Northern 3 VCT PLC Application Form - Clubfinance

Northern 3 VCT PLC Application Form - Clubfinance

Northern 3 VCT PLC Application Form - Clubfinance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

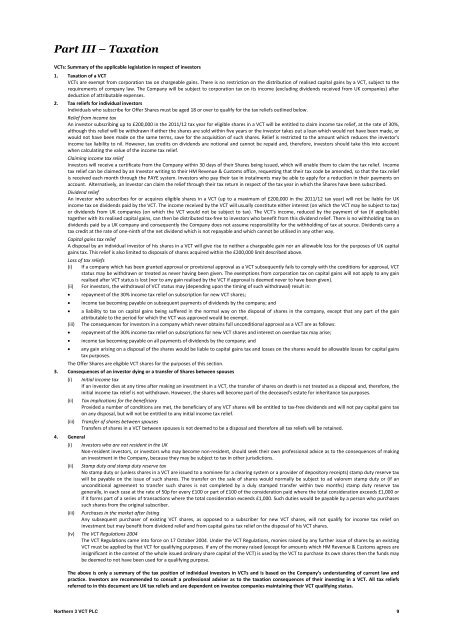

Part III – Taxation<br />

<strong>VCT</strong>s:Summaryoftheapplicablelegislationinrespectofinvestors<br />

1. Taxationofa<strong>VCT</strong><br />

<strong>VCT</strong>sareexemptfromcorporationtaxonchargeablegains.Thereisnorestrictiononthedistributionofrealisedcapitalgainsbya<strong>VCT</strong>,subjecttothe<br />

requirementsofcompanylaw.TheCompanywillbesubjecttocorporationtaxonitsincome(excludingdividendsreceivedfromUKcompanies)after<br />

deductionofattributableexpenses.<br />

2. Taxreliefsforindividualinvestors<br />

IndividualswhosubscribeforOfferSharesmustbeaged18orovertoqualifyforthetaxreliefsoutlinedbelow.<br />

Relieffromincometax<br />

Aninvestorsubscribingupto£200,000inthe2011/12taxyearforeligiblesharesina<strong>VCT</strong>willbeentitledtoclaimincometaxrelief,attherateof30%,<br />

althoughthisreliefwillbewithdrawnifeitherthesharesaresoldwithinfiveyearsortheinvestortakesoutaloanwhichwouldnothavebeenmade,or<br />

wouldnothavebeenmadeonthesameterms,savefortheacquisitionofsuchshares.Reliefisrestrictedtotheamountwhichreducestheinvestor's<br />

incometaxliabilitytonil.However,taxcreditsondividendsarenotionalandcannotberepaidand,therefore,investorsshouldtakethisintoaccount<br />

whencalculatingthevalueoftheincometaxrelief.<br />

Claimingincometaxrelief<br />

InvestorswillreceiveacertificatefromtheCompanywithin30daysoftheirSharesbeingissued,whichwillenablethemtoclaimthetaxrelief.Income<br />

taxreliefcanbeclaimedbyanInvestorwritingtotheirHMRevenue&Customsoffice,requestingthattheirtaxcodebeamended,sothatthetaxrelief<br />

isreceivedeachmonththroughthePAYEsystem.Investorswhopaytheirtaxininstalmentsmaybeabletoapplyforareductionintheirpaymentson<br />

account.Alternatively,anInvestorcanclaimthereliefthroughtheirtaxreturninrespectofthetaxyearinwhichtheShareshavebeensubscribed.<br />

Dividendrelief<br />

Aninvestorwhosubscribesfororacquireseligiblesharesina<strong>VCT</strong>(uptoamaximumof£200,000inthe2011/12taxyear)willnotbeliableforUK<br />

incometaxondividendspaidbythe<strong>VCT</strong>.Theincomereceivedbythe<strong>VCT</strong>willusuallyconstituteeitherinterest(onwhichthe<strong>VCT</strong>maybesubjecttotax)<br />

or dividends from UK companies (on which the <strong>VCT</strong> would not be subject to tax). The <strong>VCT</strong>'s income, reduced by the payment of tax (if applicable)<br />

togetherwithitsrealisedcapitalgains,canthenbedistributedtaxfreetoinvestorswhobenefitfromthisdividendrelief.Thereisnowithholdingtaxon<br />

dividendspaidbyaUKcompanyandconsequentlytheCompanydoesnotassumeresponsibilityforthewithholdingoftaxatsource.Dividendscarrya<br />

taxcreditattherateofoneninthofthenetdividendwhichisnotrepayableandwhichcannotbeutilisedinanyotherway.<br />

Capitalgainstaxrelief<br />

Adisposalbyanindividualinvestorofhissharesina<strong>VCT</strong>willgiverisetoneitherachargeablegainnoranallowablelossforthepurposesofUKcapital<br />

gainstax.Thisreliefisalsolimitedtodisposalsofsharesacquiredwithinthe£200,000limitdescribedabove.<br />

Lossoftaxreliefs<br />

(i) Ifacompanywhichhasbeengrantedapprovalorprovisionalapprovalasa<strong>VCT</strong>subsequentlyfailstocomplywiththeconditionsforapproval,<strong>VCT</strong><br />

statusmaybewithdrawnortreatedasneverhavingbeengiven.Theexemptionsfromcorporationtaxoncapitalgainswillnotapplytoanygain<br />

realisedafter<strong>VCT</strong>statusislost(nortoanygainrealisedbythe<strong>VCT</strong>ifapprovalisdeemednevertohavebeengiven).<br />

