Page 1 of 7 IN THE UNITED STATES BANKRUPTCY ... - equitatus

Page 1 of 7 IN THE UNITED STATES BANKRUPTCY ... - equitatus

Page 1 of 7 IN THE UNITED STATES BANKRUPTCY ... - equitatus

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 1 <strong>of</strong> 8<strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> <strong>STATES</strong> <strong>BANKRUPTCY</strong> COURTFOR <strong>THE</strong> NOR<strong>THE</strong>RN DISTRICT OF TEXASDALLAS DIVISIONIn re:§ Chapter 11 Cases§R.E. LOANS, LLC, §R.E. FUTURE, LLC§ Case No. 11-35865-BJHCAPITAL SALVAGE, A CALIFORNIA §CORPORATION§ JO<strong>IN</strong>TLY ADM<strong>IN</strong>ISTERED§Debtors. §SECOND QUARTERLY REPORT OFDENNIS S. FAULKNER, LIQUIDAT<strong>IN</strong>G TRUSTEE,FOR <strong>THE</strong> PERIOD END<strong>IN</strong>G DECEMBER 31, 2012Date Submitted: January 22, 2013203324093 v2<strong>Page</strong> 1 <strong>of</strong> 7

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 2 <strong>of</strong> 8Dennis Faulkner, as liquidating trustee (the “Liquidating Trustee”) <strong>of</strong> the RELLiquidating Trust, hereby files this Second Quarterly Report <strong>of</strong> Dennis S. Faulkner, LiquidatingTrustee, for the Period Ending December 31, 2012 (the “Second Report”). 1 This report isintended to be cumulative <strong>of</strong> the Liquidating Trustee’s prior quarterly reports, and should be readin conjunction with them.A. BackgroundI.<strong>IN</strong>TRODUCTIONOn September 13, 2011, the above-captioned debtors and debtors-in-possession (the“Debtors”) commenced these cases by filing voluntary petitions for relief under chapter 11 <strong>of</strong>title 11 <strong>of</strong> the United States Code (the “Bankruptcy Code”). 2 On September 22, 2011, the Office<strong>of</strong> the United States Trustee appointed the Official Committee <strong>of</strong> Noteholders (the“Committee”).On May 15, 2012, the Debtors filed the fourth amended plan <strong>of</strong> reorganization [Dkt. No.845] (as modified or amended, the “Plan”) and an amended disclosure statement [Dkt. No. 843](the “Disclosure Statement”), which Disclosure Statement was approved by order <strong>of</strong> this Courton May 16, 2012 [Dkt. No. 847]. The Plan was subsequently modified on June 1, 2012 [Dkt.No. 905] and confirmed by Order <strong>of</strong> the Court on June 26, 2012 [Dkt. No. 968] (the“Confirmation Order”). The Plan became effective on June 29, 2012 (the “Effective Date”), atwhich time Reorganized R.E. Loans, LLC; Reorganized Capital Salvage, a CaliforniaCorporation; and Reorganized R.E. Future, LLC (collectively “Reorganized Debtors”) emergedfrom chapter 11.On the Effective Date, the Reorganized Debtors executed the Liquidating TrustAgreement and Declaration <strong>of</strong> Trust (the “Trust Agreement”), which, among other things,provided for the formation <strong>of</strong> the REL Liquidating Trust (the “Trust”) and the appointment <strong>of</strong>Dennis Faulkner as Liquidating Trustee. Pursuant to the terms <strong>of</strong> the Trust Agreement, theLiquidating Trustee is vested with the authority and power to:• administer the Liquidating Trust, including the authority to convey, transfer orassign any Trust Assets;• administer, investigate, prosecute, settle and abandon all Causes <strong>of</strong> Action in thename <strong>of</strong>, and for the benefit <strong>of</strong>, the Estates; and• make Distributions provided for in the Plan.The Liquidating Trustee also has standing to monitor and seek to enforce theperformance <strong>of</strong> obligations under the Plan and the performance <strong>of</strong> other provisions <strong>of</strong> the Plan1 Capitalized terms not otherwise defined herein have the definitions described in the Plan (as defined below).2 Unless otherwise noted, all section (§) references are to the Bankruptcy Code.203324093 v2<strong>Page</strong> 2 <strong>of</strong> 7

