Company presentation - Mondobiotech

Company presentation - Mondobiotech

Company presentation - Mondobiotech

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Introduction to our<br />

business, August 2010<br />

SIX Swiss<br />

Exchange<br />

Symbol R<br />

ARE

Disclaimer<br />

The shares of <strong>Mondobiotech</strong> Holding AG have been traded since August 26th,<br />

2009 on the SIX Swiss Exchange with the symbol RARE.<br />

This document does not constitute or form<br />

part, or all, of any offer or invitation to sell or<br />

issue, neither in the United States of America<br />

nor elsewhere, or any solicitation of any offer to<br />

purchase or subscribe for, any securities, nor shall<br />

part, or all, of this document or its distribution<br />

form the basis of, or be relied on in connection<br />

with, any contract or investment decision in<br />

relation to any securities.<br />

This document includes forward-looking<br />

statements that involve substantial risks and<br />

uncertainties. These forward-looking statements<br />

are based on the <strong>Company</strong>’s current expectations<br />

and projections about future events.<br />

All statements, other than statements of historical<br />

facts, included in this document regarding the<br />

<strong>Company</strong>’s future operations, future financial<br />

position, future revenues, projected costs,<br />

plans and objectives of management<br />

are forward-looking statements.<br />

The words “anticipates”, “believes”, “estimates”,<br />

“expects”, “intends”, “may”, “plans”, “projects”,<br />

“will”, “would” and similar expressions are<br />

intended to identify forward-looking statements,<br />

although not all forward-looking statements<br />

contain these identifying words. The <strong>Company</strong><br />

may not achieve the plans, intentions or<br />

expectations disclosed in its forward-looking<br />

statements and there can be no assurance that<br />

results of the <strong>Company</strong>’s activities and its results<br />

of operations will not differ materially from its<br />

expectations.<br />

This document is from <strong>Mondobiotech</strong><br />

Holding AG. The information contained<br />

in it is intended solely for the use of the<br />

individual or entity to which they are addressed.<br />

Any unauthorized dissemination or copying<br />

of this document, is strictly prohibited<br />

and may be illegal.<br />

2/33

The context<br />

30’000 is the total number of known diseases at present.<br />

7’000 diseases are neglected or rare<br />

A Rare Disease is:<br />

In USA a disease affecting less than 200’000 people.<br />

In Europe disease affecting less than 5 in 10’000 people<br />

6% to 8% of the world population<br />

is affected by a rare disease<br />

In USA 30 million affected.<br />

In Europe 35 million affected.<br />

In the World 622 million affected.<br />

Generally there is no therapy for these patients<br />

3/33

Founders’ vision<br />

“for us, <strong>Mondobiotech</strong> is a long term<br />

project for changing the world of medicine<br />

in rare and neglected diseases.”<br />

(Fabio, Dorian, Patrick, Vera)<br />

4/33

Value drivers of our business<br />

• In the classical pharmaceutical and biotech<br />

field there is no correlation between<br />

resources invested in R&D and the resulting<br />

output obtained, at least not measurable<br />

in the numbers of new medicaments.<br />

Therefore, the development process is<br />

probably characterised by other value drivers.<br />

• We believe that in-depth information<br />

exchange, interaction, versatility and flexibility<br />

are such value drivers. Therefore, we<br />

operate with a continuously expanding<br />

community (scientists, physicians, patients,<br />

patient advocacy organisations etc.)<br />

who share their experience, know-how,<br />

expertise and skills with us and who, like us,<br />

are dedicated to the search of treatments<br />

for rare and neglected diseases<br />

(the “<strong>Mondobiotech</strong> community”).<br />

+ + +<br />

connect partecipate collaborate discuss<br />

5/33

Mission & business model<br />

Finding Therapies for Rare Diseasesof known dis<br />

• <strong>Mondobiotech</strong> is a Swiss search biotech<br />

company focused on finding treatments for<br />

rare and neglected diseases through<br />

our unique “Search & Match” engine.<br />

• The company partners with relevant<br />

communities or parties who are interested in<br />

reaching solutions for specific rare diseases.<br />

• We obtain effective and safe Medicinal<br />

Product Candidates (MPC’s) through redirecting<br />

existing and known substances into new<br />

therapeutic indications.<br />

• We analyze peptides and other biological<br />

immunomodulating substances that are<br />

naturally occurring in the human body<br />

in order to identify promising candidates<br />

for the development of medicinal<br />

products for use in the treatment of rare<br />

and neglected diseases.<br />

• The Search & Match engine combined<br />

with the know-how of our worldwide orphan<br />

scientific community has so far discovered<br />

more then 300 MPC’s for further exploration<br />

in as many as possible of the 7’000 rare<br />

and neglected diseases.<br />

• We license or sell our MPC’s to third parties<br />

(such as pharmaceutical or biotechnology<br />

companies) and/or to collaborate with<br />

third parties to obtain market authorizations<br />

and to commercialize such candidates.<br />

6/33

Key competitive strength<br />

Dry search rather than classical<br />

laboratory research (Search & Match):<br />

• By using IT tools and a proven methodology<br />

we search the vast amount of globally available<br />

data on biological and medical activities<br />

on known peptides and other biological<br />

immunomodulating substances as opposed to<br />

engaging in the traditional approach of drug<br />

discovery.<br />

Focus on bioactive substances<br />

of human origin (peptides):<br />

• We believe that peptides of human origin<br />

offer better efficacy and safety profiles<br />

compared to other classes of molecular<br />

entities.<br />

Focus on rare and neglected diseases:<br />

• We believe that rare and neglected diseases<br />

offer strong competitive advantage.<br />

Working and networking in a global<br />

community:<br />

• We believe that the mondoBIOTECH<br />

community is the only way to generate and<br />

conceive hundreds of MPC’s.<br />

Dual protection of the business:<br />

• Innovative intellectual property concepts<br />

and market protection through Orphan<br />

Medicinal Product Designations (OMPD) giving<br />

regulatory exclusivity for as much as seven<br />

years in the US, and 10 years in Europe and<br />

some other parts of the world.<br />

Outsourcing supervised by management:<br />

• The outsourcing of all non-core activities<br />

enables us to focus on our business model.<br />

7/33

<strong>Mondobiotech</strong> Community<br />

<strong>Mondobiotech</strong> collaborates with two types of communities:<br />

Scientists:<br />

• From the beginning, <strong>Mondobiotech</strong> chose and<br />

developed an open and collaborative scientific model<br />

that allows the exchange of knowledge and data.<br />

• Our frequent workshops and online collaborations<br />

enable a high level of participation allowing a natural<br />

and structural growth of the scientific community.<br />

Patients Associations:<br />

• To support the communities of patients associations<br />

<strong>Mondobiotech</strong> has developed an innovative collaborative project:<br />

the Stop Rare Foundation, www.stoprare.org.<br />

• Stoprare.org is the online place for patients associations<br />

to find, bring, support and exchange information<br />

on rare and neglected diseases, projects, research, etc.<br />

• Stop Rare Foundation’s goal is to improve the lives<br />

of patients with rare diseases and their families.<br />

8/33

Model validation<br />

For our vision, business model and potential impact on world health,<br />

the World Economic Forum selected us as Technology Pioneer 2008.<br />

“Why the company is a pioneer:<br />

Developments in technology have brought<br />

better medicines within the grasp of many<br />

patients. However, drug development remains<br />

expensive, so most large drug companies play<br />

it safe and concentrate on widespread diseases.<br />

Companies such as mondobiotech play an<br />

increasingly important role in making sure that<br />

sufferers of lesser-known diseases eventually<br />

find relief from their conditions”.<br />

(Technology Pioneer Report 2008, p.14)<br />

“To be selected as a Technology Pioneer,<br />

a company must be involved in the<br />

development of life-changing technology<br />

innovation and have potential for long–term<br />

impact on business and society. In addition,<br />

it must demonstrate visionary leadership,<br />

show the signs of being a long-standing<br />

market leader - and its technology must<br />

be proven”. (Rodolfo Lara,<br />

WEF’s Technology Pioneer program)<br />

Technology Pioneers were Google, Mozilla, the Wikimedia Foundation and Twitter.<br />

