March Final Issue.pmd - CHANGE 'Gateway to All Competitive Exams'

March Final Issue.pmd - CHANGE 'Gateway to All Competitive Exams'

March Final Issue.pmd - CHANGE 'Gateway to All Competitive Exams'

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

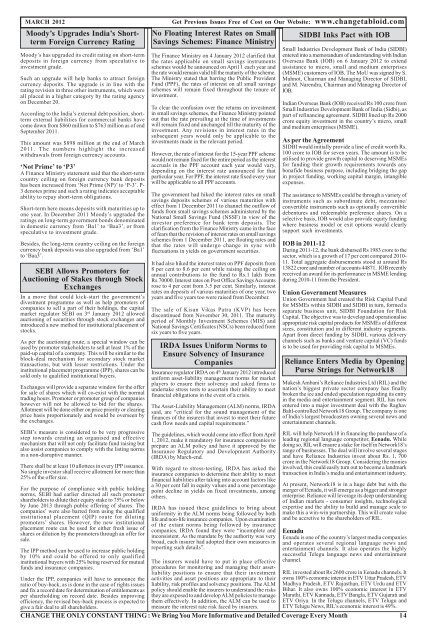

MARCH 2012 Get Previous <strong>Issue</strong>s Free of Cost on Our Website: www.changetabloid.com<br />

Moody’s Upgrades India’s Shortterm<br />

Foreign Currency Rating<br />

Moody’s has upgraded its credit rating on short-term<br />

deposits in foreign currency from speculative <strong>to</strong><br />

investment grade.<br />

Such an upgrade will help banks <strong>to</strong> attract foreign<br />

currency deposits. The upgrade is in line with the<br />

rating revision in three other instruments, which were<br />

all placed in a higher category by the rating agency<br />

on December 20.<br />

According <strong>to</strong> the India’s external debt position, shortterm<br />

external liabilities for commercial banks have<br />

come down from $860 million <strong>to</strong> $763 million as of end<br />

September 2011.<br />

This amount was $898 million at the end of <strong>March</strong><br />

2011. The numbers highlight the increased<br />

withdrawals from foreign currency accounts.<br />

‘Not Prime’ <strong>to</strong> ‘P3’<br />

A Finance Ministry statement said that the short-term<br />

country ceiling on foreign currency bank deposits<br />

has been increased from ‘Not Prime (NP)’ <strong>to</strong> ‘P-3’. P-<br />

3 denotes prime and such a rating indicates acceptable<br />

ability <strong>to</strong> repay short-term obligations.<br />

Short-term here means deposits with maturities up <strong>to</strong><br />

one year. In December 2011 Moody’s upgraded the<br />

ratings on long-term government bonds denominated<br />

in domestic currency from ‘Ba1’ <strong>to</strong> ‘Baa3’, or from<br />

speculative <strong>to</strong> investment grade.<br />

Besides, the long-term country ceiling on the foreign<br />

currency bank deposits was also upgraded from ‘Ba1’<br />

<strong>to</strong> ‘Baa3’.<br />

SEBI <strong>All</strong>ows Promoters for<br />

Auctioning of Stakes through S<strong>to</strong>ck<br />

Exchanges<br />

In a move that could kick-start the government’s<br />

divestment programme as well as help promoters of<br />

companies <strong>to</strong> sell a part of their holdings, the capital<br />

market regula<strong>to</strong>r SEBI on 3 rd January 2012 allowed<br />

auctioning of securities through s<strong>to</strong>ck exchanges and<br />

introduced a new method for institutional placement of<br />

s<strong>to</strong>cks.<br />

As per the auctioning route, a special window can be<br />

used by promoter stakeholders <strong>to</strong> sell at least 1% of the<br />

paid-up capital of a company. This will be similar <strong>to</strong> the<br />

block-deal mechanism for secondary s<strong>to</strong>ck market<br />

transactions, but with lesser restrictions. Under the<br />

institutional placement programme (IPP), shares can be<br />

sold only <strong>to</strong> qualified institutional buyers.<br />

Exchanges will provide a separate window for the offer<br />

for sale of shares which will co-exist with the normal<br />

trading hours. Promoter or promoter group of companies<br />

however will not be allowed <strong>to</strong> bid for the shares.<br />

<strong>All</strong>otment will be done either on price priority or clearing<br />