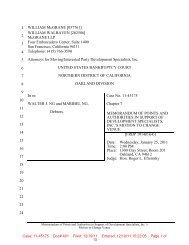

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 3 <strong>of</strong> 8that have an effect upon the treatment <strong>of</strong> Claims. The Liquidating Trustee is the sole member <strong>of</strong>Reorganized R.E. Loans.B. Trust CommitteePursuant to the Trust Agreement, the Liquidating Trustee consults with a committee (the“Trust Committee”) presently comprised <strong>of</strong> seven individuals holding Beneficial Interests in theTrust. The current members <strong>of</strong> the Trust Committee are Linda Reilly, Pearl Tom, Dixon Collins,Ron Lavelle, Steve Fong, Elliott Abrams, and Susan Uecker (the trustee <strong>of</strong> the Mortgage Fund’08 LLC Liquidating Trust (the “MF08 Trust”)). In addition, the Trust Committee appointedone nonvoting ex <strong>of</strong>ficio member, Allan Cone. Mr. Cone and the other members <strong>of</strong> the TrustCommittee (excluding Ms. Uecker) are all former members <strong>of</strong> the Noteholder Committee thatrepresented the interests <strong>of</strong> Noteholders during the chapter 11 case.C. Prior Reports203324093 v2To date, the Liquidating Trustee has filed the following quarterly reports:• First Quarterly Report <strong>of</strong> Dennis S. Faulkner, Liquidating Trustee, for the PeriodEnding September 30, 2012 (the “First Report”), dated October 19, 2012 [Dkt.Nos. 1169, 1170].A. Status <strong>of</strong> Trust AssetsII.REPORTPursuant to the Plan and the Trust Agreement, the Trust was vested on the Effective Datewith ownership <strong>of</strong> all Trust Assets, including:• all Causes <strong>of</strong> Action belonging to any <strong>of</strong> the Debtors as <strong>of</strong> the Effective Date;• 100% <strong>of</strong> the newly issued membership interests in Reorganized R.E. Loans; and• the sum <strong>of</strong> $500,000, which was funded as a contribution by Reorganized R.E.Loans to the Trust.Attached hereto as “Exhibit 1” is the Summary <strong>of</strong> Cash Transactions through December31, 2012, which reflects all cash receipts and disbursements, including all cash currently onhand.B. Fully Repaid Exchange NotesSince filing the First Report, the Liquidating Trustee has continued to negotiatesettlements with the holders <strong>of</strong> Fully Repaid Exchange Notes. On or about November 8, 2012,the Liquidating Trustee sent out a second letter to the holders <strong>of</strong> Fully Repaid Exchange Notesextending the settlement <strong>of</strong>fer described in the Plan. As <strong>of</strong> December 31, 2012, the Liquidating<strong>Page</strong> 3 <strong>of</strong> 7

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 4 <strong>of</strong> 8Trustee had settled claims on approximately one-third <strong>of</strong> the Fully Repaid Exchange Notes,resulting in the payment <strong>of</strong> settlement proceeds to the Trust in the aggregate amount <strong>of</strong>$497,025.50. The Liquidating Trustee anticipates that the next step in the monetization <strong>of</strong> theseclaims will be to initiate avoidance actions as appropriate against the remaining holders <strong>of</strong> FullyRepaid Exchange Notes who did not choose to accept the settlement proposal.C. Other Causes <strong>of</strong> ActionThe Liquidating Trustee, through special litigation counsel, continues to activelyinvestigate the other Causes <strong>of</strong> Action retained by the Trust pursuant to the Plan, includingpotential claims and causes <strong>of</strong> action against the following:• Walter Ng • Cushman Wakefield• Bruce Horwitz • George Smith Partners• Kelly Ng • Greenberg Traurig, LLP• Barney Ng • Armanino McKenna LLP• B-4 Partners, LLC • Stutman, Triester & Glatt• Bar-K, Inc. • Mackinac Partners, LLCThis investigation involves not only third-party discovery under Federal Rule <strong>of</strong>Bankruptcy Procedure 2004, but also a review <strong>of</strong> the voluminous records maintained by theDebtors. To facilitate that review, the Liquidating Trustee entered into a cost-sharing agreementwith various parties, including lead counsel for the Noteholders in the pending class-actionlawsuit (“Class Counsel”), 3 whereby those parties will help fund the costs <strong>of</strong> converting theDebtors’ records into searchable electronic format in exchange for shared access to the records.In addition, the Liquidating Trustee has engaged in ongoing discussions with Class Counselregarding a more formal cooperation and sharing agreement with respect to litigation matters.Such an agreement would inure to the benefit <strong>of</strong> Noteholders through increased coordination andsharing <strong>of</strong> expenses and information between the Liquidating Trust’s special litigation counseland Class Counsel in their respective litigation efforts. Based upon the results <strong>of</strong> theinvestigation by special litigation counsel, the Liquidating Trustee will determine how to proceedwith respect to the Causes <strong>of</strong> Action.D. Asset Disposition by Reorganized DebtorsIn conjunction with Confirmation, the Reorganized Debtors entered into exit financingwith Wells Fargo (the “Wells Fargo Exit Facility”) which is secured by first-priority, perfectedliens on all assets <strong>of</strong> the Reorganized Debtors. By its terms, the Wells Fargo Exit Facility must3 While the Liquidating Trustee has made efforts to coordinate and share certain costs with those involved in thepending class-action lawsuit, the Liquidating Trustee has no direct involvement in the prosecution <strong>of</strong> that lawsuit.203324093 v2<strong>Page</strong> 4 <strong>of</strong> 7

