Direct Managed Funds - ComSec

Direct Managed Funds - ComSec

Direct Managed Funds - ComSec

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong><br />

www.commsec.info/managedfunds<br />

Save On Fees<br />

Invest Through CommSec and Save!<br />

CommSec is Australia’s number one online broker and it’s not hard to see why. A great range of investment products, free online<br />

research, tools and expert commentary make it a simpler, smarter way to manage your portfolio.<br />

All this, plus real savings on fees! When you invest in managed funds through CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong>, you’ll save up to<br />

100% on fund entry or contribution fees*. Many funds charge an entry fee of up to 4% that can really add up over time, especially if<br />

you’re growing and diversifying your portfolio.<br />

Nominate CommSec as your fund broker today to take charge of your investing and save on entry and/or contribution fees — and<br />

use those savings to build a bigger portfolio.<br />

Why CommSec?<br />

• Choose from over 1,000 funds, including super, pensions and structured products, from over 60 leading fund managers.<br />

• Find the right funds for your needs with our free research — search for funds by investment type, fund manager, performance<br />

and more, then compare them with our Compare <strong>Funds</strong> Tool.<br />

• Save with a rebate of up to 100% of the fund entry or contribution fees charged on initial and regular investments into managed<br />

funds, super and pension funds.<br />

• Track the performance, assets and investment strategy of each fund in your portfolio.<br />

• Monitor your investment with our free Portfolio Monitoring tool**.<br />

• Free newsletters to keep you up to date with the latest investment trends and opportunities.<br />

Start Saving Today<br />

Nominate CommSec as your fund broker for new fund investments and existing fund investments. CommSec’s Contribution Fee<br />

Savings Calculator enables you to compare investments through <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> with investments via a fund manager or<br />

financial adviser that may charge a contribution fee. A simple calculation shows the impact contribution fees have on the initial value<br />

of your investment and the lost earnings from these fees over the investment period.<br />

Step<br />

Process<br />

1 Complete the Fund Broker Nomination form. You need to complete a separate form for each fund<br />

manager you have holdings with.<br />

2 Complete the form/s and send to :<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong><br />

Locked Bag 22<br />

Australia Square NSW 1215<br />

Or fax to 02 8223 7160<br />

3 Subscribe to our free investment newsletters.<br />

If you have any questions about completing the form, or would like to know how the rebate applies to your existing investments,<br />

please call us on 13 15 20, Monday to Friday, 8am – 5pm, Sydney time.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

1

Why <strong>Managed</strong> <strong>Funds</strong>?<br />

Pool your resources<br />

Diversify<br />

Invest with the<br />

professionals<br />

Start small right now<br />

Access your money<br />

when you need it<br />

When you pool your investment capital with contributions from other investors in a fund, you can<br />

access investment opportunities that might be out of your reach as an individual.<br />

Diversification means spreading your investments over a wide range of different assets. <strong>Funds</strong> can<br />

offer a level of diversification that would be difficult for individual investors to achieve.<br />

When you invest in a fund your investment is managed by a dedicated team of qualified<br />

professionals, often supported by the resources and infrastructure of a large financial institution, or<br />

by specialist managers with expertise in a particular kind of investment<br />

Many funds let you start investing with as little as $1,000. You’ll be surprised how quickly a small<br />

investment can grow, particularly when combined with a regular investment plan.<br />

When you invest in a fund (other than a super fund), you can generally withdraw all or part of your<br />

investment quickly to access your money when you need it. That’s something that can be difficult<br />

with some other investments, such as property.<br />

How <strong>Managed</strong> <strong>Funds</strong> Work<br />

Units and Unit Prices<br />

Generally, when you invest in a fund, you are allocated a number of units in the fund. The unit price is calculated by taking the total<br />

value of all of the fund’s assets on a particular day, adjusting for any liabilities, then dividing the net fund value by the total number of<br />

units held by all investors on that day.<br />

The number of units you receive depends on the amount you invest and the current unit price. For example, if you were to invest<br />

$1,000 in a fund with a current unit price of $2, you would receive 500 units. The fund manager regularly resets the unit price,<br />

usually on a daily basis. The unit price reflects the current value of the fund’s assets, less the cost of administering the fund.<br />

