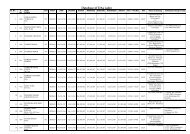

Receipts and Payments Account Format Of Zilla Parishad…….. For ...

Receipts and Payments Account Format Of Zilla Parishad…….. For ...

Receipts and Payments Account Format Of Zilla Parishad…….. For ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

iii<br />

Detailed instructions on the maintenance of these accounts, subsidiary registers/records would have to be issued by the State Government<br />

under the accounting rules.<br />

7.2 <strong>For</strong> transfer of funds to the PRIs new minor heads have been prescribed. In case funds are transferred from <strong>Zilla</strong> Parishads to Panchayat<br />

Samitis/Village Panchayats for implementation of various schemes, these transfers are to be shown as deduct receipts under the head Grants-in-aid<br />

<strong>and</strong> contributions on the receipt side of the <strong>Receipts</strong> & <strong>Payments</strong> <strong>Account</strong>s of the <strong>Zilla</strong> Parishad.<br />

7.3 The funds received under various schemes are to be shown under Grants-in-aid & contributions, scheme-wise on the receipt side.<br />

However, on the payment side, the expenditure against each scheme would have to be shown under the relevant functional head, below the minor<br />

head. (Please refer to para 2.3 <strong>and</strong> para 2.4 of the List of Codes for Functions, Programmes & Activities of PRIs, for detailed explanation)<br />

7.4 The Object heads for the sake of uniformity across the State have been st<strong>and</strong>ardised. The list of Object heads with the proposed st<strong>and</strong>ard<br />

code for each head is enclosed to be used across the State. Item-wise details of Object head expenditure like dearness allowance, house rent<br />

allowance etc. under salaries may be kept outside accounts, if required.<br />

7.5 The <strong>Receipts</strong> <strong>and</strong> <strong>Payments</strong> <strong>Account</strong> is prepared on the basis of figures in the Consolidated Abstract. Expenditure of a capital nature is<br />

distinguished from revenue expenditure with plan <strong>and</strong> non-plan classification. Non-plan expenditure is in the nature of continuance of earlier<br />

schemes.<br />

8. Only one main cash book in each PRI may be maintained incorporating balances from all subsidiary cash books, which are to be kept as<br />

necessary.<br />

9. On the basis of these model formats, the State Governments may formulate Budgeting/<strong>Account</strong>ing rules <strong>and</strong> manuals for keeping of<br />

budget/accounts for Panchayati Raj Institutions in consultation with the State <strong>Account</strong>ants General.<br />

K.N.Kh<strong>and</strong>elwal<br />

Deputy Comptroller & Auditor General of India<br />

New Delhi<br />

16 October 2002