br />

The Rest (18)<br />

39.8%<br />

QSR (28)<br />

28.3%<br />

Contract<br />

Catering (19)<br />

©<strong>Food</strong><strong>Service</strong> <strong>Europe</strong> & Middle East<br />

FOODSERVICE EUROPE & MIDDLE EAST 6/12<br />

3

MANAGEMENT<br />

Securing Growth<br />

in Difficult Times<br />

Growing in a diverse economic future: this is how the 13th <strong>Europe</strong>an <strong>Food</strong>service<br />

Summit defined the present global challenge facing the international professional catering<br />

community. The motto of this year‘s event was ‘Ideas, Visions and Creativity’ –<br />

and they are certainly more in demand than ever. We asked participants from six<br />

countries around the world about the pros and cons of growth for 2012+, about important<br />

steps they have taken over the last year and about their strategies for making<br />

further progress, even under difficult circumstances. Part 1: <strong>Food</strong>service operators<br />

from Finland, Egypt, Greece, Sweden and the USA. ir/MW/JPW<br />

■ ■ ■<br />

Our Questions ■ ■<br />

● Main drivers of growth and<br />

main obstacles – in the past 12<br />

months and for 2013+<br />

● Looking back at 2012: highlights,<br />

challenges and the<br />

general direction taken<br />

● Looking ahead: visions, ambitions,<br />

concerns<br />

Nadine Beshir<br />

Nadine Beshir, Managing Director, Cairo<br />

Kitchen, Cairo (ET)<br />

“Since the revolution, the people of<br />

Egypt are constantly looking for something<br />

new. This applies above all to art,<br />

and I count food as a form of art and creativity.<br />

People want local food, prepared<br />

in a contemporary way and served in a<br />

new environment.<br />

2012 was the year we opened our first<br />

Cairo Kitchen. Subsequently, in September,<br />

we started up a second outlet in a<br />

British school in Cairo. It was a very challenging<br />

and exciting year.<br />

It is becoming more and more difficult to<br />

find good locations at affordable prices.<br />

This is a great obstacle for us. In my country,<br />

with all its political and economic<br />

problems, lots of people invest in restaurants.<br />

The sums involved appear to be<br />

manageable. On the one hand, this is<br />

good for the economy, but it’s bad for us.<br />

Seven restaurant concepts have opened<br />

up in our neighbourhood in the last six<br />

months. I also see the political uncertainty<br />

in my country as another hurdle.<br />

To expand further, we need a stable infrastructure<br />

and reliable laws. Everything<br />

is constantly in a state of flux;<br />

things can change for the better or for<br />

the worse. We just don’t know.<br />

Before the economic and financial crisis,<br />

we weren’t at all fearful. People will always<br />

go out to eat and won’t let that be<br />

taken away from them. Even the rising<br />

cost of raw materials doesn’t cause us<br />

any sleepless nights, because we’ve already<br />

had to cope with that. To a certain<br />

extent, one has to pass the higher costs<br />

on to the customers, but most of them<br />

are understanding about it, since prices<br />

are rising in other areas too.<br />

Our aim is to set profit targets now, at a<br />

level that will allow us to expand in a<br />

sustainable way in the future. We must<br />

always harmonise both short and longterm<br />

aspects. There are two stages<br />

facing our young concept now. The first<br />

step is all about getting our brand sufficiently<br />

well known. In the second phase,<br />

we shall need to increase the number of<br />

our outlets. Our goal for the next ten<br />

years is to have opened one or two units<br />

in every larger city in Egypt. But, our immediate<br />

job is to reach the first milestone.<br />

“ www.cairokitchen.com<br />

Peter Falconer, Advisor to the Management,<br />

Tim Hortons, Oakville (CDN)<br />

“The effects of the global recession continue<br />

to linger. Recovery has been slow<br />

and in some cases sporadic over the past<br />

four years and over different geographic<br />

areas. Still, Tim Hortons remains focused<br />

on continuing to expand its business. In<br />

