Cashflow Interest-Only Adjustable Rate Mortgage (ARM) Disclosure

Cashflow Interest-Only Adjustable Rate Mortgage (ARM) Disclosure

Cashflow Interest-Only Adjustable Rate Mortgage (ARM) Disclosure

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Sovereign Bank – Wholesale Lending Division<br />

<strong>Cashflow</strong> <strong>Interest</strong>-<strong>Only</strong> <strong>Adjustable</strong> <strong>Rate</strong> <strong>Mortgage</strong> (<strong>ARM</strong>) <strong>Disclosure</strong><br />

1-Month LIBOR Index<br />

Page: 1 of 3<br />

This disclosure describes the features of the <strong>Cashflow</strong> One-Month <strong>Interest</strong>-<strong>Only</strong> LIBOR Option <strong>ARM</strong> Program.<br />

Lender reserves the right to make changes to this loan program for any reason at any time. Before completing an<br />

application for this adjustable rate mortgage loan, carefully read this disclosure. This is not a commitment to make<br />

a loan to you, nor does it describe the specific terms of the loan the Lender may offer you. Those terms will be<br />

described in your Note and Deed of Trust or <strong>Mortgage</strong>.<br />

Information on other <strong>ARM</strong> programs is available upon request.<br />

How Your <strong>Interest</strong> <strong>Rate</strong> is Determined<br />

- Following an initial period, the interest rate will vary in response to movement in an index (the "Index") plus a<br />

fixed amount of percentage points (the "Margin"). The “Index” is the one month London Interbank Offered<br />

<strong>Rate</strong> (LIBOR) as published in The Wall Street Journal. The most recent Index figure available as of the first<br />

business day after the twenty-fifth day of the month immediately preceding the month in which the <strong>Interest</strong><br />

<strong>Rate</strong> Change Date occurs is called the “Current Index.” If the Index is not available, or is otherwise<br />

unpublished, the Lender or other Note Holder will choose a new Index and a new Margin to result in a rate<br />

similar to the rate in effect at that time which is based upon comparable information. The Note Holder will<br />

give you notice of its choice.<br />

- The Margin is a number which, when added to the Index, establishes your interest rate. The Margin is<br />

expressed in percentage points and remains the same for the term of the loan. The Index plus the Margin is the<br />

fully indexed rate. The initial interest rate may be higher or lower than the fully indexed rate by an amount<br />

called a premium or discount. This premium or discounted rate applies only to the first regularly scheduled<br />

payment of the loan. It is not based on the Index. Ask us for the current margin, interest rate, and interest rate<br />

premiums or discounts. The time period for the initial interest rate is two months.<br />

How Your <strong>Interest</strong> <strong>Rate</strong> Can Change<br />

- Your <strong>Interest</strong> <strong>Rate</strong> can change monthly based upon changes in the Index. Each day on which your <strong>Interest</strong><br />

<strong>Rate</strong> can change is called an “<strong>Interest</strong> <strong>Rate</strong> Change Date.” Beginning on the first <strong>Interest</strong> <strong>Rate</strong> Change Date,<br />

your interest rate will be based on the Current Index plus the Margin. The result of this addition will then be<br />

rounded to the nearest one-eighth of one percentage point (0.125%) and is called the “Fully Indexed <strong>Rate</strong>.”<br />

Your interest rate will increase if the Index rises and decrease if the Index falls, subject to the rules and<br />

limitations (caps) described below.<br />

- Your interest rate cannot increase to a rate higher than 9.95%, 13.75% or 19.90% over the life of the loan (the<br />

“Lifetime <strong>Interest</strong> <strong>Rate</strong> Cap”). Your cap may be lower than 19.90% in exchange for a higher margin and/or<br />

points paid at closing. Ask us about our current Lifetime <strong>Interest</strong> <strong>Rate</strong> Cap.<br />

Doc. #: WDS811 Last Revised: 08/02/04

Sovereign Bank – Wholesale Lending Division<br />

How Your Monthly Payment Can Change<br />

<strong>Cashflow</strong> <strong>Interest</strong>-<strong>Only</strong> <strong>Adjustable</strong> <strong>Rate</strong> <strong>Mortgage</strong> (<strong>ARM</strong>) <strong>Disclosure</strong><br />

1-Month LIBOR Index<br />

Page: 2 of 3<br />

- Your initial full monthly payment amount will be established by calculating the amount necessary to pay off<br />

the loan in full (principal and interest) on the Maturity Date in substantially equal installments of principal and<br />

interest, based on the loan balance, term, and the initial interest rate in effect at the time of loan closing and<br />

assuming that such interest rate will remain in effect throughout the term of the loan.<br />

- Your monthly payment can increase or decrease substantially based upon changes in the interest rate. Your<br />

monthly payment amount will be established by calculating the amount necessary to pay off the loan in full<br />

