Cash Flow Lecture - UNO CBA

Cash Flow Lecture - UNO CBA

Cash Flow Lecture - UNO CBA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

2<br />

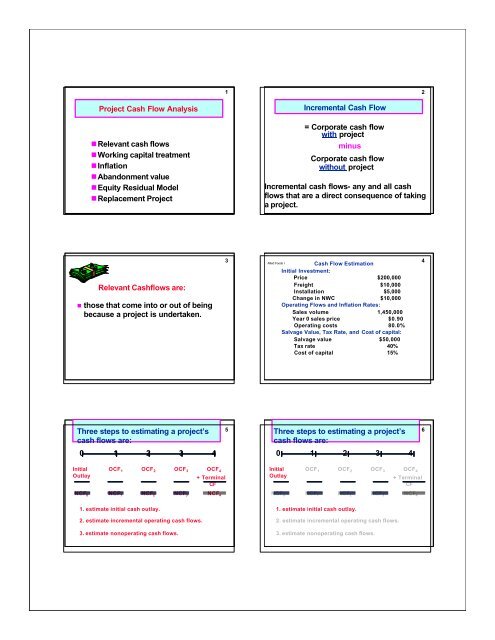

Project <strong>Cash</strong> <strong>Flow</strong> Analysis<br />

•Relevant cash flows<br />

•Working capital treatment<br />

•Inflation<br />

•Abandonment value<br />

•Equity Residual Model<br />

•Replacement Project<br />

Incremental <strong>Cash</strong> <strong>Flow</strong><br />

= Corporate cash flow<br />

with project<br />

minus<br />

Corporate cash flow<br />

without project<br />

Incremental cash flows- any and all cash<br />

flows that are a direct consequence of taking<br />

a project.<br />

Relevant <strong>Cash</strong>flows are:<br />

• those that come into or out of being<br />

because a project is undertaken.<br />

3<br />

Allied Foods I <strong>Cash</strong> <strong>Flow</strong> Estimation<br />

Initial Investment:<br />

Price $200,000<br />

Freight $10,000<br />

Installation $5,000<br />

Change in NWC $10,000<br />

Operating <strong>Flow</strong>s and Inflation Rates:<br />

Sales volume 1,450,000<br />

Year 0 sales price $0.90<br />

Operating costs 80.0%<br />

Salvage Value, Tax Rate, and Cost of capital:<br />

Salvage value $50,000<br />

Tax rate 40%<br />

Cost of capital 15%<br />

4<br />

Three steps to estimating a project’s<br />

cash flows are:<br />

5<br />

Three steps to estimating a project’s<br />

cash flows are:<br />

6<br />

0 1 2 3 4<br />

0 1 2 3 4<br />

Initial<br />

Outlay<br />

OCF 1 OCF 2 OCF 3 OCF 4<br />

+ Terminal<br />

CF<br />

Initial<br />

Outlay<br />

OCF 1 OCF 2 OCF 3 OCF 4<br />

+ Terminal<br />

CF<br />

NCF 0 NCF 1 NCF 2 NCF 3 NCF 4<br />

NCF 0 NCF 1 NCF 2 NCF 3 NCF 4<br />

1. estimate initial cash outlay.<br />

2. estimate incremental operating cash flows.<br />

3. estimate nonoperating cash flows.<br />

1. estimate initial cash outlay.<br />

2. estimate incremental operating cash flows.<br />

3. estimate nonoperating cash flows.