2012, we expect to open more restaurants<br />

in Canada than any other quickservice<br />

chain, and we recently were<br />

ranked as the fourth fastest growing<br />

chain in the United States. In our international<br />

markets, we continue to open<br />

locations in the Gulf Cooperation Council<br />

region, with an initial target of 120 locations<br />

by 2016. In total, we expect to<br />

open more than 250 new locations in<br />

2012 in North America and Gulf Cooperation<br />

Council.<br />

Our primary driver of growth is our market<br />

differentiation: a stellar brand reputation,<br />

convenience, fast and friendly<br />

service and our always fresh quality<br />

products at affordable prices. Our brand<br />

delivers value in difficult economic<br />

times, and reaps the benefit of unparalleled<br />

traffic frequency in boom times.<br />

Our obstacles to growth are consistent<br />

with those that affect all quickservice<br />

60 FOODSERVICE EUROPE & MIDDLE EAST 6/12

MANAGEMENT<br />

restaurants: intensified competitive environment<br />

and macro-economic conditions<br />

affecting our customers.<br />

2012 continues a steady string of innovation<br />

throughout the Tim Hortons<br />

chain. We’ve introduced faster, simpler<br />

payment methods to increase speed of<br />

service and convenience for our customers.<br />

On the menu side, we’ve added<br />

new products to maintain or increase<br />

our market share in the breakfast, lunch<br />

and snacking dayparts: products like<br />

grilled paninis, espresso-based lattes<br />

and cappuccinos, specialty bagels and<br />

smoothies. Our challenges have been to<br />

remind our customers of our value<br />

proposition, that we offer high quality<br />

products at reasonable prices. So we’re<br />

competing by offering menu combinations<br />

and introducing more menu options<br />

for greater customer choice at various<br />

price points.<br />

Looking ahead, Tim Hortons is executing<br />

against a four-year strategic plan that<br />

was initiated in 2010. Our ambitions are<br />

to continue to grow in Canada, expand<br />

methodically in the United States, and<br />

Peter Falconer<br />

seed the brand and business model internationally<br />

as the company continues to<br />

grow. We see the same challenges and<br />

headwinds that everyone sees, from the<br />

uncertain macro economic conditions to<br />

volatile commodity prices. Our strategic<br />

business activities help protect our business<br />

and franchisees in times of turmoil,<br />

such as buying six months in advance on<br />

coffee futures to smooth out commodity<br />

spikes. At the same time, our unique<br />

business model also defends against difficult<br />

conditions and allows for an appropriate<br />

pace of growth. For example, our<br />

vertical integration better protects<br />

against supplier disruption.<br />

We believe success can come from meeting<br />

our guests’ ever changing needs<br />

through a relentless spirit of continuous<br />

improvement and innovation, across our<br />

business and in our restaurants.”<br />

www.timhortons.com<br />

Anu Kokko, Director, Marketing and<br />

Creation, Fazer <strong>Food</strong> <strong>Service</strong>s Finland,<br />

Helsinki (FI)<br />

“I think that quality, taste and an opportunity<br />

to make individual choices will<br />

still be the key success factors in the<br />

foodservice industry in the future. The<br />

world is now more prosperous than ever<br />

before and the constant need for growth<br />

continues to play a major role. However,<br />

in the future, growth will come more and<br />

more from the service side of the business<br />

and hopefully from those sectors<br />

that use alternative, sustainable sources.<br />

Fazer <strong>Food</strong> <strong>Service</strong>s is a part of the Finn-<br />

FOODSERVICE EUROPE & MIDDLE EAST 6/12<br />

61

MANAGEMENT<br />

Anu Kokko<br />

ish Fazer Group that was founded as a<br />

family business in 1891 and has, nowadays,<br />

a turnover of ¤1,575.5 m (2011).<br />

More than 50 % of its revenue comes<br />

from outside Finland. Fazer <strong>Food</strong> <strong>Service</strong>s<br />

