MPA's motion to change venue - equitatus

MPA's motion to change venue - equitatus

MPA's motion to change venue - equitatus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

WILLIAM McGRANE [057761]<br />

WILLIAM WALRAVEN [262586]<br />

McGRANE LLP<br />

Four Embarcadero Center, Suite 1400<br />

San Francisco, California 94111<br />

Telephone: (415) 766-3590<br />

At<strong>to</strong>rneys for Moving/Interested Party Development Specialists, Inc.<br />

UNITED STATES BANKRUPTCY COURT<br />

NORTHERN DISTRICT OF CALIFORNIA<br />

OAKLAND DIVISION<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

In re:<br />

WALTER J. NG and MARIBEL NG,<br />

Deb<strong>to</strong>rs.<br />

Case No. 11-45175<br />

Chapter 7<br />

MEMORANDUM OF POINTS AND<br />

AUTHORITIES IN SUPPORT OF<br />

DEVELOPMENT SPECIALISTS,<br />

INC.’S MOTION TO CHANGE<br />

VENUE<br />

[FRBP 1014(b)(4)]<br />

Date:<br />

Time:<br />

Place:<br />

Judge:<br />

Wednesday, January 25, 2011<br />

2:00 PM<br />

1300 Clay Street, Room 201<br />

Oakland, CA 94612<br />

Hon. Roger L. Efremsky<br />

1<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 1 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

Quick Review<br />

This is a <strong>motion</strong> for <strong>change</strong> of <strong>venue</strong> brought pursuant <strong>to</strong> Rule 1014(b)(4),<br />

Federal Rules of Bankruptcy Procedure. The moving party is Development<br />

Specialists, Inc. (DSI). DSI is an interested party herein based on its very recently<br />

acquired status as an administrative credi<strong>to</strong>r of an affiliate deb<strong>to</strong>r entity of the<br />

deb<strong>to</strong>rs herein which affiliate deb<strong>to</strong>r entity named R.E. Loans, LLC. 1<br />

DSI seeks <strong>to</strong> have this bankruptcy court <strong>change</strong> the <strong>venue</strong> of In re R.E.<br />

Loans, LLC, United States Bankruptcy Court for the Northern District of Texas,<br />

Case No. 11-35865 and certain related cases (collectively, the REL Bankruptcy<br />

Case)—which REL Bankruptcy Case was first filed on September 13, 2011—<br />

away from Northern District of Texas (TXND [where it is now before the Hon.<br />

Barbara J. Houser]) and over <strong>to</strong> the Northern District of California (CAND [there<br />

<strong>to</strong> be put before the Hon. Roger L. Efremsky]) who already has the BLUE cases:<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

1 See Declaration of William McGrane etc. (McGrane Decl.) filed herewith at 2.<br />

On its face, Rule 1014(b)(4), Fed. R. of Bankr. Pro. requires only “interested<br />

party” standing as that latter term “interested party” is defined at 11 U.S.C. §1109<br />

in order <strong>to</strong> convey sufficient standing on an entity <strong>to</strong> bring on a <strong>motion</strong> of this<br />

kind. (See In re Lakeside Utilities, 18 B.R. 115, at 116 (Bankr. D. Neb. 1982).)<br />

2<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 2 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

As the bankruptcy court in which the first filed case, <strong>to</strong> wit, the bankruptcy<br />

court in which In re Walter J. Ng and Maribel Ng, CANB Case No. 11-45175 (the<br />

Walter Bankruptcy Case)—which Walter Bankruptcy Case was first filed on May<br />

12, 2011—this bankruptcy court is the appropriate bankruptcy court <strong>to</strong> hear and<br />

decide this <strong>motion</strong> <strong>to</strong> <strong>change</strong> the <strong>venue</strong> of the REL Bankruptcy Case. This is<br />

because the bankruptcy estate in the Walter Bankruptcy Case (the California<br />

