Non-financial - Singapore College of Insurance

Non-financial - Singapore College of Insurance

Non-financial - Singapore College of Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

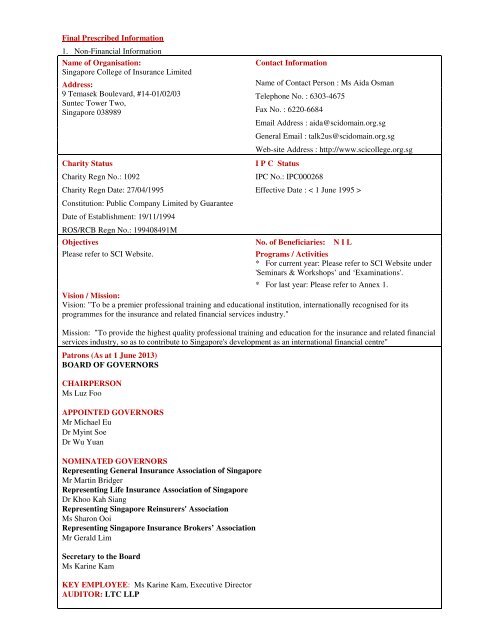

Final Prescribed Information1. <strong>Non</strong>-Financial InformationName <strong>of</strong> Organisation:<strong>Singapore</strong> <strong>College</strong> <strong>of</strong> <strong>Insurance</strong> LimitedAddress:9 Temasek Boulevard, #14-01/02/03Suntec Tower Two,<strong>Singapore</strong> 038989Charity StatusCharity Regn No.: 1092Contact InformationName <strong>of</strong> Contact Person : Ms Aida OsmanTelephone No. : 6303-4675Fax No. : 6220-6684Email Address : aida@scidomain.org.sgGeneral Email : talk2us@scidomain.org.sgWeb-site Address : http://www.scicollege.org.sgI P C StatusIPC No.: IPC000268Charity Regn Date: 27/04/1995 Effective Date : < 1 June 1995 >Constitution: Public Company Limited by GuaranteeDate <strong>of</strong> Establishment: 19/11/1994ROS/RCB Regn No.: 199408491MObjectives No. <strong>of</strong> Beneficiaries: N I LPlease refer to SCI Website.Programs / Activities* For current year: Please refer to SCI Website under'Seminars & Workshops’ and ‘Examinations'.* For last year: Please refer to Annex 1.Vision / Mission:Vision: "To be a premier pr<strong>of</strong>essional training and educational institution, internationally recognised for itsprogrammes for the insurance and related <strong>financial</strong> services industry."Mission: "To provide the highest quality pr<strong>of</strong>essional training and education for the insurance and related <strong>financial</strong>services industry, so as to contribute to <strong>Singapore</strong>'s development as an international <strong>financial</strong> centre"Patrons (As at 1 June 2013)BOARD OF GOVERNORSCHAIRPERSONMs Luz FooAPPOINTED GOVERNORSMr Michael EuDr Myint SoeDr Wu YuanNOMINATED GOVERNORSRepresenting General <strong>Insurance</strong> Association <strong>of</strong> <strong>Singapore</strong>Mr Martin BridgerRepresenting Life <strong>Insurance</strong> Association <strong>of</strong> <strong>Singapore</strong>Dr Khoo Kah SiangRepresenting <strong>Singapore</strong> Reinsurers' AssociationMs Sharon OoiRepresenting <strong>Singapore</strong> <strong>Insurance</strong> Brokers’ AssociationMr Gerald LimSecretary to the BoardMs Karine KamKEY EMPLOYEE: Ms Karine Kam, Executive DirectorAUDITOR: LTC LLP

