General terms and conditions of agreement on ... - OTP banka dd

General terms and conditions of agreement on ... - OTP banka dd

General terms and conditions of agreement on ... - OTP banka dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

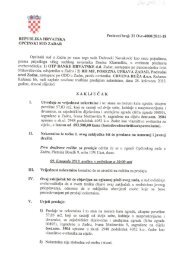

GENERAL TERMS AND CONDITIONS OF AGREEMENT ON ORDER TO PURCHASE OR SELL<br />

FINANCIAL INSTRUMENTS<br />

The Management Board <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>OTP</strong> <strong>banka</strong> Hrvatska d.d., at the a<strong>dd</strong>ress Domovinskog rata 3, 23 000<br />

Zadar, www.otp<strong>banka</strong>.hr, as Credit Instituti<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> by virtue <str<strong>on</strong>g>of</str<strong>on</strong>g> the Capital Market Act (OG 88 / 2008)<br />

hereinafter referred to as: CMA, hereby adopts:<br />

<str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> Agreement <strong>on</strong> order to purchase or sell financial<br />

instruments (hereinafter: <str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s)<br />

<strong>OTP</strong> <strong>banka</strong> Hrvatska d.d. is licensed to provide investment services <str<strong>on</strong>g>and</str<strong>on</strong>g> perform investment activities<br />

referred to in Article 5 paragraph 1 item 2 <str<strong>on</strong>g>of</str<strong>on</strong>g> the CMA:<br />

executi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> orders for the customer's account,<br />

the operating licence has been issued by the Croatian Financial Services Supervisory Agency <str<strong>on</strong>g>and</str<strong>on</strong>g> the<br />

Croatian Nati<strong>on</strong>al Bank<br />

(HANFA, Miramarska 24b,10000 Zagreb, tel. +385 (0)1 617 3200, www.hanfa.hr i<br />

HNB, Trg hrvatskih velikana 3, 10000 Zagreb, tel. +385 (0) 456 4555, www.hnb.hr )<br />

1. Basic definiti<strong>on</strong>s<br />

The below stated expressi<strong>on</strong>s used in these <str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s shall have the following<br />

meanings:<br />

• Language <str<strong>on</strong>g>of</str<strong>on</strong>g> communicati<strong>on</strong> – Croatian or English.<br />

• Price - Unit price per unit <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instrument an Order for purchase or sale <str<strong>on</strong>g>of</str<strong>on</strong>g> a financial<br />

instrument relates to (hereinafter Order).<br />

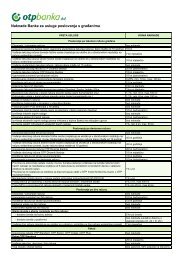

• Price list - Price list for services supplied to the Principal by the Agent with regard to effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> an<br />

Order.<br />

• Order book - A book kept by the Credit Instituti<strong>on</strong> in accordance with the provisi<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> the CMA,<br />

<str<strong>on</strong>g>and</str<strong>on</strong>g> where data <strong>on</strong> individual order accepted by the Credit Instituti<strong>on</strong> are recorded.<br />

• Quantity - Specified number <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments an Order relates to.<br />

• Order Agreement - Agreement stipulating purchase or sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments, entered into<br />

with a Principal in writing, or order <str<strong>on</strong>g>of</str<strong>on</strong>g> a Principal recorded in the Order book, i.e. Order accepted by<br />

the Agent.<br />

• Order - A unilateral representati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Principal's will instructing the Agent to perform a certain<br />

financial instruments operati<strong>on</strong> in its name <str<strong>on</strong>g>and</str<strong>on</strong>g> for the account <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal.<br />

• Principal - A legal entity or a natural pers<strong>on</strong> giving such Order to the Agent.<br />

• <str<strong>on</strong>g>General</str<strong>on</strong>g> <str<strong>on</strong>g>terms</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>c<strong>on</strong>diti<strong>on</strong>s</str<strong>on</strong>g> - These general <str<strong>on</strong>g>c<strong>on</strong>diti<strong>on</strong>s</str<strong>on</strong>g> for purchase or sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial<br />

instruments are an integral part <str<strong>on</strong>g>of</str<strong>on</strong>g> each order for purchase or sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments accepted<br />

by the Credit Instituti<strong>on</strong>, i.e. an integral part <str<strong>on</strong>g>of</str<strong>on</strong>g> each written order <str<strong>on</strong>g>agreement</str<strong>on</strong>g>, except in cases<br />

where their exclusi<strong>on</strong> is explicitly specified in such <str<strong>on</strong>g>agreement</str<strong>on</strong>g>s.<br />

• Financial instruments - Unambiguously, clearly <str<strong>on</strong>g>and</str<strong>on</strong>g> precisely determined security the order<br />

relates to, quoted <strong>on</strong> a stock exchange or other regulated market, trading venue.<br />

Parties to such Order are: a Client acting as the Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> the Credit Instituti<strong>on</strong> acting as the<br />