Deb<strong>to</strong>r’s Estate or the CDE) indirectly owns 25% of the equity security interests in<br />

the bankruptcy estate in the REL Bankruptcy Case (the Texas Deb<strong>to</strong>r’s Estate or<br />

the TDE). (See Exhibit 1 <strong>to</strong> McGrane Decl.)<br />

This undisputed and indisputable fact makes the TDE an affiliate of the<br />

CDE, thus making the REL Bankruptcy Case, in turn, subject <strong>to</strong> Rule 1014(b)(4)<br />

of the Federal Rules of Bankruptcy Procedure [which rule gives the bankruptcy<br />

judge in the first filed bankruptcy case the obligation <strong>to</strong> determine the appropriate<br />

<strong>venue</strong> for any later filed bankruptcy case involving another entity which is an<br />

affiliate of a deb<strong>to</strong>r in the first filed bankruptcy case]. (See, e.g., Near v. Great<br />

American etc. (In re Redding<strong>to</strong>n Investments Limited Partnership), 90 B.R. 429<br />

(9th Cir. B.A.P. 1988); see also 11 U.S.C. §101(2) and (15) [specifying the<br />

definitions of the terms “affiliate” and “entity”].)<br />

This <strong>motion</strong> is made pursuant <strong>to</strong> the authority contained in Rule 1014(a)(1),<br />

Federal Rules of Bankruptcy Procedure. DSI will demonstrate, infra, that both the<br />

interests of justice and the convenience of the parties are each best served by the<br />

transfer of <strong>venue</strong> prayed for in this <strong>motion</strong>.<br />

/ / /<br />

/ / /<br />

3<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 3 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

Argument<br />

1. All Relevant Fac<strong>to</strong>rs Require that the REL Bankruptcy Case be<br />

Transferred from Dallas <strong>to</strong> Oakland as Requested by this<br />

Motion.<br />

Relying on Commonwealth etc., et. al. v. Commonwealth etc., et.al. (In re<br />

Commonwealth etc., et al.), 596 F.2d 1239 (5th Cir. 1979), the Chief Bankruptcy<br />

Judge of the United States Bankruptcy Court for the Southern District of New<br />

York, the Hon. Arthur J. Gonzales—writing in In re Enron Corp., 284 B.R. 376 at<br />

387 (Bkrptcy. S.D. NY. 2002)—outlined the various fac<strong>to</strong>rs any bankruptcy court<br />

should consider in determining whether <strong>to</strong> grant a <strong>change</strong> of <strong>venue</strong> in derogation<br />

of a deb<strong>to</strong>r’s initial choice of <strong>venue</strong>. These are as follows:<br />

1. The proximity of credi<strong>to</strong>rs of every kind <strong>to</strong> the Court;<br />

2. The proximity of the deb<strong>to</strong>r <strong>to</strong> the Court;<br />

3. The proximity of the witnesses necessary <strong>to</strong> the administration of the<br />

estate;<br />

4. The location of the assets; 2<br />

5. The economic administration of the estate …<br />

2 The only explanation which the TDE has ever given DSI for its initial choice of<br />

the remote Dallas <strong>venue</strong> it chose in this case is the TDE’s hyper-technical claim<br />

that the presence of certain promissory notes present somewhere deep in the heart<br />

of Texas means that the TDE’s “principal assets in the United States” are located<br />

in Dallas. (McGrane Decl. at 4.) Other than <strong>to</strong> note the scarce-<strong>to</strong>-the-point-ofnon-existent-precedent<br />

for the TDE’s having been so bold as <strong>to</strong> file the REL<br />

Bankruptcy Case in a jurisdiction that never had any meaningful contacts with the<br />

TDE’s pre-petition business activities (see, generally, William McGrane, A<br />

Credi<strong>to</strong>r Strategy <strong>to</strong> Pre-Empt S.D.N.Y. Venue, ABI Journal, (June 2011 Ed.) at<br />

FN. 5 [Exhibit 2 <strong>to</strong> McGrane Decl.]), this brief does not purport <strong>to</strong> rely on the<br />

grounds set forth in Rule 1014(a)(2), Fed. R. Bankr. Pro. in order <strong>to</strong> obtain an<br />

order transferring <strong>venue</strong>.<br />

4<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 4 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