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 5 <strong>of</strong> 8be repaid in full by September 30, 2013, with mandatory quarterly payments due in the interim.After Wells Fargo has been fully repaid, the proceeds from the liquidation <strong>of</strong> remaining propertyare transferred to the Trust net <strong>of</strong> costs <strong>of</strong> the Reorganized Debtors.As <strong>of</strong> December 31, 2012, a total <strong>of</strong> $50.8 million in net proceeds had been generatedfrom the sale <strong>of</strong> assets by the Debtors and directed to repayment <strong>of</strong> the Debtors’ obligationsowed to Wells Fargo, satisfying both the December 31, 2012 and March 31, 2013 mandatoryquarterly payment thresholds.E. Pending Substantial Contribution Claim <strong>of</strong> Mortgage Fund ‘08On July 19, 2012, Susan Uecker, as liquidating trustee <strong>of</strong> the MF08 Trust, filed anapplication [Dkt. No. 1010] in the R.E. Loans bankruptcy case requesting allowance <strong>of</strong> anadministrative expense in the amount <strong>of</strong> $102,787.61 for legal fees and expenses incurred by theMF08 Trust in making an alleged “substantial contribution” to the R.E. Loans cases. 4 Theapplication was vigorously opposed by both the Liquidating Trustee and the ReorganizedDebtors, both <strong>of</strong> whom took the position that Ms. Uecker’s claim was not permitted under theapplicable statute and, in any event, was resolved and extinguished in connection with thecompromise and settlement <strong>of</strong> Mortgage Fund ’08’s other claims in the R.E. Loans bankruptcycase.Following a contested hearing on the merits on October 30, 2012, the Bankruptcy Courtentered an order [Dkt. No. 1186] denying the application in its entirety.F. Creditor Claims AnalysisThe Liquidating Trustee has transitioned the electronic database containing bothliabilities to creditors as set forth in Schedules filed by the Reorganized Debtors and claims filedby Creditors. All <strong>of</strong> the records have been reconciled and Creditor claims requiring objectionhave been identified. Pursuant to the Plan, objections to the allowance <strong>of</strong> claims were originallyrequired in the Plan to be filed by the Liquidating Trustee no later than October 27, 2012 (the“Claims Objection Deadline”), which is 120 days after the Effective Date. 5 By order enteredOctober 24, 2012 [Dkt. No. 1176], the Claims Objection Deadline was extended to January 28,2013.Based on his analysis <strong>of</strong> the claims register, the Liquidating Trustee identified a number<strong>of</strong> claims that should be disallowed, either on procedural grounds (e.g., duplicate claims) or moresubstantive grounds (e.g., claims asserted against the wrong legal entity). To that end, onOctober 19, 2012, the Liquidating Trustee filed objections to approximately 54 pro<strong>of</strong>s <strong>of</strong> claim.In most instances, the Liquidating Trustee’s objection was founded in some discrepancy betweenthe pro<strong>of</strong> <strong>of</strong> claim and the Debtor’s books and records as reflected on the Schedules <strong>of</strong> Assets andLiabilities. In those cases, the Liquidating Trustee sought only the disallowance <strong>of</strong> the asserted4 Section 503(b) <strong>of</strong> the Bankruptcy Code permits a party to seek reimbursement for actual, necessary expensesincurred in making “a substantial contribution in a case” under the Bankruptcy Code. 11 U.S.C. § 503(b).5 Pursuant to the Plan, the Claims Objection Deadline may be extended by order <strong>of</strong> the Bankruptcy Court.203324093 v2<strong>Page</strong> 5 <strong>of</strong> 7

