Clearing House Group Minutes - Department of Taoiseach

Clearing House Group Minutes - Department of Taoiseach

Clearing House Group Minutes - Department of Taoiseach

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

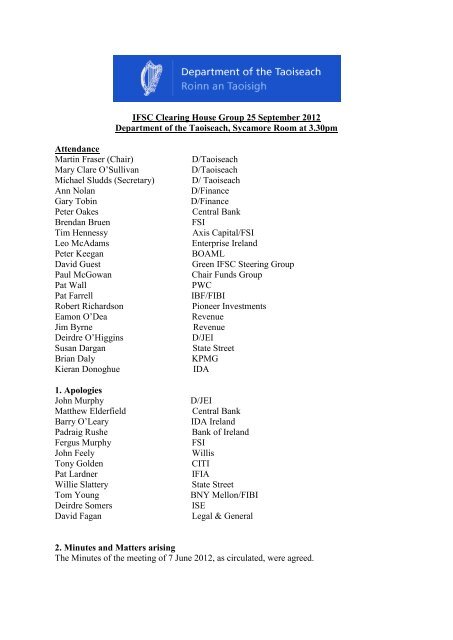

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 25 September 2012<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Sycamore Room at 3.30pm<br />

Attendance<br />

Martin Fraser (Chair)<br />

Mary Clare O‟Sullivan<br />

Michael Sludds (Secretary)<br />

Ann Nolan<br />

Gary Tobin<br />

Peter Oakes<br />

Brendan Bruen<br />

Tim Hennessy<br />

Leo McAdams<br />

Peter Keegan<br />

David Guest<br />

Paul McGowan<br />

Pat Wall<br />

Pat Farrell<br />

Robert Richardson<br />

Eamon O‟Dea<br />

Jim Byrne<br />

Deirdre O‟Higgins<br />

Susan Dargan<br />

Brian Daly<br />

Kieran Donoghue<br />

1. Apologies<br />

John Murphy<br />

Matthew Elderfield<br />

Barry O‟Leary<br />

Padraig Rushe<br />

Fergus Murphy<br />

John Feely<br />

Tony Golden<br />

Pat Lardner<br />

Willie Slattery<br />

Tom Young<br />

Deirdre Somers<br />

David Fagan<br />

D/<strong>Taoiseach</strong><br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

D/Finance<br />

D/Finance<br />

Central Bank<br />

FSI<br />

Axis Capital/FSI<br />

Enterprise Ireland<br />

BOAML<br />

Green IFSC Steering <strong>Group</strong><br />

Chair Funds <strong>Group</strong><br />

PWC<br />

IBF/FIBI<br />

Pioneer Investments<br />

Revenue<br />

Revenue<br />

D/JEI<br />

State Street<br />

KPMG<br />

IDA<br />

D/JEI<br />

Central Bank<br />

IDA Ireland<br />

Bank <strong>of</strong> Ireland<br />

FSI<br />

Willis<br />

CITI<br />

IFIA<br />

State Street<br />

BNY Mellon/FIBI<br />

ISE<br />

Legal & General<br />

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 7 June 2012, as circulated, were agreed.

3. CHG Operation/IFSC Strategy<br />

The meeting discussed various dimensions in relation to implementation <strong>of</strong> the strategy<br />

taking particular account <strong>of</strong> the competitive international environment. The idea <strong>of</strong><br />

establishing a Sub-<strong>Group</strong> was mooted.<br />

In relation to transparency, consideration will be given in advance <strong>of</strong> the next <strong>Group</strong> meeting,<br />

to the placing the <strong>Minutes</strong> <strong>of</strong> the <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> on D/<strong>Taoiseach</strong>‟s website, to<br />

publishing an annual report on the work <strong>of</strong> the CHG and to briefing the Oireachtas Joint<br />

Committee on Finance, Public Expenditure and Reform.<br />

In response to the discussion regarding the forthcoming budget, Tim Hennessy informed the<br />

meeting that the UK tax regime continued to improve and given London‟s prominence within<br />

the re/insurance market, it was increasingly challenging for Ireland to differentiate itself.<br />

4. Regulation (incl.Central Bank/Industry engagement)<br />

Peter Oakes reported that the Central Bank and Industry continue to engage on business as<br />

usual matters. He noted that Pat Farrell had informed, following previous engagements<br />

between the Central Bank and Industry that Industry will be reverting with its views on the<br />

approach to enforcement very shortly. Pat Farrell confirmed the point at the meeting. Pat<br />

Farrell informed the Chair that Industry think it important that further engagement take place<br />

on the Strategic Plan with the Central Bank before its publication. It was noted that the<br />

Strategic Plan is under draft with publication some months away.<br />

On the topic <strong>of</strong> anti-money laundering it was noted that the IFIA has, in past few days, raised<br />

the prospect <strong>of</strong> revisiting a specific area (reliance on third parties issue) <strong>of</strong> AML. The<br />

Central Bank is awaiting details from the IFIA. Paul McGowan informed that specifics <strong>of</strong> the<br />

issue will be sent to the Central Bank shortly. In response to a question from Ann Nolan<br />

about the timing <strong>of</strong> the new issue, IFIA confirmed that it will include D/Finance on the<br />

communication.<br />

5. D/Finance Update<br />

Ann Nolan, D/Finance, reported on a number <strong>of</strong> items including:<br />

AIFMD Level 2<br />

The College <strong>of</strong> Commissioners will not be disposing <strong>of</strong> the matter straight away. The process<br />

is continuing and the <strong>Department</strong> is contact with other Member States, and the Commission<br />

in relation to this matter.<br />

Anti Money Laundering Issues<br />

Discussions are ongoing between the Funds Industry, the <strong>Department</strong> <strong>of</strong> Finance and the<br />

Central Bank in relation to two related issues for some time namely Third party reliance and<br />

Secrecy Jurisdictions. It is hoped that progress can be achieved on both issues in the short<br />

term.<br />

IOSCO Multilateral Memorandum <strong>of</strong> Understanding (MMOU)<br />

Industry and the Central Bank recently informed D/Finance that failure to sign the IOSCO<br />

MMOU by the end <strong>of</strong> the year will have repercussions.<br />

The CBSE is currently between second and committee stages and has been for some time.<br />

Every effort is being made for the Bill to be completed in time for year-end.

CRD Update<br />

The Capital Requirements Directive and Regulation which are currently being discussed at<br />

trilogue stage are vitally important pieces <strong>of</strong> legislation. The need for stronger capital and<br />

liquidity standards for EU financial institutions is evident from the financial crisis. Ireland<br />

has played an active role in the negotiations during the Council Working Party group stage<br />

and will continue to monitor the progress <strong>of</strong> this proposal.<br />

General Tax Update<br />

Budget / Finance Bill 2013<br />

The annual consultation process with industry in respect <strong>of</strong> Budget and Finance Bill 2013 has<br />

commenced. Preliminary meetings have taken place with all <strong>of</strong> the CHG Tax Subgroups and<br />

we are awaiting formal pre-Budget submissions from some <strong>of</strong> the <strong>Group</strong>s (Insurance and<br />

Banking & Treasury).<br />

FATCA is one <strong>of</strong> the <strong>Department</strong>‟s (and Revenue‟s) big priorities in terms <strong>of</strong> Finance Bill<br />

2013 and negotiations with the US on an Intergovernmental Agreement are currently<br />

underway.<br />

Financial Transactions Tax (FTT)<br />

It became clear at the ECOFIN meeting in June that an EU-wide FTT would not be agreed,<br />

and those countries who favour the tax will now try to introduce it by way <strong>of</strong> “enhanced cooperation”,<br />

under which at least nine countries must participate. This requires those countries<br />

to write to the Commission asking it to produce a formal proposal for such a directive. No<br />

letter has issued to date and therefore there is no revised proposal. However, it is believed<br />

there will be a sufficient number <strong>of</strong> countries and that any new proposal will not substantially<br />

differ from the current proposal.<br />

Ireland will not be among the participating countries but the Minister for Finance has stated<br />

we will not stand in the way <strong>of</strong> those who want to introduce an FTT under the “enhanced cooperation”<br />

mechanism.<br />

The Minister had previously stated his view that an FTT would be best applied on a wide<br />

international basis to include the major financial centres; and that if it could not be introduced<br />

on a global basis, it would be better if it were introduced on an EU-wide basis to prevent any<br />

distortion <strong>of</strong> activity within the Union.<br />

EU Wide Bank Resolution Proposals<br />

Ireland has been supportive <strong>of</strong> the Commission‟s work to prepare a proposal for a Directive<br />

to establish a framework for the recovery and resolution <strong>of</strong> credit institutions and investment<br />

firms. Now that it has been published Officials from the D/Finance and the Central Bank are<br />

engaging with it at Council Working <strong>Group</strong> level.<br />

Banking Union<br />

Ireland supports the development <strong>of</strong> a banking union for Europe in principle but does not<br />

favour a fragmented approach. Further banking integration is supported and Ireland would<br />

favour its application to all banks in the 27.