A. Location of Credi<strong>to</strong>rs.<br />

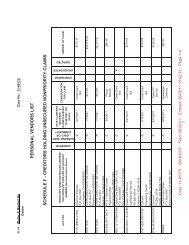

As the below chart (itself drawn from the TDE’s Amended Schedule D<br />

[Exhibit 3 <strong>to</strong> McGrane Decl.]) shows, the credi<strong>to</strong>rs of the TDE’s are located as<br />

follows:<br />

Location of Scheduled<br />

Credi<strong>to</strong>rs<br />

Number of Scheduled<br />

Credi<strong>to</strong>rs per Location<br />

Scheduled Amounts<br />

Owed <strong>to</strong> Scheduled<br />

Credi<strong>to</strong>rs<br />

California 2,644 782,219,267.72<br />

Texas 8 68,295,892.23<br />

Other States and<br />

foreign countries<br />

152 33,921,964.60<br />

B. Location of the TDE.<br />

The TDE was located, pre-petition, in Lafayette, California. (See Exhibit 4<br />

<strong>to</strong> McGrane Decl.) The TDE is presently administered by Mackinac Partners from<br />

a location in Michigan. (See Exhibit 5 <strong>to</strong> McGrane Decl.) The TDE’s lead<br />

bankruptcy counsel, Stutman, Treister & Glatt P.C. (Stutman), is located in<br />

California. (Id.)<br />

C. Location of the TDE’s Witnesses.<br />

The witnesses in the REL Bankruptcy Case are mainly the same persons<br />

and entities as make up the credi<strong>to</strong>r body in the REL Bankruptcy Case. This is<br />

particularly so in light of the various pending allegations/criminal investigations<br />

arising from the fact that the REL Bankruptcy Case has many elements of a<br />

massive Ponzi that has now entirely devastated the financial lives of literally<br />

thousands of California citizens. (See, e.g., Exhibit 6 <strong>to</strong> McGrane Decl.)<br />

/ / /<br />

5<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 5 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

D. Location of the TDE’s Assets.<br />

While, as previously noted, the multiple promissory notes which evidence<br />

the obligations of the TDE’s own deb<strong>to</strong>rs <strong>to</strong> pay the TDE money have now, very<br />

designedly, come <strong>to</strong> rest deep in the heart of Texas, the real property security for<br />

those multiple promissory notes lies within the geographical boundaries of many<br />

different places. Very, very few of which are either in or anywhere near Texas.<br />

See the TDE’s Schedule A and Amended Schedule B (Exhibits 7-8 <strong>to</strong> McGrane<br />

Decl.).<br />

E. The Economic Administration of the TDE.<br />

Given the entirely California-centric nature of the REL Bankruptcy Case,<br />

administration of that case in conjunction with the other six related bankruptcy<br />

cases either now or shortly <strong>to</strong> be before this bankruptcy court is what is most<br />

“economic” for all parties and the bankruptcy courts.<br />

But that is not all. In fact that is not nearly all. Rather, and absent a<br />

<strong>change</strong> of <strong>venue</strong>, the REL Bankruptcy Case will very likely wind up being<br />

dismissed as having been filed without authority in the first instance, a situation<br />

that would be the very antithesis of the economic administration of the TDE. 3<br />

3 There is one critical exception <strong>to</strong> the absolute rule, described, infra, which<br />

normally requires immediate dismissal of all ultra vires filings, and that exception<br />

may well wind up as a saving grace that is applicable here. Thus, many cases hold<br />

that an ultra vires filing may still be saved, post-petition, by means of a ratification<br />

by the person or entity holding the needful but not given pre-petition authority—in<br />

the case of the REL Bankruptcy Case filing, this would be the CDE, which CDE is<br />

here represented by a Chapter 7 trustee. (See In re Avalon Hotel Partners, LLC,<br />

302 B.R. 377, at 381 (Bankr. D. Ore. 2003.) As is set forth in the McGrane Decl.<br />

at 12, DSI was <strong>to</strong>ld prior <strong>to</strong> filing this <strong>motion</strong> by lead counsel for the CDE that<br />

the CDE will not ratify the ultra vires filing of the REL Bankruptcy Case postpetition<br />

pending receipt of (i) further input from the various constituencies in the<br />