9/33

The orphan market<br />

• Worldwide, the orphan drug market reached<br />

$84.9 billion in 2009. The market is expected<br />

to grow at a compound annual growth<br />

rate (CAGR) of nearly 6% to reach $112.1 billion<br />

by 2014. The US accounted for 51% of the<br />

market in 2009 and is expected to grow at<br />

a CAGR of 8.9% to reach $65.9 billion by 2014.<br />

• The total worldwide market for orphan<br />

drugs, including sales for non-orphan<br />

applications, exceeded $28 billion in 2003. The<br />

market reached $58.7 billion in 2006, growing<br />

by 8% from $54.5 billion in 2005<br />

in orphan applications only.<br />

• Biological drugs accounted for a major share<br />

(64.3%) of the orphan drug market with sales<br />

of $54.6 billion in 2009, up from $51.4 billion<br />

(Source: www.bccresearch.com/report/PHM038C.html, published:<br />

May 2010, analyst: Syamala Ariyanchira, and reports of 2004 and 2007)<br />

in 2008. The size of the biological orphan drug<br />

market is projected to grow<br />

at a 6.9% CAGR to reach $76.2 billion by 2014.<br />

• In 2009 there were a total of more then<br />

350 orphan drugs approved in USA<br />

and 62 in Europe.<br />

• 57 drugs exceeded yearly sales of $200<br />

million and 27 of those exceeded sales<br />

of $1 billion.<br />

10/33

Search & Match<br />

312 medicaments<br />

for Rare and Neglected diseases<br />

Product candidates basic characteristics:<br />

• Peptides of human origin with known<br />

biological activity.<br />

• Synthetically manufactured.<br />

• Well researched by the global scientific<br />

community.<br />

• Proven safety profile.<br />

• Mode of action through ligation to specific<br />

receptors.<br />

• Same peptide or with minor modification<br />

present in many other species, which indicates<br />

that is an ancient molecule important for the<br />

basic metabolism of life.<br />

• Therapeutic platform potential.<br />

11/33

Examples of platforms’ rationales<br />

Interferon - γ (DK 1001)<br />

Known biological activity:<br />

• Antifibrotic<br />

• Antiproliferative<br />

• Antibiotic<br />

Safety:<br />

• Approved for pediatric<br />

and adult use via subcutaneous<br />

injection in Chronic<br />

Granulomatous disease<br />

(CGD) and severe malignant<br />

osteopetrosis.<br />

Rare indications and route<br />

of administration:<br />

• IPF via inhalation.<br />

• Two other indications<br />

via injection and inhalation<br />

to be disclosed after<br />

IP protection.<br />

Aviptadil (DK 1000)<br />

Known biological activity:<br />

• Antinflammatory<br />

• Immunoregulatory<br />

• Antiproliferative<br />

• Antibiotic<br />

• Antiapoptotic<br />

Safety:<br />

• Approved in combination<br />

with phentolamine<br />

in erectile dysfunction.<br />

• Used in various clinical<br />

trials in lung diseases over<br />

more than 2 decades<br />

and hundreds of patients.<br />

Homology with other species:<br />

• Identical in the following species:<br />

human, cow, rat, pig, dog, goat,<br />

sheep, mouse, monkey.<br />

Rare indications and route<br />

of administration:<br />

• PAH via inhalation.<br />

• Sarcoidosis via inhalation.<br />

• ARDS via injection.<br />

• IPF via inhalation.<br />

DasKloster 0210 (DK 0210)<br />

Known biological activity:<br />

• Immunoregulatory<br />

• Anti-pyretic<br />

• Antiproliferative<br />

• Antiallergic<br />

• Antifibrotic<br />

• Antinflammatory<br />

Safety:<br />

• Approved in combination<br />

with met-enkephaline<br />

for multiple sclerosis.<br />

Homology with other species:<br />

• Identical in Human, mice, rat, pig.<br />

Rare indications and route<br />

of administration:<br />

• Chronic Beryllium Disease<br />

via injection.<br />

• Glomerulonephrytis<br />

via injection.<br />

• Chronic Fatigue Syndrome<br />

via injection.<br />

12/33

IP protection & orphan market exclusivity<br />

Intellectual Property protection and market exclusivity are essential for succeeding in developing new therapeutic<br />

options in rare diseases. Our products platforms are protected in a dual way, through Orphan Drug Status<br />

Designations and a novel patent concept on products and/or indications.<br />

Orphan Drug Regulations<br />

in Europe and USA<br />

• In USA rare diseases are regulated by the Jan. 4th,<br />

1983 Orphan Drug Act (ODA).<br />

• In Europe rare diseases are regulated by the year<br />

2000 EU Regulation 141/2000.<br />

• Major advantages of the Orphan Drug Regulations are:<br />

• Grants for research.<br />

• Free protocol advice assistance.<br />

• Free or consistent costs reductions<br />

for new applications, marketing<br />

authorizations and post-authorization<br />

activities.<br />

• Fast-track procedures and approvals.<br />

• Seven years (USA) and ten years<br />

(EU) market exclusivity after market authorization.<br />

<strong>Mondobiotech</strong><br />

Orphan Drug Status Designations (ODS)<br />

2003 EMEA:<br />

ODS for Aviptadil in PAH and CTEPH received 23/12/2003<br />

(EU/3/03/173).<br />

2005 FDA:<br />

ODS for Aviptadil in PAH received 22/02/2005.<br />

2005 EMEA:<br />

ODS for Interferon gamma in IPF received 30/05/2005<br />

(EU/3/05/281).<br />

2005 FDA:<br />

ODS for Aviptadil in ARDS received 01/06/2005.<br />

2006 EMEA:<br />

ODS for Aviptadil in Acute Lung Injury (ALI)<br />

received 28/08/2006 (EU/3/06/395).<br />

<strong>Mondobiotech</strong> Patents<br />

2005: Interferon gamma patent (EP 0 795 332 B1) for: “Medical use of Gamma Interferon in Interstitial Lung Diseases” received 01/06/2005.<br />

2007: Started the patent application program to cover more than 300 product platforms for rare diseases.<br />

13/33

Licensing package<br />

Products ready to enter negotiation for licensing<br />

are accompanied by full product documentation<br />

that interested parties can request.<br />

Documentation includes:<br />

Medicinal Product Candidate<br />

Development Activities<br />

Diseases<br />

Financial Information<br />

IP & Legal<br />

Offered Services<br />

Dossier, API information, Published information.<br />

In vitro activities, Pre-clinical activities, Clinical activities.<br />

Disease dossier, Centers of excellence, Patients associations & other key entities,<br />

Published data, Development plan.<br />

Key competitor, Other market information, Projected sales.<br />

Protection documentation, PCT application, ISR (if available), National applications<br />

(if available): USA, Europe, Australia, Canada, Japan, Singapore, United Arab Emirates,<br />

Korea, Russia. Orphan drug designations/Orphan drug application and granting<br />

(EU/US), EU Regulations, US Regulations, Standard licensing contract and conditions,<br />

Standard service contract.<br />

API, Protocol assistance, Orphan drug & Regulatory assistance, Networking with<br />

<strong>Mondobiotech</strong> Community (Scientific, Medical, Centers of excellence, Laboratory,<br />

