multimanager-aggressive - Liberty

multimanager-aggressive - Liberty

multimanager-aggressive - Liberty

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Excelsior Multi-Manager Aggressive Portfolio<br />

31 August 2012<br />

Portfolio Mandate<br />

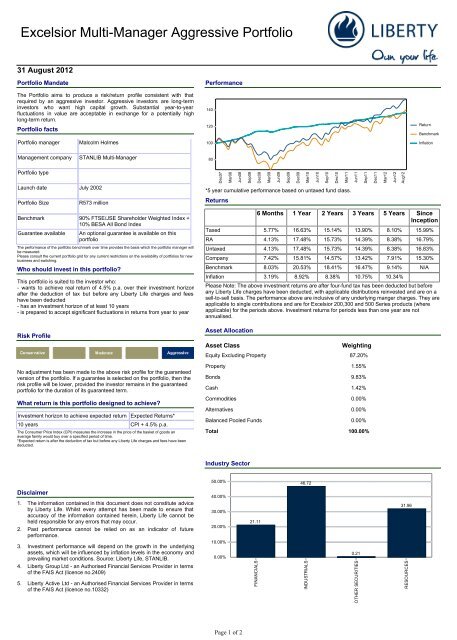

Performance<br />

The Portfolio aims to produce a risk/return profile consistent with that<br />

required by an <strong>aggressive</strong> investor. Aggressive investors are long-term<br />

investors who want high capital growth. Substantial year-to-year<br />

fluctuations in value are acceptable in exchange for a potentially high<br />

long-term return.<br />

Portfolio facts<br />

140<br />

120<br />

Return<br />

Benchmark<br />

Portfolio manager<br />

Malcolm Holmes<br />

100<br />

Inflation<br />

Management company<br />

STANLIB Multi-Manager<br />

80<br />

Portfolio type<br />

Dec07<br />

Mar08<br />

Jun08<br />

Sep08<br />

Dec08<br />

Mar09<br />

Jun09<br />

Sep09<br />

Dec09<br />

Mar10<br />

Jun10<br />

Sep10<br />

Dec10<br />

Mar11<br />

Jun11<br />

Sep11<br />

Dec11<br />

Mar12<br />

Jun12<br />

Aug12<br />

Launch date July 2002<br />

*5 year cumulative performance based on untaxed fund class.<br />

Portfolio Size<br />

R573 million<br />

Returns<br />

Benchmark 90% FTSE/JSE Shareholder Weighted Index +<br />

10% BESA All Bond Index<br />

Guarantee available<br />

An optional guarantee is available on this<br />

portfolio<br />

The performance of the portfolio benchmark over time provides the basis which the portfolio manager will<br />

be measured.<br />

Please consult the current portfolio grid for any current restrictions on the availability of portfolios for new<br />

business and switching.<br />

Who should invest in this portfolio<br />

This portfolio is suited to the investor who:<br />

- wants to achieve real return of 4.5% p.a. over their investment horizon<br />

after the deduction of tax but before any <strong>Liberty</strong> Life charges and fees<br />

have been deducted<br />

- has an investment horizon of at least 10 years<br />

- is prepared to accept significant fluctuations in returns from year to year<br />

6 Months 1 Year 2 Years 3 Years 5 Years Since<br />

Inception<br />

Taxed 5.77% 16.63% 15.14% 13.90% 8.10% 15.99%<br />

RA 4.13% 17.48% 15.73% 14.39% 8.38% 16.79%<br />

Untaxed 4.13% 17.48% 15.73% 14.39% 8.38% 16.83%<br />

Company 7.42% 15.81% 14.57% 13.42% 7.91% 15.30%<br />

Benchmark 8.03% 20.53% 18.41% 16.47% 9.14% N/A<br />

Inflation 3.19% 8.92% 8.38% 10.75% 10.34%<br />

Please Note: The above investment returns are after four-fund tax has been deducted but before<br />

any <strong>Liberty</strong> Life charges have been deducted, with applicable distributions reinvested and are on a<br />

sell-to-sell basis. The performance above are inclusive of any underlying manger charges. They are<br />

applicable to single contributions and are for Excelsior 200,300 and 500 Series products (where<br />

applicable) for the periods above. Investment returns for periods less than one year are not<br />