Agent.<br />

With such Order the Agent undertakes to purchase or sell for the Principal, for agreed commissi<strong>on</strong>,<br />

certain financial instruments in accordance with the instructi<strong>on</strong>s c<strong>on</strong>tained therein, whilst the Principal<br />

authorises the Agent to perform those operati<strong>on</strong>s.<br />

Each Order refers to an exact number <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments.<br />

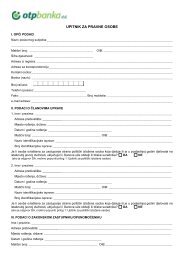

2. Documents required up<strong>on</strong> giving a first order, i.e. entering into a first order <str<strong>on</strong>g>agreement</str<strong>on</strong>g>:<br />

• copy <str<strong>on</strong>g>of</str<strong>on</strong>g> the ID card/passport - for retail domestic/foreign clients;<br />

• certificate <str<strong>on</strong>g>of</str<strong>on</strong>g> incorporati<strong>on</strong>, Notificati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> classificati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> companies according to line <str<strong>on</strong>g>of</str<strong>on</strong>g> business,<br />

signature card - for corporate clients (for foreign clients - certificate <str<strong>on</strong>g>of</str<strong>on</strong>g> the appropriate registry or<br />

other certificate issued by such competent body, translated into Croatian, or;<br />

• number <str<strong>on</strong>g>of</str<strong>on</strong>g> the domestic currency account <str<strong>on</strong>g>of</str<strong>on</strong>g> a resident natural pers<strong>on</strong> or legal entity;

• number <str<strong>on</strong>g>of</str<strong>on</strong>g> the domestic currency account <str<strong>on</strong>g>of</str<strong>on</strong>g> a n<strong>on</strong>-resident natural pers<strong>on</strong> or legal entity<br />

• number <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments account with the Central Depository & Clearing Company Inc.<br />

(hereinafter: CDCC) or other financial instruments depository, if the principal holds such an account<br />

or the number <str<strong>on</strong>g>of</str<strong>on</strong>g> account <str<strong>on</strong>g>of</str<strong>on</strong>g> the custodian.<br />

3. Entry into force<br />

An order <str<strong>on</strong>g>agreement</str<strong>on</strong>g> c<strong>on</strong>cluded (hard copy, s<str<strong>on</strong>g>of</str<strong>on</strong>g>t copy, by ph<strong>on</strong>e) between a Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> the Credit<br />

Instituti<strong>on</strong> enters into force <strong>on</strong> the day stipulated therein.<br />

An Order, as unilateral representati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> will in the meaning <str<strong>on</strong>g>of</str<strong>on</strong>g> paragraph 1 <str<strong>on</strong>g>of</str<strong>on</strong>g> Article 78 <str<strong>on</strong>g>of</str<strong>on</strong>g> the CMA,<br />

is accepted i.e. enters into force after:<br />

1. Credit Instituti<strong>on</strong> records such Order in the Order book, <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

2. the Agent receives a notificati<strong>on</strong> that the Principal has completed the following:<br />

a) in case <str<strong>on</strong>g>of</str<strong>on</strong>g> a Purchase Order - transferred the funds required for effecting the Order <strong>on</strong> a special<br />

account held with the Agent, including the funds required for expenses c<strong>on</strong>nected with effecting the<br />

Order, or<br />

b) in case <str<strong>on</strong>g>of</str<strong>on</strong>g> a Sale Order - put the financial instruments which are subject <str<strong>on</strong>g>of</str<strong>on</strong>g> such Order at the<br />

disposal <str<strong>on</strong>g>of</str<strong>on</strong>g> the Agent.<br />

3. If the Credit Instituti<strong>on</strong> does not accept such Order from the Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> does not record it in the<br />

Order book, it will notify the Principal in writing (notificati<strong>on</strong>, e-mail, fax, <str<strong>on</strong>g>and</str<strong>on</strong>g> ph<strong>on</strong>e) about the<br />

reas<strong>on</strong>s for not accepting. In that situati<strong>on</strong>, the Principal may change the Order taking into account<br />

remarks given by the Credit Instituti<strong>on</strong>.<br />

Parties to the Agreement may ab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong> the c<strong>on</strong>diti<strong>on</strong> referred to in point 2, <str<strong>on</strong>g>of</str<strong>on</strong>g> the first paragraph by<br />

way <str<strong>on</strong>g>of</str<strong>on</strong>g> a special arrangement or <str<strong>on</strong>g>agreement</str<strong>on</strong>g>, so that the order can be effective immediately <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

definitely entered into the Order book. In that case, provided that the Agent fulfils the obligati<strong>on</strong><br />

assumed under the Order, but the Principal fails to deliver to the Agent funds or make available the<br />

financial instruments required to fulfil the obligati<strong>on</strong>s arising under the Order in time, the Agent is<br />

entitled to penalty interest at the highest permitted rate, as well as indemnificati<strong>on</strong> against the loss<br />

incurred due to Principal's failure to fulfil the obligati<strong>on</strong>. Apart from that, in such case the Agent is<br />

eligible to keep the financial instruments <str<strong>on</strong>g>and</str<strong>on</strong>g>/or m<strong>on</strong>ey received under transacti<strong>on</strong> /transacti<strong>on</strong>s<br />

performed to execute the Order <strong>on</strong> a special account, <str<strong>on</strong>g>and</str<strong>on</strong>g> they serve as a pledge securing that the<br />

