Investing - Brookfield Asset Management

Investing - Brookfield Asset Management

Investing - Brookfield Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

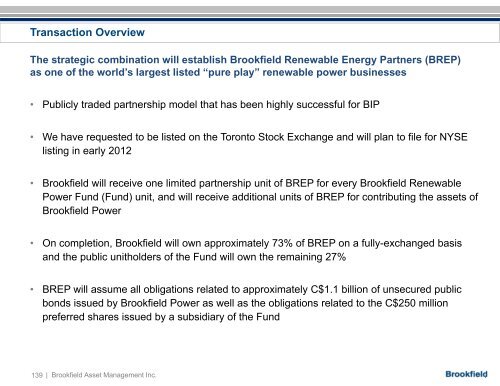

Transaction Overview<br />

The strategic combination will establish <strong>Brookfield</strong> Renewable Energy Partners (BREP)<br />

as one of the world’s largest listed “pure play” renewable power businesses<br />

• Publicly traded partnership model that has been highly successful for BIP<br />

• We have requested to be listed on the Toronto Stock Exchange and will plan to file for NYSE<br />

listing in early 2012<br />

• <strong>Brookfield</strong> will receive one limited partnership unit of BREP for every <strong>Brookfield</strong> Renewable<br />

Power Fund (Fund) unit, and will receive additional units of BREP for contributing the assets of<br />

<strong>Brookfield</strong> Power<br />

• On completion, <strong>Brookfield</strong> will own approximately 73% of BREP on a fully-exchanged basis<br />

and the public unitholders of the Fund will own the remaining 27%<br />

• BREP will assume all obligations related to approximately C$1.1 1 billion of unsecured public<br />

bonds issued by <strong>Brookfield</strong> Power as well as the obligations related to the C$250 million<br />

preferred shares issued by a subsidiary of the Fund<br />

139 | <strong>Brookfield</strong> <strong>Asset</strong> <strong>Management</strong> Inc.