Research organizations and other experts), Scientific & Medical Workshops for developing<br />

and prompting the project, Co-marketing, other development services upon request.<br />

14/33

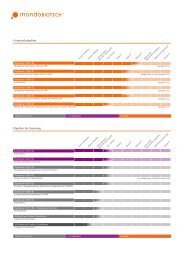

Licensed pipeline<br />

Search & Match<br />

Patent Applied<br />

Pre-clinical<br />

Development<br />

with the Community<br />

ready for licensing in negotiation licensed<br />

Phase I<br />

Phase II<br />

Phase III<br />

Marketing<br />

Autorization Applied<br />

Marketing Approved<br />

DasKloster 1001-01<br />

Idiopathic Pulmonary Fibrosis (IPF) InterMune Inc.<br />

DasKloster 1000-01<br />

Pulmonary Arterial Hypertension (PAH)<br />

DasKloster 1000–02<br />

Sarcoidosis<br />

DasKloster 1000–03<br />

Idiopathic Pulmonary Fibrosis (IPF)<br />

DasKloster 1000–04<br />

Acute Respiratory Distress Syndrome (ARDS/ALI)<br />

DasKloster 0138–01<br />

Methicillin-Resistant Staphylococcus Aureus in Cystic Fibrosis<br />

Phase IV<br />

Biogen Idec Inc. & Lung Rx, LLC<br />

Lung Rx, LLC<br />

Lung Rx, LLC<br />

Lung Rx, LLC<br />

Lung Rx, LLC<br />

15/33

Licensed products<br />

Aviptadil platform to Lung Rx (Nasdaq: UTHR), incl. Biogen Idec (Nasdaq: BIIB)<br />

DasKloster 1000-01<br />

Indication:<br />

Milestones:<br />

Royalties:<br />

Peak sales:<br />

Status:<br />

Next milestone*:<br />

DasKloster 1000-03<br />

Indication:<br />

Milestones:<br />

Royalties:<br />

Peak sales:<br />

Status:<br />

Next milestone*:<br />

DasKloster 1000-02<br />

Indication:<br />

Milestones:<br />

Royalties:<br />

Peak sales:<br />

Status:<br />

Next milestone*:<br />

DasKloster 1000-04<br />

Indication:<br />

Milestones:<br />

Royalties:<br />

Peak sales:<br />

Status:<br />

Next milestone*:<br />

Pulmonary Arterial Hypertension (PAH)<br />

US$ 10m end of phase III; US$ 20m marketing authorization<br />

approx. 10% on net sales on the whole platform<br />

estimated US$ 1.5 billion (comparables: Actelion (ATLN))<br />

preparation of phase III<br />

end of phase III expected in 2013<br />

Idiopathic Pulmonary Fibrosis (IPF)<br />

US$ 10m end of phase III; US$ 10m marketing authorization<br />

approx. 10% on net sales on the whole platform<br />

estimated US$ 1.5 billion Status:<br />

preparation of phase IIb<br />

end of phase III expected in 2013<br />

Sarcoidosis<br />

US$ 10m end of phase III; US$ 10m marketing authorization<br />

approx. 10% on net sales on the whole platform<br />

estimated US$ 200 million<br />

preparation of phase IIb<br />

end of phase III expected in 2013<br />

Acute Respiratory Distress Syndrome/Acute Lung Injury (ARDS/ALI)<br />

US$ 10m end of phase III; US$ 10m marketing authorization<br />

approx. 10% on net sales on the whole platform<br />

estimated US$ 200m<br />

preparation of phase II<br />

end of phase III expected in 2013<br />

* based on, and subject to, licensing partners development plans. 16/33

Licensed products<br />

Secretin to Lung Rx (Nasdaq: UTHR)<br />

DasKloster 0138-01<br />

Indication:<br />

Milestones:<br />

Royalties:<br />

Peak sales:<br />

Status:<br />

Next milestone*:<br />

4 further MPC for lung diseases to be chosen by Lung Rx (Nasdaq: UTHR)<br />

Interferon-γ to Intermune (Nasdaq: ITMN)<br />

DasKloster 1001-01<br />

Indication:<br />

Peak sales:<br />

Methicillin-Resistant Staphylococcus Aureus in Cystic Fibrosis (MRSA in CF)<br />

US$ 100’000 signing-up, US$ 1m end of phase II; US$ 10m marketing authorization<br />

10% on net sales<br />

US$ 200m<br />

clinical development started<br />

end of phase II expected in 2012<br />

Lung Rx, a wholly-owned subsidiary of United Therapeutics (Nasdaq: UTHR), has the right to choose between additional 4 MPC<br />

within our pipeline at its discretion. Same conditions as above. Peak sales estimated between US$ 100 - 200 million.<br />

