Northern 3 VCT PLC Application Form - Clubfinance

Northern 3 VCT PLC Application Form - Clubfinance

Northern 3 VCT PLC Application Form - Clubfinance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

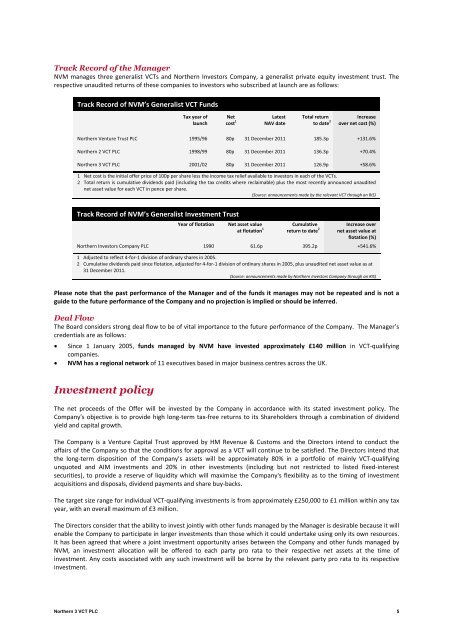

Track Record of the Manager<br />

NVMmanagesthreegeneralist<strong>VCT</strong>sand<strong>Northern</strong>InvestorsCompany,ageneralistprivateequityinvestmenttrust.The<br />

respectiveunauditedreturnsofthesecompaniestoinvestorswhosubscribedatlaunchareasfollows:<br />

<br />

TrackRecordofNVM’sGeneralist<strong>VCT</strong>Funds<br />

<br />

<br />

Taxyearof<br />

launch<br />

Net<br />

cost 1 <br />

Latest<br />

NAVdate<br />

Totalreturn<br />

todate 2 <br />

<br />

Increase<br />

overnetcost(%)<br />

<br />

<strong>Northern</strong>VentureTrust<strong>PLC</strong> 1995/96 80p 31December2011 185.3p +131.6%<br />

<br />

<strong>Northern</strong>2<strong>VCT</strong><strong>PLC</strong> 1998/99 80p 31December2011 136.3p +70.4%<br />

<br />

<strong>Northern</strong>3<strong>VCT</strong><strong>PLC</strong> 2001/02 80p 31December2011 126.9p +58.6%<br />

<br />

1 Netcostistheinitialofferpriceof100ppersharelesstheincometaxreliefavailabletoinvestorsineachofthe<strong>VCT</strong>s.<br />

2 Totalreturniscumulativedividendspaid(includingthetaxcreditswherereclaimable)plusthemostrecentlyannouncedunaudited<br />

netassetvalueforeach<strong>VCT</strong>inpencepershare.<br />

(Source:announcementsmadebytherelevant<strong>VCT</strong>throughanRIS)<br />

TrackRecordofNVM’sGeneralistInvestmentTrust<br />

Yearofflotation Netassetvalue<br />

atflotation 1 <br />

Cumulative<br />

returntodate 2 <br />

<br />

Increaseover<br />

netassetvalueat<br />

flotation(%)<br />

<br />

<strong>Northern</strong>InvestorsCompany<strong>PLC</strong> 1990 61.6p 395.2p +541.6%<br />

<br />

1 Adjustedtoreflect4for1divisionofordinarysharesin2005.<br />

2 Cumulativedividendspaidsinceflotation,adjustedfor4for1divisionofordinarysharesin2005,plusunauditednetassetvalueasat<br />

31December2011.<br />

(Source:announcementsmadeby<strong>Northern</strong>InvestorsCompanythroughanRIS)<br />

<br />

PleasenotethatthepastperformanceoftheManagerandofthefundsitmanagesmaynotberepeatedandisnota<br />

guidetothefutureperformanceoftheCompanyandnoprojectionisimpliedorshouldbeinferred.<br />

<br />

Deal Flow<br />

TheBoardconsidersstrongdealflowtobeofvitalimportancetothefutureperformanceoftheCompany.TheManager’s<br />

credentialsareasfollows:<br />

Since 1 January 2005, funds managed by NVM have invested approximately £140 million in <strong>VCT</strong>qualifying<br />

companies.<br />

<br />

NVMhasaregionalnetworkof11executivesbasedinmajorbusinesscentresacrosstheUK.<br />

<br />

<br />

Investment policy<br />

<br />

The net proceeds of the Offer will be invested by the Company in accordance with its stated investment policy. The<br />

Company'sobjectiveistoprovidehighlongtermtaxfreereturnstoitsShareholdersthroughacombinationofdividend<br />

yieldandcapitalgrowth.<br />

<br />

The Company is a Venture Capital Trust approved by HM Revenue & Customs and the Directors intend to conduct the<br />

affairsoftheCompanysothattheconditionsforapprovalasa<strong>VCT</strong>willcontinuetobesatisfied.TheDirectorsintendthat<br />

the longterm disposition of the Company's assets will be approximately 80% in a portfolio of mainly <strong>VCT</strong>qualifying<br />

unquoted and AIM investments and 20% in other investments (including but not restricted to listed fixedinterest<br />

securities),toprovideareserveofliquiditywhichwillmaximisetheCompany'sflexibilityastothetimingofinvestment<br />

acquisitionsanddisposals,dividendpaymentsandsharebuybacks.<br />

<br />

Thetargetsizerangeforindividual<strong>VCT</strong>qualifyinginvestmentsisfromapproximately£250,000to£1millionwithinanytax<br />

year,withanoverallmaximumof£3million.<br />

<br />

TheDirectorsconsiderthattheabilitytoinvestjointlywithotherfundsmanagedbytheManagerisdesirablebecauseitwill<br />

enabletheCompanytoparticipateinlargerinvestmentsthanthosewhichitcouldundertakeusingonlyitsownresources.<br />

IthasbeenagreedthatwhereajointinvestmentopportunityarisesbetweentheCompanyandotherfundsmanagedby<br />

NVM, an investment allocation will be offered to each party pro rata to their respective net assets at the time of<br />

investment.Anycostsassociatedwithanysuchinvestmentwillbebornebytherelevantpartyproratatoitsrespective<br />

investment.<br />

<strong>Northern</strong> 3 <strong>VCT</strong> <strong>PLC</strong> 5