Inherited Roth IRA Calculator - InsMark

Inherited Roth IRA Calculator - InsMark

Inherited Roth IRA Calculator - InsMark

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Preface<br />

An inherited <strong>Roth</strong> <strong>IRA</strong> is an asset accumulation<br />

and distribution program that has been granted<br />

special tax consideration. It has the following<br />

characteristics:<br />

Additional Contributions<br />

There is no provision for additional<br />

contributions.<br />

Tax Free Growth<br />

As values grow, earnings are not subject to<br />

income tax.<br />

Required Minimum Distributions<br />

There are required minimum distributions from<br />

such plans based on age(s) of participants and<br />

IRS formulas.<br />

As a result of the dynamic combination of tax<br />

free growth and tax free distributions, an<br />

inherited <strong>Roth</strong> <strong>IRA</strong> is an extraordinary financial<br />

instrument. The accompanying material should<br />

be helpful to you in analyzing the value of such<br />

a plan.<br />

Tax Free Distributions<br />

Distributions are income tax free.<br />

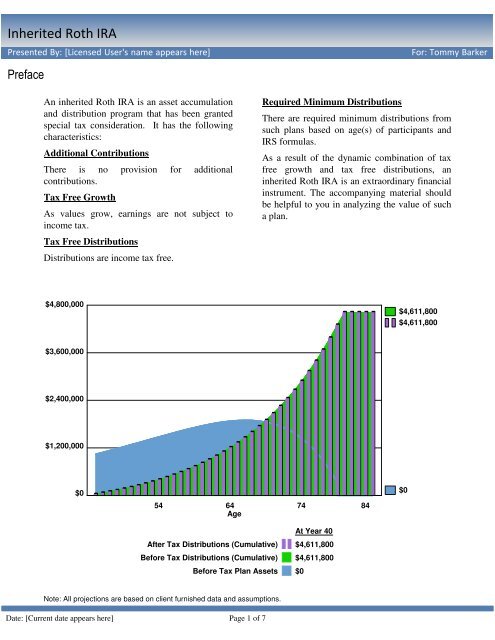

$4,800,000<br />

$4,611,800<br />

$4,611,800<br />

$3,600,000<br />

$2,400,000<br />

$1,200,000<br />

$0<br />

$0<br />

54 64 74 84<br />

Age<br />

After Tax Distributions (Cumulative) $4,611,800<br />

Before Tax Distributions (Cumulative) $4,611,800<br />

Before Tax Plan Assets $0<br />

At Year 40<br />

Note: All projections are based on client furnished data and assumptions.<br />

Date: [Current date appears here]<br />

Page 1 of 7

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Flow Chart Analysis<br />

Investment<br />

Yield<br />

<strong>Inherited</strong><br />

Plan Assets<br />

Admin.<br />

Expenses<br />

Tax Free<br />

Distributions<br />

Balance<br />

to Heirs<br />

Date: [Current date appears here]<br />

Page 2 of 7

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Distribution<br />

Current Value<br />

1,000,000<br />

Plan<br />

Yield<br />

7.50%<br />

Year<br />

Age<br />

(1)<br />

Beginning<br />

of Year<br />

Balance<br />

in Plan<br />

Assets<br />

(2)<br />

Before Tax<br />

IRS<br />

Required<br />

Minimum<br />

Distribution*<br />

(3)<br />

Before Tax<br />

Scheduled<br />

Distribution<br />

(4)<br />

After Tax<br />

Income from<br />

Scheduled<br />

Distribution<br />

(5)<br />

Year End<br />

Plan<br />

Assets<br />

1 45 1,000,000 27,855 27,855 27,855 1,045,056<br />

2 46 1,045,056 29,944 29,944 29,944 1,091,245<br />

3 47 1,091,245 32,190 32,190 32,190 1,138,484<br />

4 48 1,138,484 34,604 34,604 34,604 1,186,671<br />

5 49 1,186,671 37,200 37,200 37,200 1,235,682<br />

6 50 1,235,682 39,990 39,990 39,990 1,285,369<br />

7 51 1,285,369 42,989 42,989 42,989 1,335,558<br />

8 52 1,335,558 46,213 46,213 46,213 1,386,046<br />

9 53 1,386,046 49,679 49,679 49,679 1,436,595<br />

10 54 1,436,595 53,405 53,405 53,405 1,486,929<br />

11 55 1,486,929 57,410 57,410 57,410 1,536,733<br />

12 56 1,536,733 61,716 61,716 61,716 1,585,643<br />

13 57 1,585,643 66,345 66,345 66,345 1,633,245<br />

14 58 1,633,245 71,321 71,321 71,321 1,679,069<br />

15 59 1,679,069 76,670 76,670 76,670 1,722,579<br />

16 60 1,722,579 82,420 82,420 82,420 1,763,170<br />

17 61 1,763,170 88,602 88,602 88,602 1,800,161<br />

18 62 1,800,161 95,247 95,247 95,247 1,832,783<br />

19 63 1,832,783 102,390 102,390 102,390 1,860,172<br />

20 64 1,860,172 110,069 110,069 110,069 1,881,361<br />

21 65 1,881,361 118,325 118,325 118,325 1,895,263<br />

22 66 1,895,263 127,199 127,199 127,199 1,900,669<br />

23 67 1,900,669 136,739 136,739 136,739 1,896,225<br />

24 68 1,896,225 146,994 146,994 146,994 1,880,423<br />

25 69 1,880,423 158,019 158,019 158,019 1,851,585<br />

