Personal Deposit Account Fee Schedule

Personal Deposit Account Fee Schedule

Personal Deposit Account Fee Schedule

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

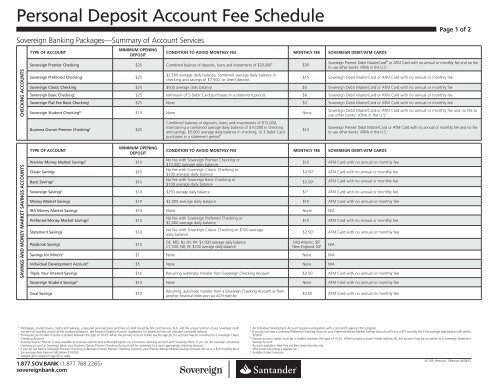

<strong>Personal</strong> <strong>Deposit</strong> <strong>Account</strong> <strong>Fee</strong> <strong>Schedule</strong><br />

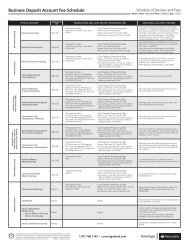

Sovereign Banking Packages—Summary of <strong>Account</strong> Services<br />

CHECKING ACCOUNTS<br />

SAVINGS AND MONEY MARKET SAVINGS ACCOUNTS<br />

TYPE OF ACCOUNT<br />

MINIMUM OPENING<br />

DEPOSIT<br />

Sovereign Premier Checking $25 Combined balance of deposits, loans and investments of $20,000 A<br />

Sovereign Preferred Checking $25<br />

CONDITION TO AVOID MONTHLY FEE MONTHLY FEE SOVEREIGN DEBIT/ATM CARDS<br />

$2,500 average daily balance, combined average daily balance in<br />

checking and savings of $7,500, or direct deposit<br />

$30<br />

Page 1 of 2<br />

Sovereign Premier Debit MasterCard ® or ATM Card with no annual or monthly fee and no fee<br />

to use other banks’ ATMs in the U.S. J<br />

$15 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Classic Checking $25 $500 average daily balance $5 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Basic Checking K $25 Minimum of 5 Debit Card purchases in a statement period $8 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Flat <strong>Fee</strong> Basic Checking I $25 None $3 Sovereign Debit MasterCard or ATM Card with no annual or monthly fee<br />

Sovereign Student Checking B $10 None None<br />

Business Owner Premier Checking C $25<br />

TYPE OF ACCOUNT<br />

MINIMUM OPENING<br />

DEPOSIT<br />

Premier Money Market Savings D $10<br />

Classic Savings $10<br />

Basic Savings K $10<br />

Combined balance of deposits, loans and investments of $15,000,<br />

maintaining a combined average daily balance of $10,000 in checking<br />

and savings, $5,000 average daily balance in checking, or 3 Debit Card<br />

purchases in a statement period A<br />

CONDITION TO AVOID MONTHLY FEE MONTHLY FEE SOVEREIGN DEBIT/ATM CARDS<br />

No fee with Sovereign Premier Checking or<br />

$10,000 average daily balance<br />

No fee with Sovereign Classic Checking or<br />

$100 average daily balance<br />

No fee with Sovereign Basic Checking or<br />

$100 average daily balance<br />

$10<br />

Sovereign Debit MasterCard or ATM Card with no annual or monthly fee and no fee to<br />

use other banks’ ATMs in the U.S. J<br />

Sovereign Premier Debit MasterCard or ATM Card with no annual or monthly fee and no fee<br />

to use other banks’ ATMs in the U.S. J<br />

$10 ATM Card with no annual or monthly fee<br />

$3.50 E ATM Card with no annual or monthly fee<br />

E $3.50 ATM Card with no annual or monthly fee<br />

Sovereign Savings K $10 $250 average daily balance $1 E ATM Card with no annual or monthly fee<br />

Money Market Savings $10 $2,000 average daily balance $10 ATM Card with no annual or monthly fee<br />