Principal will fulfil the obligati<strong>on</strong>s arising from effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> the accepted Order.<br />

Financial instruments are c<strong>on</strong>sidered as put at Agent's disposal at the moment they are recorded in<br />

the registry <str<strong>on</strong>g>of</str<strong>on</strong>g> the CDCC held by the Agent.<br />

4. Good faith<br />

The Agent undertakes to buy <str<strong>on</strong>g>and</str<strong>on</strong>g> sell financial instruments in good faith, taking into c<strong>on</strong>siderati<strong>on</strong><br />

pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>al rules <str<strong>on</strong>g>of</str<strong>on</strong>g> operati<strong>on</strong>, <strong>on</strong> behalf <str<strong>on</strong>g>and</str<strong>on</strong>g> for the account <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> following Principal's<br />

order.<br />

5. Fee for effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> order<br />

The Principal is entitled to a fee for effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> orders in accordance with the Price List applicable at<br />

the time such order is accepted, that is, at the time such Order Agreement is c<strong>on</strong>cluded. The Price List<br />

is presented <strong>on</strong> the Agent's premises <str<strong>on</strong>g>and</str<strong>on</strong>g> web pages. By agreeing <strong>on</strong> the Order, the Principal c<strong>on</strong>firms<br />

that he is acquainted with the Price List.<br />

The Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> the Agent may agree a fee different than the <strong>on</strong>e stated in the Price List.<br />

The Agent shall reduce the amount paid to the Principal by the commissi<strong>on</strong> charged for sales<br />

transacti<strong>on</strong>s, <str<strong>on</strong>g>and</str<strong>on</strong>g> the Principal shall increase the amount <str<strong>on</strong>g>of</str<strong>on</strong>g> paid m<strong>on</strong>etary funds by the commissi<strong>on</strong><br />

charged for purchase <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments.<br />

6. Other costs<br />

All c<strong>on</strong>tingent or incurred costs (market or stock exchange fee, fee <str<strong>on</strong>g>of</str<strong>on</strong>g> the CDCC, notary public fees<br />

<str<strong>on</strong>g>and</str<strong>on</strong>g> so <strong>on</strong>), as well as all tax encumbrances that may arise in the future with this kind <str<strong>on</strong>g>of</str<strong>on</strong>g> operati<strong>on</strong>s,<br />

shall be borne by the Principal, unless agreed otherwise.<br />

7. Durati<strong>on</strong><br />

The order expires with the date specified therein or up<strong>on</strong> revocati<strong>on</strong>, whereas up<strong>on</strong> lapse <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>on</strong>e year,<br />

that is, 360 calendar days from the submissi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the order to a stock exchange, the order is<br />

withdrawn from the stock exchange.

8. Order form <str<strong>on</strong>g>and</str<strong>on</strong>g> issuing<br />

The order may be issued:<br />

• in writing (by visiting the Agent's premises, the headquarters or an outlet, fax or e-mail)<br />

• by ph<strong>on</strong>e.<br />

In case <str<strong>on</strong>g>of</str<strong>on</strong>g> change <str<strong>on</strong>g>of</str<strong>on</strong>g> a<strong>dd</strong>ress, ph<strong>on</strong>e or fax numbers, the Agent will notify the Principal as so<strong>on</strong> as<br />

possible.<br />

Up<strong>on</strong> issuing sales orders, financial instruments subject <str<strong>on</strong>g>of</str<strong>on</strong>g> such sale must be delivered by the<br />

Principal, i.e. registered with the Agent, when opening the order. If the parties thereto agree this<br />

c<strong>on</strong>diti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the sales order differently, they must enter into a written <str<strong>on</strong>g>agreement</str<strong>on</strong>g> regulating such<br />

order, provided the financial instruments which are subject <str<strong>on</strong>g>of</str<strong>on</strong>g> that order be made available, i.e.<br />

registered with the Principal before settlement at the latest.<br />

Up<strong>on</strong> issuing purchase order, the Principal must effect payment <str<strong>on</strong>g>of</str<strong>on</strong>g> m<strong>on</strong>etary funds for purchase <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

financial instruments, plus broker's commissi<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> potential costs, to the account no.<br />

HR2324070001324070009 (code HR69 <str<strong>on</strong>g>and</str<strong>on</strong>g> reference number 00019 – OIB) up<strong>on</strong> opening <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

order, or that can be d<strong>on</strong>e before the settlement the latest, if so arranged.<br />

In case the Principal fails to make available - register financial instruments with the Agent, the Agent<br />

is authorised to retain the m<strong>on</strong>etary funds obtained from sold financial instruments <str<strong>on</strong>g>and</str<strong>on</strong>g> purchase the<br />

financial instruments necessary for settlement <str<strong>on</strong>g>of</str<strong>on</strong>g> the performed transacti<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> if there happens to be<br />

a difference in the two, to settle such difference from sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal.<br />