26 70 1,851,585 169,870 169,870 169,870 1,807,843<br />

27 71 1,807,843 182,610 182,610 182,610 1,747,126<br />

28 72 1,747,126 196,306 196,306 196,306 1,667,131<br />

29 73 1,667,131 211,029 211,029 211,029 1,565,310<br />

30 74 1,565,310 226,857 226,857 226,857 1,438,837<br />

2,880,207 2,880,207 2,880,207<br />

*Column (2) projects an estimate of the required minimum<br />

distribution based on asset value and beneficiary's life<br />

expectancy (reduced by one each year thereafter).<br />

Plan results are hypothetical only. Actual results will vary<br />

due to changes in contributions and withdrawals, income<br />

tax brackets, and investment performance.<br />

Date: [Current date appears here]<br />

Page 3 of 7

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Distribution<br />

Current Value<br />

1,000,000<br />

Plan<br />

Yield<br />

7.50%<br />

Year<br />

Age<br />

(1)<br />

Beginning<br />

of Year<br />

Balance<br />

in Plan<br />

Assets<br />

(2)<br />

Before Tax<br />

IRS<br />

Required<br />

Minimum<br />

Distribution*<br />

(3)<br />

Before Tax<br />

Scheduled<br />

Distribution<br />

(4)<br />

After Tax<br />

Income from<br />

Scheduled<br />

Distribution<br />

(5)<br />

Year End<br />

Plan<br />

Assets<br />

31 75 1,438,837 243,871 243,871 243,871 1,284,588<br />

32 76 1,284,588 262,161 262,161 262,161 1,099,109<br />

33 77 1,099,109 281,823 281,823 281,823 878,583<br />

34 78 878,583 302,960 302,960 302,960 618,795<br />

35 79 618,795 325,681 325,681 325,681 315,097<br />

36 80 315,097 315,097 315,097 315,097 0<br />

37 81 0 0 0 0 0<br />

38 82 0 0 0 0 0<br />

39 83 0 0 0 0 0<br />

40 84 0 0 0 0 0<br />

4,611,800 4,611,800 4,611,800<br />

*Column (2) projects an estimate of the required minimum<br />

distribution based on asset value and beneficiary's life<br />

expectancy (reduced by one each year thereafter).<br />

Plan results are hypothetical only. Actual results will vary<br />

due to changes in contributions and withdrawals, income<br />

tax brackets, and investment performance.<br />

Date: [Current date appears here]<br />

Page 4 of 7

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Summary Analysis at age 84<br />

0<br />

Plan Assets (Before Tax)<br />

4,611,800<br />

4,611,800<br />

Cum. Distributions<br />

(Before Tax)<br />

Cum. Distributions<br />

(After Tax)<br />

Note: All projections are based on client furnished data and assumptions.<br />

Date: [Current date appears here]<br />

Page 5 of 7

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Distribution<br />

Plan Assets<br />

(Before Tax)<br />

$5.6M<br />

Plan Assets (Before Tax)<br />

4.2M<br />

2.8M<br />

1.4M<br />

0<br />

$0<br />

Age 54 64 74 84<br />

Cumulative Distributions<br />

(Before Tax)<br />

Cumulative Distributions<br />

(After Tax)<br />

$5.6M<br />

Cum. Distrib. (Before Tax)<br />

$5.6M<br />

Cum. Distrib. (After Tax)<br />

4.2M<br />

$4,611,800<br />

4.2M<br />

$4,611,800<br />

2.8M<br />

2.8M<br />

1.4M<br />

1.4M<br />

0<br />

Age 54 64 74 84<br />

0<br />

Age 54 64 74 84<br />

Note: All projections are based on client furnished data and assumptions.<br />

Date: [Current date appears here]<br />

Page 6 of 7

<strong>Inherited</strong> <strong>Roth</strong> <strong>IRA</strong><br />

Presented By: [Licensed User's name appears here]<br />

For: Tommy Barker<br />

Distribution Summary<br />

$4,800,000<br />

$4,611,800<br />

$4,611,800<br />

$3,600,000<br />

$2,400,000<br />

$1,200,000<br />

$0<br />

$0<br />

54 64 74 84<br />

Age<br />

At Year 40<br />

After Tax Distributions (Cumulative) $4,611,800<br />

Before Tax Distributions (Cumulative) $4,611,800<br />

Before Tax Plan Assets $0<br />

Note: All projections are based on client furnished data and assumptions.<br />

Date: [Current date appears here]<br />

Page 7 of 7