Ireland supports the development <strong>of</strong> a banking union for Europe which immediately and<br />

permanently breaks the link between the sovereign and the banks and significantly eases the<br />

burden <strong>of</strong> support that Ireland has already provided to the banking sector.<br />

6. New Business/International Engagement and Marketing<br />

Green IFSC hosted a seminar at the Sustainability Conference in Galway in July. The<br />

seminar was well attended by international and domestic players and received excellent<br />

coverage in international journals. The keynote address by the <strong>Taoiseach</strong> served to underline<br />

Ireland's commitment to developing financial services activities which support the green<br />

economy. The Minister for Communications, Energy and Natural Resources also addressed<br />

the seminar.<br />

The 'Greening the IFSC' initiative was successfully launched by the Minister Rabbitte on<br />

September 27th. The project is supported initially by 10 major IFSC firms and SEAI. It is a<br />

key component in building credibility for Dublin as a leading centre for green funds and<br />

financing activity. It also demonstrates the commitment <strong>of</strong> the international financial services<br />

sector to the wider sustainability agenda.<br />

John Bruton <strong>of</strong> IFSC Ireland will headline a Green Funds event to be held in New York 28-<br />

30 November. The event is targeting influencers and decision makers in the global green<br />

asset management sector.<br />

In relation to Education and Skills there was a successful launch <strong>of</strong> DCU MSc in Sustainable<br />

Energy Finance in June 2012.<br />

The Green IFSC initiative continues to gather support from private sector participants and the<br />

public sector/state agencies. The focus through 2012 has been on building a credible<br />

legislative and skills framework to reinforce a strong branding and communications<br />

programme. The Steering <strong>Group</strong> will review work to date in the last quarter and agree an<br />

action plan for 2013. The mission is to build on the marketing and communications<br />

momentum and target the key players in the sector using both public and private sector<br />

resources.<br />

Enterprise Ireland hosted International Markets Week in Dublin in September. Over 100<br />

marketing executives from 30 overseas <strong>of</strong>fices representing 60 markets met with EI clients to<br />

assist them in their international growth strategies. There were over 2,300 meetings<br />

organised for 700 EI clients. All <strong>of</strong> EI‟s key Financial Services clients attended the event,<br />

with significant focus on emerging markets.<br />

EI will be holding 3 overseas Financial Services events in quarter 4 <strong>of</strong> this year, a trade<br />

mission to Canada and to South Africa and an Embassy dinner event in London.<br />

Kieran Donoghue briefed the <strong>Group</strong> on recent developments in relation to IDA marketing <strong>of</strong><br />

the sector and international engagement:<br />

IDA continues to engage with a diverse range <strong>of</strong> companies within the international financial<br />

services sector. This includes both existing investors as well as new targets. IDA has recently<br />

completed a five day promotional programme in Singapore and Kuala Lumpur. The<br />

programme team included a Senior Official from the <strong>Department</strong> <strong>of</strong> Finance. Meetings were

held with a range <strong>of</strong> institutions including Sovereign Wealth Funds, Banks, Asset / Fund<br />

Managers and Institutional investors.<br />

The programme included a specific focus on Islamic Finance and several meetings with<br />

relevant companies at the Global Islamic Finance Forum (GIFF). Islamic finance is a specific<br />

area <strong>of</strong> opportunity identified in the Government‟s Strategy for the sector. The trip confirmed<br />

several investment prospects from the region– both portfolio and direct.<br />

Forthcoming overseas marketing missions by IDA include the following:<br />

West Coast <strong>of</strong> the United States (US) in October with a focus on Payments and Financial<br />

Technology (Minister Bruton will also be in the US at this time and meetings are being put in<br />

place with FS clients)<br />

Hedge Funds - East Coast US in late October<br />

The UK (London) early November with John Bruton, President <strong>of</strong> IFSC Ireland<br />

SIBOS Japan also November.<br />

Pat Farrell gave an update on IFSC Ireland. A review <strong>of</strong> IFSC Ireland‟s mandate was<br />

recently completed by an independent consultant. Having considered the outputs and<br />

recommendations, the Council <strong>of</strong> IFSC Ireland decided to renew the mandate and that <strong>of</strong> the<br />

President for a further 2 years. Upcoming promotional events between now and year end are<br />

focused on London and New York with the latter focused on the marketing <strong>of</strong> “Green IFSC”.<br />

7. AOB<br />

Brendan Bruen reported good engagement on discussions with the Central Bank on Cross<br />

Border Guidelines.<br />

Pat Wall led a discussion on the recently published GFSI ratings which placed Ireland at 49.<br />

There was general agreement that the rating was disappointing but probably not an accurate<br />

reflection <strong>of</strong> where Ireland should be, notwithstanding the challenges we face. Pat Wall<br />

undertook to come back to the <strong>Group</strong> with suggestions.<br />

8. Date <strong>of</strong> next meeting<br />

The next meeting takes place on Thursday 22 November at 8.30am.

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 7 June 2012<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Room 308 at 8.30am<br />

Attendance<br />

Martin Fraser (Chair)<br />

Michael Sludds (Secretary)<br />

John Murphy<br />

Ann Nolan<br />

Gary Tobin<br />

Tom Young<br />

Michael Brennan<br />

Patrick Brady<br />

Brendan Bruen<br />

Tim Hennessy<br />

Leo McAdams<br />

Peter Keegan<br />

Willie Slattery<br />

David Guest<br />

David Fagan<br />

Tony Golden<br />

Pat Lardner<br />

Denis Curran<br />

Deirdre Somers<br />

Paul McGowan<br />

Pat Wall<br />

John Feely<br />

1. Apologies<br />

Matthew Elderfield<br />

Mary-Clare O‟Sullivan<br />

Barry O‟Leary<br />

Padraig Rushe<br />

Brian Daly<br />

Pat Farrell<br />

Robert Richardson<br />

Eamon Deasy<br />

Jim Byrne<br />

Fergus Murphy<br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

D/JEI<br />

D/Finance<br />

D/Finance<br />

BNY Mellon/FIBI<br />

Revenue<br />

Central Bank<br />

FSI<br />

Axis Capital/FSI<br />

Enterprise Ireland<br />

BOAML<br />

State Street<br />

Green IFSC Steering <strong>Group</strong><br />

Legal & General<br />

CITI<br />

IFIA<br />

IDA<br />

ISE<br />

Chair Funds <strong>Group</strong><br />

PWC<br />

Willis<br />

Central Bank<br />

D/<strong>Taoiseach</strong><br />

IDA Ireland<br />

Bank <strong>of</strong> Ireland<br />

KPMG<br />

IBF/FIBI<br />

Pioneer Investments<br />

Revenue<br />

Revenue<br />

FSI<br />

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 3 April 2012, as circulated, were agreed.