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 6 <strong>of</strong> 8pro<strong>of</strong> <strong>of</strong> claim, while preserving the corresponding claim described on the Schedules <strong>of</strong> Assetsand Liabilities. In cases where a pro<strong>of</strong> <strong>of</strong> claim described a claim properly asserted against anentity other than the Debtors, the Liquidating Trustee sought disallowance <strong>of</strong> the claim in itsentirety.Since the filing <strong>of</strong> the claim objections, one claim objection was withdrawn by theLiquidating Trustee and a second was continued to a later date to permit the Noteholderadditional time to investigate the objection. Following a hearing on January 3, 2013, theBankruptcy Court entered orders sustaining all <strong>of</strong> the remaining claim objections filed by theLiquidating Trustee.The Liquidating Trustee has identified approximately 10 remaining claims as potentiallyobjectionable on the grounds that, among other things, their allowance may ultimately beimpacted by the outcome <strong>of</strong> pending and contemplated litigation or trigger set<strong>of</strong>f rights againstclaims the Liquidating Trustee may have against the respective claimants. The LiquidatingTrustee may also seek subordination or disallowance <strong>of</strong> another 35 claims held by insiders.Pursuant to 11 U.S.C. § 108(a), the Liquidating Trustee has until September 13, 2013 tocommence any such litigation. For strategic reasons, the Liquidating Trustee believes it to be inthe best interests <strong>of</strong> the Liquidating Trust and its beneficiaries for any remaining claim objectionsto be filed, if at all, only in concert with related litigation. Accordingly, the Liquidating Trusteefiled a motion with the Bankruptcy Court on January 3, 2013 requesting a second extension <strong>of</strong>the Claims Objection Deadline to September 13, 2013. A hearing on that motion is scheduledfor February 5, 2013.203324093 v2<strong>Page</strong> 6 <strong>of</strong> 7

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 7 <strong>of</strong> 8Dated: January 22, 2013Respectfully Submitted,DENNIS S. FAULKNER, LIQUIDAT<strong>IN</strong>GTRUSTEEBy:/s/ Dennis S. Faulkner- and –AK<strong>IN</strong> GUMP STRAUSS HAUER & FELDLLPBy:/s/ Michael P. CooleyCharles R. Gibbs (SBN 07846300)Michael P. Cooley (SBN 24034388)1700 Pacific Avenue, Suite 4100Dallas, Texas 75201Telephone: (214) 969-2723Facsimile: (214) 969-4343Attorneys for Liquidating Trustee203324093 v2<strong>Page</strong> 7 <strong>of</strong> 7

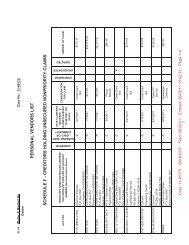

Case 11-35865-bjh11 Doc 1248 Filed 01/22/13 Entered 01/22/13 16:33:16 DescMain Document <strong>Page</strong> 8 <strong>of</strong> 8REL Liquidating TrustSummary <strong>of</strong> Cash Transactions12/31/12Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12CUMULATIVETRANSACTIONS@ 12/31/12Transfer from Debtor 500,000.00 500,000.00Settlement Receipts:Fully Repaid Exchange Notes 64,195.55 314,442.24 24,937.85 43,833.88 49,615.98 497,025.50Interest 17.76 44.10 65.72 67.97 51.55 47.43 294.53TOTAL RECEIPTS 500,017.76 64,239.65 314,507.96 25,005.82 43,885.43 49,663.41 997,320.03Administrative Costs (2,950.63) (2,806.97) (5,757.60)Committee Expenses (827.36) (827.36)Bank Service Charge (158.12) (12.00) (170.12)Pr<strong>of</strong>essional Fees:Akin Gump Strauss Hauer & Feld, LLP (5,364.50) (57,658.38) (150,296.45) (213,319.33)Alix Partners LLP (5,657.75) (5,657.75)Dennis Faulkner, Trustee (16,908.84) (5,000.00) (5,000.00) (26,908.84)Diamond McCarthy, LLP (1,634.75) (1,634.75)FTI Consulting (29,113.00) (3,252.00) (584.00) (32,949.00)Lain, Faulkner & Co. - Accounting (57,885.63) (31,610.04) (11,567.20) (101,062.87)TOTAL DISBURSEMENTS (158.12) - - (120,342.46) (97,520.42) (170,266.62) (388,287.62)NET CASH FLOW 499,859.64 64,239.65 314,507.96 (95,336.64) (53,634.99) (120,603.21) 609,032.41L:\Data\CLIENT\RE1205\Banking\Cash Summary December 2012.xlsx