Fund Distributions<br />

Most funds pay you income in the form of regular distributions. These distributions represent income earned by the fund from its<br />

assets — for example, rental income from property, or dividends from shares. You may have the option of reinvesting your fund<br />

distributions by buying extra units.<br />

Types of <strong>Managed</strong> <strong>Funds</strong><br />

A wide variety of funds are available in Australia. While they all have their own particular characteristics, each product can be<br />

categorised by:<br />

• Its structure (managed fund, super fund, allocated pension or annuity).<br />

• The assets it invests in (multi-sector or single sector).<br />

• Its investment style (active, passive, growth, value or style neutral).<br />

Structure<br />

There are three main types of funds: managed funds, super funds and retirement income funds. Each has a slightly different legal<br />

and tax structure, but they work in a similar way and offer similar investment options.<br />

<strong>Managed</strong> funds, sometimes referred to as unit trusts, can be purchased with ordinary (non-superannuation) money. There are<br />

generally no restrictions on withdrawing or investing into a managed fund. It is possible for the redemption of units in funds to be<br />

delayed or suspended as defined in the fund’s PDS.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

2

On the other hand, super fund money generally can’t be accessed until you reach retirement age. One of the benefits of super funds<br />

is the more favourable tax treatment they receive compared to other managed investments.<br />

Retirement income funds (for example, allocated pensions) provide regular income in return for a lump-sum investment. They are<br />

generally used by retirees rolling over their super savings, and provide an retirement income which may supplement or replace the<br />

government Age Pension.<br />

Assets<br />

<strong>Funds</strong> typically offer investors access to five main asset classes: cash, property, fixed interest, shares and alternative investments.<br />

Single-sector funds concentrate on a particular asset class, such as Australian shares or property. Single-sector funds can be<br />

useful in complementing other investments. For example, depending on your needs and circumstances, if you already have share<br />

investments, you might consider investing in a fixed interest fund for greater diversification across your entire investment portfolio.<br />

Alternatively, you might choose to invest in a portfolio of different single-sector funds, giving you personal control of your overall<br />

asset mix.<br />

Multi-sector funds (also known as balanced funds) invest across a range of different kinds of assets, offering you a diversified<br />

portfolio in a single investment. The precise asset mix adopted by a fund determines its individual risk-and-return characteristics.<br />

For example, a conservative fund might allocate a high proportion of its assets to fixed interest investments, such as bonds, while a<br />

growth fund might invest the majority of its assets in Australian and international shares.<br />

Investment Style<br />

<strong>Funds</strong> can be passively or actively managed.<br />

Passive or index funds aim to track a financial index as closely as possible. For example, a passively managed Australian share fund<br />

might track the S&P/ASX200 index by investing in a portfolio of shares that is intended to replicate the index. The goal of the fund<br />

manager is to ensure that the unit price rises and falls in line with the index. The main advantage of passively managed funds is that<br />

they are generally less expensive than actively managed funds because expensive stock analysis is not required.<br />

With active funds, the fund manager actively manages the fund’s investments in an effort to get the best possible return consistent<br />

with the fund’s investment rules and risk characteristics. In most cases, the aim of an active fund manager is to outperform the<br />

index by picking stocks that they believe will perform better than the index return.<br />

That’s not to say that every active manager is the same. Like musicians, different fund managers prefer different styles. Some are<br />

simply variations on a theme; others are as different as punk and Puccini. Here are some of the most common as classified by:<br />

Style<br />

Growth<br />

Value<br />

Growth at a<br />

reasonable price<br />

(GARP)<br />

Style neutral<br />

How they do it<br />

Growth managers seek out companies they believe can grow their earnings faster than the industry<br />

or overall market. The growth manager hopes to benefit from an increase in the price of a stock.<br />

Value managers focus more on a stock’s current value relative to earnings. They aim to identify<br />

companies they believe are undervalued by the market, with the aim of benefiting from an<br />

increasing share price when the rest of the market recognises those companies’ true value.<br />

GARP managers combine techniques from growth and value managers, and aim to identify<br />

investment opportunities throughout the economic cycle. They consider both earnings growth<br />

potential and value to try to find stocks that are likely to outperform but are currently undervalued.<br />

Style neutral managers adopt neither a value nor a growth style and do not have a particular bias to<br />

a group of stocks. Their objective is to protect their portfolios from investment extremes<br />

