MAA Assurance's Annual Report 2005 - Zurich

MAA Assurance's Annual Report 2005 - Zurich

MAA Assurance's Annual Report 2005 - Zurich

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

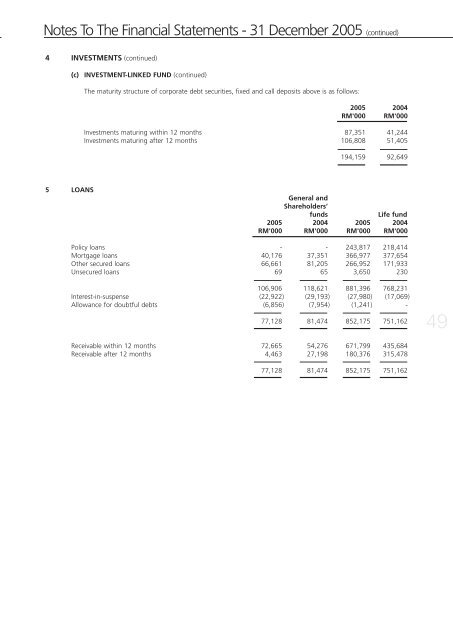

Notes To The Financial Statements - 31 December <strong>2005</strong> (continued)<br />

4 INVESTMENTS (continued)<br />

(c)<br />

INVESTMENT-LINKED FUND (continued)<br />

The maturity structure of corporate debt securities, fixed and call deposits above is as follows:<br />

<strong>2005</strong> 2004<br />

RM'000 RM'000<br />

Investments maturing within 12 months 87,351 41,244<br />

Investments maturing after 12 months 106,808 51,405<br />

194,159 92,649<br />

5 LOANS<br />

General and<br />

Shareholders’<br />

funds<br />

Life fund<br />

<strong>2005</strong> 2004 <strong>2005</strong> 2004<br />

RM'000 RM'000 RM'000 RM'000<br />

Policy loans - - 243,817 218,414<br />

Mortgage loans 40,176 37,351 366,977 377,654<br />

Other secured loans 66,661 81,205 266,952 171,933<br />

Unsecured loans 69 65 3,650 230<br />

106,906 118,621 881,396 768,231<br />

Interest-in-suspense (22,922) (29,193) (27,980) (17,069)<br />

Allowance for doubtful debts (6,856) (7,954) (1,241) -<br />

77,128 81,474 852,175 751,162<br />

49<br />

Receivable within 12 months 72,665 54,276 671,799 435,684<br />

Receivable after 12 months 4,463 27,198 180,376 315,478<br />

77,128 81,474 852,175 751,162