Deduction for tax paid abroad by a person (credit ... - Skatteetaten

Deduction for tax paid abroad by a person (credit ... - Skatteetaten

Deduction for tax paid abroad by a person (credit ... - Skatteetaten

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

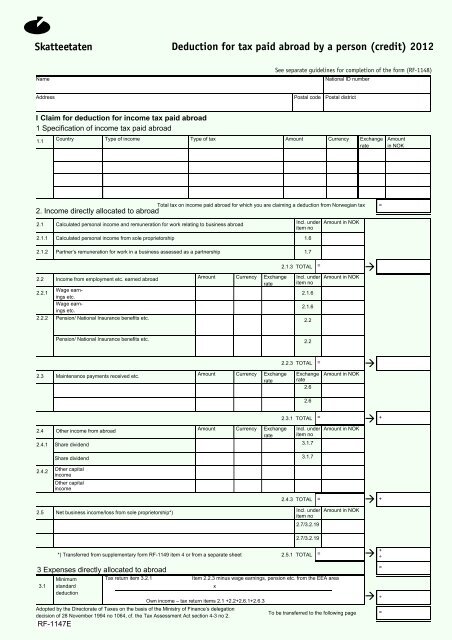

<strong>Skatteetaten</strong><br />

<strong>Deduction</strong> <strong>for</strong> <strong>tax</strong> <strong>paid</strong> <strong>abroad</strong> <strong>by</strong> a <strong>person</strong> (<strong>credit</strong>) 2012<br />

Name<br />

See separate guidelines <strong>for</strong> completion of the <strong>for</strong>m (RF-1148)<br />

National ID number<br />

Address<br />

Postal code<br />

Postal district<br />

I Claim <strong>for</strong> deduction <strong>for</strong> income <strong>tax</strong> <strong>paid</strong> <strong>abroad</strong><br />

1 Specification of income <strong>tax</strong> <strong>paid</strong> <strong>abroad</strong><br />

1.1<br />

Country Type of income Type of <strong>tax</strong><br />

Amount Currency Exchange<br />

rate<br />

Amount<br />

in NOK<br />

2. Income directly allocated to <strong>abroad</strong><br />

Total <strong>tax</strong> on income <strong>paid</strong> <strong>abroad</strong> <strong>for</strong> which you are claiming a deduction from Norwegian <strong>tax</strong><br />

=<br />

2.1 Calculated <strong>person</strong>al income and remuneration <strong>for</strong> work relating to business <strong>abroad</strong><br />

Wage earnings<br />

etc.<br />

Wage earnings<br />

etc.<br />

Pension/ National Insurance benefits etc.<br />

Incl. under<br />

item no<br />

2.1.1 Calculated <strong>person</strong>al income from sole proprietorship 1.6<br />

2.1.2 Partner’s remuneration <strong>for</strong> work in a business assessed as a partnership 1.7<br />

2.2 Income from employment etc. earned <strong>abroad</strong><br />

2.2.1<br />

2.2.2<br />

Amount Currency Exchange<br />

rate<br />

2.1.3 TOTAL<br />

=<br />

Incl. under<br />

item no<br />

2.1.6<br />

2.1.6<br />

2.2<br />

Amount in NOK<br />

Amount in NOK<br />

à<br />

Pension/ National Insurance benefits etc.<br />

2.2<br />

2.3 Maintenance payments received etc.<br />

Amount Currency Exchange<br />

rate<br />

2.2.3 TOTAL<br />

=<br />

Exchange<br />

rate<br />

2.6<br />

Amount in NOK<br />

à<br />

2.6<br />

2.4 Other income from <strong>abroad</strong><br />

Amount Currency Exchange<br />

rate<br />

2.3.1 TOTAL<br />

=<br />

Incl. under<br />

item no<br />

2.4.1 Share dividend 3.1.7<br />

Amount in NOK<br />

à<br />

+<br />

Share dividend 3.1.7<br />

2.4.2<br />

Other capital<br />

income<br />

Other capital<br />

income<br />

2.5 Net business income/loss from sole proprietorship*)<br />

2.4.3 TOTAL<br />

=<br />

Incl. under<br />

item no<br />

2.7/3.2.19<br />

Amount in NOK<br />

à<br />

+<br />

3 Expenses directly allocated to <strong>abroad</strong><br />

3.1<br />

*) Transferred from supplementary <strong>for</strong>m RF-1149 item 4 or from a separate sheet<br />