is well-known as the leading contract<br />

catering company in the Nordic<br />

countries, with an annual turnover of<br />

¤568 m (2011). Every day, around<br />

400,000 customers visit some 1,100 restaurants<br />

in Finland, Sweden, Norway<br />

and Denmark (mainly staff restaurants,<br />

some of which are also open to the public<br />

– and about 50 open-sector cafés and<br />

restaurants). Furthermore, Fazer has also<br />

established itself as the leading bakery<br />

and confectionery brand in Finland and<br />

one of the leading companies in Russia<br />

and the Baltic Sea countries with 19<br />

large-scale, industrial bakeries in Finland,<br />

Sweden, Estonia, Latvia, Lithuania<br />

and Russia. The bakery and confectionery<br />

business accounts for 64 % of Fazer<br />

Group’s turnover: ¤1,008 m (2011).<br />

When we consider the market in general<br />

and our company in particular, it is evident<br />

that to operate successfully and be<br />

competitive it will be necessary to keep<br />

our two major objectives clearly in mind:<br />

we shall need to continuously develop<br />

our core product, lunch, and to build beyond<br />

it.<br />

Furthermore, we must also be aware of<br />

the obstacles. Over the last twelve<br />

months, we have had to fight against the<br />

overall economic challenges, as well as a<br />

decrease in the number of employees at<br />

our contract clients, and we shall continue<br />

to do so next year as well. The major<br />

achievement of the last three quarters of<br />

2012 has been to lay the necessary foundations<br />

and prepare for growth.<br />

Looking ahead, it will be important for us<br />

to ensure our resilience against a possible<br />

Euro crisis and to continue to listen<br />

to the people who eat in our restaurants<br />

Wilhelm Vintilescu<br />

as well as to our clients, to understand<br />

their needs and wants and to study the<br />

market trends. Moreover, we shall have<br />

to develop further our product ranges<br />

and services in the light of their responses<br />

so that what we offer remains attractive,<br />

relevant and worthwhile. The importance<br />

of new and diverse services in<br />

our company is shown by our idea for<br />

‘Fazer Meetings and Events’. Since May<br />

2012 Fazer has run a sales service specifically<br />

designed for meetings and festivities,<br />

enabling customers to make reservations<br />

and order catering services at<br />

several locations.<br />

Our strategy for the future is based on<br />

four cornerstones:<br />

■ We focus on leading brands.<br />

■ We create an operating model that<br />

supports our goals.<br />

■ We seek growth in higher value products<br />

and services.<br />

■ We expand in growing markets.”<br />

www.fazer.com<br />

Wilhelm Vintilescu, CEO, O’Learys,<br />

Stockholm (SE)<br />

“Providing more and more people<br />

around the world with a restaurant that<br />

has a casual interior design so that does<br />

indeed feel like ‘Your Second Living<br />

Room’, and combining this with tasty,<br />

well-cooked food from good suppliers –<br />

this is our main driver today. Increasing<br />

the number of our restaurants is our key<br />

issue. In doing that, of course, the main<br />

challenge is to grow fast whilst, at the<br />

same time, keeping our unique identity<br />

and maintaining quality in all major aspects<br />

of our concept. Teaming up with<br />

the right international multi-operators is<br />

probably the way forward for O’Learys<br />

Bar&Restaurants.<br />

2012 has certainly been our most successful<br />

year since we started in 1988. In<br />

terms of growth, so far we are up 54% in<br />

chain expansion; like-for-like sales in existing<br />

restaurants have increased by<br />

17%. In June alone, like-for-like sales<br />

were up 44%, owing to the high level of<br />

interest in the <strong>Europe</strong>an Championship.<br />

As we work closely with Select <strong>Service</strong><br />

Partner (SSP), we can see that O’Learys<br />

restaurants in airports and train stations<br />

are picking up significantly. The challenge<br />

is, as I suggested, to grow in numbers<br />

whilst maintaining quality. Our educational<br />

platform, the O’Learys Academy,<br />

and the way we set up our franchisees<br />

are the most important drivers<br />

and also our major challenges.<br />

Our vision is to be one of the leading<br />

brands in the food industry. By establishing<br />

O’Learys in new markets, we want to<br />

expand the brand into several other<br />

