Supplementary Notes - Singapore College of Insurance

Supplementary Notes - Singapore College of Insurance

Supplementary Notes - Singapore College of Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

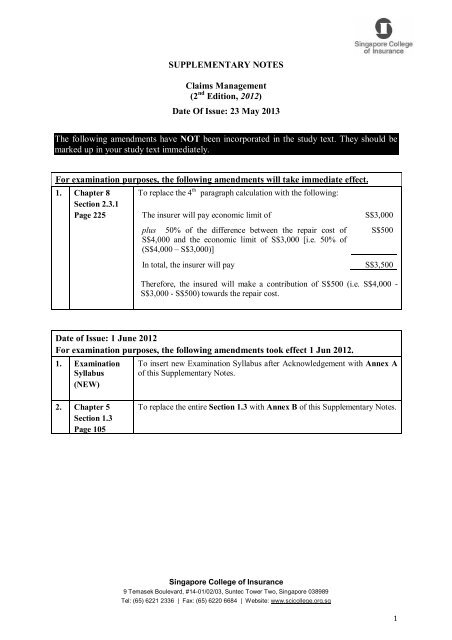

SUPPLEMENTARY NOTES<br />

Claims Management<br />

(2 nd Edition, 2012)<br />

Date Of Issue: 23 May 2013<br />

The following amendments have NOT been incorporated in the study text. They should be<br />

marked up in your study text immediately.<br />

For examination purposes, the following amendments will take immediate effect.<br />

1. Chapter 8 To replace the 4 th paragraph calculation with the following:<br />

Section 2.3.1<br />

Page 225 The insurer will pay economic limit <strong>of</strong><br />

S$3,000<br />

plus 50% <strong>of</strong> the difference between the repair cost <strong>of</strong><br />

S$4,000 and the economic limit <strong>of</strong> S$3,000 [i.e. 50% <strong>of</strong><br />

(S$4,000 – S$3,000)]<br />

In total, the insurer will pay<br />

S$500<br />

S$3,500<br />

Therefore, the insured will make a contribution <strong>of</strong> S$500 (i.e. S$4,000 -<br />

S$3,000 - S$500) towards the repair cost.<br />

Date <strong>of</strong> Issue: 1 June 2012<br />

For examination purposes, the following amendments took effect 1 Jun 2012.<br />

1. Examination<br />

Syllabus<br />

(NEW)<br />

To insert new Examination Syllabus after Acknowledgement with Annex A<br />

<strong>of</strong> this <strong>Supplementary</strong> <strong>Notes</strong>.<br />

2. Chapter 5<br />

Section 1.3<br />

Page 105<br />

To replace the entire Section 1.3 with Annex B <strong>of</strong> this <strong>Supplementary</strong> <strong>Notes</strong>.<br />

<strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong><br />

9 Temasek Boulevard, #14-01/02/03, Suntec Tower Two, <strong>Singapore</strong> 038989<br />

Tel: (65) 6221 2336 | Fax: (65) 6220 6684 | Website: www.scicollege.org.sg<br />

1

Annex A<br />

To <strong>Supplementary</strong> <strong>Notes</strong><br />

Claims Management, 2 nd Edition<br />

Date Of Issue: 1 June 2012<br />

<strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong><br />

9 Temasek Boulevard, #14-01/02/03/04, Suntec Tower Two, <strong>Singapore</strong> 038989<br />

Tel: (65) 6221 2336 | Fax: (65) 6220 6684 | E-mail: talk2us@scidomain.org.sg | Website: www.scicollege.org.sg<br />

