Consolidated Financial Statements - Minoan Lines

Consolidated Financial Statements - Minoan Lines

Consolidated Financial Statements - Minoan Lines

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MINOAN LINES SHIPPING S.A. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENS<br />

(Amounts expressed in thousands of drachmae unless otherwise stated)<br />

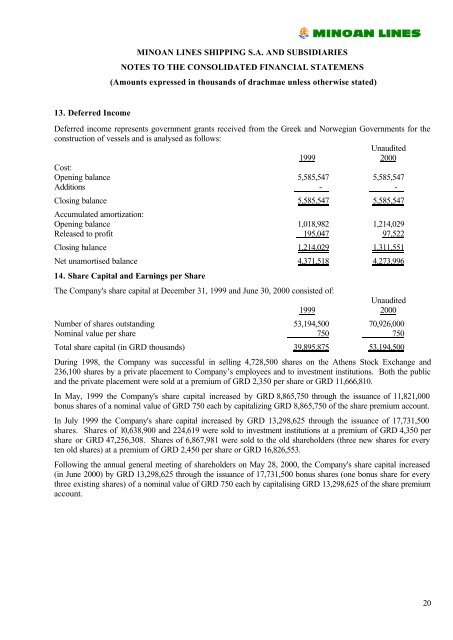

13. Deferred Income<br />

Deferred income represents government grants received from the Greek and Norwegian Governments for the<br />

construction of vessels and is analysed as follows:<br />

Unaudited<br />

1999<br />

2000<br />

Cost:<br />

Opening balance 5,585,547 5,585,547<br />

Additions - -<br />

Closing balance 5,585,547 5,585,547<br />

Accumulated amortization:<br />

Opening balance 1,018,982 1,214,029<br />

Released to profit 195,047 97,522<br />

Closing balance 1,214,029 1,311,551<br />

Net unamortised balance 4,371,518 4,273,996<br />

14. Share Capital and Earnings per Share<br />

The Company's share capital at December 31, 1999 and June 30, 2000 consisted of:<br />

1999<br />

Unaudited<br />

2000<br />

Number of shares outstanding 53,194,500 70,926,000<br />

Nominal value per share 750 750<br />

Total share capital (in GRD thousands) 39,895,875 53,194,500<br />

During 1998, the Company was successful in selling 4,728,500 shares on the Athens Stock Exchange and<br />

236,100 shares by a private placement to Company’s employees and to investment institutions. Both the public<br />

and the private placement were sold at a premium of GRD 2,350 per share or GRD 11,666,810.<br />

In May, 1999 the Company's share capital increased by GRD 8,865,750 through the issuance of 11,821,000<br />

bonus shares of a nominal value of GRD 750 each by capitalizing GRD 8,865,750 of the share premium account.<br />

In July 1999 the Company's share capital increased by GRD 13,298,625 through the issuance of 17,731,500<br />

shares. Shares of 10,638,900 and 224,619 were sold to investment institutions at a premium of GRD 4,350 per<br />

share or GRD 47,256,308. Shares of 6,867,981 were sold to the old shareholders (three new shares for every<br />

ten old shares) at a premium of GRD 2,450 per share or GRD 16,826,553.<br />

Following the annual general meeting of shareholders on May 28, 2000, the Company's share capital increased<br />

(in June 2000) by GRD 13,298,625 through the issuance of 17,731,500 bonus shares (one bonus share for every<br />

three existing shares) of a nominal value of GRD 750 each by capitalising GRD 13,298,625 of the share premium<br />

account.<br />

20