journal_january2015

journal_january2015

journal_january2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FOR PRIVATE CIRCULATION ONLY | VOL-9 | JANUARY - 2015<br />

Interview<br />

“Social media is a<br />

great friend for<br />

experiential marketing”,<br />

Dalveer Singh<br />

Leader Emerging Market - GroupM Dialogue Factory<br />

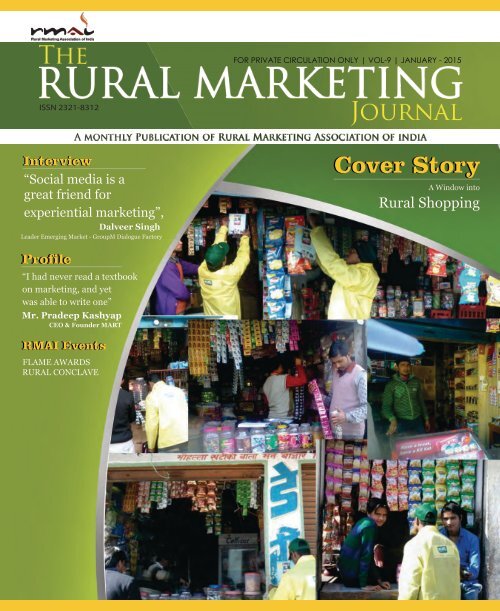

Cover Story<br />

A Window into<br />

Rural Shopping<br />

Profile<br />

“I had never read a textbook<br />

on marketing, and yet<br />

was able to write one”<br />

Mr. Pradeep Kashyap<br />

CEO & Founder MART<br />

RMAI Events<br />

FLAME AWARDS<br />

RURAL CONCLAVE

The<br />

RURAL MARKETING<br />

ISSN 2321-8312<br />

FOR PRIVATE CIRCULATION ONLY | VOL-9 | JANUARY - 2015<br />

Journal<br />

Contact Address<br />

Rural Marketing Association of India<br />

C/o. Impact Communications<br />

E-362, First Floor Nirman Vihar, Vikas Marg,<br />

New Delhi - 110092<br />

Tel. 011-40619900<br />

Mob - 9910023628 / 9818960558<br />

Learn more about RMAI at www.rmai.in<br />

EDITORIAL COMMITTEE<br />

Sanjay Kaul, Raj Kr Jha<br />

Khurram Askari, R V Rajan<br />

CONSULTANT EDITOR<br />

www.contentiveinc.com<br />

RMAI EXECUTIVE COMMITTEE 2014 - 2016<br />

President<br />

Sanjay Kaul<br />

CEO, Impact Communications<br />

Vice President<br />

Raj Kr Jha<br />

Consultant, Geometry Global<br />

Secretary<br />

George Angelo<br />

Executive Director (Sales), Dabur India Ltd<br />

Treasurer<br />

Dr. AnupKalra<br />

Executive Director, Ayurvet Ltd<br />

Zonal Head (South)<br />

Mr. KhurramAskari<br />

Director, Insight Outreach Pvt Ltd<br />

Zonal Head (West)<br />

Himanshu Shah<br />

Chief Mentor, SOI Live Marketing & Events<br />

Mr. Ranjit Kumar<br />

DDG (Rural Business) India Post, Govt of India.<br />

Mr. Biswabaran Chakrabarty<br />

General Manager, Crompton Greaves Ltd<br />

Mr. Punit Chadha<br />

General Manager (Rural Marketing), Maruti India Ltd<br />

Mr. Puneet Vidyarthi<br />

General Manager and Head (Rural), JCB India Ltd<br />

Mr. Siddhartha Chaturvedi<br />

CEO, Event Crafter<br />

Mr. Nikhil Sharma<br />

Partner, MART.<br />

From the<br />

President's Desk<br />

Dear Friends,<br />

We're proud to bring out the second<br />

edition of the e-<strong>journal</strong>, at the back of an<br />

encouraging response to the first edition.<br />

I hereby extend my heartfelt thank you for<br />

your feedback and appreciation.<br />

The second edition too promises to be a valuable read with a detailed analysis on<br />

the retail sector in rural India; perspectives on the reach and effectiveness of e-<br />

commerce in the hinterlands; initiatives by the Government and corporate towards<br />

rural development; interview with revered rural marketing professionals; effective<br />

rural marketing initiatives implemented by companies; and trends from across the<br />

world.<br />

It gives me great pleasure to announce the sixth edition of the RMAI Flame Awards<br />

2014 for Excellence in Rural Marketing & Communications, to be held on March<br />

20, 2015, at Taj Vivanta, Gurgaon. The surging number of entries received each<br />

year is a testimony to the popularity of the awards. The entry submission date has<br />

been extended to February 20, to accommodate as many entries as possible. To<br />

further strengthen its credibility, we have brought on board Ernst & Young to<br />

validate the judging process.<br />

The next few months will be action-packed for RMAI, as we organise a new edition<br />

of the Rural Conclave and the Corporate Excellence Awards, to be held on May 8-9,<br />

2015. Our goal is to bring together experienced and bright minds from<br />

Government, Corporate, Marketing and Communication and Technology sectors<br />

to foster knowledge, learning and inspiration on a wide range of subjects. India<br />

Post (Ministry of Communications & IT) is supporting RMAI for this initiative.<br />

I urge all of you members to participate in these initiatives and together chart out a<br />

new growth story for rural India. Your involvement and commitment are of<br />

paramount importance in soaring new heights in rural marketing.<br />

I hope you will find this edition of the e-<strong>journal</strong> insightful. Your valuable feedback<br />

and thoughts on the same will appreciated.<br />

Thank You<br />

Copyright RMAI.<br />

All rights reserved.<br />

Reproduction in any manner is prohibited.<br />

Published by<br />

Rural Marketing Association of India<br />

Sanjay Kaul

COVER STORY<br />

Feature -<br />

03<br />

A Window into Rural Shopping<br />

POINT-OF-VIEW<br />

07<br />

What is the future<br />

of e-commerce in rural India<br />

INTERVIEW<br />

11<br />

“Social media is a great friend for experiential<br />

marketing”, Dalveer Singh<br />

GOVERNMENT SECTOR<br />

Unnat Bharat Abhiyan for a Better Rural India<br />

13<br />

03<br />

PROFILE<br />

15<br />

Pradeep Kashyap,<br />

Founder & CEO, MART<br />

RMAI EVENTS<br />

Rural Conclave<br />

RMAI Flame Awards 2015<br />

17<br />

07<br />

13<br />

21<br />

11<br />

CSR<br />

Project Sampark:<br />

Promoting mobile telephony among women<br />

21<br />

11<br />

INNOVATION – INTERNATIONAL<br />

Mobile App to Help African Farmers<br />

24<br />

ON Ground<br />

A look at how advertisers are connecting and engaging<br />

with consumers on the ground in rural markets<br />

25<br />

15<br />

25

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

COVER STORY<br />

Feature -<br />

A Window into Rural Shopping<br />

With rising incomes and aspirations, consumers are increasingly seeking convenience and choice. They wish to upgrade and<br />

embrace the modern way of life. A modernised way of shopping is just one of the sought after changes.<br />