IRA Money Market Savings $10 None None N/A<br />

Preferred Money Market Savings G $10<br />

Statement Savings $10<br />

Passbook Savings $10<br />

No fee with Sovereign Preferred Checking or<br />

$2,000 average daily balance<br />

No fee with Sovereign Classic Checking or $100 average<br />

daily balance<br />

DE, MD, NJ, NY, PA: $1,500 average daily balance<br />

CT, MA, NH, RI: $100 average daily balance<br />

$10 ATM Card with no annual or monthly fee<br />

$3.50 E<br />

Mid-Atlantic: $5 E<br />

New England: $3 E<br />

Savings for Minors K $1 None None N/A<br />

Individual Development <strong>Account</strong> F $5 None None N/A<br />

ATM Card with no annual or monthly fee<br />

Triple Your Interest Savings $10 Recurring automatic transfer from Sovereign Checking <strong>Account</strong> $3.50 ATM Card with no annual or monthly fee<br />

Sovereign Student Savings H $10 None None ATM Card with no annual or monthly fee<br />

Goal Savings $10<br />

Recurring, automatic transfer from a Sovereign Checking <strong>Account</strong> or from<br />

another financial institution via ACH transfer<br />

A Mortgages, student loans, credit card balances, unsecured personal loans and lines of credit issued by FIA Card Services, N.A. and the unused portion of any Sovereign credit<br />

line are not counted as part of the combined balance. See <strong>Personal</strong> <strong>Deposit</strong> <strong>Account</strong> Agreement for details on how we calculate combined balance.<br />

B Primary account holder must be a student between the ages of 16-25. When the primary account holder reaches age 26, the account may be converted to a Sovereign Classic<br />

Checking <strong>Account</strong>.<br />

C Business Owner Premier is only available to business owners and authorized signers on a business checking account with Sovereign Bank. If you do not maintain a business<br />

checking account at Sovereign Bank, your Business Owner Premier Checking <strong>Account</strong> will be converted to a more appropriate checking account.<br />

D If you do not have a Sovereign Premier Checking or Business Owner Premier Checking <strong>Account</strong>, your Premier Money Market Savings <strong>Account</strong> will incur a $10 monthly fee if<br />

the average daily balance falls below $10,000.<br />

E Waived upon request if age 60 or older.<br />

1.877.SOV.BANK (1.877.768.2265)<br />

sovereignbank.com<br />

N/A<br />

$3.50 ATM Card with no annual or monthly fee<br />

F An Individual Development <strong>Account</strong> requires participation with a non-profit agency’s IDA program.<br />

G If you do not have a Sovereign Preferred Checking <strong>Account</strong>, your Preferred Money Market Savings <strong>Account</strong> will incur a $10 monthly fee if the average daily balance falls below<br />

$2,000.<br />

H Primary account holder must be a student between the ages of 16-25. When primary account holder reaches 26, the account may be converted to a Sovereign Statement<br />

Savings <strong>Account</strong>.<br />

I <strong>Account</strong>s available in New York and New Jersey branches only<br />

J ATM owner may charge a seperate fee.<br />

K Available at select branches.<br />

N1109_<strong>Personal</strong> Effective 04/09/12

<strong>Personal</strong> <strong>Deposit</strong> <strong>Account</strong> <strong>Fee</strong> <strong>Schedule</strong><br />

<strong>Schedule</strong> of Services and <strong>Fee</strong>s<br />

ACCOUNT RELATED SERVICES<br />

<strong>Account</strong> History $4.00<br />

Check Orders 1 Varies<br />

Collections (per item)<br />

Domestic $10.00<br />

International $30.00<br />

Copy of Canceled Check (12 free copies per year) 7 $5.00<br />

Date of Death Balance $20.00<br />

Duplicate Statement Copy $6.00<br />

Early <strong>Account</strong> Closing (if closed within 90 days of account opening) 10 $25.00<br />

Escheat $50.00<br />

Garnishment/Levy/Legal Processing $100.00<br />

Inactive <strong>Account</strong> (per month) $16.00<br />

(applies to checking and money market savings accounts<br />

inactive for more than one year with balances less than $250)<br />

Insufficient Funds <strong>Fee</strong> 9 $35.00<br />

Insufficient Funds (Item Returned) 9 $35.00<br />

IRA Trustee Transfer $25.00<br />

Lost Passbook $10.00<br />

Online Banking with BillPay No <strong>Fee</strong><br />

Overdraft Transfer (per transfer) 2 $12.00<br />

Research, Balance Reconciliation $20.00<br />

and/or Letter Writing Services (per hour, one hour minimum)<br />

Return <strong>Deposit</strong>ed Item 8<br />

Domestic $15.00<br />

International $25.00<br />

Savings/Money Market Savings Excess Activity (per item) $5.00<br />

Stop Payment 2 $30.00<br />

(personal check, official check, money order or ACH transaction)<br />

Sustained Overdraft 2,9 $35.00<br />

Checking<br />

Charged on the 6th consecutive business day account is overdrawn<br />

Savings and Money Market Savings $5.00 (per day)<br />

Charge of $5 per day beginning on the 6th consecutive business day account is<br />