Allied Foods I<br />

7<br />

8<br />

Net Investment Outlay:<br />

Price $200,000<br />

Freight 10,000<br />

Installation 5,000<br />

Change in NWC 10,000<br />

-------------<br />

$225,000<br />

========<br />

Three steps to estimating a project’s<br />

cash flows are:<br />

0 1 2 3 4<br />

Initial<br />

Outlay<br />

OCF 1 OCF 2 OCF 3 OCF 4<br />

+ Terminal<br />

CF<br />

NCF 0 NCF 1 NCF 2 NCF 3 NCF 4<br />

1. estimate initial cash outlay.<br />

2. estimate incremental operating cash flows.<br />

3. estimate nonoperating cash flows.<br />

9<br />

Allied Foods I<br />

Year Year<br />

10<br />

OCF t = (Revenue t - Cost t - Depr t )(1-T) + Depr t Operating costs<br />

1,044,000 1,044,000<br />

1 2<br />

Unit price<br />

$0.90 $0.90<br />

Operating cashflow (OCF t )<br />

Unit sales<br />

1,450,000 1,450,000<br />

-------- --------<br />

Revenues<br />

$1,305,000 $1,305,000<br />

Depreciation<br />

Before tax income<br />

Taxes<br />

Net income<br />

Plus depreciation<br />

Net op cash flow<br />

Allied Foods I Allied Foods I<br />

11<br />

Year Year<br />

12<br />

1 2<br />

Unit price<br />

Unit sales<br />

Depreciable basis = $215,000<br />

EOY<br />

MACRS Dep. Book<br />

Year Factor Expense Value<br />

------ ------ -------- --------<br />

1 33%<br />

2 45%<br />

3 15%<br />

4 7%<br />

------<br />

100%<br />

$70,950 $144,050<br />

96,750 47,300<br />

32,250 15,050<br />

15,050 (0)<br />

--------<br />

$215,000<br />

Revenues<br />

Operating costs<br />

Depreciation<br />

Before tax income<br />

Taxes<br />

Net income<br />

Plus depreciation<br />

Net op cash flow<br />

$0.90 $0.90<br />

1,450,000 1,450,000<br />

-------- --------<br />

$1,305,000 $1,305,000<br />

1,044,000 1,044,000<br />

70,950 96,750<br />

-------- --------<br />

$190,050 $164,250<br />

76,020 65,700<br />

-------- --------<br />

$114,030 $98,550<br />

70,950 96,750<br />

-------- --------<br />

$184,980 $195,300

Allied Foods I<br />

Year Year<br />

13<br />

Allied Foods I<br />

14<br />

3 4<br />

Unit price<br />

Unit sales<br />

Revenues<br />

Operating costs<br />

Depreciation<br />

Before tax income<br />

Taxes<br />

Net income<br />

Plus depreciation<br />

Net op cash flow<br />

$0.90 $0.90<br />

1,450,000 1,450,000<br />

-------- --------<br />

$1,305,000 $1,305,000<br />

1,044,000 1,044,000<br />

32,250 15,050<br />

-------- -------<br />

$228,750 $245,950<br />

91,500 98,380<br />

-------- --------<br />

$137,250 $147,570<br />

32,250 15,050<br />

-------- --------<br />

$169,500 $162,620<br />

Year Year Year Year Year<br />

0 1 2 3 4<br />

Net op cash flow $184,980 $195,300 $169,500 $162,620<br />

Three steps to estimating a project’s<br />

cash flows are:<br />

15<br />

Allied Foods I<br />

16<br />

0 1 2 3 4<br />

Initial<br />

Outlay<br />

OCF 1 OCF 2 OCF 3 OCF 4<br />

+ Terminal<br />

CF<br />

NCF 0 NCF 1 NCF 2 NCF 3 NCF 4<br />

1. estimate initial cash outlay.<br />

2. estimate incremental operating cash flows.<br />

Year Year Year Year Year<br />

0 1 2 3 4<br />

Net op cash flow $184,980 $195,300 $169,500 $162,620<br />

Salvage value $50,000<br />

SV tax=-(SV-BV)T (20,000)<br />

Recovery of NWC 10,000<br />

--------<br />

Termination CF $40,000<br />

-------- -------- -------- -------- --------<br />

Project NCF ($225,000) $184,980 $195,300 $169,500 $202,620<br />

3. estimate nonoperating cash flows.<br />

Allied Foods I<br />

17<br />

18<br />

NPV<br />

IRR<br />

TV<br />

MIRR<br />

Payback<br />

$310,825<br />

74.0%<br />

$937,161<br />

42.9%<br />

1.2<br />

Suppose $100,000 had been spent last<br />

year to improve the production line<br />

site. Should this cost be included in<br />

the analysis<br />

•NO. This is a sunk cost. Focus on<br />

incremental investment and<br />

operating cash flows.