INSTALLATIONIf the heating equipment manufacturer has made provisions or recommendations for the location <strong>of</strong> this control, then follow thoseinstructions. If not, the following suggestions should be observed.1. The control should be mounted in the wall, approximately five feet from the floor, as near as possible to the center <strong>of</strong> the controlledarea.2. It should be mounted on a partitioning wall, not on an outside wall.3. It should be mounted as far as possible from undesirable sources <strong>of</strong> heat and cold such as:a. Windows and doorsb. Direct rays from sunc. Hot water or cold water pipesd. Adjoining outside wallsWIRINGAll wiring must conform to local and national electrical codes and ordinances.The thermostat may be mounted in any standard 2" x 3"electrical outlet box. For ease <strong>of</strong> installation use a deep typebox.CAUTION: USE WITH COPPER CONDUCTORS ONLY.Use approved wire connectors for 12 AWG only.1. Disconnect electrical power to the system at main fuse orcircuit box.2. Make electrical connection to thermostat leads with wirenuts or other local code approved devices. All connectionsmust be tight.3. Push the lead wires into the outlet box.4. Remove thermostat cover. Push thermostat case intojunction box and secure with screws provided.Take care not to push or damage the bimetal sensingelement during installation.5. Install thermostat cover and turn knob to desired setting.TSSHC-1-40/80F Schematic DiagramTemperature Limiting PinsTemperature Limiting Option is for applications where the temperaturesetting <strong>of</strong> the control is to be set and "protected" from unauthorizedadjustment. To limit the temperature range, follow the directions below:1. Remove cover from thermostat.2. On inside <strong>of</strong> cover, firmly press small tapered end <strong>of</strong> a pin into theapproximate maximum and minimum temperature positions.3. After pressing pins into place on inside <strong>of</strong> cover, rotate temperature knobto be sure the knob is between the pins.4. Replace cover on thermostat. Check that knob rotation is limited in travelas set by the pins. If rotation <strong>of</strong> knob is outside <strong>of</strong> limits, check that the pinsare installed properly.5. Install supplied screws at top and bottom <strong>of</strong> thermostat to secure cover.©SSHC, Inc.2007 All Rights Reserved 4 Custom Drive, PO Box 769, Old Saybrook, CT 06475 (800)544-5182 (860)399-5434 (860)399-6460(fax)

VVIVIIIntermediate to AdvancedMarine <strong>Insurance</strong> - Deeper Insights Into Advanced Industry IssuesAll You Need To Know About Protection & Indemnity <strong>Insurance</strong> (NEW)SCI Marine <strong>Insurance</strong> Programme 2013AdvancedUpstream And Offshore Energy <strong>Insurance</strong> – An Advanced WorkshopSeries <strong>of</strong> Reinsurance ProgrammesIntroductoryFundamentals Of Reinsurance - Principles And PracticeCaptives And <strong>Non</strong>-Traditional Reinsurance (NEW)Liability (<strong>Insurance</strong> And) Reinsurance (NEW)Introductory to IntermediateFinancial Accounts And Reinsurance Statistics (NEW)IntermediateThe “Nuts And Bolts” Of Treaty Reinsurance: Proportional Treaty ReinsuranceThe “Nuts And Bolts” Of Treaty Reinsurance: <strong>Non</strong>-Proportional Treaty ReinsuranceTechnical Reinsurance AccountsReinsurance Contract Treaty Wordings, Individual Clauses And Contract CertaintyIntermediate to AdvancedAdvanced Reinsurance - Applications And Concepts For Property And Engineering (NEW)Reinsurance PLUSSeries <strong>of</strong> <strong>Insurance</strong> Claims ProgrammesIntroductory to IntermediateContract Law And The Principles Of <strong>Insurance</strong> (NEW)Understanding <strong>Insurance</strong> Perils And An Introduction To Business Interruption (NEW)IntermediateEmployers’ Liability <strong>Insurance</strong> Claims Handling - A Case Study ApproachLegal Principles Underlying <strong>Insurance</strong> Claims - An In-Depth StudyClaim Fraud (NEW)Managing Large Hull And Cargo Claims Cost ProactivelyContractors' Liability <strong>Insurance</strong> Claims (NEW)Understanding Motor Car Construction And Accident Repair From A Claims Perspective (ENHANCED)Intermediate to AdvancedDealing with Contractors' All Risks Claims - A Practical Approach— jointly organised by SCI & AICLAAdvancedUnderstanding An Insurer’s Contractual Rights In Managing Motor <strong>Insurance</strong> ClaimsA Practical Approach To Liability ClaimsSeries <strong>of</strong> Risk Management, Corporate Governance & Compliance ProgrammesIntroductoryUnderstanding The Financial Advisers Act (Cap 110)IntermediateCorporate Governance & Compliance For <strong>Insurance</strong> CompaniesRBC Regulatory Framework For <strong>Singapore</strong> General (Re)InsurersRBC Regulatory Framework For <strong>Singapore</strong> Insurers - A Practical Guide To Compliance (Life)AdvancedRisk Management For <strong>Insurance</strong> Companies