price basis proportionately and would be overseen by<br />

the exchanges.<br />

SEBI’s measure is considered <strong>to</strong> be very progressive<br />

step <strong>to</strong>wards creating an organised and effective<br />

mechanism that will not only facilitate fund raising but<br />

also assist companies <strong>to</strong> comply with the listing norms<br />

in a non-disruptive manner.<br />

There shall be at least 10 allottees in every IPP issuance.<br />

No single inves<strong>to</strong>r shall receive allotment for more than<br />

25% of the offer size.<br />

For the purpose of compliance with public holding<br />

norms, SEBI had earlier directed all such promoter<br />

shareholders <strong>to</strong> dilute their equity stake <strong>to</strong> 75% or below<br />

by June 2013 through public offering of shares. The<br />

companies’ were also barred from using the qualified<br />

institutional placement (QIP) route for diluting<br />

promoters’ shares. However, the new institutional<br />

placement route can be used for either fresh issue of<br />

shares or dilution by the promoters through an offer for<br />

sale.<br />

The IPP method can be used <strong>to</strong> increase public holding<br />

by 10% and could be offered <strong>to</strong> only qualified<br />

institutional buyers with 25% being reserved for mutual<br />

funds and insurance companies.<br />

No Floating Interest Rates on Small<br />

Savings Schemes: Finance Ministry<br />

The Finance Ministry on 4 January 2012 clarified that<br />

the rates applicable on small savings instruments<br />

schemes would be announced on April 1 each year and<br />

the rate would remain valid till the maturity of the scheme.<br />

The Ministry stated that barring the Public Provident<br />

Fund (PPF), the rates of interest on all small savings<br />

schemes will remain fixed throughout the tenure of<br />

investment.<br />

To clear the confusion over the returns on investment<br />

in small savings schemes, the Finance Ministry pointed<br />

out that the rate prevailing at the time of investments<br />

will remain fixed and unchanged till the maturity of the<br />

investment. Any revisions in interest rates in the<br />

subsequent years would only be applicable <strong>to</strong> the<br />

investments made in the relevant period.<br />

However, the rate of interest for the 15-year PPF scheme<br />

would not remain fixed for the entire period as the interest<br />

accruals in the PPF account each year would vary,<br />

depending on the interest rate announced for that<br />

particular year. For PPF, the interest rate fixed every year<br />

will be applicable <strong>to</strong> all PPF accounts.<br />

The government had hiked the interest rates on small<br />

savings deposits schemes of various maturities with<br />

effect from 1 December 2011 <strong>to</strong> channel the outflow of<br />

funds from small savings schemes administered by the<br />

National Small Savings Fund (NSSF) in view of the<br />

inves<strong>to</strong>r preference for bank term deposits. The<br />

clarification from the Finance Ministry came in the face<br />

of fears that the revision of interest rates on small savings<br />

schemes from 1 December 2011, are floating rates and<br />

that the rates will undergo change in sync with<br />

fluctuations in yields on government securities.<br />

It had also hiked the interest rates on PPF deposits from<br />

8 per cent <strong>to</strong> 8.6 per cent while raising the ceiling on<br />

annual contributions <strong>to</strong> the fund <strong>to</strong> Rs.1 lakh from<br />

