International Opportunities Funds - Dragon Peacock ... - MetLife Alico

International Opportunities Funds - Dragon Peacock ... - MetLife Alico

International Opportunities Funds - Dragon Peacock ... - MetLife Alico

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

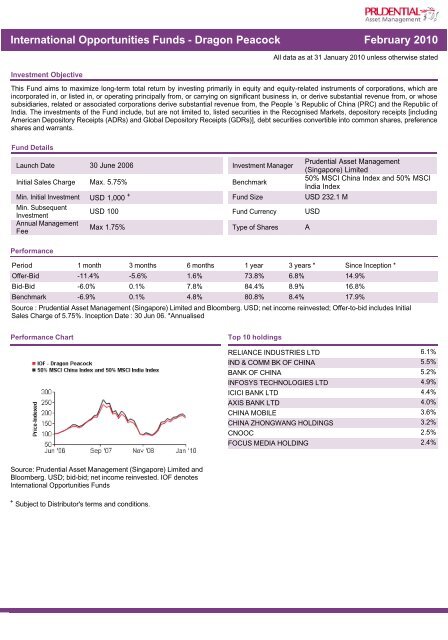

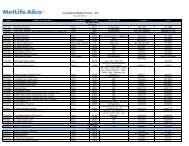

<strong>International</strong> <strong>Opportunities</strong> <strong>Funds</strong> - <strong>Dragon</strong> <strong>Peacock</strong> February 2010<br />

Investment Objective<br />

All data as at 31 January 2010 unless otherwise stated<br />

This Fund aims to maximize long-term total return by investing primarily in equity and equity-related instruments of corporations, which are<br />

incorporated in, or listed in, or operating principally from, or carrying on significant business in, or derive substantial revenue from, or whose<br />

subsidiaries, related or associated corporations derive substantial revenue from, the People ’s Republic of China (PRC) and the Republic of<br />

India. The investments of the Fund include, but are not limited to, listed securities in the Recognised Markets, depository receipts [including<br />

American Depository Receipts (ADRs) and Global Depository Receipts (GDRs)], debt securities convertible into common shares, preference<br />

shares and warrants.<br />

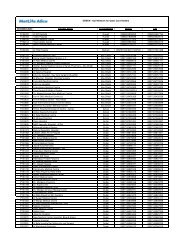

Fund Details<br />

Launch Date 30 June 2006 Investment Manager<br />

Prudential Asset Management<br />

(Singapore) Limited<br />

Initial Sales Charge Max. 5.75% Benchmark<br />

50% MSCI China Index and 50% MSCI<br />

India Index<br />

Min. Initial Investment USD 1,000<br />

+ Fund Size USD 232.1 M<br />

Min. Subsequent<br />

Investment<br />

Annual Management<br />

Fee<br />

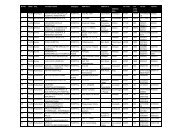

Performance<br />

Period<br />

1 month<br />

Offer-Bid -11.4%<br />

Bid-Bid -6.0%<br />

Benchmark -6.9%<br />

USD 100 Fund Currency USD<br />

Max 1.75% Type of Shares A<br />

3 months<br />

-5.6%<br />

0.1%<br />

0.1%<br />

6 months<br />

1.6%<br />

7.8%<br />

4.8%<br />

1 year<br />

73.8%<br />

84.4%<br />

80.8%<br />

3 years *<br />

6.8%<br />

8.9%<br />

8.4%<br />

Since Inception *<br />

Source : Prudential Asset Management (Singapore) Limited and Bloomberg. USD; net income reinvested; Offer-to-bid includes Initial<br />

Sales Charge of 5.75%. Inception Date : 30 Jun 06. *Annualised<br />

14.9%<br />

16.8%<br />

17.9%<br />

Performance Chart<br />

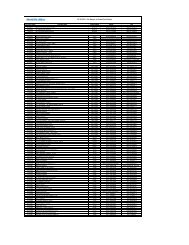

Top 10 holdings<br />

RELIANCE INDUSTRIES LTD 6.1%<br />

IND & COMM BK OF CHINA 5.5%<br />

BANK OF CHINA 5.2%<br />

INFOSYS TECHNOLOGIES LTD 4.9%<br />

ICICI BANK LTD 4.4%<br />

AXIS BANK LTD 4.0%<br />

CHINA MOBILE 3.6%<br />

CHINA ZHONGWANG HOLDINGS 3.2%<br />

CNOOC 2.5%<br />

FOCUS MEDIA HOLDING 2.4%<br />

Source: Prudential Asset Management (Singapore) Limited and<br />

Bloomberg. USD; bid-bid; net income reinvested. IOF denotes<br />

<strong>International</strong> <strong>Opportunities</strong> <strong>Funds</strong><br />

+ Subject to Distributor's terms and conditions.

Important Information<br />

The Fund is a sub-fund of the <strong>International</strong> <strong>Opportunities</strong> <strong>Funds</strong> (“the SICAV”), an open-ended investment company with variable capital<br />

(société d’investissement à capital variable) registered in the Grand Duchy of Luxembourg on the official list of collective investment<br />

undertakings pursuant to part I of the Luxembourg law of 20 December 2002 relating to undertakings for collective investment, as amended<br />

from time to time (the "2002 Law") and the Council Directive EEC/85/611 as amended (the "UCITS Directive"). This information is not an offer<br />

or solicitation of an offer for the purchase of investment shares in the Fund. A prospectus in relation to the Fund is available and may be<br />

obtained through Prudential Asset Management (Singapore) Limited ("PAMS") or any of its appointed distributors. All applications for shares<br />

in the Fund must be made on the application forms accompanying the prospectus. Potential investors should read the prospectus before<br />

deciding whether to subscribe for or purchase shares in the Fund. An investment in shares of the Fund is subject to investment risks, including<br />

the possible loss of the principal amount invested. Past performance is not necessarily a guide to the future or likely performance of the Fund.<br />

The value of the shares in the Fund and any income accruing to the shares, if any, may fall or rise. The information contained herein does not<br />

have any regard to the specific investment objective(s), financial situation or the particular needs of any person. Potential investors may wish to<br />

seek advice from a financial adviser before purchasing shares in the Fund. In the event that potential investors choose not to seek advice from<br />

a financial adviser, they should consider whether the Fund is a suitable investment for them. PAMS is an ultimately wholly-owned subsidiary of<br />

Prudential plc of the United Kingdom. PAMS and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company<br />

whose principal place of business is in the United States of America. In case of discrepancy between the English and Chinese versions of this<br />

information, the English version shall prevail.<br />

Prudential Asset Management (Singapore) Limited, Company Registration No. 199407631H<br />

30 Cecil Street #20-01 Prudential Tower. Singapore 049712 Tel (65) 6317-9618 Fax (65) 6536-3521 www.prufunds.com.sg<br />

Part of Prudential plc (United Kingdom)

Disclaimer<br />

This information has been distributed by Prudential Asset Management Limited<br />

(PAMD). PAMD is duly licensed and regulated by the Dubai Financial Services<br />

Authority (DFSA). PAMD is authorized by virtue of a Retail Endorsement to conduct<br />

financial services with or for Retail Clients, consequently, related financial products<br />

subject to the provisions set out in the offer documents of the relevant <strong>Funds</strong>, may also be<br />

offered to Retail investors. Prudential plc and PAMD is not affiliated in any manner with<br />

Prudential Financial, Inc., a company whose principal place of business is in the United<br />

States of America.