<strong>Managed</strong> funds are subject to risks. These will be specified in the risks section of the PDS and will vary from product to product,<br />

depending on their nature.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

3

How To Invest<br />

Ready To Get Started?<br />

Four easy steps to investing in funds via CommSec:<br />

1. Use our online tools to search for funds that match your goals.<br />

2. Download the fund Product Disclosure Statement (PDS) from our website, or ring 13 15 20 for assistance, 8 am to 5 pm,<br />

Sydney time, Monday to Friday.<br />

3. When you have carefully read and considered the PDS and are ready to invest, complete out the application form in the PDS<br />

and send it to the fund manager.<br />

4. Complete the Fund Broker Nomination form & send it to CommSec.<br />

Need Help Choosing A Fund?<br />

The three key factors to consider when deciding whether a fund is right for you are:<br />

1. Your investment objectives<br />

2. Your investment time frame<br />

3. Your investor profile<br />

1. Your Investment Objectives<br />

Everyone has different reasons for investing. Maybe you’re saving for a home deposit. Maybe you’re investing with your children’s<br />

education in mind. Or maybe you’re looking forward to a comfortable retirement. Whatever your situation, you need a clear<br />

understanding of your objectives before you can choose the right investment. Are you looking for capital growth, income, or a<br />

balance of the two?<br />

Different funds offer a different mix of growth and income; some funds also offer the potential for tax effective income. Here’s how<br />

your investment objectives could influence your choice of fund.<br />

Investing for growth<br />

Investing for income<br />

Balanced funds<br />

Tax effective investing<br />

If your goal is to create medium or long-term wealth, then you are likely to be a growth-oriented<br />

investor. Growth funds typically invest in shares; property funds can also offer good prospects for<br />

growth.<br />

If your aim is to live entirely off your investments, supplement your income or service a loan, you<br />

may be looking for an income fund. Income funds often have a high proportion of their capital<br />

invested in assets such as fixed interest investments or property.<br />

Balanced funds offer investors a mixture of income and capital growth. They are usually multisector<br />

funds with a diversified portfolio ranging across the different asset classes.<br />

Some funds may offer particular tax advantages. Australian share fund distributions may include<br />

imputation credits, which may help you pay less tax on your investment income. Property trusts<br />

may also receive tax concessions that may be passed on to you as tax-deferred and tax-free<br />

income. Consult your tax adviser about the tax implications of a particular fund before investing.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

4

Matching Asset Classes To Your Objectives<br />

Here’s an overview of the different investment outcomes you might expect from investing in different asset classes.<br />

Asset class Income potential Growth potential Tax effectiveness Risk<br />

Cash Low - - Low<br />

Fixed interest High Low–Medium - Medium<br />

Property High Medium Medium–High Medium<br />

Australian shares Medium Medium–High Medium–High High<br />

International shares Low High - High<br />

Past performance is not a reliable indicator of future performance.<br />

2. Your Investment Time Frame<br />

Your investment time frame can be an important factor in deciding what kind of fund is best for you.<br />

Growth assets, such as shares and property, have historically offered higher returns over the long term, but they have also been<br />

more volatile over the short term. That can mean taking on more risk if you are a short-term investor. So, if you are investing for a<br />

short-term goal, such as a holiday, you may prefer a fund with a lower risk profile.<br />

On the other hand, if you are investing for a medium-term or long-term goal, such as retirement, you will have more time to ride<br />

out short-term ups and downs, giving you the opportunity to benefit from the long-term growth potential of assets like shares<br />

and property. That means you may be more likely to consider a fund with a greater proportion of growth assets. Of course, your<br />

investment time frame is not the only thing to consider when making a decision.<br />

The type of investments you make will also depend upon your appetite for risk, especially the risk of short-term loss. The fund<br />

Product Disclosure Statement (PDS) will often specify a time frame during which the fund manager believes a particular investment<br />

should be held — typically longer for higher risk assets, and shorter for lower risk assets.<br />

3. Your Investor Profile<br />

Your choice of fund will also be affected by your investor profile, which is a combination of factors — your investment experience,<br />

your attitude to volatility, and your investment time frame.<br />

CommSec has an online investor profile tool which helps you identify your personal investor profile, then find funds that match your<br />

profile.<br />

Making Regular Contributions<br />

A proven technique to help grow your investment faster is to make regular contributions using an investment plan. Many funds have<br />

a regular savings or investment facility that makes it easy to build an investment with regular contributions starting from as little as<br />