Sapna Nair Purohit, New Delhi<br />

More than 95 per cent of the Indian retail sector falls in the<br />

category of 'unorganised sector'. According to a McKinsey<br />

& Company report titled 'The Great Indian Bazaar', the<br />

growth of organised retail is expected to be between 14 and<br />

18 per cent of the total retail market this year. This article<br />

attempts to explore the potential of rural India, as a market<br />

for modern and corporatised retail, and look at the changes<br />

and developments in the hinterland that retailers can<br />

leverage.<br />

Overview<br />

The Indian retail sector accounts for 22 per cent of the gross<br />

domestic product (GDP) and contributes to 8 per cent of<br />

the total employment. The country's vast and dynamic<br />

retail landscape presents a big opportunity to foreign<br />

investors. A report published by AT Kearney hails India as<br />

'the third most attractive retail market for global retailers<br />

among the 30 largest emerging markets'.<br />

According to management consulting firm, Technopak, the<br />

Indian retail market is projected to grow at a compound<br />

annual growth rate (CAGR) of 6 per cent to reach $865<br />

billion by 2023. This will be driven by the sustained growth<br />

of India's GDP at 6 per cent in the next decade. This growth<br />

will, in turn, translate into increased demand for retail<br />

3

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

products, and hence, growth of merchandise retail, high<br />

disposable income with the end-consumer and rapid<br />

construction of organised retail infrastructure.<br />

Growth is expected to come from clothing, textiles, fashion<br />

accessories, jewellery, watches, footwear, health, beauty<br />

care, pharmaceuticals, consumer durables, home<br />

appliances, mobiles, furnishings, utensils, furniture, food,<br />

grocery, catering, books, music, gifts, entertainment and<br />

other segments in retail.<br />

The Rural Story<br />

As per Technopak, the rural retail market was estimated to be<br />

worth $273 billion in 2014.<br />

Owing to rapid urbanisation, it is expected that an increasing<br />

share of incremental merchandise retail will come from<br />

urban and semi-urban centres. Demand is also expected to<br />

come from the emerging towns and clusters, where the<br />

primary source of livelihood has moved from agriculture to<br />

other professions.<br />

Nearly, $21 billion (56 per cent of total corporatized retail)<br />

comes from the top 24 cities that contribute to 30 per cent of<br />

the total retail basket. This is due to low penetration of<br />

corporatized food and grocery retail, poor infrastructure,<br />

inefficient supply chain and concentrated customer segment<br />

in the overall landscape.<br />

It is believed that, in the future, growth will be driven by the<br />

penetration of corporatized retail beyond these urban<br />

centres.<br />

Technopak's study reveals that even though rural India offers<br />

myriad opportunities for retailers, it is not likely to become<br />

an extension of urban India in the next decade. This is<br />

because, there exist key differences in the types of demand<br />

coming from these two pockets, even though the rural areas<br />

manage to mirror the consumption of the urban in the<br />

various retail categories.<br />

Rural Indian consumers do not seek low-priced products.<br />

Instead, they prefer products that are functionally at par,<br />

while justifying their affordability. Rural income generation<br />

being largely dependent on agriculture, is seasonal, and so is<br />

the consumption. This is unlike urban India, which follows a<br />

regular, monthly income-expenditure cycle.<br />

The erratic nature of the rural income-expenditure cycle<br />

makes credit more significant. Therefore, the availability— of<br />

credit and welfare support from the government, in particular<br />

cash reimbursement of subsidies—impacts rural spending<br />

and consumption patterns to a great extent. It is vital for<br />

brands and retailers to have a deeper understanding of rural<br />

markets and pin their fortunes on the penetration of these.<br />

However, this is easier said than done. Damodar Mall, Chief<br />

Executive Officer, Value Retail, at Reliance Retail, says, “Even<br />

in the metro cities, corporate or modern retail comprises only<br />

25 per cent of the total retail. A lot of work needs to be done<br />

there. That is why, people are not going bullish yet. The<br />

market is too complex right now and they'd rather focus on the<br />

more feasible markets where work is still to be done.”<br />

The Challenges<br />

India's diversity poses the biggest challenge for retailers. The<br />

food and grocery category has been a tough nut for companies<br />

to crack. The corporatised retail share of food and grocery<br />

grew from a mere 1 per cent to 3 per cent, whereas apparel<br />

grew from 14 per cent to 19 per cent, reveals Technopak. It has<br />

been observed that non-food categories have been more<br />

receptive towards corporatised retail and are poised to grow<br />

with improved distribution processes. They are also set to<br />

reach beyond the major urban centres and develop alternate<br />

retail.<br />

Food and grocery has been unable to migrate to the<br />

corporatised retail platform preventing it from growing to its<br />

potential. Preferences, especially in food, are extremely<br />

localised. Capturing the various demand catchments and<br />

catering to specific taste nuances is a Herculean task. This,<br />

and the fact that the supply chain does not follow a linear<br />

pattern from urban to rural, has resulted in a fairly low<br />

penetration of modern retail in rural India.<br />

Technopak's research states that this scenario is not going to<br />

change much in the near future, as policy uncertainties and<br />

4

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

lack of structural reforms across the value chain will continue<br />

to act as deterrents.<br />

Furthermore, high fragmentation, low density of population<br />

at the consumption centres, poor transportation<br />

infrastructure and complex tax regimes make it a complex<br />

market to operate in.<br />

Organised retail also faces competition from the local momand-pop<br />

stores that have been around for long and enjoy<br />

familiarity and trust among rural consumers. This makes it<br />

imperative for new retailers to invest in effective and<br />

engaging marketing campaigns, to create awareness and<br />

induce trials.<br />

Mall points out that a lot of (food) production happens<br />

around the urban areas, making it easier to distribute. “They<br />

also prefer aggregation of demand. While the demand does<br />

exist, its density is not high in rural areas, unlike in the<br />

urban,” he says.<br />

So, even though the demand for retail products in rural areas<br />

continues to outpace that of the urban areas, the dominant<br />

form of retailing in the former continues to be unorganised or<br />

informal. This comprises the traditional kirana stores for<br />

both grocery and non-grocery items, primarily due to their<br />

ease of access, affordability, credit options and convenience.<br />

Been There Done That<br />

Corporates have forayed into the rural retail market in the<br />

form of specific rural outlets selling food and grocery<br />

products. However, most of them have either exited the<br />

market or have changed their business models to sell nonretail<br />

items.<br />

DCM Shriram Consolidated Limited's (DSCL) Hariyali<br />

Bazaar retail stores, launched in 2002, in the rural areas, shut<br />

shop in 2012. Instead, it has now opted to sell fuel products.<br />

Triveni Engineering too exited the rural retail business in<br />

2010. It operated 42 Khushali Bazaar outlets in Uttar Pradesh<br />

and Uttarakhand.<br />

On the other hand, chains such as Choupal Saagar and<br />

Aadhar continue to run in the hinterland. Aadhar is a joint<br />

venture between the Future Group and Godrej Agrovet,<br />

focussing on retail distribution of consumer products for<br />

personal and household use, in rural and semi-urban India.<br />

Positioned as a rural supermarket, it currently has 40 stores<br />

spread over 100,000 sq. ft., across Gujarat and Punjab.<br />

Initially, when Godrej Agrovet launched the chain, the stores<br />

were owned and operated by the company. After Future<br />

Group bought a majority stake in the venture in 2008, it<br />

closed some company-owned outlets and expanded through<br />

franchisees. In early 2012, it entered the cash-and-carry<br />

business to sell to wholesalers and Aadhar outlets.<br />

ITC first developed linkages through its eChoupal initiative to<br />

buy agricultural products from farmers and improve<br />

productivity, helping raise their incomes. It then launched<br />

Choupal Saagar stores to sell a variety of products and<br />

services including farm inputs, consumer goods and<br />

durables, apparel and fuel.<br />

Recently, the Future Group's food and FMCG arm — Future<br />

Consumer Enterprise Limited (FCEL)— has acquired<br />

Nilgiris, the chain of convenience stores run by the Nilgiri<br />

Dairy Farm Pvt Ltd. The chain has 1,405 outlets spread across<br />

Kerala, Karnataka, Andhra Pradesh and Tamil Nadu. With<br />

this acquisition, FCEL hopes to expand geographically, by<br />

increasing its footprint of convenience stores in South India.<br />

Companies such as Hindustan Unilever Limited (HUL) are<br />

implementing special initiatives, such as Project Shakti,<br />

which is a rural distribution initiative in villages. The project<br />

benefits HUL by enhancing its direct rural reach and at the<br />

same time creates livelihood opportunities for<br />

underprivileged rural women. Having started with 17 women<br />

in one state, it has a network of 65000 Shakti entrepreneurs<br />