3. Regulation (incl.Central Bank/Industry engagement)<br />

Pat Brady reported that the Central Bank and Industry are continuing to engage, reporting<br />

progress with a number <strong>of</strong> substantive issues addressed. There was recognition <strong>of</strong> the many<br />

challenges for the international financial services industry in the difficult global environment<br />

and the ability to fulfil the objectives in the Strategy.<br />

4. Presentation by Matthew Elderfield to CHG in July<br />

The meeting was informed that Matthew Elderfield will make a presentation to the CHG on<br />

the Central Banks Strategy 2013-2015 on Tuesday 10 July at 3.30pm.<br />

5. D/Finance Update<br />

Ann Nolan reported that the <strong>Department</strong> had established an internal IFSC Working <strong>Group</strong> to<br />

enhance the <strong>Department</strong>‟s engagement with the <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> and Industry.<br />

AIFMD<br />

The <strong>Department</strong> has been in contact with the EU Commission. The Commission indicated<br />

that it was open to amendments to Article 85(d) to allow the continued delegation <strong>of</strong><br />

significant numbers <strong>of</strong> functions by fund managers where the manager retains an appropriate<br />

level <strong>of</strong> oversight and control.<br />

They had also discussed the depositary liability issues and submitted proposals jointly with<br />

the UK and Luxembourg. The Commission is examining the proposals and it is expected they<br />

will make their views known in the next few weeks.<br />

Open Ended Investment Company/SICAV Bill<br />

Industry is currently working on preparing a submission regarding the Draft Heads for<br />

consideration by the <strong>Department</strong>.<br />

The timetable is considered ambitious. Even if Heads are quickly agreed the Office <strong>of</strong> the<br />

Attorney General and the Oireachtas will have competing demands. The <strong>Department</strong> <strong>of</strong><br />

Finance will also be under pressure before during and after the presidency next year.<br />

Industry have <strong>of</strong>fered any assistance which is appropriate in preparing the Heads <strong>of</strong> a Bill<br />

which will require close consultation between the Central Bank, D/JEI and D/Finance before<br />

Government approval is sought for the Heads <strong>of</strong> Bill.<br />

CRD IV Update<br />

Following the unanimous support for the Danish Presidency compromise text at the ECOFIN<br />

meeting on 15 May, CRD IV is currently at Trialogue stage, the process where the European<br />

Parliament, the European Commission and the Danish Presidency engage in negotiations to<br />

achieve a first reading agreement. The European Parliament‟s ECON committee voted in<br />

favour <strong>of</strong> rappateur Othmar Kara‟s‟ report on 14 May.<br />

Discussions are continuing at Trialogue stage with a vote in the European Parliament on the<br />

proposal scheduled for early July. This is one <strong>of</strong> the priorities <strong>of</strong> the Danish Presidency.<br />

Aim <strong>of</strong> the Proposal<br />

The legislative package published by the European Commission on 20 July 2011 proposes to<br />

implement Basel III in EU law by a recast <strong>of</strong> the existing Capital Requirements Directive into<br />

a new Directive and a Regulation.

The aim <strong>of</strong> the proposal is to reflect the Basel III capital proposals, to introduce new<br />

sanctions for non-compliance with prudential rules, corporate governance and remuneration.<br />

These changes are due to be implemented from 1 January 2013 (there will be transitional<br />

arrangements for some elements).<br />

The proposal changes the balance <strong>of</strong> home-host supervisor responsibilities concerning<br />

liquidity supervision <strong>of</strong> branches. Under the current CRD, host supervisors are responsible<br />

for liquidity supervision, pending further coordination. CRD IV will assign this responsibility<br />

to home supervisors, but with safeguards to ensure that host supervisors have full access to<br />

information gathered by home supervisors.<br />

General Tax Update<br />

D/Finance has started a consultation process in respect <strong>of</strong> Budget and Finance Bill 2013.<br />

Meetings have taken place with the Banking and Treasury Tax Subgroup and meetings are<br />

scheduled with the Insurance and Funds <strong>Group</strong>s over the coming weeks.<br />

Presidency <strong>of</strong> the EU will be a significant priority for D/Finance over the course <strong>of</strong> the next<br />

year – there are a number <strong>of</strong> high-pr<strong>of</strong>ile tax dossiers – CCCTB, FTT, and VAT. The<br />

<strong>Department</strong> met with the European Commission in March <strong>of</strong> this year to kick <strong>of</strong>f the<br />

planning process and further meetings at Heads <strong>of</strong> Unit Level are planned for July.<br />

FTT<br />

The Government position is clear. Any tax on financial transactions would be best applied on<br />

a wide international basis to include the major financial centres. If such a tax cannot be<br />

introduced on a global basis, it would be better if it were introduced on an EU-wide basis, as<br />

this would prevent any distortion <strong>of</strong> activity within the Union. There is concern if a FTT was<br />

introduced, it could affect the financial services industry, especially in the IFSC, and lead to<br />

some activities moving abroad.<br />

D/Finance has consulted widely with the financial services industry on the implications <strong>of</strong> the<br />

FTT proposal, including a round-table meeting on 5 March. The <strong>Department</strong> is fully aware<br />

<strong>of</strong> industry concerns that the proposal may lead to loss <strong>of</strong> business and employment,<br />

particularly if it is not introduced on a global or EU-wide basis.<br />

FATCA – Foreign Account Tax Compliance Act<br />

Five Countries - Germany, Italy, U.K., Spain and France, together with the US issued a joint<br />

statement, in February, to the effect that they would explore a common approach to FATCA<br />

implementation through domestic reporting and reciprocal automatic exchange and based on<br />

existing bilateral tax treaties. In essence, country-to-country agreements would replace the<br />

agreements between the U.S. and the foreign financial institutions.<br />

Following the release <strong>of</strong> that statement, Revenue has made contact with the U.S. Treasury<br />

and is now in discussions with the U.S. with a view to implementing a country-to-country<br />

agreement with the U.S. in relation to FATCA.<br />

EU Wide Bank Resolution Proposals<br />

D/Finance mentioned the European Commission proposal for a Directive to establish a<br />

framework for the recovery and resolution <strong>of</strong> credit institutions and investment firms

The Commission characterises the overriding objective <strong>of</strong> the framework as ensuring that<br />

institutions in difficulties can be allowed to fail without risk to financial stability while<br />

avoiding costs to taxpayers.<br />

6. Strategy Progress and Monitoring<br />

Brendan Bruen and the Chairs <strong>of</strong> the IFSC Working <strong>Group</strong>s gave brief updates in respect <strong>of</strong><br />

Strategy implementation. The Chair indicated that a review <strong>of</strong> progress on the Strategy would<br />

be undertaken by the Public Sector representatives and a meeting organised in the coming<br />

weeks.<br />

7. New Business -Green IFSC<br />

Communications & Marketing<br />

Following the recent launch <strong>of</strong> the Green IFSC Global Green Asset Management network,<br />

initiative on-going marketing and communications activity has led to significant, positive<br />

media attention domestically and internationally among mainstream, green enterprise and<br />

financial services publications.<br />

Private Sector response<br />

As a direct result <strong>of</strong> increased marketing/communications activity, Green IFSC is receiving<br />

an increased number <strong>of</strong> queries from international green finance players seeking to learn<br />

more about Ireland‟s <strong>of</strong>fering in this space. Green IFSC Steering <strong>Group</strong> private sector<br />

members are assisting with query response.<br />

Education/Skills<br />

Supported by the Summit Finuas Network, education/skills pillar will launch the new DCU<br />

MsC in Sustainable Energy Finance on 25 June in the Convention Centre. Green finance<br />

educational suite <strong>of</strong> products now stands at three – DCU MsC in Sustainable Energy Finance,<br />

DCU Grad Cert in Sustainable Energy Finance and UCD Smurfit MsC in Energy &<br />

Environmental Finance.<br />

Tax/Finance<br />

Hosted by PwC, Green IFSC‟s inaugural Green Tax Breakfast briefing was held on 2 May.<br />

With a capacity audience <strong>of</strong> 127 finance and enterprise leaders, this event <strong>of</strong>fered an<br />

opportunity to brief attendees on recent green finance supportive tax measures.<br />

“Greening the IFSC”<br />

Supported by SEAI, the measurement <strong>of</strong> the IFSC‟s carbon footprint, under the “Greening<br />

the IFSC” continues. To date, 12 companies have signed up to this specific project<br />

representing 8,000 plus <strong>of</strong> IFSC employees.<br />

State agencies continue to play an important role in supporting Green IFSC efforts. Recent<br />

meetings have been held with IDA focussed on collaboration across<br />

marketing/communications activity, with follow up scheduled mid-June. Enterprise Ireland<br />

meeting is currently being scheduled.<br />

Initiative momentum is being maintained and accelerated as a result <strong>of</strong> mandate certainty.

8. International Engagement and Marketing<br />

Michael Stapleton said that John Bruton, in conjunction with IDA and IFSC Ireland, had a<br />

series <strong>of</strong> bilateral meetings with senior executives up to CEO level, <strong>of</strong> both existing clients<br />

and major target companies in the US in March.<br />

IFIA had staged two major platform events and other networking events in New York and<br />

Boston.<br />

The <strong>Taoiseach</strong>‟s visit to China had also given the IDA and Industry the opportunity to meet<br />

with a number <strong>of</strong> Chinese banks and interested parties in the aviation finance sector.<br />

9. Date <strong>of</strong> next meeting<br />

The next meeting takes place on 25 September at 3.30pm.

