Journal - Allianz

Journal - Allianz

Journal - Allianz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

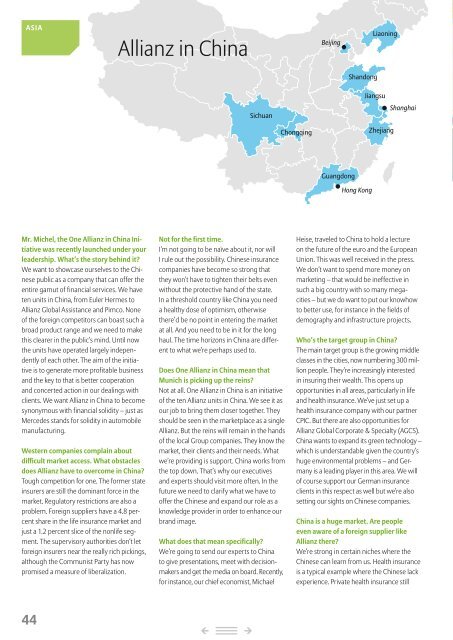

ASIA<br />

<strong>Allianz</strong> in China<br />

Beijing<br />

Liaoning<br />

Roth<br />

<strong>Allianz</strong> Group <strong>Journal</strong> 2/2013<br />

Shandong<br />

Sichuan<br />

Jiangsu<br />

Shanghai<br />

Chongqing<br />

Zhejiang<br />

Guangdong<br />

Uwe Michel<br />

Hong Kong<br />

Mr. Michel, the One <strong>Allianz</strong> in China Initiative<br />

was recently launched under your<br />

leadership. What’s the story behind it?<br />

We want to showcase ourselves to the Chinese<br />

public as a company that can offer the<br />

entire gamut of financial services. We have<br />

ten units in China, from Euler Hermes to<br />

<strong>Allianz</strong> Global Assistance and Pimco. None<br />

of the foreign competitors can boast such a<br />

broad product range and we need to make<br />

this clearer in the public’s mind. Until now<br />

the units have operated largely independently<br />

of each other. The aim of the initiative<br />

is to generate more profitable business<br />

and the key to that is better cooperation<br />

and concerted action in our dealings with<br />

clients. We want <strong>Allianz</strong> in China to become<br />

synonymous with financial solidity – just as<br />

Mercedes stands for solidity in automobile<br />

manufacturing.<br />

Western companies complain about<br />

difficult market access. What obstacles<br />

does <strong>Allianz</strong> have to overcome in China?<br />

Tough competition for one. The former state<br />

insurers are still the dominant force in the<br />

market. Regulatory restrictions are also a<br />

problem. Foreign suppliers have a 4.8 percent<br />

share in the life insurance market and<br />

just a 1.2 percent slice of the nonlife segment.<br />

The supervisory authorities don’t let<br />

foreign insurers near the really rich pickings,<br />

although the Communist Party has now<br />

promised a measure of liberalization.<br />

Not for the first time.<br />

I’m not going to be naïve about it, nor will<br />

I rule out the possibility. Chinese insurance<br />

companies have become so strong that<br />

they won’t have to tighten their belts even<br />

without the protective hand of the state.<br />

In a threshold country like China you need<br />

a healthy dose of optimism, otherwise<br />

there’d be no point in entering the market<br />

at all. And you need to be in it for the long<br />

haul. The time horizons in China are different<br />

to what we’re perhaps used to.<br />

Does One <strong>Allianz</strong> in China mean that<br />

Munich is picking up the reins?<br />

Not at all. One <strong>Allianz</strong> in China is an initiative<br />

of the ten <strong>Allianz</strong> units in China. We see it as<br />

our job to bring them closer together. They<br />

should be seen in the marketplace as a single<br />

<strong>Allianz</strong>. But the reins will remain in the hands<br />

of the local Group companies. They know the<br />

market, their clients and their needs. What<br />

we’re providing is support. China works from<br />

the top down. That’s why our executives<br />

and experts should visit more often. In the<br />

future we need to clarify what we have to<br />

offer the Chinese and expand our role as a<br />

knowledge provider in order to enhance our<br />

brand image.<br />

What does that mean specifically?<br />

We’re going to send our experts to China<br />

to give presentations, meet with decisionmakers<br />

and get the media on board. Recently,<br />

for instance, our chief economist, Michael<br />

Heise, traveled to China to hold a lecture<br />

on the future of the euro and the European<br />

Union. This was well received in the press.<br />

We don’t want to spend more money on<br />

marketing – that would be ineffective in<br />

such a big country with so many megacities<br />

– but we do want to put our knowhow<br />

to better use, for instance in the fields of<br />

demography and infrastructure projects.<br />

Who’s the target group in China?<br />

The main target group is the growing middle<br />

classes in the cities, now numbering 300 million<br />

people. They’re increasingly interested<br />

in insuring their wealth. This opens up<br />

opportunities in all areas, particularly in life<br />

and health insurance. We’ve just set up a<br />

health insurance company with our partner<br />

CPIC. But there are also opportunities for<br />

<strong>Allianz</strong> Global Corporate & Specialty (AGCS).<br />

China wants to expand its green technology –<br />

which is understandable given the country’s<br />

huge environmental problems – and Germany<br />

is a leading player in this area. We will<br />

of course support our German insurance<br />

clients in this respect as well but we’re also<br />

setting our sights on Chinese companies.<br />