annualised.<br />

Risk Profile<br />

Asset Allocation<br />

Asset Class<br />

Equity Excluding Property<br />

Weighting<br />

87.20%<br />

No adjustment has been made to the above risk profile for the guaranteed<br />

version of the portfolio. If a guarantee is selected on the portfolio, then the<br />

risk profile will be lower, provided the investor remains in the guaranteed<br />

portfolio for the duration of its guaranteed term.<br />

What return is this portfolio designed to achieve<br />

Investment horizon to achieve expected return Expected Returns*<br />

10 years CPI + 4.5% p.a.<br />

The Consumer Price Index (CPI) measures the increase in the price of the basket of goods an<br />

average family would buy over a specified period of time.<br />

*Expected return is after the deduction of tax but before any <strong>Liberty</strong> Life charges and fees have been<br />

deducted.<br />

Property<br />

1.55%<br />

Bonds<br />

9.83%<br />

Cash<br />

1.42%<br />

Commodities<br />

0.00%<br />

Alternatives<br />

0.00%<br />

Balanced Pooled Funds<br />

0.00%<br />

Total 100.00%<br />

Industry Sector<br />

50.00%<br />

46.72<br />

Disclaimer<br />

1.<br />

2.<br />

The information contained in this document does not constitute advice<br />

by <strong>Liberty</strong> Life. Whilst every attempt has been made to ensure that<br />

accuracy of the information contained herein, <strong>Liberty</strong> Life cannot be<br />

held responsible for any errors that may occur.<br />

Past performance cannot be relied on as an indicator of future<br />

performance.<br />

40.00%<br />

30.00%<br />

20.00%<br />

21.11<br />

31.96<br />

3.<br />

4.<br />

5.<br />

Investment performance will depend on the growth in the underlying<br />

assets, which will be influenced by inflation levels in the economy and<br />

prevailing market conditions. Source: <strong>Liberty</strong> Life, STANLIB.<br />

<strong>Liberty</strong> Group Ltd - an Authorised Financial Services Provider in terms<br />

of the FAIS Act (licence no.2409)<br />

<strong>Liberty</strong> Active Ltd - an Authorised Financial Services Provider in terms<br />

of the FAIS Act (licence no.10332)<br />

10.00%<br />

0.00%<br />

FINANCIALS<br />

INDUSTRIALS<br />

0.21<br />

OTHER SECURITIES<br />

RESOURCES<br />

Page 1 of 2

Excelsior Multi-Manager Aggressive Portfolio<br />

31 August 2012<br />

Underlying Building Block Weightings<br />

Excelsior Multi-Manager Aggressive<br />

Portfolio<br />

Equities<br />

Bonds<br />

9.65%<br />

Equity Local<br />

Bond Local<br />

0.23%<br />

0.24%<br />

9.95%<br />

10.05%<br />

14.27%<br />

20.08%<br />

15.53%<br />

Coronation Equity AM<br />

Foord Equity AM<br />

Oasis Equity AM<br />

Kagiso AM<br />

Mazi Capital Equity - AM<br />

Afena Equity AM<br />

Element Earth AM<br />

0.04%<br />

0.09%<br />

18.81%<br />

25.56%<br />

29.74%<br />

Prescient Bond Fund AM<br />

Cadiz African Harvest Bond AM<br />

Coronation Bond Fund AM<br />

Future Growth Bond AM<br />

Banker<br />

90.35%<br />

14.60% 15.06%<br />

Banker<br />

Transition Account<br />

25.75%<br />

Transition Account<br />

Cash<br />

28.76%<br />

39.69%<br />

Prescient Banker AM<br />

Taquanta Banker AM<br />

OMIGSA Banker AM<br />

31.55%<br />

Top 10 Equity Holdings<br />

MTN GROUP LIMITED 7.24%<br />

SASOL LIMITED 6.87%<br />

ANGLO AMERICAN PLC 6.08%<br />

STANDARD BANK GROUP LIMITED 5.99%<br />

BHP BILLITON PLC 5.18%<br />

BRITISH AMERICAN TOBACCO PLC 3.44%<br />

NASPERS LIMITED 3.21%<br />

OLD MUTUAL PLC 2.51%<br />

COMPAGNIE FINANCIERE RICHMONT 2.15%<br />

IMPALA PLATINUM HOLDINGS LIMIT<br />

Total<br />

2.14%<br />

44.81%<br />

Page 2 of 2