Northern 3 VCT PLC Application Form - Clubfinance

Northern 3 VCT PLC Application Form - Clubfinance

Northern 3 VCT PLC Application Form - Clubfinance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part I – The Company<br />

Introduction<br />

<br />

Investors who subscribe for Offer Shares benefit from having immediate exposure to the Company's existing mature<br />

venture capital portfolio, which as at 31 December 2011 consisted of 45 different investments, with an unaudited<br />

aggregatecarryingvalueof£28.5million.<br />

<br />

<br />

Income<br />

<br />

The Board has a stated objective of paying annual dividends of at least 5.0p per Share, subject to the availability of<br />

sufficientdistributableprofits.SetoutbelowisatableillustratingthereturnstoShareholdersonOfferSharesassumingan<br />

annualdividendof5.0pperOfferShareispaid.Investorsshouldnotethatthetargetminimumannualdividendof5.0pper<br />

OfferShareisanobjectiveandisnotguaranteed.<br />

<br />

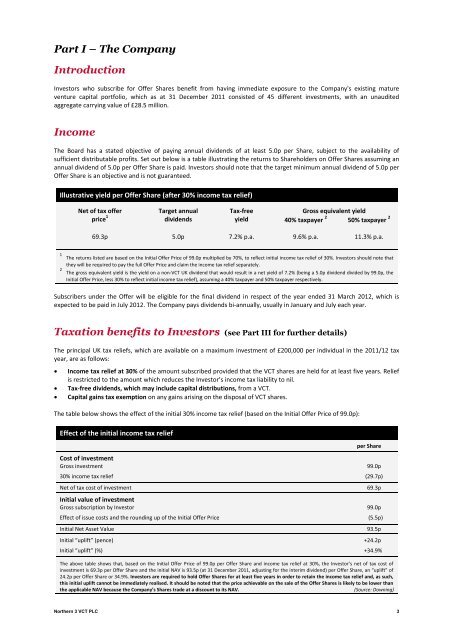

IllustrativeyieldperOfferShare(after30%incometaxrelief)<br />

<br />

Netoftaxoffer Targetannual Taxfree<br />

Grossequivalentyield<br />

price 1<br />

dividends<br />

yield<br />

40%taxpayer 2 50%taxpayer 2 <br />

<br />

69.3p 5.0p 7.2%p.a. 9.6%p.a. 11.3%p.a.<br />

<br />

<br />

1<br />

ThereturnslistedarebasedontheInitialOfferPriceof99.0pmultipliedby70%,toreflectinitialincometaxreliefof30%.Investorsshouldnotethat<br />

theywillberequiredtopaythefullOfferPriceandclaimtheincometaxreliefseparately.<br />

2<br />

Thegrossequivalentyieldistheyieldonanon<strong>VCT</strong>UKdividendthatwouldresultinanetyieldof7.2%(beinga5.0pdividenddividedby99.0p,the<br />

InitialOfferPrice,less30%toreflectinitialincometaxrelief),assuminga40%taxpayerand50%taxpayerrespectively. <br />

<br />

Subscribers under the Offer will be eligible forthe final dividend in respect ofthe year ended31 March 2012, which is<br />

expectedtobepaidinJuly2012.TheCompanypaysdividendsbiannually,usuallyinJanuaryandJulyeachyear.<br />

<br />

<br />

Taxation benefits to Investors (see Part III for further details)<br />

<br />

TheprincipalUKtaxreliefs,whichareavailableonamaximuminvestmentof£200,000perindividualinthe2011/12tax<br />

year,areasfollows:<br />

Incometaxreliefat30%oftheamountsubscribedprovidedthatthe<strong>VCT</strong>sharesareheldforatleastfiveyears.Relief<br />

isrestrictedtotheamountwhichreducestheInvestor’sincometaxliabilitytonil.<br />

Taxfreedividends,whichmayincludecapitaldistributions,froma<strong>VCT</strong>.<br />

Capitalgainstaxexemptiononanygainsarisingonthedisposalof<strong>VCT</strong>shares.<br />

<br />

Thetablebelowshowstheeffectoftheinitial30%incometaxrelief(basedontheInitialOfferPriceof99.0p):<br />

<br />

Effectoftheinitialincometaxrelief<br />

perShare<br />

Costofinvestment<br />

Grossinvestment 99.0p<br />

<br />

30%incometaxrelief (29.7p)<br />

<br />

Netoftaxcostofinvestment 69.3p<br />

<br />

Initialvalueofinvestment<br />

<br />

GrosssubscriptionbyInvestor 99.0p<br />

<br />

EffectofissuecostsandtheroundingupoftheInitialOfferPrice (5.5p)<br />

<br />

InitialNetAssetValue 93.5p<br />

<br />

Initial“uplift”(pence) +24.2p<br />

<br />

Initial“uplift”(%) +34.9%<br />

<br />

Theabovetableshowsthat,basedontheInitialOfferPriceof99.0p per Offer Share and incometaxreliefat30%,theInvestor’snetoftaxcostof<br />

investmentis69.3pperOfferShareandtheinitialNAVis93.5p(at31December2011,adjustingfortheinterimdividend)perOfferShare,an“uplift”of<br />

24.2pperOfferShareor34.9%.InvestorsarerequiredtoholdOfferSharesforatleastfiveyearsinordertoretaintheincometaxreliefand,assuch,<br />

thisinitialupliftcannotbeimmediatelyrealised.ItshouldbenotedthatthepriceachievableonthesaleoftheOfferSharesislikelytobelowerthan<br />

theapplicableNAVbecausetheCompany’sSharestradeatadiscounttoitsNAV.<br />

(Source:Downing)<br />

<br />

<strong>Northern</strong> 3 <strong>VCT</strong> <strong>PLC</strong> 3