In case the Principal fails to pay the necessary m<strong>on</strong>etary funds for the purchase <str<strong>on</strong>g>of</str<strong>on</strong>g> financial<br />

instruments, the Agent is authorised to sell the purchased financial instruments <strong>on</strong> the market at the<br />

market price.<br />

The Principal shall reimburse the Agent for any damage, costs as well as any fees incurred up<strong>on</strong><br />

performance <str<strong>on</strong>g>of</str<strong>on</strong>g> transacti<strong>on</strong>s entailed by a mistake <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal.<br />

All a<strong>dd</strong>iti<strong>on</strong>al costs incurred due to Principal's delay in making the financial instruments available for<br />

sale or failure to provide m<strong>on</strong>etary funds for purchase <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments to the Agent will be<br />

charged to the Principal.<br />

9. Price at which order is effected<br />

Price at which the Agent must effect the Order is set in dependence <str<strong>on</strong>g>of</str<strong>on</strong>g> the financial instrument stated<br />

in such Order:<br />

• Maximum price (for purchase), or<br />

• Minimum price (for sale).<br />

The Credit Instituti<strong>on</strong> must act in such a way <strong>on</strong> the Order that, in case <str<strong>on</strong>g>of</str<strong>on</strong>g> its executi<strong>on</strong>, the price at<br />

which the financial instruments<br />

• are acquired further to the purchase Order, equals or is lower than the maximum price;<br />

• are sold further to the sales Order, equals or exceeds the minimum price.<br />

10. Manner <str<strong>on</strong>g>of</str<strong>on</strong>g> effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> Orders<br />

The Agent must carry out his obligati<strong>on</strong>s in accordance with the instructi<strong>on</strong>s received <str<strong>on</strong>g>and</str<strong>on</strong>g> with due<br />

care <str<strong>on</strong>g>of</str<strong>on</strong>g> a c<strong>on</strong>scientious businessman, whilst remaining within the boundaries set in the Order <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

paying attenti<strong>on</strong> to the interests <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal, which serve as guidance. Should the Agent deem<br />

that carrying out the Order in accordance with the instructi<strong>on</strong>s given therein would be detrimental to<br />

the Principal, he shall make it known to the Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> ask for new instructi<strong>on</strong>s. The Agent may<br />

ab<str<strong>on</strong>g>and</str<strong>on</strong>g><strong>on</strong> the instructi<strong>on</strong>s c<strong>on</strong>tained within the Order <strong>on</strong>ly if he suspects them to be detrimental to the<br />

interest <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal, whose c<strong>on</strong>sent cannot be requested due to tight schedule or other reas<strong>on</strong>s.<br />

11. Keeping <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments with the Agent <str<strong>on</strong>g>and</str<strong>on</strong>g> settlement<br />

The Agent will keep the financial instruments made available to him for sale purposes until settlement<br />

under the c<strong>on</strong>cluded transacti<strong>on</strong>, or return them up<strong>on</strong> expiry <str<strong>on</strong>g>of</str<strong>on</strong>g> n<strong>on</strong>-effected order or up<strong>on</strong> revocati<strong>on</strong><br />

by the Principal.<br />

12. Order priority<br />

When carrying out the obligati<strong>on</strong>s arising from Orders, the Agent must follow the priorities set in the<br />

Order book1.<br />

Priority <str<strong>on</strong>g>of</str<strong>on</strong>g> individual Orders is set according to the price <str<strong>on</strong>g>and</str<strong>on</strong>g> chr<strong>on</strong>ology <str<strong>on</strong>g>of</str<strong>on</strong>g> entries in the Order book,<br />

in a way that an order which was accepted earlier has priority over an order accepted later, if the

same price is in questi<strong>on</strong>. The Agent submits orders to the system <str<strong>on</strong>g>of</str<strong>on</strong>g> the regulated market <str<strong>on</strong>g>and</str<strong>on</strong>g> other<br />

trading venues in accordance with the sequence <str<strong>on</strong>g>of</str<strong>on</strong>g> placed orders in the Order book. The Order<br />

effecting chr<strong>on</strong>ology (c<strong>on</strong>cluding <str<strong>on</strong>g>of</str<strong>on</strong>g> transacti<strong>on</strong>s whereby Orders are effected) depends <strong>on</strong> the<br />

<str<strong>on</strong>g>c<strong>on</strong>diti<strong>on</strong>s</str<strong>on</strong>g> <strong>on</strong> the market <str<strong>on</strong>g>and</str<strong>on</strong>g> instructi<strong>on</strong>s given to the Agent by the Principal in the Order.<br />

13. Entrusting Order effecting to third parties<br />

The Agent may entrust effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> Orders to third party/parties <strong>on</strong>ly if forced to do so by<br />

circumstances, force majeure, whereby the <str<strong>on</strong>g>c<strong>on</strong>diti<strong>on</strong>s</str<strong>on</strong>g> set for the Agent for effecting the Order shall<br />

remain as if carried out by the Agent.<br />

14. Order book<br />

All orders, regardless <str<strong>on</strong>g>of</str<strong>on</strong>g> the manner they have been received in, must be entered into the Order book.<br />