A1

Examination Syllabus<br />

Examination Syllabus<br />

1. Understand the claims environment<br />

1.1 Claims management strategy<br />

1.2 Claims philosophies<br />

1.3 Organisation design and structure<br />

1.3.1 Claims department within the insurer (divisional /<br />

functional / other)<br />

1.3.2 Interaction <strong>of</strong> claims department with other functions<br />

1.3.3 Internal structure <strong>of</strong> the department; job roles, teams,<br />

responsibilities, specialism<br />

1.3.4 Referral points; authorities<br />

1.3.5 The role and responsibilities <strong>of</strong> the department manager<br />

1.4 Policy interpretation<br />

1.5 Regulation and legislation<br />

1.5.1 Implication <strong>of</strong> Consumer Protection (Fair Trading) Act<br />

(Cap. 52A)<br />

1.5.2 Contract certainty<br />

2. Understand and apply claims service management practices<br />

2.1 Customer experience – expectations, satisfaction<br />

2.1.1 Ethical codes <strong>of</strong> practice<br />

2.1.2 Use <strong>of</strong> Claims service as a marketing tool<br />

2.1.3 Treating Customers Fairly<br />

2.2 Customer retention<br />

2.3 Complaints handling<br />

2.3.1 Alternative Dispute Resolution<br />

Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited | A2 | A2

Legal Aspects Of <strong>Insurance</strong><br />

2.4 Policyholder litigation and breach <strong>of</strong> contract<br />

2.4.1 Bad faith<br />

3. Understand and apply claims management practices<br />

3.1 Design and implementation <strong>of</strong> claims handling procedures for<br />

both first and third party<br />

3.2 Civil Procedure Rules<br />

3.3 The pre-action protocols<br />

3.4 Process review and quality management<br />

3.5 Compliance with claims procedures<br />

3.6 Claims handling operation<br />

3.6.1 Segmentation (volume and complexity)<br />

3.6.2 Authorities<br />

3.6.3 Outsourcing<br />

3.6.4 Delegated authorities<br />

3.6.5 Catastrophe management<br />

3.7 Supplier and relationship management; panels<br />

3.7.1 Loss adjusters<br />

3.7.2 Solicitors<br />

3.7.3 Suppliers <strong>of</strong> goods and services<br />

3.8 Call centre management<br />

4. Understand and apply claims technical management<br />

4.1 Reserving philosophies<br />

4.2 Interaction between claims, actuaries and underwriting<br />

4.3 Information technology<br />

A3 | Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited

Examination Syllabus<br />

4.4 Management information<br />

4.5 Fraudulent claims<br />

4.5.1 Ethical aspects<br />

4.6 London and Lloyd’s market<br />

4.7 Reinsurance<br />

4.8 Subrogation and recoveries<br />

4.9 International claims<br />

5. Understand and calculate the cost <strong>of</strong> management practices<br />

5.1 Cost control strategy<br />

5.1.1 Indemnity spend, handling spend and their<br />

interrelationship<br />

5.2 Estimating and reserving<br />

5.3 Leakage<br />

5.4 Cost <strong>of</strong> the claims function – internal costs, share <strong>of</strong> overheads,<br />

etc<br />

Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited | A4

Annex B<br />

To <strong>Supplementary</strong> <strong>Notes</strong><br />

Claims Management<br />

2 nd Edition<br />

Date Of Issue: 1 June 2012<br />

<strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong><br />

9 Temasek Boulevard, #14-01/02/03/04, Suntec Tower Two, <strong>Singapore</strong> 038989<br />

Tel: (65) 6221 2336 | Fax: (65) 6220 6684 | E-mail: talk2us@scidomain.org.sg | Website: www.scicollege.org.sg<br />

B1

B2 | Claims Management<br />

1.3 Cost Of Claims Management<br />

In this context, “cost” refers firstly to the cost <strong>of</strong> running the claims<br />

operation, and secondly, to the cost <strong>of</strong> settling the claims by the claims<br />

department. Managing the cost means controlling the amount <strong>of</strong> money<br />

expended over a defined period <strong>of</strong> time.<br />

The operating costs are:<br />

• the cost <strong>of</strong> running the claims department itself, such as the staff<br />

remuneration <strong>of</strong> the claims department;<br />

• costs allocated to the department from costs <strong>of</strong> running the entire<br />

operation, i.e. costs incurred running the insurance company as a whole,<br />

such as IT, <strong>of</strong>fice space, and other department staff members; and<br />

• external costs, i.e. the cost <strong>of</strong> engaging service suppliers and vendors.<br />

In this section, we will consider the internal costs relating to the business.<br />

1.3.1 Internal Cost<br />

When we look at outsourcing, we say that the cost <strong>of</strong> outsourcing<br />

has to be balanced against the savings made in respect <strong>of</strong> internal<br />

costs. However, what are these costs and how do they impact on<br />

the business<br />

Every dollar taken in premium must meet the cost, not only <strong>of</strong> claims<br />

and <strong>of</strong> fees, but also <strong>of</strong> running the business. These costs include,<br />

but are not limited to:<br />

• Staff costs, including salaries, bonuses, employee benefits,<br />

employer’s contributions to the Central Provident Fund;<br />

• Corporate tax and other taxes;<br />

• Cleaning and sanitation;<br />

• Maintaining the <strong>of</strong>fice building, property, machinery and <strong>of</strong>fice<br />

equipment (e.g. company cars, photocopiers, computer system,<br />

phone system, etc.);<br />

• Utilities, including air-condition;<br />

• rentals;<br />

• Stationery, printing and mailing; and<br />

• Company insurance.<br />

In addition, if an insurer has a branch network, each branch will need<br />

to contribute a proportion <strong>of</strong> its income to the head <strong>of</strong>fice for its<br />

share <strong>of</strong> overheads. These overheads include, but are not limited to:<br />

• travel costs;<br />

• hotel costs<br />

• training;<br />

• subsistence;<br />

Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited

5. Claims Cost Management | B3<br />

• entertainment;<br />

• marketing;<br />

• printing;<br />

• legal fees;<br />

• human resources;<br />

• server maintenance; and<br />

• IT helpdesk.<br />

Having looked at some <strong>of</strong> the internal costs <strong>of</strong> the claims<br />

department, we will move on to consider some <strong>of</strong> the external costs.<br />

