Consumer Complaints on Life Insurance / Annuity Contracts - Ohio ...

Consumer Complaints on Life Insurance / Annuity Contracts - Ohio ...

Consumer Complaints on Life Insurance / Annuity Contracts - Ohio ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

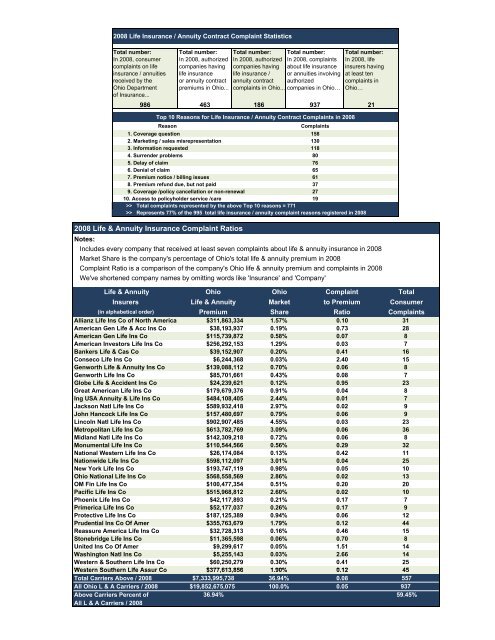

2008 <strong>Life</strong> <strong>Insurance</strong> / <strong>Annuity</strong> C<strong>on</strong>tract Complaint Statistics<br />

Total number:<br />

In 2008, c<strong>on</strong>sumer<br />

complaints <strong>on</strong> life<br />

insurance / annuities<br />

received by the<br />

<strong>Ohio</strong> Department<br />

of <strong>Insurance</strong>...<br />

Total number:<br />

In 2008, authorized<br />

companies having<br />

life insurance<br />

or annuity c<strong>on</strong>tract<br />

premiums in <strong>Ohio</strong>...<br />

Total number:<br />

In 2008, authorized<br />

companies having<br />

life insurance /<br />

annuity c<strong>on</strong>tract<br />

complaints in <strong>Ohio</strong>...<br />

Total number:<br />

In 2008, complaints<br />

about life insurance<br />

or annuities involving<br />

authorized<br />

companies in <strong>Ohio</strong>…<br />

Total number:<br />

In 2008, life<br />

insurers having<br />

at least ten<br />

complaints in<br />

<strong>Ohio</strong>…<br />

986 463 186 937 21<br />

Top 10 Reas<strong>on</strong>s for <strong>Life</strong> <strong>Insurance</strong> / <strong>Annuity</strong> C<strong>on</strong>tract <str<strong>on</strong>g>Complaints</str<strong>on</strong>g> in 2008<br />

Reas<strong>on</strong><br />

<str<strong>on</strong>g>Complaints</str<strong>on</strong>g><br />

1. Coverage questi<strong>on</strong> 158<br />

2. Marketing / sales misrepresentati<strong>on</strong> 130<br />

3. Informati<strong>on</strong> requested 118<br />

4. Surrender problems 80<br />

5. Delay of claim 76<br />

6. Denial of claim 65<br />

7. Premium notice / billing issues 61<br />

8. Premium refund due, but not paid 37<br />

9. Coverage /policy cancellati<strong>on</strong> or n<strong>on</strong>-renewal 27<br />

10. Access to policyholder service /care 19<br />

>> Total complaints represented by the above Top 10 reas<strong>on</strong>s = 771<br />

>> Represents 77% of the 995 total life insurance / annuity complaint reas<strong>on</strong>s registered in 2008<br />

2008 <strong>Life</strong> & <strong>Annuity</strong> <strong>Insurance</strong> Complaint Ratios<br />

Notes:<br />

Includes every company that received at least seven complaints about life & annuity insurance in 2008<br />

Market Share is the company's percentage of <strong>Ohio</strong>'s total life & annuity premium in 2008<br />

Complaint Ratio is a comparis<strong>on</strong> of the company's <strong>Ohio</strong> life & annuity premium and complaints in 2008<br />

We've shortened company names by omitting words like '<strong>Insurance</strong>' and 'Company'<br />

<strong>Life</strong> & <strong>Annuity</strong> <strong>Ohio</strong> <strong>Ohio</strong> Complaint Total<br />