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 3 April 2012<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Italian Room at 5pm<br />

Attendance<br />

Martin Fraser (Chair)<br />

Mary Clare O‟Sullivan<br />

Michael Sludds (Secretary)<br />

Michael Stapleton<br />

John Murphy<br />

Ann Nolan<br />

Tom Young<br />

Eamonn O‟Dea<br />

Jim Byrne<br />

Patrick Brady<br />

Brendan Bruen<br />

Padraig Rushe<br />

Brian Daly<br />

Tim Hennessy<br />

Julie Sinnamon<br />

Pat Farrell<br />

Peter Keegan<br />

Willie Slattery<br />

David Guest<br />

Robert Richardson<br />

John Travers<br />

David Fagan<br />

Tony Golden<br />

Gary Palmer<br />

Denis Curran<br />

Deirdre Somers<br />

Breda Power<br />

1. Apologies<br />

Fergus Murphy<br />

John Feely<br />

Matthew Elderfield<br />

Barry O‟Leary<br />

Paul McGowan<br />

Pat Wall<br />

D/<strong>Taoiseach</strong><br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

IDA Ireland<br />

D/JEI<br />

D/Finance<br />

BNY Mellon/FIBI<br />

Revenue<br />

Revenue<br />

Central Bank<br />

FSI<br />

Bank <strong>of</strong> Ireland<br />

KPMG<br />

Axis Capital/FSI<br />

Enterprise Ireland<br />

IBF/FIBI<br />

BOAML<br />

State Street<br />

Green IFSC Steering <strong>Group</strong><br />

Pioneer Investments<br />

Chair, Green Evaluation Team<br />

Legal & General<br />

CITI<br />

IFIA<br />

IDA<br />

ISE<br />

D/JEI<br />

FSI<br />

Attain<br />

Central Bank<br />

IDA Ireland<br />

Chair Funds <strong>Group</strong><br />

PWC<br />

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 18 January 2012, as circulated, were agreed.<br />

The Chair introduced Mary Clare O‟Sullivan, D/<strong>Taoiseach</strong>, to her first meeting <strong>of</strong> the <strong>Group</strong>.

The Chair thanked Gary Palmer <strong>of</strong> the Irish Funds Industry Association for the excellent<br />

contribution he had given over the years to both the Funds Working <strong>Group</strong> and the <strong>Clearing</strong><br />

<strong>House</strong> <strong>Group</strong>. On behalf <strong>of</strong> the <strong>Group</strong> he wished Gary every success in the future.<br />

3. <strong>Department</strong> <strong>of</strong> Finance update<br />

Ann Nolan updated the <strong>Group</strong> on a number <strong>of</strong> issues:<br />

The Finance Act passed through all stages <strong>of</strong> the Oireachtas and was signed into law by the<br />

President. The Act contains 13 sections which introduce 21 individual measures to support<br />

the ambitious jobs targets contained in the IFSC Strategy.<br />

In summary, the measures enhance the competitive position <strong>of</strong> the sector through:<br />

o Reducing double taxation in the corporate treasury and aircraft leasing sectors,<br />

o Providing clarity around the tax treatment <strong>of</strong> complex financial transactions in<br />

terms <strong>of</strong> stamp duty in particular,<br />

o Addressing tax issues arising for investment funds due to the UCITS IV Directive<br />

which was implemented on 1 July 2011, and<br />

o Further easing the administrative burden in relation to non-resident investors in<br />

Irish investment funds.<br />

Taken together with the Special Assignee Relief Programme and Foreign Earnings<br />

Deduction, the measures represent a significant package which will support the<br />

competitiveness <strong>of</strong> the industry and hopefully assist in creating new jobs.<br />

Financial Transactions Tax<br />

Opinion on the FTT is polarised, and there could be considerable discussion on the subject at<br />

the upcoming Informal ECOFIN. A clearer picture may emerge after that meeting.<br />

D/Finance position on the proposals for an FTT is clear. Any tax on financial transactions<br />

would be best applied on a wide international basis to include the major financial centres. If<br />

such a tax cannot be introduced on a global basis, it would be better if it were introduced on<br />

an EU-wide basis, as this would prevent any distortion <strong>of</strong> activity within the Union. The<br />

major concern is that, if an FTT is introduced, it could affect the financial services industry,<br />

especially in the IFSC, and lead to some activities moving abroad.<br />

D/Finance has consulted widely with the financial services industry on the implications <strong>of</strong> the<br />

FTT proposal, including most recently a round-table meeting on 5 March. The <strong>Department</strong> is<br />

fully aware <strong>of</strong> industry concerns that the proposal may lead to loss <strong>of</strong> business and<br />

employment, particularly if it is not introduced on a global or EU-wide basis.<br />

FATCA - Foreign Account Tax Compliance Act<br />

The European Commission had been negotiating with the US on behalf <strong>of</strong> all member states<br />

until a group <strong>of</strong> five countries (France, Germany, Italy, Spain and UK) broke away and issued<br />

a joint statement with the US announcing their intention to explore a common approach to<br />

FATCA implementation through domestic reporting and reciprocal automatic exchange and<br />

based on existing bilateral tax treaties.

What is envisaged is that the relevant financial institutions in those member states would<br />

report to their national Revenue authorities in respect <strong>of</strong> US investors. The national Revenue<br />

authorities would then deal direct with the IRS in the automatic exchange <strong>of</strong> information.<br />

The issue has been discussed with the relevant representatives <strong>of</strong> the IFS industry and the<br />

industry favours an approach whereby Ireland would also seek to enter into a bilateral<br />

agreement with the US whereby reporting from Irish financial institutions would be to the<br />

Irish Revenue who would then exchange information directly with the IRS.<br />

Jim Byrne, Revenue, reported that following the issue <strong>of</strong> the Joint Statement by the U.S.,<br />

Germany, Italy, U.K., Spain and France, Ireland decided to initiate contact with the U.S.,<br />

with a view to exploring a common approach to FATCA implementation through domestic<br />

reporting and automatic exchange and based on existing bilateral tax treaties.<br />

Revenue has made contact with the U.S. Treasury and is now in discussions with U.S.<br />

The U.S. have outlined that they are not engaging in negotiations with individual States but<br />

are developing a model global agreement. Ireland is one <strong>of</strong> a number <strong>of</strong> countries with which<br />

discussions in relation to a model agreement are ongoing.<br />

The model agreement will not alter or amend the obligation to identify or report certain<br />

information under FATCA but will outline an alternative pathway for reporting FATCA.<br />

The model agreement is expected by the end <strong>of</strong> June.<br />

4. Regulation<br />

Regarding Central Bank/Industry engagement, the industry side is finalising its submission to<br />

the Central Bank and expects to meet with the Bank soon. A more substantive report will be<br />

made to the next CHG meeting.<br />

AML continues to be an area where further engagement with the Central Bank and D/<br />

Finance would be <strong>of</strong> benefit. Industry is currently working towards an AML workshop with<br />

the Central Bank, where industry's proposals regarding areas where concerns arising from<br />

AML inspections will be considered. Additionally, the AML workshop will also look to<br />

agree a framework/procedure for a risk based assessment <strong>of</strong> third parties/jurisdictions<br />

pending a legislative amendment to the CJA 2010 to provide for this.<br />

Following this workshop it is proposed that the Investment Funds Sectoral Guidelines will be<br />

revised and updated to reflect the proposals agreed during the workshop, following which the<br />

revised guidelines will be shared with the Central Bank for review/agreement.<br />

With regard to reliance on third parties in jurisdictions where banking secrecy exists, it was<br />

noted that while other jurisdictions appear to have similar requirements when relying on third<br />

parties in jurisdictions with banking secrecy, the challenges <strong>of</strong> accepting undertakings from<br />

such third parties, which reference local secrecy laws, were not so acute in other jurisdictions.<br />

It was noted that the D/Finance have written to the Commission to understand how this issue<br />

was being addressed in other Member States.<br />

5. New Business<br />

Green IFSC

John Travers presented the findings <strong>of</strong> the independent Review <strong>Group</strong> which was established<br />

to undertake an evaluation <strong>of</strong> the Global Green Interchange (GGI) Report and the<br />

implementation plan contained therein and report back to Government.<br />

Ultimately the Review Document has recommended against one <strong>of</strong> the key recommendations<br />

<strong>of</strong> the original GGI report which was the establishment <strong>of</strong> an International Carbon Registry in<br />

Dublin. However, the Review does highlight a number <strong>of</strong> other positive elements <strong>of</strong> the<br />