(ii) Forinvestors,thewithdrawalof<strong>VCT</strong>statusmay(dependinguponthetimingofsuchwithdrawal)resultin:<br />

repaymentofthe30%incometaxreliefonsubscriptionfornew<strong>VCT</strong>shares;<br />

incometaxbecomingpayableonsubsequentpaymentsofdividendsbythecompany;and<br />

aliabilitytotaxoncapitalgainsbeingsufferedinthenormalwayonthedisposalofsharesinthecompany,exceptthat anypartofthegain<br />

attributabletotheperiodforwhichthe<strong>VCT</strong>wasapprovedwouldbeexempt.<br />

(iii) Theconsequencesforinvestorsinacompanywhichneverobtainsfullunconditionalapprovalasa<strong>VCT</strong>areasfollows:<br />

repaymentofthe30%incometaxreliefonsubscriptionsfornew<strong>VCT</strong>sharesandinterestonoverduetaxmayarise;<br />

incometaxbecomingpayableonallpaymentsofdividendsbythecompany;and<br />

anygainarisingonadisposaloftheshareswouldbeliabletocapitalgainstaxandlossesontheshareswouldbeallowablelossesforcapitalgains<br />

taxpurposes. <br />

TheOfferSharesareeligible<strong>VCT</strong>sharesforthepurposesofthissection.<br />

3. ConsequencesofaninvestordyingoratransferofSharesbetweenspouses<br />

(i) Initialincometax<br />

Ifaninvestordiesatanytimeaftermakinganinvestmentina<strong>VCT</strong>,thetransferofsharesondeathisnottreatedasadisposaland,therefore,the<br />

initialincometaxreliefisnotwithdrawn.However,theshareswillbecomepartofthedeceased'sestateforinheritancetaxpurposes.<br />

(ii) Taximplicationsforthebeneficiary<br />

Providedanumberofconditionsaremet,thebeneficiaryofany<strong>VCT</strong>shareswillbeentitledtotaxfreedividendsandwillnotpaycapitalgainstax<br />

onanydisposal,butwillnotbeentitledtoanyinitialincometaxrelief.<br />

(iii) Transferofsharesbetweenspouses<br />

Transfersofsharesina<strong>VCT</strong>betweenspousesisnotdeemedtobeadisposalandthereforealltaxreliefswillberetained.<br />

4. General<br />

(i) InvestorswhoarenotresidentintheUK<br />

Nonresidentinvestors,orinvestorswhomaybecomenonresident,shouldseektheirownprofessionaladviceastotheconsequencesofmaking<br />

aninvestmentintheCompany,becausetheymaybesubjecttotaxinotherjurisdictions.<br />

(ii) Stampdutyandstampdutyreservetax<br />

Nostampdutyor(unlesssharesina<strong>VCT</strong>areissuedtoanomineeforaclearingsystemoraproviderofdepositoryreceipts)stampdutyreservetax<br />

willbepayableontheissueofsuchshares.Thetransferonthesaleofshareswouldnormallybesubjecttoadvaloremstampdutyor(ifan<br />

unconditional agreement to transfer such shares is not completed by a duly stamped transfer within two months) stamp duty reserve tax<br />

generally,ineachcaseattherateof50pforevery£100orpartof£100oftheconsiderationpaidwherethetotalconsiderationexceeds£1,000or<br />

ifitformspartofaseriesoftransactionswherethetotalconsiderationexceeds£1,000.Suchdutieswouldbepayablebyapersonwhopurchases<br />

suchsharesfromtheoriginalsubscriber.<br />

(iii) Purchasesinthemarketafterlisting<br />

Any subsequent purchaser of existing <strong>VCT</strong> shares, as opposed to a subscriber for new <strong>VCT</strong> shares, will not qualify for income tax relief on<br />

investmentbutmaybenefitfromdividendreliefandfromcapitalgainstaxreliefonthedisposalofhis<strong>VCT</strong>shares.<br />

(iv) The<strong>VCT</strong>Regulations2004<br />

The<strong>VCT</strong>Regulationscameintoforceon17October2004.Underthe<strong>VCT</strong>Regulations,moniesraisedbyanyfurtherissueofsharesbyanexisting<br />

<strong>VCT</strong>mustbeappliedbythat<strong>VCT</strong>forqualifyingpurposes.Ifanyofthemoneyraised(exceptforamountswhichHMRevenue&Customsagreesare<br />

insignificantinthecontextofthewholeissuedordinarysharecapitalofthe<strong>VCT</strong>)isusedbythe<strong>VCT</strong>topurchaseitsownsharesthenthefundsmay<br />

bedeemedtonothavebeenusedforaqualifyingpurpose.<br />

<br />

Theaboveisonlyasummaryofthetaxpositionofindividualinvestorsin<strong>VCT</strong>sandisbasedontheCompany’sunderstandingofcurrentlawand<br />

practice.Investorsarerecommendedtoconsultaprofessionaladviserastothetaxationconsequencesoftheirinvestingina<strong>VCT</strong>.Alltaxreliefs<br />

referredtointhisdocumentareUKtaxreliefsandaredependentoninvesteecompaniesmaintainingtheir<strong>VCT</strong>qualifyingstatus.<br />

<strong>Northern</strong> 3 <strong>VCT</strong> <strong>PLC</strong> 9