PEF Annual Report 2012 - Punjab Education Foundation

PEF Annual Report 2012 - Punjab Education Foundation

PEF Annual Report 2012 - Punjab Education Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

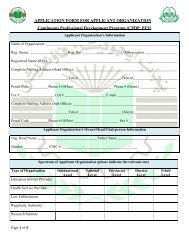

<strong>Punjab</strong> <strong>Education</strong> <strong>Foundation</strong><br />

Other than the aforesaid standards, interpretations and amendments, the International Accounting<br />

Standards Board (IASB) has also issued the following standards which have not been adopted by the<br />

Securities and Exchange Commission of Pakistan:<br />

IFRS 1 – First Time Adoption of International Financial <strong>Report</strong>ing Standards<br />

IFRS 9 – Financial Instruments<br />

IFRS 10 – Consolidated Financial Statements<br />

IFRS 11 – Joint Arrangements<br />

IFRS 12 – Disclosure of Interests in Other Entities<br />

IFRS 13 – Fair Value Measurement<br />

The amendments to IAS 19 Employee Benefits are effective for annual period beginning on or after<br />

January 1, 2013. The amendments eliminate the corridor approach and therefore require an entity to<br />

recognize changes in defined benefit plans obligations and plan assets when they occur. All actuarial<br />

gains or losses in other comprehensive income arising during the year are recognized immediately<br />

through other comprehensive income. The amendments also require additional disclosures and<br />

retrospective application with certain exceptions. Management anticipates that the amendments will be<br />

adopted in the <strong>Foundation</strong>’s financial statements for annual period beginning on or after January 1,<br />

2013, and the application of amendments may have impact on amounts reported in respect of defined<br />

benefit plans.<br />

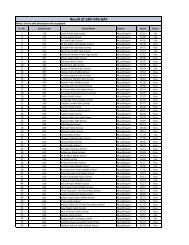

The potential impact of the said changes on the financial position and performance for the year <strong>2012</strong> is<br />

estimated as under:<br />

Amounts (Rs.)<br />

Net decrease in other comprehensive income<br />

12,575,341<br />

Increase in deferred liabilities:<br />

Gratuity 7,237,163<br />

Pension 5,338,178<br />

6 Significant accounting judgments, estimates & assumptions<br />

The preparation of financial statements in conformity with approved accounting standards requires management<br />

to make estimates, assumptions and use judgments that affect the application of policies and reported amount of<br />

assets and liabilities and income and expenses. Estimates, assumptions and judgments are continually evaluated<br />

and are based on historical experience and other factors, including reasonable expectations of future events.<br />

Revision to accounting estimates are recognized prospectively commencing from the period of revision. The<br />

areas where various assumptions and estimates are significant to the <strong>Foundation</strong>’s financial statements or where<br />

judgments were exercised in application of accounting policies are as follows:<br />

- Residual values of property and equipment (note 4.3 and 8)<br />

- Staff retirement benefits (note 4.1 and 20)<br />

Useful lives & residual values of property & equipment<br />

The <strong>Foundation</strong> reviews appropriateness of the rate of depreciation, useful lives and residual values used in the<br />

calculation of depreciation. Further, where applicable, an estimate of the recoverable amount of assets is made<br />

for possible impairment on an annual basis. In making these estimates, the <strong>Foundation</strong> uses the technical<br />

resources available with the <strong>Foundation</strong>. Any change in the estimates in the future may affect the carrying<br />

amount of respective item of property and equipment with corresponding effects on the depreciation charge and<br />

impairment.<br />

49