Idiopathic Pulmonary Fibrosis (IPF)<br />

US$ 100 - 400 million (source: Global Data - IPF market report 2010)<br />

The project is on-hold at Intermune and will not more generate revenue flows. Based on our<br />

know-how in IPF, we intend to re-define the formulation and the clinical development of INF-γ<br />

and working for having this drug approved for IPF.<br />

* based on, and subject to, licensing partners development plans. 17/33

Licensed pipeline<br />

DasKloster 0182–01<br />

Sarcoidosis<br />

DasKloster 0210–01<br />

Chronic Beryllium Disease<br />

DasKloster 0274–01<br />

Pseudomonas Aeruginosa in Cystic Fibrosis<br />

DasKloster 0249–01<br />

Drug-Resistant Tuberculosis<br />

DasKloster 0247–01<br />

Chronic Thromboembolic Pulmonary Hypertension (CTEPH)<br />

DasKloster 0080-01<br />

Lymphangioleiomyomatosis (LAM)<br />

DasKloster 0039–01<br />

Asbestosis<br />

DasKloster 0112-01 + DasKloster 0228–01<br />

Scleroderma<br />

28 Medicinal Product Candidates<br />

Target not disclosed<br />

260 Medicinal Product Candidates<br />

Target not disclosed<br />

Search & Match<br />

Patent Applied<br />

Pre-clinical<br />

Development<br />

with the Community<br />

ready for licensing in negotiation licensed<br />

Phase I<br />

Phase II<br />

Phase III<br />

Marketing<br />

Autorization Applied<br />

Marketing Approved<br />

Phase IV<br />

In collaboration with Pharmarare SA<br />

18/33

Products for licensing<br />

MPC at advanced development stage<br />

We intend to enter into licensing-out agreements. We are also evaluating new approaches for financing further development, and with<br />

respect to one of such MPC, a development contribution agreement for CHF 1.5 million is in place with Pharmarare SA (privately held company).<br />

Once commercialized, we will share milestones and royalties on such MPC. We estimate a standard licensing-out agreement structure<br />

as it was the case with Lung Rx but with favorable royalty rates and peak sales for these MPC between US$ 100 - 200 million.<br />

DasKloster 0182-01<br />

DasKloster 0210-01<br />

DasKloster 0274-01<br />

DasKloster 0249-01<br />

DasKloster 0247-01<br />

DasKloster 0080-01<br />

DasKloster 0039-01<br />

DasKloster 0112-01 + DasKloster 0228-01<br />

MPC at early development stage<br />

We work with the mondobiotech community to complete the dossiers and have them ready to further development and/or out-licensed.<br />

We estimate a standard licensing-out agreement structure pursuant to the above and peak sales for these MPC between US$ 100 - 150 million.<br />

• 28 MPC’s (targets undisclosed)<br />

Patent filed pipeline<br />

IP filed for patent granting (start nationalization phases first half 2010) covering the MPC’s in different disease areas and ready for being further<br />

developed and/or licensed. We estimate a standard licensing-out agreement structure at least as it was the case with United Therapeutics and<br />

peak sales on these MPC between US$ 50 - 150 million.<br />

• 260 MPC’s (targets undisclosed)<br />

Sarcoidosis<br />

Chronic Beryllium Disease (CBD)<br />

Pseudomonas Aeruginosa in Cystic Fibrosis<br />

XDR & MDR Tuberculosis<br />

Chronic Thromboembolic Pulmonary Hypertension (CTEPH)<br />

Lymphangioleiomyomatosis (LAM)<br />

Asbestosis<br />

Scleroderma<br />

19/33

Business validation<br />

Science<br />

IP<br />

Business<br />

Strategic Alliances<br />

Financial<br />

Founders<br />

More than 300 potentially efficacious treatments discovered.<br />

1 product in phase III and 4 products in phase II clinical trials,<br />

6 products ready to enter in clinical trials phases, 32 products to start<br />

clinical development, 260 products to start development.<br />

6 Orphan Medicinal Products Designations in USA and Europe, 1 patent<br />

granted for IFN-γ (EP 0 795 332 B1) and the products in the pipeline<br />

protected by patent applications.<br />

10 indications licensed to two partners, InterMune and Lung Rx, a United<br />

Therapeutics subsidiary (incl. Biogen Idec), and capacity to license more.<br />

23andMe for genetic research for patients in rare diseases;<br />

Bachem for peptides manufacturing; Nebu-Tec for inhalation;<br />

SRI for preclinical testing and biological screening.<br />

Traded at the SIX Swiss Exchange with symbol RARE,<br />

top investors from family firms continue their commitment<br />

to the company, BSI bank of Generali Insurance Group<br />

as house bank and WR Hambrecht bank as financial advisor.<br />

Majority shareholders still involved as from the beginning with the same<br />

long term investment vision.<br />

20/33

WR Hambrecht+Co.<br />

• Founded in 1998 by William R. Hambrecht,<br />

WR Hambrecht + Co is a financial services firm committed<br />

to using technology and auction processes to provide<br />

open and fair access to financial markets for all its clients.<br />

The firm’s impartial auctions, which allow the market to<br />

determine pricing and allocation, are dramatically changing<br />

the financial services landscape. www.wrhambrecht.com<br />

• William R. Hambrecht in 1968 co-founded Hambrecht &<br />

Quist, an investment banking firm specialized in emerging<br />

high-growth technology companies that was sold in 1999<br />

for US$ 1.35B to Chase Manhattan Bank.<br />

• WR Hambrecht + Co. and <strong>Mondobiotech</strong> signed<br />

a collaboration agreement in April 2010 for the exclusive<br />

placement of <strong>Mondobiotech</strong> securities and other financial<br />

and strategic services.<br />

• WR Hambrecht + Co. has auctioned in the last decade<br />

some of the most important IPOs including Google, NetSuite<br />

and Morningstar plus other important placements.<br />

21/33

Stock snapshot<br />

Reported capital Commercial register<br />

Listed share capital (in units) 1'327'805 Share capital (in units) 54'229'365<br />