overdrawn<br />

Unavailable Funds <strong>Fee</strong> 9 $35.00<br />

Unavailable Funds (Item Returned) 9 $35.00<br />

DEBIT/ATM CARD SERVICES<br />

Foreign Currency Exchange<br />

ATM Card 3% of transaction in U.S. dollars<br />

International Transaction<br />

Debit Card 4% of transaction in U.S. dollars<br />

Improperly Endorsed <strong>Deposit</strong> (per item) $2.00<br />

Replacement Card—Expedited $30.00<br />

Lost, Damaged, or Extra Debit Card $5.00 11<br />

Withdrawal at ATM not owned by Sovereign or one of its divisions 6<br />

Domestic–Classic Checking and Savings $3.00<br />

Domestic–Flat <strong>Fee</strong> Basic Checking, Basic Checking and Savings $3.50<br />

Domestic–Premier Checking, Business Owner Premier Checking, No <strong>Fee</strong><br />

Student Checking and Savings<br />

Domestic–All Other <strong>Account</strong>s $2.50<br />

International–All <strong>Account</strong>s $6.00<br />

SPECIAL SERVICES<br />

American Express ® Gift Card (per item) $5.00<br />

American Express Gift Cheque (per item) $2.50<br />

American Express Travelers Cheques<br />

Regular (per $100) 2 $2.00<br />

Cheques for Two ® (per $100)<br />

U.S. Currency $2.00<br />

Foreign Currency $1.00<br />

Bond Coupon (per envelope) $7.00<br />

Certified Check $15.00<br />

Copy of Official Check or Money Order (per item) $5.00<br />

International Draft $25.00<br />

Money Order $5.00<br />

Official Bank Check 2 $10.00<br />

Safe <strong>Deposit</strong> Box<br />

Annual Rental Varies4 10% discount with autopay per box5 Drilling $150.00<br />

Late Charge $15.00<br />

Lost Key $15.00<br />

Wire Transfer<br />

Domestic Incoming 3 $13.00<br />

Domestic Outgoing $25.00<br />

International Incoming 3<br />

U.S. Currency $13.00<br />

Foreign Currency No <strong>Fee</strong><br />

International Outgoing<br />

U.S. Currency $40.00<br />

Foreign Currency $31.00<br />

1 Free Graystone checks or $15 discount toward alternate designs with Sovereign Premier Checking or Business Owner<br />

Premier Checking. First order of 20 antique style checks free with Sovereign Student Checking. After first order, students<br />

purchase their checks. Graystone Checks are $14.95 per order with Sovereign Preferred Checking.<br />

2 Does not apply to Sovereign Premier Checking, Premier Partnership Checking or Business Owner Premier Checking.<br />

3 Does not apply to Sovereign Student Checking <strong>Account</strong>s.<br />

4 Sovereign Premier Checking and Business Owner Premier Checking <strong>Account</strong>s receive a free small box or a 50% discount<br />

on any size box rented for the life of the account. Additional boxes are eligible for a 10% discount with autopay.<br />

5 Cannot be combined with any other safe deposit box discounts.<br />

6 ATM owner may charge a separate fee.<br />

7 25 free copies for accounts opened in Maryland or Massachusetts.<br />

8 <strong>Fee</strong> for accounts opened in New York is $10.00 or in Massachusetts is $5.00.<br />

9 Always know your balance before you write a check or use your Sovereign Debit/ATM Card. If any payment request you<br />

make exceeds your available balance, we may approve your request at our discretion. However, you may be assessed the<br />

current Insufficient or Unavailable Funds <strong>Fee</strong> whether or not we honor your request.<br />

10 <strong>Fee</strong> only applies to checking accounts.<br />

11 No fee for Sovereign Premier or Business Owner Premier accounts even after February 1, 2012.<br />

Page 2 of 2<br />

Sovereign Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander,<br />

S.A. © 2012 Sovereign Bank, N.A. | Sovereign and Santander and its logo are registered<br />

trademarks of Sovereign Bank, N.A. and Banco Santander, S.A. respectively, or their<br />

affiliates or subsidiaries in the United States and other countries. MasterCard is a registered<br />

trademark of MasterCard International Incorporated.