Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

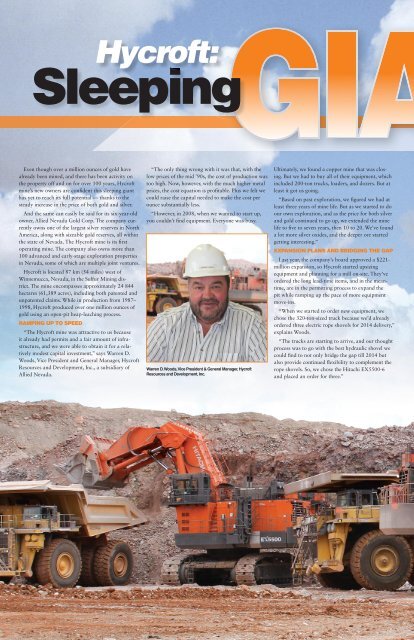

Hycroft:<br />

sleeping<br />

Even though over a million ounces of gold have<br />

already been mined, and there has been activity on<br />

the property off and on for over 100 years, Hycroft<br />

mine’s new owners are confdent this sleeping giant<br />

has yet to reach its full potential — thanks to the<br />

steady increase in the price of both gold and silver.<br />

And the same can easily be said for its six-year-old<br />

owner, Allied Nevada Gold Corp. The company currently<br />

owns one of the largest silver reserves in North<br />

America, along with sizeable gold reserves, all within<br />

the state of Nevada. The Hycroft mine is its frst<br />

operating mine. The company also owns more than<br />

100 advanced and early-stage exploration properties<br />

in Nevada, some of which are multiple joint ventures.<br />

Hycroft is located 87 km (54 miles) west of<br />

Winnemucca, Nevada, in the Sulfur Mining district.<br />

The mine encompasses approximately 24 844<br />

hectares (61,389 acres), including both patented and<br />

unpatented claims. While in production from 1987–<br />

1998, Hycroft produced over one million ounces of<br />

gold using an open-pit heap-leaching process.<br />

RAmpING up To speed<br />

“The Hycroft mine was attractive to us because<br />

it already had permits and a fair amount of infrastructure,<br />

and we were able to obtain it for a relatively<br />

modest capital investment,” says Warren D.<br />

Woods, Vice President and General Manager, Hycroft<br />

Resources and Development, Inc., a subsidiary of<br />

Allied Nevada.<br />

“The only thing wrong with it was that, with the<br />

low prices of the mid ’90s, the cost of production was<br />

too high. Now, however, with the much higher metal<br />

prices, the cost equation is proftable. Plus we felt we<br />

could raise the capital needed to make the cost per<br />

ounce substantially less.<br />

“However, in 2008, when we wanted to start up,<br />

you couldn’t fnd equipment. Everyone was busy.<br />

Warren D. Woods, Vice President & General Manager, Hycroft<br />

Resources and Development, Inc.<br />

Ultimately, we found a copper mine that was closing.<br />

But we had to buy all of their equipment, which<br />

included 200-ton trucks, loaders, and dozers. But at<br />

least it got us going.<br />

“Based on past exploration, we fgured we had at<br />

least three years of mine life. But as we started to do<br />

our own exploration, and as the price for both silver<br />

and gold continued to go up, we extended the mine<br />

life to fve to seven years, then 10 to 20. We’ve found<br />

a lot more silver oxides, and the deeper ore started<br />

getting interesting.”<br />

expANsIoN plANs ANd bRIdGING The GAp<br />

Last year, the company’s board approved a $221-<br />

million expansion, so Hycroft started upsizing<br />

equipment and planning for a mill on-site. They’ve<br />

ordered the long lead-time items, and in the meantime,<br />

are in the permitting process to expand the<br />

pit while ramping up the pace of more equipment<br />

move-ins.<br />

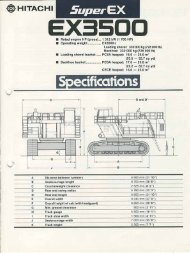

“When we started to order new equipment, we<br />

chose the 320-ton-sized truck because we’d already<br />

ordered three electric rope shovels for 2014 delivery,”<br />

explains Woods.<br />

“The trucks are starting to arrive, and our thought<br />

process was to go with the best hydraulic shovel we<br />

could fnd to not only bridge the gap till 2014 but<br />

also provide continued fexibility to complement the<br />

rope shovels. So, we chose the <strong>Hitachi</strong> EX5500-6<br />

and placed an order for three.”