If the price of a can of fresh lemon<br />

juice is expected to increase by 1.5%<br />

per year while operating costs are<br />

expected to increase by 8.0% per year,<br />

would this affect the analysis<br />

•Yes, because the discount rate is<br />

quoted on a nominal basis the cash<br />

flows and profitability analysis will<br />

be biased if quoted on a real basis.<br />

19<br />

If the plant space could be leased out<br />

for $25,000 a year, would this affect<br />

the analysis<br />

•Yes. Accepting the project means we<br />

will not receive the $25,000. This is<br />

an opportunity cost and it should be<br />

charged to the project.<br />

20<br />

If the new product line would decrease<br />

sales of the firm’s other products by<br />

$15,000 per year, and decrease<br />

operating costs of other porducts by<br />

$20,000 would this affect the analysis<br />

•Yes. The effects on the other projects’<br />

CFs is an “externality”.<br />

•Net CF loss per year on other lines<br />

would be a cost to this project.<br />

•Externalities will be positive if new<br />

projects are complements to existing<br />

assets, negative if substitutes.<br />

21<br />

Allied Foods<br />

2<br />

Allied Foods<br />

(with inflation and externalities)<br />

• Operating <strong>Flow</strong>s and Inflation Rates:<br />

Sales volume 1,450,000<br />

Year 0 sales price $0.90<br />

Operating costs 80.0%<br />

Price inflation 1.5%<br />

Cost inflation 8.0%<br />

• Salvage Value, Tax Rate, and Cost of Capital:<br />

Salvage value $50,000<br />

Tax rate 40%<br />

Cost of capital 15%<br />

• Effects on Other Projects:<br />

Revenue reduction $40,000<br />

Cost reduction $20,000<br />

22<br />

Allied Foods2<br />

Unit price<br />

Unit sales<br />

Revenues<br />

Operating costs<br />

Depreciation<br />

Other project effects<br />

Before tax income<br />

Taxes<br />

Net income<br />

Plus depreciation<br />

Net op cash flow<br />

Year Year Year<br />

0 1 2<br />

-------- -------- --------<br />

$0.90 $0.91 $0.93<br />

1,450,000 1,450,000<br />

-------- --------<br />

$1,324,575 $1,344,444<br />

1,127,520 1,217,722<br />

*Note that because 70,950 of differing 96,750 economic<br />

pressures operating 20,000 costs will 20,000 not remain<br />

at 80% of sales.<br />

Yr1 operating costs $106,105 = (0.90 X 0.80)x(1.08) $9,972<br />

42,442 x 1,450,000 = $1,127,520 3,989<br />

-------- --------<br />

$63,663 $5,983<br />

Yr2 operating costs = $1,127,520 X 1.08 =<br />

$1,217,721.60 70,950<br />

--------<br />

$134,613<br />

96,750<br />

--------<br />

$102,733<br />

23<br />

Allied Foods2<br />

Unit price<br />

Unit sales<br />

Revenues<br />

Operating costs<br />

Depreciation<br />

Other project effects<br />

Before tax income<br />

Taxes<br />

Net income<br />

Plus depreciation<br />

Net op cash flow<br />

Year Year<br />

3 4<br />

-------- --------<br />

$0.94 $0.96<br />

1,450,000 1,450,000<br />

-------- --------<br />

$1,364,610 $1,385,079<br />

1,315,139 1,420,350<br />

32,250 15,050<br />

20,000 20,000<br />

-------- --------<br />

($2,779) ($70,321)<br />

(1,112) (28,128)<br />

-------- --------<br />

($1,667) ($42,193)<br />

32,250 15,050<br />

-------- --------<br />

$30,583 ($27,143)<br />

24

Allied Foods2 Allied Foods2<br />

25<br />

26<br />

Year Year Year Year Year<br />

0 1 2 3 4<br />

Net op cash flow $134,613 $102,733 $30,583 ($27,143)<br />

Salvage value $50,000<br />

SV tax=-(SV-BV)T ( 20,000)<br />

Recovery of NWC 10,000<br />

--------<br />

Termination CF $40,000<br />

-------- -------- -------- -------- --------<br />

Project NCF ($225,000) $134,613 $102,733 $30,583 $12,857<br />

NPV<br />

IRR<br />

TV<br />

MIRR<br />

Payback<br />

($2,804)<br />

14.1%<br />

$388,622<br />

14.6%<br />

1.9<br />

27<br />

Allied Foods3<br />

28<br />

If you terminate a project before the<br />

asset is fully depreciated, will this<br />

affect the profitability of the project<br />

•Yes, the early termination of a project<br />

may either decrease or increase the<br />

profitability of a project.<br />

Year Year Year Year<br />

0 1 2 3<br />

Net op cash flow $134,613 $102,733 $30,583<br />

Salvage value $50,000<br />

SV tax (13,980)<br />

Recovery of NWC 10,000<br />

--------<br />

Termination CF $46,020<br />

-------- -------- -------- --------<br />

Project NCF ($225,000) $134,613 $102,733 $76,603<br />

Allied Foods3<br />

29<br />

30<br />

Conclusions<br />

NPV<br />

IRR<br />

TV<br />

MIRR<br />

Payback<br />

$20,103<br />

20.9%<br />

$372,771<br />

18.3%<br />

1.9<br />

•The project is acceptable only if<br />

operated for 3 years.<br />

•A project’s engineering life does not<br />

always equal its economic life.<br />

•The ability to abandon a project may<br />

make an otherwise unattractive<br />

project acceptable.<br />

•Abandonment possibilities will be<br />

very important when we get to risk.