today. Its products are distributed in over 165,000 villages<br />

and reach over four million rural households.<br />

Opportunities<br />

The rural market, despite presenting numerous<br />

impediments in the expansion of retail, also paints an<br />

encouraging picture. Reports state that rural incomes and<br />

consumptions are rising steadily. The average wages, under<br />

the National Rural Employment Guarantee Programme,<br />

5

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

E-tailing<br />

E-commerce is being touted as another key trigger for the<br />

expansion of retail in rural India. Leading the non-store retail<br />

segment, the e-tailing market was estimated at $ 1 billion, in<br />

2013, and is projected to grow at a rate of 50 per cent per year,<br />

to reach $ 56 billion by 2023, as per Technopak. This growth<br />

is expected to be driven by mobile transactions, even in rural<br />

India.<br />

have risen to Rs 128 in 2012–13 from Rs 65 in 2006–07,<br />

average monthly per capita spending in rural areas has<br />

jumped by 36 per cent to Rs 1,430 in 2011–12 from Rs 1,053 in<br />

2009–10.<br />

There has been a gradual shift in the mindset of consumers<br />

too, resulting in an improvement in lifestyle which organised<br />

retail can tap. According to Mall, the new rural woman<br />

consumer prefers to shop for her personal care products from<br />

a modern retail outlet that offers a variety of premium brands<br />

and options, instead of purchasing it from the local<br />

shopkeeper, who is all too familiar with her in-law's<br />

preferences.<br />

“Younger women find it disempowering to deal with the<br />

shopkeeper— buying from a man who is known to the entire<br />

family. As women get more educated and have a point of<br />

view, as incomes increase, and as women's empowerment<br />

gets unlocked by self-service, modern retail will grow,” Mall<br />

says, hopefully. The coming of age of the middle class,<br />

coupled with their growing confidence will be the engine for<br />

the growth of modern retail in rural markets.<br />

The phenomenon of modern retail is already catching on in<br />

rural India as shops are being transformed into self-service or<br />

partial self-service, to attract the discerning new consumers,<br />

especially the women. Being able to hand-pick products of<br />

one's choice and choose from a display is surely a sign of<br />

modernity.<br />

Aspirations of consumers in small cities and towns (beyond<br />

the top 15) are increasingly converging with that of their<br />

counterparts in the metros and mini-metros. Exposure and<br />

affordability are driving this parity. However, the limited<br />

penetration of the brick and mortar business network in these<br />

towns has paved the way for an alternate retail channel to<br />

thrive. Nearly half of the current e-tail sale comes from towns<br />

and cities beyond the eight metros. And this is poised to surge.<br />

Recognising this opportunity, online marketplace Snapdeal<br />

has partnered with alternate delivery channel provider FINO<br />

PayTech. Together, they have launched assisted e-commerce<br />

centres in semi-urban, rural and low-income residential areas<br />

across India.<br />

Snapdeal plans to set up e-commerce outlets or kiosks across<br />

70,000 rural areas in 65 cities by the end of 2015. The first set<br />

of assisted e-commerce outlets will come up at Dharavi<br />

(Mumbai), Varanasi, Valsad (Gujarat), and urban villages in<br />

Noida, Gurgaon, Hyderabad and Jaipur. Meanwhile, Flipkart<br />

has joined hands with the Government of India to train people<br />

from semi-urban and rural areas and employ them at the<br />

company or its business partners.<br />

All in all, if companies can find a way to tide over the<br />

infrastructural and logistical challenges that this complex<br />

market poses, in tandem with consumers' preferences, retail<br />

is set to flourish in locations yet to be explored.<br />

6

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

POINT-OF-VIEW<br />

What is the future<br />

of e-commerce in rural India<br />

The Indian rural market is beckoning to the e-commerce companies to tap its potential<br />

According to the latest research by leading global research and advisory firm, Forrester, the Indian e-commerce market is all set to<br />

show the fasted growth within the Asia-Pacific region at a compound annual growth rate (CAGR) of over 57 per cent between 2012<br />

and 2016. It is believed that the number of online shoppers has been on the rise, and is expected to grow to 40 million in the next<br />

two years, from the current 25 million.<br />

E-commerce players are well aware that this growth will be fuelled by the non-metros, especially small towns. They are striving to<br />

make in-roads into the rural markets, even as mainstream commerce struggles. Two top e-commerce companies talk about the<br />

peculiarities of the rural markets, their strategies and factors that will accelerate growth.<br />

Challenges<br />

Shivani Dhanda,<br />

Head – Marketing, eBay India<br />

A major challenge faced by the e-commerce industry in India is the lack of a robust<br />

ecosystem, especially in the area of connectivity and product delivery. Owing to the vast<br />

geography of rural India, it is sometimes challenging to reach remote corners.<br />

However, most courier companies have invested in technology and processes to<br />

overcome this challenge. At eBay India, we launched the PowerShip initiative wherein<br />

we have tied up with leading courier companies to significantly increase the efficiency of<br />

managing multiple item shipments for eBay merchants and delivery of items to buyers.<br />

PowerShip sellers can avail special courier rates and ship to over 1200 cities and towns in<br />

India.<br />

As the e-commerce ecosystem matures in India, many such innovations will boost online<br />

shopping in rural markets.<br />

Tapping the rural<br />

The tier II and III cities as well as the rural areas are going to be the next big thing for e-<br />

commerce. They have shown extreme potential recently and are growing at a burgeoning<br />

pace. According to the eBay India Census 2014, an analysis of all online buying and<br />

7

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

selling transactions by Indians on eBay India, over a period of 18 months showed that out of the 4,556 e-commerce hubs in the<br />

country, there are 1,233 rural hubs along with 3,313 Bharat hubs (tier II and III cities). There has been a significant upsurge in the<br />

number of rural hubs as compared to the previous Census.<br />

With the quantum of customers logging on to e-commerce sites, to shop online, increasing at a rapid pace, all players are looking<br />

forward to tapping the rural market and connecting with the emerging online shopper in these areas.<br />

Growth Triggers<br />

2015 is going to be the year of customers shopping online from non-metro cities. There has been a significant uptake of products by<br />

customers from rural markets as revealed by the eBay India Census 2014.<br />

The increasing penetration of the Internet into the rural markets coupled with the surge in the number of users accessing the<br />

Internet through mobile phones and devices, is expected to expand the reach of e-commerce across the challenging geographies of<br />

the country.<br />

According to the eBay India Census 2014, Guntur (Andhra Pradesh), Tada (Andhra Pradesh), Karthikappally (Kerala), Ghattia<br />

(Madhya Pradesh), Chorayasi (Gujarat), Jalgaon (Maharashtra), Budgam (Jammu & Kashmir), Cachar (Assam), Adur (Kerala)<br />

and Villupuram (Tamil Nadu) are the top ten rural hubs in the country.<br />

Popular Categories<br />

According to the Census, the top five products traded in the rural markets are — mobile accessories, tools and hardware, stationery<br />

and office supplies, coins and notes, chocolates, cakes and food items. The top five products exported from the rural markets are<br />

—jewellery, watches, decorative pieces, cell phones and accessories, home and garden products, clothing, shoes and accessories.<br />

We expect these products to be traded extensively, with other products in the lifestyle and electronics category catching up fast.<br />

Challenges<br />

With its increasing disposable income and exposure to urban trends, thanks to the<br />

media, the rural market is becoming increasingly attractive for various industries,<br />

especially e-commerce. Internet bridges the supply chain gap between brands and the<br />

rural market. However, there continue to be some key challenges, which are largely in<br />

the area of infrastructure. You can say that between the demand and supply sides, there<br />

are more supply-side challenges. Internet penetration is still low compared to the urban<br />

areas, and mobile Internet will play a big role in bridging this gap. Then, there is the<br />

challenge of logistics-related infrastructure and low reach of logistics partners. The only<br />

third-party logistics provider (3PL) with a wide reach is India Post, which is now<br />

investing in e-commerce deliveries, but has a long way to go.<br />

Devesh Rai G,<br />

Founding Member and Corporate Vice President -<br />

Business Development, ShopClues<br />

8

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

Tapping the rural<br />

E-commerce players are well aware of the opportunity that lies in the rural markets. On the one hand, there are strong demandside<br />

factors, such as high disposable income, willingness to spend, exposure to urban trends, and desire and ambition to own the<br />

best. On the other hand, there is the opportunity arising out of the limited reach of the traditional offline supply chain. Right now,<br />

these factors are playing a big role in the growth in sales from tier II and tier III towns—a major focus and growth driver for<br />