China is a huge market. Are people<br />

even aware of a foreign supplier like<br />

<strong>Allianz</strong> there?<br />

We’re strong in certain niches where the<br />

Chinese can learn from us. Health insurance<br />

is a typical example where the Chinese lack<br />

experience. Private health insurance still<br />

accounts for only a small fraction of healthcare<br />

expenditure. We can contribute expertise<br />

in terms of products, risk management<br />

and IT. CPIC, with whom we’ve set up the<br />

joint venture, is contributing its sales network<br />

and contacts with state agencies. I’m<br />

optimistic that we can secure a slice of the<br />

pie in China. Of course we need to ensure<br />

that the gains from this knowledge transfer<br />

will benefit all parties concerned.<br />

<strong>Allianz</strong> will be the minority partner in the<br />

joint venture. Is that a paradigm shift?<br />

It’s quite a step for <strong>Allianz</strong> to be the minority<br />

partner in a joint venture, as is the case in<br />

the health insurance company we’ve just set<br />

up. But we realized that we wouldn’t stand<br />

a chance if we entered the market alone.<br />

So we asked ourselves three key questions:<br />

What is the added value for <strong>Allianz</strong>? How<br />

big is the risk as the minority partner? And<br />

will we be able to take any profit we make<br />

out of China?<br />

Other companies have decided to<br />

cut back or give up their commitment<br />

in China. Is that also an option for<br />

<strong>Allianz</strong>?<br />

It’s always an option. Of course we must<br />

ensure that we don’t fall by the wayside.<br />

The question is whether we can do something<br />

constructive in China with the money<br />

that our shareholders put at our disposal.<br />

I’m certain that we’re in a position to do<br />

so, and One <strong>Allianz</strong> in China can make an<br />

important contribution. Needless to say,<br />

clients won’t take out insurance just because<br />

we’ve launched this initiative. They’ll do<br />

so because Global Automotive has a good<br />

product range or because AGCS offers good<br />

cover. One <strong>Allianz</strong> in China aims to facilitate<br />

information exchange between the subsidiaries.<br />

They need to discuss who’s got which<br />

clients and how the units can cooperate in<br />

supporting them. Customer managers from<br />

the various <strong>Allianz</strong> units are already teaming<br />

up to approach major clients.<br />

How’s that working out?<br />

The response has been extremely positive.<br />

<strong>Allianz</strong> China, Global Automotive and<br />

<strong>Allianz</strong> Global Assistance have already<br />

signed contracts with an international<br />

telematics company. The premium income<br />

amounts to ten million euros. And we have<br />

many other companies on our target list.<br />

As <strong>Allianz</strong> is a European provider, isn’t<br />

the financial crisis throwing a wrench in<br />

the works?<br />

Europe is no longer seen as a bastion of<br />

security, and naturally the state of the euro<br />

crops up in every conversation. But <strong>Allianz</strong> is<br />

still regarded as a stable company in China,<br />

and our good rating helps a lot. This is exactly<br />

the strong image that we want to convey to<br />

the public. It will also enhance our attractiveness<br />

as an employer. Employee loyalty is an<br />

on going issue for us in China.<br />

Are people running away?<br />

We have a very high staff turnover. It’s hard<br />

to find good employees in China, and even<br />

harder to keep them. We train them and<br />

then they’re poached by the competition. In<br />

April, we had our first internal China job fair.<br />

More than 40 Chinese speaking employees<br />

from different <strong>Allianz</strong> departments who can<br />

see themselves working in China took part.<br />

That gives me hope. We have to get the<br />

message across that <strong>Allianz</strong> is a top-notch<br />

company that is listed on the Fortune 100<br />

Index and that, thanks to its wide-ranging<br />

activities, offers exciting advancement and<br />

career opportunities. Then we can get to<br />

grips with staff turnover. We need to be<br />

seen on the market as a single multifaceted<br />

unit. This is precisely the aim of One <strong>Allianz</strong><br />

in China. I’m convinced that we can adapt<br />

to the Chinese market and be successful.<br />

How far should adaption go?<br />

It’s got nothing to do with currying favor.<br />

It’s about understanding the market so that<br />

we can put our knowledge to good use.<br />

The Chinese want to work with us precisely<br />

because we’re German, because we’re European.<br />

We’ve created a good base in China in<br />

the past few years, also in terms of business<br />

licenses. But now it’s finally time to reap the<br />

harvest.<br />

44<br />

<br />

<br />

<br />

<br />

45