1.3.2 Fee Spend<br />

Insurers seek the service <strong>of</strong> loss adjusters and legal advisers to assist<br />

in the handling <strong>of</strong> complex or large claims. Such service providers<br />

have their own stakeholders who are running these commercial<br />

enterprises to maximise pr<strong>of</strong>itability. Therefore, it is essential that<br />

the claims manager negotiates a competitive price prior to the<br />

agreement <strong>of</strong> service rendering by such service providers, be it<br />

hourly rate or fixed fee basis.<br />

These are the costs <strong>of</strong> actually running the claims department. The<br />

other major source <strong>of</strong> expenditure is the cost <strong>of</strong> settling claims.<br />

1.3.3 Indemnity Spend<br />

Indemnity spend is the total spend by an insurer in respect <strong>of</strong><br />

payments made to indemnify policyholders following the submission<br />

<strong>of</strong> valid claims. Insurers are able to benchmark average indemnity<br />

spend for certain types <strong>of</strong> claims across the market, as well as being<br />

able to compare and contrast it in the light <strong>of</strong> different portfolios <strong>of</strong><br />

business. This is usually undertaken by reference to premium in<br />

order to calculate a loss ratio, thus:<br />

Indemnity claims spend<br />

Premium<br />

= Loss ratio<br />

1.3.4 Controlling Costs<br />

One <strong>of</strong> the roles <strong>of</strong> the claims manager is to manage the cost <strong>of</strong> the<br />

claims department. There are several ways to compare the cost <strong>of</strong><br />

managing a claims department against those <strong>of</strong> its competitors:<br />

• unit case costs, i.e. the average operational cost <strong>of</strong> handling a<br />

claim;<br />

• average time spent on one claim; and<br />

• claims expense ratio, i.e. the ratio <strong>of</strong> internal costs to premiums.<br />

As claims management is specifically interested in operational costs,<br />

it is also important to consider how to control these, through:<br />

• competent and well-trained staff;<br />

• efficient administrative support;<br />

Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited

B4 | Claims Management<br />

• efficient claims procedures;<br />

• efficient record-keeping;<br />

• a well-written corporate claims philosophy;<br />

• use <strong>of</strong> a quality management programme;<br />

• effective management <strong>of</strong> the claims department;<br />

• effective use <strong>of</strong> IT; and<br />

• use <strong>of</strong> outsourcing.<br />

Operational costs <strong>of</strong>ten add up to a significant outlay for the<br />

insurance company. In order to keep these costs to a minimum,<br />

there should be a constant review to incorporate potential:<br />

• restructuring;<br />

• merging;<br />

• management changes;<br />

• IT system changes;<br />

• systems and processing changes;<br />

• partial or total outsourcing <strong>of</strong> the claims function; and<br />

• changes in the make-up <strong>of</strong> the book or the nature <strong>of</strong> the risks<br />

written.<br />

The geographical structure <strong>of</strong> the company can also influence costs.<br />

A trend in recent years is to have fewer and larger cost centres.<br />

The claims manager cannot analyse the management <strong>of</strong> the<br />

operational costs <strong>of</strong> the claims department in isolation: any reduction<br />

in the operational costs can have an impact on how well it operates.<br />

A reduction may have an impact on:<br />

• how many claims are overpaid;<br />

• customer satisfaction reflected in:<br />

- reduced customer retention;<br />

- reduced customer enquiries;<br />

- damage to brand and reputation;<br />

- FIDReC adjudication fee charges as complaints increase; and<br />

• the potential for punitive costs / awards if deadlines are missed.<br />

Such effects may outweigh savings made. Conversely, an increase<br />

in operational costs - provided that they are properly targeted and<br />

can result in an improvement in areas important to the customer - is<br />

likely to have a positive impact. The claims manager needs to<br />

balance the cost <strong>of</strong> the operation against the desired level <strong>of</strong> service.<br />

A company can gain a competitive advantage by having the most<br />

efficient expense ratios. An efficient expense ratio gets the balance<br />

between cost and loss <strong>of</strong> expertise right.<br />

Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited

5. Claims Cost Management | B5<br />

Many insurers prefer a lower initial cost base at the outset and then<br />

try to control spend, by putting in place rigid processes via IT, audit<br />

and supervision.<br />

The importance <strong>of</strong> claims cost in the insurance industry cannot be<br />

underestimated.<br />

If the cost <strong>of</strong> claims at any point in time (including the estimated<br />

future cost) exceeds the available resources to pay such liabilities,<br />

then the insurance company is technically insolvent and must enter<br />

into insolvency. Hence, the estimation <strong>of</strong> future liabilities is just as<br />

important as the control <strong>of</strong> current claim payments.<br />

Copyright reserved by <strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> Limited