Green IFSC Initiative.<br />

With regard to the Green Finance proposals (Pillar 2), the Evaluation <strong>Group</strong> agreed that there<br />

are significant investment location opportunities for Ireland in this space and that these are<br />

best pursued on the basis <strong>of</strong> agreed partnership arrangements between the private sector and<br />

the development agencies. Both sectors are active in this space at present but, even taking<br />

account <strong>of</strong> the inherent differences in their roles, their respective activities are somewhat<br />

more fragmented than they should be if Ireland Inc's promotional activities are to be<br />

optimised. There is a need for an agreed, joint promotional approach. Some <strong>of</strong> this work will<br />

be industry-driven, some will be agency/Government-driven and some will involve shared<br />

activities.<br />

In relation to the Education, Skills and Innovation aspects <strong>of</strong> the report (Pillar 3) the<br />

Evaluation <strong>Group</strong> considered that these are well articulated and agreed that ongoing work<br />

needs to be further enhanced and developed to create a pool <strong>of</strong> pr<strong>of</strong>essional expertise which<br />

will meet the requirements <strong>of</strong> investors in green finance and associated projects in<br />

consultation with training bodies, with the third- level education providers and with the<br />

<strong>Department</strong> <strong>of</strong> Education and the HEA.<br />

Regarding the proposals in respect <strong>of</strong> carbon markets (Pillar 1: the establishment <strong>of</strong> a<br />

sovereign-backed International Carbon Standard (ICS) and a Dublin International Voluntary<br />

Offset Registry/DIVOR by the Government) the Evaluation <strong>Group</strong> do not consider that the<br />

case for such initiatives, radical and innovative as they are, as set out in the report, are<br />

sufficiently robust to allow their endorsement by the <strong>Group</strong>. The reasons for that conclusion<br />

are set out in detail in the report <strong>of</strong> the Evaluation <strong>Group</strong>.<br />

Following Mr Travers presentation there was a general discussion on the next steps. It was<br />

agreed that the development agencies, IDA and Enterprise Ireland, should meet as a matter <strong>of</strong><br />

urgency with representatives <strong>of</strong> the <strong>Group</strong> to progress the required partnership arrangements<br />

on the promotion and development <strong>of</strong> the green finance initiatives as advocated by both the<br />

Evaluation <strong>Group</strong> and the <strong>Group</strong>. It was agreed that any further consideration <strong>of</strong> the<br />

ICS/DIVOR proposals be "parked" pending progress on these initiatives.<br />

Tony Golden, Citi, said that Investment funds which invest in 'Green or Environmental<br />

Companies' and which are traded and listed on a regulated stock exchange are no different to<br />

administering any other UCITS or regulated fund. Investment funds which invest in 'Carbon<br />

Credits' or indeed start up early stage finance green companies may be a little more complex<br />

and may fit more into a non-UCITS or QIF type fund. However, provided there are no issues<br />

in obtaining prices for these type securities, they can be easily administered.<br />

He felt that from a pure 'custody and clearing perspective', there is a possible opportunity.<br />

The clearing and settlement aspects <strong>of</strong> carbon credit trading, as well as the issuance and<br />

paying agency aspects which relate to a carbon credit type security is perhaps an activity

where IFSC could carve out an opportunity as a centre <strong>of</strong> excellence. In other words, while<br />

there may/may not be a Carbon credit trading opportunity, there could be opportunities for<br />

custody, clearing, issuance and paying agency activities for the IFSC. Citi has an <strong>of</strong>fering<br />

currently available.<br />

David Guest reported that progress on the Green IFSC initiative had continued during the<br />

evaluation period in respect <strong>of</strong> the marketing <strong>of</strong> green financial services and green finance<br />

education. He noted that Michael Sludds from <strong>Department</strong> <strong>of</strong> an <strong>Taoiseach</strong> would be joining<br />

the Green IFSC Steering <strong>Group</strong> and also noted the support given by an <strong>Taoiseach</strong> to the<br />

Green Asset Management Global network initiative at recent events in the US and China.<br />

6. International Engagement and Marketing<br />

Michael Stapleton said that John Bruton, in conjunction with IDA and IFSC Ireland, had a<br />

series <strong>of</strong> bilateral meetings with senior executives up to CEO level, <strong>of</strong> both existing clients<br />

and major target companies in the US in March.<br />

IFIA had staged two major platform events and other networking events in New York and<br />

Boston.<br />

The <strong>Taoiseach</strong>‟s visit to China had also given the IDA and Industry the opportunity to meet<br />

with a number <strong>of</strong> Chinese banks and interested parties in the aviation finance sector.<br />

7. Strategy Update from Working <strong>Group</strong> Chairs<br />

Asset Management Working <strong>Group</strong><br />

Robert Richardson reported that the <strong>Group</strong> had completed a first draft <strong>of</strong> its strategy<br />

document for input into the overall IFSC Strategy.<br />

Insurance Working <strong>Group</strong><br />

Tim Hennessy informed the meeting that the industry members <strong>of</strong> the Insurance Working<br />

<strong>Group</strong> had met on two occasions to develop their views on possibilities to further develop<br />

employment opportunities within existing markets along with opportunities for new entrants.<br />

A matrix across the various re/insurance industry sectors was developed encompassing<br />

product, jurisdiction, regulatory, tax etc. The broad themes are consistent with Insurance<br />

opportunities for growth included in the 2011-16 IFSC Strategy document. Meetings had<br />

also been held with FSI and the Insurance Working <strong>Group</strong> output will be incorporated into<br />

the overall document being coordinated by FSI.<br />

Banking and Treasury Working <strong>Group</strong><br />

David Guest reported that a Working <strong>Group</strong> was progressing with an initiative with<br />

participants in the Private Equity/Venture capital sector. The objective <strong>of</strong> the initiative is to<br />

determine whether marketing and development <strong>of</strong> the IFSC can be expanded to promote<br />

growth in this sector together with the established IFSC sectors. The Banking and Treasury<br />

<strong>Group</strong> was also monitoring developments in payment services, intellectual property<br />

commercialisation and Islamic finance to identify links and synergies with existing CHG<br />

initiatives.

Funds Working <strong>Group</strong><br />

Gary Palmer said that a matrix <strong>of</strong> action points for the Funds industry had been drawn up and<br />

a number <strong>of</strong> sub-group meetings had taken place to discuss implementation.<br />

Pension Funds Working <strong>Group</strong><br />

A Pension Funds Focus <strong>Group</strong> is scheduled for 22 May to discuss the future potential for<br />

cross-border pensions and asset pooling.<br />

8. Date <strong>of</strong> next meeting:<br />

The next meeting <strong>of</strong> the <strong>Group</strong> takes place on Thursday 7 June at 8.30am.

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 18 January 2012<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Room 308 at 10am<br />

Attendance<br />

Martin Fraser (Chair)<br />

Michael Sludds (Secretary)<br />

Kieran Donoghue<br />

John Murphy<br />

Ann Nolan<br />

Gary Tobin<br />

Pat Casey<br />

Ge<strong>of</strong>frey Keating<br />

Tom Young<br />

Eamonn O‟Dea<br />

Jim Byrne<br />

Patrick Brady<br />

Brendan Bruen<br />

Padraig Rushe<br />

Brian Daly<br />

Paul McGowan<br />

Tim Hennessy<br />

Joe Breslin<br />

Pat Farrell<br />

Peter Keegan<br />

Pat Wall<br />

Willie Slattery<br />

David Guest<br />

Robert Richardson<br />

John Travers<br />

David Fagan<br />

Tony Golden<br />

Gary Palmer<br />

1. Apologies<br />

Fergus Murphy<br />

John Feely<br />

Matthew Elderfield<br />

Barry O‟Leary<br />

Deirdre Somers<br />

Breda Power<br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

IDA Ireland<br />

D/JEI<br />

D/Finance<br />

D/Finance<br />

D/Finance<br />

D/<strong>Taoiseach</strong><br />

BNY Mellon/FIBI<br />

Revenue<br />

Revenue<br />

Central Bank<br />

FSI<br />

Bank <strong>of</strong> Ireland<br />

KPMG<br />

Chair Funds <strong>Group</strong><br />

Axis Capital/FSI<br />

Enterprise Ireland<br />

IBF/FIBI<br />

BOAML<br />

PWC<br />

State Street<br />

Green IFSC Steering <strong>Group</strong><br />

Pioneer Investments<br />

Chair, Green Evaluation Team<br />

Legal & General<br />

CITI<br />

IFIA<br />

FSI<br />

Attain<br />

Central Bank<br />

IDA Ireland<br />

ISE<br />

D/JEI<br />

The Chair welcomed the newly appointed Secretary General <strong>of</strong> D/JEI, John Murphy, to the<br />

<strong>Group</strong>.