Rs.70000. Interest rates on Post Office Savings Accounts<br />

rose <strong>to</strong> 4 per cent from 3.5 per cent. Similarly, interest<br />

rates on deposits of various maturities of one year, two<br />

years and five years <strong>to</strong>o were raised from December.<br />

The sale of Kisan Vikas Patra (KVP) has been<br />

discontinued from November 30, 2011. The maturity<br />

period of Monthly Investment Schemes (MIS) and<br />

National Savings Certificates (NSCs) been reduced from<br />

six years <strong>to</strong> five years.<br />

IRDA <strong>Issue</strong>s Uniform Norms <strong>to</strong><br />

Ensure Solvency of Insurance<br />

Companies<br />

Insurance regula<strong>to</strong>r IRDA on 4 th January 2012 introduced<br />

uniform asset-liability management norms for market<br />

players <strong>to</strong> ensure their solvency and asked firms <strong>to</strong><br />

undertake stress tests <strong>to</strong> ascertain their ability <strong>to</strong> meet<br />

financial obligations in the event of a crisis.<br />

The Asset-Liability Management (ALM) norms, IRDA<br />

said, are “critical for the sound management of the<br />

finances of the insurers that invest <strong>to</strong> meet their future<br />

cash flow needs and capital requirements.”<br />

The guidelines, which would come in<strong>to</strong> effect from April<br />

1, 2012, make it manda<strong>to</strong>ry for insurance companies <strong>to</strong><br />

prepare an ALM policy and have it approved by the<br />

Insurance Regula<strong>to</strong>ry and Development Authority<br />

(IRDA) by <strong>March</strong>-end.<br />

With regard <strong>to</strong> stress-testing, IRDA has asked the<br />

insurance companies <strong>to</strong> determine their ability <strong>to</strong> meet<br />

financial liabilities after taking in<strong>to</strong> account fac<strong>to</strong>rs like<br />

a 30 per cent fall in equity values and a one percentage<br />

point decline in yields on fixed investments, among<br />

others.<br />

IRDA has issued these guidelines <strong>to</strong> bring about<br />

uniformity in the ALM norms being followed by both<br />

life and non-life insurance companies. Upon examination<br />

of the extant norms being followed by insurance<br />

companies, IRDA found they were “incomplete and<br />

inconsistent. As the mandate by the authority was very<br />

broad, each insurer had adopted their own measures in<br />

reporting such details”.<br />

SIDBI Inks Pact with IOB<br />

Small Industries Development Bank of India (SIDBI)<br />

entered in<strong>to</strong> a memorandum of understanding with Indian<br />

Overseas Bank (IOB) on 6 January 2012 <strong>to</strong> extend<br />

assistance <strong>to</strong> micro, small and medium enterprises<br />

(MSME) cus<strong>to</strong>mers of IOB. The MoU was signed by S.<br />

Muhnot, Chairman and Managing Direc<strong>to</strong>r of SIDBI,<br />

and M. Narendra, Chairman and Managing Direc<strong>to</strong>r of<br />

IOB.<br />

Indian Overseas Bank (IOB) received Rs 100 crore from<br />

Small Industries Development Bank of India (Sidbi), as<br />

part of refinancing agreement. SIDBI lined up Rs 2000<br />

crore equity investment in the country’s micro, small<br />

and medium enterprises (MSME).<br />

As per the Agreement<br />

SIDBI would initially provide a line of credit worth Rs.<br />

100 crore <strong>to</strong> IOB for seven years. The amount is <strong>to</strong> be<br />

utilised <strong>to</strong> provide growth capital <strong>to</strong> deserving MSMEs<br />