Types of Abandonment<br />

•Sale to another party who can obtain<br />

greater cash flows, e.g., IBM sold<br />

typewriter division.<br />

•Abandon because the project is<br />

losing money, e.g., smokeless<br />

cigarette.<br />

31<br />

Fairways Driving Range<br />

• Initial Investment:<br />

Dispensing Machine $2,000<br />

Pick-up vehicle $7,000<br />

Tractor and Accessories $9,000<br />

Change in NWC $3,000<br />

• Operating <strong>Flow</strong>s and Inflation Rates:<br />

Sales of buckets of balls 20,000<br />

price per bucket $3.00<br />

Fixed costs $53,000<br />

Op costs 5.0%<br />

Price inflation 4.0%<br />

Cost inflation 5.0%<br />

Growth in Unit Sales 10.0%<br />

• Salvage Value, Tax Rate, and Cost of Capital:<br />

Salvage value $1,800<br />

Tax rate 30%<br />

Market value of business $10,000<br />

Cost of capital 14.3%<br />

32<br />

Fairways 1 Fairways 1<br />

33<br />

34<br />

Net Investment Outlay:<br />

Dispensing Machine $2,000<br />

Pick-up vehicle $7,000<br />

Tractor and Accessories $9,000<br />

Change in NWC $3,000<br />

--------<br />

$21,000<br />

Depreciable basis = $18,000<br />

EOY<br />

MACRS Dep. Book<br />

Year Factor Expense Value<br />

------ ------ -------- --------<br />

1 33% $5,940 $12,060<br />

2 45% 8,100 3,960<br />

3 15% 2,700 1,260<br />

4 7% 1,260 0<br />

------ --------- -------<br />

100% $18,000<br />

35<br />

Year Year Year Year<br />

0 1 2 3<br />

-------- -------- -------- --------<br />

Unit price $3.00 $3.12 $3.24 $3.37<br />

Unit sales 20,000 22,000 24,200 26,620<br />

Revenues $68,640 $78,524 $89,832<br />

Fixed Costs ($53,000) ($53,000) ($53,000)<br />

Operating costs per unit 0.1575 0.1654 0.1736<br />

Total Operating costs (3,465) (4,002) (4,622)<br />

Depreciation (5,940) (8,100) (2,700)<br />

-------- -------- --------<br />

Before tax income $6,235 $13,422 $29,509<br />

Taxes 1,871 4,027 8,853<br />

-------- -------- --------<br />

Net income $4,365 $9,396 $20,657<br />

Plus depreciation 5,940 8,100 2,700<br />

-------- -------- --------<br />

Net op cash flow $10,305 $17,496 $23,357<br />

Net op cash flow $10,305 $17,496 $23,357<br />

Salvage value<br />

SV tax<br />

Market Value of Business*<br />

Tax on sale of business<br />

Termination CF<br />

$1,800<br />

(162)<br />

10,000<br />

(3,000)<br />

$8,638<br />

-------- -------- -------- --------<br />

Project NCF ($21,000) $10,305 $17,496 $31,995<br />

*NWC is captured in the price when the business is sold.<br />

36

37<br />

38<br />

Decision Measures:<br />

NPV<br />

IRR<br />

TV<br />

MIRR<br />

Payback<br />

Should CFs include interest expense<br />

Dividends<br />

Fairways Driving Range<br />

Equity Residual Model<br />

39<br />

Fairways 1<br />

40<br />

• Salvage Value, Tax Rate, and Cost of Capital:<br />

Salvage value $1,800<br />

Tax rate 30%<br />

Market value of business $10,000<br />

Percent of Debt Financing 50%<br />

Cost of Debt 12%<br />

Cost of Equity 25%<br />

Net Investment Outlay:<br />

Dispensing Machine $2,000<br />

Pick-up vehicle $7,000<br />

Tractor and Accessories $9,000<br />

Change in NWC $3,000<br />

--------<br />

$21,000<br />

========<br />

Equity Investment $10,500<br />

Debt Financing $10,500<br />

Year Year Year Year<br />

0 1 2 3<br />

-------- -------- -------- --------<br />

Unit price $3.00 $3.12 $3.24 $3.37<br />

Unit sales 20,000 22,000 24,200 26,620<br />

Revenues $68,640 $78,524 $89,832<br />

Fixed Costs ($53,000) ($53,000) ($53,000)<br />

Operating costs per unit 0.1575 0.1654 0.1736<br />

Total Operating costs (3,465) (4,002) (4,622)<br />