ShopClues in particular. The same will follow in rural areas as well.<br />

Growth Triggers<br />

In my opinion, the growth of e-commerce is faster and will continue to be faster than what most of us can fathom. ShopClues<br />

already sees a lot of orders from the hinterland with village post office addresses. So, clearly, e-commerce has already taken off in<br />

the rural areas. It will definitely see a major upward trend in the next two years, following improvements in the Internet and<br />

logistics infrastructure.<br />

Popular Categories<br />

Electronics and fashion will be major drivers. Within electronics, demand will mainly come from low to mid-range mobiles,<br />

laptops and appliances, which do not have reach in the rural markets. Fashion will remain centred around affordable daily wear,<br />

with low- to mid-range brands taking the lion's share.<br />

Challenges<br />

The retail landscape has changed globally, and is changing in India too. E-commerce has<br />

transformed the way people shop and do business. Simplicity and accessibility have been<br />

the hallmark of the e-commerce industry growth in India, led by companies like<br />

Snapdeal. Internet connectivity, which is low at less than 10 per cent, is a significant<br />

challenge in reaching out to the rural consumers. Low penetration of Internet banking<br />

and credit/ debit cards is also a barrier in the way of online shopping. This is now being<br />

overcome with the 'cash on delivery' option. However, the biggest challenge has been the<br />

lack of trust in online shopping, which is being addressed through active communication<br />

via various mass media channels.<br />

Sandeep Komaravelly,<br />

Senior VP – Marketing, Snapdeal<br />

Tapping the rural<br />

Snapdeal.com is betting big on the tier II, tier III and rural markets as rising aspirations<br />

and corresponding increase in digital penetration will lead to growth, driven by these<br />

9

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

centres. Currently, over 60 per cent of its users are from these markets. To tap the markets beyond the top ten cities and in smaller<br />

cities, towns and rural markets, the logistics and delivery network has been strengthened to reach over 15000 pin codes in the<br />

country. The recent tie-up with India Post will further strengthen the efforts in this direction.<br />

Furthermore, India currently has 40 million mobile Internet users and this is expected to grow exponentially in the near future.<br />

This is why Snapdeal.com has consciously built its presence on mobile platforms and is leading the m-commerce revolution in<br />

India, with over 65 per cent of orders coming from mobile phones. Just a year ago, this figure was a little over 5 per cent. Hybrid e-<br />

commerce models, like assisted e-commerce and easy payment options like 'cash on delivery' also play an important role in<br />

building e-commerce.<br />

Growth Triggers<br />

The penetration of smartphones clubbed with rising aspirations, have enabled the growth of e-commerce in rural areas.<br />

Furthermore, increased assortment of products, easy return policy, free trials and cash on delivery will play a huge role in further<br />

scaling up e-commerce in rural India.<br />

Sellers play a pivotal role in the growth of any market, therefore, a strong seller ecosystem is critical for the development of e-<br />

commerce. Snapdeal currently has close to a 100,000 sellers on its platform, and a large percentage of these sellers come from the<br />

small, remote towns and cities of the country. For the rural sellers, Snapdeal acts as an enabler giving them access to an online<br />

platform that extends their reach nationally, whilst supplying locally. The synthesis of this latent desire of small businesses to<br />

expand nationally has been key to the success of e-commerce and will lead to growth in the rural market.<br />

Popular Categories<br />

In the past, people in the rural areas had to go to distant places or nearby cities to purchase luxury and speciality products. With e-<br />

commerce, they are now able to access them from within the comfort of their homes, at par with urban dwellers. The credit goes to<br />

the accessibility offered by e-commerce platforms like Snapdeal. There is a huge demand for footwear, clothing, mobile phones<br />

and electronics in the rural markets, similar to the trend seen in urban markets.<br />

New innovative categories like agri products are also gaining popularity. The recently launched agri store, which is making<br />

available over 300 products, has received a very positive response. Similarly, increased demand for affordable mobile and<br />

computing devices and other categories like medical devices, hardware and fixtures, is anticipated among others that are difficult<br />