Listed share capital CHF 132'781 Share capital CHF 661'797<br />

Conditional capital (in units) 3'269'413<br />

Conditional capital CHF 326'941<br />

Authorised capital (in units) 3'190'279<br />

Authorised capital CHF 319'028<br />

Shares detail<br />

Valor symbol RARE Trading 26.08.2009 -<br />

Valor number 10'191'073 Security type Registered share<br />

ISIN CH0101910732<br />

Trading currency CHF Security segment Swiss Shares<br />

Exchange SIX Swiss Exchange Primary listed yes<br />

Product line Mid & Small Caps Swiss Shares<br />

Issued by mondoBIOTECH holding AG Regulatory standard Main Standard<br />

Number in issue 1'327'805 Clearing via SegaInterSettle AG<br />

Nominal value 0.10 Settlement currency CHF<br />

Dividend entitlement 1x per year<br />

R ARE<br />

SIX Swiss<br />

Exchange<br />

Symbol<br />

Index member SPI SXI Bio+Medtech<br />

SPI Extra SXI Life Sciences<br />

SPI ex SLI Swiss All Share Index<br />

Sarasin Swiss IPO Index<br />

Stock value on July 27th, 2010 at 5pm: CHF 73.00<br />

Market Cap on July 27th, 2010 at 5pm: CHF 483.11 million<br />

Stock quote online www.six-swiss-exchange.com/shares/security_info_en.html?id=CH0101910732CHF4<br />

22/33

Share capital structure<br />

A corporate structure to ensure stability and a long time horizon:<br />

• The original investors and co-founders<br />

own the unlisted share majority with privileged<br />

voting rights in order to underscore their<br />

commitment.<br />

• The community can also hold a financial<br />

stake in the company by purchasing SIX<br />

Swiss Exchange listed shares.<br />

• This dual share structure generates stability<br />

in the long term and ensures the company’s<br />

leadership team maintains the ability to<br />

continue the innovative approach that has<br />

characterized the company from the outset<br />

without it suffering from an unfriendly<br />

take-over or any other form of control oriented<br />

speculation.<br />

• Google, The New York Times,<br />

The Washington Post, The Wall Street Journal,<br />

Roche and Berkshire Hathaway (a Warren<br />

Buffett’s subsidiary) are all examples of<br />

companies having a similar capital structure.<br />

23/33

Financial strategy<br />

Small, flexible and specialized<br />

organization with high value added<br />

profile and clear cost structure for:<br />

• discovering and conceiving MPC’s<br />

• interacting and networking with<br />

the <strong>Mondobiotech</strong> community<br />

• outsourcing all non-core activities<br />

Aggressive licensing strategy<br />

breaking the tradition:<br />

• moderate signing-up and milestones<br />

at early development stages<br />

• significant milestones and royalties at,<br />

and after, marketing authorization<br />

Goals:<br />

• demonstrate effectiveness and efficacy<br />

of the business model<br />

• finance organic growth of the structure<br />

through multiple fund raisings<br />

• enlarge shareholders’ basis through<br />

the public listing of the company<br />

Financials:<br />

• Cash and Cash equivalents on Dec. 31st 2009:<br />

4,6mio.<br />

• Raised on Jan. 25th 2010:<br />

net CHF 8,5mio.<br />

• Expenses estimation for 2010:<br />

CHF 12,6mio.<br />

24/33

Financial data - segment reporting<br />

(in 1’000 CHF)<br />

‘Project’ segment (core):<br />

• moderate cost effect of our discovering and conceiving approach and the community networking clearly stated.<br />

• we are able to generate revenues.<br />

‘Services’ segment (not core - deriving from collaborations with licensing-out partners):<br />

• our partners are ready to pay for high value added services.<br />

* Financial data are in thousand CHF. Adjustments may not exactly correspond to audited financial data.<br />

Projects Services Corporate Total<br />

31.12.2009:<br />

Revenues from external customers 610 13.130 - 13.740<br />

Inter-segment revenues 95 - 685 780<br />

Segmental costs (13.398) (11.496) (1.735) (26.628)<br />

Segmental operating results (12.693) 1.635 (1.050) (12.108)<br />

Included in segmental operating resut are><br />

- depreciacion, amortization and other write-offs (5.336) (108) - (5.444)<br />

31.12.2008:<br />

Revenues from external customers 316 14.229 - 14.545<br />

Inter-segment revenues 262 - 632 894<br />

Segmental costs (11.622) (12.349) (637) (24.608)<br />

Segmental operating results (11.044) 1.880 (5) (9.169)<br />

Included in segmental operating resut are><br />

- depreciacion, amortization and other write-offs (3.402) (206) (36) (3.644)<br />

