Working With Checking and Savings Accounts - The Homer Fund

Working With Checking and Savings Accounts - The Homer Fund

Working With Checking and Savings Accounts - The Homer Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

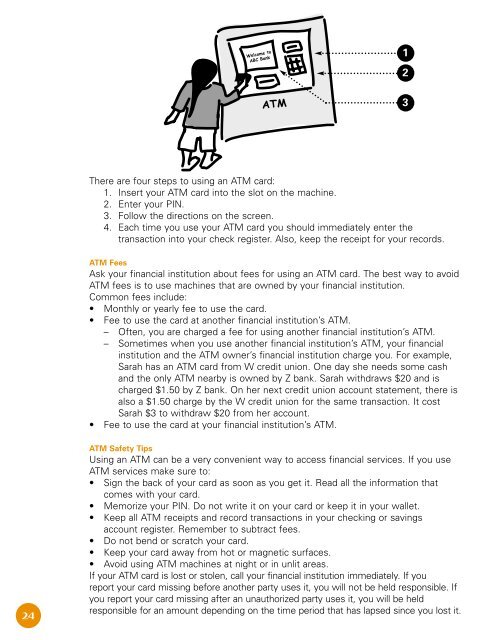

1<br />

2<br />

3<br />

<strong>The</strong>re are four steps to using an ATM card:<br />

1. Insert your ATM card into the slot on the machine.<br />

2. Enter your PIN.<br />

3. Follow the directions on the screen.<br />

4. Each time you use your ATM card you should immediately enter the<br />

transaction into your check register. Also, keep the receipt for your records.<br />

ATM Fees<br />

Ask your financial institution about fees for using an ATM card. <strong>The</strong> best way to avoid<br />

ATM fees is to use machines that are owned by your financial institution.<br />

Common fees include:<br />

• Monthly or yearly fee to use the card.<br />

• Fee to use the card at another financial institution’s ATM.<br />

– Often, you are charged a fee for using another financial institution’s ATM.<br />

– Sometimes when you use another financial institution’s ATM, your financial<br />

institution <strong>and</strong> the ATM owner’s financial institution charge you. For example,<br />

Sarah has an ATM card from W credit union. One day she needs some cash<br />

<strong>and</strong> the only ATM nearby is owned by Z bank. Sarah withdraws $20 <strong>and</strong> is<br />

charged $1.50 by Z bank. On her next credit union account statement, there is<br />

also a $1.50 charge by the W credit union for the same transaction. It cost<br />

Sarah $3 to withdraw $20 from her account.<br />

• Fee to use the card at your financial institution’s ATM.<br />

24<br />

ATM Safety Tips<br />

Using an ATM can be a very convenient way to access financial services. If you use<br />

ATM services make sure to:<br />

• Sign the back of your card as soon as you get it. Read all the information that<br />

comes with your card.<br />

• Memorize your PIN. Do not write it on your card or keep it in your wallet.<br />

• Keep all ATM receipts <strong>and</strong> record transactions in your checking or savings<br />

account register. Remember to subtract fees.<br />

• Do not bend or scratch your card.<br />

• Keep your card away from hot or magnetic surfaces.<br />

• Avoid using ATM machines at night or in unlit areas.<br />

If your ATM card is lost or stolen, call your financial institution immediately. If you<br />

report your card missing before another party uses it, you will not be held responsible. If<br />

you report your card missing after an unauthorized party uses it, you will be held<br />

responsible for an amount depending on the time period that has lapsed since you lost it.