(principal and interest) at the Maturity Date in substantially equal installments of principal and interest, based<br />

on the loan balance, remaining term, and the interest rate in effect during the month prior to the payment<br />

adjustment date, which occurs monthly (the "Payment Change Date"). The result of this calculation is called<br />

the "Full Monthly Payment." The new payment is based on the assumption that such interest rate will remain<br />

in effect throughout the term of the loan.<br />

<strong>Interest</strong>-<strong>Only</strong> Payment Option<br />

- Each month for the first 180 payments due, you will have the option to make an interest-only payment (i.e., a<br />

payment equal to the interest accrued on the principal balance at either the initial interest rate for the first two<br />

months or at the fully indexed rate for the next 178 months). Following the 180 th payment, this interest-only<br />

payment option will expire, and you must pay the Full Monthly Payment each month thereafter.<br />

EXAMPLE:<br />

- On a $10,000, 30 year loan with an Initial <strong>Interest</strong> <strong>Rate</strong> of 3.150% (premium of .025%), in effect on March 25,<br />

2004, the maximum amount this interest rate can rise is 16.75 percentage points to 19.90% (Lifetime <strong>Interest</strong><br />

<strong>Rate</strong> Cap). If the interest rate reached the Lifetime <strong>Interest</strong> <strong>Rate</strong> Cap in the third month of the loan, the<br />

monthly payment could rise from an initial interest-only payment of $26.25 available during the first two<br />

months to a maximum interest-only payment of $165.83 in the third month and, assuming interest-only<br />

payments were made during the first 180 months of the loan at the Lifetime <strong>Interest</strong> <strong>Rate</strong> Cap, a maximum<br />

principal and interest-only payment of $174.89 in the 181 st Month.<br />

- To see what your payment amount is, divide your mortgage amount by $10,000; then multiply the monthly<br />

payment by that amount. For example, the initial interest-only monthly payment for a mortgage amount of<br />

$200,000 would be: $200,000 divided by $10,000 = 20; 20 x $26.25 = $525.00.<br />

Payment Change Notification<br />

- You will be notified in writing at least 25 days before the payment adjustment becomes effective. This notice<br />

will contain information about your new and prior interest rates, the index values upon which the new and old<br />

interest rates were based, the new monthly payment necessary to fully amortize the loan, and the current loan<br />

balance.<br />

Doc. #: WDS811 Last Revised: 08/02/04

Sovereign Bank – Wholesale Lending Division<br />

Prepayment Penalty<br />

<strong>Cashflow</strong> <strong>Interest</strong>-<strong>Only</strong> <strong>Adjustable</strong> <strong>Rate</strong> <strong>Mortgage</strong> (<strong>ARM</strong>) <strong>Disclosure</strong><br />

1-Month LIBOR Index<br />

Page: 3 of 3<br />

IF YOUR LOAN HAS A 1-YEAR PREPAYMENT PENALTY:<br />

- In the case of a full or partial (defined as payment of 20% or more of the original principal loan balance)<br />

prepayment during the first twelve (12) months of the term of the Note, you will be charged a prepayment fee<br />

in an amount equal to two percent (2%) of the prepayment amount. The prepayment fee will be waived by the<br />

Note Holder if full prepayment is due to the sale of the subject property and you obtain financing for your<br />

new property from the Note Holder at an amount at least 90% of the payoff amount of your current loan<br />

within 90 days of prepayment.<br />

IF YOUR LOAN HAS A 3-YEAR PREPAYMENT PENALTY:<br />

- In the case of a full or partial (defined as payment of 20% or more of the original principal loan balance during<br />

any 12 month period) prepayment of the subject mortgage, you will be charged a prepayment fee in an amount<br />

equal to a percentage of the prepayment amount as follows: (i) a sum equal to three percent (3%) if<br />

prepayment is made during the first 12 months of the term of the Note; (ii) a sum equal to two percent (2%) if<br />

prepayment is made during the 13th through 24th months of the term of the Note; and (iii) a sum equal to one<br />

percent (1%) if prepayment is made during the 25th through 36th months of the term of the Note. The<br />

prepayment fee will be waived by the Note Holder if full prepayment is due to the sale of the subject property<br />

and you obtain financing for your new property from the Note Holder at an amount at least 90% of the payoff<br />

amount of your current loan within 90 days of prepayment.<br />

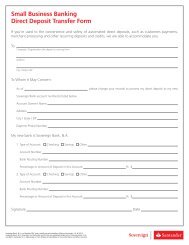

IMPORTANT – SIGNATURE<br />

I/We each hereby acknowledge that I/We have read and received a copy of this Loan Program <strong>Disclosure</strong><br />

describing the <strong>Cashflow</strong> <strong>Interest</strong>-<strong>Only</strong> One-Month LIBOR Index <strong>ARM</strong> Program and the Consumer<br />

Handbook on <strong>Adjustable</strong> <strong>Rate</strong> <strong>Mortgage</strong>s.<br />

I/We also understand that this disclosure is not a commitment to make a loan.<br />

Print Name Property Address<br />

Signature Date<br />

Print Name Property Address<br />

Signature Date<br />

Doc. #: WDS811 Last Revised: 08/02/04