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 24 November 2011, as circulated, were agreed.<br />

3. IFSC Strategy Implementation<br />

Brendan Bruen updated the <strong>Group</strong> on progress on the IFSC Strategy. The Working <strong>Group</strong>s<br />

were preparing implementation plans for the end <strong>of</strong> February, and work was also progressing<br />

on cross-sector elements.<br />

The Chairs <strong>of</strong> the Working <strong>Group</strong>s updated the <strong>Group</strong> on specific issues under consideration.<br />

The intention is to present work on a consolidated list <strong>of</strong> action areas at the next <strong>Group</strong><br />

meeting.<br />

4. Green IFSC Evaluation process<br />

Kieran Donoghue reported that the Evaluation <strong>Group</strong> had met on a number <strong>of</strong> occasions<br />

since being established at the end <strong>of</strong> September 2011. The <strong>Group</strong> were reviewing the draft<br />

findings <strong>of</strong> the Steering <strong>Group</strong> implementation plan and expected to report back to<br />

D/<strong>Taoiseach</strong> shortly.<br />

The Chair <strong>of</strong> the Evaluation <strong>Group</strong>, John Travers, would meet with Martin Fraser to inform<br />

him <strong>of</strong> the <strong>Group</strong>‟s findings.<br />

5. EU<br />

(a) Recent Developments<br />

D/ Finance reported that:<br />

The European Commission published a proposal on 30 September for a Directive on a<br />

common system <strong>of</strong> financial transaction tax.<br />

The Minister has indicated that Ireland does not agree to such a tax being introduced<br />

except at a global level or at least by all 27 Member States <strong>of</strong> the European Union,<br />

including the United Kingdom.<br />

The <strong>Taoiseach</strong> reiterated this view during the British-Irish Council meeting in Dublin in<br />

January 2012.<br />

The <strong>Department</strong> <strong>of</strong> Finance hosted a roundtable discussion on the FTT in October 2011<br />

and has sought input from each <strong>of</strong> the CHG subgroups in terms <strong>of</strong> the potential impact <strong>of</strong><br />

the FTT on their sector.<br />

The proposals are being discussed at EU Council Working <strong>Group</strong> level and the first<br />

meeting dealing with the text <strong>of</strong> the proposal took place on the 3 January.<br />

The next meeting is scheduled for March 2012 and D/Finance intends to host another<br />

roundtable discussion with the IFS industry in advance <strong>of</strong> that meeting.<br />

(b) Presidency Preparations<br />

D/Finance gave a comprehensive overview indicating anything they anticipate will arise in<br />

the international financial services area during the Irish Presidency:

2012 sees the Danish and Cypriot Presidencies. This will form the backdrop to the Irish<br />

Presidency.<br />

Danish Presidency<br />

The Danes have identified a number <strong>of</strong> priorities in Financial Services and have plans to<br />

make progress on the 10 Financial Services dossiers currently under ECOFIN and the 2<br />

Financial Services files which will fall under the Competiveness Council.<br />

They hope to secure either a first or second reading agreement with the European Parliament<br />

on the following dossiers:<br />

i. Mortgage Credit Directive<br />

ii. CRD IV<br />

iii. Deposit Guarantee Schemes<br />

iv. Omnibus II<br />

v. Investor Compensation Schemes<br />

vi. EMIR<br />

vii. Venture Capital Funds (Competitiveness Council)<br />

viii. Social Entrepreneurship Funds (Competitiveness Council)<br />

Denmark hopes to get an agreed general approach at Council on the Credit Ratings Agencies<br />

dossier and on the Transparency dossier. This would then leave the Trilogue negotiations to<br />

the Cypriot Presidency and possibly the Irish Presidency.<br />

It is the Danish intention on the Central Securities Depositories and MIFID and Market<br />

Abuse to produce a Progress Report at the end <strong>of</strong> their 6 months. These two files will then<br />

fall into the Irish Presidency at Trilogue stage, if not finalising negotiations on a common<br />

approach.<br />

EU Commission proposals<br />

Denmark will also deal with a number <strong>of</strong> forthcoming proposals from the Commission if and<br />

when they are adopted:<br />

Crisis Management (Bank recovery and resolution) – end January/early February.<br />

Discussions within the Commission are being finalised but there remains a problem regarding<br />

choosing a date to release this. A worsening <strong>of</strong> the banking situation may lead to further<br />

delay.<br />

Central Securities Depositories – end January/early February<br />

Protection <strong>of</strong> Investors (PRIPS) – end February/early March<br />

Insurance Mediation Directive – end February/early March<br />

UCITS V – April<br />

AIFMD LII – Quarter 2<br />

Other matters<br />

Work is also ongoing on the non-legislative file on Shadow Banking. The Commission will<br />

put forward a communication on this by end March and will be holding a conference around<br />

27 April

Cypriot Presidency<br />

Negotiations on the following files will be initiated by the Cypriot Presidency and will form<br />

part <strong>of</strong> the Irish Presidency agenda:<br />

Directive on legal certainty <strong>of</strong> securities holding and transactions (SLD)<br />

Institutions for Occupational Retirement Provisions (IORP) – The <strong>Department</strong> <strong>of</strong> Social<br />

Protection take the lead on this file.<br />

Close-out Netting<br />

Irish Presidency planning<br />

The agenda is evolving and will become clearer as the Danish and Cypriot presidencies<br />

progress.<br />

Discussions with the Commission and Trio partners [Lithuania and Greece] will be important<br />

part <strong>of</strong> the decision making process on priorities.<br />

The Minister for Finance and the Government will decide on our priorities.<br />

Trilogue discussions with European Parliament will be a key part <strong>of</strong> the Irish Presidency.<br />

D/<strong>Taoiseach</strong> updated the <strong>Group</strong> on Presidency preparations and priorities for the Irish<br />

Presidency. At the last two IDCCP meetings in November and December 2011, <strong>Department</strong>s<br />

highlighted emerging issues and draft legislation that is likely to figure on Ireland‟s<br />

Presidency agenda in 2013.These discussions will feed into the Trio and national Presidency<br />

programming process. Regular meetings are taking place with Attachés focussing on<br />

emerging sectoral priorities and this work will also contribute to the clearer definition <strong>of</strong> Irish<br />

Presidency themes. The IDCCP will continue to evaluate and refine the Presidency priorities<br />

and to assess emerging overall themes.<br />

It was also reported that the Presidency would largely be based in Dublin and that it provided<br />

a unique promotional opportunity for Ireland to assist in rebuilding Ireland‟s reputation in<br />

Europe and internationally.<br />

6. Budget and Finance Bill process<br />

In December‟s Budget, the Minister announced the introduction <strong>of</strong> a new Special Assignee<br />

Relief Programme and a new Foreign Earnings Deduction for temporary assignments to<br />

BRICS countries in order to help address this issue.<br />

The Minister also reiterated the Government‟s commitment to the 12.5% corporate tax rate<br />

and announced that Finance Bill 2012 would contain a further package <strong>of</strong> measures to<br />

support the IFS industry.<br />

The Finance Bill will be published on 9 February.<br />

As mentioned at the November 2011 CHG meeting, the Tax Policy Unit in the <strong>Department</strong> <strong>of</strong><br />

Finance has been working closely with the different industry subgroups in the run-up to the<br />

Finance Bill and three further meetings took place in December and January.

