bg4kk_f

bg4kk_f

bg4kk_f

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Florida SELF does not qualify as a green bank, but its operations are very similar. SELF is currently<br />

capitalized by the U.S. Treasury’s CDFI Fund, a grant via the U.S. Department of Energy’s (DOE’s) Energy<br />

Efficiency and Conservation Block Grant Program, and individual philanthropic and private-sector<br />

investments. SELF is actively seeking additional private and philanthropic capital to further diversify its<br />

pool of funding sources.<br />

SELF’s major program is the Clean Energy Loan Fund program, which lends up to $50,000 to residential<br />

and small commercial customers for an interest rate of less than 9 percent over a tenor of up to 15<br />

years. SELF’s approach to financing places an emphasis on project installation and technology quality.<br />

While the program offers financing for a wide variety of energy efficiency and renewable energy<br />

products, SELF performs research to test and evaluate clean energy technologies prior to approving<br />

them in its financing portfolio. Additionally, the program requires that the borrower’s property undergo<br />

an energy audit prior to project implementation; the audit informs not only the project itself but also<br />

the specific financing terms that the program offers to the customer.<br />

In addition to the Clean Energy Loan Fund program, SELF provides underwriting services for the St. Lucie<br />

County Commercial PACE program.<br />

SELF has successfully closed more than 295 loans totaling above $2.5 million, 31 with a default rate of<br />

fewer than two percent.<br />

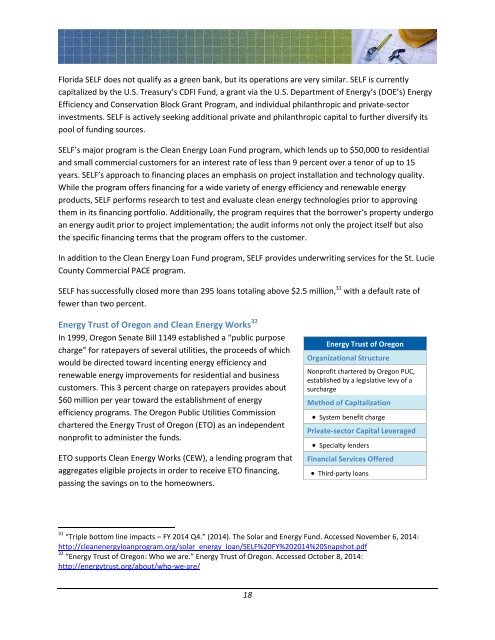

Energy Trust of Oregon and Clean Energy Works 32<br />

In 1999, Oregon Senate Bill 1149 established a “public purpose<br />

charge” for ratepayers of several utilities, the proceeds of which<br />

would be directed toward incenting energy efficiency and<br />

renewable energy improvements for residential and business<br />

customers. This 3 percent charge on ratepayers provides about<br />

$60 million per year toward the establishment of energy<br />

efficiency programs. The Oregon Public Utilities Commission<br />

chartered the Energy Trust of Oregon (ETO) as an independent<br />

nonprofit to administer the funds.<br />

ETO supports Clean Energy Works (CEW), a lending program that<br />

aggregates eligible projects in order to receive ETO financing,<br />

passing the savings on to the homeowners.<br />

Energy Trust of Oregon<br />

Organizational Structure<br />

Nonprofit chartered by Oregon PUC,<br />

established by a legislative levy of a<br />

surcharge<br />

Method of Capitalization<br />

System benefit charge<br />

Private-sector Capital Leveraged<br />

Specialty lenders<br />

Financial Services Offered<br />

Third-party loans<br />

31 “Triple bottom line impacts – FY 2014 Q4.” (2014). The Solar and Energy Fund. Accessed November 6, 2014:<br />

http://cleanenergyloanprogram.org/solar_energy_loan/SELF%20FY%202014%20Snapshot.pdf<br />

32 “Energy Trust of Oregon: Who we are.” Energy Trust of Oregon. Accessed October 8, 2014:<br />

http://energytrust.org/about/who-we-are/<br />

18