countries and to become a role model<br />

within the industry with profitable,<br />

proud and happy franchisees.<br />

We are certainly humble enough to understand<br />

that there may be obstacles to<br />

growth over time. One main issue at the<br />

moment is whether customers will<br />

change the behavior they adopted when<br />

the Euro crisis hit … On the other hand,<br />

we must believe that we can attract customers<br />

whatever the climate. I am convinced<br />

that O’Learys will be attractive to<br />

many generations to come. ‘Your Second<br />

Living Room’ will always be a place to<br />

meet. www.olearys.se<br />

Magda Bresta, Strategy Director, Gregory’s<br />

<strong>Food</strong> <strong>Service</strong> Group, Athens (GR)<br />

“Like almost every other market, the<br />

Greek take-away food & coffee sector has<br />

been ‘traumatized’ by the severe economic,<br />

political and social crises of the<br />

past five years. Gregory’s, currently <strong>Europe</strong>’s<br />

8th largest coffee bar chain, entered<br />

this difficult period as the market<br />

leader in Greece (260 Coffeeright outlets,<br />

the majority of which are in Greece).<br />

First we re-evaluated our situation at<br />

home and afterwards we looked at the<br />

<strong>Europe</strong>an food & coffee market. Using<br />

these evaluations as a basis, we endeavoured<br />

to find the drivers behind potential<br />

growth and possibilities for entering<br />

new segments of our local market in<br />

Greece (e.g. bakery & patisserie products).<br />

Apart from that, we explored our<br />

chances of further expansion outside<br />

Greece (e.g. with a new store in the Bahamas).<br />

Besides the crisis-related changes in<br />

consumer behaviour we had to contend<br />

with the market’s low entry barriers, the<br />

62 FOODSERVICE EUROPE & MIDDLE EAST 6/12

MANAGEMENT<br />

low initial investment proposed by some<br />

competitors or independent operators<br />

(it is fairly easy to enter the take-away<br />

food & coffee market), the new government<br />

regulations for the industry and<br />

the revised taxation laws.<br />

We consider 2012 to be a very difficult,<br />

but surprisingly rewarding year for<br />

Gregory’s. Coping with the turbulent environment<br />

in Southern <strong>Europe</strong> has been<br />

a demanding task for every company.<br />

Nevertheless, we have been able to<br />

achieve positive results during the last<br />

three quarters. The driving force behind<br />

Gregory’s is our strategic plan, focusing<br />

on continued support for our franchisepartners,<br />

investing further in R&D and<br />

promoting product categories and services<br />

that add extra value to everyday<br />

transactions.<br />

At the beginning of 2012, Gregory’s introduced<br />

a bold pricing strategy: we<br />

were the first company to reduce the<br />

price of all coffee-based beverages, as a<br />

‘Thank you’ to our guests. The new pricing<br />

policy was backed by an extensive<br />

promotional campaign and strengthened<br />

further by below-the-line activities.<br />

The message of the campaign: great value<br />

for money, affordable for everyone.<br />

Thus, Gregory’s was able to keep customers<br />

happy, while increasing the<br />

number of visits.<br />

We realized from the very beginning of<br />

the crisis that all the variables had<br />

changed. The consumers’ behavioural<br />

patterns had changed, the average ticket<br />

was lower, and overall spending decreased<br />

significantly. People not only<br />

became more pessimistic about their future,<br />

they also saw their current income<br />

shrinking.<br />

Given the nature of our products (low<br />

price vs. high perceived value), we succeeded<br />

in preparing our partners for the<br />

deployment of strategies that might<br />

change the course of the market. By lowering<br />

operating costs and improving efficiency,<br />

Gregory’s successfully overcame<br />

some of the biggest risks. We also<br />

managed to lower the initial investment<br />

needed to open up a new store.<br />

Magda Bresta<br />

Keeping up with an environment that is<br />

constantly changing is in itself a very difficult<br />

task. Coming up with new ideas,<br />

recognizing opportunities as they arise,<br />

improving existing practices, educating<br />

partners and associates, expanding into<br />

new markets and overcoming obstacles,<br />

all within an unstable environment, will<br />

be the challenges that determine the<br />

market winners in the near future.”<br />

