Investing - Brookfield Asset Management

Investing - Brookfield Asset Management

Investing - Brookfield Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Transport & Energy Platform<br />

• Stable performance driven by access fees to critical infrastructure<br />

– Benefit from increased movement of energy, freight and bulk commodities<br />

– Favourable results despite economic head wind<br />

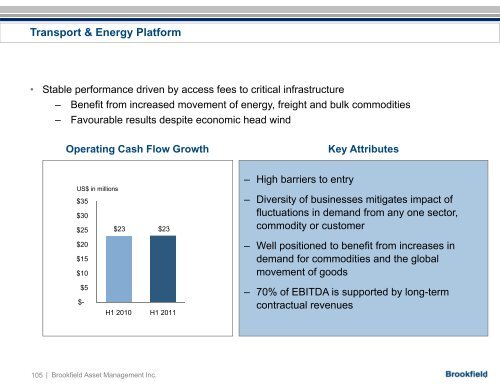

Operating Cash Flow Growth<br />

Key Attributes<br />

t<br />

US$ in millions<br />

$25<br />

$23 $23<br />

– High barriers to entry<br />

$35 – Diversity of businesses mitigates impact of<br />

$30<br />

fluctuations in demand from any one sector,<br />

commodity or customer<br />

$20 – Well positioned to benefit from increases in<br />

$15<br />

demand for commodities and the global<br />

$10<br />

movement of goods<br />

$5<br />

$-<br />

H1 2010 H1 2011<br />

– 70% of EBITDA is supported by long-term<br />

contractual revenues<br />

105 | <strong>Brookfield</strong> <strong>Asset</strong> <strong>Management</strong> Inc.