25/33

Financial data - global view<br />

(in 1’000 CHF)<br />

We generated operating revenues of CHF 45.5 million in the last years (2006 - 2009)<br />

from licensing out (11.5m) and development services (34m), against operating expenses of CHF 74.7 million.<br />

We raised net proceeds of CHF 28 million in the same period. On February we closed a further reserved<br />

fund raising for net CHF 8.5 million. To fund the further development of our pipeline, we plan additional share<br />

capital increases. We intend to issue new shares to investors and to the <strong>Mondobiotech</strong> community.<br />

* Financial data are in thousand CHF. Adjustments may not exactly correspond to audited financial data.<br />

2009 2008 2007 2006<br />

Revenues 13.740 14.545 14.827 2.480<br />

Research & development (20.146) (20.173) (11.291) (4.824)<br />

Sales & marketing (3.632) (2.351) (3.762) (2.047)<br />

Management & administration (2.071) (1.192) (1.510) (1.754)<br />

Operating result (12.108) (9.170) (1.735) (6.145)<br />

Total non-current and other current assets 60.586 62.576 68.121 61.458<br />

Cash and cash equivalents 4.632 14.085 11.009 15.306<br />

Total assets 65.218 76.662 79.130 76.764<br />

Total shareholder's equity 56.733 68.937 64.496 66.134<br />

Liabilities 8.486 7.725 14.634 10.630<br />

Total equities and liabilities 65.218 76.662 79.130 76.764<br />

26/33

Financial Calendar<br />

Next Corporate Appointments:<br />

• August 31st 2010<br />

• March 31st 2011<br />

• April/May 2011<br />

Half Year Financial Results 2010<br />

Annual Report 2010<br />

Ordinary General Assembly, DasKlosterStans<br />

For additional information on please contact <strong>Mondobiotech</strong> Investor & External Relations:<br />