to access offline, locally.<br />

10

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

Excerpts<br />

1. When do brands tend to experiment<br />

with 'Experiential Marketing' Is there a<br />

favourable time<br />

It all depends on the media mix for the brand or<br />

the category, and where exactly experiential<br />

marketing fits into the marketing and<br />

communications programme.<br />

However, when budgets are more, brand<br />

managers tend to experiment more whereas<br />

during tough times, they prefer to stick to tried<br />

and tested methods. This is because, in case of<br />

mass media, an advertiser can substantiate his<br />

spends in terms of the outcome.<br />

INTERVIEW<br />

“Social media is a<br />

great friend for<br />

experiential marketing”<br />

Dalveer Singh<br />

Leader Emerging Market - GroupM Dialogue Factory<br />

With over 20 years of experience, the current head of<br />

experiential marketing, APAC, Group M, has been a<br />

seasoned rural marketing practitioner. He talks of<br />

how the rise of the social media has aided experiential<br />

marketing, and how this form of advertising will<br />

continue to grow…<br />

But I think, this is a lazy way of marketing. Smart<br />

marketers would often go the experiential way.<br />

Experiential marketing has always seen a<br />

growing trajectory. At the same time, I also<br />

believe that anything new takes a while to catch<br />

up, though this form of marketing has been<br />

around for a long time now.<br />

2. Which are the sectors best suited for<br />

experiential marketing<br />

It fits in very well in the fast-moving consumer<br />

goods (FMCG) and automobile sectors but not in<br />

the banking, financial services and insurance<br />

(BFSI) sectors, where there is nothing to<br />

experience.<br />

Whenever a marketer needs to showcase a<br />

product or its features, be it taste, appearance,<br />

feel or touch, you need experiential marketing. It<br />

is not meant for selling concepts. There are some<br />

advantages as well as certain limitations of this<br />

form of advertising, just as in other mediums.<br />

3. How has social media changed the<br />

rules of experiential marketing and<br />

activation<br />

11

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

I think social media has done a lot of good to experiential<br />

marketing. In fact, it is a friend to this form of advertising.<br />

Till yesterday, we had to use a pamphlet or a poster to<br />

announce a campaign or an activity. Now, this can easily be<br />

done through social media, which can amplify an activity<br />

better and more effectively.<br />

Word of mouth can be used effectively by brands on social<br />

media. Though very few brands have tried it, the ones which<br />

have, managed to achieve great results.<br />

4. Mass media has penetrated deep into rural India.<br />

What does it spell for the activation industry,<br />

especially in the rural markets<br />

As far as the reach of the mass media is concerned, there are<br />

the media-dark states and media-light states. We say that the<br />

BIMARU (Bihar, Madhya Pradesh, Rajasthan, Uttar<br />

Pradesh) states are media-dark states, so experiential<br />

marketing is needed there.<br />

However, I feel that if I need to sell facewash or conditioner in<br />

a media-light state, such as Tamil Nadu, Andhra Pradesh or<br />

Punjab, I still need to ride on experiential marketing.<br />

Yes, mass media does help create a reach, but does it really<br />

persuade people to try a new category To buy something<br />

new, you have to again ride on experiential marketing. So, the<br />

theory of these being media-dark markets is an old one.<br />

Experiential marketing helps to enhance experiences and<br />

bring them to life. And it can be applied across categories!<br />

5. Which vehicle do you feel is the cheapest and most<br />

effective to reach out to Rural India Is experiential<br />

marketing giving way to mass media<br />

Experiential marketing was never cheap and still is not. You<br />

cannot compare mass media costs to experiential marketing,<br />

because the impact is very different. I cannot say that radio is<br />

the best medium or press is the best medium. There is no one<br />

single medium that one can say is the best to reach out to<br />

rural masses either.<br />

To spread awareness, you will need static media. To explain<br />

things, you will need interactive media. To talk to a large<br />

congregation of people, you will need to use mailer and haats.<br />

So, depending on what your marketing and communication<br />

objective is, you will need a mix as no single media will work.<br />

6. Be it the Lifebuoy Roti Campaign or the Coke Small<br />

World Machine campaign, we have seen some<br />

innovative work in experiential marketing in the last<br />

few years. Has this form of advertising come of age,<br />

to be able to build brands today<br />

I do not think any single campaign can build a brand.<br />

Lifebuoy was built through the handwash programme, and<br />

the roti campaign during the Kumbh mela was just one of the<br />

components. So, there are many things you do to build a<br />

brand in rural markets.<br />

While mass media does play a role, the haats and mailer are<br />

also equally important.<br />

7. With 20 years in below-the-line marketing, how do<br />

you see your professional life when you look back<br />

I think I had a great 20 years. The job is excellent, actually. In<br />

my opinion, people who work in the rural and emerging<br />

markets have a great job to do, because they are connected to<br />

the consumers, and are also travelling continuously.<br />

When I took up rural marketing as a career, people<br />

questioned 'what is rural'<br />

Rural marketing has not only taken me across 40 countries<br />

today, but also to every nook and corner of each one.<br />

Rural marketers understand the pulse of the market because<br />

they are much closer to the consumers; the interaction with<br />

them is on ground and not in air-conditioned offices.<br />

I am very happy that I picked rural which was not very<br />

attractive then, and have contributed to making it attractive.<br />

8. Putting your wide experience to use, how do you<br />

foresee this sector growing<br />

If you look at the 6.2 billion consumers across the globe, you<br />

will still have half of them in the rural areas till 2030 or 2050.<br />

Those are the next frontiers. There are very few people in the<br />

country who understand rural consumers well. There are not<br />

many who understand the nuances of below-the-line (BTL)<br />

and even fewer who understand experiential marketing. So,<br />

to me, this is the sector, which will keep growing.<br />

12

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

GOVERNMENT SECTOR<br />

Unnat Bharat Abhiyan<br />

for a Better Rural India<br />

In its effort to develop rural India, the Government has launched the Unnat Bharat Abhiyan to use India's<br />

knowledge capital to bring about a social change and encourage rural entrepreneurship. Team Contentive<br />

Inc. looks at what the Unnat Bharat Abhiyan challenge entails<br />

As India progresses, it becomes evident that the pace of modernisation is not the same throughout. While cities and metros are<br />

modernising at an exponential rate, villages tend to progress comparatively slower. Even today, there are villages that do not have<br />

electricity and where people need to do back-breaking labour just to survive. With nearly 70 per cent of India living in rural areas,<br />

and employing nearly 51 per cent of the total workforce, there is an urgent need to modernise this population.<br />

The Government has, over time, introduced innumerable schemes and campaigns to bridge this gap<br />

but the urban–rural divide continues to grow. Currently, a plethora of campaigns are being<br />

run by it to develop the rural areas and bring them up to the level of their urban<br />

counterparts.<br />

On October 31, the Ministry of Human Resource Development (MHRD)<br />

launched the Unnat Bharat Abhiyan (UBA) to look at development from a<br />

perspective of knowledge rather than finance. It has roped in leading<br />

technology institutions like the Indian Institutes of Technology<br />

(IITs) and the National Institutes of Technology (NITs) in this<br />

mission. These institutions will use their intellectual prowess to<br />

design and develop solutions to the problems that rural India<br />

faces, through the use of technology. Unnat Bharat has a twofold<br />

aim: build the capacity of the institutes of higher<br />

education for research and training relevant to India; and<br />

provide rural India with professional resource support from<br />

these institutes of higher education. While MHRD will be<br />

overseeing UBA, IIT-Delhi has been chosen as the nodal<br />

agency to coordinate with the other IITs and NITs<br />

participating in the campaign.<br />

The Unnat Bharat Abhiyan envisages the IITs and NITs<br />

adopting ten villages within their neighbourhood for<br />

development. Students from these institutes will then visit the<br />

villages to identify the problems that they face. They will then find<br />

financially-viable solutions to these problems. Once a solution has<br />

been identified, the industry will be involved to scale it up. It hopes<br />

to prepare a roadmap for the holistic development of rural India. So<br />

13

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

far, the institutes have identified 132 villages for their work.<br />

While MHRD has formally launched UBA and laid out a<br />

roadmap for the same, the situation on the ground is<br />

different. Professor SK Saha, who oversees the<br />

implementation of UBA at IIT Delhi, explains, 'The concept<br />

is still in its nascent stage. All IIT coordinators of the Unnat<br />

Bharat Abhiyan (UBA) cells are discussing under the<br />

guidance of MHRD.' He points out that the IITs have already<br />

been involved in rural development under rural<br />

development centres or Rural Technology Action Groups<br />

(RuTAG). For example, IIT Delhi has a Centre for Rural<br />

Development and Technology (CRDT) which started in 1978.<br />

Similarly, IIT Bombay has the Centre for Technology<br />

Alternatives for Rural Areas (CTARA) and IIT Kharagpur has<br />

the Rural Development Centre (RDC). These will play a<br />

major role once UBA hits the road. However,currently, the<br />

IITs are developing the roadmap provided by MHRD, which<br />

will later be shared with the NITs and other technical<br />

institutes.<br />

What makes the Unnat Bharat Abhiyan unique is that it uses<br />

India's intellectual rather than monetary wealth to bring<br />

about a societal change. The costs for the campaign are to be<br />

met from the various programmes already under way, with<br />

additional funds being mobilised on a project-to- project<br />

basis. Each technology institute is required to set up an interdisciplinary<br />