The data c<strong>on</strong>tained within that book, or the data <strong>on</strong> c<strong>on</strong>cluded order <str<strong>on</strong>g>agreement</str<strong>on</strong>g>s c<strong>on</strong>stitute a<br />

business secret. The data c<strong>on</strong>tained in the Order book, or the data <strong>on</strong> order <str<strong>on</strong>g>agreement</str<strong>on</strong>g>s c<strong>on</strong>cluded<br />

shall be submitted for inspecti<strong>on</strong> to the authorised bodies, in accordance with the Credit Instituti<strong>on</strong>s<br />

Act, the Capital Market Act <str<strong>on</strong>g>and</str<strong>on</strong>g> other applicable regulati<strong>on</strong>s. The data c<strong>on</strong>tained in the order<br />

<str<strong>on</strong>g>agreement</str<strong>on</strong>g>s <str<strong>on</strong>g>and</str<strong>on</strong>g> Order book shall be made available to pers<strong>on</strong>s carrying out internal <str<strong>on</strong>g>and</str<strong>on</strong>g> external<br />

audits <str<strong>on</strong>g>and</str<strong>on</strong>g> c<strong>on</strong>trol <str<strong>on</strong>g>of</str<strong>on</strong>g> the Credit Instituti<strong>on</strong>, or providing accounting services or maintaining the IT<br />

system <str<strong>on</strong>g>of</str<strong>on</strong>g> the Credit Instituti<strong>on</strong>, or creating computer programmes, as well as other pers<strong>on</strong>s who can<br />

have access to them as a c<strong>on</strong>sequence <str<strong>on</strong>g>of</str<strong>on</strong>g> the functi<strong>on</strong>s they hold or activities they perform within the<br />

Credit Instituti<strong>on</strong> or for the Credit Instituti<strong>on</strong>, subject to familiarisati<strong>on</strong> with the obligati<strong>on</strong> to keep the<br />

data <str<strong>on</strong>g>of</str<strong>on</strong>g> the Credit Instituti<strong>on</strong> c<strong>on</strong>tained therein <str<strong>on</strong>g>and</str<strong>on</strong>g> in other documentati<strong>on</strong> secret.<br />

15. Financial instruments <str<strong>on</strong>g>and</str<strong>on</strong>g> m<strong>on</strong>etary funds for effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> Orders, <str<strong>on</strong>g>and</str<strong>on</strong>g> the financial<br />

instruments acquired by effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> Orders<br />

Except in cases when differently laid down in the Order, the Agent will treat the financial instruments<br />

<str<strong>on</strong>g>and</str<strong>on</strong>g> /or m<strong>on</strong>etary funds he has received or has had at disposal as a c<strong>on</strong>sequence <str<strong>on</strong>g>of</str<strong>on</strong>g> effecting or<br />

partial effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> the Order in accordance with the Principal's instructi<strong>on</strong>s. The Principal <str<strong>on</strong>g>and</str<strong>on</strong>g> the<br />

Agent may agree that the menti<strong>on</strong>ed financial instruments <str<strong>on</strong>g>and</str<strong>on</strong>g> /or m<strong>on</strong>etary funds be used for<br />

effecting <str<strong>on</strong>g>of</str<strong>on</strong>g> new Orders.<br />

The Agent is a member <str<strong>on</strong>g>of</str<strong>on</strong>g> the CDCC, <str<strong>on</strong>g>and</str<strong>on</strong>g> treats m<strong>on</strong>etary funds <str<strong>on</strong>g>and</str<strong>on</strong>g> financial instruments in<br />

accordance with the rules set out by the CDCC.<br />

Unless otherwise instructed, or in absence <str<strong>on</strong>g>of</str<strong>on</strong>g> arranged settlement, m<strong>on</strong>etary funds acquired by sale <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

financial instruments shall be paid to the current account <str<strong>on</strong>g>of</str<strong>on</strong>g> the Principal <strong>on</strong> the 2nd business day<br />

from the day the Order related transacti<strong>on</strong>(s) were carried out at latest. Likewise, unless otherwise<br />

agreed, or in absence <str<strong>on</strong>g>of</str<strong>on</strong>g> arranged settlement, the financial instruments acquired by such purchase<br />

shall be remitted to the Principal's account with the CDCC <strong>on</strong> the 2nd business day from the related<br />

transacti<strong>on</strong>s.<br />

Purchased financial instruments are registered in the CDCC through the Agent, unless otherwise<br />

instructed by the Principal.<br />

Any surpluses remaining after purchase or deriving from sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments will be disposed<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> according to the Principal's order, i.e. if it has not been defined in the order, further to the<br />

Principal's instructi<strong>on</strong>.<br />

The Agent may request from the Principal a<strong>dd</strong>iti<strong>on</strong>al m<strong>on</strong>ey to settle the costs <str<strong>on</strong>g>of</str<strong>on</strong>g> purchased financial<br />

instruments in cases where it is impossible to fully settle the costs under Principal's orders through no<br />

fault <str<strong>on</strong>g>of</str<strong>on</strong>g> the Agent, but, am<strong>on</strong>g others, due to changes to the exchange rates, changes to the prices in<br />

the market, increased amount <str<strong>on</strong>g>of</str<strong>on</strong>g> due interest, etc.<br />

