Consumer Complaints On Auto Insurance - Ohio Department of ...

Consumer Complaints On Auto Insurance - Ohio Department of ...

Consumer Complaints On Auto Insurance - Ohio Department of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

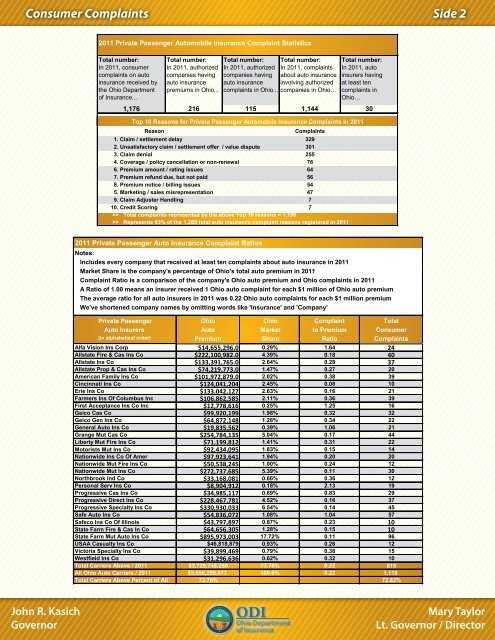

<strong>Consumer</strong> <strong>Complaints</strong> Side 2<br />

2011 Private Passenger <strong>Auto</strong>mobile <strong>Insurance</strong> Complaint Statistics<br />

Total number:<br />

In 2011, consumer<br />

complaints on auto<br />

insurance received by<br />

the <strong>Ohio</strong> <strong>Department</strong><br />

<strong>of</strong> <strong>Insurance</strong>...<br />

Total number:<br />

In 2011, authorized<br />

companies having<br />

auto insurance<br />

premiums in <strong>Ohio</strong>...<br />

Total number: Total number:<br />

In 2011, authorized<br />

companies having<br />

auto insurance<br />

complaints in <strong>Ohio</strong>...<br />

In 2011, complaints<br />

about auto insurance<br />

involving authorized<br />

companies in <strong>Ohio</strong>…<br />

Total number:<br />

In 2011, auto<br />

insurers having<br />

at least ten<br />

complaints in<br />

<strong>Ohio</strong>…<br />

1,176 216 115 1,144 30<br />

Top 10 Reasons for Private Passenger <strong>Auto</strong>mobile <strong>Insurance</strong> <strong>Complaints</strong> in 2011<br />

Reason<br />

<strong>Complaints</strong><br />

1. Claim / settlement delay 329<br />

2. Unsatisfactory claim / settlement <strong>of</strong>fer / value dispute 301<br />

3. Claim denial 255<br />

4. Coverage / policy cancellation or non-renewal 76<br />

6. Premium amount / rating issues 64<br />

7. Premium refund due, but not paid 56<br />

8. Premium notice / billing issues 54<br />

5. Marketing / sales misrepresentation 47<br />

9. Claim Adjuster Handling 7<br />

10. Credit Scoring 7<br />

>> Total complaints represented by the above Top 10 reasons = 1,196<br />

>> Represents 93% <strong>of</strong> the 1,289 total auto insurance complaint reasons registered in 2011<br />

2011 Private Passenger <strong>Auto</strong> <strong>Insurance</strong> Complaint Ratios<br />

Notes:<br />

Includes every company that received at least ten complaints about auto insurance in 2011<br />

Market Share is the company's percentage <strong>of</strong> <strong>Ohio</strong>'s total auto premium in 2011<br />

Complaint Ratio is a comparison <strong>of</strong> the company's <strong>Ohio</strong> auto premium and <strong>Ohio</strong> complaints in 2011<br />

A Ratio <strong>of</strong> 1.00 means an insurer received 1 <strong>Ohio</strong> auto complaint for each $1 million <strong>of</strong> <strong>Ohio</strong> auto premium<br />

The average ratio for all auto insurers in 2011 was 0.22 <strong>Ohio</strong> auto complaints for each $1 million premium<br />

We've shortened company names by omitting words like '<strong>Insurance</strong>' and 'Company'<br />

Private Passenger <strong>Ohio</strong> <strong>Ohio</strong> Complaint Total<br />

<strong>Auto</strong> Insurers <strong>Auto</strong> Market to Premium <strong>Consumer</strong><br />

(in alphabetical order) Premium Share Ratio <strong>Complaints</strong><br />

Alfa Vision Ins Corp $14,655,296.0 0.29% 1.64 24<br />

Allstate Fire & Cas Ins Co $222,100,982.0 4.39% 0.18 40<br />

Allstate Ins Co $133,391,765.0 2.64% 0.28 37<br />

Allstate Prop & Cas Ins Co $74,219,773.0 1.47% 0.27 20<br />

American Family Ins Co $101,972,879.0 2.02% 0.38 39<br />

Cincinnati Ins Co $124,041,204 2.45% 0.08 10<br />

Erie Ins Co $133,042,127 2.63% 0.16 21<br />

Farmers Ins Of Columbus Inc $106,862,585 2.11% 0.36 39<br />

First Acceptance Ins Co Inc $12,778,616 0.25% 1.25 16<br />

Geico Cas Co $99,920,199 1.98% 0.32 32<br />

Geico Gen Ins Co $64,872,148 1.28% 0.34 22<br />

General <strong>Auto</strong> Ins Co $19,835,562 0.39% 1.06 21<br />

Grange Mut Cas Co $254,784,135 5.04% 0.17 44<br />

Liberty Mut Fire Ins Co $71,199,812 1.41% 0.31 22<br />

Motorists Mut Ins Co $92,434,095 1.83% 0.15 14<br />

Nationwide Ins Co Of Amer $97,923,641 1.94% 0.20 20<br />

Nationwide Mut Fire Ins Co $50,538,245 1.00% 0.24 12<br />

Nationwide Mut Ins Co $272,737,685 5.39% 0.11 30<br />

Northbrook Ind Co $33,168,081 0.66% 0.36 12<br />

Personal Serv Ins Co $8,904,912 0.18% 2.13 19<br />

Progressive Cas Ins Co $34,985,117 0.69% 0.83 29<br />

Progressive Direct Ins Co $228,467,781 4.52% 0.16 37<br />

Progressive Specialty Ins Co $330,930,033 6.54% 0.14 45<br />

Safe <strong>Auto</strong> Ins Co $54,836,072 1.08% 1.04 57<br />

Safeco Ins Co Of Illinois $43,797,897 0.87% 0.23 10<br />

State Farm Fire & Cas In Co $64,656,305 1.28% 0.15 10<br />

State Farm Mut <strong>Auto</strong> Ins Co $895,973,003 17.72% 0.11 96<br />

USAA Casualty Ins Co $46,818,879 0.93% 0.26 12<br />

Victoria Specialty Ins Co $39,899,469 0.79% 0.38 15<br />

Westfield Ins Co $31,296,636 0.62% 0.32 10<br />

Total Carriers Above / 2011 $3,729,748,298 73.76% 0.22 815<br />

All <strong>Ohio</strong> <strong>Auto</strong> Carriers / 2011 $5,056,298,077 100.0% 0.22 1,119<br />

Total Carriers Above Percent <strong>of</strong> All 73.76% 72.83%<br />

John R. Kasich<br />

Governor<br />

Mary Taylor<br />

Lt. Governor / Director