D/Finance pointed out that when considering industry proposals, they must also be mindful <strong>of</strong><br />

Ireland‟s tax reputation.<br />

In this regard, in relation to the Funds Industry proposal for the introduction <strong>of</strong> a bespoke tax<br />

regime for a new type <strong>of</strong> investment vehicle – an „Alternative Investment Company‟<br />

D/Finance said they had to consider the broader implications <strong>of</strong> individual proposals in terms<br />

<strong>of</strong> their potential impact on Ireland‟s reputation.<br />

It was the <strong>Department</strong>‟s view that the introduction <strong>of</strong> such a vehicle could be viewed<br />

negatively by our Treaty partners as overly aggressive and as a result, the proposal was not<br />

being considered for the Finance Bill.<br />

The <strong>Department</strong> understood the industry‟s disappointment but highlighted that virtually all <strong>of</strong><br />

the other issues contained in the Funds Industry pre-Budget submission were being<br />

progressed and that the <strong>Department</strong> is working with the Funds industry to develop a new<br />

corporate funds structure in Ireland.<br />

There are between 15 and 20 individual measures under consideration. The aim <strong>of</strong> a number<br />

<strong>of</strong> these measures is to simplify the tax treatment applying to complex financial transactions<br />

in order to make it easier to do business.<br />

7. Report on Central Bank / industry engagement<br />

Discussions are ongoing between the Central Bank and industry, and meetings will take place<br />

over the coming weeks.<br />

8. Marketing IDA/IFSC Ireland<br />

IDA reported that the 2012 marketing programme was underway. A number <strong>of</strong> forthcoming<br />

international events involving the <strong>Taoiseach</strong>, the IDA and IFSC Ireland were outlined. IDA<br />

was cautiously optimistic on the prospects for 2012.<br />

Martin Fraser informed the meeting that a high pr<strong>of</strong>ile inward visit from China was<br />

earmarked for February and that the <strong>Taoiseach</strong> would visit Davos in February and a number<br />

<strong>of</strong> cities in the US as part <strong>of</strong> the St Patricks Day celebrations.<br />

9. AOB<br />

John Murphy said that a Jobs Action Plan was being finalised within D/JEI and would be<br />

announced shortly. He also mentioned that consideration was being given restructuring<br />

within the <strong>Department</strong> and its Agencies.<br />

10. Date <strong>of</strong> next meeting:<br />

The next meeting takes place at 5pm on Tuesday 3 April 2012 in the Italian Room, Ground<br />

Floor.

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 24 November 2011<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Room 308 at 8.30am<br />

Attendance<br />

Martin Fraser (Chair)<br />

Michael Sludds (Secretary)<br />

Barry O‟Leary<br />

Kieran Donoghue<br />

Ann Nolan<br />

Gary Tobin<br />

Eamonn O‟Dea<br />

Jim Byrne<br />

Matthew Elderfield<br />

Patrick Brady<br />

Breda Power<br />

Brendan Bruen<br />

Tom Young<br />

Padraig Rushe<br />

Brian Daly<br />

Paul McGowan<br />

Tim Hennessy<br />

David Fagan<br />

Joe Breslin<br />

Pat Farrell<br />

Peter Keegan<br />

Pat Wall<br />

Deirdre Somers<br />

Willie Slattery<br />

David Guest<br />

Robert Richardson<br />

John Travers<br />

1. Apologies<br />

Fergus Murphy<br />

Tony Golden<br />

John Feely<br />

Gary Palmer<br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

IDA Ireland<br />

IDA Ireland<br />

D/Finance<br />

D/Finance<br />

Revenue<br />

Revenue<br />

Central Bank<br />

Central Bank<br />

D/JEI<br />

FSI<br />

FIBI<br />

Bank <strong>of</strong> Ireland<br />

KPMG<br />

Chair Funds <strong>Group</strong><br />

Axis Capital/FSI<br />

Legal & General<br />

Enterprise Ireland<br />

IBF/FIBI<br />

BOAML<br />

PWC<br />

ISE<br />

State Street<br />

Ulster Bank<br />

Pioneer Investments<br />

Chair, Green Evaluation Team<br />

FSI<br />

CITI<br />

Attain<br />

IFIA<br />

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 14 July 2011, as circulated, were agreed.<br />

3. IFSC Strategy Implementation<br />

Brendan Bruen updated the group on implementation <strong>of</strong> the IFSC strategy. A proposed roadmap<br />

for Q1 2012 was circulated outlining a number <strong>of</strong> actions. The goal was to tie down the<br />

high-level objectives that had been agreed to specific initiatives, timelines and ownership. In

areas where clear responsibility lies with an existing body or working group, this would be<br />

formally delegated.<br />

The Working <strong>Group</strong>s were being asked to complete work plans by the 28 February on aspects<br />

<strong>of</strong> the strategy that were sector specific. Cross-sectoral strands were also on-going, and a<br />

consolidated plan would be prepared for the March meeting <strong>of</strong> the group. In implementing<br />

the strategy, consideration will be given to the establishment <strong>of</strong> standing cross-sector groups<br />

where appropriate, if necessary adjusting the meeting frequency <strong>of</strong> the sector working groups<br />

to keep workload constant.<br />

Timelines were agreed as:<br />

By Jan 31 – Industry submission to Central Bank<br />

By Jan 31 – Go-live <strong>of</strong> IT resource<br />

By Feb 28 – Each Working <strong>Group</strong> to document implementation and ownership plans<br />

and provide to the <strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>.<br />

By Feb 28 – Work plans (supported by workshops if necessary) on<br />

o Education and skills<br />

o Tax priorities<br />

o Shared services, ICT/FS convergence<br />

o Targeting <strong>of</strong> Asian market<br />

o Coordination <strong>of</strong> international engagement and marketing<br />

March - Broad industry workshop involving CHG and Working <strong>Group</strong>s to review<br />

progress and identify outstanding items.<br />

4. Green IFSC Evaluation process<br />

David Guest confirmed that he and other members <strong>of</strong> the Green IFSC Steering <strong>Group</strong> were<br />

scheduled to meet the Chairman <strong>of</strong> the review panel, John Travers, on 28 November.<br />

The Review panel is to meet twice in December including a meeting with the full Steering<br />

<strong>Group</strong> on 20 December. He also emphasised the importance <strong>of</strong> completing the review process<br />

within a reasonable timeframe, ideally by end January 2012.<br />

5. Budget and Finance Bill process<br />

Ann Nolan reported to the meeting that:<br />

The Tax Policy Unit in the <strong>Department</strong> <strong>of</strong> Finance has met with the tax subgroups <strong>of</strong> the<br />

various IFSC sectors: funds, banking and treasury, insurance, Green IFSC and international<br />

asset financing in the run up to the Budget and Finance Bill.<br />

In total more than 10 separate meetings have so far taken place.<br />

A specific paper on tax issues impacting on the IFSC prepared by the <strong>Department</strong> <strong>of</strong> Finance<br />

was discussed recently by the Government's Tax Strategy <strong>Group</strong>.<br />

Many <strong>of</strong> the issues raised by the various tax subgroups were sector specific and these are<br />

being pursued bilaterally in the context <strong>of</strong> the forthcoming Finance Bill which will be<br />

published early February 2012.<br />

Some issues raised cut across different IFSC sectors. The most prominent issue has been in<br />

relation to SARP - the Special Assignee Relief Programme.

It is hoped that a significant package <strong>of</strong> IFSC supportive measures will be included in the<br />

Finance Bill.<br />

Obviously, given the current state <strong>of</strong> the public finances, the focus has been on progressing<br />

issues with little or no cost for the Exchequer.<br />

The Budget speech is currently in preparation. The speech will once again outline the<br />

Government's absolute commitment to the 12.5% Corporation tax regime.<br />

6. Report on Central Bank / industry engagement<br />

Matthew Elderfield reported that a very useful meeting had taken place between the senior<br />

regulatory management team <strong>of</strong> the Central Bank and senior industry representatives in<br />

September at which the Central Bank set out its strategy for 2012, including setting out the<br />

banking and supervisory challenges, rolling out the new supervisory approach (PRISM) and<br />

reforming supervision and regulation.<br />

Pat Farrell said that industry would send in a formal response before January 31 2012.<br />

Matthew Elderfield indicated that bilaterals with industry would continue in the future. The<br />

Chairman concluded that this was a useful exchange and the bilaterals were a good forum for<br />

discussing regulation specific issues.<br />

7. Marketing IDA/IFSC Ireland<br />

IDA Ireland provided an update on the pulse <strong>of</strong> their international financial services business;<br />

- Activity within the Sector is strong, based on site visits, investor queries and investments<br />

won;<br />

- Overseas marketing activity continues apace and has been enhanced by the effective<br />

collaboration with IFSC Ireland;<br />

- Client feedback on the various platform events put in place with IFSC Ireland has been very<br />

positive and further events are planned for 2012 in Frankfurt, New York, Brussels and<br />

London;<br />

- IDA plans to allocate additional resources to its financial services Division during 2012<br />

through internal redeployment;<br />

- The recent joint venture with the funds industry whereby IDA's overseas <strong>of</strong>fice network will<br />

act as representative <strong>of</strong>fices for the Sector is a further positive development.<br />

Pat Farrell updated on the activities <strong>of</strong> IFSC Ireland. There were two important dimensions<br />

to John Bruton‟s programme in 2011; overseas promotional visits to target markets in<br />

collaboration with IDA Ireland and industry representative bodies, bilateral meetings both<br />

here and overseas with firms interested in making new or additional investment into Ireland.<br />

An important complimentary aspect to John‟s work was his strong articulation <strong>of</strong> the Ireland<br />

Inc story as an integral part <strong>of</strong> the overall messaging.<br />

8. Date <strong>of</strong> next meeting:<br />

The next meeting takes place at 10am on Wednesday 18 January 2012.