16. Notificati<strong>on</strong> <strong>on</strong> effecting<br />

The Principal shall be notified <str<strong>on</strong>g>of</str<strong>on</strong>g> the performed transacti<strong>on</strong>s by fax, e-mail <str<strong>on</strong>g>and</str<strong>on</strong>g>/or regular mail<br />

(calculati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments purchase or sale) sent to the a<strong>dd</strong>ress designated for that purpose<br />

in the Order, <strong>on</strong> the same day or <strong>on</strong> the business day following such transacti<strong>on</strong>.<br />

The Agent shall not be liable for safety or c<strong>on</strong>fidentiality <str<strong>on</strong>g>of</str<strong>on</strong>g> the transfer <str<strong>on</strong>g>of</str<strong>on</strong>g> such calculati<strong>on</strong>s by ph<strong>on</strong>e,<br />

fax or e-mail.<br />

The Principal must notify the Agent <str<strong>on</strong>g>of</str<strong>on</strong>g> change <str<strong>on</strong>g>of</str<strong>on</strong>g> the a<strong>dd</strong>ress, ph<strong>on</strong>e or fax numbers as so<strong>on</strong> as<br />

possible, <str<strong>on</strong>g>and</str<strong>on</strong>g> by the third business day following such change the latest.<br />

17. Manner <str<strong>on</strong>g>of</str<strong>on</strong>g> calculati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> commissi<strong>on</strong>s

The broker's commissi<strong>on</strong> is charged in accordance with the applicable price list, which has been<br />

revealed to the client, the Principal.<br />

Up<strong>on</strong> purchase <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments, the total purchase price shall be increased by the commissi<strong>on</strong>,<br />

i.e. average unit purchase price per financial instrument, whilst for sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments the<br />

commissi<strong>on</strong> amount is deducted from the total sale price, i.e. average unit sale price per financial<br />

instrument.<br />

18. Terminati<strong>on</strong><br />

The Principal may terminate the order <str<strong>on</strong>g>agreement</str<strong>on</strong>g> arising from the Order accepted by the Credit<br />

Instituti<strong>on</strong> in the part yet to be executed, i.e. before the Credit Instituti<strong>on</strong> undertakes acti<strong>on</strong>s towards<br />

the third parties <str<strong>on</strong>g>and</str<strong>on</strong>g> thus create liabilities for the Principal or itself. Terminati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> order <str<strong>on</strong>g>agreement</str<strong>on</strong>g><br />

c<strong>on</strong>cluded in the manner set by this paragraph shall be carried out in <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the ways predicted for<br />

issuing <str<strong>on</strong>g>of</str<strong>on</strong>g> orders.<br />

The Agent may cancel the accepted Order in full or in the part which has not been effected if such<br />

effecting would clearly be detrimental, or liability for <str<strong>on</strong>g>of</str<strong>on</strong>g>fence or crime would arise for the Agent or its<br />

employees, or it would disturb the market integrity or violate the rules <str<strong>on</strong>g>of</str<strong>on</strong>g> the code <str<strong>on</strong>g>of</str<strong>on</strong>g> ethical c<strong>on</strong>duct<br />

in financial instruments trading.<br />

In case <str<strong>on</strong>g>of</str<strong>on</strong>g> terminati<strong>on</strong>, the Agent must return the m<strong>on</strong>etary funds deposited for purchase <str<strong>on</strong>g>of</str<strong>on</strong>g> financial<br />

instruments to the Principal <strong>on</strong>ce the costs incurred up to that point have been deducted, that is, the<br />

Agent shall return the financial instruments, unless the Principal has instructed differently.<br />

Terminati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> order <str<strong>on</strong>g>agreement</str<strong>on</strong>g> may be effected by the parties thereto in the manner set by the<br />

<str<strong>on</strong>g>agreement</str<strong>on</strong>g> itself or by these <str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s.<br />

19. Order modificati<strong>on</strong><br />

Each change to the accepted order, as well as the proposal for change to the c<strong>on</strong>cluded order<br />

<str<strong>on</strong>g>agreement</str<strong>on</strong>g>, by the Principal (with excepti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> reducti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the quantity <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments) shall<br />

be c<strong>on</strong>sidered terminati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the existing order <str<strong>on</strong>g>agreement</str<strong>on</strong>g> in the meaning <str<strong>on</strong>g>of</str<strong>on</strong>g> the preceding item, as<br />

well as issuing <str<strong>on</strong>g>of</str<strong>on</strong>g> a new order in the meaning <str<strong>on</strong>g>of</str<strong>on</strong>g> paragraph 1 <str<strong>on</strong>g>of</str<strong>on</strong>g> Article 78 <str<strong>on</strong>g>of</str<strong>on</strong>g> the CMA.<br />

