MAA Assurance's Annual Report 2005 - Zurich

MAA Assurance's Annual Report 2005 - Zurich

MAA Assurance's Annual Report 2005 - Zurich

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

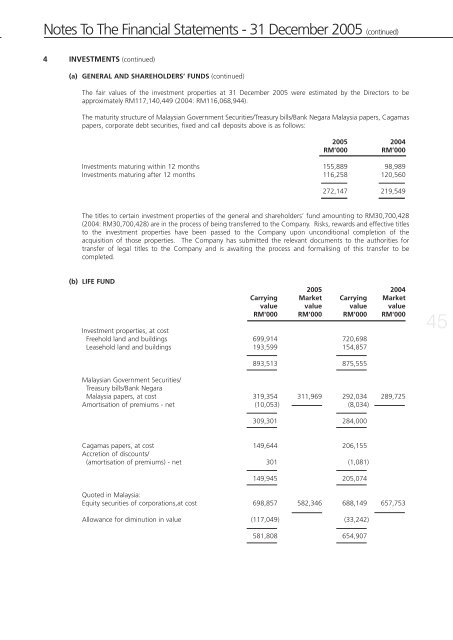

Notes To The Financial Statements - 31 December <strong>2005</strong> (continued)<br />

4 INVESTMENTS (continued)<br />

(a) GENERAL AND SHAREHOLDERS’ FUNDS (continued)<br />

The fair values of the investment properties at 31 December <strong>2005</strong> were estimated by the Directors to be<br />

approximately RM117,140,449 (2004: RM116,068,944).<br />

The maturity structure of Malaysian Government Securities/Treasury bills/Bank Negara Malaysia papers, Cagamas<br />

papers, corporate debt securities, fixed and call deposits above is as follows:<br />

<strong>2005</strong> 2004<br />

RM’000 RM’000<br />

Investments maturing within 12 months 155,889 98,989<br />

Investments maturing after 12 months 116,258 120,560<br />

272,147 219,549<br />

The titles to certain investment properties of the general and shareholders’ fund amounting to RM30,700,428<br />

(2004: RM30,700,428) are in the process of being transferred to the Company. Risks, rewards and effective titles<br />

to the investment properties have been passed to the Company upon unconditional completion of the<br />

acquisition of those properties. The Company has submitted the relevant documents to the authorities for<br />

transfer of legal titles to the Company and is awaiting the process and formalising of this transfer to be<br />

completed.<br />

(b) LIFE FUND<br />

<strong>2005</strong> 2004<br />

Carrying Market Carrying Market<br />

value value value value<br />

RM'000 RM'000 RM'000 RM'000<br />

Investment properties, at cost<br />

Freehold land and buildings 699,914 720,698<br />

Leasehold land and buildings 193,599 154,857<br />

45<br />

893,513 875,555<br />

Malaysian Government Securities/<br />

Treasury bills/Bank Negara<br />

Malaysia papers, at cost 319,354 311,969 292,034 289,725<br />

Amortisation of premiums - net (10,053) (8,034)<br />

309,301 284,000<br />

Cagamas papers, at cost 149,644 206,155<br />

Accretion of discounts/<br />

(amortisation of premiums) - net 301 (1,081)<br />

149,945 205,074<br />

Quoted in Malaysia:<br />

Equity securities of corporations,at cost 698,857 582,346 688,149 657,753<br />

Allowance for diminution in value (117,049) (33,242)<br />

581,808 654,907