6<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 6 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

Thus, while the REL Bankruptcy Case was allegedly authorized by the<br />

TDE’s sole member and manager, B-4 Partners LLC (B4) by and through a B4<br />

manager named Kelly Ng (Kelly) (see Exhibit 9 <strong>to</strong> McGrane Decl.), according <strong>to</strong><br />

both the B4 Operating Agreement and an “Application etc.” filed by Stutman <strong>to</strong><br />

employ the present REL manager, Mackinac Partners—and as of September 12,<br />

2011 (the REL Bankruptcy Case Petition Date)—Kelly was then (on the REL<br />

Bankruptcy Case Petition Date) only one of what were in fact two then serving<br />

B4 Partners. (See Exhibit 5 <strong>to</strong> McGrane Decl. at 19 at page 9; see also Exhibit 1<br />

<strong>to</strong> McGrane Decl. at Exhibit A <strong>to</strong> First Amendment etc.) The CDE was the other<br />

manager of B4 as of the REL Bankruptcy Case Petition Date. 4<br />

Exhibit 1 <strong>to</strong> McGrane Decl. at Article 4, section 4.2(a)(iv) reads, in<br />

Walter Bankruptcy Case as well as (ii) a final determination of this <strong>motion</strong> on its<br />

merits by this bankruptcy court. The CDE, in the interim, intends <strong>to</strong> ask for an<br />

extension of time within which <strong>to</strong> assume or reject Exhibit 1 <strong>to</strong> the extent said<br />

Exhibit 1 may be subject <strong>to</strong> being properly characterized as an execu<strong>to</strong>ry contract.<br />

4 While Article 9 at page 26 of Exhibit 1 <strong>to</strong> the McGrane Decl. specifies the “…<br />

Bankruptcy … of the sole remaining [B4] Manager … [is] a Dissolution Event<br />

[that] shall dissolve [B4] …” the mere filing of Walter’s Bankruptcy Case was not<br />

a Dissolution Event because the CDE was not then sole remaining manager of B4.<br />

(See In re Deluca, 194 B.R. 65 (Bankr. E.D. Va. 1996), a case involving the<br />

bankruptcy of such a sole remaining manager of a limited liability company.)<br />

There is nothing in Exhibit 1 <strong>to</strong> the McGrane Decl. which in any manner states<br />

that a B4 manager au<strong>to</strong>matically loses his, her or its status as a B4 manager simply<br />

by virtue of his filing for personal bankruptcy. Rather, and as is demonstrated by<br />

Exhibit 1 at First Amendment etc., a B4 manager could be removed (and a new<br />

manager substituted in the old manager’s place) only by means of a written<br />

resignation or a vote of a majority in interest. (See Cal. Corporations Code §<br />

17152 [requiring a written resignation or vote <strong>to</strong> effectuate removal of a<br />

manager].) NOTE: despite repeated inquiries from DSI’s lead counsel <strong>to</strong> the<br />

TDE’s lead counsel, DSI has not been made aware of any evidence that either of<br />

these two things have ever occurred. (See Group Exhibit 10 <strong>to</strong> McGrane Decl.)<br />

7<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 7 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

pertinent part, as follows:<br />

Major Decisions. Without limiting the generality of Section 4.1<br />

hereof and except as otherwise expressly provided by this<br />

Agreement, upon the unanimous agreement of the Managers, a<br />

Manager shall have the power and authority, on behalf of the<br />

Company:<br />

. . .<br />

To … dispose of any Company Properties, including selling or<br />

otherwise disposing of all or substantially all of the assets of the<br />

Company as part of a single transaction or plan. [Emphasis added.]<br />

Exhibit 1 <strong>to</strong> McGrane Decl. at Article 4, section 4.3(c)(ii) reads, in<br />

pertinent part, as follows:<br />

Necessary Powers. Upon due authorization pursuant <strong>to</strong> paragraphs<br />