Interest Expense (1,260) (1,260) (1,260)<br />

Depreciation<br />

Before tax income<br />

Taxes<br />

Net income<br />

Plus depreciation<br />

(5,940) (8,100) (2,700)<br />

-------- -------- --------<br />

$4,975 $12,162 $28,249<br />

(1,493) (3,649) (8,475)<br />

-------- -------- --------<br />

$3,483 $8,514 $19,775<br />

5,940 8,100 2,700<br />

-------- -------- --------<br />

Net op cash flow $9,423 $16,614 $22,475<br />

41<br />

Fairways 2<br />

Year Year Year Year<br />

0 1 2 3<br />

Net op cash flow $9,422 $16,613 $22,474<br />

Salvage value $1,800<br />

SV tax (162)<br />

Market value of business* 10,000<br />

Tax on sale of business (3,000)<br />

Principal Repayment (10,500)<br />

-----------<br />

Termination CF (1,862)<br />

-------- -------- -------- --------<br />

Project NCF ($10,500) $9,422 $16,613 $20,612<br />

*NWC is captured in the price when the business is sold.<br />

42

With an equity residual model, the<br />

cost of equity, K=25%, is used to find<br />

the project’s NPV, MIRR, and IRR.<br />

43<br />

Adjusted-present-value (APV)<br />

44<br />

NPV<br />

IRR<br />

TV<br />

MIRR<br />

Payback<br />

APV = NPV + NPVF<br />

The value of a project to a levered firm (APV)<br />

is equal to the value of the project to an<br />

unlevered firm (NPV) plus the net present value<br />

of the financing side effects (NPVF).<br />

Adjusted Present Value (APV)<br />

45<br />

Adjusted Present Value (APV)<br />

46<br />

There are four side effects caused by the issuance of<br />

debt:<br />

1.The Tax Subsidy to Debt. (T C B)<br />

2.The Costs of Issuing New Securities.<br />

3.The Costs of Financial Distress.<br />

4. Subsidies to Debt Financing.<br />

<strong>Cash</strong> flows are the same as the typical NPV<br />

estimation:<br />

Year Year Year Year<br />

0 1 2 3<br />

($21,000) $10,305 $17,496 $31,995<br />

However, like the equity residual model, the cost of<br />

equity is used to find the NPV of the unlevered firm:<br />

NPV =<br />

(Unlevered K= 25%)<br />

Note: We can not use the IRR or MIRR for comparison or decision<br />

making.<br />

Adjusted Present Value (APV)<br />

47<br />

Adjusted Present Value (APV)<br />

48<br />

Floatation Costs are paid immediately but are amortized<br />

over the life of the loan.<br />

Floatation Costs<br />

(1% of debt)<br />

Deduction<br />

Tax shield = Deduction * t<br />

Floatation <strong>Cash</strong> <strong>Flow</strong><br />

NPV of Floatation Costs:<br />

(discounted at the risk free rate of 10%)<br />

Year Year Year Year<br />

0 1 2 3<br />

Tax Subsidy<br />

Year Year Year Year<br />

0 1 2 3<br />

Loan Amount $10,500<br />

Interest Paid @ 12%<br />

After tax cost of debt (Int*(1-t))<br />

Balloon payment of debt<br />

<strong>Cash</strong> <strong>Flow</strong><br />

NPV of Tax Subsidy:<br />

(discounted at the risk free rate of 10%)

Adjusted Present Value (APV)<br />

49<br />

If this were a replacement rather than<br />

a new project, would the analysis<br />

change<br />

50<br />

APV = NPV(Equity) + NPV(Floatation Costs) + NPV (Tax Subsidy)<br />

APV =<br />

NPV =<br />

NPV (FTE) =<br />

•Yes. The old equipment would be<br />

sold and the incremental CFs would<br />

be the changes from the old to the<br />

new situation.<br />

Operating <strong>Cash</strong> <strong>Flow</strong>s for a<br />

Replacement Project<br />

(New Revenue - New Cost - New depr)(1-T) + New depr<br />

- (Old Revenue - Old Cost - Old depr)(1-T) + Old depr<br />

---------------------------------------------------------------------------------<br />

