Consolidated Financial Statements - Minoan Lines

Consolidated Financial Statements - Minoan Lines

Consolidated Financial Statements - Minoan Lines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MINOAN LINES SHIPPING S.A. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENS<br />

(Amounts expressed in thousands of drachmae unless otherwise stated)<br />

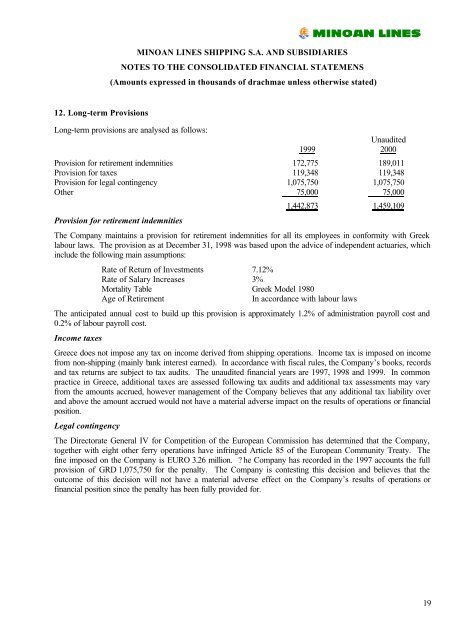

12. Long-term Provisions<br />

Long-term provisions are analysed as follows:<br />

1999<br />

Unaudited<br />

2000<br />

Provision for retirement indemnities 172,775 189,011<br />

Provision for taxes 119,348 119,348<br />

Provision for legal contingency 1,075,750 1,075,750<br />

Other 75,000 75,000<br />

Provision for retirement indemnities<br />

1,442,873 1,459,109<br />

The Company maintains a provision for retirement indemnities for all its employees in conformity with Greek<br />

labour laws. The provision as at December 31, 1998 was based upon the advice of independent actuaries, which<br />

include the following main assumptions:<br />

Rate of Return of Investments 7.12%<br />

Rate of Salary Increases 3%<br />

Mortality Table Greek Model 1980<br />

Age of Retirement<br />

In accordance with labour laws<br />

The anticipated annual cost to build up this provision is approximately 1.2% of administration payroll cost and<br />

0.2% of labour payroll cost.<br />

Income taxes<br />

Greece does not impose any tax on income derived from shipping operations. Income tax is imposed on income<br />

from non-shipping (mainly bank interest earned). In accordance with fiscal rules, the Company’s books, records<br />

and tax returns are subject to tax audits. The unaudited financial years are 1997, 1998 and 1999. In common<br />

practice in Greece, additional taxes are assessed following tax audits and additional tax assessments may vary<br />

from the amounts accrued, however management of the Company believes that any additional tax liability over<br />

and above the amount accrued would not have a material adverse impact on the results of operations or financial<br />

position.<br />

Legal contingency<br />

The Directorate General IV for Competition of the European Commission has determined that the Company,<br />

together with eight other ferry operations have infringed Article 85 of the European Community Treaty. The<br />

fine imposed on the Company is EURO 3.26 million. ? he Company has recorded in the 1997 accounts the full<br />

provision of GRD 1,075,750 for the penalty. The Company is contesting this decision and believes that the<br />

outcome of this decision will not have a material adverse effect on the Company’s results of operations or<br />

financial position since the penalty has been fully provided for.<br />

19