Minimum<br />

standard<br />

deduction<br />

Tax return item 3.2.1<br />

Item 2.2.3 minus wage earnings, pension etc. from the EEA area<br />

Own income – <strong>tax</strong> return items 2.1 +2.2+2.6.1+2.6.3<br />

Adopted <strong>by</strong> the Directorate of Taxes on the basis of the Ministry of Finance’s delegation<br />

decision of 28 November 1994 no 1064, cf. the Tax Assessment Act section 4-3 no 2.<br />

RF-1147E<br />

x<br />

2.7/3.2.19<br />

2.5.1 TOTAL<br />

To be transferred to the following page<br />

=<br />

à<br />

à<br />

+<br />

÷<br />

=<br />

÷<br />

=

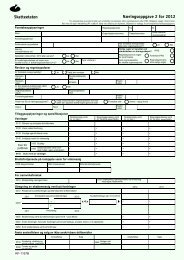

Amount transferred from the previous page<br />

3.2 Other expenses<br />

Incl. under<br />

item no<br />

Amount in NOK<br />

4 Expenses allocated to <strong>abroad</strong> in accordance with the indirect method<br />

4.1<br />

Interest expenses<br />

4.2 Other expenses<br />

Type of<br />

expense<br />

Type of<br />

expense<br />

Expense<br />

Tax return item 3.3.1+3.3.2<br />

Corrected net income<br />

Expense<br />

Corrected net income<br />

5 Net business income/loss from business assessed as a partnership<br />

5.1 Partner’s share of net business income/loss<br />

x<br />

x<br />

Corrected net income<br />

Net income from <strong>abroad</strong> be<strong>for</strong>e the deduction of<br />

expenses allocated in accordance with the indirect method<br />

Item 3.3 above (minus wage earnings, pension income etc.<br />

x<br />

Item 3.3. above<br />

Item 3.3. above<br />

Allocation ratio<br />

Incl. in<br />

item no<br />

=<br />

Amount in NOK<br />

à<br />

à<br />

4.3 TOTAL =<br />

à<br />

Incl. under<br />

item no<br />

3.3 TOTAL<br />

Amount in NOK<br />

à<br />

2.7 +<br />

3.2.19<br />

à ÷<br />

÷<br />

=<br />

÷<br />

÷<br />

II Claim <strong>for</strong> deduction <strong>for</strong> wealth <strong>tax</strong> <strong>paid</strong> <strong>abroad</strong><br />

6 Specification of wealth <strong>tax</strong> <strong>paid</strong> <strong>abroad</strong><br />

Net income from <strong>abroad</strong> 5.2 TOTAL<br />

6.1 Country Type of capital Tax type<br />

Amount Currency<br />

=<br />

Exchange<br />

rate<br />

Amount in NOK<br />

7. Capital/debt <strong>abroad</strong><br />

7.1 Capital <strong>tax</strong>ed <strong>abroad</strong><br />

Total wealth <strong>tax</strong> <strong>paid</strong> <strong>abroad</strong> <strong>for</strong> which you are claiming a deduction from Norwegian <strong>tax</strong><br />

Incl. under<br />

item no<br />

4.6<br />

Amount in NOK<br />

=<br />

4.6<br />

7.2 SUM<br />

=<br />

à<br />

7.3 Debt<br />

Tax return<br />

item 4.8<br />

x<br />

Item 7.2 above<br />

Total capital<br />

à<br />

÷<br />

7.4 Partner’s share of capital/debt in business assessed as a partnership<br />

Incl. under<br />

item no<br />

Amount in NOK<br />

4.5.4<br />

à +<br />

4.8.1/<br />

4.8.3<br />

à ÷<br />

III Claim <strong>for</strong> deduction <strong>for</strong> <strong>for</strong>eign <strong>tax</strong> carried <strong>for</strong>ward<br />

=<br />

År A. Foreign income <strong>tax</strong> carry <strong>for</strong>ward B. Foreign wealth <strong>tax</strong> carry <strong>for</strong>ward<br />

8<br />

2007<br />

III Claim <strong>for</strong> carry-back <strong>for</strong> <strong>for</strong>eign <strong>tax</strong> to 2011<br />

9<br />

2008<br />

2009<br />

2010<br />

2011<br />

Are you claiming a deduction in <strong>tax</strong> <strong>for</strong> the preceding year <strong>for</strong> <strong>for</strong>eign <strong>tax</strong> that cannot be deducted from this year’s <strong>tax</strong>? Yes No<br />

If you tick the box <strong>for</strong> yes under item 9, you must submit an enclosure with your <strong>tax</strong> return to substantiate that no <strong>tax</strong>able income/capital<br />

will accrue to you <strong>abroad</strong> during the income years 2013-2017 <strong>for</strong> which a <strong>credit</strong> can be claimed.<br />

Date<br />

Signature