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 14 July 2011<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Room 301 at 9.30am<br />

Attendance<br />

Dermot McCarthy (Chair)<br />

Michael Sludds (Secretary)<br />

Kieran Donoghue<br />

Gary Tobin<br />

Jim Byrne<br />

Bob Keane<br />

Fergus Murphy<br />

Brendan Bruen<br />

Tony Golden<br />

Padraig Rushe<br />

Brian Daly<br />

Paul McGowan<br />

Tim Hennessy<br />

David Fagan<br />

Joe Breslin<br />

Pat Farrell<br />

Patrick Brady<br />

Peter Keegan<br />

Pat Wall<br />

Aileen O‟Donoghue<br />

Breda Power<br />

Willie Slattery<br />

David Guest<br />

Robert Richardson<br />

Gary Palmer<br />

1. Apologies<br />

Kevin Cardiff<br />

Matthew Elderfield<br />

William Beausang<br />

Neil Ward<br />

Barry O‟Leary<br />

John Feely<br />

Deirdre Somers<br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

IDA Ireland<br />

D/Finance<br />

Revenue<br />

D/ETI<br />

FSI<br />

FSI<br />

CITI<br />

Bank <strong>of</strong> Ireland<br />

KPMG<br />

Chair Funds <strong>Group</strong><br />

Axis Capital/FSI<br />

Legal & General<br />

Enterprise Ireland<br />

IBF/FIBI<br />

Central Bank<br />

BOAML<br />

PWC<br />

ISE<br />

D/JEI<br />

State Street<br />

Ulster Bank<br />

Pioneer Investments<br />

IFIA<br />

D/Finance<br />

Central Bank<br />

D/Finance<br />

BMO<br />

IDA Ireland<br />

Attain<br />

ISE<br />

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 23 June 2011, as circulated, were agreed.<br />

3. Adoption <strong>of</strong> Strategy Document<br />

In relation to the IFSC Strategy, the Chair noted that the document agreed by the <strong>Group</strong> at its<br />

previous meeting had been finalised and approved by Cabinet. Printed versions <strong>of</strong> the

document were circulated at the meeting and would be made available online later in the day.<br />

The <strong>Taoiseach</strong> would be formally launching the Strategy and holding a press conference<br />

immediately after the conclusion <strong>of</strong> the meeting.<br />

4. AOB<br />

Tim Hennessy noted that further discussions had taken place between industry and the<br />

<strong>Department</strong> <strong>of</strong> Finance in relation to a possible call on the Insurance Compensation Fund<br />

arising from the failure <strong>of</strong> Quinn Insurance. The compatibility <strong>of</strong> the levy provisions with the<br />

Non-Life Directive was in question and concerns had been raised at an EU level by both DG<br />

Internal Market and DG Competition.<br />

The Chair indicated that this would be his last meeting in the role, and thanked the <strong>Group</strong> for<br />

their work. Brendan Bruen expressed thanks on behalf <strong>of</strong> the industry to the Chair and a<br />

presentation was made to the Chair in appreciation <strong>of</strong> his work and dedication over many<br />

years.<br />

5. Next Meeting<br />

The next meeting takes place at 8.30am on Thursday 8 September, 2011.

IFSC <strong>Clearing</strong> <strong>House</strong> <strong>Group</strong> 23 June 2011<br />

<strong>Department</strong> <strong>of</strong> the <strong>Taoiseach</strong>, Room 308 at 8.30am<br />

Attendance<br />

Dermot McCarthy (Chair)<br />

Michael Sludds (Secretary)<br />

Kieran Donoghue<br />

Gary Tobin<br />

Jim Byrne<br />

Bob Keane<br />

Fergus Murphy<br />

Brendan Bruen<br />

Tony Golden<br />

Padraig Rushe<br />

Brian Daly<br />

Paul McGowan<br />

Tim Hennessy<br />

David Fagan<br />

Julie Sinnamon<br />

Pat Farrell<br />

Patrick Brady<br />

Peter Keegan<br />

Pat Wall<br />

Aileen O‟Donoghue<br />

Breda Power<br />

Willie Slattery<br />

1. Apologies<br />

Robert Richardson<br />

Gary Palmer<br />

Kevin Cardiff<br />

Matthew Elderfield<br />

William Beausang<br />

Neil Ward<br />

Barry O‟Leary<br />

John Feely<br />

Deirdre Somers<br />

David Guest<br />

D/<strong>Taoiseach</strong><br />

D/ <strong>Taoiseach</strong><br />

IDA Ireland<br />

D/Finance<br />

Revenue<br />

D/ETI<br />

FSI<br />

FSI<br />

CITI<br />

Bank <strong>of</strong> Ireland<br />

KPMG<br />

Chair Funds <strong>Group</strong><br />

Axis Capital/FSI<br />

Legal & General<br />

Enterprise Ireland<br />

IBF/FIBI<br />

Central Bank<br />

BOAML<br />

PWC<br />

ISE<br />

D/JEI<br />

State Street<br />

Pioneer Investments<br />

IFIA<br />

D/Finance<br />

Central Bank<br />

D/Finance<br />

BMO<br />

IDA Ireland<br />

Attain<br />

ISE<br />

Ulster Bank<br />

The <strong>Group</strong> observed a minutes silence in respect <strong>of</strong> the late Mr Brian Lenihan T.D., Mrs<br />

Betty Tobin, Mrs Molly O‟Dea and Mr Liam Donlon<br />

2. <strong>Minutes</strong> and Matters arising<br />

The <strong>Minutes</strong> <strong>of</strong> the meeting <strong>of</strong> 12 May 2011, as circulated, were agreed.

3. Marketing and Messaging <strong>of</strong> the industry<br />

Pat Farrell and IDA reported that an update on the IFSC Ireland programme <strong>of</strong> events is to be<br />

provided and circulated to the <strong>Group</strong>.<br />

A set <strong>of</strong> proposed events with John Bruton (IFSC Ireland) are being considered for 2012.<br />

4. Adoption <strong>of</strong> Strategy Document<br />

The Chair proposed the final draft <strong>of</strong> the strategy document as circulated for adoption on<br />

behalf <strong>of</strong> the <strong>Group</strong> and for submission to Government. Two amendments <strong>of</strong> an<br />

uncontroversial nature were noted as pending in respect <strong>of</strong> educational links and payments.<br />

Brendan Bruen thanked industry and public sector members <strong>of</strong> the group for their assistance.<br />

He noted that further work was now being undertaken to plan implementation and ownership<br />

<strong>of</strong> the various elements <strong>of</strong> the strategy. The Chair thanked the <strong>Group</strong> for their contribution in<br />

bringing the Strategy to completion.<br />

The proposal to adopt the strategy was agreed unanimously and the Chair indicated that it<br />

would be submitted to Government in the coming weeks.<br />

5. Green IFSC<br />

Padraig Rushe reported that the implementation plan in draft form was now with the IDA and<br />

EI for validation. He said it was a comprehensive document covering all aspects <strong>of</strong> the<br />

transition to a global low-carbon economy.<br />

Kieran Donoghue acknowledged that the IDA received the document on 10 June and that the<br />

intention was to establish an Expert <strong>Group</strong> with international expertise to evaluate the<br />

proposal and funding by September 2011.<br />

6. AOB<br />

Tim Hennessy updated the meeting on the Insurance Compensation Fund, the concern <strong>of</strong> the<br />

industry that the statutory basis <strong>of</strong> the Fund no longer reflects the reality <strong>of</strong> the non-life<br />

insurance industry established here, and the severe competitive damage that the imposition <strong>of</strong><br />

the proposed levy would have on the international industry. It was noted that since the last<br />

CHG meeting, the <strong>Taoiseach</strong> had written to Minister Noonan highlighting the concerns <strong>of</strong> the<br />