20. Client classificati<strong>on</strong><br />

In accordance with the CMA the investment company performs client classificati<strong>on</strong> as regards their<br />

know-how, experience, financial st<str<strong>on</strong>g>and</str<strong>on</strong>g>ing <str<strong>on</strong>g>and</str<strong>on</strong>g> investment goals, as small <str<strong>on</strong>g>and</str<strong>on</strong>g> pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>al investors.<br />

The Credit Instituti<strong>on</strong> enters with a client into a brokerage services <str<strong>on</strong>g>agreement</str<strong>on</strong>g> (mediati<strong>on</strong> in financial<br />

instruments trading) which includes client classificati<strong>on</strong>. By signing the <str<strong>on</strong>g>agreement</str<strong>on</strong>g>, the client accepts<br />

his or her classificati<strong>on</strong> status.<br />

21. Safekeeping, processing <str<strong>on</strong>g>and</str<strong>on</strong>g> protecti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> data<br />

The Credit Instituti<strong>on</strong> shall gather <str<strong>on</strong>g>and</str<strong>on</strong>g> undertake further processing <str<strong>on</strong>g>of</str<strong>on</strong>g> client pers<strong>on</strong>al data solely for<br />

the purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> executi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>agreement</str<strong>on</strong>g> entered into between the parties, in accordance with the<br />

Pers<strong>on</strong>al Data Protecti<strong>on</strong> Act.<br />

If necessary, all data delivered to the Credit Instituti<strong>on</strong> can be delivered to other financial instituti<strong>on</strong>s<br />

should they require them to achieve the purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>agreement</str<strong>on</strong>g>, as well as to supervisory bodies<br />

<str<strong>on</strong>g>and</str<strong>on</strong>g> other competent bodies <str<strong>on</strong>g>and</str<strong>on</strong>g> entities authorised by law to request such data.<br />

By signing the brokerage service <str<strong>on</strong>g>agreement</str<strong>on</strong>g>, the client grants explicit c<strong>on</strong>sent to the Credit Instituti<strong>on</strong><br />

to undertake all acti<strong>on</strong>s c<strong>on</strong>nected to gathering <str<strong>on</strong>g>and</str<strong>on</strong>g> processing <str<strong>on</strong>g>of</str<strong>on</strong>g> pers<strong>on</strong>al data menti<strong>on</strong>ed in the<br />

<str<strong>on</strong>g>agreement</str<strong>on</strong>g> or any other document c<strong>on</strong>nected to implementati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the provisi<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>agreement</str<strong>on</strong>g>.<br />

The customer is aware <str<strong>on</strong>g>of</str<strong>on</strong>g> the right to recall the given c<strong>on</strong>sent for pers<strong>on</strong>al data processing.<br />

The Credit Instituti<strong>on</strong> undertakes to treat all data supplied by the client in accordance with the law,<br />

<str<strong>on</strong>g>and</str<strong>on</strong>g> such data shall be deemed a business secret.<br />

22. Investor Protecti<strong>on</strong> Fund<br />

The Credit Instituti<strong>on</strong> is a member <str<strong>on</strong>g>of</str<strong>on</strong>g> the Investor Protecti<strong>on</strong> Fund <str<strong>on</strong>g>and</str<strong>on</strong>g> participates in the Fund's<br />

assets in accordance with the Act. Fund's assets are used for payment <str<strong>on</strong>g>of</str<strong>on</strong>g> secured claims held by<br />

clients <str<strong>on</strong>g>of</str<strong>on</strong>g> the Fund member not able to meet its obligati<strong>on</strong>s.<br />

23. Risks

Financial instruments operati<strong>on</strong>s, including purchase <str<strong>on</strong>g>and</str<strong>on</strong>g> sale <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments, bear certain<br />

risks. It is almost impossible possible to list all such risks, but they mostly include unexpected changes<br />

to the prices <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments, inability <str<strong>on</strong>g>of</str<strong>on</strong>g> the issuer to perform the obligati<strong>on</strong>s undertaken in<br />

relati<strong>on</strong> to such financial instruments, impositi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> a<strong>dd</strong>iti<strong>on</strong>al obligati<strong>on</strong>s, limitati<strong>on</strong>s imposed <strong>on</strong> the<br />

owners <str<strong>on</strong>g>of</str<strong>on</strong>g> such financial instruments by the state, changes to the market liquidity <str<strong>on</strong>g>of</str<strong>on</strong>g> certain financial<br />

instruments, etc. The price <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments changes in accordance with the market <str<strong>on</strong>g>c<strong>on</strong>diti<strong>on</strong>s</str<strong>on</strong>g>,<br />

which may be affected by a number <str<strong>on</strong>g>of</str<strong>on</strong>g> factors, some <str<strong>on</strong>g>of</str<strong>on</strong>g> which are entirely unpredictable. Fulfilling the<br />

obligati<strong>on</strong>s arising from financial instruments for their issuers can also be brought into questi<strong>on</strong>, or<br />

even fail in total, due to disturbances in operati<strong>on</strong>s or the ec<strong>on</strong>omic status <str<strong>on</strong>g>of</str<strong>on</strong>g> the issuer. By changing<br />

