Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Financial Statements of - Shoppers Drug Mart

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHOPPERS DRUG MART CORPORATION<br />

Notes to the Condensed Consolidated <strong>Financial</strong> <strong>Statements</strong><br />

(unaudited)<br />

(in thousands <strong>of</strong> Canadian dollars, except per share data)<br />

12. EXPLANATION OF TRANSITION TO IFRS (continued)<br />

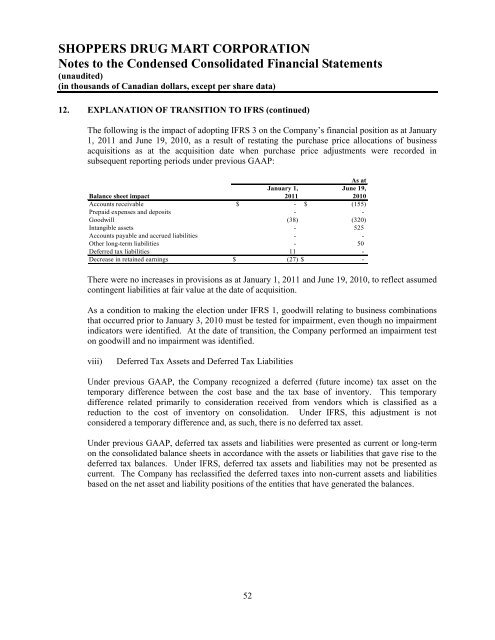

The following is the impact <strong>of</strong> adopting IFRS 3 on the Company’s financial position as at January<br />

1, 2011 and June 19, 2010, as a result <strong>of</strong> restating the purchase price allocations <strong>of</strong> business<br />

acquisitions as at the acquisition date when purchase price adjustments were recorded in<br />

subsequent reporting periods under previous GAAP:<br />

As at<br />

Balance sheet impact<br />

Accounts receivable $<br />

January 1,<br />

2011<br />

- $<br />

June 19,<br />

2010<br />

(155)<br />

Prepaid expenses and deposits - -<br />

Goodwill (38) (320)<br />

Intangible assets - 525<br />

Accounts payable and accrued liabilities - -<br />

Other long-term liabilities - 50<br />

Deferred tax liabilities 11 -<br />

Decrease in retained earnings $ (27) $ -<br />

There were no increases in provisions as at January 1, 2011 and June 19, 2010, to reflect assumed<br />

contingent liabilities at fair value at the date <strong>of</strong> acquisition.<br />

As a condition to making the election under IFRS 1, goodwill relating to business combinations<br />

that occurred prior to January 3, 2010 must be tested for impairment, even though no impairment<br />

indicators were identified. At the date <strong>of</strong> transition, the Company performed an impairment test<br />

on goodwill and no impairment was identified.<br />

viii)<br />

Deferred Tax Assets and Deferred Tax Liabilities<br />

Under previous GAAP, the Company recognized a deferred (future income) tax asset on the<br />

temporary difference between the cost base and the tax base <strong>of</strong> inventory. This temporary<br />

difference related primarily to consideration received from vendors which is classified as a<br />

reduction to the cost <strong>of</strong> inventory on consolidation. Under IFRS, this adjustment is not<br />

considered a temporary difference and, as such, there is no deferred tax asset.<br />

Under previous GAAP, deferred tax assets and liabilities were presented as current or long-term<br />

on the consolidated balance sheets in accordance with the assets or liabilities that gave rise to the<br />

deferred tax balances. Under IFRS, deferred tax assets and liabilities may not be presented as<br />

current. The Company has reclassified the deferred taxes into non-current assets and liabilities<br />

based on the net asset and liability positions <strong>of</strong> the entities that have generated the balances.<br />

52