Unnat Bharat Cell, consisting of teachers and<br />

students to undertake the projects. At the same time, the<br />

Unnat Bharat Abhiyan is also an inter-ministry exercise, with<br />

the ministries of Human Resource Development,<br />

Agriculture, Rural Development, Water Resources, Science<br />

and Technology, Renewable Energy, MSME and Textiles (for<br />

artisans), Labour and Employment working in tandem<br />

towards a common goal. Once the institutes conceive a new<br />

project, it will be taken to the appropriate funding agency for<br />

funds. This way, the overall cost of the project can be kept<br />

under control.<br />

According to Professor Saha, the Unnat Bharat Abhiyan<br />

comes with its own challenges for the educational institutes.<br />

He says, the rural community needs to be studied to<br />

understand how technology can be used to uplift it. But for<br />

that, the institutes will have to earn the trust and confidence<br />

of the rural communities. The communities will have to<br />

convinced to use the solutions developed by these<br />

institutions, which can be an uphill task, as the solutions<br />

might not work at the first instance and may need further<br />

tweaking. Finally, he says, even if a technology finds<br />

acceptance with the rural community, finding entrepreneurs<br />

to take it further can prove to be a further challenge. When<br />

asked about rural entrepreneurship, he posed the question<br />

back to RMAI asking how it could help in this mission.<br />

IIT Roorkee, one of the participating IITs, provides a<br />

showcase for the campaign's success so far. It has taken the<br />

charge of five villages in Uttarakhand. It set up the RuTAG for<br />

the same. To achieve rural transformation, IIT Roorkee has<br />

designed a five-point roadmap wherein it identifies the<br />

technology for bringing about rural development, builds up<br />

strategies for capacity building, facilitates rural<br />

entrepreneurs to adopt the technology, conducts research<br />

that impacts the rural society, and brings about a societal<br />

development by polishing local skills through the use of<br />

technology.<br />

IIT Roorkee students studied the Bageshwari Charkha, used<br />

in Uttarakhand for making thread from the locally available<br />

Tibati wool. With the application of simple technology, they<br />

were able to produce a better version of the charkha, that<br />

resulted in increased efficiency and output. Using a<br />

collaborative system, all villagers in the adopted villages were<br />

taught to use the new charkha, thereby making its use<br />

widespread. The students also designed a low-cost solaroperated<br />

pine needle biomass briquetting machine that was<br />

easy to maintain, so that it could be easily deployed by the<br />

villagers. This proved to be beneficial for all, as it was<br />

environment friendly, easy to manufacture, a great<br />

employment opportunity for the people, and also more<br />

convenient to use than the traditional machines.<br />

IIT Roorkee's work in the villages of Uttarakhand has also<br />

been responsible for developing entrepreneurship in the<br />

villages. The water mills developed and deployed by it were<br />

later handed over to entrepreneurs, who in turn, provided<br />

livelihood to the people who were appointed to operate them.<br />

The water mills were also a source of clean energy for the<br />

villages.<br />

Just as other government initiatives, the Unnat Bharat<br />

Abhiyan too is unique as it puts educational institutes at the<br />

forefront, while the Government takes a back seat, only<br />

coming in the picture when the projects needs financing.<br />

Even when a project takes off, the Government choses to hand<br />

over its reins to local entrepreneurs so as to promote local<br />

economy. In this hands-off approach, the onus of building the<br />

rural economy rests largely on the institutes and the villagers<br />

themselves. Once the campaign is rolled out by the IITs, the<br />

rural economy is bound to benefit. Its dependence on urban<br />

markets for goods will diminish, as will the annual migration<br />

of labour from the villages to the cities. It looks all set to be a<br />

game changer.<br />

14

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

PROFILE<br />

Pradeep Kashyap,<br />

founder & CEO, MART<br />

JANUARY 2015<br />

“I had never read a textbook on<br />

marketing, and yet was able to write one”<br />

Kashyap put away 18 years of experience in the<br />

corporate sector, to find his true calling. Here,<br />

he talks about his early days, learning the skill of<br />

management on the job, his big shift from the<br />

corporate world and his tryst with rural India…<br />

Pradeep Kashyap, the founder and CEO of<br />

MART, is known as the Father of Rural<br />

Marketing in India. A BITS Pilani graduate in<br />

Engineering, he had never studied management<br />

or marketing. Yet, he advises aspiring managers<br />

from some of the most coveted B-schools like<br />

IIM-A and professionals from the corporate<br />

world.<br />

Kashyap's first job was with Exide, after<br />

graduating from BITS Pilani in 1969. The<br />

company was then hiring engineers to sell<br />

technical products like batteries. He spent six<br />

years doing 'technical selling', as a Marketing<br />

Executive in Kolkata and Delhi. This stint put<br />

him in a dilemma – while he understood the<br />

technical side of things, the management part<br />

remained an unknown territory.<br />

“I realised that I wasn't industry ready because I<br />

didn't have a management qualification. It took a<br />

while to get my teeth into management concepts,<br />

like financial projections, return on investment<br />

and break-even analysis,” recalls Kashyap.<br />

He then moved to MICO Bosch. Back then, Bosch<br />

had a monopoly in making fuel injection<br />

equipment for trucks and diesel vehicles in India.<br />

Here, he was tasked with setting up an office in<br />

Delhi to handle the company's northern<br />

operations. At a young age of 28, a cautious<br />

Kashyap travelled to the different company's<br />

offices to learn how to set up a new office. Soon,<br />

he had a 100 people reporting to him. As Bosch's<br />

regional head, he managed their distribution<br />

system.<br />

After seven years, he moved to Denso, in 1984, as<br />

head of marketing. The World's largest<br />

automotive parts manufacturing company had<br />

just set up operations in India and Kashyap was<br />

its second employee. He was mandated to set up<br />

the marketing division. It was a massive task.<br />

“Advertising our products in the open market<br />

and dealing with ad agencies were all new to me.<br />

Besides, other functions like after-sales services<br />

and spare parts division had to be set up too,” he<br />

remembers.<br />

315

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

One of his biggest contributions was that he negotiated hard<br />

with all client companies to pay against a letter of credit and<br />

bank guarantee. This ensured that the company received the<br />

payment on the day the goods were supplied thus ensuring a<br />

healthy cash flow. Despite resistance from big companies like<br />

Hindustan Motors, he insisted on implementing the system,<br />

which is followed even today.<br />

Around 1987, while he was at Denso, Kashyap started feeling<br />

restless. “I was not enjoying what I was doing; work was<br />

getting repetitive. I began to wonder what the purpose of life<br />

was. I asked myself, 'Do I want to continue like this for the<br />

next 30 years' It is said that when the disciple is ready, the<br />

guru appears. And that is what happened with me,” he<br />

reminisces. He found his spiritual guru, an Englishman who<br />

was an erstwhile aeronautical engineer, who ran an ashram<br />

beyond Almora. After discussions with him, Kashyap decided<br />

to work towards helping the poor.<br />

He bid adieu to his corporate life in 1987 and started<br />

travelling to the villages. A city-bred man, he had never<br />

seriously visited a village before. “The poverty really moved<br />

me. I felt I had to do something. The only thing I knew or had<br />

learnt was marketing. So, I decided that I should be working<br />

in the marketing space,” he says about his foray into rural<br />

development.<br />

He was appointed as marketing advisor to the Government of<br />

India, by the Ministry of Rural Development. He travelled the<br />

length and breadth of the country, meeting artisans,<br />

embroidery workers and craftsmen. “They were living in very<br />

difficult conditions. The problem was that while they<br />

produced exquisite products in the villages, the consumers<br />

were in the city and they had no clue how to access them,”<br />

Kashyap says.<br />

He started a system of marketing by which artisans could<br />

showcase their work in the cities, by way of sales exhibitions<br />

christened Gram Shree Melas or wealth of villages. The travel<br />

and other expenses of the artisans were funded by the<br />

Government and they were allowed to keep all the profits<br />

they made through sales. He executed 300 exhibitions across<br />

75 cities in India, over 10 years, helping hundreds of<br />

thousands of women. He remembers the first exhibition held<br />

at Udaipur, which was attended by the then Prime Minister,<br />

Rajiv Gandhi, who was impressed and suggested that such<br />

exhibitions be held in every state.<br />

In his next assignment, he was tasked with reviving the Khadi<br />

Commission, which, despite having 8000 showrooms, was<br />

not doing well. From answering queries of people from far-off<br />

states on a plethora of products like how to market a special<br />

type of chilli, to understanding how a mela is organised, every<br />

day, Kashyap says, would be exciting. “It was a very rich<br />

learning experience understanding the fabric of this country,”<br />

he adds. He was also advisor to the UN and World Bank.<br />

In 1993, he was requested by Ela Bhatt Founder, SEWA to bid<br />

for a World Bank- funded women's economic empowerment<br />

project. He worked on the proposal, which the bank liked and<br />

wanted him to execute for which he was required to set up a<br />

team. And that was the genesis of MART.<br />

“I had no grand vision, no plans or inclination to set up an<br />

organisation because I had left my corporate career to serve<br />

the poor,” he confesses. MART continued to work only on<br />

livelihoods and enterprise till 2000.<br />

In 2000, Kashyap was presenting MART's work at a<br />

conference in Hyderabad where the President of Birla<br />

Cement was present who approached him to do a marketing<br />

study. This was the beginning of MART's work with the<br />

corporate sector. Its work with Unilever's Project Shakti is the<br />