the tax policy, introducing limitati<strong>on</strong>s <strong>on</strong> disposal <str<strong>on</strong>g>of</str<strong>on</strong>g> financial instruments, tax policies <str<strong>on</strong>g>and</str<strong>on</strong>g> by other<br />

such measures, the state can influence the quality <str<strong>on</strong>g>and</str<strong>on</strong>g> value <str<strong>on</strong>g>of</str<strong>on</strong>g> individual investments. That is why<br />

the investors are recommended to attempt to rec<strong>on</strong>cile the size, structure, maturity <str<strong>on</strong>g>and</str<strong>on</strong>g> risk <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

investment with their present <str<strong>on</strong>g>and</str<strong>on</strong>g> assumed future assets status up<strong>on</strong> selecti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> financial<br />

instruments, taking into account their experience in investing into the same or similar areas, as well as<br />

to ask for advice <str<strong>on</strong>g>of</str<strong>on</strong>g> a pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>al pers<strong>on</strong> or instituti<strong>on</strong> if necessary. By issuing <str<strong>on</strong>g>of</str<strong>on</strong>g> an Order, the<br />

Principal c<strong>on</strong>firms the awareness <str<strong>on</strong>g>of</str<strong>on</strong>g> the risks c<strong>on</strong>nected to the financial instruments market, that the<br />

Agent has provided him with data <str<strong>on</strong>g>and</str<strong>on</strong>g> informati<strong>on</strong> requested <str<strong>on</strong>g>and</str<strong>on</strong>g> that all his inquiries regarding<br />

market circumstances <str<strong>on</strong>g>and</str<strong>on</strong>g> financial instruments the Order relates to have been answered to his<br />

satisfacti<strong>on</strong>.<br />

24. Internal bylaws, decisi<strong>on</strong>s <str<strong>on</strong>g>and</str<strong>on</strong>g> instructi<strong>on</strong>s<br />

The Credit Instituti<strong>on</strong> shall harm<strong>on</strong>ise its internal rules, instructi<strong>on</strong>s, procedures etc. with the CMA <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

make them available to clients by publishing them <strong>on</strong> its web pages <str<strong>on</strong>g>and</str<strong>on</strong>g> displaying them <strong>on</strong> the<br />

premises <str<strong>on</strong>g>of</str<strong>on</strong>g> the Credit Instituti<strong>on</strong>.<br />

By signing the order <str<strong>on</strong>g>and</str<strong>on</strong>g>/or the order <str<strong>on</strong>g>agreement</str<strong>on</strong>g>, placing orders by ph<strong>on</strong>e or e-mail, clients fully<br />

accept the <str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s, rules, instructi<strong>on</strong>s, procedures, policies etc. <str<strong>on</strong>g>of</str<strong>on</strong>g> the Credit<br />

Instituti<strong>on</strong>.<br />

25. Regulated market membership<br />

The Agent hereby c<strong>on</strong>firms the membership in the stock exchange, regulated market <str<strong>on</strong>g>and</str<strong>on</strong>g> active<br />

engagement in other potential trading venues.<br />

26. Right <str<strong>on</strong>g>of</str<strong>on</strong>g> retenti<strong>on</strong><br />

In case <str<strong>on</strong>g>of</str<strong>on</strong>g> any debts that the Principal owes to the Agent, the Agent has the right <str<strong>on</strong>g>of</str<strong>on</strong>g> retenti<strong>on</strong> (ius<br />

retenti<strong>on</strong>is) over financial instruments for the purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> selling them in order to settle all the claims<br />

from the Principal, as well as the right to compensati<strong>on</strong> from the Principal's funds <strong>on</strong> a special account<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> the amount owed by the Principal.<br />

27. Settlement <str<strong>on</strong>g>of</str<strong>on</strong>g> disputes<br />

All disputes arising from the existence, interpretati<strong>on</strong> or applicati<strong>on</strong> here<str<strong>on</strong>g>of</str<strong>on</strong>g> will be resolved before the<br />

Court in Zadar, which has the subject matter jurisdicti<strong>on</strong>.<br />

28. Amendments to relevant regulati<strong>on</strong>s<br />

In case <str<strong>on</strong>g>of</str<strong>on</strong>g> amendments to regulati<strong>on</strong>s pursuant to which these Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s have been<br />

passed, the Credit Instituti<strong>on</strong> shall initiate the process <str<strong>on</strong>g>of</str<strong>on</strong>g> amending these Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s.<br />

In case that the provisi<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> these Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s are not in compliance with relevant<br />

regulati<strong>on</strong>s (statutory <str<strong>on</strong>g>and</str<strong>on</strong>g> sec<strong>on</strong>dary), those regulati<strong>on</strong>s shall apply until amendments are made.<br />

29. Entry into force<br />

These <str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s shall enter into force <strong>on</strong> 06th October 2014, whereas by their<br />

adopti<strong>on</strong> the <str<strong>on</strong>g>General</str<strong>on</strong>g> Terms <str<strong>on</strong>g>and</str<strong>on</strong>g> C<strong>on</strong>diti<strong>on</strong>s passed <strong>on</strong> 14th May 2013 shall cease to have effect.<br />

Zadar, 06th October 2014<br />

kč/mč/ah