(@Revenue - @ Cost - @ depr)(1-T) + @ depr<br />

51<br />

McDwyer Corporation<br />

• Initial Investment: (000)<br />

Price $300,000<br />

Freight $10,000<br />

Change in NWC $0<br />

Sale of old machine $80,000<br />

• Operating <strong>Flow</strong>s and Inflation Rates:<br />

New: Old:<br />

Sales volume 200,000 200,000<br />

Year 0 sales price $3.25 $3.25<br />

Op costs 70.0% 80.0%<br />

Price inflation 4.0% 4.0%<br />

Cost inflation 3.0% 3.0%<br />

• Salvage Value, Tax Rate, and Cost of Capital:<br />

Salvage value $40,000 $30,000<br />

Tax rate 40%<br />

Cost of capital 12%<br />

Depreciation: 3 yr MACRS Straight Line<br />

Current Book Value $100,000<br />

Life 4 years 2 years left<br />

52<br />

Net Investment Outlay:<br />

Price ($300,000)<br />

Freight (10,000)<br />

Sell old machine 80,000<br />

Tax on old machine<br />

-(80,000-100,000)*.4= 8,000<br />

--------<br />

($222,000)<br />

53<br />

McDwyer<br />

Depreciable basis = $310,000<br />

EOY<br />

MACRS Dep. Book<br />

Year Factor Expense Value<br />

------ ------ -------- --------<br />

1 33% $102,300 $207,700<br />

2 45% 139,500 68,200<br />

3 15% 46,500 21,700<br />

4 7% 21,700 0<br />

------ ------------- ----------<br />

100% $310,000<br />

54

Year Year Year<br />

0 1 2<br />

New: -------- -------- --------<br />

55<br />

Year Year<br />

3 4<br />

-------- --------<br />

Unit price $3.25 $3.38 $3.52 $3.66 $3.80<br />

Unit sales 200,000 200,000 200,000 200,000<br />

Old: -------- -------- -------- --------<br />

Unit price $3.25 $3.38 $3.52 $0.00 $0.00<br />

Unit sales 200,000 200,000 0 0<br />

Change in Revenues $0 $0 $731,162 $760,408<br />

New Cost per Unit $2.34 $2.41 $2.49 $2.56<br />

New Operating costs 468,650 482,710 497,191 512,107<br />

Old Cost per Unit 2.68 2.76 0 0<br />

Old Operating costs 535,600 551,668 0 0<br />

Change Operating costs ($66,950) ($68,959) $497,191 $512,107<br />

New Depreciation 102,300 139,500 46,500 21,700<br />

Old Depreciation 50000 50000 0 0<br />

Change in Depreciation 52300 89500 46500 21700<br />

-------- -------- -------- --------<br />

Before tax income $14,650 ($20,541) $187,471 $226,602<br />

Taxes 5,860 (8,217) 74,988 90,641<br />

-------- -------- -------- --------<br />

Change in Net income $8,790 ($12,325) $112,482 $135,961<br />

Plus change in depreciation 52,300 89,500 46,500 21,700<br />

-------- -------- -------- --------<br />

Net change in operating cash flow $61,090 $77,175 $158,982 $157,661<br />

Net change in operating<br />

cash flow<br />

$61,090 $77,175 $158,982 $157,661<br />

-------- -------- -------- --------<br />

Salvage value ($30,000) $40,000<br />