4.2(a) … either Manager, acting alone, has the authority <strong>to</strong> do any of<br />

the following … (ii) To exercise all rights, powers, privileges and<br />

other incidents of ownership or possession with respect <strong>to</strong> any<br />

property … owned by the Company. [Emphasis added.]<br />

The upshot of the above is perfectly clear.<br />

Under the B4 Operating Agreement (Exhibit 1 <strong>to</strong> the McGrane Decl.) any<br />

and all major decisions required unanimity among Kelly and Walter prior <strong>to</strong> their<br />

implementation. Therefore Stutman was mistaken in relying on unilateral action<br />

by Kelly as sufficient authorization for it <strong>to</strong> file the REL Bankruptcy Case as such<br />

unilateral action by Kelly was simply not enough, especially when the major<br />

decision in question was whether <strong>to</strong> cynically file a bankruptcy case in a distant<br />

8<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 8 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

jurisdiction in order <strong>to</strong> deprive victims of what was a nearly billion dollar Ponzi<br />

scheme of a forum conveniens.<br />

Many persuasive bankruptcy cases address a situation where, as here, an<br />

LLC operating agreement requires a manager authorizing a filing for bankruptcy<br />

on behalf of a limited liability company (here a manager of one limited liability<br />

company authorizing the bankruptcy of its wholly owned subsidiary limited<br />

liability company, <strong>to</strong> wit REL as a wholly owned subsidiary of B4) <strong>to</strong> obtain<br />

certain consents before filing for bankruptcy on behalf of a limited liability<br />

company. (See, e.g., In re Avalon Hotel Partners, LLC, supra; In re Ice Oasis,<br />

LLC, 2008 WL 5753355 (Bankr N. D. Cal. 2008); In re Orchards Vill. Invs., LLC,<br />

405 B.R. 341 (Bankr. D. Or. 2009).)<br />

The above cited cases each hold, inter alia, that any decision <strong>to</strong> file for<br />

bankruptcy is tantamount <strong>to</strong> an out of the ordinary course or ‘major’ decision and<br />

thus that any on-the-spot-LLC agent actually signing off on a filing for bankruptcy<br />

(here Kelly acting as a single manager for B4) must strictly comply with the<br />

requirements of the LLC operating agreement for purposes of obtaining due<br />

authorization <strong>to</strong> make such a filing. This is on pain of having any unauthorized<br />

filing for bankruptcy later construed as an ultra vires act and any bankruptcy case<br />

so filed being later dismissed by the bankruptcy court in which it was filed.<br />

/ / /<br />

/ / /<br />

/ / /<br />

/ / /<br />

/ / /<br />

9<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 9 of<br />

10

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

Conclusion<br />

The REL Bankruptcy Case was filed without any proper authorization, in a<br />

very wrong place, and for all the worst possible reasons. Sadly—and as a direct<br />

result of this cynical filing of the REL Bankruptcy Case in a remote jurisdiction by<br />

the TDE’s current management—thousands of local persons and entities who have<br />

already been victimized by pre-petition criminal behavior have now also had their<br />

faith in the administration of the federal bankruptcy system badly shaken.<br />

This Oakland bankruptcy court now has the opportunity <strong>to</strong> show these<br />

almost entirely local persons and entities that the federal bankruptcy system does<br />

work and that help is on the way <strong>to</strong> them from this Oakland bankruptcy court.<br />

Accordingly, this <strong>motion</strong> should be immediately granted and the REL Bankruptcy<br />

Case ordered transferred from Dallas <strong>to</strong> Oakland forthwith.<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

Dated: December 19, 2011<br />

McGRANE LLP<br />

By: /s/William McGrane<br />

William McGrane<br />

At<strong>to</strong>rneys for Moving Party/Interested Party<br />

Development Specialists, Inc.<br />

10<br />

Memorandum of Points and Authorities in Support of Development Specialists, Inc.’s<br />

Motion <strong>to</strong> Change Venue<br />

Case: 11-45175 Doc# 401 Filed: 12/19/11 Entered: 12/19/11 15:22:05 Page 10 of<br />

10