investor@mondobiotech.com - T. +41 840 200 010.<br />

27/33

Management<br />

Patrick<br />

Pozzorini<br />

Chief Financial<br />

Officer, founder.<br />

Patrick holds a degree<br />

in business economics<br />

from the University<br />

of Zurich. From 1995<br />

to 2000, he worked<br />

for Pricewaterhouse<br />

Coopers AG and<br />

from 1992 to 1995<br />

for Fidinam Group.<br />

He was born in 1967.<br />

Vera<br />

Cavalli<br />

Chief Pharmaceutical<br />

Officer, founder.<br />

Vera graduated<br />

in pharmacy at the<br />

University of Basel.<br />

She gained five years<br />

of pharmacy business<br />

experience working<br />

in various pharmacies.<br />

From 1999 to 2000<br />

she worked in the sales<br />

department for the<br />

Swiss market of Searle<br />

SA (Monsanto group).<br />

She was born in 1968.<br />

Fabio<br />

Cavalli<br />

Executive Chairman<br />

& Chief Business Architect,<br />

founder.<br />

Fabio has founded<br />

several successful<br />

start-ups in IT,<br />

consumer services<br />

and sports goods<br />

fields, gaining<br />

thereby considerable<br />

marketing and<br />

sales experience.<br />

Fabio is Swiss<br />

Entrepreneur of<br />

the year 2006.<br />

He was born in 1955.<br />

Ruggero<br />

Gramatica<br />

Chief Executive Officer.<br />

Ruggero has an extensive<br />

experience in startups<br />

and companies’<br />

turnaround particularly<br />

in the services industry<br />

having successfully<br />

contributed to the<br />

growth of Fastweb,<br />

Covad Communications,<br />

PacificBell, Omnitel-<br />

Vodafone, Bulldog<br />

and OnTelecoms .<br />

He brings strategic<br />

leadership as<br />

well as technological<br />

and operational<br />

expertise to bear.<br />

He was born in 1965.<br />

Maria Teresa<br />

D’Antonangelo<br />

Chief Operating Officer.<br />

Maria Teresa graduated<br />

in Law at the University<br />

of Parma. She specialized<br />

in the field of Intellectual<br />

and Industrial Property<br />

Litigations with Prof.<br />

Mario Franzosi in Milan.<br />

She has been admitted<br />

to the Doctorate in<br />

Intellectual Property Law<br />

at the University of Parma.<br />

She was born in 1973.<br />

Dorian<br />

Bevec<br />

Chief Scientific<br />

Officer, founder.<br />

Dorian holds a Ph.D.<br />

from the Ludwig-<br />

Maximilians-University<br />

of Munich and a habilitation<br />

(Venia Docendi) from<br />

the University of Vienna.<br />

He worked as Head<br />

of Molecular Biology<br />

and project team leader<br />

at the Sandoz Research<br />

Institute in Vienna for ten<br />

years and at Axxima AG<br />

in Martinsried for two years.<br />

He was born in 1957.<br />

28/33

Board<br />

Robert Edward<br />

Patterson<br />

Managing Director<br />

Peninsula Venture<br />

Fabio Cavalli<br />

Executive Chairman,<br />

Chief Business<br />

Architect, founder<br />

Prof.<br />

Michael Alan Keller<br />

Stanford University Librarian<br />

Graf Francis<br />

von Seilern-Aspang<br />

CEO Industrie u. Finanzkontor<br />

Prof. Dr. Med.<br />

Thomas Cerny<br />

Head of Oncology,<br />

University of St. Gallen<br />

Prinz Michael von<br />

und zu Liechtenstein<br />

Vice – Chairman<br />

Ruggero<br />

Gramatica<br />

CEO <strong>Mondobiotech</strong><br />

Prof.<br />

Geoffrey West<br />

Distinguished Professor and former<br />

President of the Santa Fe Institute<br />

Vera Cavalli<br />

Chief Pharmaceutical<br />

Officer, founder<br />

Prof. Dr.<br />

Robert Huber<br />

Nobel Prize Laureate<br />

Prof.<br />

Roland M. du Bois<br />

Professor of Respiratory Medicine,<br />

Imperial College, London<br />

29/33

Awards<br />

2008<br />

<strong>Mondobiotech</strong><br />

recepient<br />

of The Swiss<br />

Innovation<br />