$100 a month.<br />

Dollar Cost Averaging<br />

By using a regular investment plan, you can also take advantage of an investment strategy called dollar cost averaging. The<br />

principle behind dollar cost averaging is simple. You invest the same amount each month. In the meantime, the fund’s unit price<br />

fluctuates with the market value of its assets. When the unit price is lower, your investment buys more units; when it’s higher, your<br />

investment buys fewer units. As a result, dollar cost averaging can help deliver a lower average entry price over time.<br />

Borrowing To Invest In <strong>Managed</strong> <strong>Funds</strong><br />

Borrowing to invest, or gearing, gives you a wider range of investment opportunities and increases your potential returns. A<br />

CommSec margin loan is a loan designed specifically for investing in shares or managed funds.<br />

Monitoring Your Investment Portfolio<br />

If you are a registered CommSec client, you’ll have access to our easy-to-use portfolio monitoring tool. You can use the portfolio<br />

tool to track the current value of your investments, your profit or loss and your overall portfolio asset allocation.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

5

Fees And Charges<br />

Fund Manager Fees<br />

There are a number of different types of fees that may affect your fund investment. The most common are outlined below. To find<br />

out about the fees that apply to a specific fund, search for the fund/s you want and refer to the fund PDS or the Fund Profile.<br />

Contribution fee<br />

Trailing commission<br />

Adviser services fee<br />

Management fees<br />

Other fees<br />

Most fund managers charge a contribution fee as a percentage of the amount invested. This fee is<br />

deducted from the value of your initial investment so that you receive fewer units in the fund than<br />

you otherwise would. And remember, if you invest through CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong>, we’ll<br />

rebate up to 100% of the normal contribution fee. CommSec’s Contribution Fee Savings Calculator<br />

enables you to compare investments through <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> with investments via a fund<br />

manager or financial adviser that may charge a contribution fee. A simple calculation shows the<br />

impact contribution fees have on the initial value of your investment and the lost earnings from these<br />

fees over the investment period.<br />

The trailing commission is paid out of the fee the fund manager receives for investing and<br />

administering client funds. It is a set percentage of the market value of your investment and is<br />

determined by the fund manager.<br />

Some fund managers make it possible for an ongoing or one-off adviser services fee to be charged<br />

by the Dealer or Adviser. This fee is paid out of the balance of your fund monies and is a percentage<br />

of the value of your investment. The fee is deducted from your account either as a one-off charge or<br />

periodically by way of a redemption of units.<br />

These include ongoing administration, investment management, expense recovery and other fees<br />

charged by the fund manager. Ongoing fees are deducted from the value of the fund before the unit<br />

price is calculated.<br />

Other fees, such as switching fees, withdrawal fees and termination fees may also apply. These fees<br />

and their terms may vary between fund managers.<br />

How We Get Paid<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> does not charge you directly for our service. Instead, when you invest through us we receive a<br />

fee from the fund manager. The way we are paid depends on our arrangement with the fund manager, but we generally receive a<br />

trailing commission paid by the fund manager from their management fee. To find out about the commissions we receive for a fund,<br />

search for the fund/s you want and refer to the fund PDS or the Fund Profile.<br />

Sometimes we will give you the opportunity to invest in structured investment products that may be priced differently from standard<br />

managed and super funds offered through CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong>. Any fees or charges will be outlined separately in<br />

each offering.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

6

Free Newsletters<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> provides regular educational and technical information about investing in managed funds and<br />

structured products, as well as offering unique and exclusive investment opportunities.<br />

Selector’s List<br />

Subscribe online at funds.commsec.com.au<br />

A half yearly managed funds publication packed full of informative articles on new opportunities, practical portfolio strategies and<br />

innovative approaches to investment. Expert analysis on the economy and the top rated unit trusts, super, pension and multi-sector<br />

funds as rated by Morningstar.<br />

<strong>Funds</strong> Monthly Newsletter<br />

Subscribe online at funds.commsec.com.au<br />

A monthly e-newsletter from CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> designed to keep you informed on market conditions and<br />

investment opportunities. It also brings you the latest featured managed funds and items of interest to help you manage your<br />

portfolio.<br />

<strong>Managed</strong> <strong>Funds</strong> and Structured Products Alerts<br />