for funding their growth requirements <strong>to</strong>wards any<br />

bonafide business purpose, including bridging the gap<br />

in project funding, working capital margin, intangible<br />

expenses.<br />

The assistance <strong>to</strong> MSMEs could be through a variety of<br />

instruments such as subordinate debt, mezzanine/<br />

convertible instruments such as optionally convertible<br />

debentures and redeemable preference shares. On a<br />

selective basis, IOB would also provide equity funding<br />

where business model or exit options would clearly<br />

support such investments.<br />

IOB in 2011-12<br />

During 2011-12, the bank disbursed Rs 1983 crore <strong>to</strong> the<br />

sec<strong>to</strong>r, which is a growth of 17 per cent compared 2010-<br />

11. Total aggregate disbursements s<strong>to</strong>od at around Rs<br />

13822 crore and number of accounts 44871. IOB recently<br />

received an award for its performance in MSME lending<br />

during 2010-11 from the President.<br />

Union Government Measures<br />

Union Government had created the Risk Capital Fund<br />

for MSMEs within SIDBI and SIDBI in turn, formed a<br />

separate business unit, SIDBI Foundation for Risk<br />

Capital. The objective was <strong>to</strong> develop and operationalise<br />

appropriate risk capital products for MSMEs of different<br />

sizes, constitution and in different industry segments.<br />

Apart from direct funding by SIDBI, various delivery<br />

channels such as banks and venture capital (VC) funds<br />

is <strong>to</strong> be used for providing risk capital <strong>to</strong> MSMEs.<br />

Reliance Enters Media by Opening<br />

Purse Strings for Network18<br />

Mukesh Ambani’s Reliance Industries Ltd (RIL) and the<br />

nation’s biggest private sec<strong>to</strong>r company has finally<br />

broken the ice and ended speculation regarding its entry<br />

in the media and entertainment segment. RIL has now<br />

entered in<strong>to</strong> a major investment deal with the Raghav<br />

Bahl-controlled Network18 Group. The company is one<br />

of India’s largest broadcasters owning several news and<br />

entertainment channels.<br />

RIL will help Network18 in financing the purchase of a<br />

leading regional language competi<strong>to</strong>r, Eenadu. While<br />

doing so, RIL will ensure a stake for itself in Network18’s<br />

range of businesses. The deal will involve several stages<br />

and have Reliance Industries invest about Rs. 1, 700<br />

crore in the Network18 Group. Considering the monies<br />

involved, this could easily turn out <strong>to</strong> become a landmark<br />

transaction in India’s media and entertainment industry.<br />

At present, Network18 is in a huge debt but with the<br />

merger of Eenadu, it will emerge as a bigger and stronger<br />

enterprise. Reliance will leverage its deep understanding<br />

of Indian markets - consumer insights, technological<br />

expertise and the ability <strong>to</strong> build and manage scale <strong>to</strong><br />

make this a win-win partnership. This will create value<br />

and be accretive <strong>to</strong> the shareholders of RIL.<br />

Eenadu<br />

Eenadu is one of the country’s largest media companies<br />

and operates several regional language news and<br />

entertainment channels. It also operates the highly<br />

successful Telegu language news and entertainment<br />

channel.<br />

The insurers would have <strong>to</strong> put in place effective<br />

procedures for moni<strong>to</strong>ring and managing their assetliability<br />

positions <strong>to</strong> ensure that their investment RIL invested about Rs 2600 crore in Eenadu channels. It<br />

Under the IPP, companies will have <strong>to</strong> announce the activities and asset positions are appropriate <strong>to</strong> their owns 100% economic interest in ETV Uttar Pradesh, ETV<br />

ratio of buy-back, as is done in the case of rights issues liability, risk profiles and solvency positions. The ALM Madhya Pradesh, ETV Rajasthan, ETV Urdu and ETV<br />

and fix a record date for determination of entitlements as policy should enable the insurers <strong>to</strong> understand the risks Bihar. It also owns 100% economic interest in ETV<br />

per shareholding on record date. Besides improving they are exposed <strong>to</strong> and develop ALM policies <strong>to</strong> manage Marathi, ETV Kannada, ETV Bangla, ETV Gujarati and<br />

efficiency, the revised buy-back process is expected <strong>to</strong> them effectively. In addition, the ALM can be used <strong>to</strong> ETV Oriya. In the Telugu channels, ETV Telugu and<br />

give a fair deal <strong>to</strong> all shareholders.<br />

measure the interest rate risk faced by insurers. ETV Telugu News, RIL’s economic interest is 49%.<br />

<strong>CHANGE</strong> THE ONLY CONSTANT THING : We Bring You More Informative and Detailed Coverage Every Month 14