www.gregorys.gr<br />

■<br />

INTERNATIONAL TRADE JOURNAL FOR THE HOTEL, RESTAURANT<br />

& CATERING INDUSTRY 6/12<br />

Published by: Deutscher Fachverlag GmbH<br />

Address: Mainzer Landstrasse 251,<br />

60326 Frankfurt am Main, Germany<br />

Mail address: 60264 Frankfurt am Main,<br />

Germany<br />

Supervisory Board: Klaus Kottmeier,<br />

Andreas Lorch, Catrin Lorch, Peter Russ<br />

Executive Management Board: Peter Kley,<br />

Holger Knapp, Sönke Reimers, Angela Wisken<br />

Divisional Managing Directors:<br />

Peter Esser, Markus Gotta<br />

Phone: +49.69.7595-01, fax: -1510<br />

eMail: info@food-service-europe.com<br />

Editor-in-chief: Gretel Weiss (-1511). Editor<br />

in charge according to German press law.<br />

Managing editor: Marianne Wachholz (-1513)<br />

Editors: Charlotte Holzhäuser (-1506), Jutta<br />

Pfann schmidt- Wahl (-1514), Ilona Renner<br />

(-1798), Katrin Schendekehl (-1512), Barbara<br />

Schindler (-1503), Katrin Wissmann (-1512)<br />

Division manager: Dipl.-Kfm. Christiane Pretz (-1783)<br />

Sales manager: Dipl.-Kfm. Friederike Smuda (-1791)<br />

Marketing manager: Olga Fomitschow (-1271)<br />

Circulation manager: Klaus Gast (-1972)<br />

Director print media services: Kurt Herzig (-2461)<br />

Print production: Hans Dreyer (manager) (-2463)<br />

Logistics: Veronika Lorey (manager) (-2201)<br />

Design, graphical layout: Ch. Kummer, I. Wudtke<br />

Printed in Germany by: SocietätsDruck,<br />

Kurhessenstrasse 4-6, 64546 Mörfelden-Walldorf<br />

Banks:<br />

• Frankfurter Sparkasse, Frankfurt am Main,<br />

Germany. Sorting code: 500 502 01, account<br />

number: 34926, SWIFT CODE: HELA DEF 1822<br />

• Commerzbank Frankfurt am Main, Germany<br />

Sorting code: 500 400 00, account number:<br />

586555500, SWIFT CODE: COBA FF<br />

Subscription (6 issues/year): <strong>Europe</strong> excl.<br />

Germany U132.68 (incl. mailing fees and 7%<br />

VAT), Germany U124.00 (incl. mailing fees and<br />

U8.11 VAT), other countries U147.00 (incl.<br />

mailing fees).<br />

The publisher does not assume and hereby<br />

disclaims any liability to any person for any loss<br />

or damage caused by errors or omissions in<br />

the material contained herein, regardless of<br />

whether such errors result from negligence,<br />

accident or any other cause whatsoever.<br />

<strong>Food</strong><strong>Service</strong> <strong>Europe</strong> & Middle East<br />

Copyright by Deutscher Fachverlag GmbH<br />

All rights reserved. ISSN 2192-7987<br />

Other hotel & restaurant publications by<br />

Verlagsgruppe Deutscher Fachverlag:<br />

Germany: food-service, gv-praxis.<br />

In our affiliate Matthaes Verlag:<br />

AHGZ with supplement Der Hotelier.<br />

Austria: Österreichische Hotel & GV Praxis,<br />

Verlagsbüro Salzburg, Schrannengasse 2,<br />

A-5020 Salzburg, phone: +43.662.877108,<br />

fax: +43.662.877108-3, office@hgvpraxis.at<br />

Poland: <strong>Food</strong> <strong>Service</strong>, VFP Communications Ltd. Sp.<br />

z o.o., ul. Wa Miedzeszy´nski 630, 03-994 Warzsawa,<br />

phone: +48 22 5146500, fax: +48 22 7405055,<br />

maciej.nowak@media.com.pl, www.foodservice24.pl<br />

Russia: <strong>Food</strong><strong>Service</strong>, O.O.O. Russkoje Professionalnoje<br />

Isdatjelstwo, 2-nd Zvenigorodskaya 2/1,<br />

123100 Moscow, phone/fax: +7 495 228-1966,<br />

matveeva@prph.ru, www.prph.ru<br />

India: food<strong>Service</strong> India, Images Multimedia<br />

Pvt. Ltd. (29,6 %), S-21, Okhla Industrial Area,<br />

Phase - II, New Delhi 110 020 Indien, Phone:<br />

0091 11 4052-5000, Fax: -5001, info@imagesgroup.in,<br />

www.imagesgroup.in<br />

When an article presented by an author is accepted<br />

by the Publishing Company, the Publishing<br />

Company is granted the exclusive publication<br />

rights for the duration of the statutory<br />

copyright period. This transfer of copyright<br />

particularly covers the rights of the Publishing<br />

Company to reproduce (per microfilm, photocopy,<br />

CD-ROM or other processes) the article<br />

for business purposes and/or to feed it into<br />

either electronic or non-electronic data bases.<br />

Contributing Authors<br />

Lydie Anastassion, Paris, France<br />

Katie Dunne, Elliott Marketing & PR, Great<br />

Horwood, UK<br />

Doris Evans, Titirangi, Auckland, New Zealand<br />

Puck Kerkhoven, Hilversum, New Netherlands<br />

Sofia Selberg, Conceptuelle, Stockholm,<br />

Sweden<br />

Bruce Whitehall, Wallington, UK<br />

Translation Richard Hockaday, Frankfurt (M),<br />

Germany<br />

FOODSERVICE EUROPE & MIDDLE EAST 6/12<br />

63