SV tax $12,000 (16,000)<br />

-------- --------<br />

Termination CF ($18,000) $24,000<br />

-------- -------- -------- -------- --------<br />

Project NCF ($222,000) $61,090 $59,175 $158,982 $181,661<br />

56<br />

McDwyer 57<br />

58<br />

How many piano tuners are there in<br />

Omaha<br />

NPV<br />

IRR<br />

TV<br />

MIRR<br />

Payback<br />

Estimating the revenue, operating costs, and external effects<br />

of a project or business plan is similar to the Fermi problem<br />

just discussed.<br />

• If we become bogged down in obtaining the exact estimate,<br />

wasted time and effort may be spent on a superfluous<br />

process, or worse, no estimate is made because of<br />

concerns about being wrong.<br />

• If we simply throw out a guess without breaking down the<br />

estimating process, significant and biased errors may be<br />

made.<br />

• To estimate a project’s revenue, cost, or external effect, we<br />

should break the estimation processes down into several<br />

incremental steps. Because of the law of diversification, an<br />

error made in one step may be corrected by an opposite<br />

error in another step.<br />

• In addition, risk analysis will aid us in identifying those<br />

incremental estimates that significantly affect profitablility<br />

and warrant more research.<br />

59<br />

What is the role of the executive<br />

manager in the cash flow estimation<br />

process<br />

•Coordination with other<br />

departments<br />

•Maintaining consistency of<br />

assumptions<br />

•Elimination of biases in the<br />

forecasts<br />

60

61<br />

62<br />

What is cash flow estimation bias<br />

•CF’s are estimated for many future<br />

periods.<br />

•If company has many projects and<br />

errors are random and unbiased,<br />

errors will cancel out (aggregate<br />

NPV estimate will be OK).<br />

•Studies show that forecasts often are<br />

biased (overly optimistic revenues,<br />

underestimated costs).<br />

What steps can management take to<br />

eliminate the incentives for cash flow<br />

estimation bias<br />

•Routinely compare CF estimates with<br />

those actually realized and reward<br />

managers who are forecasting well,<br />

penalize those who are not.<br />

•When evidence of bias exists, the<br />

project’s CF estimates should be<br />

adjusted to offset the bias.<br />

63<br />

What is option value<br />

•Investment in a project may lead to<br />

other valuable opportunities.<br />

•Investment now may extinguish<br />

opportunity to undertake same<br />

project in the future.<br />

•True project NPV = NPV + value of<br />

options.