VIIIIXXXIXIIXIIIXIVSeries <strong>of</strong> <strong>Insurance</strong> Management ProgrammesIntermediateReading & Understanding <strong>Insurance</strong> Financial StatementsLearning To Lead <strong>Insurance</strong> CompaniesCoaching & Mentoring A New Generation <strong>Insurance</strong> Workforce (NEW)Practical Aspects Of Statutory Accounting Principles And Accounting For <strong>Insurance</strong> ContractsSeries <strong>of</strong> Specialist <strong>Insurance</strong> ProgrammesIntermediateJewellers' Block <strong>Insurance</strong> (NEW)Political Risks And Structured Trade Credit <strong>Insurance</strong> (NEW)Series <strong>of</strong> <strong>Insurance</strong> Business Training ProgrammesIntermediateUnderstanding The Personal Data Protection Act And Its Legal Implications (NEW)Building A Powerful Broking Brand (NEW)Networking for Brokers (NEW)Broking Service Excellence (NEW)Effective Broker / Client Communication (NEW)Presentation Skills For <strong>Insurance</strong> Pr<strong>of</strong>essionals And BrokersPresenting <strong>Insurance</strong> Proposals To SMEs (NEW)Negotiation Skills For Insurers And Brokers – The Harvard ModelSeries <strong>of</strong> Pr<strong>of</strong>essional & Financial Risks ProgrammesIntroductoryFundamentals Of Financial Lines <strong>Insurance</strong>s (NEW)IntermediateUnderwriting Directors’ & Officers’ Liability And Pr<strong>of</strong>essional Indemnity <strong>Insurance</strong>sSeries <strong>of</strong> Life & Health <strong>Insurance</strong> ProgrammesIntermediateCritical Illness <strong>Insurance</strong> Claims HandlingLife & Health <strong>Insurance</strong> Fraud ClaimsTalent ProgrammesIntermediate1st Asian Aviation Risks, Liabilities and <strong>Insurance</strong> Course (NEW)CPD CoursesIntermediateMarketing <strong>of</strong> Business <strong>Insurance</strong> To SMEsBuy & Sell Agreements Relevant To Financial AdvisersBuy & Sell Agreements Relevant To Financial Advisers (Part 2)

C 2 - CERTIFICATION & COMPETENCIES1 Certificate Of Pr<strong>of</strong>iciency In Travel <strong>Insurance</strong>2 Certificate Of Pr<strong>of</strong>iciency In Card Protection <strong>Insurance</strong>3 Certificate Of Pr<strong>of</strong>iciency In Foreign Domestic Worker <strong>Insurance</strong>4 Certificate Of Pr<strong>of</strong>iciency In Foreign Worker <strong>Insurance</strong>5 Certificate Of Pr<strong>of</strong>iciency In Motor <strong>Insurance</strong>6 Certificate Of Pr<strong>of</strong>iciency In Freight Forwarders <strong>Insurance</strong>7 Certificate Of Pr<strong>of</strong>iciency In Electrical Protection <strong>Insurance</strong>8 Introduction To Basic Concepts & Principles In General <strong>Insurance</strong> (BCP)9 Fundamentals Of Personal General <strong>Insurance</strong> (PGI)10 Fundamentals Of Commercial General <strong>Insurance</strong> (ComGI)11 Certificate In Health <strong>Insurance</strong> (CHI)12 Certificate In Reinsurance (CRI)CORPORATE TRAINING SOLUTIONS (CTS) PROGRAMMES123Life ReinsuranceThe Art <strong>of</strong> Conducting <strong>Non</strong>-Proportional Reinsurance Treaty BusinessUnderwriting Business Interruption <strong>Insurance</strong>