Insurers <strong>Life</strong> & <strong>Annuity</strong> Market to Premium <str<strong>on</strong>g>C<strong>on</strong>sumer</str<strong>on</strong>g><br />

(in alphabetical order) Premium Share Ratio <str<strong>on</strong>g>Complaints</str<strong>on</strong>g><br />

Allianz <strong>Life</strong> Ins Co of North America $311,863,334 1.57% 0.10 31<br />

American Gen <strong>Life</strong> & Acc Ins Co $38,193,937 0.19% 0.73 28<br />

American Gen <strong>Life</strong> Ins Co $115,739,872 0.58% 0.07 8<br />

American Investors <strong>Life</strong> Ins Co $256,292,153 1.29% 0.03 7<br />

Bankers <strong>Life</strong> & Cas Co $39,152,907 0.20% 0.41 16<br />

C<strong>on</strong>seco <strong>Life</strong> Ins Co $6,244,368 0.03% 2.40 15<br />

Genworth <strong>Life</strong> & <strong>Annuity</strong> Ins Co $139,088,112 0.70% 0.06 8<br />

Genworth <strong>Life</strong> Ins Co<br />

$85,701,661 0.43% 0.08 7<br />

Globe <strong>Life</strong> & Accident Ins Co $24,239,621 0.12% 0.95 23<br />

Great American <strong>Life</strong> Ins Co $179,679,376 0.91% 0.04 8<br />

Ing USA <strong>Annuity</strong> & <strong>Life</strong> Ins Co $484,108,405 2.44% 0.01 7<br />

Jacks<strong>on</strong> Natl <strong>Life</strong> Ins Co $589,932,418 2.97% 0.02 9<br />

John Hancock <strong>Life</strong> Ins Co $157,480,697 0.79% 0.06 9<br />

Lincoln Natl <strong>Life</strong> Ins Co $902,907,485 4.55% 0.03 23<br />

Metropolitan <strong>Life</strong> Ins Co $613,782,769 3.09% 0.06 36<br />

Midland Natl <strong>Life</strong> Ins Co $142,309,218 0.72% 0.06 8<br />

M<strong>on</strong>umental <strong>Life</strong> Ins Co $110,544,566 0.56% 0.29 32<br />

Nati<strong>on</strong>al Western <strong>Life</strong> Ins Co $26,174,084 0.13% 0.42 11<br />

Nati<strong>on</strong>wide <strong>Life</strong> Ins Co $598,112,097 3.01% 0.04 25<br />

New York <strong>Life</strong> Ins Co $193,747,119 0.98% 0.05 10<br />

<strong>Ohio</strong> Nati<strong>on</strong>al <strong>Life</strong> Ins Co $568,558,569 2.86% 0.02 13<br />

OM Fin <strong>Life</strong> Ins Co $100,477,354 0.51% 0.20 20<br />

Pacific <strong>Life</strong> Ins Co $515,968,812 2.60% 0.02 10<br />

Phoenix <strong>Life</strong> Ins Co $42,117,893 0.21% 0.17 7<br />

Primerica <strong>Life</strong> Ins Co $52,177,037 0.26% 0.17 9<br />

Protective <strong>Life</strong> Ins Co $187,125,389 0.94% 0.06 12<br />

Prudential Ins Co Of Amer $355,763,679 1.79% 0.12 44<br />

Reassure America <strong>Life</strong> Ins Co $32,728,313 0.16% 0.46 15<br />

St<strong>on</strong>ebridge <strong>Life</strong> Ins Co $11,365,598 0.06% 0.70 8<br />

United Ins Co Of Amer $9,299,617 0.05% 1.51 14<br />

Washingt<strong>on</strong> Natl Ins Co $5,255,143 0.03% 2.66 14<br />

Western & Southern <strong>Life</strong> Ins Co $60,250,279 0.30% 0.41 25<br />

Western Southern <strong>Life</strong> Assur Co $377, 613 , 856<br />

1. 90%<br />

012 0.12 45<br />

Total Carriers Above / 2008 $7,333,995,738 36.94% 0.08 557<br />

All <strong>Ohio</strong> L & A Carriers / 2008 $19,852,675,075 100.0% 0.05 937<br />

Above Carriers Percent of 36.94% 59.45%<br />

All L & A Carriers / 2008