most notable where 46000 women micro-entrepreneurs,<br />

from micro-finance groups were appointed as company<br />

dealers. This caught the world's attention and went on to<br />

become a Harvard a case study. This marked MART's rural<br />

marketing work going global.<br />

According to Kashyap, it is only in recent years that<br />

companies have started showing interest in rural marketing.<br />

“Till 2000, there was not much serious interest in rural<br />

marketing from the corporate sector, except for companies<br />

like ITC and HUL. The usual response used to be 'where is the<br />

market'; 'people are so poor',” he says.<br />

From the year 2010 onwards, companies started showing<br />

serious interest. They wanted to know more about the market<br />

and go beyond pilots. “The rural market has arrived. It is now<br />

growing faster than the urban market. Also there is much<br />

more headroom to grow in rural because the penetration and<br />

consumption levels for brands is much lesser than urban.<br />

Affordability too has improved,” he observes. He firmly<br />

believes that the opportunities, for innovation and pathbreaking<br />

ideas, are much greater in rural than in the urban<br />

sector.<br />

His advice to young rural marketing professionals is to have a<br />

lot of passion but more compassion. “One must empathise<br />

with the poor. One should have affinity and associations with<br />

these people. Corporate marketers tend to look at these<br />

markets as business opportunities only. My mantra is 'you<br />

need a business mind with a social heart',” he says.<br />

Kashyap says that it is 'common sense' that has helped him<br />

achieve the success and stature he has today. “I'm not a<br />

management graduate; have never worked for an FMCG<br />

company. My idea of marketing was very basic and that was a<br />

huge disadvantage. I have learnt everything from common<br />

sense considering I had never read a textbook on marketing.”<br />

he says.<br />

Having worked for 45 years, Kashyap now wishes to<br />

slowdown. His idea of unwinding is watching the snowcapped<br />

mountains from the window of his cottage in the hills.<br />

16

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

RMAI<br />

FLAME AWARDS 2014<br />

INTERVIEW<br />

S. Sivakumar,<br />

Jury Chair<br />

Chief Executive ITC Ltd. (ABD)<br />

1. What are the key parameters on which you will judge the entries<br />

this year<br />

Whether the product or service has (a) made a positive difference to the rural<br />

consumers, (b) done things on scale, (c) excelled in execution, (d) brought in<br />

a new insight or a novel idea…<br />

2. How well do you think marketers and agencies have been able<br />

to adapt to the changing rural landscape, over time<br />

Two things have basically changed in the rural landscape, over time. Firstly,<br />

the aspirations of rural consumers have, by and large, converged with those of<br />

their urban counterparts. And, with improving transportation and telecom<br />

infrastructure, they are better connected to the world than before. Marketers have done well to introduce new categories, improve<br />

features in their offerings to fulfil the consumer aspirations. Marketers have also done well to leverage new technologies and<br />

channels to reach out to the rural consumers.<br />

On the other hand, relatively lower incomes, inadequate availability of electricity, unreliable agricultural extension services, poor<br />

quality of education and healthcare are also harsh realities for a large majority of the rural consumers. Regrettably, one hasn't seen<br />

enough innovation in business models to bring access to these basic services to rural Indians.<br />

3. From your observations, which are the categories that see most innovative rural marketing initiatives and<br />

which don't<br />

Generally speaking, I see innovation in marketing consumer goods (both fast moving and durables) as well as automobiles. Not as<br />

much in categories like financial services and agricultural inputs.<br />

4. What are your expectations from the entries this year<br />

As has been the case every year so far, I expect to see more and better entries than last year! An interesting trend last year was the<br />

advent of partnerships, either product + service or product + channel, which helped marketers achieve more from less. In the<br />

previous year, it was technology in focus. I hope to see more consumer-centric innovations this year.<br />

19

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

INTERVIEW<br />

Govindraj Ethiraj<br />

Committee Chairman,<br />

Founder of Ping Digital Broadcast and<br />

ex-Founder-Editor in Chief of Bloomberg TV India<br />

1. What are the key parameters on which you will judge the entries this<br />

year<br />

Impact. The entries should have the ability to have influenced consumers to adapt to<br />

a new concept or switch loyalties where an existing product or service exists. Next is<br />

innovation, particularly in context of the challenges of creating or distributing a<br />

product or service in rural India.<br />

2. How well do you think marketers and agencies have been able to adapt to<br />

the changing rural landscape, over time<br />

Marketers and agencies have adapted well. Going by the entries that we have seen in<br />

recent years, there is evidently a lot of thought and effort going into understand and<br />

then create for the rural market. We have to bear in mind that margins are often low<br />

and returns take time. So it's not a simple bet for companies, large or small. And India is a complex market with sharp differences<br />

between regions and geographies too.<br />

3. From your observations, which are the categories that see most innovative rural marketing initiatives and<br />

which don't <br />

Acutally, all categories see innovative entries. It's not fair to compare, let's say, a tractor maker's renewed rural push with a more<br />

customized model versus a telecom company's subscription drive versus a pharmaceutical giant's attempts to disseminate<br />

knowledge on a new veterinary product before seeding the product. Companies and agencies innovate within the briefs they are<br />

working with and the constraints they are fighting against. Obviously the ones that do the best win the awards !<br />

4. What are your expectations from the entries this year<br />

India's rural landscape is changing dramatically. Telecom penetration and thus habits continue to change. Mass media<br />

consumption is broadening. There are continual shifts in demographics. Did you know that horticulture production at 268.9<br />

million tonne, surpassed foodgrain production, at 257.1 million tonne, in 2012-13, for the first time in India This figure may not<br />

mean much to marketers today but reflects changes of a nature we had not anticipated, at least in the agrarian part of rural India.<br />

We would expect campaigns that respond to changes in the landscape, in attitudes and purchasing propensity. Successful,<br />

innovative campaigns by nature will reflect a strong understanding of rural India as we know it, in all its ever-changing vastness.<br />

20

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

CSR<br />

Project Sampark:<br />

Promoting mobile telephony among women<br />

As part of its CSR activity, telecom service provider, Uninor, has been promoting the use of mobile telephones among rural<br />

women and also empowering them in the process.<br />

Newspapers routinely carry reports of panchayats prohibiting women from owning mobile phones. Telecom service provider,<br />

Uninor, has taken a stand against this and through its CSR (corporate social responsibility) activity, Project Sampark, it has been<br />

promoting the use of mobile telephones among rural women.<br />

The project was launched in September 2014, with the sole objective of bridging the mobile gender gap in rural India. It was<br />

revealed in a study commissioned by GFK in Aligarh district, in Uttar Pradesh, that while 76 out of 100 males used a mobile phone,<br />

the figure was only 29 for women.<br />

The reason for this was that it was the men who decided<br />

whether or not women should get a mobile phone. Also, mobile<br />

phones were thought to be too complicated for women. To<br />

combat this misconception, Uninor, with a grant from GSMA's<br />

Mobile for Development Foundation via its Connected Women<br />

Programme, launched Project Sampark.<br />

Uninor has committed to a contribution of $113,654 towards<br />

this initiative, while the Mobile for Development Foundation<br />

will be contributing $ 70,000.<br />

The project aims to create awareness regarding mobile phones<br />

as a tool for facilitation of women, and encourage their<br />

ownership by women. The project also aims to enroll 62,000<br />

customers within the first year in its pilot project alone, and<br />

then target 200,000 customers in the second year, of which, 50<br />

percent will be women.<br />

Speaking on the launch of Project Sampark, Morten Karlsen<br />

Sorby, CEO, Uninor, said that mobile technology had the<br />

ability 'to change the way people communicate', and that<br />

'gender disparity is echoed in mobile usage'.<br />

Uninor launched the pilot project for the initiative in 87 villages<br />

of Aligarh district in western Uttar Pradesh. Its uniqueness lies<br />

21

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

in the fact that while<br />

promoting the use of<br />

mobile phones, it also<br />

provides employment<br />

o p p o r t u n i t i e s t o<br />

women, who are the<br />

main drivers of the<br />

project. It uses forty<br />

w o m e n a n d f o u r<br />

supervisors including<br />

A n g a n w a d i a n d<br />

A c c r e d i t e d S o c i a l<br />

H e a l t h A c t i v i s t s<br />

(ASHA) to help spread<br />

knowledge about the<br />

benefits of mobile<br />

phones among women.<br />

Also, Project Sampark<br />

attempts to deal with<br />

the barrier against women by working around it rather than demolishing it. It makes men active participants while giving SIM<br />

cards to women. Uninor introduced a unique product that links to the SIM card in a manner that the recharge of either SIM accrues<br />

additional benefits to the other. In addition, a pre-decided number of free minutes is offered between the two cards. The aim is to<br />

offer a bonus to the male member whenever he tops up the SIM used by the woman relative. The Bandhan Pack, as it is called,<br />

provides an incentive to the men on taking a SIM for their wives or sisters, as they get an additional benefit each time the card is<br />

recharged. At just Rs 50, it is affordable too. The Bandhan Pack also allows for future value addition on the SIMs, like mobile health<br />

services on the woman's SIM, to create benefits in addition to connectivity.<br />