Subscribe online at funds.commsec.com.au<br />

A regular email alert on all the latest managed funds and structured products information.<br />

Contact Us<br />

directfunds@commsec.com.au<br />

13 15 20 (8am to 5pm, Sydney time)<br />

www.commsec.info/managedfunds<br />

Important Information<br />

Commonwealth Securities Limited ABN 60 067 254 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124<br />

AFSL 234945 and a participant of the ASX Group and the Sydney Futures Exchange.<br />

This is general information only and has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason any individual<br />

should, before acting on the information, consider the appropriateness of it having regard to your objectives, needs, financial and taxation situation and if necessary, seek appropriate<br />

independent financial and taxation advice. If the advice relates to a particular financial product, you should obtain a Product Disclosure Statement (PDS) or prospectus relating to the product<br />

and consider it before making any decision about whether to acquire the product. PDS’s are available from Commonwealth Securities at funds.commsec.com.au or by contacting 13 15 20.<br />

Commonwealth Securities does not guarantee the performance of any fund or trust and makes no specific recommendation on funds or trusts included in any prospectus or offer document<br />

on its website. Past performance is not indicative of future performance.<br />

*For information on entry and adviser fees please see the relevant product disclosure statement for each fund available on the website at www.funds.commsec.com.au. All applications for a<br />

CommSec Margin Loan are subject to the Commonwealth Bank’s credit approval process.<br />

* Entry & contribution fees are usually rebated in the form of additional units. Ongoing fees and charges may apply. Please refer to the PDS of the provider for further information. All fees are<br />

disclosed in either the PDS or via CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> website www.funds.commsec.com.au.<br />

** Available to CommSec registered clients only.<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

7

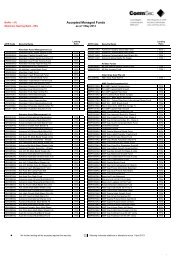

Nominate CommSec as your Fund Broker<br />

Choose to invest in over 1,000 <strong>Managed</strong> <strong>Funds</strong> via CommSec and receive up to 100%<br />

rebate on entry fees and regular contributions. You’ll pay no transfer fees when you<br />

nominate CommSec as your Fund Broker, and the transfer process is simple.<br />

To nominate CommSec as your Fund Broker, complete and return this form by:<br />

Fax 02 8223 7160 | Scan and email directfunds@commsec.com.au | Mail Locked Bag 22, Australia Square NSW 1215<br />

Personal details<br />

Name<br />

Street Address<br />

Suburb State Postcode<br />

Phone<br />

Mobile<br />

Email<br />

New or existing investments to be transferred to CommSec<br />

(Please complete a separate form for each Fund Manager)<br />

Please note: CommSec can only be nominated as your Fund Broker for <strong>Funds</strong> available on funds.commsec.com.au<br />

Fund Manager Name<br />

Fund Account Number Fund name Estimated<br />

Investment<br />

Amount<br />

$<br />

$<br />

$<br />

$<br />

$<br />

Regular<br />

Savings Plan<br />

(Y/N)<br />

Estimated or<br />

New<br />

Investment<br />

(E/N)<br />

Please sign and date<br />

Signature Date DD/MM/YY<br />

Important information: Commonwealth Securities Limited ABN 60 067 254 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of<br />

Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 and a participant of the ASX Group and the Sydney Futures Exchange.<br />

This is general information only and has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason any individual<br />

should, before acting on the information, consider the appropriateness of it having regard to your objectives, needs, financial and taxation situation and if necessary, seek appropriate<br />

independent financial and taxation advice. If the advice relates to a particular financial product, you should obtain a Product Disclosure Statement (PDS) or prospectus relating to the product<br />

and consider it before making any decision about whether to acquire the product. PDS’s are available from Commonwealth Securities at<br />

funds.commsec.com.au or by contacting 13 15 20.<br />

Commonwealth Securities does not guarantee the performance of any fund or trust and makes no specific recommendation on funds or trusts included in any<br />

prospectus or offer document on its website. Past performance is not indicative of future performance<br />

CommSec <strong>Direct</strong> <strong>Managed</strong> <strong>Funds</strong> | www.commsec.info/managedfunds<br />

8