Award by<br />

the Central<br />

Swiss Chamber<br />

of Commerce.<br />

2007<br />

<strong>Mondobiotech</strong><br />

selected as<br />

Technology<br />

Pioneer<br />

by the World<br />

Economic<br />

Forum.<br />

2007<br />

<strong>Mondobiotech</strong><br />

selected by<br />

an independent<br />

jury as the<br />

Best Innovator.<br />

2006<br />

Chief Business<br />

Architect<br />

Fabio Cavalli<br />

receives<br />

Start-up Swiss<br />

Entrepreneur<br />

of the Year.<br />

2005<br />

Winner<br />

of the Swiss Life<br />

Sciences Prize.<br />

30/33

About us<br />

• We started the <strong>Company</strong> in 2001 on two<br />

fundamental ideas: use known, existing substances<br />

with safe profiles; interact and network with the<br />

communities.<br />

• The first licensing-out agreement was signed<br />

at the end 2001/beginning 2002 with NASDAQ-listed<br />

Intermune, Inc.<br />

• From 2001 to 2006 we developed the methodology<br />

to continuously generate a large number of MPC’s,<br />

the Search & Match Engine.<br />

• In 2006 we closed our second licensing-out<br />

agreement with NASDAQ-listed Biogen Idec, Inc.<br />

• In 2007, we entered into a third licensing-out<br />

agreement with NASDAQ-listed United Therapeutics,<br />

Inc. for five MPC projects at ‘dry search’ stage only.<br />

This agreement was important for us insofar as<br />

it demonstrated the scientific foundation of our<br />

business model.<br />

• In 2009 we began a partnership with 23andMe, Inc.<br />

to advance research in collecting data by genotyping<br />

patients affected by rare diseases.<br />

• As of August 2009 the shares of the <strong>Company</strong> are<br />

listed on the SIX Swiss Exchange with the symbol<br />

RARE.<br />

• In September 2009 we enforced our agreement<br />

with SIX-listed Bachem Holding AG with respect to<br />

peptides in the development of MPC’s.<br />

• Beginning 2010 we expanded our agreement<br />

with Biogen Idec Inc. to United Therapeutics, Inc.,<br />

therefore ensuring the development of Aviptadil to a<br />

whole platform.<br />

• In April 2010 we signed a collaboration agreement<br />

with WR Hambrecht + Co. for the exclusive<br />

placement of <strong>Mondobiotech</strong> securities and other<br />

financial and strategic services.<br />

• To date, we have more then 300 MPCs covered by<br />

intellectual property for further development and/or<br />

licensing.<br />

31/33

Meet us<br />

Selected management will present the company at the following conferences:<br />

• Sept. 13-15, 2010<br />

• Sept. 15-17, 2010<br />

• Sept. 29-30, 2010<br />

• Oct. 10-12, 2010<br />

Rodman & Renshaw 12th Annual Healthcare Conference New York Palace Hotel,<br />

New York USA<br />

www.rodm.com/conferences<br />

BioPharm America 2010 Marriot Boston Copley Place, Boston USA<br />

www.ebdgroup.com/bpa/index.php<br />

10th Annual Biotech in Europe Investor Forum<br />

Radisson Blu Hotel, Zurich Airport Switzerland<br />

www.sachsforum.com/zurich10/index.html<br />

<strong>Mondobiotech</strong> will present on Sept. 29th in the afternoon session<br />

18th Annual BioPartnering Europe QEII Conference Center, London<br />

UK www.techvision.com/bpe<br />

<strong>Mondobiotech</strong> will present on Oct. 12th at 9.30am in the Abbey Room West<br />

To organize 1-to-1 meetings with the management at these events or in other venues please contact<br />

<strong>Mondobiotech</strong> Investor & External Relations: investor@mondobiotech.com - T. +41 840 200 010.<br />

32/33

<strong>Mondobiotech</strong> Holding AG<br />

DasKloster<br />

Mürgstrasse 18<br />

CH – 6370 Stans<br />

Switzerland<br />

www.mondobiotech.com<br />

IR Contact<br />

Paolo Bassanini<br />

T +41 840 200 010<br />

F +41 840 200 011<br />

investor@mondobiotech.com