To ensure that both SIM cards are used, Uninor also set up a women-only call centre, Dial, in which the women call up the<br />

subscribers and ensure that both mobile connections are used. The women are knowledgeable about Uninor's products, and are<br />

able to assist the callers about the services. The call centres are also used to reach out to the mobile users whenever new schemes<br />

and facilities are offered by Uninor. In this way, Uninor also contributes to improving working opportunities for rural women.<br />

To spread knowledge about the benefits of mobile phones, Uninor conducted nukkad nataks or street plays with the theme 'Mera<br />

Mobile Mera Sathi'. Performed at the local markets, village haats and panchayat meetings, these street plays talked of the benefits<br />

of mobile phones for women. They also talked of how mobile phones can improve a woman's social and economic status as well as<br />

bring in gender equality.<br />

Since the launch of the project, Uninor has sold nearly 7000 Bandhan packs in its pilot scheme. The project also became selfsufficient<br />

within four months of its launch.<br />

Project Sampark showcases how corporates can align their social responsibility with commercial interests. In its attempt to<br />

highlight the importance of mobile phones, Uninor managed to promote its own brand and was able to get customers for its<br />

network. It also paved the way for other networks to make inroads into the rural markets with their own products.<br />

22

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

TREND - INDIA<br />

A Soap that Floats<br />

An innovative soap that promises to be a boon for all those who prefer bathing in rivers and ponds<br />

Villagers in Kerala often face a typical problem. While bathing in the rivers or ponds, they often lose their soap in the water, where it<br />

eventually sinks. CA Vincent of Katoor in the Thrissur district of Kerala decided to solve this problem by manufacturing a soap that floats.<br />

The floating soap was a result of experiments conducted by him in his soap manufacturing unit for about 14 years. The idea was to create a<br />

soap whose density is lighter than that of water, enabling it to float.<br />

Made from Sodium Hydroxide and coconut oil/vegetable oil, the composition of the floating soap is kept the same as regular soaps.<br />

However, the process of making it is modified such that its density is maintained at 0.873 g/cm3. Further, this soap is less acidic than<br />

traditional soaps, helping the skin retain natural oils. In the making of the soap, no animal fat or synthetic chemical is used. The soap also<br />

dries quickly on removing from water as compared to traditional soaps.<br />

impact of audio in Rural Markets<br />

Can you imagine an ad running on the TV without any audio<br />

Well that will not make any sense and in a similar way any<br />

advertising without the audio is ineffective. If you try to recollect<br />

the famous ads then you will realize that the one thing you<br />

remember about them is their audio or jingles or the slogan. Be it<br />

‘washing powder Nirma, or recently, ‘Har ek friend zaroori hota<br />

hai’, you must have noticed that you can recall the audio easily.<br />

Music and advertising is a combination that helps the audience<br />

to connect with the ad in an emotional way. Studies shows that<br />

audio in an advertisement has more recall value than the video.<br />

Audio mediums have their own set of strengths. For many<br />

businesses, audio mediums are much more affordable,<br />

convincing and effective advertising media. Unlike newspaper<br />

ads, audio ads are more than just ink on paper. Apart from audio<br />

advertising, a major theme is that each medium has its own<br />

biases. Apparently, each medium presents certain types of<br />

information easily and well. Compared with print, television and<br />

computers, audio seems to be relatively stimulating to the<br />

cognitive process of imagination.<br />

SBI-KCC (State Bank of India – Kisan Credit Card) campaign<br />

conducted by Vritti iMedia is a fair and clear example of audio<br />

advertising. The purpose of SBI-KCC is to provide timely and<br />

adequate credit to farmers to meet their production credit needs<br />

besides meeting contingency expenses, and expenses related to<br />

ancillary activities through simplified procedure facilitating<br />

availment of the loans as and when needed.<br />

To identify the power of audio ads Vritti i Media carried out a<br />

research of SBI-KCC campaign in Karnataka through which they<br />

came to know about the following facts :-<br />

1. Out of every 500 hundred people 477 witnessed the<br />

automated bus announcements.<br />

2. 308 people heard the announcement of SBI-KCC.<br />

3. When asked about their opinions on the ad around 35%<br />

people felt that the ad was very good and informative.<br />

4. Around 237 out of every 500 people wait on the bus stops for<br />

more than 15 mins which confirms that they have heard the<br />

ads.<br />

The positive point's people have mentioned about the SBI-KCC<br />

coming to bus stand audio media are: people are happy to know<br />

about the details of loans at bus stand. They feel that this process<br />

of passing information will reach most of the farmers. Also it was<br />

educating and audio was very clear and loud.<br />

This brings us to a conclusion that audio medium is far more a<br />

better medium when it comes to reach and the recall value.<br />

The writer is Mr. Rajesh Radhakrishnan - Director- Marketing<br />

Strategies and Public relations at Vritti i-Media<br />

23

JANUARY 2015<br />

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

INNOVATION – INTERNATIONAL<br />

Mobile App to Help African Farmers<br />

A mobile app helps farmers in East Africa diagnose and treat their cattle and livestock for common diseases<br />

There are over 100 million farmers in East Africa, spread across thousands of square miles. For these farmers, livestock and cattle<br />

are prime assets, providing them meat, dairy, manure and a mode of transport. However, owing to the remoteness of the farmers<br />

and the fact that they are spread across a large area, establishment of a centralised healthcare system would prove to be costly and<br />

also inefficient.<br />

Veterinarians and animal health workers who visit these remote locations are rarely aware beforehand of what ails the animals.<br />

Microsoft funded a Scotland-based technology company, Cojengo, to create a mobile app for the farmers in Kenya, Ehtiopia,<br />

Uganda and Tanzania. The app, called VetAfrica, is a tool that farmers can use to provide quick and effective healthcare to their<br />

farm animals.<br />

VetAfrica works in two ways. First, it helps farmers treat their ailing animals by providing them a correct diagnosis based on the<br />

symptoms entered into the app. Second, vets and animal health workers can use the data given by farmers, when they visit the<br />

rural areas, to provide better healthcare, as they are better informed.<br />

The app covers common animal diseases, like Anaplasmosis, Babesiosis, Cowdriosis, Fasciolosis, Parasitic Gastroenteritis,<br />

Schistosomosis, Theileriosis and Trypanosomosis. Keeping in mind the unreliable Internet access in rural Africa, VetAfrica is<br />

designed to work offline, and syncs data when an appropriate network, WiFi or GPS, is available.<br />

VetAfrica is currently available only on Windows phones on a try-before-you-buy basis. Users can use the app for free for 15 times<br />

to evaluate its usefulness before opting for a full subscription. Keeping in mind the cost consciousness of rural African farmers,<br />

VetAfrica offers subscriptions for 30, 90 and 360 days.<br />

24

THE<br />

RURAL MARKETING<br />

JOURNAL<br />

JANUARY 2015<br />

ON GROUND<br />

PERFETTI<br />

On Ground Activation: Anugrah Madison<br />

“MASTI KI PAATHSHALA” to schools for a major confectionary brand<br />

Brief –<br />

Perfetti Van Melle a leading confectionary manufacturer in the country launched its Juzt Jelly & Creamfills candies in WB & Bihar<br />

Post distribution & fair amount of TV bursts it wanted us to achieve the following business<br />